When you're deciding between gold bars and gold coins, it really boils down to a simple trade-off: cost efficiency versus flexibility. If your main goal is to get the most gold for your money, bars are almost always the answer. But if you value liquidity and the ability to sell off smaller portions of your stack, government-minted gold coins are tough to beat.

A Head-to-Head Comparison of Gold Bars vs Coins

Choosing the right form of physical gold is one of the first, and most important, decisions you'll make. Both bars and coins are fantastic ways to hold tangible wealth, but they're built for different strategies. Your best choice hinges on what you’re trying to accomplish—are you looking to maximize your ounces for the lowest possible cost, or do you need the flexibility to sell easily and in smaller chunks?

The interest in gold as a stable, reliable asset is nothing new, but it's certainly growing. The global gold bullion market was valued at a staggering $52.75 billion in 2023 and is only expected to climb as more people seek safe-haven assets. While bars dominate this market thanks to their lower premiums, coins hold their own because of their recognizability, collectibility, and legal tender status.

To help you get started, let's break down the fundamental differences between the two.

Quick Comparison: Gold Bars vs Gold Coins

For a quick, at-a-glance look, this table sums up the core distinctions between bars and coins. It's a great way to see which one aligns better with your personal style before we dive into the details.

Attribute |

Gold Bars |

Gold Coins |

|---|---|---|

Price Premium |

Lower, especially for larger sizes. You get more gold for your dollar. |

Higher due to minting costs, design, and government backing. |

Liquidity |

Very high, but large bars might need an assay before a dealer buys. |

Extremely high. Globally recognized and easy to sell instantly. |

Divisibility |

Low. Selling a big bar is an all-or-nothing deal. |

High. You can sell one coin at a time as needed. |

Storage |

Highly space-efficient. Easy to stack and store securely. |

Less space-efficient due to protective tubes or capsules. |

As you can see, there’s no single "best" option—only what’s best for your situation. The right choice depends entirely on your priorities as an investor.

