Why American Gold Remains a Top Choice for Investors

American gold refers to the American Gold Eagle, the official gold bullion coin of the United States. First released by the U.S. Mint in 1986, these 22-karat gold coins are backed by the U.S. government for weight and purity. Available in four sizes—1 oz, 1/2 oz, 1/4 oz, and 1/10 oz—they are a trusted investment and a piece of American heritage.

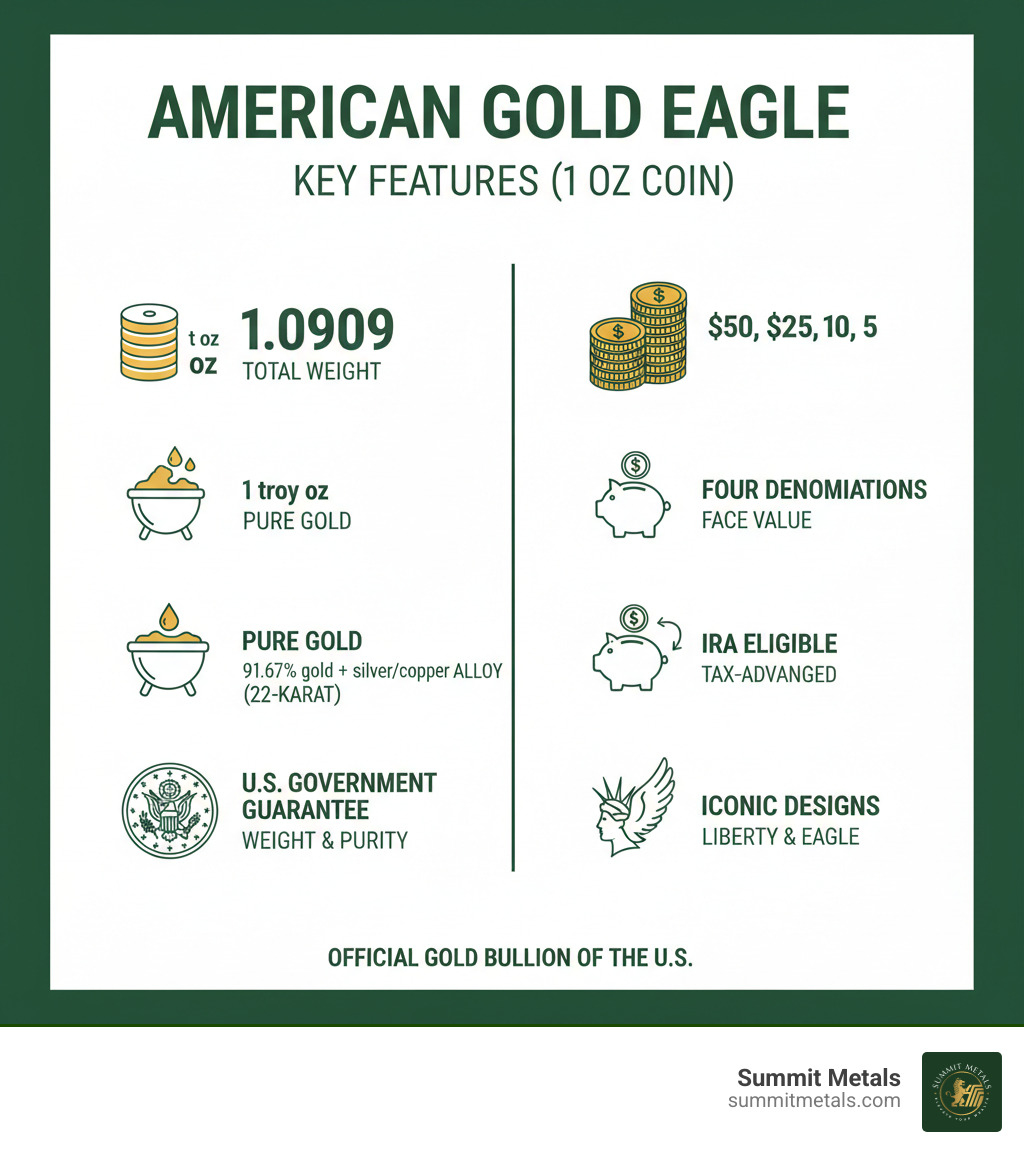

Quick Facts: American Gold Eagle Coins

- Official Coin: The American Gold Eagle is the nation's official gold bullion coin, authorized by the Gold Bullion Coin Act of 1985.

