Why Understanding Premium Over Spot Matters for Your Investment

When you see gold trading at $2,650 per ounce but dealers are selling coins for $2,750, you're looking at the premium over spot—the extra cost above the raw metal's market price. This isn't a dealer trying to rip you off; it's the real cost of owning physical precious metals.

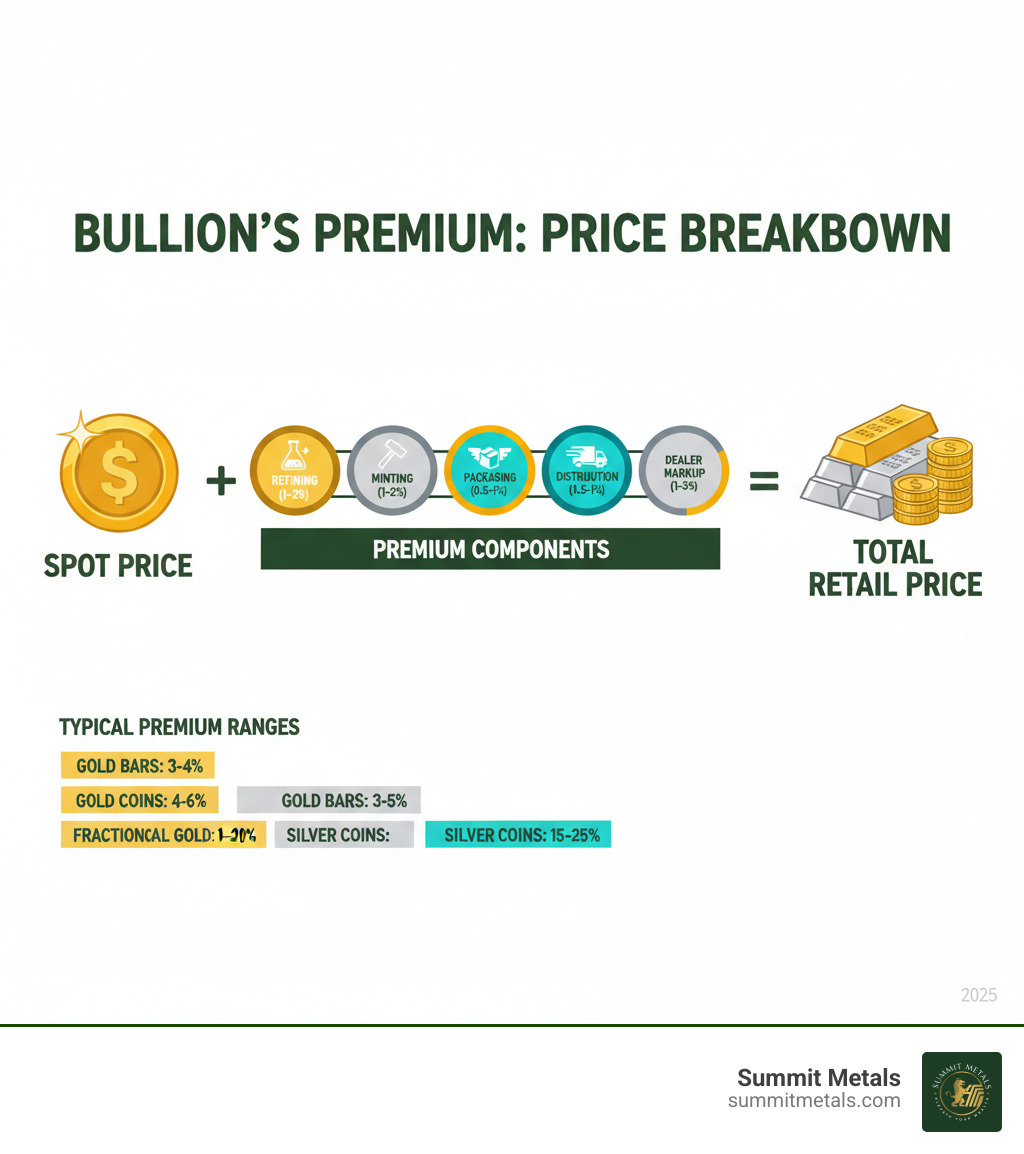

Premium over spot explained:

