Why Gold IRA Retirement Planning is Essential for Your Financial Security

Gold IRA retirement planning is a powerful strategy to protect your nest egg from inflation and market volatility. By holding physical precious metals in a tax-advantaged account, you add a layer of tangible security that traditional paper assets can't provide.

Key Benefits:

- Diversification: Reduces portfolio risk with assets that don't correlate with stocks and bonds.

- Inflation Hedge: Gold has historically maintained its purchasing power during inflationary periods.

- Tax Advantages: Enjoy the same tax-deferred or tax-free growth as traditional IRAs.

- Tangible Security: You own physical assets stored in secure, IRS-approved depositories.

How It Works:

- Open a self-directed IRA with an approved custodian.

- Fund the account via rollover, transfer, or cash contribution.

- Purchase IRS-approved gold, silver, platinum, or palladium.

- Store your metals in an insured, IRS-approved depository.

2025 Contribution Limits:

- Under 50: $7,000 annually

- 50 and older: $8,000 annually (includes $1,000 catch-up)

Many investors realize their portfolios are over-exposed to stock and bond markets, leading them to Gold IRAs for true diversification. With gold outperforming the S&P 500 in 2024, its role as a stabilizing asset is more critical than ever.

Summit Metals' Autoinvest simplifies this process through dollar-cost averaging. Set up automatic monthly purchases, just like a 401(k), to build your precious metals position steadily and without emotion.

I'm Eric Roach. After a decade on Wall Street advising Fortune 500 companies on hedging strategies, I now help individual investors apply those same principles to fortify their retirement with physical precious metals.

What is a Gold IRA and How Does It Work?

A Gold IRA is a self-directed IRA (SDIRA) that allows you to hold physical precious metals like gold, silver, platinum, and palladium in your retirement portfolio. Unlike stocks or bonds, these are tangible assets that provide a unique layer of security against market volatility.

