Why the American Silver Eagle Reigns Supreme

The silver eagle 1 ounce coin stands as America's premier silver bullion investment, combining government backing with timeless design. Since 1986, these coins have captured the attention of both serious investors and passionate collectors worldwide.

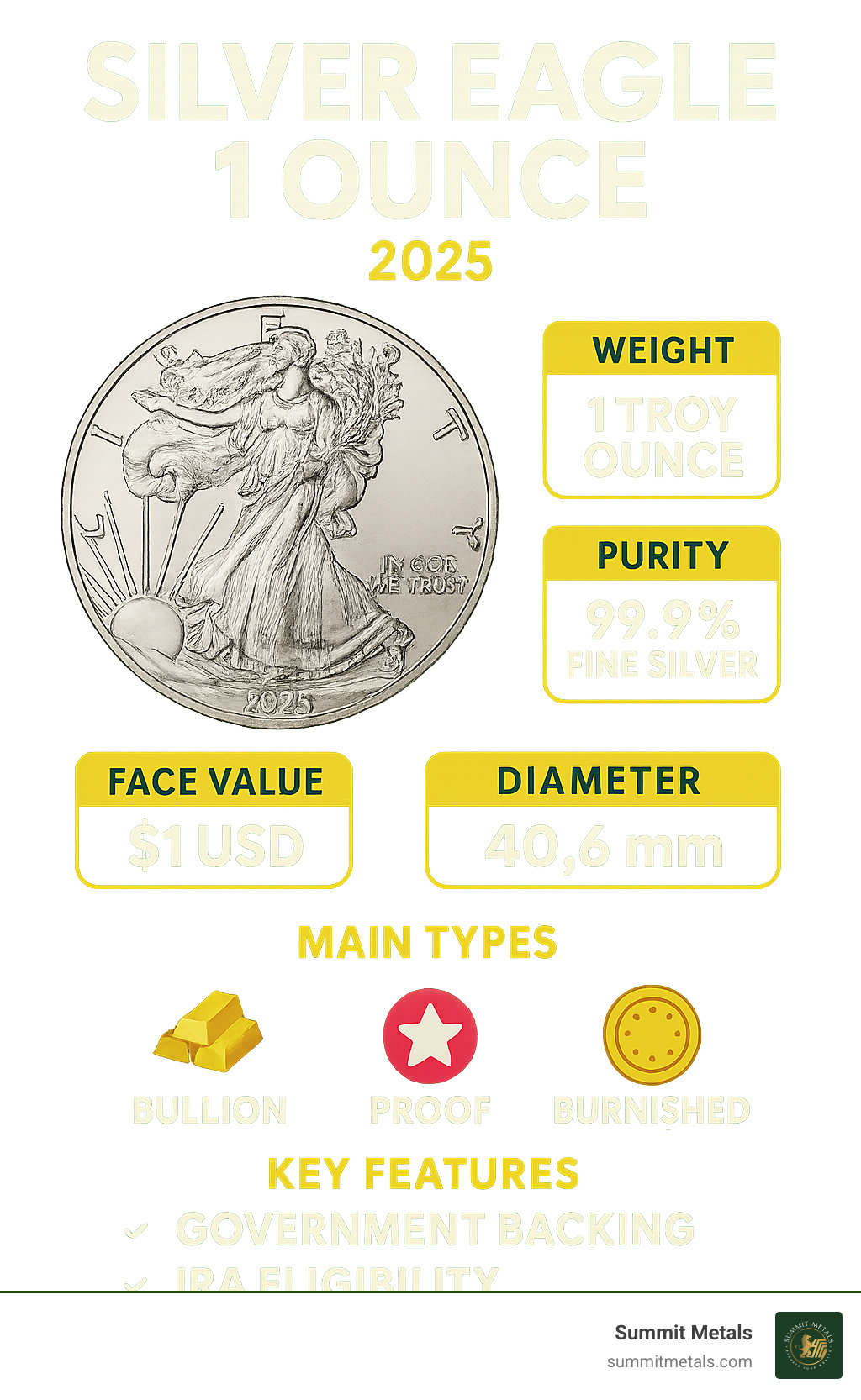

Key Silver Eagle 1 Ounce Specifications:

- Weight: 1 troy ounce (31.103 grams)

- Purity: 99.9% fine silver

- Face Value: $1 USD (backed by U.S. government)

- Diameter: 40.6 mm (1.598 inches)

- Composition: 99.9% silver, 0.1% copper

- Edge: Reeded with anti-counterfeiting variation (Type 2)

What makes the silver eagle 1 ounce coin special isn't just its silver content. It's the only official silver bullion coin produced by the United States Mint, giving it best credibility in the precious metals market.

