Why Dollar-Cost Averaging Gold Is Your Best Defense Against Market Volatility

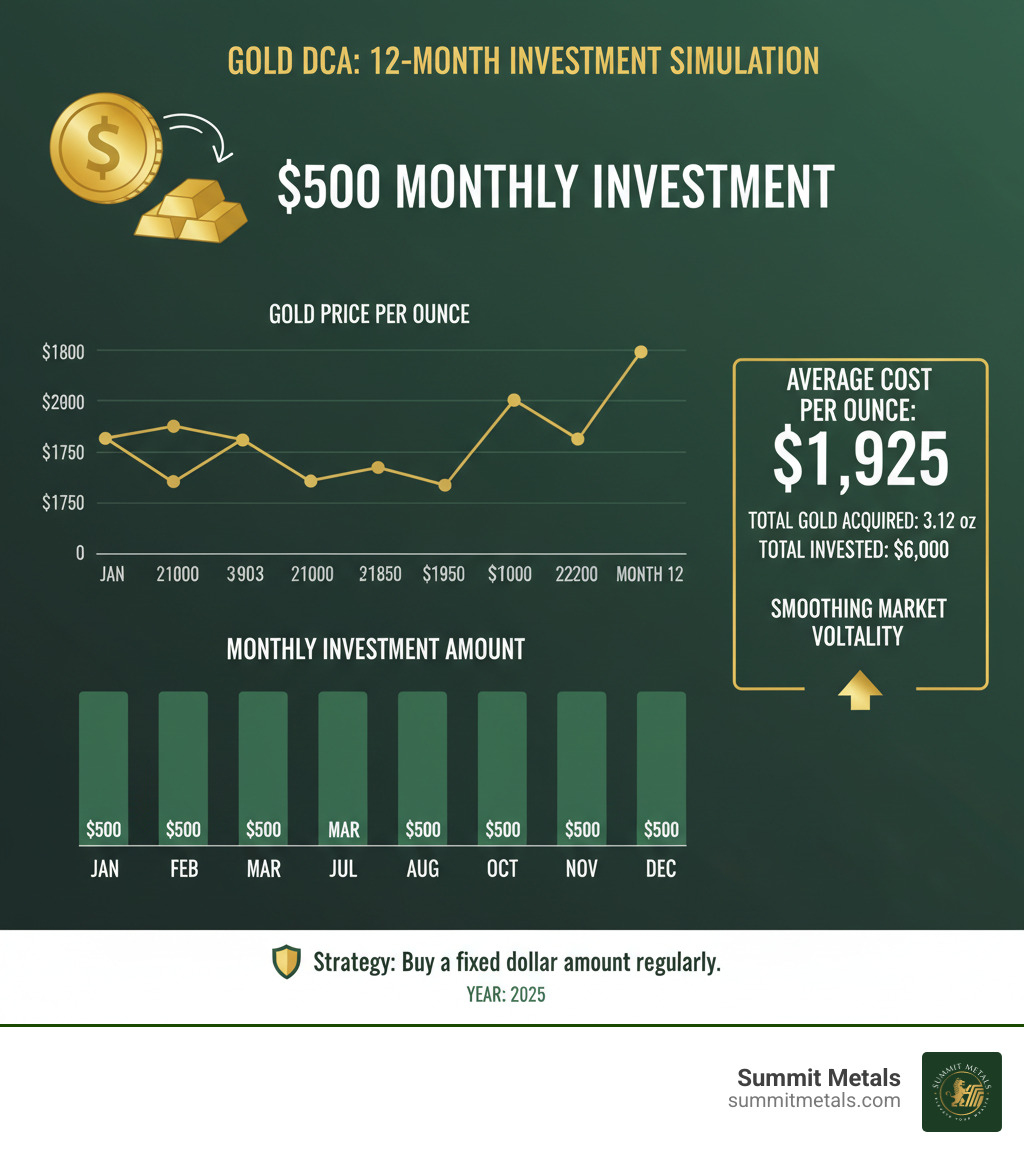

Dollar cost averaging gold is an investment strategy where you buy a fixed dollar amount of gold at regular intervals, regardless of the price. This approach smooths out price fluctuations and removes the stress of trying to time the market.

Key Benefits of Dollar-Cost Averaging Gold:

- Reduces Risk: Spreads purchases across different price points.

- Eliminates Timing Stress: No need to predict market tops or bottoms.

- Builds Discipline: Creates consistent investment habits.

- Lower Average Cost: You buy more when prices dip and less when they rise.

- Accessible Entry: Start with smaller amounts instead of a large lump sum.

