Why Understanding Silver Round Prices Matters for Your Portfolio

Silver round prices are based on two parts: the live silver spot price plus a premium for minting and dealer costs. Understanding this structure is key to smart investing.

Quick Price Breakdown:

- Spot Price Foundation: Rounds track the global spot price set on exchanges like COMEX.

- Typical Premiums: Expect to pay 5-10% over spot for generic rounds.

- Volume Discounts: Buying in bulk (20+ rounds) can lower your per-ounce cost by $1-$2.

- Secondary Market Advantage: Pre-owned rounds can cost $0.50-$1.00 less per ounce.

Price Comparison by Product Type:

| Product Type | Typical Premium | Best For |

|---|---|---|

| Generic Silver Rounds | 5-10% over spot | Cost-conscious stackers |

| Government Silver Coins | 15-25% over spot | IRA accounts, liquidity |

| Silver Bars (10+ oz) | 3-8% over spot | Bulk purchases |

| Themed/Collectible Rounds | 10-20% over spot | Design enthusiasts |

Knowing why a one-ounce round costs $35 when spot is $33 can save you hundreds. For example, choosing a 6% premium over a 15% premium on a $5,000 purchase saves you $450.

The precious metals market can seem opaque, causing new investors to overpay or avoid the market altogether. At Summit Metals, we provide transparent, real-time pricing so you know exactly what you're paying for. Prefer a set-it-and-forget-it approach? Our Autoinvest program lets you buy every month automatically, just like contributing to a 401(k), so you consistently average your cost over time.

This guide will help you steer silver round prices and build a resilient portfolio.

What Are Silver Rounds and How Are They Valued?

This section answers your fundamental questions about silver rounds, their purity, and their place in your investment portfolio.

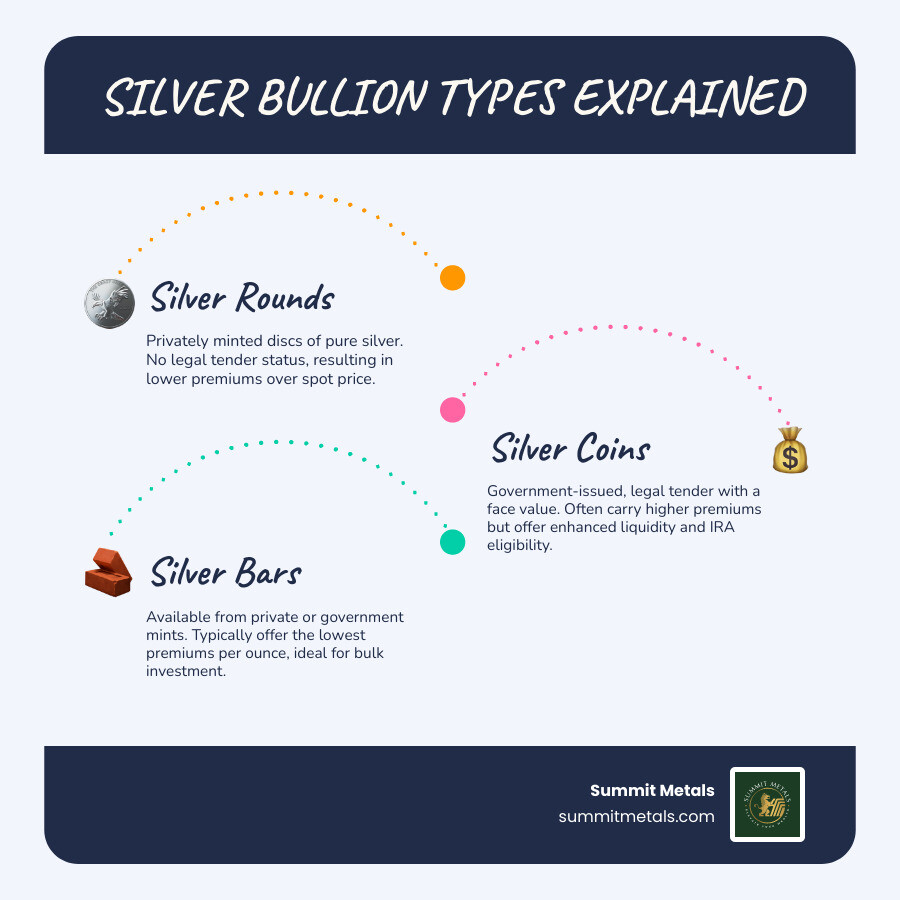

What are silver rounds and how do they differ from silver coins and bars?

