Why 1 oz Gold Coins Remain the Most Popular Choice for Investors

A 1 oz gold coin is the most widely purchased gold bullion product worldwide, striking the perfect balance between value, portability, and liquidity. These coins contain one troy ounce of gold and are minted by sovereign governments, offering legal tender status and government-backed authenticity. Popular options like the American Gold Eagle and Canadian Maple Leaf are typically 22-karat to 24-karat gold and are eligible for inclusion in a Precious Metals IRA.

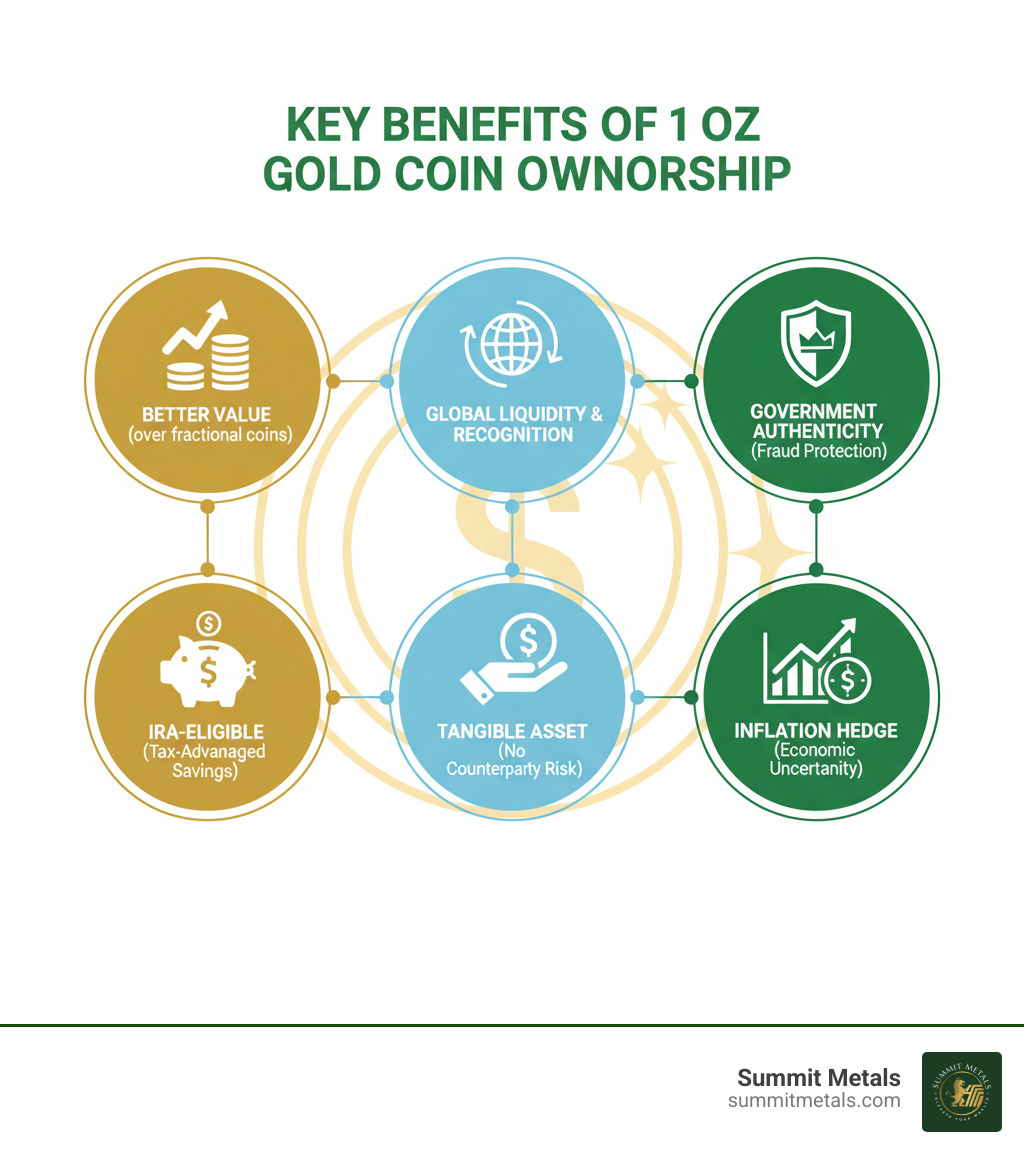

Physical gold has served as a store of value for millennia, and today's 1 oz gold coin remains the gold standard for investors seeking to protect purchasing power against inflation and economic uncertainty. Unlike paper assets, physical gold coins aren't vulnerable to counterparty risk or hacking. You hold a tangible asset that markets worldwide recognize as a "safe haven." The 1 oz weight class dominates sales because it offers substantial value with superior liquidity and a better premium-to-spot ratio than smaller fractional coins. This guide will walk you through everything you need to know to buy with confidence and build lasting wealth through physical gold.

