Introduction: More Than Just a Coin

The silver maple leaf spot price is a critical metric for investors seeking to understand the true value of one of the world's most recognized bullion coins. Here's a look at recent pricing:

Current Silver Maple Leaf Pricing (as of publication):

| Component | Price Range |

|---|---|

| Silver Spot Price | $17.03 - $47.54 per oz |

| Standard Silver Maple Leaf (2015+) | $63.25 - $63.31 per oz |

| Backdated Silver Maple Leaf | $49.98 - $51.02 per oz (bulk) |

| Special Editions (Wildlife, Zodiac) | $53.23 - $60.85 per oz |

Prices shown are at the time of this publication.

The Canadian Silver Maple Leaf isn't just another silver coin—it's a cornerstone of precious metals investing, renowned for its .9999 purity and global recognition. However, investors often notice that the price paid for a Silver Maple Leaf is always higher than the raw silver spot price quoted online.

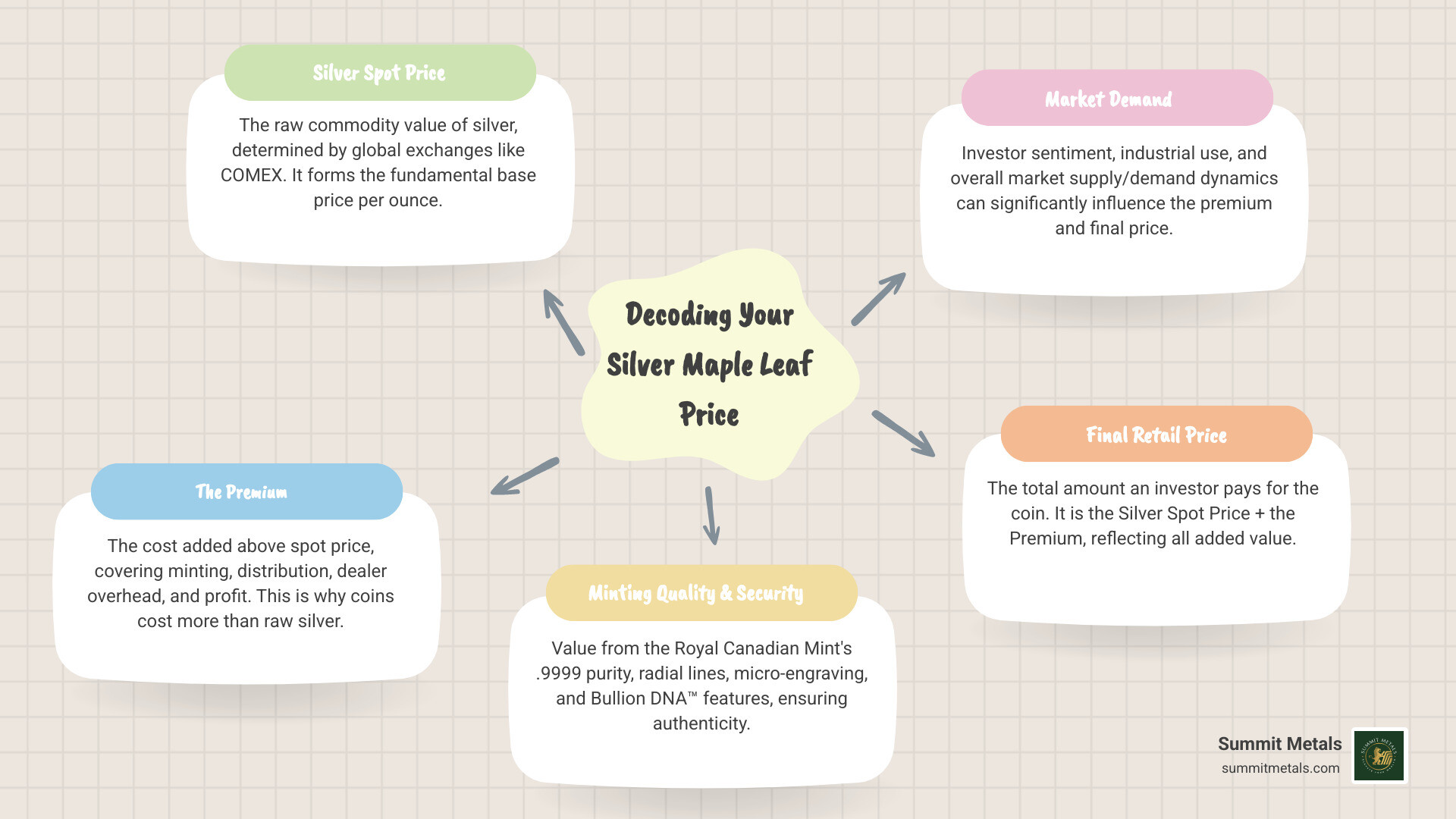

This gap isn't arbitrary. The final price is a complex interplay of raw metal value, minting quality, security features, and market demand. Understanding this difference is essential for making informed investment decisions.

This guide will break down every component that contributes to the silver maple leaf spot price—from the base commodity value to the premiums that reflect the Royal Canadian Mint's world-class production standards. You'll learn what drives price fluctuations and how to build your stack at the best possible value.

Silver maple leaf spot price glossary:

- physical precious metals

- silver investment strategies

- precious metal broker

Understanding the Current Silver Maple Leaf Spot Price

When we talk about the silver maple leaf spot price, we're discussing a combination of the raw silver's market value and the added costs of changing that metal into a globally recognized coin. For investors in Wyoming or Salt Lake City, understanding this distinction is crucial.

What is the Silver "Spot Price"?

The "spot price" of silver is the current market price for raw, unrefined silver for immediate delivery. Think of it as the base value of one troy ounce of pure silver before it's minted. This price is determined by global commodity markets, primarily through futures contracts traded on exchanges like the COMEX (Commodity Exchange).