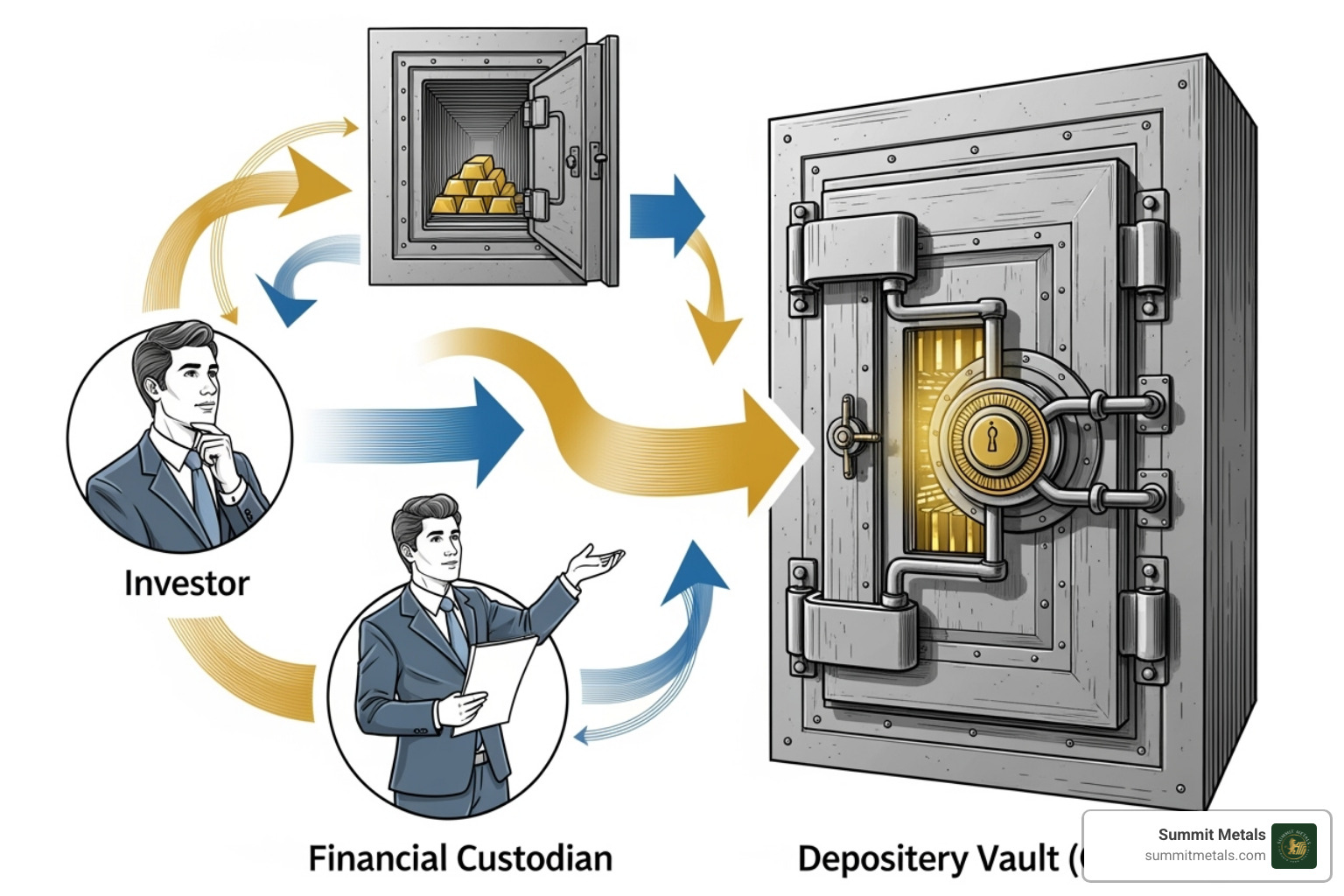

The IRS has specific rules for these accounts to ensure your assets are protected. Your Gold IRA retirement planning involves a specialized custodian who manages the account and ensures compliance, and an IRS-approved depository—a high-security, insured vault—where your physical metals are stored. You, as the investor, direct the purchases.

The process is straightforward:

- Choose a qualified custodian specializing in SDIRAs.

- Fund your account through a rollover from a 401(k) or IRA, or with cash contributions within annual limits.

- Select your physical metals. Unlike ETFs, you are buying actual metal that is shipped to your secure depository.

This structure provides all the tax advantages of a standard retirement account while adding the unique benefits of physical precious metals. For a complete overview, see our IRA Gold Investment: A Comprehensive Guide to Securing Your Future.

Understanding the Types of Gold IRAs

Gold IRAs come in different types to suit your tax strategy, but all allow you to hold the same physical precious metals. The main difference is how and when your investment is taxed.

Traditional Gold IRA: Contributions are often tax-deductible, lowering your taxable income today. Your metals grow tax-deferred, and you pay ordinary income tax on withdrawals in retirement. This is ideal if you expect to be in a lower tax bracket during retirement.

Roth Gold IRA: You contribute with after-tax dollars (no upfront deduction), but your investments grow completely tax-free. Qualified withdrawals in retirement are not taxed, which is a significant advantage if you expect to be in a higher tax bracket later in life.

SEP Gold IRA: Designed for self-employed individuals and small business owners, these accounts allow for much higher contribution limits than traditional or Roth IRAs. They function like a Traditional IRA with pre-tax funding and tax-deferred growth, but on a larger scale.

Your choice depends on your current and expected future tax situation. The IRS offers more details on Traditional and Roth IRAs to help you decide.

