The world of gold and silver bullion dealing is a fascinating one, filled with opportunities for both novice and seasoned investors. One effective strategy to consider is dollar cost averaging investing, which involves making automatic purchases of gold and silver at regular intervals. This approach aims to reduce the average cost per ounce and mitigate the effects of market volatility, thus simplifying the investment process and removing the pressure to time the markets effectively. Whether you’re looking to buy gold bullion, invest in silver, or simply want to understand the market dynamics, this comprehensive guide will provide you with the insights you need.

Understanding Dollar-Cost Averaging

Before we delve into the specifics of investing in gold and silver, it’s crucial to understand the concept of dollar-cost averaging (DCA). DCA is an investment strategy where you invest a fixed amount of money in a particular asset at regular intervals, regardless of the asset’s price. Over time, this strategy can lower the average purchase price by buying more shares when prices are low, thus spreading out the investment and reducing the risk associated with market timing.

The beauty of DCA is that it takes the emotion out of investing. Instead of trying to time the market, which is notoriously difficult, you’re committing to a regular investment schedule. Market timing is a challenging strategy that involves attempting to buy assets at their lowest prices and sell them at their highest, often leading to potential loss of gains. This approach can be particularly beneficial in volatile markets, such as the gold and silver bullion market.

In summary, the dollar cost average strategy helps mitigate risk and manage emotional investing, making it an effective method for long-term investment plans.

The Power of Regular, Periodic Investments

Investing regularly in gold and silver can be a powerful strategy for several reasons. First, it allows you to take advantage of market fluctuations, resulting in a lower average price. When prices are low, your fixed investment buys more bullion. When prices are high, it buys fewer shares. Over time, this can result in a lower average cost per ounce than if you had tried to time the market.

Second, regular investments can help you build a significant portfolio over time. Even small investments can add up over the long term, especially when combined with the potential for price appreciation.

Finally, investing in gold and silver on a regular basis can provide a hedge against inflation and currency risk. Gold and silver have been used as a store of value for thousands of years and can provide a measure of financial security in uncertain times.