Why the 1 oz Gold Coin is the Investor's Choice

The 1 oz gold coin is often the smartest choice for building lasting wealth, delivering benefits that smaller coins and even gold bars can't match. It serves as a financial insurance policy—a hedge against inflation that has protected wealth for thousands of years. Unlike paper currency, gold's intrinsic value isn't tied to any government's printing press or corporation's promises.

The 1 oz weight class truly shines in its liquidity. A 1 oz American Gold Eagle coin is recognized and accepted globally, allowing you to convert your coin to cash quickly and easily. This universal acceptance is a crucial advantage when markets are volatile.

Furthermore, the 1 oz gold coin offers better value compared to the spot price than smaller fractional coins. While quarter-ounce or tenth-ounce coins seem more affordable, they carry significantly higher premiums. With a 1 oz coin, you pay less per gram of gold, stretching your investment dollars further.

To build wealth systematically, consider using an Autoinvest program to purchase your 1 oz gold coins regularly, similar to a 401(k). By buying consistently, you smooth out price fluctuations through dollar-cost averaging and build your tangible asset portfolio steadily. For more on this strategy, see our guide on the role of physical gold purchase in diversifying portfolio.

Holding a physical 1 oz gold coin eliminates counterparty risk—it can't be hacked, erased, or disappear in a bankruptcy. But should you buy coins or bars? Coins offer compelling advantages, particularly in fraud protection.

| Criteria | 1 oz Gold Coins | 1 oz Gold Bars |

|---|---|---|

| Face Value/Legal Tender | Yes (e.g., $50 for American Gold Eagle) | No |

| Fraud Protection | Government-backed authenticity and legal tender status provide an additional layer of trust. Intricate designs and official minting make counterfeiting extremely difficult. | Authenticity depends entirely on the refiner's reputation and accompanying certificates. More vulnerable to sophisticated counterfeits. |

| Global Recognizability | Highly recognized and accepted worldwide, especially sovereign coins from major government mints. | Recognized, but acceptance varies more by refiner and region. |

| Premium over Spot | Generally higher due to minting costs and intricate designs, but better value than fractional coins. | Typically lower, as bars are simpler to produce. |

| Durability | Often alloyed (e.g., 22-karat) for increased hardness and scratch resistance during handling and storage. | Usually 24-karat (.999+ fine), making them softer and more prone to damage. |

The legal tender status of a 1 oz gold coin is a government guarantee of authenticity, offering a layer of trust that bars lack. For a deeper comparison, check out our article on gold bars vs coins. The 1 oz gold coin delivers the ideal combination of value, security, and liquidity for serious investors.

Exploring the Most Popular 1 oz Gold Coins

When investing in 1 oz gold coins, a select group of sovereign mints dominates the landscape. These government-minted coins offer guaranteed weight and purity, backed by the full faith and credit of nations like the U.S., Canada, and South Africa. This backing eliminates much of the guesswork for investors.

The 1 oz American Gold Eagle coin has been the world's most popular gold coin since its 1986 debut. Our quick start guide to Gold Eagle coins offers more detail.

The American Gold Eagle: A Closer Look

The Gold Eagle features Augustus Saint-Gaudens' famed Lady Liberty design on the obverse. The reverse, updated in 2021, displays a striking portrait of a bald eagle's head by Jennie Norris.

From a practical standpoint, the coin contains one troy ounce of pure gold in a 22-karat (.9167 fineness) composition. The remaining alloy of silver and copper makes the coin significantly more durable and resistant to scratches than softer 24-karat gold. While the coin's total weight is 1.0909 troy ounces, the U.S. Government guarantees it contains exactly one troy ounce of pure gold. This rock-solid guarantee, along with its IRA eligibility, makes it a top choice for investors. For official specs, see the U.S. Mint's details on the American Eagle Gold Coin.

Other World-Renowned 1 oz Gold Coins

While the Eagle is popular, several other exceptional 1 oz gold coin options exist, each with unique merits.