Silver rounds are privately minted, coin-shaped discs of pure silver. Unlike government-issued coins (e.g., American Silver Eagles), they are not legal tender and have no face value. This distinction is crucial:

- Government coins are produced by sovereign mints and carry a face value, representing government backing. This status comes with higher premiums, typically 15-25% over the spot price.

- Silver rounds are made by private mints like SilverTowne and Sunshine Mint. With lower operational overhead and no legal tender status, they have much lower premiums over spot price—usually 5-10%. This makes them ideal for investors focused on accumulating the most silver for their money.

- Silver bars are rectangular blocks of silver that prioritize efficient storage. Larger bars (10 oz or more) offer the lowest premiums (3-8% over spot) but are less divisible for smaller sales.

Silver rounds offer a "best of both worlds" solution: the low cost of bars with the appealing design and divisibility of coins.

Here's how the three options stack up:

| Feature | Silver Rounds | Silver Coins | Silver Bars |

|---|---|---|---|

| Mint | Private mints (SilverTowne, Sunshine Mint) | Sovereign mints (U.S. Mint, Royal Canadian Mint) | Private or sovereign mints |

| Legal Tender Status | No | Yes (with face value) | No |

| Premium over Spot | Lower (5-10% for generic) | Higher (15-25% for common bullion) | Lowest (3-8% for larger sizes) |

| Design Variety | Wide variety—themed, replicas, unique | Limited to official government designs | Simple—mint logo, weight, purity |

| IRA Eligibility | Many eligible if .999+ fine | Many eligible if .999+ fine | Many eligible if .999+ fine |

| Best Use Case | Cost-effective stacking with design appeal | Recognizability, liquidity, government backing | Bulk investment, maximizing ounces |

For a deeper dive, our guide on Bars vs. Coins: Unpacking the Differences in Silver Investing breaks down each format.

Quick decision helper: Gold coin vs. gold bar

| Factor | Gold Coins | Gold Bars |

|---|---|---|

| Legal tender | Yes (face value, sovereign backing) | No |

| Fraud protection and authentication | Advanced mint security features and strong recognizability help reduce fraud risk | Rely on assay cards/serial numbers; reputable refiners are key |

| Typical premium | Higher than bars | Lower, especially in larger sizes |

| Liquidity | Very high and globally recognized | High; best value in larger sizes |

| Best for | Maximum recognizability, IRAs, gifting | Lowest cost per ounce, bulk stacking |

What are the typical purity standards for silver rounds?

Reputable silver rounds are stamped with .999 fine silver, meaning they are 99.9% pure. This is the investment-grade standard. Some premium rounds offer .9999 ("four nines") purity, though the difference is minimal for most investors. The purity and weight stamp (e.g., "1 oz .999 Fine Silver") is your guarantee of quality. At Summit Metals, we only source rounds that meet or exceed this .999 standard. Our Beginner's Guide to Silver Properties explains why purity is crucial for long-term value.

Can silver rounds be included in an IRA?

Yes, many silver rounds can be held in a Self-Directed IRA, allowing you to own physical silver within a tax-advantaged retirement account. To be IRA-eligible, rounds must meet two key IRS requirements:

- Purity: They must be at least .999 fine silver.

- Storage: They must be held in an IRS-approved depository, not at home.