- Composition: 22-karat gold (91.67% gold, 3% silver, 5.33% copper) for durability.

- Sizes & Face Values: 1 oz ($50), 1/2 oz ($25), 1/4 oz ($10), 1/10 oz ($5).

- Government Guarantee: Weight, content, and purity are backed by the U.S. government.

- IRA Eligible: Can be included in a Precious Metals IRA for tax-advantaged retirement savings.

- Design: Features Lady Liberty on the obverse (inspired by Augustus Saint-Gaudens' 1907 "Double Eagle") and an eagle on the reverse (updated in 2021 for the coin's 35th anniversary).

As one of the world's most recognizable and liquid gold coins, the American Gold Eagle offers a reliable way to own physical gold. This finite asset has historically served as a hedge against inflation and economic uncertainty, with gold prices reaching all-time highs above $3,500 per ounce in 2025.

For both new and seasoned investors, American gold coins offer a unique combination of intrinsic value, government backing, and historical significance. Their availability in multiple sizes makes them accessible for any budget, and their legal tender status provides fraud protection that gold bars cannot offer.

I'm Eric Roach. After a decade on Wall Street advising on multi-billion-dollar transactions, I now apply that institutional expertise to help everyday investors protect their wealth with american gold. Let me guide you through what you need to know about this cornerstone investment.

The History and Creation of the American Gold Eagle

The American Gold Eagle's story began when a 1985 ban on the South African Krugerrand left a void for American gold investors. Congress responded with the Gold Bullion Coin Act of 1985, officially enacted as Public Law 99-185. This legislation created a uniquely American investment by mandating that all gold be sourced from within the United States, ensuring every american gold Eagle is a domestic product from mine to mint. Proceeds from coin sales were even designated to help pay down the national debt.

The name "Eagle" pays homage to America's pre-1933 $10 gold pieces, connecting modern investors to a rich heritage. This history and explicit government backing quickly established the American Gold Eagle as a premier choice for investors worldwide.

The Role of the U.S. Mint

The United States Mint is the sole producer of American Gold Eagles, and every coin carries an official government guarantee of its weight, content, and purity. This promise sets these coins apart from privately minted gold. Most are struck at the renowned West Point Mint in New York.

The U.S. Mint does not sell bullion Gold Eagles directly to the public. Instead, it uses a network of authorized purchasers and dealers. This is where trusted partners like Summit Metals come in. We source authentic coins from this official supply chain, offering them at competitive prices due to our bulk purchasing power. While collector versions (proof and uncirculated) are available from the Mint, investment-grade bullion is best sourced through an authorized dealer for optimal pricing.

The Mint's strict oversight ensures every American Gold Eagle is a trusted form of american gold. You can learn more about the full American Eagle Coin Program on the official American Eagle Gold Bullion Coins | U.S. Mint page.

Anatomy of an American Gold Eagle: Design and Specifications

An american gold Eagle is more than precious metal; it's a piece of American artistry and heritage. Its design and composition reflect the nation's values, making it both visually striking and technically impressive.

Obverse Design: A Timeless Liberty

The obverse features Augustus Saint-Gaudens' celebrated design from the 1907 $20 "Double Eagle" coin. It depicts Lady Liberty striding forward, holding a torch for enlightenment and an olive branch for peace. The U.S. Capitol is in the background, and the figure is surrounded by 50 stars, one for each state. This masterpiece of numismatic art embodies American values in a way that remains powerful over a century later.

Reverse Design: The Evolving Eagle

The reverse design has evolved. From 1986 to 2021, the Type 1 design by Miley Busiek featured a "Family of Eagles," with a male eagle returning to a nest where a female and their eaglets waited. In 2021, for the coin's 35th anniversary, the Mint introduced the Type 2 design. Created by Jennie Norris, it features a detailed portrait of an eagle's head and includes improved anti-counterfeiting features. While new coins feature the Type 2 design, Type 1 coins remain popular with collectors.

