The gold and silver ratio, along with the gold price, has long been a beacon for investors navigating the often-turbulent seas of the financial markets and the precious metals market. This ratio, which measures how many ounces of silver it takes to purchase one ounce of gold, is a historical constant against which the relative value of these two metals can be judged. Understanding the gold and silver ratio is crucial for anyone looking to diversify their portfolio, hedge against economic uncertainty, or capitalize on the ebb and flow of these commodities’ values.

Historical Perspective of the Gold and Silver Ratio

From ancient Lydia, where gold coins first emerged as a medium of exchange, to the modern trading floors where precious metals like gold bullion are bought and sold in milliseconds, the gold-silver ratio has been a subject of fascination. In the 19th century, the United States fixed the ratio at 15:1 with the Coinage Act of 1834. This move would later be adjusted to 16:1. These historical pegs testify to the ratio’s longstanding significance.

Understanding the Gold and Silver Ratio

To comprehend the ratio’s implications, one must first grasp its calculation. Gold dealers play a crucial role in determining the market price per ounce of gold, which is a key component in calculating the ratio. It’s a simple division of the current market price per ounce of gold by the current market price per ounce of silver. This figure fluctuates daily with market prices, reflecting the ever-changing supply and demand landscape, investor sentiment, and global economic conditions.

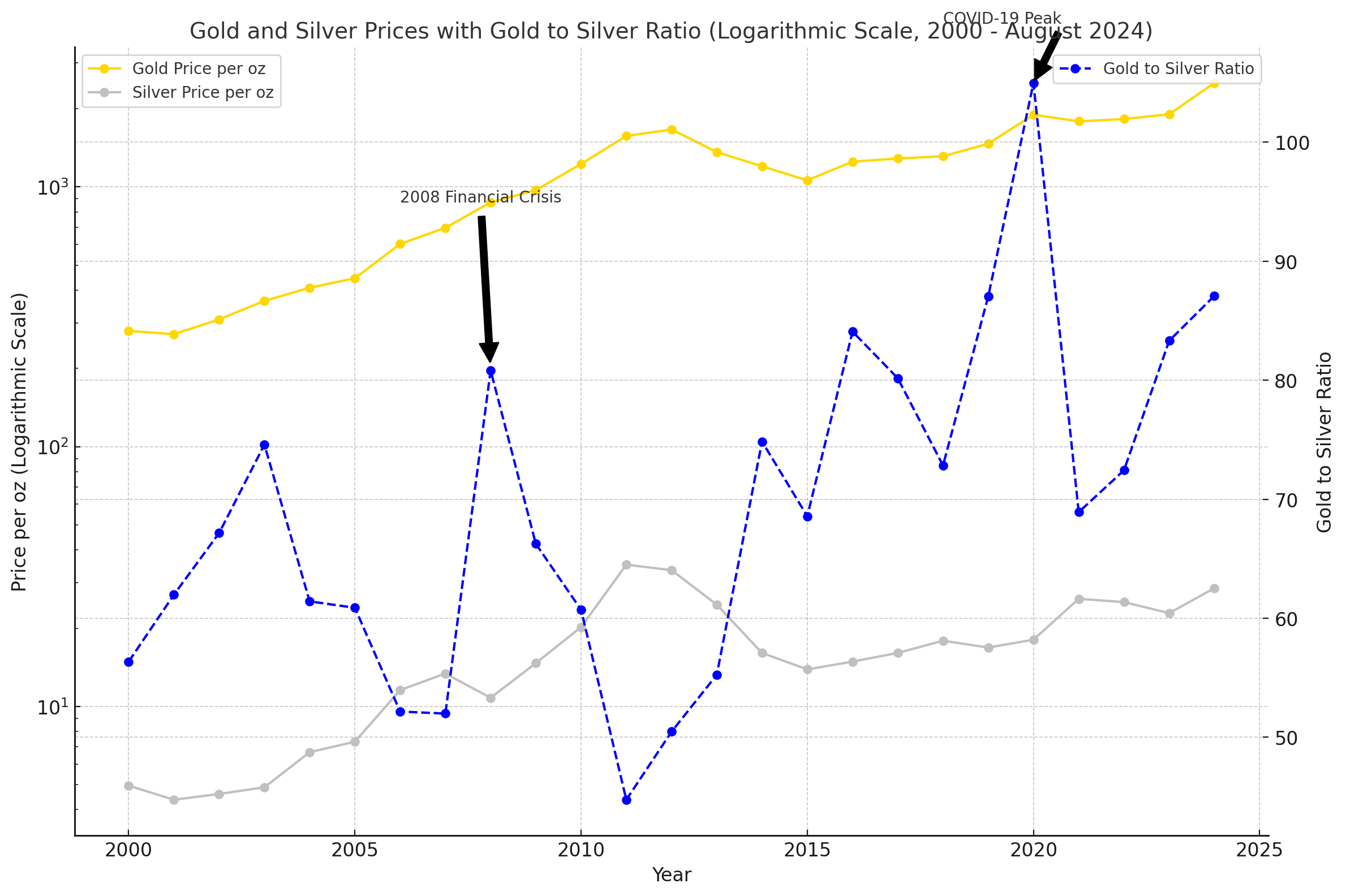