The coin features Adolph A. Weinman's iconic Walking Liberty design on the front—the same design that graced half-dollar coins from 1916 to 1947. The reverse showcases either the classic heraldic eagle (Type 1, 1986-2021) or the newer eagle-landing design (Type 2, 2021-present) by Emily Damstra.

Whether you're building a precious metals portfolio or starting a coin collection, the silver eagle 1 ounce offers three main versions to choose from: bullion coins for investors, proof coins for collectors, and burnished coins that blend both worlds.

I'm Eric Roach, and during my decade on Wall Street advising Fortune 500 companies, I've guided clients through complex hedging strategies that often included precious metals like the silver eagle 1 ounce as portfolio insurance. Today, I help individual investors understand how these government-backed coins can serve as a liquid, tangible hedge against economic uncertainty.

The Rich History and Significance of the Silver Eagle

The story of the silver eagle 1 ounce coin begins with a stroke of President Reagan's pen on July 9, 1985. The Liberty Coin Act of 1985 authorized the U.S. Mint to do something brilliant—turn silver sitting in the National Defense Stockpile into coins that Americans could actually own and invest in.

Just over a year later, on November 24, 1986, the first silver eagle 1 ounce coins rolled off the presses. That initial run of 5.393 million coins marked the beginning of what would become America's most successful bullion program. What started as a practical way to monetize government silver reserves quickly became something much bigger—a cornerstone of precious metals investing.

The Silver Eagle program has weathered every economic storm since 1986, often serving as America's go-to safe-haven asset. During the 2008 financial crisis, demand became so intense that the U.S. Mint made a tough decision—they suspended proof and burnished production in 2009 just to redirect silver blanks to bullion coins. Investors needed their silver, and the Mint prioritized getting it to them.

The COVID-19 pandemic created an even more dramatic situation. Between April 8–20, 2020, the Philadelphia Mint struck 240,000 "Emergency Issues" to meet unprecedented demand. These coins carry special significance because they represent America's response to crisis—when uncertainty hit, people turned to silver eagle 1 ounce coins.

Production numbers tell fascinating stories about our economy. The record high came in 2015 with 47 million coins minted, while 1996 saw the lowest production at just 3.603 million coins. These swings reflect everything from silver prices to investor sentiment to world events.

