Why Understanding Precious Metal Price History Matters for Your Wealth

Precious metal price history proves that gold, silver, platinum, and palladium are enduring stores of value. Understanding their performance through financial crises and economic shifts is key to making informed investment decisions.

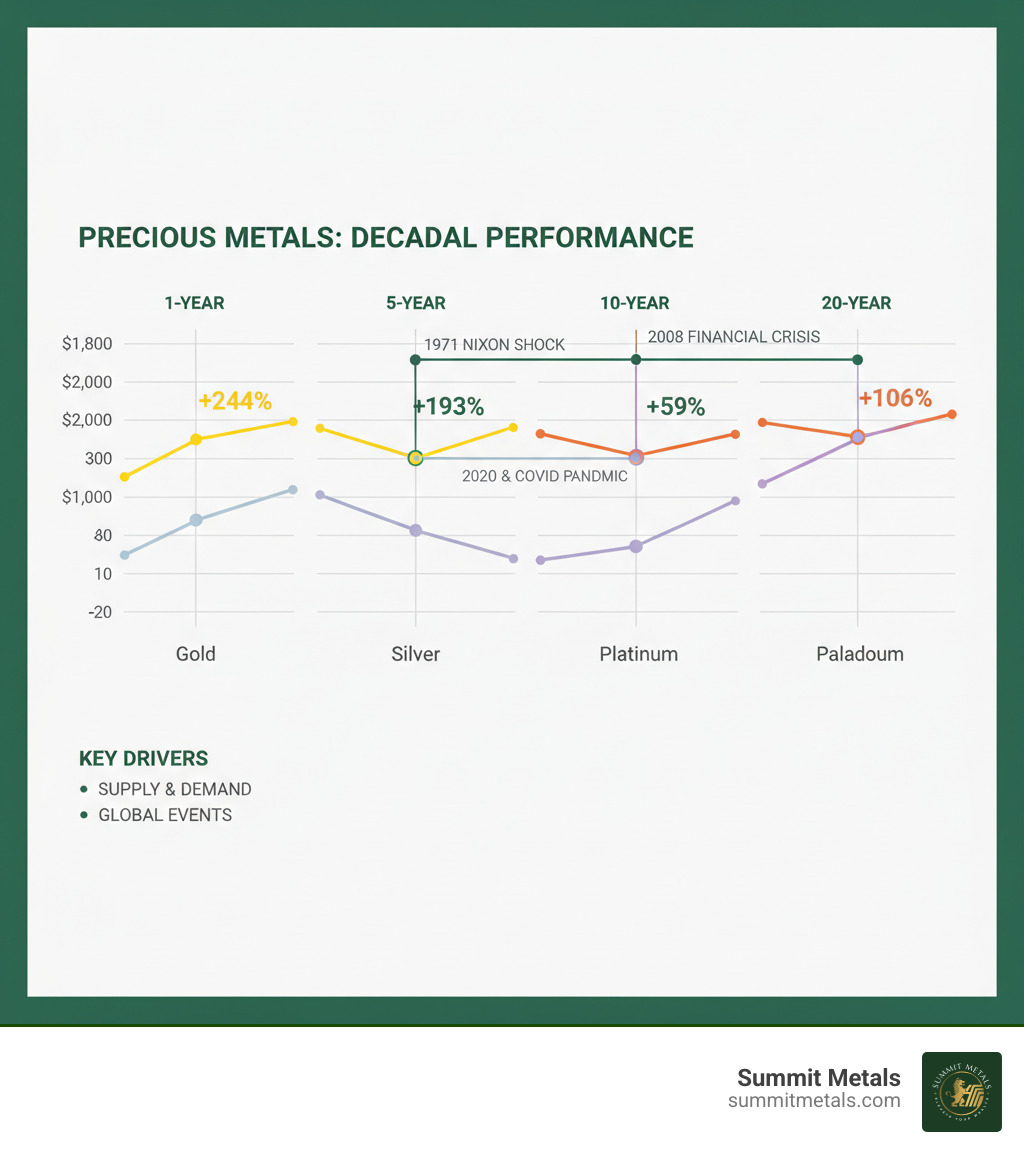

Key Historical Performance Summary:

- Gold: Up 244% over 10 years, 6,035% since 1971.