The spot price fluctuates constantly based on supply, demand, economic news, and investor sentiment. The wide range seen in the intro ($17.03 - $47.54) reflects different data sources, currency conversions, and the precise moment of measurement over time. The collective expectations of futures traders heavily influence today's spot price, creating the price findy mechanism for raw silver.

For more in-depth information on how silver pricing works, you can explore our guide: More info about silver pricing.

The Premium: Why a Maple Leaf Costs More Than Raw Silver

The price of a physical Silver Maple Leaf is always higher than the spot price. This difference is the "premium," which covers several essential costs:

- Minting Costs: The Royal Canadian Mint (RCM) uses state-of-the-art facilities and advanced techniques to produce these high-quality coins.

- Distribution and Logistics: Moving precious metals securely from the mint to distributors and then to dealers involves significant costs for transport, insurance, and storage.

- Dealer Overhead: As a reputable dealer, Summit Metals incurs costs for secure storage, authentication, customer service, and maintaining our physical locations in places like Wyoming and Salt Lake City.

- Security Features: The RCM's anti-counterfeiting measures, like radial lines, micro-engraved privy marks, and Bullion DNA™ technology, add to the production cost but improve the coin's integrity.

- MINTSHIELD™ Technology: This RCM innovation significantly reduces "milk spots" (white blemishes), adding value and appeal to the coins.

These factors mean the finished product commands a premium comparable to other prestigious sovereign coins like the American Silver Eagle, reflecting its superior quality. You can find more details on current offerings here: Leaf It to Silver: Top Deals on 2025 Silver Maple Leaf Coins.

Calculating the Final Price You Pay

The final price for a Silver Maple Leaf coin is a straightforward calculation:

Spot Price + Premium = Total Cost

Several factors contribute to this total cost:

- Current Silver Spot Price: The foundational price of the raw silver. We monitor real-time pricing from sources like The Globe and Mail's commodity data, Barchart Solutions, and CME Group.

- Premium: This covers minting, shipping, insurance, and dealer operational costs.