Iconic Design: A Symbol of American Freedom

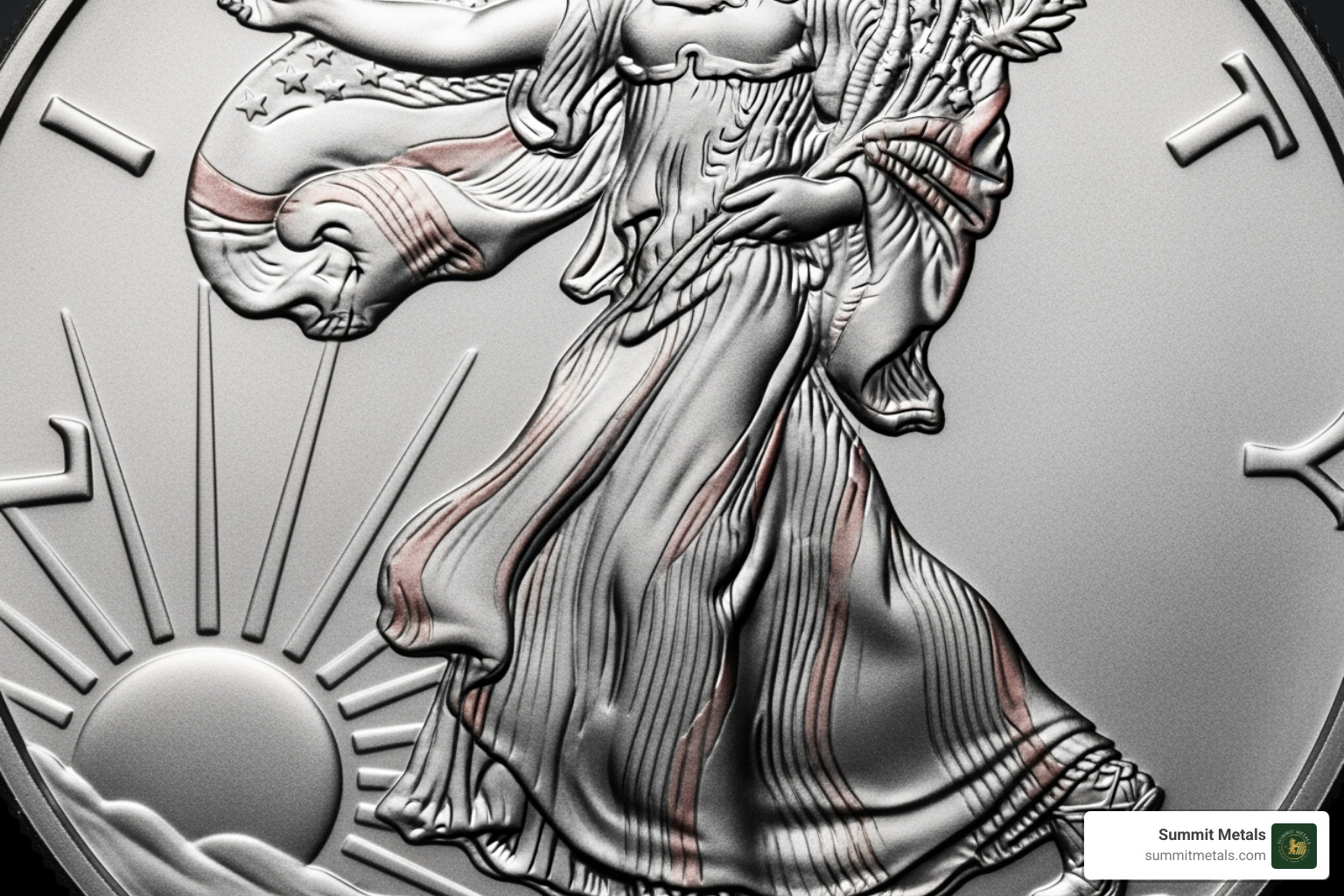

When you hold a silver eagle 1 ounce coin, you're looking at one of America's most beloved coin designs. The Walking Liberty on the front isn't just beautiful—it's a masterpiece created by Adolph A. Weinman in 1916 for the Walking Liberty Half-Dollar.

Lady Liberty strides confidently toward the rising sun, draped in the American flag with her Phrygian cap symbolizing freedom. At her feet, you'll find laurel and oak branches representing victory and strength. The rising sun behind her speaks to hope and new beginnings—themes that resonate just as strongly today as they did over a century ago.

The design was so perfect that when the American Eagle program launched in 1986, there was never any question about which design to use. Weinman's Walking Liberty had already proven its timeless appeal during its original 31-year run, and it continues to capture hearts today.

This isn't just patriotism for show—it's artistry that tells America's story. Every time you look at the obverse of your silver eagle 1 ounce coin, you're seeing the same symbol of freedom that inspired Americans through two world wars and countless challenges.

The Evolution of the Reverse Design

The back of the silver eagle 1 ounce coin has an interesting story of its own. For 35 years, from 1986 to 2021, John Mercanti's Heraldic Eagle dominated the reverse. This powerful Type 1 design featured the Great Seal of the United States—an eagle clutching arrows and an olive branch, surrounded by 13 stars for the original colonies.

Then came 2021, and everything changed. To celebrate the 35th anniversary of the program, Emily Damstra created a stunning new Type 2 reverse. Her Eagle Landing design shows an American bald eagle coming in for a landing while grasping an oak branch. It's more naturalistic and modern while keeping all the patriotic symbolism intact.

This design change was huge—only the second time in the program's history that the reverse was altered. The oak branch in the eagle's talons symbolizes strength and endurance, while the landing posture suggests America's readiness to defend its values.

For collectors and investors, this change created an interesting divide. Silver eagle 1 ounce coins minted before 2021 carry the classic Heraldic Eagle, while those from 2021 onward feature the new Eagle Landing design. Both are beautiful, but the transition year makes 2021 particularly significant for anyone building a collection.

A Guide to the Different Silver Eagle 1 Ounce Versions

When you're ready to add silver eagle 1 ounce coins to your portfolio, you'll quickly find there's more than one type to choose from. Each version serves different goals, and understanding these differences can save you money and help you make smarter investment decisions.