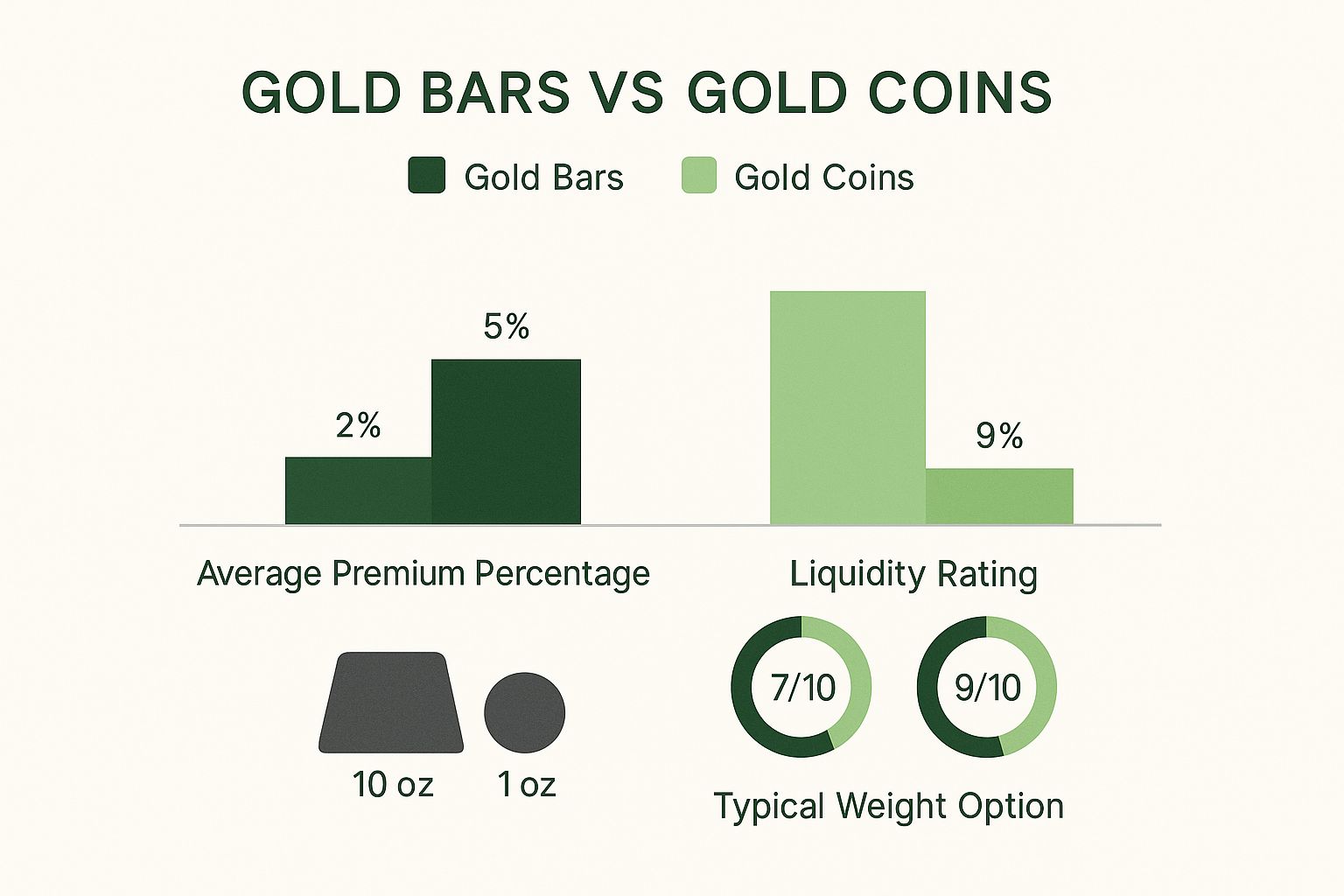

This infographic gives a great visual summary of how these trade-offs play out in the real world, comparing premiums, liquidity, and typical sizes.

The data makes it pretty clear: bars are the lean, cost-effective choice for bulk accumulation, while coins offer unmatched flexibility and ease of use. Getting a handle on these key differences is the first step to building a gold stack that truly works for you.

For a deeper dive into building your strategy, check out our gold investment guides and tips.

Analyzing Premiums and Your Purchase Power

When you start comparing gold bars vs. coins, the first thing you need to wrap your head around is the premium. This isn't some complex financial term; it’s simply the amount you pay over the gold's base market price (what we call the spot price). The premium is what covers the cost of making the product, getting it to you, and the dealer’s margin.

It directly affects how much physical gold you actually get for your hard-earned money. A lower premium means your capital is working harder for you, securing more ounces. And in this department, gold bars have a clear and distinct advantage, especially as you start buying in larger sizes.

Why Gold Bars Offer Lower Premiums

The reason is pretty simple: manufacturing efficiency. Pouring or stamping a gold bar is a much more straightforward process than minting a sovereign coin. Bars are designed to be simple, uniform blocks of metal, which keeps the production costs way down. That efficiency means savings for you.

On the other hand, government-minted coins like the American Gold Eagle Coin are a different animal. They involve intricate designs, special anti-counterfeiting features, and the full backing of a government mint—all things that add to the cost and, therefore, the premium.

Key Takeaway: A gold bar's job is to deliver a specific weight of pure gold for the lowest possible cost. A gold coin's job is to deliver that same weight but with added features like recognizability and government guarantees, which you inevitably pay for.

This price difference really stands out as you scale up. For example, the premium on a single 10-ounce gold bar is almost always lower than the combined premiums you'd pay on ten separate 1-ounce gold bars. The same logic holds true when you compare a simple 1 oz gold bar to a 1-ounce coin; the bar is consistently the more cost-effective choice for getting more gold for your dollar.

Maximizing Your Purchase in a Real-World Scenario

Let's put this into a practical example. Imagine you have a set budget you want to put into gold.

-

Option A: You could buy several 1 oz gold coins. A noticeable chunk of your budget will be eaten up by the higher premiums on each individual coin.

-

Option B: You could buy a single, larger gold bar for the same total price. Because the premium per ounce is significantly lower, more of your money goes directly toward the gold itself.

The result? Option B leaves you holding more total ounces of gold. This is exactly why serious stackers and large-scale investors have historically favored bars. They're prized for their straightforward, high-purity value. Many bars boast a purity of 99.5% to 99.99%, and their no-frills, standardized form factor ensures they cost less per ounce than their coin counterparts. You can learn more about how different gold products stack up at sbcgold.com.