- Spot price = Current market price for raw precious metals

- Premium = Additional costs for refining, minting, packaging, and distribution

- Total price = Spot price + Premium = What you actually pay

Here's what creates that premium:

- Production costs - Refining ore, minting coins, quality assurance

- Logistics - Secure packaging, insured shipping, storage

- Market forces - Supply shortages, demand spikes, economic uncertainty

- Product type - Coins cost more than bars, fractional pieces cost more per ounce

Typical premium ranges:

- Gold bars: 3-4%

- Gold coins: 4-6%

- Silver bars: 3-5%

- Silver coins: 15-25%

- Fractional gold: 15-20%

The key is knowing what's fair and what's inflated pricing designed to pad dealer profits.

I'm Eric Roach. After a decade on Wall Street, I learned that understanding premium over spot is crucial for any precious metals investor. Today, I help people like you steer these pricing complexities to build wealth with physical gold and silver.

Deconstructing the Price: Spot vs. Premium

Understanding the difference between spot price and premium over spot is the key to smart precious metals investing. Think of it as wholesale versus retail—it's essential for making informed decisions.

What is the Spot Price?

The spot price is the live market price for one troy ounce of a raw precious metal, like gold or silver, for immediate delivery. It's the baseline wholesale value, determined by trading on major commodity exchanges like COMEX and the LBMA.

This price changes constantly during trading hours based on economic news, currency fluctuations, and investor sentiment around the world.

Paper vs. Physical Markets

The spot price you see on the news primarily reflects the "paper" market—futures contracts and other derivatives. The physical market, where investors buy tangible coins and bars, uses the spot price as a starting point. However, the final price is also affected by the real-world supply and demand for tangible products. A shortage of physical silver coins, for instance, will drive their premiums up even if the paper spot price is flat.

As buyers of physical metal, we are "price takers" who start with the wholesale spot price and add the real-world costs of creating a finished product.

What is the Premium Over Spot?

The premium over spot covers all the real-world costs of changing a raw commodity into a finished, investable product. These costs include refining, minting, authentication, packaging, insurance, and delivery.

The Bid-Ask Spread

Dealers operate on a bid-ask spread. The "bid" is the price they will pay to buy metal from you, and the "ask" is the price they will sell it for. The spot price typically falls between these two numbers. This spread covers the dealer's costs, market risk, and operational overhead.

Why You Can't Buy at Spot Price

Simply put, you can't buy at spot price because it's a wholesale commodity price, not a retail price for a finished product. As we explain in our guide on Spot Price vs. Premium: How Precious Metals Pricing Works, the journey from raw metal to an investment-grade product involves real costs.

The premium over spot isn't just a markup; it's what makes the physical precious metals market possible.

What Factors Create the Premium Over Spot?

The premium over spot isn't a single markup. It's a collection of costs that turn raw metal into an investment-grade product. Each step in the process adds a layer to the final price you pay.

From Mine to Mint: Production and Logistics Costs

The journey from raw ore to a finished coin involves significant expense, all of which contributes to the premium:

- Refining: Purifying raw ore into .999 or .9999 fine metal.

- Minting & Fabrication: Creating coins and bars, a process that ranges from simple casting to complex, high-pressure striking for coins.

- Assaying & Certification: Verifying the weight and purity of every product to guarantee quality.

- Packaging: Using tamper-evident packaging (TEP) to ensure authenticity and protect the product.

- Logistics & Security: Covering the costs of armored transport, secure storage, and insurance from the mint to your door.

Even large institutions like central banks face these same fundamental costs, as detailed in Why Central Banks Buy Gold and Why You Should Too: A Look Into the Power of Physical Gold.

Market Forces: The Impact of Supply and Demand

While production costs set a baseline premium, market forces can cause premiums to swing dramatically.

- Demand Surges: During times of economic uncertainty, investor demand for physical metals can overwhelm supply, pushing premiums higher.

- Supply Constraints: Mints have physical limits on how many coins they can produce. When demand outstrips this capacity, premiums rise.