Think of it like buying a car - you wouldn't choose a Ferrari for daily commuting or a compact car for hauling cargo. Similarly, your choice between bullion, proof, and burnished Silver Eagles depends on whether you're investing for silver content or collecting for numismatic value.

| Type | Finish | Mint Mark | Mintage | Target Audience | Typical Premium |

|---|---|---|---|---|---|

| Bullion | Brilliant Uncirculated | None | Highest | Investors | Lowest |

| Proof | Mirror/Frosted | W, S, or P | Lower | Collectors | Higher |

| Burnished | Matte-like | W | Lowest | Hybrid | Medium |

Bullion Silver Eagles

If you're focused on silver content over collectibility, bullion Silver Eagles are your best friend. These coins feature a brilliant uncirculated finish that gives them a clean, shiny appearance straight from the mint. You won't find any mint marks on these coins, which keeps things simple.

Bullion Silver Eagles offer the most bang for your buck. With the highest annual production numbers, they carry the lowest premiums over spot silver prices. When silver moves up or down, these coins track that movement closely - exactly what most investors want.

The U.S. Mint produces most bullion Silver Eagles at West Point, though they've fired up the presses at Philadelphia and San Francisco during high-demand periods. The distribution system works through authorized purchasers who must order hefty minimums of 25,000 coins, which eventually makes its way to dealers like Summit Metals.

Proof Silver Eagles

Proof Silver Eagles are the premium option for collectors who appreciate craftsmanship and limited production. These coins undergo a special minting process where dies and blanks get extra attention, creating those stunning mirror-like surfaces with frosted design details that catch the light beautifully.

Every proof coin carries a mint mark - "W" for West Point, "S" for San Francisco, or "P" for Philadelphia - and arrives in protective packaging with a certificate of authenticity. Think of these as the dress-up version of Silver Eagles, complete with lower mintage numbers that justify their higher premiums.

The proof program has had its share of drama. In 2009, the Mint actually suspended proof production to focus on meeting massive bullion demand during the financial crisis. This created additional scarcity for certain years, which collectors love but can make completing date sets more expensive.

Burnished (Uncirculated) Silver Eagles

Burnished Silver Eagles entered the scene in 2006 for the program's 20th anniversary, and they've carved out their own niche ever since. These coins feature a distinctive matte-like finish created by burnishing the coin blanks before striking - imagine the difference between polished chrome and brushed aluminum.

All burnished Silver Eagles sport the "W" mint mark and come exclusively from West Point. Their limited production numbers typically stay under 200,000 annually, making them scarcer than bullion coins but more accessible than many proof issues.

The burnished finish gives these coins a unique appearance that appeals to collectors while maintaining the investment appeal of their silver eagle 1 ounce content. They're like the sweet spot between pure investment and pure collecting - perfect for those who want something special without paying proof coin premiums.

Graded and Special Issues

Third-party grading services like PCGS and NGC have created an entire secondary market for silver eagle 1 ounce coins. Perfect MS-70 or PR-70 grades can command significant premiums, especially with special designations like "First Day of Issue" or "Early Releases."

Special issues have punctuated the Silver Eagle program's history with memorable releases. The 1995-W proof stands out as the ultimate key date - its extremely low mintage has pushed values into the thousands of dollars. Anniversary sets, improved uncirculated versions, and reverse proof coins have all added variety and excitement to the program.

These special issues often develop numismatic premiums that go far beyond their silver content, potentially providing additional returns for collectors. However, they require more market knowledge and timing than standard bullion coins, making them better suited for experienced collectors rather than beginning investors.

Investing in the Silver Eagle 1 Ounce Coin

When it comes to building a solid precious metals portfolio, the silver eagle 1 ounce coin stands out as one of the smartest choices you can make. There's something deeply satisfying about holding real silver in your hands - especially when that silver comes with the full backing of the U.S. government.

What makes Silver Eagles particularly attractive for investors is their role as a hedge against inflation. When paper currencies lose value or stock markets get volatile, precious metals often hold their ground. During the 2008 financial crisis and again during the COVID-19 pandemic, investors flocked to Silver Eagles as a safe haven asset.

The global recognition of these coins is another major advantage. Walk into any coin shop in Tokyo, London, or New York, and they'll instantly recognize a Silver Eagle. This worldwide acceptance means you can liquidate your investment almost anywhere, making these coins incredibly liquid compared to other silver products.