At the end of the day, if your main goal is to accumulate the absolute maximum amount of physical gold for your capital, bars are the undeniable winner in the gold bars vs. coins debate. This unmatched efficiency makes them the bedrock of many serious precious metals portfolios.

Evaluating Liquidity and Resale Opportunities

Sure, all physical gold is a highly liquid asset, but the real-world ease of turning it back into cash can look very different when you compare bars and coins. This difference in liquidity—how fast you can sell—is a huge factor that should shape how you buy, especially when you think about your exit plan.

The secret to great liquidity is universal recognition and trust. This is where government-minted bullion coins absolutely dominate the conversation.

The Immediate Advantage of Gold Coins

Sovereign gold coins, like the iconic Canadian Gold Maple Leaf, are known and trusted by dealers and private buyers all over the world. Their standardized weight, purity, and government backing basically serve as a built-in certificate of authenticity.

This global trust means you can walk into almost any bullion dealer on the planet and expect to sell your coin with zero hassle. The transaction is quick and clean because the buyer already has complete confidence in what you’re handing them.

Key Insight: The instant recognizability of a government-minted coin cuts out the entire verification step from the selling process. This makes it the most liquid form of physical gold you can own for fast, small-scale sales.

This high level of trust also opens up a massive secondary market. You aren't just limited to major dealers. Private collectors and local buyers are often eager to snap up well-known coins, giving you far more options when it’s time to sell.

Understanding the Resale of Gold Bars

Gold bars, particularly the larger ones, play in a slightly different resale arena. They’re just as valuable, of course, but verifying them can be a more involved process, especially if they aren't from a top-tier refiner.

-

LBMA Certification: Bars from London Bullion Market Association (LBMA) approved refiners, like the highly respected PAMP Suisse Gold Bars, are the gold standard. They are extremely liquid among major dealers.

-

Assay Requirements: If you’re selling a very large bar or one from a lesser-known producer, the buyer will almost certainly require an assay. This professional test verifies the bar's exact weight and purity, which can add a bit of time and a small cost to the sale.

-

Sealed Packaging: Many modern bars are sold in tamper-evident packaging that includes a matching serial number and assay card. Keeping this packaging pristine is absolutely critical for a smooth and fast resale.

The perfect buyer for a large gold bar is usually a major bullion dealer with the equipment to handle and verify it properly. So while your pool of potential buyers might feel a bit smaller than it is with coins, the demand from these large-scale dealers is always strong. For those who bought bars from popular retailers, knowing the resale ins and outs is vital; we cover this in our guide on selling your gold bar for maximum value.

Ultimately, it all comes down to your exit strategy. If you think you might need quick cash or want the flexibility to sell to the widest possible audience, gold coins offer unmatched ease. If you're a serious accumulator working with trusted dealers, the liquidity of certified bars will serve you perfectly well.

Practical Insights on Storage and Security

So you’ve got your gold. Now what? The next, and arguably one of the most important, steps is figuring out how to keep it safe. Owning a physical asset like gold demands a rock-solid plan for storage and security, and whether you chose bars or coins really matters here.

The day-to-day reality of protecting your bullion boils down to some pretty simple concepts: space, efficiency, and how easy it is to handle. And in the great debate of gold bars vs. coins, the physical shape and size of each one creates some clear advantages depending on how you plan to store it.

The Space Efficiency of Gold Bars

If you're trying to maximize your storage space, gold bars win. Hands down. Their clean, rectangular shape was literally designed for one thing: stacking efficiently. Whether you're using a home safe or a professional vault, bars can be packed in tightly with almost no wasted space.

This is a huge deal for anyone holding a significant amount of gold. A stack of 10 oz gold bars, for example, will take up a much smaller footprint than the same weight in coins. This lets you store more wealth in a smaller, more discreet location.

Key Insight: The stackable design of gold bars makes them the top choice for anyone looking to store a lot of gold in a limited space. For sheer density and storage efficiency in a vault or safe, they're simply unmatched.

