Why Silver Versus Gold Investment Decisions Matter More Than Ever

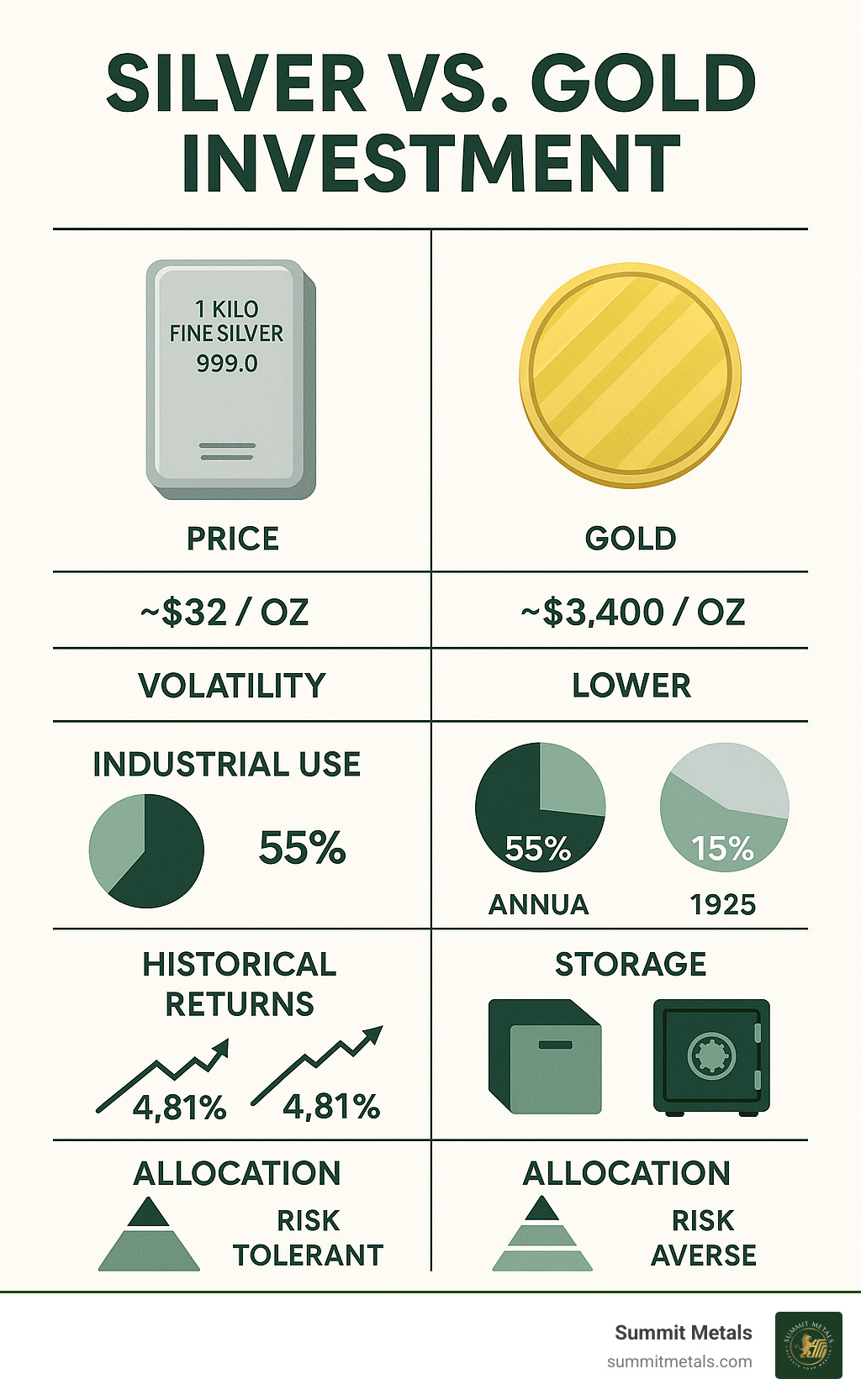

Silver versus gold investment choices have become critical as economic uncertainty drives more investors toward precious metals. Here's the quick comparison:

Gold Investment Advantages:

- Stability: Less volatile, better for wealth preservation

- Safe Haven: Strongest performance during economic crises

- Liquidity: Higher value density, easier storage

- Track Record: 4.81% annual returns since 1925

Silver Investment Advantages:

- Affordability: Lower entry point at ~$32/oz vs ~$3,400/oz for gold

- Growth Potential: Higher volatility creates larger percentage gains

- Industrial Demand: Over 50% used in technology, solar, EVs

- Undervalued: Gold-silver ratio above 100:1 suggests silver is cheap

Both metals serve as an inflation hedge, but gold excels during downturns while silver benefits from economic growth and industrial demand.

