Why Silver Bullion Deserves a Place in Your Investment Strategy

Silver bullion is investment-grade physical silver, such as coins, bars, or rounds, valued for its metal content rather than collectible rarity. For centuries, it has served as both currency and a tool for wealth protection. Today, it remains one of the most accessible precious metals for investors seeking to shield their savings from economic uncertainty.

Quick Answer: Silver Bullion Essentials

- What it is: .999 or .9999 pure silver in coins, bars, or rounds

- Why buy it: Hedge against inflation, store of wealth, portfolio diversification

- Main forms: Government coins (legal tender, higher premiums), bars (lower premiums, efficient storage), rounds (privately minted, affordable)

- Key factors: Purity, weight, mint reputation, premium over spot price

- Storage: Home safe, bank deposit box, or third-party depository

Unlike paper assets, silver bullion is a tangible asset you can hold. It doesn't rely on a government's promise or a company's performance. When inflation erodes the dollar's purchasing power, silver typically maintains or increases its value. The metal also has a dual role; over half of the silver supply serves industrial uses in electronics, solar panels, and medical equipment, creating sustained demand that supports long-term price stability.

This guide walks you through the key factors in choosing silver bullion. You'll learn which forms offer the best value, how to identify reputable mints, what drives pricing, and how to store your investment securely. I'm Eric Roach, and with over a decade of experience in precious metals, I'll show you how to apply proven strategies to your silver bullion purchases.

What is Silver Bullion and Why is it a Valuable Asset?

Silver bullion is high-purity silver in a form designed for investmenttypically coins, bars, or rounds valued for their metal content. Unlike paper currency, which derives its value from government decree, silver possesses intrinsic value rooted in its physical properties and finite supply. This is why civilizations have long recognized it as a store of wealth.

For an independent overview of silver's role as an investment, see Silver as an investment.

Holding a tangible asset offers unique security. Physical silver bullion exists independently of bank networks or central bank policies. For portfolio diversification, precious metals often move independently of stocks and bonds. When the stock market tumbles, silver can stabilize your overall investment strategy. You can learn more about Why Gold and Silver: Understanding Their Value as Safe Haven Assets to build a more resilient portfolio.

Finally, industrial demand creates a powerful price floor. Approximately 56% of the global silver supply serves practical purposes in solar panels, electronics, and medical equipment. Silver isn't just a shiny metal people want; it's a material industries need.

The Role of Silver as an Inflation Hedge

When inflation rises and your dollars buy less, silver bullion tends to maintain or increase its purchasing power. This is why investors turn to precious metals for wealth preservation during periods of currency devaluation.

As central banks increase the money supply, the relative scarcity of silver makes it more valuable. Your ounces of silver don't lose their worth when a government prints more currency; they simply become worth more in those devalued currency terms. This pattern has repeated through decades of economic uncertainty, from the 1970s stagflation to the aftermath of the 2008 financial crisis. Amid modern concerns about banking stability, as explored in 63 Banks Near Collapse: Protect Your Wealth From the Looming Financial Crisis With Inflation-Proof Strategies, physical silver offers the same protective role.

Silver's Dual Role: Investment and Industry

What truly sets silver apart is its dual role as both an investment and a critical industrial commodity. While investment demand fluctuates with economic sentiment, industrial use provides steady, foundational demand.

- Electronics: Silver's exceptional conductivity makes it indispensable in smartphones, computers, and circuit boards.

- Solar Panels: Photovoltaic cells require silver paste to convert sunlight into electricity. As the world transitions to renewable energy, this demand is growing substantially.

- Medical Applications: Silver's natural antimicrobial properties are used in hospital instruments and wound dressings.

- Automotive: Electric vehicles, with their advanced electronics and battery systems, represent a growing source of silver demand.

This industrial backbone means that even when investment sentiment cools, there's constant practical demand supporting silver prices. This unique combination underscores Silver's Worth: A Deep Dive Into Precious Metal Value.