- Silver: Gained 193% over 10 years; more volatile than gold.

- Platinum: Rose 59% over 10 years, historically trading near or above gold.

- Palladium: Climbed 106% over 10 years, driven by automotive demand.

Prices are driven by supply (mining, recycling), demand (investment, industrial), currency dynamics (inverse to USD), and major events like the 1971 Nixon Shock and 2008 financial crisis.

This isn't just about charts; it's about real-world results. A small allocation to physical metals helped one executive retire eight months early, while another investor used his appreciated silver to rebuild a property after a disaster without selling stocks.

Long-term charts show the true value of precious metals as a hedge against inflation and risk, unlike short-term charts which often show market noise. The key is to use this history to build a strategy. One of the most effective is dollar-cost averaging: investing a fixed amount at regular intervals. This removes emotion and smooths out volatility.

Summit Metals' Autoinvest program makes this effortless. Like a 401(k) contribution, you can set up automatic monthly purchases of gold or silver to build your holdings consistently. This disciplined approach, used by institutional players, is the best way to protect and grow wealth over time.

A Century of Value: Unpacking the Precious Metal Price History

Studying precious metal price history over the last century reveals how these assets perform during times of crisis and change. Long-term trends show clear patterns that daily price swings obscure. Three pivotal moments stand out: the 1971 Nixon Shock, which ended the gold standard and allowed prices to float freely; the 2008 Financial Crisis, when gold soared as other investments crumbled; and the COVID-19 Pandemic, which drove investors back to the safety of physical metals amid massive government stimulus. These events show a recurring theme: precious metals act as a financial lifeboat when traditional assets sink.

Gold: The Enduring Safe Haven

For millennia, gold has been humanity's trusted insurance policy. It preserves wealth when inflation erodes paper currency and holds its value during geopolitical turmoil. This isn't speculation; it's a pattern proven over decades. The 100-year chart shows a clear upward trajectory, especially since 1971. You can learn more in our guide, A Brief History of Gold as Currency and Store of Value, and track live prices on our Gold Prices Today page. Because of its consistency, many investors use dollar-cost averaging to build their gold positions gradually, using programs like Summit Metals' Autoinvest to accumulate metal steadily, just like a 401(k).

Silver: The Dual-Purpose Metal

Often called "poor man's gold," silver is both a monetary metal and an industrial workhorse. Over half of its annual demand comes from applications like electronics, solar panels, and medical equipment. This dual nature makes it more volatile than gold. When the economy booms, industrial demand can send silver prices soaring. In a recession, it often falls harder than gold. The gold-to-silver ratio—how many ounces of silver it takes to buy one ounce of gold—is a key indicator. Historically averaging around 60:1, it currently sits near 79:1, which may signal that silver is undervalued relative to gold. Explore silver's price movements on our Historical Price of Silver Graph and learn to use the ratio in our guide to Understanding the Gold-Silver Ratio. Its affordability makes it popular for building physical holdings, and a monthly Autoinvest plan can smooth out its inherent volatility.

Platinum & Palladium: The Industrial Powerhouses

Platinum and palladium are primarily driven by the automotive industry, where they are critical components in catalytic converters that reduce vehicle emissions. Surging demand from tightening emissions standards caused palladium to trade above gold for several years—a historical anomaly. However, this reliance on a single industry creates risk. The vast majority of the world's supply comes from Russia and South Africa, making prices highly sensitive to geopolitical disruptions in those regions. The shift toward electric vehicles, which don't need catalytic converters, adds long-term uncertainty, though platinum is used in emerging hydrogen fuel cell technology. These metals are far more sensitive to economic cycles than gold, making them suitable for diversification but requiring a higher tolerance for volatility. Their price relationship with gold can signal value opportunities, such as when platinum trades at a significant discount to gold.

The Mechanics of the Market: How Prices Are Set and Read

Understanding precious metal price history requires knowing how prices are determined. The global market operates 24/7, with prices reflecting the collective actions of investors, industrial buyers, and central banks. Learning to read these market signals transforms confusing charts into valuable insights.