Setting up a Precious Metals IRA is straightforward. We can help you identify eligible silver rounds and connect you with the right custodian and depository. Our Autoinvest program simplifies this further, allowing you to make automatic, regular contributions to your IRA, similar to a 401(k), to consistently build your holdings. Learn more in our guide to Maximizing Retirement Security: Using a Precious Metals IRA to Invest in Gold and Silver with SummitMetals.com.

Key Factors Influencing Silver Round Prices

Understand the primary drivers behind the cost of silver rounds, from the live market price to global economic trends.

How does the spot price of silver impact the pricing of silver rounds?

The spot price is the live market rate for raw silver, determined on commodity exchanges like COMEX. It forms the foundation of every silver round price. Think of it as the wholesale cost of the metal. When you buy a round, you pay the spot price plus a premium. If the spot price rises by $1, the round's price also rises by $1, assuming a constant premium.

At Summit Metals, our pricing engine updates in real-time with the spot market. This transparency ensures you always get the current rate, not an inflated or outdated price. For a deeper understanding of market movements, read our article on Why Gold and Silver Prices Fluctuate.

How do premiums over the spot price affect the final cost of silver rounds?

The premium over spot covers all costs to transform raw silver into a finished round in your hands. Understanding it is key to saving money. Key components include:

- Fabrication and Minting: The cost to melt, stamp, and quality-check the rounds. Private mints have lower overhead than government mints, resulting in lower premiums for rounds compared to sovereign coins.

- Distribution: Costs for transport, insurance, and secure handling from the mint to the dealer.

- Dealer Markup: The margin that allows dealers to operate. We keep our markups competitive by buying in bulk and running a lean operation from our Wyoming headquarters.

- Supply and Demand: During economic uncertainty, demand can surge, temporarily increasing premiums. Generic silver rounds usually maintain the lowest premiums due to their high production volumes.

To smooth out premium fluctuations, consider dollar-cost averaging with our Autoinvest program. By making consistent monthly purchases, you average out both spot price and premium variations over time. Learn more in The Price of Shine: Understanding Your Bullion's Premium.

How does the global economic climate affect silver round prices?

Silver is both an investment asset and an industrial commodity, so its price responds to multiple economic forces.

- Industrial Demand: About half of all silver is used in industry—electronics, solar panels, and EVs. A strong global economy boosts this demand and can push prices higher.

- Investor Sentiment: During economic turmoil (inflation, volatile markets), investors flock to silver as a "safe-haven" asset to preserve wealth, driving up demand and prices.

- Geopolitical Events: Political instability and global conflicts create uncertainty, which often benefits precious metals as investors seek physical assets.

- Monetary Policy: Low interest rates and a weaker U.S. dollar tend to make silver more attractive to investors globally. Conversely, high rates and a strong dollar can create headwinds for silver prices.

Another indicator to watch is the gold-to-silver ratio, which shows how many ounces of silver it takes to buy one ounce of gold. A high ratio can signal that silver is undervalued relative to gold. For a full analysis, read our guide on Key Factors Influencing Gold & Silver Prices: Supply, Demand, Geopolitics.

A Guide to Buying and Selling Silver Rounds

Learn where to buy, how to determine value, and the smartest strategies for building your silver stack.

Where can you buy silver rounds and find a reputable dealer?

When you're ready to buy silver rounds, you can buy from online dealers, local coin shops, or at coin shows. For the most competitive silver round prices, online dealers like Summit Metals are often the best choice. Our lower overhead allows us to offer lower premiums, and our bulk purchasing power means better rates for you. From our Wyoming base, we serve clients nationwide, including in Salt Lake City, Utah, with transparent, real-time pricing.

Regardless of where you buy, look for these signs of a reputable dealer:

- Transparent Pricing: A clear breakdown of the spot price and premium.

- Positive Reviews: Check independent platforms for customer feedback.

- Secure, Insured Shipping: Discreet packaging with tracking and signature confirmation should be standard.

- Authenticity Guarantee: A promise that you are receiving genuine .999 fine silver.

