Why Collecting Silver Eagles Has Become America's Favorite Precious Metals Pursuit

Collecting Silver Eagles is one of the most accessible ways to build wealth with precious metals while owning pieces of American history. These coins offer a unique combination of investment value and collector appeal.

Key Benefits of Collecting Silver Eagles:

- Government Backing: Each coin is guaranteed to contain one troy ounce of .999 fine silver.

- Beautiful Design: Features the iconic Walking Liberty design from 1916.

- Flexible Strategies: Options include date runs, mint marks, special finishes, and graded coins.

- Strong Resale Market: With over 500 million sold since 1986, the market is highly liquid.

- Inflation Hedge: Physical silver helps protect purchasing power during economic uncertainty.

The American Silver Eagle launched in 1986 and became the world's most popular silver coin. With premiums of $5-8 over spot silver prices in 2025, these coins bridge the gap between bullion investment and numismatic collecting. Whether you want a simple date run or are hunting for key dates like the 1995-W Proof, Silver Eagles offer something for every budget and goal.

Important collecting silver eagles terms:

- 1 oz proof silver american eagle

- american silver eagle 999

- Buy Certified Silver

The Allure of the American Silver Eagle: History and Design

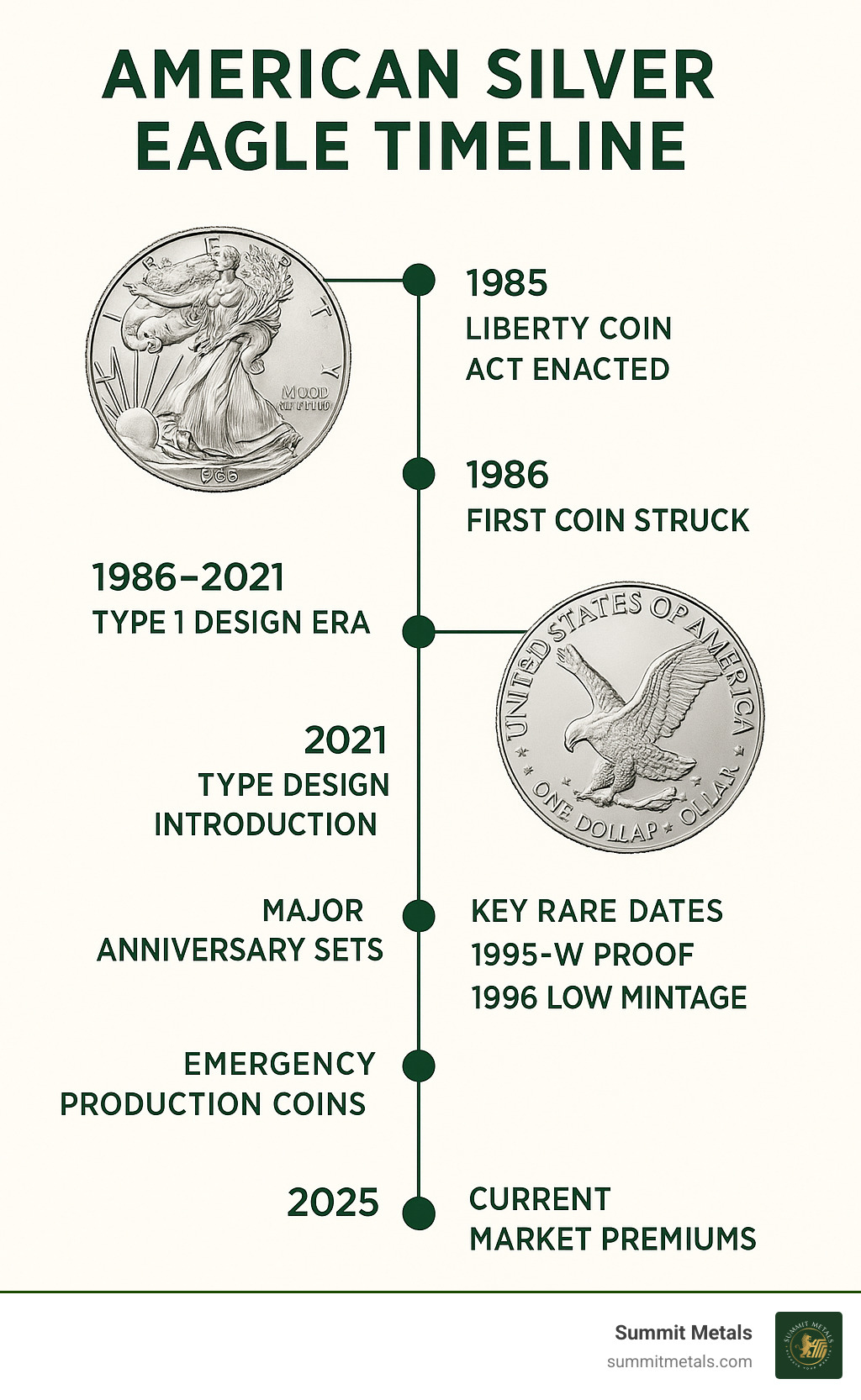

The American Silver Eagle's story began with the 1985 Liberty Coin Act, which authorized the U.S. Mint to produce silver coins using the National Defense Stockpile. The first coin was struck on October 29, 1986, creating a new legend in precious metals.