- Bid vs. Ask Price: You buy at the "ask" price and sell at the "bid" price. The difference is the "spread," a normal part of market function.

- Quantity Purchased: Because we purchase in bulk, Summit Metals can offer better pricing per ounce, especially for larger quantities.

- Payment Method: Wire transfers may result in slightly lower prices compared to credit cards due to lower processing fees.

For example, if the silver spot price is $25/ounce and a Silver Maple Leaf has a premium of $5, the total cost would be $30. We pride ourselves on this transparency, so you always know what you're paying for.

Key Factors Driving the Price of Silver Maple Leafs

The silver maple leaf spot price isn't a static number; it's a reflection of complex global forces. Several key factors influence both the underlying spot price of silver and the premium attached to the Maple Leaf coin. Understanding these drivers helps anticipate market movements.

Global Supply and the "Green Revolution"

Industrial demand is a significant driver of silver's price. Silver is an indispensable commodity with the highest electrical and thermal conductivity of all metals, making it critical for the "Green Revolution":

- Solar Panels (Photovoltaics): Silver is a crucial component in photovoltaic cells. With solar demand skyrocketing globally, silver consumption has seen massive increases, with forecasts suggesting even higher demand ahead.

- Electric Vehicles (EVs): EVs use approximately twice as much silver as traditional cars. As EV sales increase, this trend adds significant pressure to silver demand.

- Electronics: Silver is vital in countless electronic components, from smartphones to medical devices.

The silver market has been in a supply deficit for several years, meaning demand has consistently outstripped new supply from mining. This sustained deficit, combined with surging industrial consumption, puts upward pressure on the silver maple leaf spot price.

Economic Indicators and Investor Behavior

Beyond industrial use, silver's role as a financial asset profoundly impacts its price.

- Inflation Hedge: When inflation erodes the purchasing power of fiat currencies, investors often turn to precious metals like silver as a store of value.

- Interest Rates: Higher interest rates can make interest-bearing assets more attractive than non-yielding silver. Conversely, lower rates can make silver more appealing.

- Market Volatility: During periods of economic uncertainty, silver often acts as a "safe-haven asset," increasing demand.

- Geopolitical Factors: Global instability can also trigger investor demand for silver as a hedge against uncertainty.

- Gold-to-Silver Ratio: This ratio indicates how many ounces of silver it takes to buy one ounce of gold. Investors use it to gauge which metal is relatively undervalued, influencing buying decisions.

Understanding these signals is key to predicting movements in the silver maple leaf spot price. For more insights, consider reading: Investing in Gold: Your Guide to Purchasing Canadian Maple Leaf Coins.

The Coin's Anatomy: How Purity and Security Add Value

The Silver Maple Leaf's inherent characteristics contribute to its price.

- .9999 Fine Silver Purity: The Royal Canadian Mint (RCM) is renowned for producing coins with 99.99% pure silver. This exceptional purity is a hallmark of the Maple Leaf and is highly sought after.

-

Advanced Security Features: The RCM's innovations protect against counterfeiting and add to the coin's trustworthiness:

- Radial Lines: Precisely machined lines create a unique light-diffracting pattern that is difficult to replicate.

- Micro-Engraved Leaf: A tiny, laser-engraved maple leaf privy mark contains the last two digits of the mintage year, allowing for immediate authentication via Bullion DNA™ technology.

- MINTSHIELD™ Technology: This proprietary surface protection significantly reduces milk spotting, improving the coin's aesthetic appeal and long-term value.

These characteristics make the Silver Maple Leaf a globally recognized and trusted asset, influencing its demand and price. The RCM's prestige is also reflected in its other products, as discussed here: Why the Canadian Gold Maple Leaf is a Collector's Dream.

