The Mystery of the California Gold Rush Coin

If you're wondering about blake & co assayers $20 gold 1855 value, here's the truth you need to know:

Quick Answer:

- Genuine coins: Only one specimen is known to exist (at the Smithsonian, with questioned authenticity)

- Common brass/silver reproductions: $5-$20 (souvenir or token value)

- Chrysler promotional tokens (1969): $10-$20

- Brass patterns (if authentic): Potentially thousands, but extremely rare

Your coin is most likely:

- A brass or silver-plated token sold as a souvenir

- A 1969 Chrysler "Gold Duster" promotional piece

- A fantasy/advertising token from the 1950s or later

To verify if you have something rare: A genuine Blake & Co. $20 gold piece would weigh exactly 32.9 grams, be made of .900 fine gold, and have a reeded edge. Anything else is a reproduction.

Blake & Co. was a real assayer during the California Gold Rush, but they never actually minted official coins for circulation. When Gorham Blake attempted to create private coinage in Sacramento in 1854-1855, the government was already cracking down on unofficial money. The company was known for producing gold bars—many recovered from the S.S. Central America shipwreck—but no authentic Blake & Co. coins from 1855 entered widespread use.

I'm Eric Roach. With over a decade of experience advising on historical coins and precious metals, I help investors distinguish fantasy pieces from real assets. Understanding the blake & co assayers $20 gold 1855 value is a perfect example of why authentication is critical—whether you're examining a Gold Rush relic or building a secure portfolio of real gold and silver.

The Real Story of Blake & Co. Assayers

The California Gold Rush didn't just create wealth—it created a currency crisis. Between 1848 and 1855, a flood of fortune-seekers into California created an economic boom, but the infrastructure to support it didn't exist. Gold dust became the everyday currency, making transactions slow and reliant on trust. For a deeper look at this chaotic period, check out our article When Gold Fever Struck: A Deep Dive into the American Gold Rush.

Into this wild financial landscape stepped private assayers like Blake & Co. Understanding their story is key to knowing the blake & co assayers $20 gold 1855 value and why these pieces are so mysterious.

Who Were Blake & Co.?

Gorham Blake founded Blake & Co. in Sacramento, California, operating primarily during 1854-1855. Blake was no amateur; he had serious credentials, including working as a gold dust buyer for the trusted Wells Fargo.

The company's main business was ore assaying—testing raw gold to determine its purity and converting it into standardized gold bars. These bars were essential for commerce, as a Blake & Co. bar guaranteed a specific gold content and weight.

Many Blake & Co. gold bars have been recovered from the S.S. Central America shipwreck, a vessel that sank in 1857 carrying a fortune in Gold Rush treasure. These bars prove Blake & Co. was a legitimate player in the gold bar business. The coins, however, are a more complicated story.

Why Did They Want to Make Coins?

Buying simple goods with gold dust was exhausting, requiring scales and purity verification for every transaction. California desperately needed actual coins—standardized money that everyone could trust.

The San Francisco Mint opened in 1854 but couldn't keep up with demand, creating a massive U.S. currency shortage. This opened the door for private coinage. Companies like Kellogg & Co. and Wass, Molitor & Co. produced their own gold coins that were widely accepted because they contained known amounts of gold.

Blake & Co. saw this opportunity and advertised their willingness to turn raw gold into bars or coins, leveraging their assaying expertise and community trust.

But timing is everything, and Blake & Co. was late to market. By the time they were ready to produce coins, the federal government had already started its crackdown on private minting. The U.S. government didn't appreciate the competition and began shutting down these operations.

This is why Blake & Co. never produced coins for circulation. What remains are patterns, tokens, and reproductions—not the circulating gold pieces they envisioned. Determining the coin's value requires careful investigation, which we'll cover next.