The Global Benchmark: Understanding the LBMA's Role

The London Bullion Market Association (LBMA) is the global authority that establishes the benchmark prices for gold, silver, platinum, and palladium. These benchmarks, determined through transparent daily auctions, serve as the official reference point for dealers and financial institutions worldwide. For gold and silver, the benchmarks are administered by ICE Benchmark Administration (IBA), while the London Metal Exchange (LME) administers them for platinum and palladium. This system ensures that the prices you see at Summit Metals are rooted in a transparent, globally recognized process. You can see these official prices on the LBMA Precious Metal Prices website.

Supply and Demand: The Fundamental Price Drivers

At its core, precious metal price history is a story of supply and demand. When demand outstrips supply, prices rise, and vice versa. These forces operate on multiple levels:

Supply Side: This includes new mining output, recycling of old jewelry and industrial parts, and central bank sales. Geopolitical instability or labor strikes in key producing countries like South Africa (platinum) and Russia (palladium) can significantly impact supply.

Demand Side: This is driven by investment demand (surging during uncertainty), jewelry consumption (especially in India and China), and industrial demand (critical for silver, platinum, and palladium). Central banks have also become net buyers in recent years, adding to demand as they diversify away from the US dollar.

Understanding how these forces interact is key to interpreting price movements. We explore these dynamics further in our guide on Key Factors Influencing Gold & Silver Prices.

The Role of Currencies in Precious Metal Price History

Precious metals are priced globally in US dollars. This creates a critical inverse relationship: when the dollar strengthens, metals become more expensive for foreign buyers, which can dampen demand and lower prices. Conversely, a weaker dollar makes metals cheaper internationally, often boosting demand and prices. We unpack this in detail in The Interplay of Interest Rates, the Dollar, and Gold Prices.

When you look at prices, you'll see two figures:

- The ask price is what you pay to buy metal.

- The bid price is what you receive when you sell metal.

The difference between them is the bid-ask spread. A narrow spread indicates a liquid, healthy market, while a wider spread suggests lower liquidity or higher volatility. At Summit Metals, we use our bulk purchasing power to offer competitive spreads, ensuring you get transparent pricing and excellent value.

From History to Strategy: Building Your Precious Metals Portfolio

Understanding precious metal price history is the first step; the next is to use that knowledge to build a resilient portfolio. The principles are the same whether you're in Salt Lake City or anywhere else: make informed decisions, act consistently, and maintain a long-term perspective.

Applying Precious Metal Price History to Your Investments

History provides a playbook. Events like the 2008 financial crisis and the COVID-19 pandemic showed that gold and silver thrive when traditional investments falter. The key is to separate long-term signals from short-term noise. Daily price swings are often just noise, but 10- or 20-year charts reveal the true role of precious metals as a hedge against inflation and economic uncertainty. This historical perspective helps you make smarter decisions, like evaluating the gold-to-silver ratio to spot potential value, rather than reacting to headlines. Our guide on the Price of Gold and Silver Bullion for Wealth Protection explores how to apply these insights.

The Power of Consistency: Dollar-Cost Averaging

Trying to time the market is a losing game. A better approach is dollar-cost averaging: investing a fixed amount of money at regular intervals, regardless of price. When prices are high, your investment buys fewer ounces. When prices are low, it buys more. Over time, this strategy averages out your purchase price and smooths out volatility. More importantly, it removes emotion from investing. You stick to a disciplined plan, which is how real wealth is built. This is the same principle behind your 401(k) contributions—consistent, automated investing.

That's why we created our Autoinvest program at Summit Metals. You can set up automatic monthly purchases of gold or silver, and the system does the work for you. It's a set-it-and-forget-it approach that builds your holdings steadily and effortlessly. Ready to put your strategy on autopilot? Set up your Autoinvest plan and start building your position today.

Choosing Your Metal: Coins vs. Bars

Once you decide to buy, you'll choose between coins and bars. Both contain the same intrinsic metal value, but they have different advantages.