Composition, Weights, and Denominations

American Gold Eagles are struck in durable 22-karat gold, an alloy of 91.67% pure gold, 3% silver, and 5.33% copper. This composition, known as "crown gold," provides wear resistance, making the coins less prone to scratches and dings than pure 24-karat gold. While a 1 oz coin contains exactly one troy ounce of pure gold, its total weight is slightly higher (1.0909 troy ounces) due to the added alloy metals.

Gold Eagles are available in four sizes with corresponding legal tender face values: 1 oz ($50), 1/2 oz ($25), 1/4 oz ($10), and the 1/10 oz is $5. These face values are nominal; the coin's real value is based on its gold content and the current spot price. The availability of fractional sizes makes gold investing accessible to all budgets and allows for easier liquidation of smaller portions of your holdings. For more on this strategy, see The Benefits of Buying Fractional Gold: Why Smaller is Often Better Than Waiting for a 1oz Gold Coin. Whether you choose a full ounce or a fractional piece, you get the same government guarantee and iconic design.

Investing in American Gold: A Guide for Buyers

Before investing in american gold, it's important to understand your options and the unique advantages of the American Gold Eagle.

Bullion, Proof, and Uncirculated: What's the Difference?

American Gold Eagles come in three main varieties:

- Bullion: These are the standard investment-grade coins, struck for investors who want to own physical gold at a price close to the spot price. Their value is tied directly to their gold content.

- Proof: These are special collector coins made with polished dies, resulting in a mirror-like finish. They are produced in limited quantities, carry a "W" mint mark for the West Point Mint, and command higher premiums.

- Uncirculated (Burnished): Also for collectors, these coins have a unique matte finish and are sold in protective packaging. They also carry a mint mark.

For most investors focused on wealth preservation, bullion coins offer the best value.

Key Benefits of Owning American Gold

Owning American Gold Eagles provides several key benefits:

- High Liquidity: These coins are recognized and accepted by dealers worldwide, making them easy to buy and sell at fair market prices.

- Government Guarantee: The U.S. government backs every coin for its weight, content, and purity, providing a level of trust that is best.

- Inflation and Economic Hedge: Gold has historically served as a safe haven, preserving wealth during times of currency devaluation and market volatility. The historical record answers the question, Is Gold a Good Investment?.

- IRA Eligibility: American Gold Eagles are approved for inclusion in Precious Metals IRAs, allowing you to hold physical american gold in a tax-advantaged retirement account. Learn more in our guide, Retirement Riches: How Gold IRAs Can Fortify Your Financial Future.

- Privacy: Purchases of these coins are generally not subject to IRS broker reporting, offering a degree of financial discretion.

American Gold Coins vs. Gold Bars: Why Coins Stand Out

While both coins and bars offer a way to own gold, American Gold Eagles have distinct advantages. Their legal tender status grants them legal protection against counterfeiting that gold bars lack. They are also more divisible, more recognizable, and ultimately more liquid. While coins carry a slightly higher premium than bars, this cost covers the government guarantee, improved security, and superior flexibility. For investors prioritizing security, the choice is clear.

| Feature | American Gold Eagle Coins | Gold Bars |

|---|---|---|

| Legal Tender Status | Yes—backed by the U.S. government with official face value | No—simply refined bullion |

| Divisibility | Available in four fractional sizes for flexible liquidation | Typically larger sizes; less practical for partial sales |

| Counterfeit Protection | Government-backed with intricate designs and security features; protected by anti-fraud laws | Relies on refiner reputation and assay certificates; more vulnerable to sophisticated fakes |

| Recognizability | Universally recognized and accepted worldwide | Recognition varies by refiner brand |

| Premiums | Slightly higher due to minting costs and government backing | Generally lower due to simpler production |

The bottom line: For investors who prioritize security, liquidity, and peace of mind, the fraud protection and universal trust of American Gold Eagle coins make them the smarter choice over gold bars.

