Why American Silver Eagles Are America's Most Trusted Silver Coin

The American Silver Eagle is the pinnacle of precious metals investing in the U.S. As the nation's official silver bullion coin, it combines investment-grade silver with iconic American artistry.

Key Facts About American Silver Eagles:

- Official Status: U.S. government-backed silver bullion coin since 1986

- Silver Content: Exactly 1 troy ounce of 99.9% pure silver

- Face Value: $1 legal tender (though intrinsic value far exceeds this)

- Design: Features Adolph A. Weinman's "Walking Liberty" and eagle reverse

- Guarantee: Weight, content, and purity certified by the U.S. Mint

- IRA Eligible: Approved for precious metals retirement accounts

Its government backing and consistent quality set the American Silver Eagle apart from generic silver rounds, as it carries the full faith and credit of the United States government.

Current pricing varies based on silver spot price plus dealer premiums, with 2025 coins ranging from approximately $49.99 to over $1,200 depending on finish and certification. Prices shown are at the time of this publication.

Whether you're building wealth through dollar-cost averaging with an Autoinvest program or seeking collectible numismatic pieces, American Silver Eagles offer the best liquidity and recognition in the precious metals market.

I'm Eric Roach. In my decade-plus career on Wall Street, I've guided clients in allocating millions into precious metals. I've consistently seen American silver eagles serve as a cornerstone for diversified portfolios and a hedge against economic uncertainty, outperforming expectations in long-term wealth strategies.

American silver eagles terms explained:

- Buy Certified Silver

- Precious Metals Investment

- fine silver dollar coin

What is an American Silver Eagle? The Official Silver Bullion Coin of the U.S.

Since 1986, the American Silver Eagle has been the official silver bullion coin of the United States. It's more than just precious metal; it's a government-backed promise renowned for its beautiful design. As the world's best-selling silver coin, it marries investment security with artistic beauty, appealing to both seasoned investors and collectors.

Every American Silver Eagle contains exactly one troy ounce of 99.9% pure silver. This is a guarantee backed by the full faith and credit of the U.S. government, giving investors peace of mind.