Coins, like the American Eagle or Canadian Maple Leaf, are minted by sovereign governments and have legal tender status. This face value offers an extra layer of fraud protection, as counterfeiting them is a more serious crime. They are instantly recognizable and highly liquid worldwide. The trade-off is a slightly higher premium over the spot price to cover minting and design costs.

Bars are produced by private refiners and are all about efficiency. They typically have lower premiums, meaning you get more metal for your money. They are also more compact for storage in larger quantities. While reputable bars have security features, they lack the legal tender status and instant global recognition of government coins.

Here’s a quick comparison:

| Feature | Gold/Silver Coins | Gold/Silver Bars |

|---|---|---|

| Premium Over Spot | Generally higher | Generally lower |

| Legal Tender Status | Yes, with face value | No face value |

| Global Recognition | Extremely high | Depends on refiner brand |

| Liquidity | Excellent | Good, but may be slower for large bars |

| Anti-Counterfeiting | Advanced features + legal protection | Security features vary by refiner |

| Storage Efficiency | Less compact | More compact |

| Divisibility | Excellent (1 oz units) | Less flexible for large bars |

Many investors hold both: coins for liquidity and security, and bars to maximize their metal holdings. At Summit Metals, we offer a full range of authenticated coins and bars. To understand how pricing works for different weights, see our guide on Gold Prices Today in USA Per Gram.

Frequently Asked Questions about Precious Metal Prices

Here are answers to some of the most common questions we hear from investors in Utah and across the country about precious metal price history.

What is the most significant historical event that affected gold prices?

The single most transformative event was the 1971 "Nixon Shock." Before then, the US dollar was pegged to gold at a fixed rate of $35 per ounce under the Bretton Woods Agreement. When President Nixon severed this link, he ended the gold standard and allowed gold's price to be determined by the free market. Unchained from a fixed price, gold began to reflect its true value as a hedge against inflation and currency devaluation, surging from $35 to over $800 by 1980 and continuing its long-term climb ever since.

Why is silver more volatile than gold?

Silver's price swings are more dramatic than gold's for two main reasons. First, the silver market is much smaller, so it takes less capital to move prices significantly. Think of it as making bigger ripples in a smaller pond. Second, silver has a dual identity. While gold is primarily an investment and monetary asset, about 50-60% of silver's demand is industrial (electronics, solar panels, etc.). This ties its price to the health of the global economy. In a boom, industrial demand can cause silver to outperform gold. In a recession, that same demand dries up, causing it to fall more sharply.

How do I start investing using dollar-cost averaging?

Getting started with dollar-cost averaging is simple and one of the most effective ways to build a position over time, turning the lessons of precious metal price history into a practical strategy.

- Set a Budget: Decide on a fixed amount you can comfortably invest each month.

- Establish a Schedule: Commit to purchasing at a regular interval (e.g., monthly).

- Automate the Process: The easiest way to ensure consistency and remove emotion is to automate your purchases. Summit Metals' Autoinvest program was designed for this exact purpose. You set it up once, and it automatically buys your chosen metal on your schedule, just like a 401(k) contribution. Set up your Autoinvest plan to start building your holdings effortlessly.

Conclusion: Securing Your Future with the Lessons of the Past

The journey through precious metal price history offers a clear lesson: gold and silver are proven, reliable stores of value that have outlasted empires and survived every market crash. They serve as tangible anchors in an uncertain financial world.

History shows that trying to time the market is a losing game. The winning approach is a disciplined strategy built on historical truths. Dollar-cost averaging is one of the most effective strategies for long-term success. By investing a consistent amount over time, you remove emotion and build your position through all market conditions.

Summit Metals' Autoinvest program makes this easy. Like a 401(k) contribution, it automates your monthly purchases, allowing you to build wealth without stress or guesswork. The value of precious metals isn't based on a promise—it's intrinsic, physical, and real.

Take the next step. Use the lessons of history to secure your future. Explore live and historical price charts to see today's market, and consider how Autoinvest can help you build a resilient portfolio. The future is uncertain, but with the right strategy, you can be prepared.