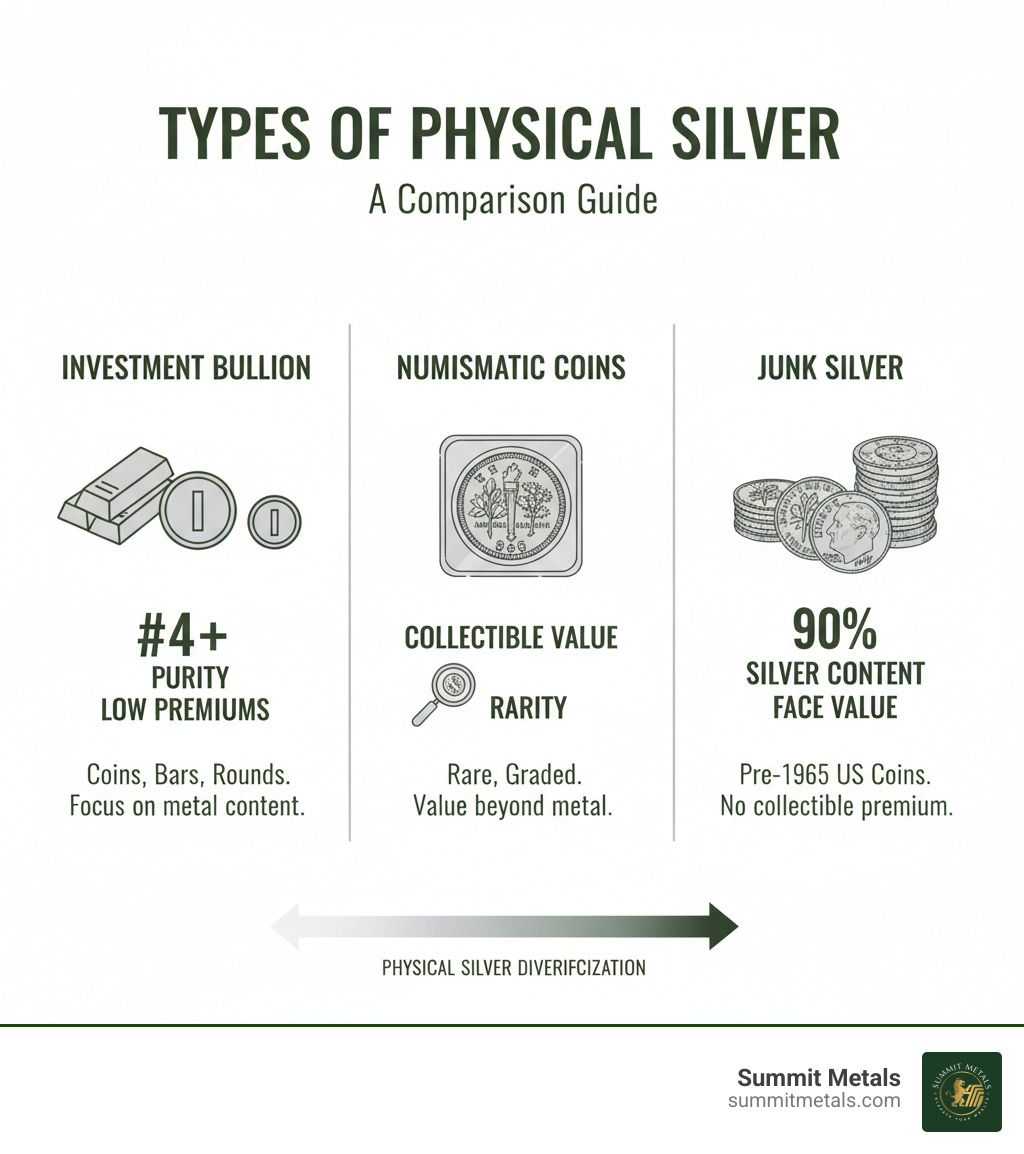

Comparing the Different Forms of Silver Bullion

When investing in silver bullion, you'll find three main forms: coins, bars, and rounds. Each offers distinct benefits, price points, and practical considerations. Understanding these differences helps you choose the form that best matches your investment goals.

To help you see these differences clearly, here's a side-by-side comparison:

| Feature | Silver Coins | Silver Bars | Silver Rounds |

|---|---|---|---|

| Premium over Spot | Generally higher | Often lowest | Moderate to low |

| Liquidity | Excellent (globally recognized) | Very good (standardized weights) | Good (depends on design/mint) |

| Stackability | Lower (can be bulky) | Highest (flat, uniform, efficient) | Moderate (can be stacked) |

| Government Backing | Yes (legal tender status) | Some (government mints), mostly private | No (privately minted) |

| Counterfeit Risk | Lower (advanced security features) | Moderate (less intricate designs) | Moderate (fewer security features) |

| Face Value Protection | Yes (provides a value floor) | No (valued by metal content) | No (valued by metal content) |