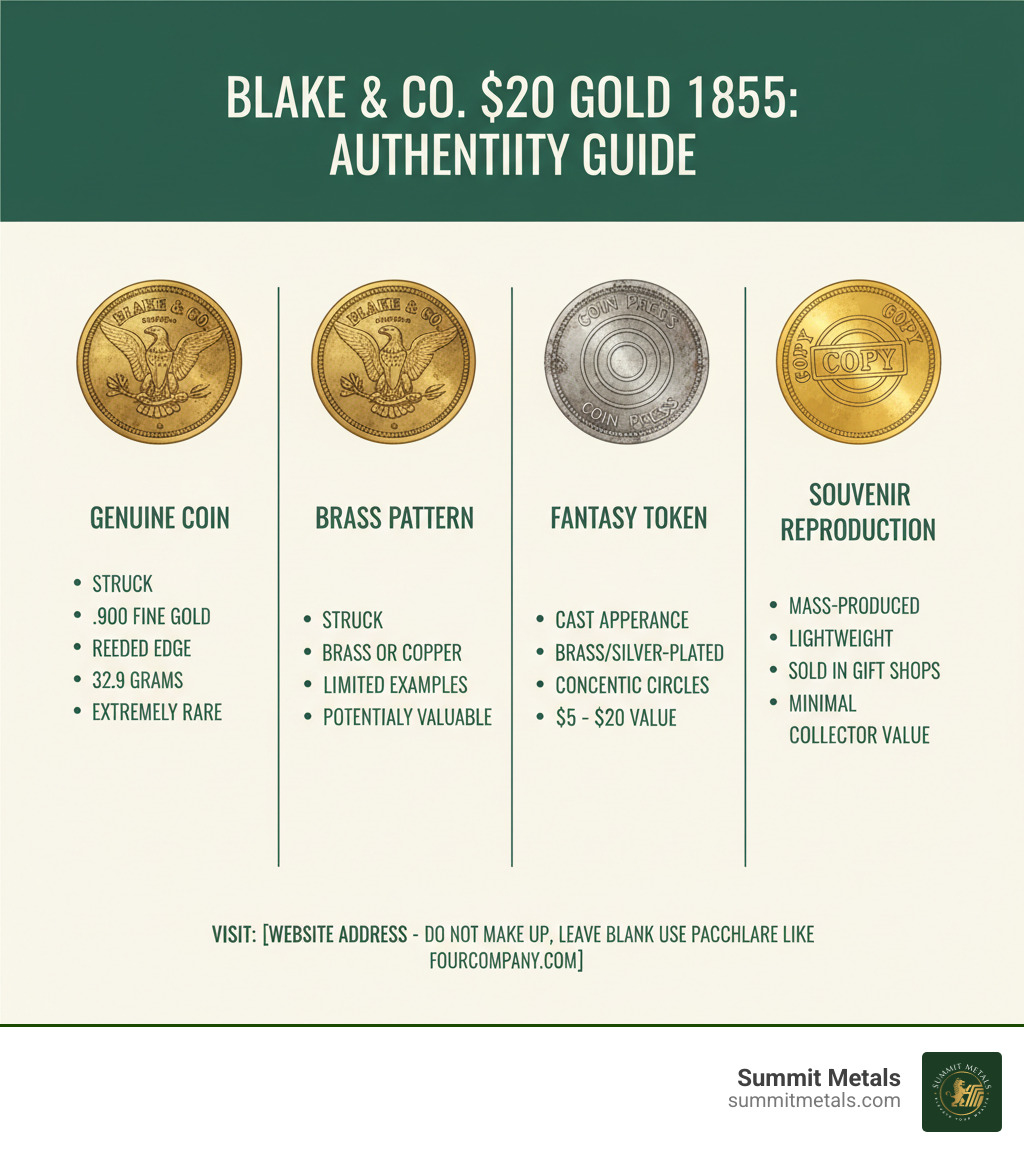

A 3-Step Guide to Identifying Your Blake & Co. Coin

So you've found a coin marked "Blake & Co. Assayers 1855 $20 Gold" in a drawer or at an estate sale. Your heart races—could it be a valuable Gold Rush relic? This guide will walk you through determining your coin's authenticity, from visual checks to physical tests.

Step 1: The Visual Inspection

First, look at your coin under good lighting. How it was made reveals much about its authenticity.

Authentic Gold Rush coins were struck—pressed between dies for sharp, clear details. Reproductions are often cast in molds, resulting in a softer, grainier appearance with less definition.

Examine the design elements. The obverse (front) typically shows concentric circles with the text "BLAKE & CO. ASSAYERS / 20". The reverse (back) usually has a coin press image with "SAC. CALIFORNIA GOLD / SMV / .900 / 1855 / 20 DOLLS." "SAC." refers to Sacramento, and "SMV" likely means "Standard Mint Value."

Interestingly, some rare brass and copper patterns from Blake & Co. exist with different designs, such as a Liberty Head on the obverse and an eagle on the reverse, often dated 1856. To see what genuine Liberty Head gold coins look like, our article Discovering the Legacy of Liberty Head Gold Coins offers excellent references.

Compare your coin to images of genuine territorial gold. A sharp, professional strike suggests authenticity, while crude, fuzzy details point to a reproduction.

Above: Notice the difference between a genuine, struck gold coin (left) with sharp details, and a cast replica (right) with softer, less precise features.

Step 2: Physical Characteristics and Tests

The coin's physical properties are the most reliable indicators of authenticity. You'll need a precise digital scale.