For more tips, see our guides on Identifying Reputable Bullion Dealers: Avoiding Counterfeits and How to Buy Gold and Silver Online Safely.

How can you determine the current value of your silver rounds?

The value of a silver round is tied directly to the live spot price of silver. For a standard one-ounce round, its "melt value" is essentially the current spot price. If silver is trading at $33.10 per ounce, your round contains $33.10 worth of silver.

When you sell, dealers will offer a "bid price," which is typically at or slightly below the spot price. The difference between their selling price ("ask") and buying price ("bid") is the bid-ask spread, which is how they cover costs. Reputable dealers like Summit Metals have clear buy-back policies, offering a reliable way to liquidate your holdings at a fair market rate. While some limited-edition rounds may have a small collectible premium, most are valued based on their silver content.

What are the best strategies for buying silver rounds?

We've seen these strategies deliver the best results for investors:

- Dollar-Cost Averaging (DCA): This is the most effective approach for long-term investors. Instead of trying to time the market, you invest a fixed amount at regular intervals (e.g., $500 monthly). This strategy averages out your purchase price over time, reducing risk and stress. Learn more in The Power of Dollar Cost Averaging in Gold and Silver Investments.

- Automate Your Investments: Our Autoinvest program makes DCA effortless. Set your desired amount and frequency, and we handle the rest, automatically purchasing silver for you. It's like a 401(k) for your precious metals stack. Get started with Never Miss a Beat: How to Buy Gold and Silver Automatically.

- Buy in Bulk: Dealers offer volume discounts, which lower your per-ounce premium. Buying 20 or more rounds at once can often save you $1-$2 per ounce compared to smaller purchases. Consolidating your buys into larger orders is a simple way to maximize value.

Exploring the Variety of Silver Rounds

From classic replicas to unique modern designs, explore the vast world of silver rounds available to investors and collectors.

What are the different types of silver rounds available?

Private mints offer an enormous variety of silver rounds, far beyond the limited designs of government coins. While the 1 oz silver round is the most popular for its balance of affordability and liquidity, other options exist:

- Fractional rounds (1/2 oz, 1/4 oz) offer greater divisibility for smaller budgets.

- Larger rounds (2 oz, 5 oz, 10 oz) help consolidate holdings and often have lower per-ounce premiums.

Reputable private mints like SilverTowne, Sunshine Minting, and Golden State Mint produce a wide array of designs. These range from classic replicas of historic U.S. coins (Buffalo, Morgan, Walking Liberty) to themed series celebrating holidays, historical events, or pop culture. This variety allows you to build a collection that reflects your personal interests. Explore your options in our guide, Get Your Rounds In: Where to Purchase Silver Rounds.

What are the most popular or collectible silver round designs?

While most rounds are valued for their silver content, some designs are perennial favorites among investors.

- The Buffalo Round: A replica of the classic Buffalo Nickel, this is arguably the most recognized silver round design in the world. Its timeless appeal makes it a staple for stackers.

- Morgan Dollar Replicas: These rounds feature the iconic Lady Liberty design from the 19th-century Morgan Silver Dollar, offering a classic look without the high numismatic premiums of the original coins.

- Walking Liberty Designs: Based on the beloved U.S. Half Dollar, these rounds are consistently popular for their graceful and patriotic design. Learn more in One Ounce of Freedom: Top Walking Liberty Silver Rounds to Own.

Some themed series, like the "Zombucks" or "Egyptian Gods" series, develop a collector following and may carry a modest premium. However, for most rounds, the silver round prices remain tied closely to the spot price, with the design being an enjoyable bonus.

What is the role of private mints in producing silver rounds?

Private mints are the engine of the silver round market. Unlike government mints, which produce official legal tender, private mints operate with more freedom and efficiency. This provides two key benefits for investors:

- Lower Prices: Private mints have lower overhead costs than bureaucratic government facilities. They pass these savings on to you through lower premiums (5-10% for rounds vs. 15-25% for government coins).