The Strategic Advantages of Gold in Your Retirement Portfolio

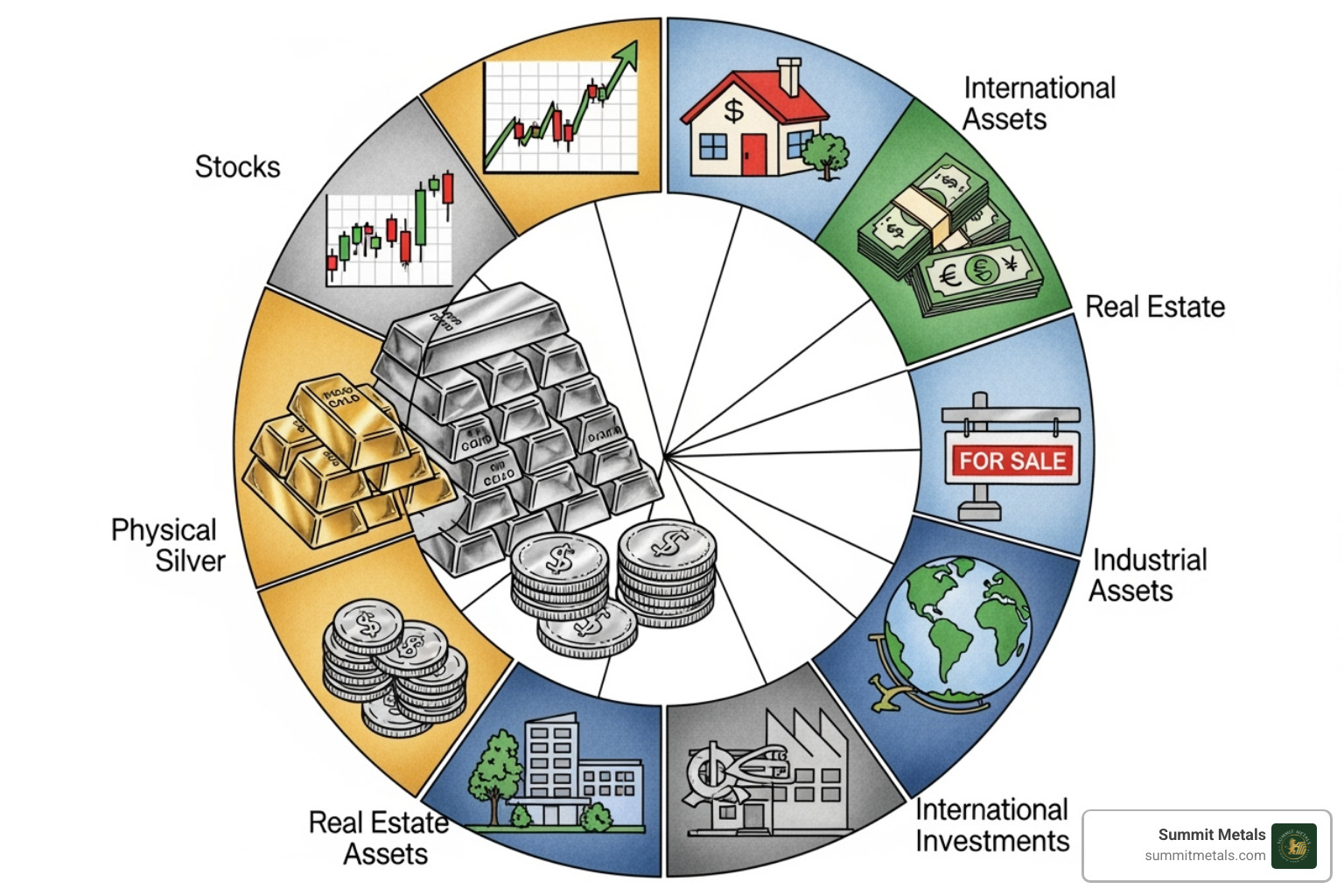

In gold IRA retirement planning, gold acts as a stabilizing force in your portfolio. While stocks and bonds react to market swings and interest rate changes, gold's value is influenced by different factors, making it a powerful tool for financial security.

Portfolio diversification is the primary advantage. Gold often moves independently of traditional assets. During market downturns like the 2008 financial crisis, gold has historically held or gained value, cushioning portfolios from significant losses. This low correlation is key to building a resilient nest egg.

Gold is also a premier inflation hedge. As the cost of living rises and erodes the purchasing power of currencies like the dollar, gold's value tends to increase, helping to preserve your wealth over the long term.

During periods of economic uncertainty, investors flock to gold as a safe-haven asset. Its thousands-of-years history as a store of value provides confidence that paper currencies, subject to government policies and printing, cannot match. Gold has outperformed the S&P 500 in 2024 and continues its strong performance, with some analysts predicting significant gains by 2026.

For more on this topic, read our guide on The Strategic Role of Gold in Long-Term Portfolio Management.