Portfolio diversification becomes much easier when you include tangible assets like Silver Eagles. While stocks and bonds exist only on paper (or computer screens), your silver coins provide real, physical wealth that doesn't depend on any company's performance or government's promises beyond the metal content itself.

Key Factors Influencing the Silver Eagle 1 Ounce Price

Understanding what drives silver eagle 1 ounce pricing helps you make smarter buying decisions. The foundation is always the silver spot price - the current market value of raw silver. In 2023, silver bounced between $20.34 and $26.25 per ounce, and every Silver Eagle's value moves with these fluctuations.

But you'll always pay more than spot price, and that's where premiums come in. Think of premiums as the cost of changing raw silver into a beautiful, government-guaranteed coin. Bullion Silver Eagles typically carry the lowest premiums since they're mass-produced for investors. Proof coins command higher premiums due to their special production process and lower mintage numbers.

Supply and demand can dramatically affect these premiums. During the pandemic, premiums spiked to $20 over spot price as mints struggled to keep up with demand. When economic uncertainty rises, more people want Silver Eagles, driving prices higher.

Mintage numbers create long-term value differences between years. The 1996 bullion Silver Eagle, with only 3.6 million coins minted, trades for significantly more than common years. Meanwhile, the ultra-rare 1995-W proof commands thousands of dollars due to its extremely limited production.

Coin condition matters too, especially for collectors. A perfect MS-70 graded Silver Eagle brings substantial premiums over raw coins. Even minor scratches or spots can affect value, which is why proper storage and handling are so important.

Economic uncertainty acts as a major demand driver. Recessions, inflation concerns, and geopolitical tensions all push investors toward precious metals. When people lose confidence in paper assets, they turn to the tangible security of silver.

IRA Eligibility and Selling Your Coins

Here's some great news for retirement planning: silver eagle 1 ounce coins qualify for Precious Metals IRAs. The IRS requirements for bullion specify that coins must be .999 fine silver and produced by a government mint - requirements that Silver Eagles easily meet.

Setting up a Precious Metals IRA does require using approved custodians for storage, since you can't keep IRA metals at home. While this adds storage costs, it provides professional security and ensures IRS compliance. Many investors find the tax advantages worthwhile, especially for long-term holdings.

When you're ready to sell your Silver Eagles, you have several solid options. Many dealers offer buy-back policies with competitive pricing. At Summit Metals, we maintain transparent buy-back processes with real-time pricing, so you always know exactly what your coins are worth.

The payment process is typically straightforward - you can often lock in a price quote for a specific period, giving you time to ship your coins securely. This price-locking feature protects you from silver price drops during shipping.

Whether you're buying for portfolio diversification or planning for retirement, Silver Eagles offer a compelling combination of government backing, liquidity, and long-term value preservation. Their track record speaks for itself - over 35 years of consistent demand from investors worldwide.

Minting, Distribution, and Security

Behind every silver eagle 1 ounce coin lies a sophisticated production and distribution system that ensures quality, authenticity, and widespread availability. The U.S. Mint has refined this process over nearly four decades to create one of the world's most trusted precious metals programs.

The West Point Mint in New York serves as the primary home for Silver Eagle production. This facility, originally built as a gold bullion depository during the Great Depression, now houses the most advanced coin production equipment in the world. When demand spikes - like during the 2020 pandemic - the Philadelphia and San Francisco mints step in to help meet investor needs.

Here's something many investors don't realize: you can't actually buy Silver Eagles directly from the U.S. Mint. Instead, the Mint works exclusively with authorized purchasers - large precious metals dealers who must meet strict financial requirements and purchase minimum quantities of 25,000 coins at a time.

This system might seem complicated, but it actually works in your favor. These authorized purchasers then sell to smaller dealers like Summit Metals, creating a competitive marketplace that helps keep premiums reasonable. The multi-tier distribution ensures that whether you're in Wyoming or New York, you can access authentic Silver Eagles at fair prices.

How Silver Eagles are Packaged and Sold

The beauty of silver eagle 1 ounce coins lies partly in their flexible packaging options. Whether you're buying your first coin or adding to a substantial collection, there's a packaging solution that fits your needs and budget.

Individual coins come protected in clear plastic flips or hard plastic capsules. This option works perfectly for new investors testing the waters or collectors seeking specific dates. The protective packaging prevents scratches and handling damage that could affect the coin's value.