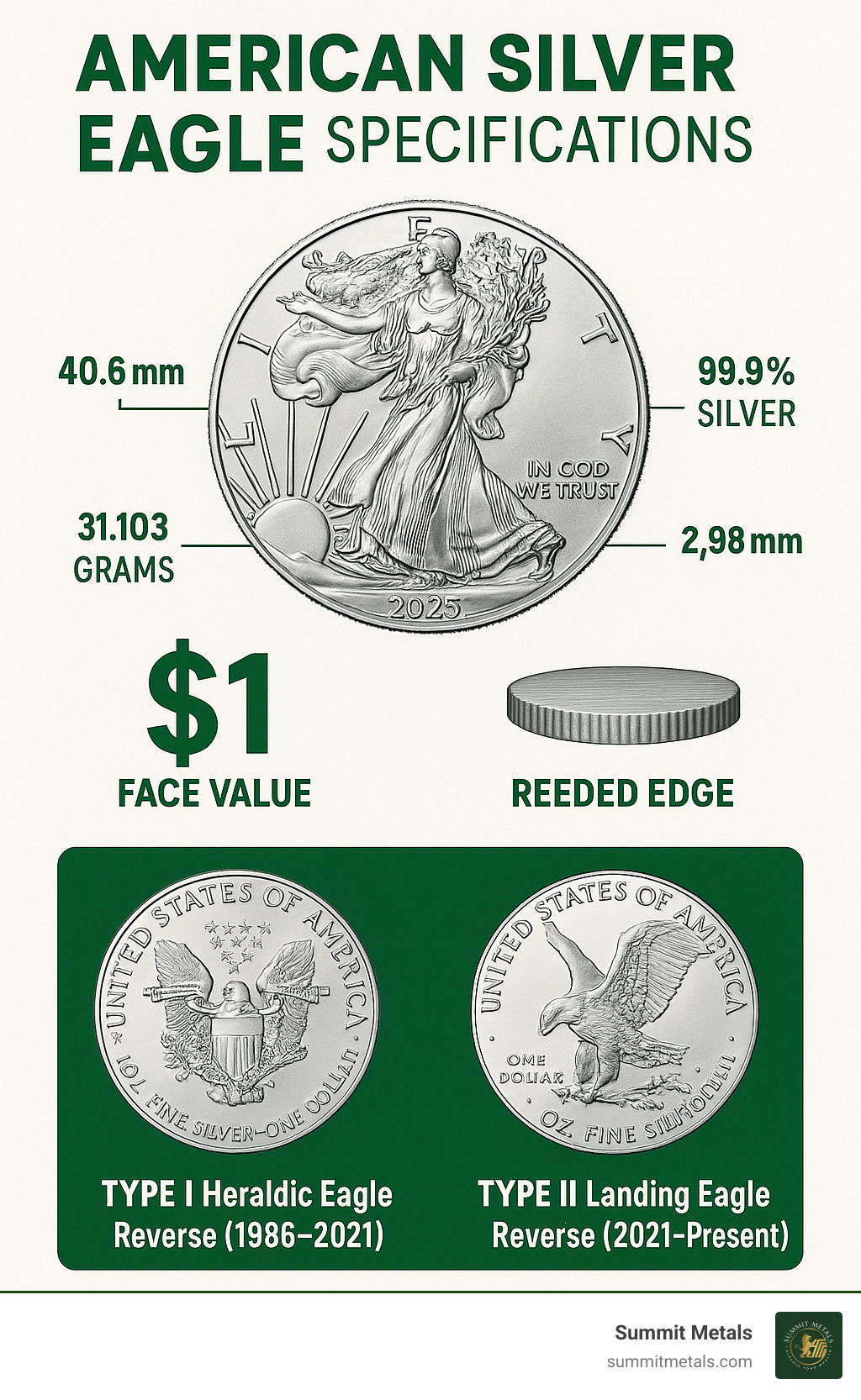

The specifications tell a story of precision and consistency:

| Specification | Value |

|---|---|

| Diameter | 40.6 mm (1.598 inches) |

| Weight | 31.103 grams (1.00 troy oz) |

| Purity | 99.9% pure silver (0.999 fine) |

| Thickness | 2.98 mm (0.1173 inches) |

| Face Value | $1.00 (USD) |

Key Features and Design

The coin's obverse (front) features Adolph A. Weinman's timeless "Walking Liberty" design. It depicts Lady Liberty striding forward, draped in the American flag and holding oak and laurel branches. First seen on the 1916 Half Dollar, modern minting has improved this masterpiece, widely considered one of the most beautiful U.S. Mint designs.

The reverse of the coin has evolved. From 1986 to mid-2021, it featured John Mercanti's Type I "Heraldic Eagle" design, showing a powerful eagle with a shield, an olive branch, and arrows, surrounded by thirteen stars. In 2021, the new Type II design by Emily Damstra was introduced. Her "Landing Eagle" is a dynamic and realistic depiction of a bald eagle landing with an oak branch, showcasing remarkable detail.

The Type II design also brought improved security features, including subtle variations in the coin's reeding that help prevent counterfeiting, ensuring American silver eagles remain a secure investment.

Legal Tender and Government Backing

Each American Silver Eagle has a face value of one dollar, making it official legal tender. While its intrinsic silver value is far higher, this face value is significant. The $1 designation signifies the U.S. government's guarantee of the coin's weight, content, and purity: exactly one troy ounce of 99.9% pure silver. This provides investors with government-backed certainty.

This backing makes American silver eagles incredibly liquid assets. Unlike privately minted silver rounds, these coins are instantly recognizable and trusted worldwide, ensuring ready markets and competitive pricing.

The Liberty Coin Act of 1985 and 31 U.S.C. § 5112 provide the legal framework for the coin's production. This solid legal backing gives investors confidence, especially those using an Autoinvest program to dollar-cost average into silver, similar to a 401k. This combination of government backing, quality, and recognition makes American silver eagles an ideal choice for any precious metals investor.

A Rich History: The Origins of the American Silver Eagle

The American Silver Eagle's story begins with the Liberty Coin Act of 1985, signed into law during the Reagan administration. This legislation provided a brilliant solution to a practical problem. The U.S. government held a large silver surplus in the National Defense Stockpile, and Congress decided to use this silver to create a beautiful and valuable investment coin for Americans rather than selling the metal on the open market.

The first American Silver Eagle was minted on November 24, 1986, quickly becoming America's most beloved silver coin. For 35 years, the coin maintained its classic look. Then in 2021, the U.S. Mint updated the reverse design for the first time, introducing Emily Damstra's "Landing Eagle" and marking a new chapter in the coin's history.