The Core Benefits of Gold IRA Retirement Planning

Gold IRA retirement planning provides a market volatility buffer. Because of its lack of correlation to stocks, your gold holdings can remain stable or even rise when the market is turbulent. This tangible asset security offers peace of mind that digital assets cannot; you own real, finite wealth independent of corporate balance sheets or government printing presses.

Summit Metals' Autoinvest program makes disciplined investing simple. Through dollar-cost averaging, you can set up automatic monthly purchases, removing the guesswork of market timing. This strategy smooths out price fluctuations over time, allowing you to build your physical gold and silver position steadily, just like with a 401(k). Ready to start? You can set up monthly purchases with Autoinvest today.

[COMPARISON CHART] Gold Coins vs. Gold Bars for Your IRA

When adding gold to your IRA, you'll choose between coins and bars. Both are excellent options, but they serve different investor needs.

| Feature | Gold Coins (e.g., American Eagle) | Gold Bars (e.g., PAMP Suisse) |

|---|---|---|

| Premiums | Generally higher | Generally lower per ounce |

| Liquidity | Highly liquid, easy to sell in small amounts | Can be less divisible, better for large transactions |

| Government Backing | Face value backed by government, fraud protection | Backed by refinery reputation |

| Recognition | Globally recognized | Widely recognized, but brand matters |

| Best For | Flexibility, security, fraud protection | Maximizing metal per dollar |

Note: Gold coins offer the added benefit of a government-backed face value, providing an extra layer of fraud protection.

Coins like the American Gold Eagle have legal tender status, which offers an additional layer of security and makes them instantly recognizable. Bars, however, typically have lower premiums over spot price, meaning you get more gold for your money, making them ideal for investors looking to maximize their holdings.

Navigating the Rules and Realities of Gold IRA Retirement Planning

Successful gold IRA retirement planning requires understanding the IRS framework designed to protect your investment. The most critical rule is that you cannot take physical possession of your IRA metals. Storing them at home is considered a taxable distribution, triggering taxes and a potential 10% early withdrawal penalty if you're under 59½. All metals must be held in an IRS-approved depository and managed by a qualified custodian.

Contribution limits for 2024 are $7,000 for those under 50 and $8,000 for those 50 and older (including a $1,000 catch-up contribution), with similar limits expected for 2025. These limits apply across all your combined IRA accounts.

Be aware of the costs involved:

- Setup and Administration Fees: Charged by the custodian to open and maintain your account.

- Storage and Insurance Fees: Paid to the depository for securely vaulting your metals.

- Dealer Premiums: The amount you pay over the metal's spot price, which is typically 5-10% for quality bullion.

It's also important to acknowledge volatility risk. Gold's price can fluctuate. While it's a liquid asset, selling physical metal involves working with a dealer and may not be as instantaneous as selling a stock.

Beware of high-pressure tactics pushing numismatic or collectible coins with excessive premiums (40-200% over spot). These are generally unsuitable for retirement investing. For official guidance, you can read the IRS rules on collectibles in retirement accounts.

Eligible Precious Metals and Purity Standards

The IRS has strict requirements for the metals allowed in a Gold IRA. Only four metals qualify, and they must meet specific IRS purity standards.

- Gold: Must be .995 fine (99.5% pure). An exception is the U.S. Gold Eagle, which is 22-karat but government-backed.

- Silver: Must be .999 fine (99.9% pure).

- Platinum & Palladium: Must be .9995 fine (99.95% pure).

These standards ensure you are investing in investment-grade bullion. Popular eligible products include American Eagle coins, Canadian Maple Leaf coins, and bars from reputable refineries like PAMP Suisse. Collectible or numismatic coins are not permitted and should be avoided due to high markups and valuation difficulties. At Summit Metals, we only offer IRA-eligible metals with transparent pricing. Learn more in our Foundational Precious Metals Knowledge guide.