Quick Chooser: Coins vs. Bars

| Choose Silver Coins when you... | Choose Silver Bars when you... |

|---|---|

| Want maximum global recognition and easy resale | Want the lowest premium per ounce to maximize ounces |

| Value legal tender status and advanced anti-counterfeit features | Need efficient storage and larger formats (10 oz, 100 oz, kilo) |

| Prefer small, giftable, or tradable denominations | Are building a long-term stack focused purely on metal content |

| Appreciate a face value that adds a minimal floor and fraud protection | Plan to dollar-cost average larger amounts at the best price per ounce |

Key Characteristics of Silver Bullion Coins

Produced by national mints, silver bullion coins carry legal tender status in their country of origin. This government backing makes them globally recognized and highly liquid, providing a legal foundation that confirms authenticity and protects against fraud. This assurance comes at a cost, as coins typically carry higher premiums over the spot price.

Many coins, like the American Silver Eagle and Canadian Silver Maple Leaf, also have an element of collectibility. Mints often include advanced security features to combat counterfeiting, such as the Royal Canadian Mint's "Bullion DNA" technology. Learn more in our guides to American Eagle Coins and the Canadian Silver Maple Coin.

Understanding Silver Bullion Bar Options

For investors focused on maximizing their silver holdings while minimizing costs, silver bullion bars are the clear winner. Their main advantage is lower premiums over the spot price, as their simpler designs are less expensive to manufacture. If your goal is pure exposure to silver's price, bars are an excellent choice.

Their flat, rectangular shape also makes them incredibly stackable and space-efficient. Bars are available in various weights, from 1 oz and 10 oz up to 100 oz and 1-kilogram sizes, suiting different budgets. They come in two styles: cast bars (poured, rustic look, lowest premiums) and minted bars (cut and stamped, polished look, slightly higher premiums). Our Comprehensive Buyer's Handbook for Silver Bars can help you get started.

The Appeal of Silver Rounds

Silver rounds are privately minted, meaning they have no face value and are not legal tender. This results in a lower cost than coins, making them an excellent entry point for new investors. The primary appeal of rounds is the wide variety of designs available, as private mints have more creative freedom than government entities. This allows investors to curate a collection of beautiful pieces while still investing in .999 fine silver. While they lack the official recognition of coins, rounds from reputable private mints are easily traded. For more details, see our guide on Silver Round Prices.

A Buyer's Guide: Factors to Consider When Purchasing Silver

Before you start buying silver bullion, it's important to understand the key factors that determine value and quality. Empowering our investors in Utah and beyond with this knowledge is a core belief at Summit Metals.

Purity, Weight, and Design

These three elements are the foundation of any silver bullion purchase.

- Purity: Investment-grade silver is typically .999 fine (99.9% pure). Some mints, like the Royal Canadian Mint, offer .9999 fine silver, showcasing exceptional refining. The American Silver Eagle is .999 fine, and you can learn more in our guide, Eagle Eye on Value: Decoding the American Silver Eagle .999 Fine Silver.

- Weight: Silver is measured in troy ounces (about 31.1 grams). While 1 oz is common for coins and rounds, bars come in a wider range of sizes, including 5 oz, 10 oz, and 100 oz.

- Design: While beautiful designs can add collector appeal, the investment value comes primarily from the metal content. However, iconic designs like the American Silver Eagle are highly liquid. Some designs also include advanced security features, like microscopic markings or special finishes that prevent blemishes, adding another layer of trust to your investment.

Reputable Mints and Brands

Buying from reputable mints and brands is essential for ensuring authenticity and resale value. Bullion from recognized organizations commands better prices and is easier to sell because its quality is trusted worldwide. Key names include:

- U.S. Mint (American Silver Eagle)

- Royal Canadian Mint (Silver Maple Leaf)

- The Perth Mint (Kookaburra, Kangaroo series)

- PAMP Suisse (Famous for its "Lady Fortuna" bars)

- Valcambi Suisse (Known for high-quality Swiss engineering)

- Vintage brands like Engelhard and Johnson Matthey are also highly sought after.

Prioritizing reputable sources helps you avoid counterfeits and ensures your investment is solid. For more guidance, read our article on Identifying Reputable Bullion Dealers: Avoiding Counterfeits.

Understanding Pricing: Spot Price and Premiums

The price of silver bullion is determined by two components: the spot price and the premium.

