Gold has been a cornerstone of wealth preservation for centuries, serving as a currency, a store of value, and a hedge against economic instability. In modern financial markets, gold has evolved from a commodity to a critical component of diversified portfolios. As investors seek to maximize returns while minimizing risk, gold’s unique properties as a non-correlated asset make it a compelling choice for inclusion in long-term investment strategies. This article delves into the role of gold within an investment portfolio, focusing on its ability to enhance long-term returns and provide stability during economic stress. By analyzing correlations between gold and other major asset classes, we can uncover gold’s unique advantages to investors in achieving their financial objectives.

Understanding Correlations in a Portfolio with Bonds

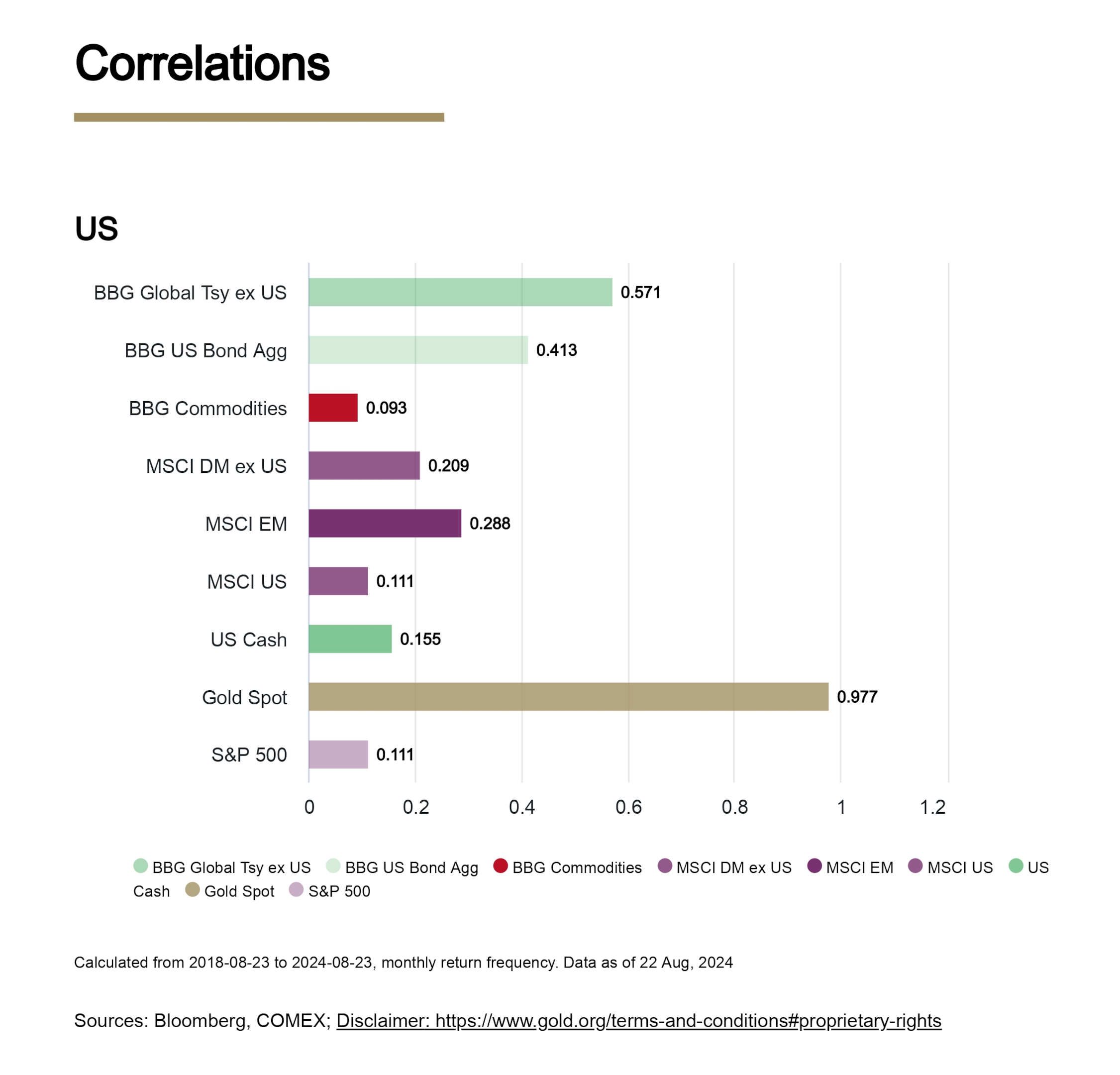

Correlation coefficients are a fundamental concept in portfolio management, as they measure the degree to which two assets move with each other. When building a diversified portfolio, the goal is often to combine assets with low or negative correlations. This strategy can help reduce overall portfolio volatility and improve risk-adjusted returns. The chart provided in this analysis, based on data from August 2018 to August 2024, offers insights into how various asset classes, including gold, correlate with one another.