Gold prices can swing dramatically, making market timing nearly impossible. That's where dollar cost averaging shines. It works like your 401(k) contributions: every paycheck, a fixed amount is invested, whether the market is up or down. With dollar cost averaging gold, you're steadily accumulating physical gold as a hedge against inflation and economic uncertainty.

Historical data is compelling: an investor who used dollar cost averaging to buy gold monthly from 1990 to today would have an average cost of roughly $750 per ounce, more than doubling their investment.

With over a decade of Wall Street experience in investment banking and risk management, I now help everyday investors apply institutional tactics like dollar cost averaging gold to build wealth through precious metals.

What is Dollar-Cost Averaging and How Does It Apply to Gold?

Dollar-cost averaging is a strategy where you invest a fixed amount in an asset at regular intervals—like clockwork. It's a smart way to build your portfolio without the stress of market timing. No crystal ball required.

When you apply this to gold, you commit to buying a set dollar amount—perhaps $200 or $500—every month or quarter, regardless of the price. It's the same principle that makes 401(k) contributions so effective, but you're building a foundation of physical gold instead of paper assets.

Gold prices can swing wildly based on Federal Reserve announcements or geopolitical tensions. Dollar cost averaging gold removes that emotional rollercoaster. You're not trying to outsmart the market—you're letting time and consistency work for you.

The beauty of automatic investing through Summit Metals' Autoinvest program is that it works exactly like your workplace retirement plan. Set it up once, and your gold accumulation happens on autopilot. For the foundational knowledge you need to get started, check out our comprehensive guide: Gold Investment 101: Turning Your Savings into Solid Gold.

The Core Mechanic: Smoothing Out Your Average Cost

Here's where the magic happens. When gold prices drop, your fixed investment buys more ounces. When prices climb, it buys fewer. Over time, this creates a smoothing effect on your average cost per ounce.

It's mathematical insurance against bad timing. Instead of risking a large sum on one purchase at a potential peak, you spread your entries across multiple price points. This long-term perspective is especially powerful for gold, which most investors hold for wealth preservation.

The result is a lower average cost than if you'd tried to time a single, large purchase, and you'll sleep better knowing you didn't invest your entire budget right before a price correction.

Why Use DCA for a Tangible Asset Like Gold?

Gold is a tangible asset you can hold, making it uniquely suited for DCA as you steadily build a real, inflation-resistant store of value.

Unlike stocks or bonds, gold has served as an inflation hedge for millennia. When currencies lose purchasing power, gold typically maintains or increases its value. It also provides crucial portfolio diversification, often moving opposite to crashing stock markets.

Central banks classify gold as a Tier One risk-free asset. By using DCA, you're following the same institutional strategy to protect against fiat currency devaluation and economic uncertainty. In today's volatile environment, this steady accumulation builds a financial fortress against future economic storms. Learn more in our analysis: Maximizing Your Investment in a Chaotic Global Economy.

The Pros and Cons of Dollar Cost Averaging Gold

Like any investment strategy, dollar cost averaging gold has advantages and drawbacks. Understanding both sides helps you align the strategy with your financial goals. For a comprehensive overview, see: The Power of Dollar Cost Averaging in Gold and Silver Investments.

Primary Benefits of a DCA Strategy

The biggest advantage of dollar cost averaging gold is that it reduces emotional investing. DCA removes the stress of buying at a market peak by automating your purchases. You set a monthly amount and stick to it, whether gold is at $1,800 or $2,100 per ounce.

This approach offers several key benefits:

- Eliminates Market Timing Stress: You invest consistently without worrying if you should wait for a dip or jump in now.

- Fosters Disciplined Saving: Regular gold purchases through programs like Summit Metals' Autoinvest create a rhythm of wealth building, just like automatic 401(k) contributions.

- Lowers Barrier to Entry: You can start with as little as $100-$200 per month instead of waiting to save a large lump sum.

- Potential for Lower Average Cost: Your fixed dollar amount automatically buys more ounces when prices dip and fewer when they rise, averaging your cost over time.

Potential Drawbacks and Risks

Now for the reality check. DCA isn't perfect, and it's important to understand the trade-offs.

- Underperformance in Bull Markets: In a strong, sustained bull market, DCA may underperform a lump-sum investment made early on. Since markets tend to trend upward over time, getting money in sooner can lead to greater returns.

- Accumulated Transaction Fees: Each purchase of physical gold includes premiums and potential shipping costs. While Summit Metals offers competitive pricing, frequent small purchases can lead to higher total fees than one large purchase.

- No Guarantee of Profit: DCA manages risk and averages cost; it doesn't eliminate the possibility of losses if gold enters a prolonged bear market.

- Opportunity Cost: The cash you hold for future DCA purchases isn't earning returns, which can represent missed gains in a rapidly rising market.