Weight is critical. A genuine $20 gold piece would weigh exactly 32.9 grams, matching the U.S. $20 Double Eagle. If your coin's weight differs significantly, it's not genuine gold. Brass and copper tokens are much lighter.

Next, consider the composition. A true gold coin would be .900 fine gold (90% gold, 10% copper). Most reproductions are brass, copper, or gold-plated base metal. If your coin is plated, look for wear spots where the base metal shows through. Our guide on How to Tell if Gold is Real offers more tests you can do at home.

The diameter of the Smithsonian specimen is 3.2 cm (32 mm). Many brass patterns share this diameter, so it's just one piece of the puzzle.

Finally, check the edge type. An authentic high-denomination gold coin would have a reeded edge (small parallel grooves) to prevent shaving off metal. A smooth edge is a strong sign of a reproduction.

If your coin passes these tests, it's extraordinary and needs professional authentication. However, given the rarity and the questioned status of the Smithsonian's own specimen, a genuine piece would be astronomically valuable but nearly impossible to definitively authenticate.

Step 3: Understanding the "Blake & Co Assayers $20 Gold 1855 Value"

Now, let's identify what your coin actually is. Most Blake & Co. pieces are "fantasy pieces"—items that resemble real coins but were never issued as currency.

Most common are souvenir or advertising tokens made of brass or copper, produced decades after the Gold Rush. Some were even used as gambling markers in Nevada casinos in the mid-20th century.

Surprisingly, many are 1969 Chrysler "Gold Duster" promotional tokens. These mass-produced brass replicas were car-launch giveaways. If your coin looks pristine or a relative owned a Gold Duster, you've likely solved the mystery! These sell for $10-$20 as novelties.

A few genuine Blake & Co. pattern coins exist, struck in brass and copper. These rare test pieces can be worth thousands but are not gold.

The most intriguing piece is the single Blake & Co. $20 gold coin at the Smithsonian National Museum of American History. You can view it on the Smithsonian's website, but note the museum states, "the authenticity of this object is in question." This priceless historical artifact is not for sale.

So, what's the real blake & co assayers $20 gold 1855 value for your coin? If it's a common brass or silver reproduction, you're looking at $5 to $20. If it's a Chrysler token, perhaps $10 to $20. Only the exceedingly rare brass or copper patterns might be worth thousands, and would require professional grading.

What Is Your Blake & Co. Coin Actually Worth?

Let's get straight to the point: the value of your Blake & Co. piece depends entirely on what it is. Here's the realistic valuation for each scenario.

The Value of Common Reproductions and Tokens

If you're holding a Blake & Co. piece, it's almost certainly a reproduction. Most are made of brass or other base metals, created as souvenirs, advertising gimmicks, or what collectors call "fantasy pieces"—coins that look historical but were never used as money.

So what's the blake & co assayers $20 gold 1855 value for these common tokens? Not much beyond their novelty appeal. At the time of this publication, you'll find these pieces selling on sites like eBay for $5 to $20. For example, an "EXC 1855 ' $20 GOLD' Blake & Co Assayers Calif Sacramento Mint Fantasy token" was listed on eBay for US $18.50.

Above: A typical online listing for a Blake & Co. fantasy token, often sold for souvenir value.

While not financially valuable, these tokens are cool conversation pieces that link to the Gold Rush spirit. Just don't plan your retirement around one.

The Potential Value of a Genuine Pattern

Now we're in much rarer territory. A few genuine brass and copper pattern strikes from Blake & Co. exist. These are authentic historical artifacts from the company's attempt at coinage.

Because of their extreme rarity, these patterns carry substantial numismatic value. While they appear on the market too infrequently for recent auction data, rare Gold Rush patterns from similar assayers can command prices in the thousands to tens of thousands of dollars.

The catch? A genuine pattern requires professional authentication from a service like PCGS (Professional Coin Grading Service) or NGC (Numismatic Guaranty Company). Their experts can distinguish real patterns from reproductions, providing a certified grade that establishes legitimacy and market value. Without certification, its value is purely speculative.

The "Priceless" Smithsonian Specimen and the Blake & Co Assayers $20 Gold 1855 Value

One Blake & Co. $20 gold piece stands apart: the specimen in the Smithsonian's National Numismatic Collection. It's the definitive reference point, but its story is complicated.

Even this unique specimen's authenticity is questioned by experts. The Smithsonian itself notes that "the authenticity of this object is in question." It could be a unique pattern or even an early fantasy strike.

Regardless, this piece is "priceless." As part of the national collection, it's an irreplaceable historical artifact that's not for sale. Its value is measured in historical significance, not dollars. For all practical purposes, the coin you own is not this one.