The obverse (front) features Adolph A. Weinman’s iconic "Walking Liberty" design from the 1916 Half Dollar. Widely considered one of America's most beautiful coin designs, it depicts Lady Liberty striding toward a new day, draped in the flag. This timeless image of hope and freedom appeals to collectors and investors alike.

From 1986 to mid-2021, the reverse (back) featured the "Heraldic Eagle" by John Mercanti, symbolizing strength and peace. In mid-2021, the coin underwent a major design change. The U.S. Mint introduced the new "Type 2 Eagle Landing" reverse by artist Emily Damstra. This design, featuring an eagle landing on an oak branch, also incorporated new anti-counterfeiting features like a reeded edge notch for improved security. The obverse was also refreshed to better reflect Weinman's original intent. The transition created a unique collecting opportunity in 2021 with both Type 1 and Type 2 designs available.

This commitment to artistic excellence and security has only improved the appeal of collecting Silver Eagles. For more insights into the captivating designs and history of these coins, you can explore our resources. More info about American Eagle Dollars

Specifications and Silver Content

Beyond their beauty, American Silver Eagles are defined by their precise specifications. Each coin contains exactly one troy ounce (31.103 grams) of 99.9% fine silver (.999 pure). This weight and purity are backed by the full faith and credit of the U.S. government, ensuring authenticity and value worldwide.

The coins measure 40.6 mm in diameter and 2.98 mm thick. While they have a symbolic face value of one dollar, their true worth comes from their silver content and numismatic value. The U.S. Mint's commitment to these specifications makes the American Silver Eagle a trusted and liquid asset. You can learn more about the program through official channels. U.S. Mint American Eagle Program

Bullion vs. Collector Editions: Understanding the Types

When collecting Silver Eagles, you'll find several varieties, each serving a different purpose. The U.S. Mint produces three main versions: Bullion for investors, Proof for collectors who value presentation, and Burnished for those seeking a unique finish. Each type has its own character and appeal.

| Feature | Bullion Silver Eagles | Proof Silver Eagles | Burnished Silver Eagles |

|---|---|---|---|

| Finish | Brilliant Uncirculated (BU) | Mirror-like fields, frosted design elements (cameo effect) | Soft, matte finish (similar to early U.S. coins) |

| Mint Mark | None (origin identified by packaging/pedigree) | Yes ("W" for West Point, "S" for San Francisco, "P" for Philadelphia) | Yes ("W" for West Point) |

| Mintage | Highest (tens of millions annually) | Lower (hundreds of thousands annually) | Lowest (hundreds of thousands annually, often under 200k) |

| Availability | Sold by authorized dealers, not directly by U.S. Mint | Sold directly by U.S. Mint and through authorized dealers | Sold directly by U.S. Mint and through authorized dealers |

Bullion Eagles

Bullion Silver Eagles are the backbone of most precious metals collections, designed to provide government-guaranteed silver at competitive prices. They feature a brilliant uncirculated finish that showcases the coin's natural mint luster.

Bullion Eagles don't have mint marks. While most are struck at West Point, the Philadelphia and San Francisco Mints have assisted during high-demand periods. Grading services can identify the mint of origin on certified coins based on their original sealed packaging.

Annual mintages often reach tens of millions—for example, 47 million during the peak demand of 2015. This massive production keeps premiums reasonable and ensures excellent liquidity. You can't buy bullion Eagles directly from the U.S. Mint; they are distributed through authorized purchasers to dealers like us, creating a robust market for stacking silver.

Silver Eagle Bullion Coin Explained

Proof Eagles

Proof Silver Eagles are where artistry meets investing. A special minting process creates the "cameo effect"—deeply mirrored backgrounds that contrast with frosted design elements for a stunning result.

Every Proof Eagle has a mint mark: "W" for West Point, "S" for San Francisco, or "P" for Philadelphia. The minting location has changed over the years, offering variety for collectors. Since 2018, both West Point and San Francisco have produced Proof Eagles annually.