The Handling and Storage of Gold Coins

Gold coins bring a different set of pros and cons to the storage conversation. They almost always come in protective plastic tubes or individual capsules. While this is great for keeping the coin's condition pristine, it also makes them way bulkier and less space-efficient than bars.

A single tube holding twenty 1-ounce gold coins will take up way more room than two 10-ounce bars. The trade-off? Coins are much easier to handle. Counting, organizing, and moving coins in their designated tubes is a breeze. This benefit applies to other metals, too, as you'll find when storing physical silver coins.

If you're thinking about off-site storage, looking into professional secure, climate-controlled storage options can give you an extra layer of protection for your assets. This is a practical route for both bars and coins, moving the security burden off your shoulders.

At the end of the day, it comes down to what you prioritize. If your main focus is cramming the most value into the smallest possible space, gold bars are the logical choice. But if you value easy handling, better organization, and the built-in protection of capsules and tubes, coins are a fantastic fit, even if they take up a bit more room.

When you're buying physical gold, you need to have absolute confidence in what you're holding. This is where the gold bars vs. coins debate gets really interesting, because how you verify your gold’s authenticity depends heavily on its form. Both have rock-solid security, but they get there in different ways.

With government-minted bullion coins, the security is literally baked right in. Modern mints are in a constant arms race against counterfeiters, and they've become masters of creating design elements that are incredibly difficult, if not impossible, to fake. This gives the coins a built-in layer of trust that's understood and accepted all over the world.

Coin Security Features

Sovereign mints aren't just making coins; they're competing to see who can produce the most secure product. This has led to some seriously impressive features you can often see and feel, making authentication faster and more reliable for everyone from seasoned dealers to first-time buyers.

You'll see common anti-counterfeiting measures like:

-

Micro-Engraved Markings: Think of the tiny, laser-etched maple leaf on coins from the Royal Canadian Mint. You can only see these intricate details under magnification.

-

Radial Lines: These are incredibly fine lines that radiate from the coin's center. They're machined with such precision that they create a unique, light-diffracting pattern that’s a nightmare for forgers to replicate.

-

Complex Engravings: The sheer artistry, sharp details, and high relief on a government-issued coin are expensive and technically demanding to reproduce well. A cheap knock-off just won't have the same crispness.

The bottom line? The advanced security features on sovereign coins are like a public, verifiable guarantee of authenticity. This makes them exceptionally easy to trust, trade, and sell anywhere on the globe.

Bar Authentication and Verification

Gold bars operate on a different system of trust—one that’s built around the refiner's reputation and the integrity of its packaging. When you buy a gold bar, you're placing your trust in the manufacturer that produced it and the dealer who's selling it to you.

The most critical security layers for bars are all about provenance and packaging:

-

Assay Cards: Most bars these days are sealed in a tamper-evident card. This card contains all the vital stats—weight, purity, and a unique serial number that matches the number stamped on the bar itself.

-

Renowned Refiners: Bars from world-class refiners like Valcambi are trusted implicitly within the industry. A Valcambi Gold Bar purchased from a reputable source is universally accepted, no questions asked.

-

Unique Serial Numbers: Every single bar has its own distinct serial number. This creates a clear and unbroken chain of custody, from the moment it leaves the refiner to the moment it's in your hands.

Ultimately, your first and best line of defense against counterfeits—whether you're buying bars or coins—is your choice of dealer. Our guide on identifying reputable bullion dealers and avoiding counterfeits is a must-read for making a secure purchase. Your confidence begins and ends with buying from a source you can trust.

Aligning Your Choice with Your Investment Goals

The whole debate over gold bars versus gold coins isn't about finding some universal "best" option. It never has been. The real goal is to figure out which one is the best fit for your specific financial strategy. After weighing all the factors—premiums, liquidity, storage, and security—the last step is to line up your choice with what you actually want to achieve.

When you look at it through the lens of your personal goals, the right choice becomes obvious. Are you trying to build a serious store of wealth for the long haul, or do you need something more nimble that you can divide and access easily? Answering that question is how you build a precious metals portfolio that actually works for you.

Scenario 1: The Large-Scale Accumulator

For anyone whose main goal is to get the most gold for their money, gold bars are the clear winner. It’s not even a close contest. If your focus is on long-term wealth preservation and you want to be as cost-efficient as possible, the lower premiums on larger bars mean more of your cash is converted directly into pure gold. This strategy is all about building a dense, cost-effective core position.