The Spot Price is the live market price for one troy ounce of raw silver. It fluctuates constantly based on global supply and demand, economic data, and geopolitical events.

The Premium is the additional cost above the spot price. This covers manufacturing, distribution, and the dealer's overhead. Premiums vary based on:

- Form: Coins generally have higher premiums than bars or rounds.

- Brand: Products from major government mints often carry higher premiums.

- Size: Smaller items (e.g., 1 oz coins) have a higher premium per ounce than larger items (e.g., 100 oz bars).

- Market Conditions: High demand or supply shortages can increase premiums.

The final price is almost always "spot price + premium." As an investor, seeking products with lower premiums can help you accumulate more silver for your money. Online dealers like Summit Metals often offer competitive pricing due to lower overhead and bulk purchasing power. Learn more in our guides on How Precious Metals Pricing Works and How to Buy Gold and Silver Online Safely.

Smart Strategies for Investing and Storing Your Silver

Investing in silver bullion is a long-term strategy. To build a resilient portfolio, you need smart approaches that mitigate risk and ensure the security of your assets.

Building Your Portfolio with Dollar-Cost Averaging

Silver's price can be volatile, and timing the market is nearly impossible. That's where dollar-cost averaging is invaluable. Instead of investing a lump sum, you invest a fixed dollar amount at regular intervals (e.g., monthly or quarterly).

This simple approach means you buy more ounces when prices are low and fewer when prices are high. Over time, this averages out your purchase price and removes emotion from your investment decisions, mitigating the risk of buying at a temporary peak. It's the same steady, disciplined principle used in 401(k) contributions.

To make this easy, Summit Metals created the Autoinvest program. You can set up automatic monthly silver purchases, allowing your stack to grow consistently without having to watch the markets. It's a powerful way to put your wealth protection strategy on autopilot. Learn more about The Power of Dollar-Cost Averaging and How to Buy Gold and Silver Automatically.

Security and Storage Considerations

Deciding where to store your silver bullion is critical for security and peace of mind.

- Home Storage: A high-quality, bolted-down safe offers direct access. However, you are fully responsible for security and insurance. Standard homeowner's policies often have low limits for precious metals, so a separate rider is usually necessary.

- Bank Safe Deposit Boxes: These offer professional security at a bank. Access is limited to banking hours, and you must confirm that your holdings are properly insured, as bank insurance may not cover the contents.

- Third-Party Depositories: For substantial holdings or IRA metals, these specialized facilities offer the highest level of security. They provide 24/7 monitoring, full insurance, and regular audits. While there are storage fees, the professional security and comprehensive coverage are often worth the cost.

Regardless of your choice, proper insurance is non-negotiable. For a complete overview, read our guide on Top Storage for Silver: Best Practices for Safekeeping Your Investment.

Current Market Outlook and Trends

Understanding market forces helps you make informed decisions. Currently, several powerful trends are shaping silver's trajectory.

A sustained global supply deficit is a major factor. For several years, global consumption has outpaced production, tightening inventories and putting upward pressure on prices. At the same time, geopolitical influences and economic uncertainty continue to drive investors toward safe-haven assets like silver bullion.

The secret weapon for silver may be technological advancement. Unlike gold, silver is critical for modern industry. The green energy transition (solar panels), electric vehicles, and 5G networks all rely on silver's unique properties. This industrial demand creates a strong price floor.

When you combine a supply deficit with growing industrial use and its role as an inflation hedge, many experts see a bullish long-term outlook for silver. Stay informed on market dynamics and learn more about The Bullish Case for Silver.

Conclusion

We've covered the essential aspects of silver bullion, from its intrinsic value as a tangible asset to the practical details of investing. Silver is more than just a shiny metal; it's a powerful hedge against inflation, a key component in modern industry, and a timeless store of wealth.

We explored the unique benefits of coins, bars, and rounds, helping you align your choice with your investment goals. By focusing on purity, reputable mints, and understanding the relationship between spot price and premiums, you can make informed and confident purchasing decisions.

Long-term success is built on smart strategies like dollar-cost averaging—which our Autoinvest program simplifies—and securing your assets with proper storage and insurance.

At Summit Metals, we are dedicated to being your trusted partner. We offer transparent, real-time pricing and competitive rates, ensuring you receive exceptional value. We believe physical silver bullion is an indispensable part of a diversified portfolio, providing stability and growth potential in today's economic landscape.

Ready to take the next step? We invite you to Explore our extensive collection of silver bullion and build your path to financial resilience.