When you see the gold price today in the USA per gram, you're looking at what's called the "spot price." Think of it as the live, up-to-the-minute cost for one gram of pure, 24-karat gold that’s ready for immediate delivery. This isn't a price that gets set once a day; it’s constantly on the move, shifting with every trade made across the globe.

Understanding the Gold Spot Price

The gold spot price behaves a lot like a stock traded on the NASDAQ. It's a global benchmark, shaped by the endless stream of buy and sell orders flowing through major commodity exchanges, from New York's COMEX to the prestigious London Bullion Market. This constant activity means the price instantly reacts to everything from real-time supply and demand shifts to major geopolitical news and fresh economic data.

Essentially, the spot price is the baseline value for pure, raw gold before it's turned into a coin, bar, or piece of jewelry.

Here’s a crucial detail, though. While you might be searching for the gold price today in the USA per gram, you'll almost always see it quoted in a different unit: the troy ounce. The troy ounce is the gold industry's standard, and it's the number you'll see splashed across financial news headlines.

Converting Troy Ounces to Grams

So, how do you get from the standard troy ounce price to the per-gram price you care about? It just takes a little bit of simple math. But first, it’s important to know you're not dealing with the same kind of ounce you use for cooking.

A troy ounce, the standard for precious metals, is a bit heavier than the common "avoirdupois" ounce. One troy ounce equals 31.103 grams, while a standard ounce is only about 28.35 grams.

To figure out the price per gram, you take the current spot price per troy ounce and simply divide it by 31.103.

For example, if gold's spot price is $2,300 per troy ounce, the price per gram is right around $73.95 ($2,300 ÷ 31.103). This simple formula is the key to unlocking the true value of gold in smaller increments, which is especially useful when looking at jewelry or smaller investment bars. Getting comfortable with this conversion is the first step toward becoming a much smarter gold buyer.

To make things even easier, here’s a quick guide to the most common weight measurements you'll encounter when dealing with gold.

Quick Gold Measurement Conversion Guide

|

Unit |

Grams (Approx.) |

Common Use |

|---|---|---|

|

Gram (g) |

1 g |

The base unit for smaller items like jewelry and fractional bullion. |

|

Troy Ounce (ozt) |

31.103 g |

The global industry standard for pricing and trading gold bullion. |

|

Kilogram (kg) |

1,000 g |

Used for large institutional and central bank gold bars. |

|

Pennyweight (dwt) |

1.555 g |

An older unit sometimes still used for pricing scrap gold. |

Keeping these conversions handy will help you quickly assess the value of gold no matter how it's presented, from a tiny gold nugget to a hefty investment bar.

How Global Markets Set the Daily Gold Price

The gold price today in USA per gram isn't pulled out of thin air or dictated by a committee. It’s the result of a massive, non-stop global auction. A good way to picture it is a worldwide relay race, where the baton of gold trading is passed continuously from one major financial center to the next as the sun moves across the globe.

This constant churn of activity happens across two main arenas: the over-the-counter (OTC) market and the major futures exchanges. They each have a unique job, but they're deeply connected and constantly influence one another to create the live price you see.

The biggest player in the OTC world is London, overseen by the London Bullion Market Association (LBMA). This is where the heavyweights—central banks, refineries, and huge bullion dealers—trade directly with each other. We’re not talking about a few coins here; these are monumental deals for physical gold bars that establish a foundational wholesale price for the rest of the world.

The LBMA holds a special auction twice every business day, known as the LBMA Gold Price. Think of it as a global "price check" that provides a trusted reference point for all sorts of contracts and trades, affecting everything from multi-ton bank deals down to the cost of a single gram.

The Role of Futures Exchanges

While London's heart beats to the rhythm of physical gold, New York’s COMEX exchange is the undisputed king of gold futures contracts. A futures contract isn’t about trading gold today; it's a binding promise to buy or sell gold at a set price on a specific date in the future.

So, why does this matter? Because these contracts give everyone from hedge funds to jewelry makers a way to manage risk or bet on where the price is headed. A jewelry business, for example, might buy a futures contract to lock in today's gold price for a shipment they need in three months. This protects them from any sudden price spikes.

All this trading activity on futures creates a powerful indicator of market sentiment. When traders are buying up futures, it signals they expect the price to rise, which can push the current spot price higher.