- Canadian Gold Maple Leaf: The standard for purity, this coin from the Royal Canadian Mint is struck in .9999 fine 24-karat gold. It features industry-leading anti-counterfeiting technology, including radial lines and micro-engraved laser marks. Learn more in our guide to 1 oz gold maple leaf coins.

- South African Krugerrand: As the world's first modern bullion coin (1967), the Krugerrand opened gold investing to the masses. Like the Eagle, it uses a durable 22-karat gold alloy and remains one of the most liquid coins globally. Find more about the enduring allure of the Krugerrand.

- American Gold Buffalo: The U.S. Mint's first 24-karat offering, this .9999 fine gold coin features the iconic 1913 Buffalo Nickel design. It appeals to investors who prioritize maximum purity in a U.S. coin.

- Austrian Philharmonic: Minted in .9999 pure gold, this coin celebrates Vienna's famous orchestra. It dominates the European gold market and is highly recognized worldwide.

- Australian Kangaroo: This .9999 fine gold coin from the Perth Mint is unique for its annually changing reverse design featuring a kangaroo, attracting both investors and collectors.

Each of these coins offers a distinct blend of history, beauty, and investment value. At Summit Metals, we offer a diverse selection to help you find the right coin for your portfolio.

Understanding the Value of Your 1 oz Gold Coin

The value of a 1 oz gold coin is determined by more than just its weight. Understanding these factors helps you make smarter investment decisions.

The spot price is the foundationthe live market price for one troy ounce of raw gold. This is the baseline value of the metal in your coin. However, you will pay a premium over the spot price. This premium covers minting, distribution, and dealer costs. The good news is that 1 oz gold coins offer better value compared to spot price than smaller fractional coins because fixed costs are spread over more gold. For a full breakdown, read Understanding your bullion's premium.

Finally, consider melt value versus numismatic value. Melt value is the worth of the gold content alone. Most bullion coins trade near this value. Numismatic value applies to rare or historically significant coins, which can carry a much higher price tag for collectors. For wealth-building, most investors focus on bullion coins valued for their metal content.

Factors Influencing the Price of a 1 oz Gold Coin

The price of a 1 oz gold coin is dynamic, influenced by several key forces:

- Gold Spot Price Fluctuations: Gold trades 24/7, reacting to economic data, currency movements (especially the U.S. dollar), and interest rate changes.

- Supply and Demand: High demand for physical coins, especially during mint production slowdowns, can increase premiums.

- Geopolitical and Economic Uncertainty: Crises like wars, banking failures, or high inflation often drive investors toward gold as a safe-haven asset.

- Minting and Dealer Costs: Production complexity and dealer overhead are factored into the final premium. At Summit Metals, we use bulk purchasing to keep our premiums competitive.

Our guide on key factors influencing gold & silver prices explores these relationships in depth.

Purity, Composition, and Condition Explained

The characteristics of your 1 oz gold coin impact its value and investment potential.

- Purity and Composition: 24-karat (.999+ fine) coins like the Canadian Maple Leaf offer maximum purity but are softer and more prone to damage. 22-karat (.9167 fine) coins like the American Gold Eagle contain an alloy of silver and copper, making them far more durable for handling. Both types contain exactly one troy ounce of pure gold. Learn more about karats and purity in gold.

- Condition: Brilliant Uncirculated (BU) coins are new from the mint and are the standard for most investors. Cull condition coins have significant wear or damage and trade closer to their melt value. Graded coins have been professionally certified for authenticity and condition by services like PCGS or NGC and sealed in a protective "slab." A high grade (e.g., MS-70) commands a significant premium. To learn more about grading standards, consult established third-party grading services.

Your choice depends on your goals. BU coins offer the best balance of quality and value, while graded coins provide certified perfection for those seeking collectible quality.

Smart Strategies for Purchasing Your Coins

Acquiring a 1 oz gold coin is a significant financial step. A smart strategy begins with defining your investment goals (e.g., long-term inflation hedge vs. collection) and setting a budget. The 1 oz weight class offers better value compared to the spot price of gold than smaller coins, making it an efficient choice. For larger investments, consider bulk purchases in mint tubes (typically 20 coins) or "Monster Boxes" (500 coins), which can reduce the per-coin premium. Our guide on mastering bulk gold purchasing explains how to maximize value. Finally, plan for secure storage, whether in a home safe or a third-party depository. Our ultimate guide to precious metals storage covers your options.