For more perspectives on investment strategies, you can explore resources like Forbes Advisor. The key is matching the strategy to your situation. DCA is ideal for investors who value peace of mind and steady accumulation over trying to time the market.

DCA vs. Lump-Sum Investing (LSI): Which is Right for Your Gold Portfolio?

Choosing between dollar cost averaging (DCA) and lump-sum investing (LSI) for gold depends on your risk tolerance, financial situation, and market outlook. LSI means investing all your capital at once, while DCA spreads it out over time. The right choice is about what helps you invest with confidence.

For more on these approaches, read: The Strategic Approaches to Investing in Gold and Silver.

When DCA Makes More Sense

Dollar cost averaging gold is often the best choice in these situations:

- Volatile or Sideways Markets: DCA automatically helps you buy more when prices are low and less when they are high.

- Limited Upfront Capital: You can start investing today with smaller, regular amounts instead of waiting to save a large sum.

- Risk-Averse Investors: DCA mitigates the risk of investing a large sum right before a market downturn.

- Long-Term Wealth Building: It creates a disciplined, automatic investment habit. Our Summit Metals Autoinvest program is designed for this, making monthly gold purchases as simple as a 401(k) contribution.

When LSI Might Be Superior

Lump-sum investing can be the better option under certain conditions:

- Strong, Consistent Bull Markets: Historical data shows that since markets tend to trend up over time, getting all your money invested at once can lead to higher returns.

- Substantial Available Capital: If you have a large sum ready and believe the market is heading higher, LSI puts your capital to work immediately.

- Higher Risk Tolerance: For investors who can stomach short-term volatility, LSI offers the potential for maximum gains if timed well.

TABLE: DCA vs. LSI for Gold Investors

| Strategy | Best For | Market Condition | Risk Level | Psychological Impact |

|---|---|---|---|---|

| Dollar-Cost Averaging (DCA) | Building wealth gradually, risk-averse investors, limited upfront capital | Volatile, sideways, or uncertain trends | Lower (spread over time) | Reduced stress, disciplined approach, avoids emotional decisions, peace of mind |

| Lump-Sum Investing (LSI) | Maximizing returns in bull markets, investors with ample capital | Consistently upward trending | Higher (concentrated risk) | Potential for higher regret if market drops, but also higher satisfaction if market rises |

There's no single wrong answer. Many investors use a hybrid approach, making an initial lump-sum investment and then adding to it with regular DCA purchases. The key is to choose a strategy you can stick with.

How to Implement a Dollar-Cost Averaging Gold Strategy

Putting dollar cost averaging gold into action is more straightforward than you might think. With the right tools, you can create an automated strategy that works as smoothly as your 401(k) contributions.

For comprehensive guidance, check out our resource: How to Invest in Precious Metals: A Safe Haven in Uncertain Times.

Step 1: Choose Your Gold Investment Vehicle

Your first decision is what type of gold to buy. At Summit Metals, we offer several options to fit your goals and budget.

Physical gold is the most popular choice for DCA strategies. Your options include:

- American Eagle coins

- Canadian Maple Leaf coins

- South African Krugerrand coins

- Gold bars in various sizes

- Digital gold ownership through our secure platform

The choice between coins and bars often comes down to security versus cost-effectiveness.

COMPARISON CHART: Gold Coin vs. Gold Bar

| Benefits of Gold Coins | Benefits of Gold Bars |

|---|---|

| Face value protected by government - Legal tender status provides an extra layer of security. | Lower premiums per ounce - More of your money goes toward actual gold content. |

| Easier to verify authenticity - Recognizable government designs simplify fraud detection. | Efficient for larger investments - Better cost-effectiveness for substantial positions. |

| Often more liquid - Widely recognized coins like American Eagles sell quickly. | Compact storage - Higher gold density means less space needed for storage. |

| Potential collectible value - Numismatic premiums can develop beyond gold content. | Pure commodity play - A straightforward investment without collectible factors. |

For most starting a dollar cost averaging gold plan, we recommend popular coins like American Eagles for their government backing and peace of mind.

Step 2: Setting Up Your Dollar-Cost Averaging Gold Plan

Once you've chosen your gold, setting up your plan is simple.

- Set a realistic budget. Decide what you can comfortably invest each month. Consistency matters more than the amount.

- Choose your frequency. Monthly purchases align well with most people's income schedules and capture the market's averaging effect.

- Select a trusted dealer. Choose a dealer like Summit Metals, based in Wyoming, known for transparent, real-time pricing and competitive rates.

- Automate everything. Our Summit Metals Autoinvest program is the key. It handles your gold purchases automatically, just like a 401(k). Set it up once, and your gold position grows without constant management.