The chart illustrates the correlations between several major asset classes, such as U.S. equities (represented by the S&P 500), global treasuries (BBG Global Tsy ex-US), U.S. bonds (BBG US Bond Agg), commodities, and cash. Gold (Gold Spot) notably stands out due to its relatively low correlations with most of these assets.

- Gold vs. S&P 500: The correlation between gold and the S&P 500 is low (0.111), indicating that gold prices move independently of U.S. equities. This low correlation is crucial for reducing portfolio volatility, particularly during market downturns. When equities are underperforming, gold often provides a counterbalance, helping to stabilize the portfolio’s overall value.

- Gold vs. U.S. Bonds (BBG US Bond Agg): The correlation between gold and U.S. bonds is even lower (0.093), suggesting that gold can effectively counterbalance to fixed-income investments. Bonds, typically considered safer investments, can be negatively impacted by rising interest rates. During such periods, gold’s non-yield-bearing nature becomes an advantage, as its value is not directly tied to interest rate movements.

- Gold vs. Commodities (BBG Commodities): The correlation between gold and broader commodities is moderate (0.288), reflecting gold's unique status among commodities. Unlike industrial commodities driven by economic cycles, gold often benefits during economic slowdowns. This moderate correlation indicates that while gold shares some characteristics with other commodities, it also maintains its distinct behavior, particularly during periods of financial stress.

These correlations underscore the strategic value of including gold in a diversified portfolio. Gold’s ability to move independently of traditional assets makes it an excellent tool for reducing risk while maintaining exposure to potential gains.

Gold’s Role in Enhancing Long-Term Returns

The role of gold in a portfolio is not just about risk management; it also contributes to long-term returns, particularly as a hedge against inflation and currency devaluation. Investors often seek assets that can preserve their wealth over time, and gold has consistently proven to be one of the most reliable options.

Rebalancing gold allocations can lead to profit while maintaining an optimal risk-return balance.

Hedge Against Inflation: Historically, gold has been a reliable hedge against inflation. During periods of rising prices, the value of fiat currencies tends to decline, whereas gold’s purchasing power remains relatively stable. This attribute is particularly beneficial in preserving a portfolio’s real value over time. For instance, during the inflationary period of the 1970s, gold prices surged, providing a haven for investors as other asset classes struggled to keep up with rising prices.

-

Performance in Economic Downturns: Gold’s performance during economic downturns is another critical factor for long-term investors. For instance, during the 2008 financial crisis and the recent COVID-19 pandemic, gold prices surged as investors sought safety amidst market turmoil. This behavior is reflected in the chart’s low correlation between gold and equities, reinforcing gold’s role as a safe-haven during market stress. During these periods, while stock markets were experiencing significant declines, gold prices often rose, helping to offset losses in other parts of the portfolio.

Global Demand and Supply Dynamics: Global demand and supply dynamics also influence gold’s performance. Central banks’ purchases, especially in emerging markets, have added a demand layer supporting gold prices. Additionally, geopolitical tensions and economic uncertainty often drive demand for gold, further solidifying its place in a diversified portfolio. The World Gold Council reports that central banks have been net buyers of gold in recent years, reflecting a growing recognition of its value as a reserve asset.

-

Wealth Preservation: Beyond its role as a hedge and safe-haven, gold also plays a critical role in wealth preservation. In regions experiencing currency crises or hyperinflation, gold has historically been used as a store of value. In countries like Venezuela or Zimbabwe, where local currencies have collapsed, gold has provided a means of preserving purchasing power. This aspect of gold’s utility is crucial for investors concerned about fiat currencies’ long-term stability.

Economic Stress and Gold's Stability

Economic stress often triggers a flight to safety as investors move away from riskier assets like equities into safe-haven assets like gold. The chart’s data reveals that gold’s low correlation with other assets makes it particularly valuable during economic uncertainty. Additionally, gold helps in managing portfolio risk during economic stress by providing stability and reducing the potential for the collective performance of assets within an investment portfolio to fall short of financial goals.

-

Safe-Haven Asset: Gold’s reputation as a safe-haven asset is well-earned. It tends to appreciate when investor confidence in financial systems wanes. During crises, gold’s value is often driven by psychological factors, such as fear and uncertainty, which leads to increased demand and higher prices. For example, during the early stages of the COVID-19 pandemic, gold prices soared as investors sought refuge from the volatility in equity markets.

-

Central Bank Policies: Central banks play a significant role in the gold market. During periods of loose monetary policy, such as quantitative easing, the value of fiat currencies can decline, boosting gold prices. The low correlation between gold and other financial assets during these periods highlights gold’s role as a safeguard against currency depreciation. Moreover, in environments where central banks are cutting interest rates to stimulate the economy, the opportunity cost of holding gold, which does not yield interest, diminishes, making it a more attractive option for investors.