Silver Maple Leaf vs. Other Bullion: A Comparative Look

When considering the silver maple leaf spot price and its premium, it's helpful to compare it to other popular silver bullion products. The "best" choice often depends on your investment goals. Here’s how the Silver Maple Leaf stacks up against common alternatives available in places like Wyoming and Salt Lake City:

| Feature | Silver Maple Leaf | American Silver Eagle | Generic 1 oz Silver Round | 1 oz Silver Bar |

|---|---|---|---|---|

| Purity | .9999 Fine Silver | .999 Fine Silver | Typically .999 Fine Silver | Typically .999 Fine Silver |

| Government Backing | Yes (Royal Canadian Mint) | Yes (U.S. Mint) | No | No |

| Typical Premium (over spot) | Moderate to High | High | Low | Lowest |

| Security Features | Radial lines, micro-engraved maple leaf (Bullion DNA™), MINTSHIELD™ anti-milk spot protection | Reeded edge | None | None (beyond serial numbers on some larger bars) |

| Legal Tender Status | Yes ($5 CAD face value) | Yes ($1 USD face value) | No | No |

| Liquidity | Excellent (globally recognized) | Excellent (U.S. highly recognized) | Good (widely accepted) | Excellent (widely accepted) |

| Fraud Protection | High (government backing, advanced security, face value) | High (government backing, face value) | Low (no official backing or advanced features) | Low (no official backing or advanced features) |

- Sovereign Coins (Silver Maple Leaf, American Silver Eagle): Produced by government mints, these coins carry a face value (e.g., $5 CAD for the Maple Leaf). This government backing provides trust, liquidity, and a powerful deterrent against counterfeiting, as faking legal tender carries harsh penalties. Their premiums are higher due to superior quality, security, and brand recognition.

- Generic Silver Rounds: These privately minted pieces offer a cost-effective way to acquire silver with low premiums. However, they lack government backing, a legal tender face value, and advanced security, which can make them slightly less liquid or require more scrutiny during resale.

- Silver Bars: Available in various weights, silver bars typically offer the lowest premium per ounce, especially in larger sizes. They are ideal for investors focused purely on accumulating mass for the lowest cost but lack the security and government backing of sovereign coins.

For investors prioritizing low premiums, bars or rounds might seem appealing. However, for those seeking the highest assurance of authenticity, global recognition, and security, the Silver Maple Leaf is an outstanding choice. Its combination of .9999 purity and advanced RCM features makes it a premium, trusted product in the bullion world.

Decoding Price Variations in Silver Maple Leaf Coins

The silver maple leaf spot price isn't uniform across all Maple Leaf coins. Beyond the base spot price and standard premium, specific characteristics like the year of mintage or unique designs can significantly influence a coin's value, blending bullion investment with numismatics (coin collecting).

You might wonder why a 2008 Inukshuk Silver Maple Leaf could have a different price than a standard 2023 coin. It all comes down to collector demand, rarity, and specific features. For a broader understanding of these unique coins, check out: Silver Maple Leaf Coins: Your Pocket-Sized Guide to Numismatic Wonders.

Why the Year of Your Silver Maple Leaf Matters for its Spot Price

The year a Silver Maple Leaf was minted can affect its price, primarily due to security features and market perception:

- Pre-2015 vs. Post-2014 Security Features: The Royal Canadian Mint significantly upgraded its anti-counterfeiting measures in 2014. Coins minted from 2015 onwards feature advanced radial lines and the micro-engraved maple leaf with Bullion DNA™. These features can make newer coins more appealing, potentially leading to slightly higher premiums. For example, a "Silver Maple Leaf Coin (2015 or Later)" was priced at $63.25/oz, while a general "Silver Maple Leaf Coin" was $61.89/oz (as of publication).

- Condition and Wear: For older coins, physical condition plays a role. While bullion is valued for its metal content, severe scratches or dents can slightly reduce its premium. Backdated coins, often sold in bulk, might be priced lower than current year issues because they are common dates and may have minor imperfections. For example, "RCM 1oz Silver Canadian Maple Leaf - Backdated" could be found for $49.98 to $51.02 per ounce for bulk quantities (as of publication).

When purchasing Silver Maple Leafs, especially backdated ones, it’s wise to buy from a trusted dealer who guarantees authenticity and accurately describes the product's condition.