The decision between these precious metals isn't just about price - it's about matching your investment strategy to your financial goals and risk tolerance. Gold offers the stability of a proven store of value, while silver presents opportunities for higher returns through its dual role as both an investment asset and industrial commodity.

With inflation concerns and economic volatility continuing to shape markets, understanding the key differences between these metals has never been more important for building a resilient portfolio.

I'm Eric Roach, and during my decade as an investment banking advisor on Wall Street, I've guided clients through complex hedging strategies and market cycles, experience I now apply to silver versus gold investment decisions for individual investors. My background helping Fortune 500 companies structure defensive strategies translates directly to helping everyday investors steer precious metals allocation within their portfolios.

Key terms for silver versus gold investment:

- gold investment

The Core Differences: A Head-to-Head Comparison

When considering a silver versus gold investment, we're looking at two distinct precious metals, each with its own unique characteristics that influence its role in an investment portfolio. While both are considered monetary metals and investment assets, their differences in utility, demand, cost, and volatility are significant.

Let's explore a head-to-head comparison to understand these core differences:

| Metric | Gold | Silver |

|---|---|---|

| Industrial Use | Limited (jewelry, dentistry) | Significant (>50% in electronics, solar, EVs) |

| Volatility | Lower (more stable) | Higher (2-3x greater than gold) |

| Cost per Ounce | Higher (e.g., ~$3,097 as of March 2025) | Lower (e.g., ~$34.31 as of March 2025) |

| Primary Role | Store of value, safe haven, wealth preservation | Industrial commodity, monetary metal, growth potential |

| Market Size | Larger, deeper market | Smaller, more volatile market |

Utility and Industrial Demand

One of the most striking differences between gold and silver lies in their utility and industrial demand. Gold has been revered for millennia primarily as a monetary metal, a store of value, and a symbol of wealth. Its industrial applications are relatively limited, mainly found in jewelry (which accounts for a significant portion of its demand), some dentistry, and high-end electronics where its conductivity and corrosion resistance are critical. In 2021, investments accounted for nearly 90% of gold demand, with only 10% in industrial activities.

Silver, on the other hand, boasts a dual role. While it has a rich history as a monetary metal, its industrial demand is substantial and growing. More than half of all silver bought and sold on the market is used commercially, with applications ranging from dentistry to electronics. According to the World Silver Survey, over 50% of all silver’s demand comes from heavy industry and high technology, including smartphones, tablets, automobile electrical systems, solar-panel cells, and many other products. This makes silver's price movements inherently tied to global economic growth and technological advancements. When industries boom, demand for silver tends to rise, and vice versa. This industrial indispensability gives silver a unique demand floor that gold largely lacks. To learn more about silver's investment potential, check out our guide: Is Silver a Good Investment?

Cost, Volatility, and Accessibility

When we look at the cost per ounce, silver is significantly more affordable than gold. As of March 2025, silver is trading at approximately $34.31 per ounce, while gold is around $3,097 per ounce. This vast price difference makes silver far more accessible to beginner investors or those with smaller budgets, allowing them to acquire more physical ounces for the same capital outlay.

However, this affordability comes with a trade-off: volatility. Silver is known for its dramatic price swings, often being two to three times more volatile than gold on a given day. This higher volatility can translate into greater potential for percentage gains during bull markets, but also larger percentage losses during downturns. For example, a $3 change in silver's price (from $34.31 to $37.31) represents nearly a 10% fluctuation, whereas a $3 change in gold's price (from $3,097 to $3,100) is negligible. This makes silver a more speculative investment for those with a higher risk tolerance, seeking quicker returns. Gold, due to its higher price point and deeper market, tends to be more stable and less prone to sharp daily fluctuations. Understanding Why Gold and Silver Prices Fluctuate is key to navigating these markets.

Historical Returns and Performance as an Inflation Hedge

Let's talk numbers! When we examine long-term historical returns, both gold and silver have served as stores of value, but with differing performances. From the end of 1925 to the end of 2023 (a 98-year period), gold returned 4.81 percent compounded annually. Silver, over the same period, returned 3.71 percent compounded annually. To put this in perspective, inflation ran 2.96 percent compounded annually over that same timeframe. So, while both metals outpaced inflation, gold provided a slightly better real return.