Exclusivity is key; while bullion mintages are in the millions, Proof mintages are typically in the hundreds of thousands. The 2023-W Proof, for example, had a mintage of 559,975. These coins come in protective packaging and command higher premiums due to their superior finish and collectibility.

1 oz Proof Silver American Eagles

Burnished and Special Finish Eagles

Burnished Silver Eagles have a unique, soft matte-like finish, giving them an almost antique appearance. Struck on specially prepared planchets, they are distinct from both brilliant bullion and mirrored proof coins.

All Burnished Eagles carry the "W" mint mark from West Point and typically have the lowest mintages of the three main types. The 2019-W saw just 125,564 coins minted, making them significantly more exclusive.

The Mint has also released special finishes that create unique collecting opportunities. Reverse Proof coins flip the traditional proof finish (frosted fields, mirrored designs), while Improved Reverse Proof coins use multiple frosting and polishing levels for incredible depth.

The 2019-S Improved Reverse Proof Silver Eagle, with only 29,707 minted, is a prime example. These special finishes often appear in anniversary sets, adding excitement and rarity for dedicated collectors.

Popular Strategies for Collecting Silver Eagles

Collecting Silver Eagles offers flexible strategies for any budget or investment goal. The most rewarding collections are built over time with clear goals, making the journey enjoyable.

Beginner Tips for Collecting Silver Eagles

Starting your collection doesn't require a massive budget. The most popular beginner strategy is building a date run—acquiring one Silver Eagle for each year since 1986. It's an affordable way to own a complete historical timeline of the coin.

You can focus on budget-friendly bullion coins, premium proof coins, or a mix. Many collectors start with a Type 1 set (1986-2020) before beginning a Type 2 collection (2021-present). The 2021 transition year is unique for having both designs.

Ungraded coins ("raw" coins) offer excellent value for beginners, as they lack the higher premiums of graded coins. Proper handling is crucial for preserving your collection's value. Oils from your skin can cause permanent damage. Always hold coins by their edges, ideally with cotton gloves, and use acid-free storage like holders, tubes, or albums.

The Basics of Gold and Silver Stacking

Advanced Strategies for Collecting Silver Eagles

Once you've mastered the basics, advanced strategies open up new possibilities, often focusing on attributes that increase a coin's numismatic value.

- Collecting by mint mark adds rarity. Proof and Burnished Eagles carry "W," "S," or "P" mint marks, with some being scarcer than others in certain years.

- Grade-focused collecting means pursuing perfect MS70 (bullion) or PR70 (proof) specimens. While early-date MS70 coins can be very expensive (over $1,000), post-2000 examples are more accessible. A complete MS70 set is a significant investment, potentially costing $50,000 to $100,000.

- Special labels and variety hunting appeals to those who love the thrill of the find. Grading services offer unique labels like "First Strike" or hand-signed labels that add value. Hunting for varieties like the 2008-W Reverse of 2007 (only 46,318 minted) can be very rewarding, with this coin trading for around $1,000 in perfect MS70 condition.

A Modern Approach: Dollar-Cost Averaging with Autoinvest

Smart collectors use their Silver Eagles for both collecting and investing. An effective long-term strategy is dollar-cost averaging, which involves consistently purchasing a fixed dollar amount of Silver Eagles at regular intervals.

When silver prices dip, you buy more coins; when prices rise, you buy fewer. Over time, this averages out your purchase price and reduces risk. This is similar to 401k contributions—a steady, automatic way to build wealth without the stress of timing the market.

Summit Metals Autoinvest makes this strategy effortless. You can set up automated monthly purchases of American Silver Eagles from our real-time inventory. Your collection grows steadily each month, building your precious metals portfolio one coin at a time. This modern approach blends collecting passion with disciplined financial wisdom, creating an investment strategy that works for you.

Learn about Autopay Subscriptions

What Makes a Silver Eagle Valuable?: Key Dates, Mint Marks, and Grading

The value of a Silver Eagle goes beyond its silver content. The excitement for collectors lies in finding key dates and rare varieties that command high premiums, blending investment with treasure hunting. A coin's numismatic value—its worth as a collectible—is driven by mintage, demand, and condition.

Key Dates and Rare Varieties to Watch For

Certain standout coins are prized for their low mintages, production quirks, or unique circumstances.

- 1995-W Proof: The undisputed king of the series, with only 30,102 minted as part of a 10th-anniversary set. Prices range from $3,500 to over $20,000 for a perfect PR70.

- 1996 Bullion: The lowest-mintage regular bullion issue, with just over 3.6 million produced. Clean, ungraded examples trade for $60+, with certified MS70 coins fetching more.