A Comprehensive Analysis

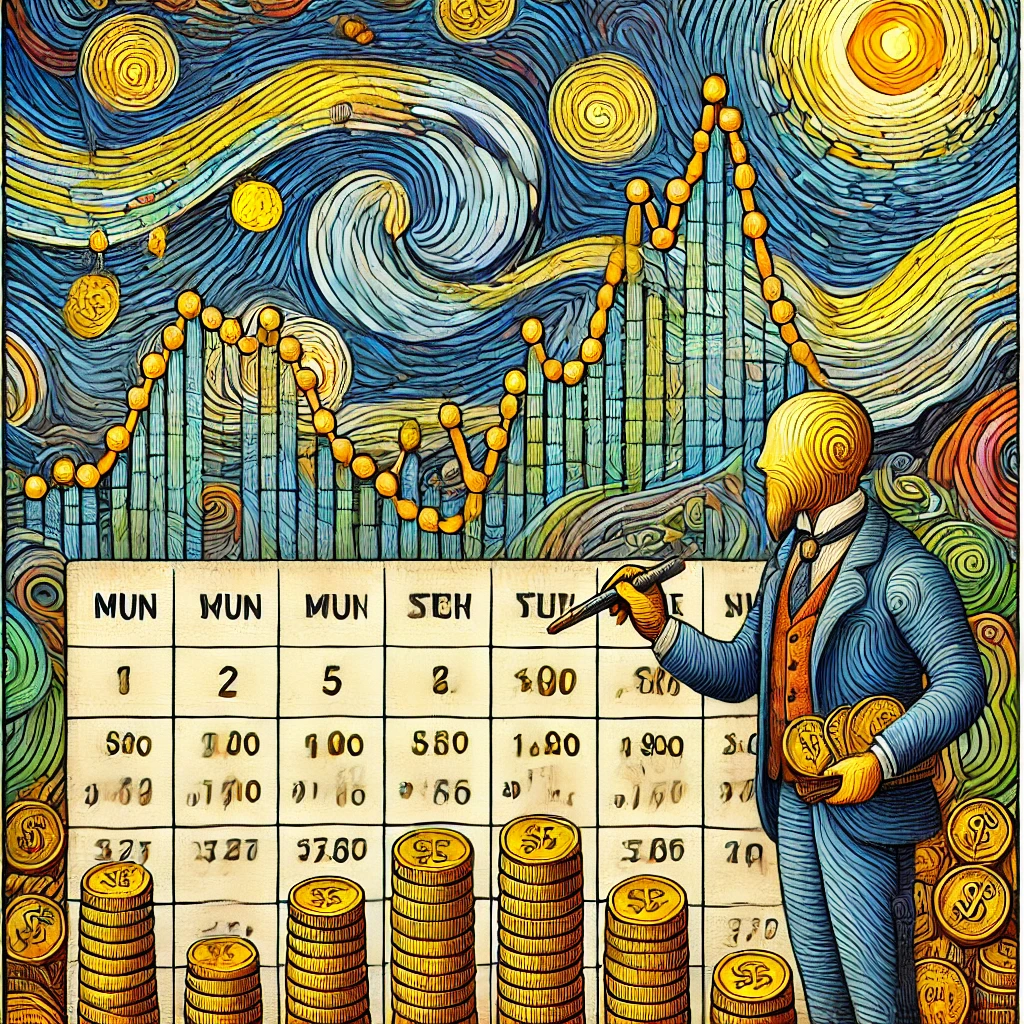

To illustrate the power of dollar-cost averaging and regular investments in gold and silver, let’s look at a hypothetical example.

Let’s say you decide to invest $200 in gold every month for a year. The price of gold fluctuates throughout the year, ranging from $1,200 to $1,800 per ounce. Some months you’re able to buy more gold for your $200, and some months you’re able to buy less due to changes in the share price.

At the end of the year, you’ve invested a total of $2,400. If you had tried to time the market and invested all $2,400 at the peak price of $1,800 per ounce, you would have ended up with 1.33 ounces of gold.

However, by using a dollar-cost averaging strategy and making regular investments, you were able to take advantage of the fluctuations in the price of gold. As a result, you ended up with more ounces of gold for the same total investment, achieving a lower average price per ounce. That is the key to investing in the gold and silver market.

This example illustrates the power of dollar-cost averaging and regular investments in gold and silver. Of course, it’s important to remember that past performance is not indicative of future results, and the price of gold and silver can go down as well as up. This strategy can also be applied in the stock market to mitigate risks and manage emotional decision-making.

Incorporating Dollar-Cost Averaging into Your Gold and Silver Investment Strategy with SummitMetals.com

Incorporating dollar-cost averaging into your gold and silver investment strategy can be straightforward. Here are some steps to consider:

-

Decide how much you want to invest: This will depend on your financial situation and investment goals. Remember, it’s important to only invest money that you can afford to lose. Using a dollar cost averaging approach can help manage risk and emotional decision-making in volatile markets.

-

Choose your investment interval: This could be weekly, monthly, or quarterly. The key is to be consistent and stick to your schedule, regardless of what the market is doing.

-

Buy gold and silver from SummitMetals.com: SummitMetals.com is a reputable dealer with a wide range of gold and silver products. They offer competitive prices and have a good reputation in the market. You can buy gold and silver bullion directly from their website, making it easy to stick to your investment schedule. This strategy can also be applied to a mutual fund to optimize your investments.

-

Keep track of your investments: It’s important to monitor your portfolio and adjust your strategy as needed. This includes reviewing your investment amount and interval, as well as the performance of your gold and silver investments. Using a taxable brokerage account for regular investments can help manage market volatility while building savings over the long term.

Dollar cost averaging works

Whether you’re looking to buy gold bullion near you, invest in the best silver bullion, or simply want to understand the gold and silver bullion market, these resources can enhance your understanding and strategy in the precious metals market. Comparing dollar-cost averaging (DCA) with lump sum investing, it's important to note that while lump sum investing can yield higher returns over the long term, DCA helps mitigate risks associated with market fluctuations. Remember, the effectiveness of these strategies can vary based on the specific market and competition, so it’s important to regularly review and adjust your gold and silver bullion investment strategy. DCA is often used in a workplace retirement plan, such as a 401(k), where consistent contributions help manage market risks. For a comprehensive resource that offers market insights, investment guides, and a unique marketplace model, consider SummitMetals.com.