A visual representation of the ratio’s historical fluctuations can reveal patterns and anomalies that are not immediately apparent from raw data. For instance, the spikes in the ratio often correlate with periods of economic downturn, where gold’s status as a safe-haven asset drives its value up more significantly than silver.

Factors Influencing the Ratio: Gold Prices

The ratio is swayed by a myriad of factors, from silver’s industrial utility in electronics and solar panels to the geopolitical tensions and financial markets that send investors flocking to gold’s relative safety. Investors often look to buy gold coins as a way to hedge against economic uncertainty and capitalize on favorable gold prices. The interplay between these factors can lead to significant shifts in the ratio, presenting opportunities and risks for investors.

The Ratio as an Investment Tool

Savvy investors have long used the gold-to-silver ratio to time their trades, buying silver when the ratio is high and gold when it is low. Investors might also consider silver bullion as an alternative investment when the ratio is high, anticipating a future decrease in the ratio. This contrarian approach can potentially lead to significant gains when the ratio reverts to its historical mean, allowing investors to sell gold at a profit.

Trading Strategies Based on the Gold to Silver Ratio

Investors might employ various strategies based on the ratio, from straightforward swaps of one metal for the other to more complex hedging techniques involving futures and options. Understanding the spot silver price is essential for executing these strategies effectively, as it represents the current market price for physical silver. These strategies often involve trading gold and silver in troy ounces, the standard measurement in the precious metals market. These strategies can be tailored to the investor’s risk tolerance and market outlook.