How to Choose a Reputable Dealer and Buy Your 1 oz Gold Coin

Choosing the right dealer is the most critical step. A reputable dealer guarantees authenticity and fair, transparent pricing. While local shops offer in-person service, online dealers like Summit Metals often provide more competitive pricing and a wider selection due to lower overhead. We combine the convenience of online shopping with the trust you'd expect from a local business with roots in Wyoming and strong ties to Utah.

Always check a dealer's reputation through customer reviews and industry standing. Trustworthy dealers provide transparent pricing with no hidden fees. Most importantly, buying from an established dealer is your best defense against counterfeits, as they source products through secure, authorized channels. Our guide on identifying reputable bullion dealers offers essential tips.

Automate Your Investment with Dollar-Cost Averaging

Trying to "time the market" is a losing game. A smarter approach is dollar-cost averaging (DCA)—investing a fixed amount at regular intervals. This strategy averages out your purchase price, as you naturally buy more gold when prices are low and less when they are high.

Our Autoinvest program makes this easy, allowing you to set up recurring purchases of your favorite 1 oz gold coins, just like a 401(k)-style investment.

- Consistency: It removes emotion from buying and keeps you on plan.

- Mitigate Volatility: Spreading out purchases reduces the impact of market swings.

- Build Wealth Steadily: It's a proven, disciplined path to long-term financial security.

- Convenience: Set it once, and we handle the rest, ensuring you get priority access to fresh inventory.

Learn more about the power of dollar cost averaging and how our Autopays can work for you. Automating your purchases is one of the smartest strategies for long-term wealth preservation.

Frequently Asked Questions about 1 oz Gold Coins

As you consider investing in a 1 oz gold coin, some common questions likely come to mind. Here are concise answers to the most frequent concerns.

Is a 1 oz gold coin a good investment?

Yes. A 1 oz gold coin is a cornerstone of wealth preservation for several reasons. It's a proven hedge against inflation, a store of value during economic uncertainty, and an excellent tool for portfolio diversification, as gold often moves independently of stocks and bonds. Furthermore, the 1 oz weight class offers better value compared to the spot price of gold than smaller coins, and its high liquidity ensures you can easily convert it to cash worldwide. For a deeper dive, read is gold a good investment?.

Can I include 1 oz gold coins in my IRA?

Yes, many 1 oz gold coins can be included in a Precious Metals IRA, offering powerful tax advantages. The IRS requires gold to be at least .995 fine (99.5% pure). This means 24-karat coins like the Canadian Gold Maple Leaf and American Gold Buffalo qualify. The 1 oz American Gold Eagle coin is a notable exception; despite being 22-karat, it is specifically approved for IRAs due to its U.S. legal tender status. A critical rule is that IRA metals must be stored in an IRS-approved depository, not at home. We can help you steer the process of setting up a gold IRA. Explore how a gold IRA can fortify your financial future.

How do I know if my 1 oz gold coin is real?

Authenticity is paramount. Your best defense is to buy from a reputable dealer like Summit Metals. We guarantee the authenticity of every product, sourced through secure, verified channels. Our guide on identifying reputable bullion dealers is a must-read.

You can also perform simple tests:

- Weight and Dimension Test: Use a precise scale and calipers. An authentic coin's specifications are exact and publicly available.

- Magnet Test: Gold is not magnetic. A strong attraction to a magnet is a definitive red flag.

- Professional Verification: For ultimate certainty, services like PCGS or NGC can professionally grade and certify your coin's authenticity.

For more detailed methods, see our guide on how to tell if gold is real.

Conclusion

Your journey into 1 oz gold coin investing is about building a foundation of lasting financial security. The 1 oz gold coin stands out for its exceptional liquidity, better value over spot price, and proven role as a hedge against inflation and economic uncertainty. Whether you choose the durable American Gold Eagle, the pure Canadian Maple Leaf, or the historic South African Krugerrand, you are investing in a tangible, globally recognized asset backed by a sovereign government.

Smart investing requires choosing a reputable dealer who offers transparency and authenticity. At Summit Metals, we leverage our bulk purchasing power to provide competitive, real-time pricing on genuine precious metals. We are committed to helping Americans secure their financial futures.

For those looking to build wealth steadily, our Autoinvest program applies the power of dollar-cost averaging to precious metals. You can automatically purchase 1 oz gold coins monthly, removing emotion and market-timing stress from the process.

A 1 oz gold coin represents financial independence and the confidence that comes from holding a real asset. We invite you to take the next step. Start your gold investment journey with our strategic guides and find how simple building lasting wealth can be.