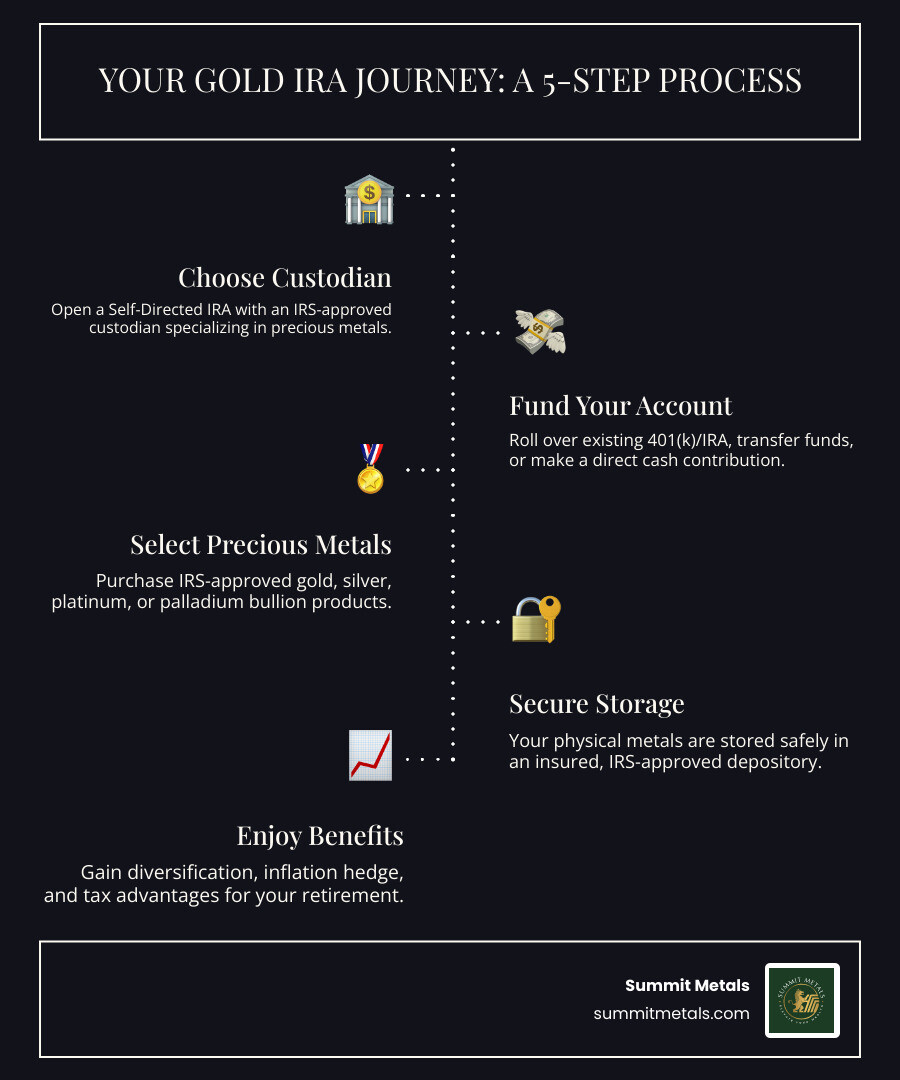

Step-by-Step Guide to Setting Up Your Gold IRA

Starting your gold IRA retirement planning journey is a straightforward process when broken down into four key steps.

Choose a Reputable Custodian: You need a self-directed IRA custodian specializing in precious metals. They handle administration and ensure IRS compliance. Look for one with a solid track record and transparent fees. We at Summit Metals partner with trusted custodians to simplify this for you.

Fund Your Account: The most popular method is a rollover from an existing 401(k), 403(b), or traditional IRA. You can also do a direct transfer from another IRA or make cash contributions up to the annual IRS limit.

Select Your Precious Metals: Choose from IRS-approved gold, silver, platinum, or palladium that meets purity standards. A reputable dealer like Summit Metals will execute the purchase on your behalf, offering authenticated, IRA-eligible metals with transparent pricing.

Arrange Secure Storage: Your physical metals must be stored in an IRS-approved depository. These are fully insured, high-security facilities. Your custodian will arrange this for you, and you'll receive statements confirming your holdings.

Once set up, you can automate future investments with our Autoinvest program, using dollar-cost averaging to build your position over time. For a detailed walkthrough, see our guide on Maximizing Retirement Security Using a Precious Metals IRA.