The trade-off, of course, is that you give up divisibility. Selling a large gold bar is an all-or-nothing deal. But for the serious accumulator, that’s not really a problem—the whole point is to hold, not to be making frequent sales.

Key Insight: For sheer purchasing power and efficient, long-term storage, gold bars are unmatched. They are the ideal tool for building the foundation of a serious physical gold position.

Scenario 2: The Flexible Strategist

On the other hand, if you value liquidity, divisibility, and instant global recognition above all else, then gold coins offer superior strategic value. The power to sell a small piece of your holdings without having to liquidate a major asset gives you incredible flexibility. This makes coins absolutely perfect for anyone who wants the option to tap into their wealth in smaller, more manageable amounts. For those building a portfolio around this approach, there are many expert tips on investing in coins that can help you make smart decisions.

This flexibility doesn’t come for free; you’ll pay a higher premium per ounce. For many investors, though, the transactional ease and the peace of mind that come with holding universally trusted coins are well worth the extra cost.

The Hybrid Approach: A Balanced Strategy

Here's a secret from seasoned investors: you don’t have to pick just one. Many of the smartest people in this space use a hybrid approach to get the best of both worlds. It looks something like this:

-

Core Holdings: Building the foundation of their portfolio with larger gold bars. This maximizes cost-efficiency and locks in long-term value.

-

Flexible Holdings: Adding smaller, government-minted coins on top of that base for liquidity and easy divisibility.

This balanced method gives you a cost-effective anchor for wealth preservation while making sure you have flexible assets ready for whatever life throws at you. Understanding the role of physical gold purchase in diversifying a portfolio is crucial for building a truly resilient financial future.

Frequently Asked Questions

When you're weighing the pros and cons of gold bars versus gold coins, a few questions almost always pop up. Let's tackle some of the most common ones I hear from investors to clear up any confusion and help you decide with confidence.

Is It Better to Buy One Large Gold Bar or Several Small Coins?

This really boils down to your personal investment strategy and what you're trying to accomplish.

If your goal is pure, cost-effective wealth accumulation, a single large bar—like a 10 oz Gold Bar—is almost always the winner. You'll pay a lower premium per ounce, meaning more of your money goes directly into the gold itself.

On the other hand, holding several smaller coins, like 1 oz American Gold Eagles, gives you incredible divisibility. This flexibility is key. If you ever need to free up a bit of cash, you can sell off one or two coins without having to liquidate a much larger, all-or-nothing asset.

Do Gold Coins Have Value Beyond Their Gold Content?

For most standard bullion coins, their value is overwhelmingly tied to the gold they contain, plus a small premium over the spot price. That's their primary job.

However, some coins can take on a life of their own, developing numismatic or collectible value. This happens when a coin is particularly rare, has historical significance, or is in flawless condition. This extra layer of value can push its price far beyond what the metal alone is worth.

While most investors rightly focus on the bullion value, don't forget this potential for numismatic appreciation. It's a unique perk that only coins can offer. For pure metal investing, though, it's best to treat bullion coins as being valued for their gold content.

Are Gold Bars Harder to Sell Than Gold Coins?

Not necessarily "harder," but the selling experience can be a little different.

Government-minted coins like the American Eagle or Canadian Maple Leaf are recognized and trusted globally. You can walk into just about any dealer in the world, and they'll know exactly what you have, making for a quick and easy sale.

Gold bars, especially from smaller or less-known refiners, might require an extra step. A buyer may want to perform an assay test to verify the bar's purity and weight, which can slow things down a bit. However, if you stick with bars from top-tier, globally respected mints like PAMP Suisse or Valcambi—especially if you keep them in their original sealed assay cards—they are extremely liquid and sought after by all major dealers.

We dig into many more common questions on our full FAQ page. It's a great resource to help you invest with complete confidence.

At Summit Metals, we stock a huge selection of both gold bars and coins to fit any investor's goals. Whether you’re chasing the lowest premiums with bars or prioritizing the flexibility of coins, we’ve got the right products to help you build a solid precious metals portfolio.