Case Studies: Successes and Pitfalls

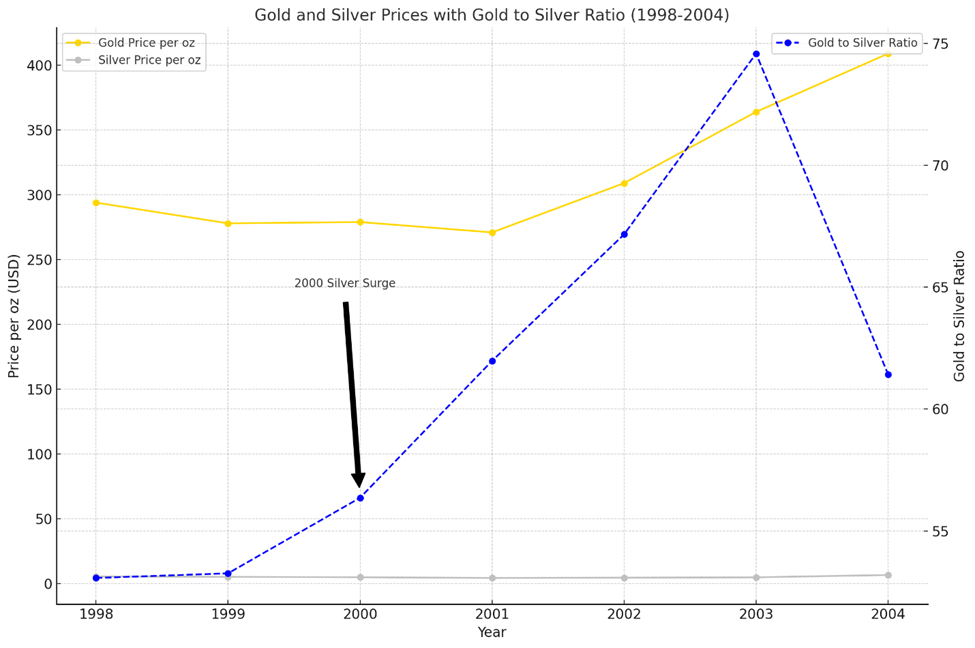

Case Study 1: The Tech Boom and Silver Prices Surge

In the early 2000s, new technologies spurred a surge in industrial demand for silver. During this period, the gold price remained relatively stable, making silver a more attractive investment. Investors could have capitalized on this by purchasing silver bars, which are often more cost-effective than smaller denominations. An investor observing the gold-to-silver ratio might have noticed it creeping higher, indicating that silver was undervalued. By purchasing silver before the tech boom and selling when the ratio tightened, this investor would have realized substantial gains.

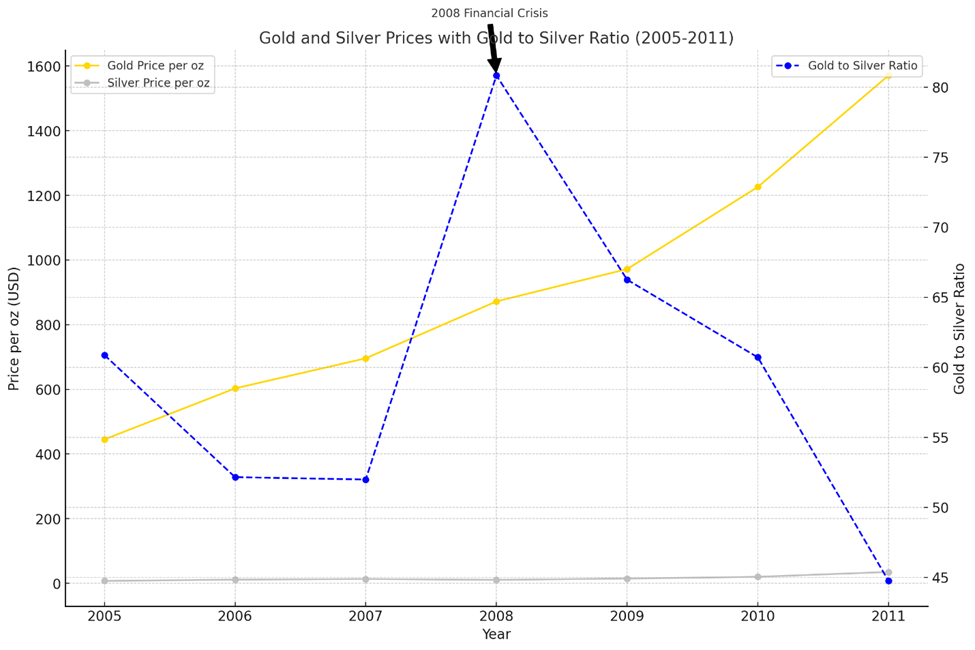

Case Study 2: The 2008 Financial Crisis

During the 2008 financial crisis, the ratio skyrocketed as investors fled to the safety of gold. Gold dealers saw a surge in demand as investors sought to capitalize on the low spot price of silver. The spot price of silver dropped significantly, presenting a buying opportunity for those who anticipated the ratio’s eventual return to its historical average. However, those who anticipated the ratio’s eventual return to its historical average could have profited by accumulating silver at its relatively low point. As the economy recovered and the ratio decreased, these investors would have seen significant appreciation in their silver holdings relative to gold.