-

Historical Case Studies: Historical data from the chart illustrates that gold has consistently provided stability during past recessions. For example, during the financial crises covered in the chart’s time frame, gold outperformed most other assets, offering investors a crucial lifeline during turbulent times. The 2008 financial crisis is a prime example, where gold maintained its value and appreciated, providing a much-needed cushion for portfolios heavily exposed to equities and bonds.

-

Geopolitical Tensions: Apart from economic downturns, geopolitical tensions contribute to gold’s appeal. Events such as wars, political instability, and international conflicts can lead to uncertainty in global markets, prompting investors to seek the stability that gold offers. The chart’s data, covering a period marked by various geopolitical events, underscores how gold has historically reacted to such situations, often appreciating as other assets decline.

-

Currency Diversification: In times of economic stress, when the U.S. dollar’s value weakens, gold becomes an attractive asset for diversifying currency exposure. Investors looking to protect their portfolios from currency depreciation often turn to gold, which is not tied to any single currency and thus provides a hedge against currency-related risks.

Practical Implications for Portfolio Risk Management

Given the insights from the chart, investors can leverage gold’s unique properties to enhance portfolio performance. Incorporating gold into a diversified portfolio requires careful consideration of its allocation and the overall investment strategy. Comparing actively managed funds to index funds can also provide valuable insights into different investment approaches.

-

Optimal Allocation: Research suggests 5-10% in gold can significantly improve a portfolio’s risk-adjusted returns. The exact allocation depends on individual risk tolerance and investment goals. For conservative investors, a higher allocation may be warranted to maximize protection during downturns. For those with a higher risk appetite, a lower allocation can still provide diversification benefits without overly dampening potential returns from other, more aggressive investments.

Rebalancing Strategies: Regular portfolio rebalancing is essential to maintaining the optimal gold allocation. As the value of gold and other assets changes over time, rebalancing ensures that the portfolio remains aligned with the investor’s risk tolerance and objectives. For instance, during periods of rapid gold price appreciation, the allocation to gold may exceed the desired level, requiring the sale of some gold to bring the portfolio back into balance. Conversely, rebalancing may involve purchasing additional gold to restore the intended allocation during declining gold prices. Index data can be crucial in these decision-making processes.

-

Diversification with Other Commodities: While gold is unique, other commodities can complement its role in a portfolio. Silver, for instance, shares some of gold’s properties but also has industrial uses that drive its demand. Including a mix of precious metals can further enhance diversification. Additionally, commodities like oil and agricultural products can provide exposure to different economic cycles, further broadening the portfolio’s risk profile. The significance of market capitalization in the context of the S&P 500 index is also noteworthy, as it represents a substantial portion of large-cap U.S. equities.

-

Gold ETFs and Other Investment Vehicles: For investors who prefer not to hold physical gold, exchange-traded funds (ETFs) offer a convenient and liquid way to gain exposure to gold. Gold ETFs track the price of gold and can be easily traded on stock exchanges. Other options include gold mining stocks, which offer leveraged exposure to gold prices, and gold mutual funds, which pool investor capital to invest in gold-related assets.

-

Tax Considerations: Investing in gold also has tax implications that investors must consider. In many jurisdictions, gold is classified as a collectible, subject to higher capital gains taxes than other investments like stocks or bonds. Understanding the tax treatment of gold investments is crucial for optimizing after-tax returns. Financial advisors and service providers offer various services, including enhanced website functionalities and financial advice, to help investors navigate these complexities.

Conclusion

The chart clearly demonstrated gold’s role as a stabilizing force in a diversified portfolio. Its low correlation with major asset classes, combined with its performance during economic downturns, makes it invaluable for long-term investors. By carefully considering gold’s allocation within a portfolio, investors can achieve better risk-adjusted returns and greater resilience against economic stress.

In the evolving economic landscape, gold’s role will likely remain significant. As central banks navigate complex financial challenges and global uncertainties persist, gold will continue to offer protection and growth potential for those who strategically incorporate it into their investment portfolios. Whether through direct investment in physical gold, gold ETFs, or other financial instruments tied to gold, the strategic inclusion of this precious metal can play a crucial role in long-term wealth preservation and growth within a business framework.

References

- Bloomberg, COMEX (2024). Data sourced from Bloomberg and COMEX, covering correlations from August 2018 to August 2024.

- World Gold Council (2024). Historical data and analysis on gold’s performance during economic crises.

- Ray Dalio, Bridgewater Associates (2020). On the role of gold in risk parity portfolios and during periods of economic stress.

- Federal Reserve Economic Data (FRED) (2024). Data on interest rates, inflation, and central bank policies.