How East and West Influence Price

The gold market truly never sleeps. Its center of gravity just shifts around the world over a 24-hour cycle, and major price swings often happen when these regional markets overlap.

Here’s a simplified look at the daily flow:

-

Asian Markets: The trading day kicks off in places like Shanghai and Tokyo. Strong early demand from this region, which has a huge appetite for physical gold, can set an upward trend for the entire day.

-

European Markets: As London traders get to their desks, trading volume explodes. This is when the crucial LBMA price benchmarks are set, drawing the market's full attention.

-

US Markets: Finally, New York logs on, and the spotlight shifts to the COMEX. The period when London and New York are both open (usually 8:00 AM to 12:00 PM EST) is typically the busiest, most liquid, and often most volatile part of the trading day.

This round-the-clock, interconnected system means the gold price is always reacting to new information, whether it’s an economic report from the U.S. or shifting consumer demand in China. The gold price today in USA per gram is the living, breathing result of this complex global dance.

Economic Forces That Move the Price of Gold

The daily shifts in the gold price today in USA per gram are rarely random. They're direct reactions to powerful economic forces that sway investor mood and alter the metal's appeal. If you want to understand why gold’s value changes—often in ways that seem to defy the logic of other markets—you need to understand these drivers.

Think of the financial world as a massive ocean. Four key factors act as powerful currents, each capable of pushing the price of gold higher or pulling it lower. These forces are inflation, interest rates, the strength of the U.S. dollar, and the buying (or selling) habits of central banks.

Inflation a Declining Dollar

Inflation is probably the most well-known driver of gold demand. When the cost of living goes up, every dollar in your pocket buys a little less than it did yesterday. This slow erosion of purchasing power sends investors looking for a safe harbor—an asset that can preserve their wealth. Historically, gold has earned a reputation as a reliable "wealth life raft" during these inflationary storms.

As the value of paper currency like the U.S. dollar falls, the intrinsic value of a finite, physical asset like gold tends to rise. It’s not necessarily that gold becomes more valuable on its own, but rather that it takes more of those devalued dollars to buy the same amount of gold.

This relationship works like a classic economic see-saw. When investors start to worry about rising inflation, they often flock to gold, which drives up demand and its price. This is a big reason why so many people see gold as a fundamental hedge against economic trouble. For a more detailed look, you can explore our guide explaining the reasons why gold and silver prices fluctuate.

The Federal Reserve and Interest Rates

Another huge factor is the monetary policy set by the U.S. Federal Reserve, especially its decisions on interest rates. Gold is what’s known as a non-yielding asset; unlike a savings account or a government bond, it doesn't pay you interest just for holding it.

This fact sets up a direct competition for an investor's money.

-

When interest rates rise: Assets that pay interest, like bonds, suddenly look a lot more attractive. Why hold a lump of non-yielding metal when you can earn a safe, predictable return elsewhere? This often leads to lower demand for gold and a falling price.

-

When interest rates fall: The opposite is true. Bonds and savings accounts offer meager returns, which lowers the "opportunity cost" of owning gold. In this kind of low-rate environment, gold's primary job as a store of value shines, and demand often pushes the price higher.

The Power of the US Dollar

Since gold is priced globally in U.S. dollars, the strength of the dollar itself has a direct and inverse effect on its price. Think about it: when the dollar gets stronger compared to other world currencies, it takes fewer dollars to buy one ounce of gold. The result? The dollar price of gold falls.

On the flip side, when the U.S. dollar weakens, you need more dollars to buy that same ounce of gold, which pushes its price up. This is why you'll often see gold prices climb when the U.S. Dollar Index (DXY) drops, and vice versa. It’s a constant tug-of-war that has a major say in the day-to-day price of gold.

A Historical Look at US Gold Prices

To really understand the gold price today in USA per gram, it helps to take a step back and look at where it's been. For a long time, gold's value wasn't the result of a bustling global marketplace. Instead, it was set by government decree.

This period, known as the Gold Standard, was all about stability. It's a world away from the minute-by-minute price swings we're used to now.

The Era of Fixed Prices

Back when the Gold Standard was in effect, the U.S. dollar was directly tied to a specific amount of gold. You could, in theory, walk into a bank and exchange your paper money for physical gold at a set rate. This tethered the currency's value to a tangible asset, which gave people a strong sense of security and kept prices under control.