The Iconic "Walking Liberty" Obverse

The obverse of the American Silver Eagle features the "Walking Liberty," one of the most beautiful coin designs ever created. It was originally designed by Adolph A. Weinman for the 1916 Half-Dollar. The design shows Lady Liberty striding confidently, draped in the American flag. She holds oak and laurel branches (symbols of strength and victory) and wears a Phrygian cap, an ancient symbol of freedom. Behind her, a rising sun represents hope and America's bright future. It's a powerful image that captures the American spirit.

The Eagle Reverse: A Tale of Two Designs

The reverse of the American Silver Eagle has featured two distinct, impressive designs.

From 1986 to mid-2021, the Type I Heraldic Eagle by John Mercanti was featured. Based on the Great Seal of the United States, it depicted a bald eagle with a shield, an olive branch (peace), and arrows (strength), with thirteen stars overhead representing the original colonies.

In 2021, Emily Damstra's Type II Landing Eagle was introduced. This dynamic design shows a bald eagle in action, landing with an oak branch in its talons. The realistic detail is incredible, from individual feathers to the eagle's focused expression. This change also introduced new security features to help prevent counterfeiting.

Both designs are beautiful, making American Silver Eagles a special investment in genuine American artistry backed by the U.S. government.

Investing in and Collecting American Silver Eagles

Investing in American Silver Eagles offers both financial prudence and personal satisfaction. These coins are a strategic asset, providing a hedge against inflation and a tool for portfolio diversification. As tangible assets, they are a wise choice for wealth preservation, especially in times of economic uncertainty.

The high liquidity of American Silver Eagles is a key advantage. They are widely recognized and sought after, ensuring a ready market for quick and easy liquidation. This makes them an excellent choice for both new and seasoned investors.

How to Invest in American Silver Eagles

Acquiring American Silver Eagles is straightforward. The price consists of the silver spot price plus a "premium" covering minting, distribution, and dealer costs. The U.S. Mint sells through authorized purchasers, who then sell to retailers like us and finally to you.

At Summit Metals, we offer transparent, real-time pricing and competitive rates. For those looking to build their portfolio systematically, we recommend dollar-cost averaging. This strategy involves investing a fixed amount at regular intervals to mitigate risk by averaging your purchase price over time.

Our exclusive Autoinvest program makes this easy. Just like a 401k, our Autoinvest service allows you to buy American Silver Eagles monthly, effortlessly building your precious metals holdings without constantly monitoring the market.

More info about our Autoinvest service

The Role of Third-Party Grading

For collectors and investors seeking to maximize value, third-party grading services like PCGS (Professional Coin Grading Service) and NGC (Numismatic Guaranty Corporation) are crucial. These services evaluate coins on the 1-to-70 Sheldon Scale, ensuring authenticity and assessing their condition. A grade of MS-70 (Mint State 70) is considered flawless.

Graded coins are encapsulated in secure plastic "slabs" that protect them and preserve their condition. This certification provides verifiable authenticity and quality assessment. High-grade coins often command significantly higher prices. Special designations like "First Day of Issue" or "Early Release" can further improve a coin's numismatic value. We recommend considering professional grading for your most prized American Silver Eagles to ensure their long-term value.

Understanding the Value and Variations

The value of an American Silver Eagle is determined by more than just its silver content. Several factors influence the final price of these beautiful coins. Silver market trends can be dynamic, but despite price fluctuations, American Silver Eagles consistently maintain strong demand, with millions of bullion coins sold annually. This robust interest shows that investors continue to view these coins as a solid wealth preservation strategy. Prices shown are at the time of this publication.

Factors Influencing Price

Understanding the drivers of price helps you make smarter investments.

- Silver spot price: The real-time market price for one troy ounce of silver forms the coin's base value.

- Dealer premiums: These are charges above the spot price that cover minting, distribution, and dealer costs. Premiums fluctuate based on market demand and supply.

- Numismatic value: This refers to the collector value beyond the silver content. Complete sets or rare coins can sell for significant premiums.

- Rarity and key dates: Certain coins, like the low-mintage 1995-W Proof Silver Eagle, are exceptionally rare and valuable. Production disruptions, like the 2020 "Emergency Issues," can also create valuable varieties.

- Graded population: Coins certified by PCGS or NGC in high grades like MS-69 or MS-70 command substantial premiums due to their guaranteed quality and authenticity.

Types of American Silver Eagles

The U.S. Mint produces American Silver Eagles in several finishes for different buyers.