Step 3: Factoring in Costs for Your Dollar-Cost Averaging Gold Plan

Understanding the costs of dollar cost averaging gold helps you optimize your strategy.

- Premiums over Spot Price: This is the cost above the raw gold price to cover minting and distribution. Smaller items (e.g., 1/10 oz coins) have higher percentage premiums than larger ones (e.g., 1 oz bars).

- Shipping: Frequent small deliveries can be costly. Consolidate purchases or use programs with free shipping thresholds to save money.

- Storage: For larger holdings, professional vaulting offers security and insurance for an annual fee, typically 0.5% to 1%.

- Transaction Fees: Reputable dealers have minimal fees, but always factor them into your total cost.

A well-structured DCA plan makes these costs predictable and manageable. For more on timing and costs, read: Gold Price: Why Waiting to Buy Could Cost You.

Advanced Applications and Related Strategies

Once you've mastered dollar cost averaging gold, you can explore more advanced techniques. Think of basic DCA as a solid foundation upon which you can build.

For a comprehensive look at precious metals strategies, see our guide: Investing in Gold and Silver: A Decision Guide for Savvy Investors.

Applying DCA to Silver and Platinum

The DCA strategy works exceptionally well for other precious metals, too. The higher volatility of silver and platinum can make DCA even more effective, as regular purchases are more likely to catch significant price dips. You can also use the Gold-to-Silver Ratio to guide your purchases, buying more silver when it's historically cheap compared to gold.

For more on silver strategies, dive into: Silver Linings: Smart Strategies for Investing in Precious Metal.

Combining DCA with Other Investment Techniques

DCA plays well with other strategies. Consider these hybrid approaches:

- Value Averaging: A more active strategy where you invest more when the price drops and less when it rises to keep your portfolio's growth on a steady value track.

- Lump-Sum/DCA Hybrid: Invest a portion of your capital upfront and dollar-cost average the rest to balance immediate exposure with risk mitigation.

- Portfolio Rebalancing: Periodically sell or buy assets to return your portfolio to its target allocation (e.g., 10% in precious metals).

- Using Limit Orders: Set a maximum price you're willing to pay for your monthly purchase to avoid buying during significant price spikes.

The key is finding a strategy that matches your goals. Many investors prefer the simplicity of pure DCA through programs like our Summit Metals Autoinvest, which automates monthly purchases just like a 401(k). Complexity isn't always better; the best strategy is the one you'll stick with.

Frequently Asked Questions about Dollar-Cost Averaging Gold

Here are clear, honest answers to the most common questions we receive about dollar cost averaging gold.

Is DCA a good strategy for gold right now?

Yes. DCA is a long-term strategy designed to work in any market condition—up, down, or sideways. It removes the stress of trying to perfectly time your entry, making "right now" always a good time to start accumulating for the long term.

What's the minimum amount needed to start dollar-cost averaging gold?

You can start with surprisingly small amounts. Fractional gold products like grams are available. Our Summit Metals Autoinvest program is designed for accessibility, with monthly minimums often around $100-$200, making it easy for anyone to begin their dollar cost averaging gold journey. Consistency is more important than the initial amount.

Does DCA work better for gold coins or gold bars?

Both work well, and the choice depends on your priorities.

- Gold coins are often preferred by new investors. They offer government-backed security, are easy to authenticate, and are highly liquid. This provides peace of mind.

- Gold bars are more cost-efficient. They have lower premiums per ounce, meaning more of your money buys pure gold. They are ideal for investors focused on accumulating weight efficiently.

Many investors start with coins for their security features and add bars later as their holdings grow. Our team at Summit Metals can help you decide what's right for your goals.

Conclusion: Build Your Golden Nest Egg with Discipline

Building wealth through dollar cost averaging gold is a strategy built on discipline, not on trying to outsmart the market. It's about making consistent, smart decisions over the long term and removing emotion from the process.

By automating your investments, you build wealth steadily, buying more when prices are low and less when they are high. This is the path to creating a real, tangible nest egg that can weather economic uncertainty.

The beauty of DCA lies in its simplicity. You set your budget, choose your frequency, and let the strategy do the heavy lifting, helping you stick to your plan even when headlines scream about market chaos.

At Summit Metals, our Autoinvest program makes this process as simple and automatic as your 401(k) contributions. Whether you're starting with $100 or $500 a month, regular investments in an asset that has preserved wealth for millennia can compound into a substantial holding over time.

Take control of your financial future. The best time to start dollar cost averaging gold was yesterday. The second-best time is right now.

Start your automated gold investment plan today with Summit Metals Autoinvest