Key Considerations for a 401(k) to Gold IRA Rollover

Rolling over a 401(k) is a smart move but requires careful execution to avoid penalties. Keep these points in mind:

- Confirm Eligibility: Check with your 401(k) plan administrator. Most plans only allow rollovers after you leave the company or reach age 59½.

- Choose a Direct Rollover: This is the safest method. Funds move directly from your old plan to your new Gold IRA custodian, avoiding tax withholding and deadlines.

- Avoid the 60-Day Rule Trap: With an indirect rollover, you have 60 days to deposit the funds. If you miss the deadline, the IRS treats it as a taxable distribution, and 20% is typically withheld for taxes upfront. A direct rollover avoids this risk entirely.

- Beware of High-Pressure Sales: The CFTC warns against schemes pushing overpriced numismatic coins. Stick to investment-grade bullion with transparent pricing. At Summit Metals, we prioritize education over pressure. Review the CFTC Customer Advisory on Precious Metals Schemes for more information.

Frequently Asked Questions about Gold IRAs

Starting on gold IRA retirement planning naturally brings up questions. Here are answers to some of the most common ones we receive.

Can I store my Gold IRA metals at home?

No. IRS regulations are very clear on this: all physical precious metals held within an IRA must be stored by a qualified trustee or custodian in an IRS-approved, third-party depository. Taking personal possession of the metals, even in a secure home safe, is considered a taxable distribution. This would subject the full value of the metals to income tax and a potential 10% early withdrawal penalty if you are under age 59½. These secure depositories are fully insured and monitored 24/7, offering far greater protection than home storage.

What are the main costs associated with a Gold IRA?

Gold IRA retirement planning involves specific costs that differ from standard brokerage accounts. It's important to be aware of them upfront:

- Setup Fee: A one-time charge from the custodian to establish your account.

- Annual Administration Fee: An ongoing fee for account maintenance, paperwork, and compliance.

- Storage and Insurance Fees: Paid to the depository for securely vaulting and insuring your metals.

- Dealer Markup (Premium): The difference between the spot price of the metal and the purchase price. For investment-grade bullion, this is typically 5-10%. Be wary of companies charging 40-200% premiums for so-called "collectible" coins.

At Summit Metals, we provide full transparency on all costs, so there are no surprises.

How do I take distributions from my Gold IRA?

Taking distributions from a Gold IRA follows the same rules as a traditional IRA. You can begin taking penalty-free distributions at age 59½. For Traditional Gold IRAs, Required Minimum Distributions (RMDs) must begin at age 73. Roth Gold IRAs do not have RMDs for the original owner.

You have two options for receiving your distribution:

- In-Kind Distribution: You can have the actual physical precious metals shipped directly to you. The fair market value at the time of distribution is treated as taxable income.

- Liquidation: The custodian can sell the metals on your behalf and send you the cash proceeds.

We recommend consulting a tax professional to determine the most efficient strategy for your specific financial situation.

Conclusion: Fortify Your Future with a Trusted Partner

Your journey into gold IRA retirement planning highlights a crucial strategy for modern retirement: securing your future with tangible assets. In an unpredictable financial world, precious metals offer true diversification and inflation protection that stocks and bonds alone cannot provide. A Gold IRA combines the tax advantages of a retirement account with the enduring value of physical gold, creating a powerful anchor for your portfolio.

At Summit Metals, we are committed to making this process transparent and accessible. Based in Wyoming and serving investors nationwide from locations like Salt Lake City, Utah, we've built our reputation on honesty. Our real-time pricing and competitive rates, achieved through bulk purchasing, ensure you receive fair value without hidden fees or markups.

Our innovative Autoinvest program empowers you to build wealth consistently. By setting up automatic monthly purchases, you can use dollar-cost averaging to grow your precious metals holdings steadily, removing the stress of trying to time the market. It’s the same disciplined approach used in 401(k)s, now applied to the world's most trusted store of value.

Partnering with a company that prioritizes your financial security is key. We're not just selling metals; we're helping you build a more resilient retirement. When you're ready to take control, we're here to guide you.

Explore our comprehensive guide to IRA gold investing to secure your future and find why thousands of investors trust Summit Metals.