Mint tubes containing exactly 20 coins offer the sweet spot for many investors. These official U.S. Mint tubes provide quantity discounts while remaining manageable for storage. The tubes themselves have become collectible, with their distinctive green color and official markings adding authenticity to your holdings.

For serious investors, monster boxes represent the ultimate in Silver Eagle purchasing power. These sealed boxes contain 500 coins arranged in 25 mint tubes. The factory-sealed nature of monster boxes provides ironclad authenticity assurance, and many dealers pay premiums for intact monster boxes when you're ready to sell.

Proof coins deserve special mention for their neat presentation. These collector-focused coins arrive in individual presentation boxes with certificates of authenticity. The packaging alone tells you these coins are something special - and the mirror-like finish inside confirms it.

Advanced Security Features to Prevent Counterfeiting

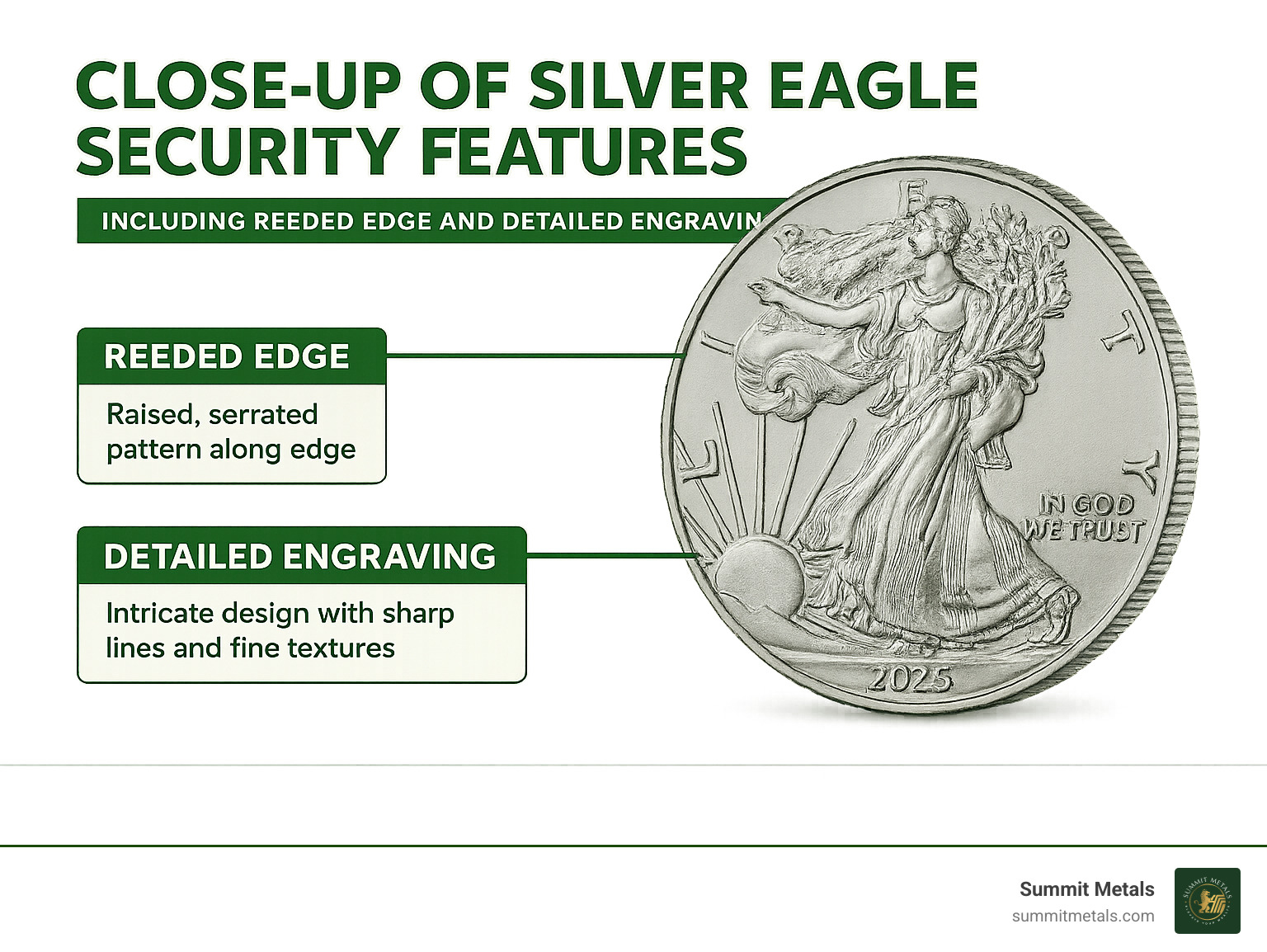

The U.S. Mint takes counterfeiting seriously, and silver eagle 1 ounce coins include several sophisticated security features that protect your investment. These aren't just technical specifications - they're your assurance that what you're buying is genuine American silver.