For decades, the price of gold barely budged. It was the foundation of the financial system, not a speculative asset to trade.

Official changes to the U.S. gold price were rare. It was first pegged at $19.75 per ounce way back in 1792. In 1834, it was adjusted to $20.67 per ounce, and it stayed there for almost 100 years. The next major change didn't happen until 1934, in the midst of the Great Depression, when the government raised the price to $35 per ounce. That move was a huge signal that the government's approach to money was changing. You can dig into the full history of these fixed prices to see how early policies shaped its role.

The Shift to a Free-Floating Market

Everything changed in 1971. That year, President Nixon announced that the U.S. dollar would no longer be convertible to gold. Just like that, the government's price controls were gone, and gold was allowed to float freely on the open market.

Almost overnight, its price started reacting to real-world events, economic pressures, and investor moods.

The 1970s was its first big test. With inflation running wild and an oil crisis shaking the globe, investors piled into gold as a safe haven, pushing its price to levels no one had ever seen before. This period really cemented gold's modern reputation as a hedge against economic trouble—a role it continues to play today.

We saw a repeat performance during the 2008 financial crisis. As the global banking system looked like it might implode, trust in traditional financial institutions vanished. Where did people turn? To gold. Its value skyrocketed as investors sought refuge in its timeless stability, reinforcing its status as the ultimate "crisis commodity."