- Economic & Geopolitical Events: As discussed in The Interplay of Interest Rates, the Dollar, and Gold Prices, macroeconomic factors influence both spot prices and premiums. News like the Fed projecting fewer rate cuts can shift sentiment quickly.

During the 2008 financial crisis, for example, premiums on American Silver Eagles soared to over 100%. While silver's spot price was under $10, coins sold for $20 or more because mints couldn't keep up with demand.

The Final Mile: Dealer Markups and Product Uniqueness

The last components of the premium relate to the dealer's business and the specific attributes of the product.

- Dealer Overhead: Reputable dealers have significant costs, including secure vaults, specialized insurance, technology, and knowledgeable staff. Their markup, often thin on bullion, covers these costs and the risk of holding volatile inventory.

- Numismatic Value: This collector value can increase premiums. Factors like rarity, historical significance, and condition can make a coin worth more than its metal content alone. A rare, graded coin is valued for more than just its weight in gold.

Understanding these forces is key to building a strong portfolio, a topic we explore in Maximizing Your Investment in a Chaotic Global Economy: Why Gold and Silver Are Essential for Portfolio Diversification in 2024.

A Buyer's Comparison: Premiums on Coins, Bars, and Rounds

When shopping for physical precious metals, the type of product you choose has a major impact on the premium over spot you'll pay. Each serves a different purpose for investors.

Understanding the Premium Over Spot on Different Product Types

- Bars offer the lowest premiums. Their simple manufacturing process makes them the most cost-effective way to accumulate the maximum amount of metal for your money.

- Coins have higher premiums due to the costs of intricate minting, but they offer unique benefits. Government-issued coins like American Eagles are backed for weight and purity, have legal tender status, and are globally recognized, making them highly liquid and secure.

- Rounds are a middle ground. These privately minted, coin-shaped products often feature attractive designs at a lower premium than government coins, but without the legal tender status.

Here's how these options stack up:

| Product Type | Bullion Coins | Bullion Bars | Bullion Rounds |

|---|---|---|---|

| Typical Premium | 4-6% gold, 15-25% silver | 3-4% gold, 3-5% silver | Between bars and coins |

| Legal Tender | Yes (face value protection) | No | No |

| Government Backing | Yes | No | No |

| Fraud Protection | Excellent | Good | Good |

| Liquidity | Highest | High | Moderate |

| Best For | Balanced investment approach | Maximum metal accumulation | Entry-level investors |

The benefits of owning gold coins, such as their face value and government guarantee, provide an extra layer of security and trust that many investors find justifies the higher premium.

Size Matters: How Weight Influences Your Premium

A fundamental rule of bullion is that smaller products carry a higher percentage premium. The fixed costs of manufacturing and handling are spread over less metal, increasing the per-ounce cost.

- Fractional pieces (e.g., 1/10 oz or 1/4 oz) are accessible but have high premiums, sometimes 15-20% or more. You can see this reflected in the Gold Price Today in USA Per Gram.

- One-ounce products are the most popular choice, offering an excellent balance of low premiums (typically 3-6% for gold) and high liquidity.

- Larger bars (e.g., 10 oz or Kilo) have the lowest percentage premiums, making them efficient for large-scale investors, but they offer less flexibility when selling.

Gold vs. Silver: A Tale of Two Premiums

Silver premiums are consistently higher than gold premiums as a percentage, and it comes down to simple math. The fixed dollar cost to mint and handle a one-ounce coin is similar for both metals. However, that fixed cost represents a much larger percentage of silver's lower spot price.

For example, a $3 fabrication cost is 15% of a $20 silver coin but only 0.15% of a $2,000 gold coin. The bulkier nature of silver also adds to shipping and storage costs, further contributing to its higher premium. This doesn't make silver a bad investment; it's just a mechanical reality of the market, as we explore in The Midas Touch: Exploring the Benefits of Gold Investment.

Investing Smarter: How to Steer Premiums Like a Pro

Knowing what drives the premium over spot is the first step. Using that knowledge to invest wisely is the next. Success hinges on identifying fair prices and investing with consistency.

Identifying a Fair Deal and Avoiding Scams

Knowing typical premium ranges helps you spot a fair deal. For standard 1 oz gold products, a 3-6% premium is reasonable. For silver, expect 3-5% for bars and 15-25% for popular coins.