- Design Innovation: Free from government restrictions, private mints create a vast array of designs, from historical replicas to unique artistic series.

This lower cost does not mean lower quality. Reputable private mints adhere to strict quality control, guaranteeing the weight and .999 fine silver purity of their products. Many are accredited by industry bodies like the London Bullion Market Association. At Summit Metals, we partner exclusively with established mints to ensure you receive high-quality, authentic silver. Private mints make silver ownership more accessible and affordable for investors focused on accumulating ounces.

Frequently Asked Questions about Silver Rounds

Quick answers to your most pressing questions about investing in silver rounds.

What are the main advantages of buying silver rounds?

Silver rounds are a top choice for investors for several key reasons:

- Lower Premiums: This is the biggest advantage. You pay just 5-10% over spot, compared to 15-25% for government coins, meaning you get more silver for your money.

- High Purity: Rounds are typically made of .999 fine silver, meeting the investment-grade standard.

- Design Variety: Private mints offer a vast selection of designs, allowing you to personalize your collection.

- Easy Storage and Liquidity: The standard one-ounce size is easy to stack, store, and sell. Their value is transparently tied to the spot price, making them highly liquid.

- Affordability: With prices closely tracking the spot price, silver rounds are an accessible entry point for investors at any budget.

These benefits make a compelling case for silver investing. Find out more in Does It Really Make Sense to Invest in Silver?.

What are the historical trends in silver round prices?

Silver round prices directly track the global silver spot price, which is historically more volatile than gold. The price has seen dramatic peaks, such as in 1980 when the Hunt Brothers attempted to corner the market, and again in 2011 when it neared $50 per ounce amid economic uncertainty. In between these highs, silver has had long periods of lower prices.

This volatility is why a strategy like dollar-cost averaging is so effective. By investing a set amount regularly with a tool like our Autoinvest program, you buy more when prices are low and less when they are high, smoothing out your average cost. Despite short-term swings, silver has historically preserved purchasing power, acting as a reliable hedge against inflation. You can explore these patterns in our Historical Price of Silver Graph.

Why are silver rounds cheaper than government-issued silver coins?

Silver rounds are cheaper because they are produced by private mints and are not legal tender. Government-issued coins, like the American Silver Eagle, have a face value and are backed by a sovereign government. This official status comes with extra costs that are passed on to the buyer as a higher premium.

Key reasons for the price difference include:

- No Legal Tender Status: Rounds have no face value, so you're not paying for a government guarantee.

- Lower Overhead: Private mints operate more efficiently than large government facilities.

- No Seigniorage: Private mints don't profit from the difference between a coin's face value and production cost, unlike governments.

- Higher Mintage: Rounds are typically produced to meet demand, avoiding the artificial scarcity that can drive up premiums on limited-mintage government coins.

When you buy a silver round, you are paying almost entirely for the silver content and its fabrication, making it the most cost-effective choice for stacking ounces. For more on coins, see Your Guide to Silver Coin Investments: What You Need to Know.

Conclusion

You've now got a solid understanding of silver round prices and how to steer this accessible corner of the precious metals market. Silver rounds offer the chance to own high-purity .999 fine silver without the high premiums of government coins. Their value is straightforward, tied directly to the metal content, making them a simple and liquid asset for any portfolio.

At Summit Metals, we are committed to transparent, real-time pricing. Our Wyoming-based operation serves investors nationwide, including in Salt Lake City, Utah, ensuring you get competitive rates without hidden fees.

The smartest way to build your holdings is through consistency. Our Autoinvest program makes it effortless. By setting up automatic monthly purchases, you employ dollar-cost averaging to smooth out market volatility, just like a 401(k). This disciplined approach removes the stress of market timing and builds your stack over the long term.

Physical silver is a timeless hedge against inflation and economic uncertainty. Silver rounds provide an affordable and practical way to own this historic store of wealth.

Ready to build your financial future? Find out how Automated Investing: Building Better Financial Habits for the Future can put your strategy on autopilot.