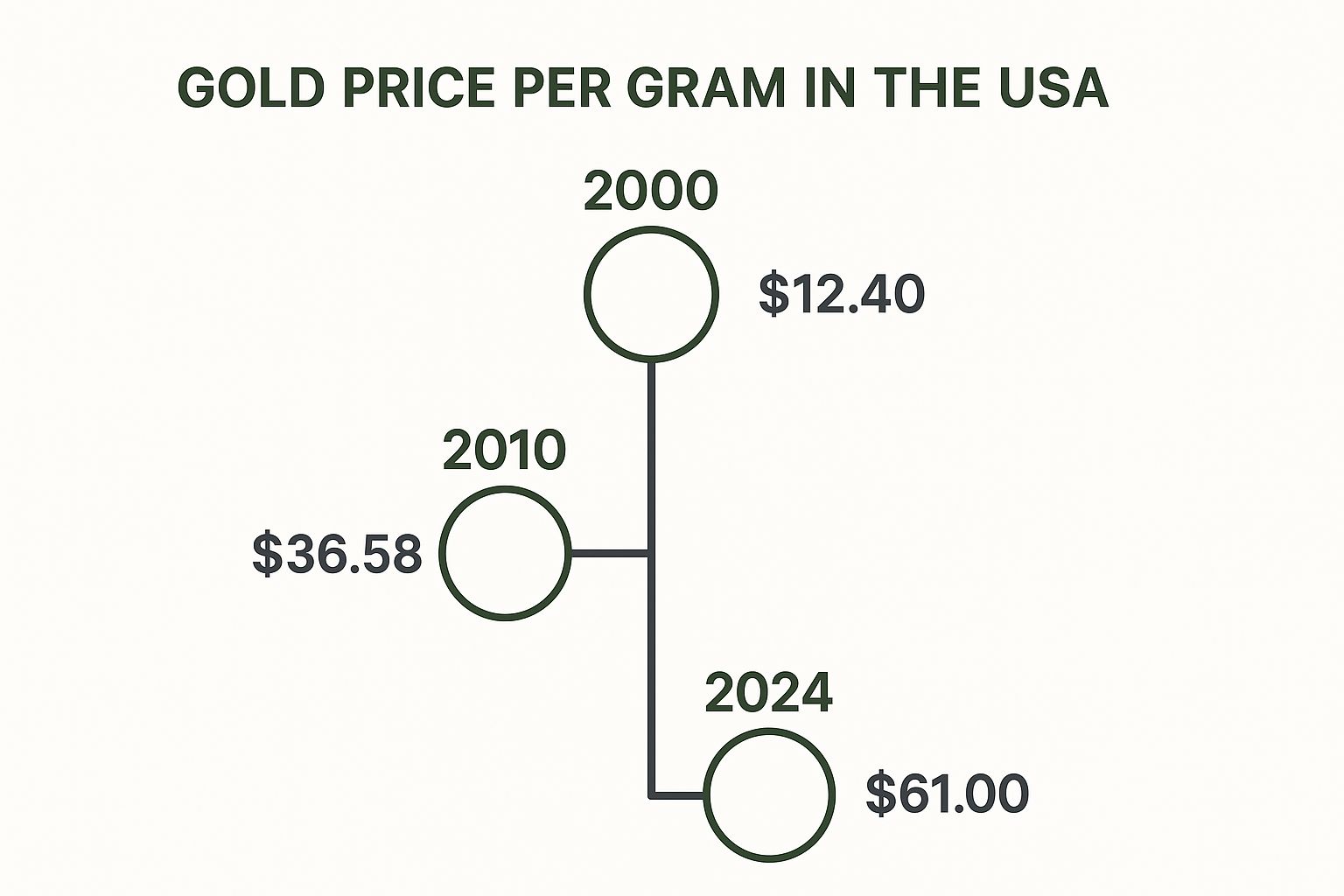

This chart really puts the journey into perspective, showing the dramatic growth in gold's per-gram price since it started trading freely.

The numbers speak for themselves. The price per gram shot up by nearly five times between the year 2000 and 2024 alone.

This trip through history—from a fixed monetary anchor to a dynamic global asset—is essential. Knowing how gold has reacted during past economic storms gives you a much deeper appreciation for its enduring appeal and the forces that still drive the gold price today in USA per gram.

How Karat Purity Affects Gold's Value

When you see the live spot price of gold, you’re looking at the price for pure, 24-karat gold. But here’s the thing: most gold items we own, especially jewelry, aren't actually pure gold. This is where karat purity comes into play, and understanding it is key to figuring out what your gold is really worth.

Think of it like this: 24K gold is like a high-performance race car. It’s the peak of performance—99.9% pure—but it’s also soft and impractical for daily use. You wouldn't drive a Formula 1 car to the grocery store.

To make gold strong enough for a ring or a necklace you can wear every day, jewelers mix it with other metals like copper, silver, or zinc. These added metals are called alloys, and they give the gold durability.

The karat system is just a scale out of 24 parts that tells you how much pure gold is in the mix. So, a 14K gold ring is 14 parts pure gold and 10 parts other metals, making it 58.3% gold. This percentage is the crucial link between your item and the gold price today in USA per gram.

Gold Karat Purity Breakdown

To make this crystal clear, here’s a quick-reference table that breaks down the most common karat types. You can use it to see exactly how much pure gold is in your items.

|

Karat (K) |

Purity (% Gold) |

Fineness (per 1000 parts) |

Common Use |

|---|---|---|---|

|

24K |

99.9% |

999 |

Investment-grade bars and coins |

|

22K |

91.7% |

917 |

American Gold Eagle coins, high-end jewelry |

|

18K |

75.0% |

750 |

Fine jewelry, watches |

|

14K |

58.3% |

583 |

Most common jewelry in the U.S. |

|

10K |

41.7% |

417 |

Durable, affordable jewelry |

As you can see, the lower the karat number, the less pure gold it contains—but the more durable the item generally is.

Calculating Your Gold's Actual Worth

So, how do you use this knowledge to calculate your gold's "melt value"—the raw value of its gold content? It’s a pretty simple two-step process.

Let's say you have a necklace stamped "18K" that weighs 10 grams.

-

Find the Gold Content: First, figure out the purity. We know 18K gold is 75% pure (or 18 divided by 24). Multiply the total weight by this percentage: 10 grams x 0.75 = 7.5 grams of pure gold.

-

Calculate the Value: Now, just multiply that pure gold weight by the current spot price per gram. That’s it! You've just calculated its true intrinsic worth.

This simple math lets you look past a store's retail price and see the real value of the precious metal you're holding. If you want to go deeper, you can learn more by understanding karats and purity in gold and how it all connects.

It's crucial to remember this: The value is based on the weight of the pure gold only, not the total weight of the jewelry piece. The alloys have negligible value in this calculation.

How to Invest in Gold Based on Per Gram Prices

So, you now understand how the gold price today in USA per gram gets its number. That's the first step. The next is putting that knowledge into action.