However, it's crucial to compare these returns to other asset classes. If we had invested the same $20.63 in the S&P 500 in 1925, it would have grown to $300,538 by 2023, representing a compounded annual return of 10.3%. This suggests that for pure long-term capital appreciation, diversified stock portfolios have historically outperformed precious metals. This is an important consideration for investors. You might find our article Why Gold's Return is Higher Than You Think enlightening.

As inflation hedges, both gold and silver are often touted as safe-haven assets. Gold's correlation with inflation is generally stronger; during periods of high inflation and market uncertainty, investors tend to flock to gold to protect their wealth. Silver also acts as an inflation hedge, but its effectiveness can be influenced by its industrial demand. While industrial demand might wane during economic slowdowns (which often accompany high inflation), investment demand for silver tends to increase, offsetting some of this effect. Gold is considered a more powerful diversifier, consistently uncorrelated to stocks and with very low correlations with other major asset classes, making it a reliable hedge against broader market downturns.

How to Invest: Building Your Precious Metals Portfolio

Investing in gold and silver isn't just about choosing which metal to buy; it's also about deciding how to own it. For savvy investors, understanding the various avenues to build a precious metals portfolio is essential.

At Summit Metals, we focus on helping you acquire physical precious metals, which many consider the most direct and secure way to invest. Our transparent, real-time pricing and competitive rates, achieved through bulk purchasing, ensure you get the best value. For a comprehensive overview, check out The Ultimate Beginner's Guide to Investing in Precious Metals.

Physical Bullion: Coins vs. Bars

When it comes to physical bullion, the choice often boils down to coins or bars. Both offer direct ownership of the metal, but they have distinct characteristics that might make one more suitable for your investment goals.

Gold: Coins vs. Bars

| Feature | Gold Coins | Gold Bars |

|---|---|---|

| Liquidity | Highly liquid and easily recognizable (e.g., American Eagles, Canadian Maples). | Highly liquid, especially from reputable refiners. Larger bars may be slightly less liquid than smaller coins. |

| Premiums | Typically have higher premiums over the spot price due to minting costs and numismatic value. | Generally have lower premiums per ounce, making them more cost-effective for large-volume purchases. |

| Divisibility | Smaller denominations (e.g., 1/10 oz, 1/4 oz) offer greater flexibility for selling smaller portions of your holdings. | Less divisible. Selling a portion of a large bar is not possible without melting and recasting. |

| Authenticity | Government-minted coins have legal tender face value and security features, making them harder to counterfeit. | Reputable bars come with serial numbers and assay certificates, but require more diligence to verify. |

| Best For | Beginners, those seeking flexibility, and collectors. | Large-scale investors focused on acquiring the most ounces for their money. |

Silver: Coins vs. Bars

| Feature | Silver Coins | Silver Bars |

|---|---|---|

| Liquidity | Very high. Government-minted coins like the American Silver Eagle are globally recognized and easy to trade. | High, but larger bars (e.g., 100 oz) can be harder to sell quickly than smaller units. |

| Premiums | Premiums are higher than bars but are often a smaller percentage of the total cost compared to gold coins. | The most cost-effective way to buy silver in bulk, with very low premiums over the spot price. |

| Divisibility | Excellent. Available in small, manageable units (typically 1 oz), making them easy to sell in increments. | Less divisible. A 100 oz bar must be sold as a single unit. |

| Storage | Can be bulky. Storing a significant dollar value in silver coins requires more space than the equivalent value in gold. | More space-efficient for large quantities than coins, as they are stackable and uniform. |

| Best For | Investors who prioritize liquidity and divisibility, and those who enjoy the collectibility of coins. | Investors looking to maximize their silver holdings for the lowest possible cost per ounce. |

For a deeper dive into this choice, read our guide on Gold Bars vs. Coins.

Dollar-Cost Averaging with Autoinvest

Market timing is notoriously difficult, even for seasoned professionals. A powerful strategy to mitigate risk and build your holdings steadily is dollar-cost averaging (DCA). This involves investing a fixed amount of money at regular intervals, regardless of the price. When prices are low, you buy more ounces; when they're high, you buy fewer. Over time, this approach can lower your average cost per ounce.

At Summit Metals, we've made this strategy simple and accessible with our Autoinvest program. It's like a 401k for precious metals. You can set up a recurring monthly purchase of gold or silver, and we'll handle the rest. It’s the easiest way to build your precious metals portfolio automatically, removing the emotion from buying decisions and ensuring you consistently grow your wealth.