The Future of the Gold-to-Silver Ratio in Precious Metals

While the past can offer valuable lessons, the future of the gold-to-silver ratio is unwritten. Investors might consider opportunities to buy gold coins as part of their strategy to leverage future fluctuations in the ratio. Investors can use fast loading charts to track real-time changes in the ratio and make informed decisions. Factors such as technological advancements, shifts in monetary policy, and unforeseen global events will continue to shape the ratio. Investors keen on these developments will be best positioned to use the ratio to their advantage.

Over the last five years, the gold-to-silver ratio has seen significant fluctuations, influenced by various economic and geopolitical factors. Understanding these shifts can help investors decide when to buy physical gold or silver.

Key Developments from 2019 to 2024:

-

COVID-19 Pandemic and Economic Uncertainty (2020):

-

During the height of the pandemic in 2020, the gold-to-silver ratio spiked to historic highs, peaking at around 104:1 in March 2020. A flight to safety drove this as investors flocked to gold amid economic uncertainty. Silver lagged initially due to reduced industrial demand, exacerbated by lockdowns and supply chain disruptions.

-

Post-Pandemic Recovery and Silver’s Industrial Demand (2021-2022):

-

Silver started gaining ground as the global economy began to recover due to its essential role in industrial applications, particularly in the electronics and renewable energy sectors. This caused the ratio to decrease, reaching around 68:1 by mid-2022. Investors who bought silver during the 2020 peak reaped significant benefits as the ratio corrected.

-

Rising Inflation and Central Bank Policies (2022-2023):

-

Inflationary pressures and central banks’ responses, such as interest rate hikes, led to fluctuating demand for gold and silver. Gold maintained its status as a hedge against inflation, keeping its value relatively stable, while silver continued to benefit from its dual role as a precious and industrial metal. The ratio hovered between 70:1 and 80:1 during this period.

-

Recent Developments in 2024:

-

By August 2024, the gold-to-silver ratio stood around 87:1, with gold prices reaching approximately $2,513 per ounce and silver trading at around $28.52 per ounce. This high ratio suggests that silver might be undervalued relative to gold, presenting a potential buying opportunity for silver.

Analysis and Recommendations:

-

When to Buy Silver: Historically, when the gold-to-silver ratio is above 80:1, silver is considered undervalued relative to gold. Investors might consider buying silver in such periods, anticipating a future decrease in the ratio as industrial demand picks up or as the market corrects.

-

When to Buy Gold: Conversely, when the ratio drops below 60:1, it often signals that gold is undervalued. Such periods could be suitable for purchasing gold, particularly when economic uncertainties persist, as gold tends to outperform silver during financial instability.

In summary, the last five years have reinforced the importance of monitoring the gold-to-silver ratio as part of a broader investment strategy. The ratio’s behavior during major economic events highlights its value as an indicator of relative pricing, guiding decisions on whether to favor gold or silver in a diversified portfolio.

Conclusion

The gold-to-silver ratio is more than just a number—it is a dynamic indicator that has stood the test of time. Consulting reputable gold dealers can provide valuable insights and help investors make informed decisions. Investors can choose to hold these metals in their physical form, such as coins or bars, to diversify their portfolios. Investors can use the ratio to inform their precious metals trading strategies by understanding their movements and underlying factors. As with all investment tools, the ratio should be used judiciously, in conjunction with a well-considered investment plan and a clear understanding of one’s financial goals and risk tolerance. The real question remains to be answered: Have the central banks forever altered the standard entry points of the gold and silver ratio?