- 2019-S Improved Reverse Proof: A modern classic with only 29,707 minted. This was the first use of this special finish, and perfect PR70 examples now trade for $3,000-$5,000.

- Emergency Production Coins: When demand overwhelmed the West Point Mint, production shifted to Philadelphia. The 2015 (P) (79,640 mintage) and 2020 (P) (240,000 mintage) coins carry no "P" mint mark and are identified only by their original packaging, making them rare.

- Low Mintage Burnished Issues: The 2018-W (138,947 mintage) and 2019-W (125,564 mintage) Burnished Eagles have some of the lowest production numbers and are considered potential future key dates.

- 2008-W Reverse of 2007: A subtle die variety with a mintage of only 46,318. This "sleeper" coin is valued around $500 in MS69 and $1,000 in MS70.

While the 1995-W Proof gets the headlines, condition can create extraordinary value in other dates. A 1999 PCGS MS70 once sold for $13,000, proving that top-grade coins from any year can be highly valuable.

One Ounce Wonders: Top Silver Eagle Coins Worth Your Investment

The Role of Grading and Mint Marks

Professional grading by services like PCGS and NGC provides precision. They use the 70-point Sheldon scale, where MS70/PR70 represents a perfect, flawless coin. This standardized assessment covers strike quality and any post-minting damage. Their population reports show exactly how many coins exist in each grade, which helps determine rarity and value.

While modern minting means MS70 grades for recent years aren't always rare, achieving that top grade for older or lower-mintage coins is exceptionally challenging and valuable.

Mint marks add another layer of intrigue for Proof ("W," "S," or "P") and Burnished ("W") coins, differentiating production runs and special issues. Bullion coins lack mint marks, but grading services can identify their origin (e.g., "Struck at West Point") based on original packaging.

Buying certified American Silver Eagles provides confidence. You get guaranteed authenticity and condition, a peace of mind that is invaluable for serious collectors and investors.

Where to Buy Certified American Silver Eagles

Frequently Asked Questions about Collecting Silver Eagles

As you begin collecting Silver Eagles, some common questions arise. Here are the answers to the most frequent inquiries.

What is the rarest American Silver Eagle?

The 1995-W Proof Silver Eagle is the rarest, with a mintage of just 30,102. It was only available in a special 10th Anniversary Set, making it a true collector's prize. Its combination of low mintage, historical significance, and high demand makes it the series' holy grail.

Is it better to buy graded or ungraded Silver Eagles?

The choice depends on your goals. Ungraded (raw) coins are ideal for accumulating silver for its metal value, as they have lower premiums. They are the cost-effective workhorses of a precious metals portfolio.

Graded coins, certified by services like PCGS or NGC, offer professional authentication and a precise condition assessment. While they carry higher premiums, they preserve potential numismatic value that can far exceed the coin's silver content, making them the preferred choice for serious collectors focused on condition and long-term appreciation.

How should I store my Silver Eagle collection?

Proper storage is critical to protect your collection's value. The golden rule is to use only non-PVC, archival-safe storage like capsules, tubes, or albums. PVC can leach chemicals and permanently damage coins.

Store your collection in a cool, dry environment with stable temperatures (60-70°F) and low humidity to prevent issues like milk spots or hazing. For valuable pieces, consider a quality home safe or professional depository services.

Most importantly, always handle coins by their edges, preferably with cotton gloves. Oils from your skin can cause permanent spots and reduce a coin's value.

Conclusion: Start Your Silver Eagle Journey

Collecting Silver Eagles is more than just buying silver; it's an opportunity to own pieces of American artistry while building tangible wealth. These coins bridge the gap between smart investing and the joy of collecting.

Every Silver Eagle combines Adolph Weinman's timeless Walking Liberty design with a government guarantee of one troy ounce of .999 fine silver. Unlike paper assets, you're acquiring tangible pieces of history that have proven their resilience since 1986.

The flexibility of collecting Silver Eagles means there's a path for everyone, from building a simple date run to hunting for key dates like the 1995-W Proof or seeking flawless graded specimens. With over 500 million coins sold, the Silver Eagle market is one of the most liquid in the world, ensuring buyers are always available when you're ready to sell.

For long-term growth, our Autoinvest program acts like a 401k for precious metals. Automated monthly purchases of Silver Eagles allow you to use dollar-cost averaging to build a substantial collection and smooth out market volatility. It's a smart, disciplined way to build wealth.

At Summit Metals, trust is paramount. We offer transparent, real-time pricing and competitive rates thanks to our bulk purchasing power. You get honest value with no hidden fees.

Your Silver Eagle collection is a legacy you can pass down through generations—a real, permanent asset in an uncertain world. Ready to start your journey?