The takeaway is that your piece is highly unlikely to be a genuine Gold Rush-era circulating gold coin from Blake & Co. The company's attempt at coinage never got off the ground, leaving only patterns, tokens, and later reproductions.

Investing in Real Gold: From Fantasy Coins to Tangible Wealth

The Blake & Co. story teaches a valuable lesson: not everything that looks like gold is a sound investment. While these historical tokens are fascinating, they aren't the foundation of a precious metals strategy. If you're serious about building tangible wealth, the path is through authenticated, investment-grade gold and silver.

Fantasy Tokens vs. Authentic Territorial Gold

Let's be clear about the comparison. A brass Blake & Co. token is a piece of memorabilia. An authentic territorial gold coin—like a genuine Kellogg & Co. $20 piece—is an entirely different asset.

The difference is stark. A common Blake & Co. reproduction is worth less than $20. An authentic Kellogg & Co. territorial gold coin contains .900 fine gold and can be worth $3,500 to over $20,000, backed by both its gold content and numismatic rarity.

| Feature | Blake & Co. Token (Common Reproduction) | Authentic Kellogg & Co. $20 Gold Coin |

|---|---|---|

| Material | Brass, copper, or gold-plated base metal | .900 fine gold (90% pure gold) |

| Value | <$20 (souvenir/collectible token) | $3,500 - $20,000+ (numismatic & melt value) |

| Purpose | Souvenir, advertising, fantasy piece | Commerce, store of wealth |

| Rarity | Common, mass-produced | Extremely rare, few examples known |

| Authentication | Not necessary, clearly a reproduction | Essential, requires professional grading (PCGS/NGC) |

Note: Prices shown are at the time of this publication and are for illustrative purposes.

While rare territorial gold coins are incredible collector's items, most investors build wealth with modern sovereign gold coins and bars. Sovereign coins like the American Gold Eagle offer unique advantages over bars because they are legal tender. For a deeper dive into this decision, check out our guide on Gold Bars vs. Coins.

Building Your Treasure Chest with Dollar-Cost Averaging

Those Gold Rush miners who struck it rich did so through consistent, daily effort. The same principle applies to building wealth with precious metals today.

Dollar-cost averaging is your modern-day gold pan. Instead of trying to time the market, you invest a fixed amount at regular intervals. When prices are high, you buy less gold; when prices dip, you automatically buy more. Over time, you average out the volatility and steadily build your stack.

Think of it like a 401k, but for real, tangible wealth you can hold. No market-timing stress, just consistent, disciplined investing.

This disciplined strategy, often called 'autoinvesting,' is simple with Summit Metals. Our Autopays service lets you set up automatic, recurring purchases on your schedule. It's the set-it-and-forget-it approach to building tangible wealth, backed by our commitment to authenticated products and transparent pricing. You can learn more about The Power of Dollar-Cost Averaging in Gold and Silver Investments and explore our Autopays service to start your journey.

The blake & co assayers $20 gold 1855 value might be limited to historical curiosity, but the value of a disciplined precious metals investment strategy is something you can build your future on.

Conclusion: A Fascinating Story, Not a Buried Treasure

The Blake & Co. 1855 $20 piece is a captivating relic of Gold Rush ambition, a numismatic ghost from a time when private enterprise tried to solve a currency crisis. The pieces that surface today carry the romantic weight of that era, even if they don't carry the weight of actual gold.

For those holding such a piece, the reality is clear: it's almost certainly a modern reproduction, fantasy token, or promotional item like the 1969 Chrysler "Gold Duster" giveaway. Its blake & co assayers $20 gold 1855 value is sentimental, rarely exceeding $20. But that doesn't diminish the story it tells.

The real treasure lies in building a secure financial portfolio with authenticated precious metals. A Blake & Co. token is a conversation piece, but it won't protect your wealth against inflation or economic uncertainty. That's where genuine, investment-grade gold and silver come in.

At Summit Metals, based in Wyoming, we understand the importance of genuine value. We've built our reputation on providing authenticated gold and silver with real-time, transparent pricing. Every purchase is backed by our commitment to authenticity—no fantasy pieces, just real precious metals you can trust.

Whether you're a seasoned investor or just starting, we're here to help you steer this world with confidence. Our guides cover everything from understanding gold bars vs. coins to implementing smart strategies like dollar-cost averaging through our Autopays service. It's investing in real wealth, one authentic piece at a time.

The Blake & Co. story reminds us that not everything that looks like treasure actually is—but the pursuit of real value, backed by authenticity and knowledge, is always worthwhile. Start your investment journey with our comprehensive guides and tips and find what genuine precious metals ownership can mean for your financial future.