Investing in gold isn't a one-size-fits-all game. The best path for you really depends on your financial goals, how much risk you're comfortable with, and whether you actually want to hold the metal in your hands.

There are three main ways to get into the market, and each interacts with the live spot price a little differently. Let's walk through them so you can figure out which one makes the most sense for you.

Physical Gold Coins and Bars

This is the classic, time-tested way to own gold. When you buy physical bullion, like American Gold Eagle coins or one-ounce bars, you're getting a tangible asset you can see and touch. It’s real.

But you'll never pay just the spot price. The price you pay, known as the retail price, always includes a "premium" over the gold's melt value.

A premium is simply the cost added on top of the raw gold value. It covers the expenses for minting the coin or refining the bar, distribution, and the dealer’s own business costs. Think of it like the difference between buying raw lumber and a finished piece of furniture.

Even though you pay a bit more than the spot price per gram, the trade-off is that you own an asset that is completely yours, with no third-party risk. If you want to dive deeper into specific products, our gold investment guides and tips offer a wealth of information.

Gold Exchange-Traded Funds (ETFs)

What if you want to benefit from gold's price changes without dealing with storage or security? A Gold ETF could be your answer. An ETF is a type of security that behaves like a stock and is designed to mirror the price of gold. When the spot price of gold moves, the ETF's share price generally follows suit.

-

Pros: They are incredibly easy to buy and sell through any standard brokerage account. They're also highly liquid, and the associated costs (premiums) are very low.

-

Cons: You don't actually own the physical metal. You own a share in a trust that holds the gold, which introduces a different kind of risk.

Gold Mining Stocks

For those with a higher risk tolerance, buying shares in gold mining companies is another option. This can be the most rewarding path, but it's also the most volatile.

The value of these stocks is tied to the price of gold, but it's also heavily influenced by other factors. Things like the company's management team, its operational costs, and whether it strikes a new major gold deposit can all dramatically affect the stock price, independent of gold's daily moves.

Once you’ve made your choice and acquired some gold, it's smart to track its performance as part of your overall financial picture. You might find it helpful to use our portfolio tracking tool - on our site to be published September 2025.

Answering Your Questions About Gold Prices

Even when you have a good handle on how the gold market operates, a few practical questions almost always pop up once you’re ready to buy or sell. Let's walk through some of the most common ones to clear up any lingering confusion about the gold price today in USA per gram.

Why Is My Purchase Price Higher Than the Spot Price?

You'll notice that the price you actually pay for a gold coin or bar is always a bit higher than the live spot price you see on the charts. This difference is known as the "premium."

Think of it this way: the spot price is like the wholesale cost of raw lumber. The price you pay for a finely crafted piece of furniture made from that lumber will naturally be higher. The premium on a gold product covers all the real-world costs involved in getting it from a raw commodity into your hands—things like minting the coin, secure shipping, insurance, and the dealer’s operational costs. For rare or collectible coins, the premium can be significantly higher, reflecting their numismatic value which is separate from their gold content.

Simply put, the spot price is for the raw, unrefined gold. The premium covers the cost of turning that metal into a tangible product you can own.

Where Can I Find the Most Accurate Live Gold Price?

For the most trustworthy, up-to-the-minute gold prices, you need to go to sources that pull their data directly from the global commodities markets. These aren't just random websites; they are industry-standard platforms.

Excellent choices include top-tier financial news outlets like Bloomberg and Reuters, the websites of major bullion dealers, or specialized market data providers like us SummitMetals Gold/Silver Chart. These sites update in real-time throughout the trading day, giving you a live look at global market activity.

Is There a Best Time of Day to Buy Gold?

While gold trades nearly around the clock, the market really comes alive when the major trading hubs in London and New York overlap. This window, which typically falls between 8:00 AM and 12:00 PM EST, is when trading volume and liquidity are at their absolute peak.

During these hours, the gap between buying and selling prices (the "spread") is often at its tightest, which can be a slight advantage for buyers. But here’s a word of advice from experience: trying to time the market for the perfect daily dip is a fool's errand. A much more effective strategy is to make your buying decisions based on your long-term financial goals, not on chasing tiny, unpredictable price swings.

At Summit Metals, we help investors build lasting portfolios with high-quality gold and silver bullion. To start your own investment journey, feel free to explore our collection of gold and silver coins and bars.