Understanding the Higher Silver Maple Leaf Spot Price for Special Editions

While most Silver Maple Leafs are bullion, the RCM also produces special editions that command higher premiums due to limited mintage and unique designs. These coins appeal to both investors and collectors:

- Collector Demand and Limited Mintage: Special edition coins, often featuring privy marks or commemorative themes, are produced in smaller quantities. This scarcity drives collector demand, pushing their prices well above the typical bullion premium.

-

Examples of Special Series:

- Wildlife Series (2011-2013): Coins like the Timberwolf, Grizzly Bear, and Cougar. A "RCM 1oz Silver Wildlife Timberwolf - 2011" was priced around $55.24 - $57.45 (as of publication).

- Birds of Prey Series (2014-2015): Featuring designs like the Bald Eagle and Peregrine Falcon.

- Zodiac Privy Series: Limited editions with zodiac sign privy marks, such as the "RCM Zodiac Privy 1oz Silver Maple Leaf, Gemini - 2004," which was priced at $60.85 - $63.28 (as of publication).

- Commemorative Issues: Coins like the "RCM 1oz Silver Canada 150 Voyageur - 2017" or the "RCM 1oz Silver 25th Anniversary - 2013."

These special editions demonstrate how the silver maple leaf spot price can be influenced by factors beyond just the pure metal content. While standard bullion coins are ideal for pure investment, special editions offer potential for numismatic appreciation.

Smart Investing Strategies for Silver Maple Leafs

Understanding the silver maple leaf spot price is the first step; applying that knowledge is next. A thoughtful approach can maximize your returns and minimize risks. The Silver Maple Leaf, with its high purity and global recognition, is an excellent choice for a long-term hold in a diversified portfolio.

Build Your Stack Steadily with Autoinvest

One of the most effective strategies for long-term investing is dollar-cost averaging: investing a fixed amount of money at regular intervals, regardless of price. This approach averages out your purchase price over time and mitigates the risk of trying to "time" the market.

At Summit Metals, we make this easy with our Autoinvest program. Think of it as a 401k-style plan for physical silver. You set up automated monthly purchases, and we handle the rest, sending you authenticated Silver Maple Leafs consistently.

Benefits of Autoinvest:

- Mitigates Volatility: Takes the emotion out of investing and reduces the impact of short-term price swings.

- Consistent Investing: Helps you build your silver stack steadily without constantly monitoring the market.

- Convenience: Once set up, your portfolio grows automatically.

- Long-Term Growth: Aligns with a long-term philosophy, allowing you to benefit from silver's potential appreciation over time.

We believe consistent, disciplined investing is the path to success. Learn more and set up your automated investment plan today: Set up your investment plan.

Using Price History to Inform Your Buys

While dollar-cost averaging is excellent for consistent accumulation, understanding silver's price history can help you recognize trends and provide valuable perspective.

- Historical Highs and Lows: Silver has seen significant price movements, reaching nominal highs around $49 per troy ounce in 1980 and again in 2011. After 2011, it traded in a lower range before breaching $20 in 2020 and rising over $30 in 2024.

- Recognizing Trends: Studying historical price charts from reputable financial data providers allows you to identify long-term trends, support levels, and resistance levels. This knowledge empowers you to make more informed buying decisions.

- Impact of Events: Historical data shows how global events—like financial crises, quantitative easing, or increased industrial demand—can dramatically affect silver prices. This helps us understand the resilience and potential of silver as an asset.

Past performance is not indicative of future results, but it provides crucial context for any investor.

Conclusion: Investing with Confidence

The price of a Silver Maple Leaf is a clear indicator of the global silver market, improved by the coin's best quality and security. By understanding the difference between the spot price and the premium, and the factors that influence them, you can invest with greater confidence. For transparent, real-time pricing on authenticated precious metals, dealers like Summit Metals provide the tools and inventory to help you build a valuable portfolio. Ready to start or expand your silver holdings? Learn how to buy silver bullion at spot price.