- Bullion versions are the most common type, designed for investment. They are sold with modest premiums over the spot price, often in tubes of 20 or "Monster Boxes" of 500. They do not have mint marks.

- Proof finish coins are for collectors. They are struck multiple times with polished dies to create a stunning mirrored background with frosted designs. They bear mint marks (W, S, or P) and command higher premiums due to limited mintages.

- Burnished (Uncirculated) finish coins have a unique matte, satiny appearance. Bearing the 'W' mint mark, they are produced in smaller quantities, making them rare and sought after.

- Reverse Proof finish coins feature frosted backgrounds with mirrored designs. They are produced for special sets and are highly prized for their unique look and limited availability.

- Special issues and sets celebrate milestones and events, such as anniversary sets or historical commemoratives. These sets often contain unique finishes that collectors love.

Building your American Silver Eagles collection is manageable. Our Autoinvest program lets you dollar-cost average into these coins monthly, just like a 401k, helping you build your portfolio over time.

Frequently Asked Questions about American Silver Eagles

Here are answers to some of the most common questions we receive about American Silver Eagles.

Are American Silver Eagles a good investment?

Yes, American Silver Eagles are an excellent choice for precious metals investing.

- Government Backing: The U.S. government guarantees each coin contains one troy ounce of 99.9% pure silver, a level of certainty not found in generic silver rounds.

- High Liquidity: As the world's most recognized silver coin, they are easy to buy and sell, ensuring you won't be stuck when it's time to liquidate.

- Investment Value: Silver has historically served as a hedge against inflation and economic uncertainty. American Silver Eagles are also IRA-eligible, offering potential tax advantages for retirement savings.

Our Autoinvest program simplifies investing by allowing you to automatically purchase American Silver Eagles regularly. This dollar-cost averaging strategy smooths out price fluctuations and helps you build wealth steadily.

What is the difference between a bullion and a proof Silver Eagle?

The main difference relates to their purpose: investing versus collecting.

Bullion coins are designed for investors. Their value is primarily tied to their one-troy-ounce silver content. They are struck once, have a standard finish, and do not have mint marks, making them a cost-effective way to own silver. They are ideal for accumulating ounces at prices closer to the silver spot price.

Proof coins are collector's items. They undergo a special minting process where polished dies strike the coin multiple times. This creates a beautiful mirror-like finish with frosted details, known as a cameo effect. They carry mint marks ('W' or 'S') and command higher premiums due to their artistic quality and limited production.

Where are American Silver Eagles minted?

American Silver Eagles are produced at several world-class U.S. Mint facilities.

- West Point Mint (W): The primary producer of bullion Silver Eagles (which have no mint mark). It also mints collector versions, such as proof and burnished coins, which bear the 'W' mint mark.

- Philadelphia Mint (P): Has produced Silver Eagles, including notable "Emergency Issue" bullion coins in 2020 that are sought after by collectors.

- San Francisco Mint (S): Produces collector versions, particularly proof coins bearing the 'S' mint mark, known for their stunning craftsmanship.

Regardless of the mint, every American Silver Eagle meets the same high standards for weight, purity, and quality, making it the world's most trusted silver bullion coin.

Conclusion

For nearly four decades, the American Silver Eagle has represented the best of precious metals investing, capturing the hearts of investors and collectors since its 1986 debut.

Beyond their guaranteed one troy ounce of 99.9% pure silver, these coins offer peace of mind through government backing. Each coin is a piece of American artistry, telling our nation's story through the timeless "Walking Liberty" and iconic eagle reverse designs. Whether you prefer the classic Heraldic Eagle (1986-2021) or the dynamic Landing Eagle (2021-Present), you are connected to America's legacy.

For investors, Silver Eagles are a liquid, recognizable, government-backed tangible asset, ideal for uncertain times. They are eligible for Precious Metals IRAs, enhancing their appeal for long-term wealth building. To build your holdings systematically, our Autoinvest program allows you to dollar-cost average into silver ownership monthly, just like a 401k.

Collectors are drawn to the variety of finishes, from bullion to proof, burnished, and special commemorative sets. Grading services like PCGS and NGC can authenticate and preserve these coins, turning them into certified treasures that can appreciate far beyond their silver value.

At Summit Metals, we've seen how American Silver Eagles serve as both a smart financial move and a source of pride. They are a bridge between America's artistic heritage and your financial future.

Ready to start your journey with America's most trusted silver coin?

Start building your silver portfolio with our Autoinvest program