Beware of dealers who "pad the spot price." They may advertise a low premium but inflate the spot price they show you to hide their true markup. Always verify the live spot price on an independent financial site before buying. Focus on the final, all-in price you pay.

At Summit Metals, we provide transparent, real-time pricing. Our bulk purchasing power allows us to offer competitive rates to investors from our Wyoming base to customers in Salt Lake City and across the nation.

As we cover in Gold Price: Why Waiting to Buy Could Cost You, trying to time the market is less effective than finding a fair price and getting started.

The Power of Consistency: Dollar-Cost Averaging with Autoinvest

Instead of trying to time the market, smart investors use dollar-cost averaging: investing a fixed dollar amount on a regular schedule. This strategy smooths out your average cost per ounce over time, as you automatically buy more metal when prices are low and less when they are high.

Automating this process removes emotion and indecision from your investment plan. This is why we created our Autoinvest program at Summit Metals. It allows you to set up recurring purchases, building your precious metals position automatically each month, just like contributing to a 401k.

This disciplined approach helps you build your position over time without the stress of making one large purchase at the perfect moment. You can learn more in our guide, The Power of Dollar Cost Averaging in Gold and Silver Investments.

Ready to start? You can set up your automated investment plan with Autoinvest at Summit Metals and begin building your precious metals wealth today.

Frequently Asked Questions about Premium Over Spot

Here are straight answers to some of the most common questions we hear about premium over spot.

What is a reasonable premium for a 1 oz gold coin?

For a standard 1 oz government-minted gold coin like an American Gold Eagle or Canadian Maple Leaf, a fair premium is typically in the 3-6% range. This can fluctuate with market demand and supply. The premium is justified by the coin's government guarantee of weight and purity, its legal tender status, and its high liquidity worldwide.

At Summit Metals, we use our bulk purchasing power to offer our customers highly competitive rates, and we personally aim for premiums under 5% on full-ounce gold coins.

Why are silver premiums often higher than gold premiums as a percentage?

Silver's spot price is much lower than gold's, but the fixed dollar costs of minting, handling, and storing a one-ounce coin are similar for both. This fixed cost represents a much higher percentage of silver's total price. For example, a $3 production cost is a small fraction of a $2,000 gold coin's price but a significant portion of a $25 silver coin's price. It's not about dealer greed; it's mathematical reality.

Is it ever possible to buy physical precious metals at the spot price?

No, it's not possible for retail investors to buy physical metals at spot price in a standard transaction. The premium covers the real, unavoidable costs of production and distribution.

While a dealer might occasionally run a limited-time, loss-leader promotion at or near spot to attract customers, be wary of any offer that seems too good to be true, as it could indicate fraud or hidden fees. The security of buying authenticated metals from a reputable dealer is worth the fair premium.

Instead of chasing impossible deals, focus on consistent investing. Our Autoinvest program lets you use dollar-cost averaging to build your holdings steadily over time, smoothing out both spot price and premium fluctuations.

Conclusion: Making an Informed Investment

That gap between the spot price on the news and the dealer's price is the premium over spot. It's not a hidden fee; it's the legitimate cost of turning raw metal into a tangible, secure investment you can hold. The premium covers everything from refining and minting to insured shipping.

Understanding these drivers empowers you as an investor. You can now spot a fair deal, recognize when a price is inflated, and know why different products carry different premiums. Most importantly, you can choose products that match your goals—whether that's accumulating maximum ounces with low-premium bars or enjoying the security of government-backed coins.

Market forces will always cause premiums to fluctuate, but with this knowledge, you can steer those changes without making emotional decisions.

Smart investing is a long game. That's why many of our customers use our Autoinvest program. It automates your purchases, allowing you to dollar-cost average your way to a strong precious metals position without the stress of timing the market. It's a disciplined approach to building wealth, just like contributing to a 401k.

At Summit Metals, we've built our business on transparent, real-time pricing and competitive rates. No games, no hidden fees. The price you see is the price you pay.

Now you're equipped to invest with confidence. Ready to put this knowledge to work? Learn what gold and silver is best for your portfolio and start building your financial future today.