Learn more about The Power of Dollar Cost Averaging in Gold and Silver Investments and set up your monthly investment with Autoinvest at Summit Metals today.

Strategic Choices for Your Silver Versus Gold Investment

Choosing between gold and silver isn't a one-size-fits-all decision. The right choice depends on your investment strategy, risk tolerance, and the current economic climate. Understanding when each metal shines can help you balance your portfolio effectively. For a deeper look at portfolio diversification, see our guide on Maximizing Your Investment in a Chaotic Global Economy: Why Gold and Silver are Essential for Portfolio Diversification in 2024.

| Investor Profile | Choose Gold When... | Choose Silver When... |

|---|---|---|

| Conservative Investor | You prioritize wealth preservation and stability. Gold is your anchor in a storm. | You want a tangible asset but are willing to accept some volatility for higher growth potential. |

| Aggressive Investor | You want a safe-haven asset to balance higher-risk investments in your portfolio. | You are seeking higher percentage returns and can tolerate significant price swings. |

| Economic Outlook | You anticipate economic downturns, high inflation, or geopolitical instability. | You anticipate strong economic growth, industrial expansion, and technological innovation. |

When to Choose Gold Over Silver

Gold is the ultimate safe-haven asset. Investors flock to it during times of crisis because it has a long history of retaining its value when other assets, like stocks and currencies, falter. Its low correlation to the stock market makes it an excellent tool for diversification and risk management. If your primary goal is to protect your wealth from inflation and geopolitical uncertainty, gold is the superior choice. Learn more about The Strategic Role of Gold in Long-Term Portfolio Management.

When to Choose Silver Over Gold

Silver offers a more speculative opportunity with higher potential rewards. Because of its significant industrial use, its price is sensitive to economic cycles. During periods of economic expansion and technological advancement (especially in green energy and electronics), silver demand can soar, leading to substantial price increases. Its lower price point also means you can buy more ounces for your money, amplifying percentage gains. If you have a higher risk tolerance and are looking for growth, silver's dual nature as both a monetary and industrial metal gives it a strategic edge.

Understanding the Gold-to-Silver Ratio

The gold-to-silver ratio is a powerful tool for investors. It tells you how many ounces of silver it takes to buy one ounce of gold. By tracking this ratio, you can get a sense of which metal is relatively undervalued.

| Ratio Level | What It Means | Potential Strategy |

|---|---|---|

| High Ratio (e.g., > 80:1) | Silver is considered undervalued relative to gold. | This may be a good time to buy silver or even trade some gold for silver. |

| Low Ratio (e.g., < 40:1) | Silver is considered overvalued relative to gold. | This may be a good time to sell silver or trade it for gold. |

The historical average is around 50-60:1. When the ratio is significantly higher, it suggests that silver has more room to run up in price compared to gold. For a complete guide, see our article on Understanding the Gold-Silver Ratio: A Key Indicator for Precious Metals Investors.

Frequently Asked Questions about Silver Versus Gold Investment

For a beginner, is gold or silver a better investment?

For beginners, the choice often depends on budget and risk tolerance. Silver is more accessible due to its lower price per ounce, allowing you to purchase more physical metal for a smaller initial investment. However, it is also more volatile. Gold is more expensive but offers greater stability, making it a safer choice for those focused on wealth preservation. A common strategy is to start with silver to build a position and later diversify into gold. For guidance on how much to allocate, see our article: How Much of My Net Worth Should Be in Gold & Silver?

How do gold and silver perform differently during a recession?

During a recession, both metals are seen as safe havens, but they behave differently. Gold typically performs very well, as investors seek its stability when other assets are falling. Its price often rises due to this "flight to safety." Silver's performance can be mixed. Its industrial demand may fall as economic activity slows, putting downward pressure on its price. However, its role as a monetary metal means investment demand often increases, which can offset the industrial slump. Generally, gold is considered the more reliable recession-proof asset. Learn more about their roles as safe haven assets here.

What are the storage considerations for a silver versus gold investment?

Because of its high value density, gold is much easier and cheaper to store. A significant amount of wealth can be held in a small physical space, like a safe deposit box or a home safe. Silver, being much less dense and cheaper per ounce, requires significantly more space for the same dollar value. For example, $50,000 worth of gold might fit in your pocket, while the same value in silver could weigh over 100 pounds and fill a large box. This makes storage costs for silver proportionally higher, especially if using a third-party depository. For more details, read our Top Tips for Precious Metals Storage: Secure Your Investments.