How to Buy and Secure Your American Gold

Acquiring and protecting your american gold is straightforward with the right approach.

Where to Buy Your American Gold

While collector versions can be bought from the U.S. Mint, bullion American Gold Eagles are sold through a network of authorized dealers. Choosing a reputable dealer is crucial. At Summit Metals, we are a trusted source for authenticated american gold, offering transparent, real-time pricing and competitive rates. Our guide on Identifying Reputable Bullion Dealers: Avoiding Counterfeits can help you vet sellers. For most investors, buying from an established online dealer like us offers the best combination of convenience, price, and security. Learn more at How to Buy Gold and Silver Online Safely.

Smart Buying Strategies for American Gold

The price of an American Gold Eagle is the gold "spot price" plus a "premium," which covers minting, distribution, and dealer costs. A smart strategy to manage price fluctuations is Dollar Cost Averaging (DCA). This involves investing a fixed amount at regular intervals, which averages out your cost over time and removes the stress of market timing. Read more in The Power of Dollar Cost Averaging in Gold and Silver Investments.

Summit Metals makes this easy with our Autoinvest program. You can set up automatic monthly purchases of American Gold Eagles, building your holdings consistently, much like a 401k. It’s a “set it and forget it” strategy for building wealth in american gold.

Storing Your Investment

Proper storage is essential for protecting your american gold.

- Home Safe: Offers convenient access for smaller holdings. Ensure it's fire-resistant, bolted down, and check your insurance for coverage limits on precious metals.

- Bank Safety Deposit Box: Provides high security but with access limited to banking hours. Contents are not FDIC insured.

- Third-Party Depository: The best option for larger investments and Gold IRAs. These specialized facilities offer maximum security, regular audits, and full insurance.

Your choice depends on your investment size and need for access. For a detailed comparison, see The Ultimate Guide to Gold and Other Precious Metals Storage.

Frequently Asked Questions about American Gold Eagles

Here are answers to the most common questions we receive about investing in American Gold Eagles.

Are American Gold Eagles a good investment?

Yes. They are considered an excellent investment due to their U.S. government guarantee for weight and purity, high global liquidity, and proven performance as a hedge against inflation and economic uncertainty. This makes american gold a cornerstone for any diversified portfolio aimed at long-term wealth preservation and growth.

What is the difference between the face value and the real value of a Gold Eagle?

The face value ($50 for a 1 oz coin) is a nominal, symbolic value that designates the coin as official U.S. legal tender. The coin's real (or intrinsic) value is based on its gold content multiplied by the current spot price of gold, which is thousands of dollars. The legal tender status is important because it provides an extra layer of anti-counterfeiting protection not afforded to gold bars.

How can I tell if my American Gold Eagle is real?

Authentic coins have precise specifications for weight, dimensions, and design details that are difficult to replicate. The 22-karat alloy also has a distinct color and density. The most reliable way to guarantee authenticity is to buy from a reputable dealer like Summit Metals, who sources directly from the U.S. Mint's authorized network. For self-verification tips, consult our guide, How to Tell if Gold is Real.

Conclusion: Securing Your Future with American Gold

The American Gold Eagle is more than an investment; it's a tangible piece of American heritage and a cornerstone of sound financial planning. By combining the security of a U.S. government guarantee with the intrinsic value of gold, it has become a time-tested vehicle for preserving wealth.

The coin's government guarantee of weight and purity and its iconic, historic designs set it apart. It is both a work of art and one of the most liquid and trusted gold investments in the world. To hedge against inflation or add tangible american gold to your portfolio, the Gold Eagle is a clear choice, with multiple sizes making it accessible for any budget.

Working with a reputable dealer like Summit Metals is key. Based in Wyoming and serving clients from Salt Lake City, Utah, and across the country, we offer transparent pricing and competitive rates. We are especially proud of our Autoinvest program, which removes the guesswork from investing. Set up automatic monthly purchases to dollar-cost average into your gold position, just like a 401k. It's a systematic, emotion-free way to build wealth.

Ready to secure your future with american gold? Explore our offerings or learn more with our complete guide: Everything You Need to Know About American Eagle Coins.