The most significant recent addition is the reeded edge variation found on Type 2 coins (2021-present). Look closely at the edge of these newer coins and you'll notice what appears to be a missing reed or small notch. This isn't a mistake - it's an intentional anti-counterfeiting feature that's extremely difficult for counterfeiters to replicate accurately.

The intricate details in Weinman's Walking Liberty design serve as another layer of protection. Those fine lines in Liberty's flowing gown, the delicate features of her face, and the precise lettering all require sophisticated equipment to reproduce. Counterfeit coins often show softness or missing details in these critical areas.

Here's a simple test you can do at home: genuine Silver Eagles have precise specifications for weight (31.103 grams), diameter (40.6mm), and thickness (2.98mm). A basic scale and caliper can help verify these measurements. Significant deviations often indicate counterfeits.

The magnetic properties of pure silver also provide a quick authenticity check. Pure silver is diamagnetic, meaning it's slightly repelled by strong magnets. While this test won't catch sophisticated silver-plated counterfeits, it can help identify obvious fakes made from magnetic metals.

At Summit Metals, we source our Silver Eagles directly from authorized distributors and stand behind every coin's authenticity. Our transparent pricing and authentication guarantee give you confidence that your silver eagle 1 ounce coins are genuine government silver, not clever imitations.

Conclusion: Is the 1 oz Silver Eagle Your Next Investment?

After exploring the rich history, beautiful design, and investment potential of the silver eagle 1 ounce coin, one question remains: Is it right for your portfolio?

The answer depends on your investment goals, but the Silver Eagle's track record speaks volumes. For nearly four decades, these coins have weathered economic storms, market volatility, and global uncertainty while maintaining their appeal to both investors and collectors.

The tangible advantage sets Silver Eagles apart from paper investments. When you hold a silver eagle 1 ounce coin, you're holding real wealth - not a promise or digital entry. This psychological benefit becomes particularly valuable during uncertain times when confidence in traditional investments wavers.

The government guarantee backing every Silver Eagle provides security that private mint products simply cannot match. The U.S. Mint's reputation and the coin's status as legal tender create a foundation of trust that resonates globally.

Portfolio diversification represents another compelling reason to consider Silver Eagles. Precious metals often move independently of stocks and bonds, providing balance when other assets struggle. The 2008 financial crisis and 2020 pandemic demonstrated how quickly investors turn to tangible assets during turbulent periods.

For those planning long-term wealth preservation, the IRA eligibility of Silver Eagles opens doors to tax-advantaged investing. This feature allows you to build precious metals exposure while potentially reducing your tax burden - a win-win situation for retirement planning.

The liquidity advantage cannot be overstated. Silver Eagles enjoy global recognition and acceptance, making them easy to buy and sell. Whether you're dealing with local coin shops or international dealers, these coins command respect and competitive pricing.

Three distinct versions - bullion, proof, and burnished - ensure there's a Silver Eagle for every investor. Bullion coins offer the most cost-effective silver exposure, while proof and burnished coins provide potential numismatic premiums for those seeking additional upside.

At Summit Metals, we've built our reputation on transparent pricing and authentic products. Our bulk purchasing power translates directly into better prices for you, while our authentication process ensures every coin meets the highest standards.

The beauty of Silver Eagles extends beyond their investment potential. Weinman's Walking Liberty design captures American ideals in precious metal form, creating coins that are as aesthetically pleasing as they are financially sound.

Whether you're just starting your precious metals journey or adding to an established portfolio, the silver eagle 1 ounce coin offers proven performance and enduring value. Its combination of government backing, beautiful design, high liquidity, and investment flexibility makes it suitable for investors across all experience levels.

Ready to find why these American treasures have captivated investors for nearly four decades? Browse our collection of Silver Eagle 1 ounce coins and take the first step toward adding tangible wealth to your portfolio.

Prices shown are at the time of this publication and subject to market fluctuations.