Portfolio diversification is a fundamental principle of investing; it’s designed to reduce risk by spreading your investments across different asset classes. Equities, bonds, and real estate are commonly used to diversify your portfolio, but gold has historically been a game changer in performance and a hedge against the unknown. In this post, we will look at the role of physical gold in your portfolio, its history, its benefits, and how purchasing physical gold can add to your overall returns.

What is Gold

Gold is a remarkable asset that has been a store of value for thousands of years. Unlike stocks or bonds, which are tied to the performance of companies or governments, gold’s value isn’t tied to the health of any entity; instead, the gold price is influenced by economic factors, historical trends, and real-time market updates. Historically, gold coins have played a significant role as currency and continue to be a valuable investment option in both bullion and numismatic markets. Its value is intrinsic, driven by its rarity, durability, and global demand. This inherent value makes gold a hedge against economic and financial instability.

Gold is often called a “safe-haven” asset, meaning it tends to hold or increase in value during economic turmoil, currency devaluation, or geopolitical tensions. While other assets may lose value during those times, gold’s stability makes it an attractive option for investors looking to protect their wealth.

Gold’s History

To understand the role of gold in diversification, you need to look at its history. Historically, gold bars and other forms of gold investments have played crucial roles in preserving wealth. Over the past century, gold has been shown to preserve wealth and add to portfolio returns, especially during times of market stress. Gold prices today reflect these historical trends, providing real-time insights into its ongoing value.

Gold in the Great Depression

During the Great Depression of the 1930s, gold went up as investors fled the collapsing stock market and banking system. While equities lost value, gold held its purchasing power, proving it could stabilize a diversified portfolio.

Gold in the 1970s

The 1970s were marked by high inflation and stagflation, with the economy stagnating and inflation high. During this period, gold prices went up. Gold was a hedge against the devaluing of fiat currencies. Investors who had physical gold during this decade made big returns, proving that gold can protect against inflation.

Gold in the 2008 Financial Crisis

Stock prices and other financial assets declined dramatically during the 2008 global financial crisis. However, gold prices went up as investors sought safe-haven assets. Portfolios with physical gold had less volatility and better overall returns during this period, proving that gold is a risk manager.

Gold in the 21st Century

After the 2008 financial crisis, gold continues to perform well, reaching all-time highs in 2024. While gold can be volatile in the short term, its long-term trend is up due to ongoing demand and its store-of-value function. Even recently, during the COVID-19 pandemic, gold has been resilient and added to portfolio stability.

Why Physical Gold in Your Portfolio for Diversification

Owning physical gold in your diversified portfolio offers:

Inflation Hedge

Gold’s most significant advantage is its ability to hedge against inflation. When the purchasing power of paper currency declines due to inflation, gold’s value increases. This inverse relationship makes gold a way to protect your wealth in an inflationary environment.

Additionally, gold jewelry not only serves as a personal aesthetic appeal but also stands as a serious financial asset.

Currency Devaluation Protection

Gold is a global asset that is not tied to any specific currency. When a country’s currency devalues, the price of gold in that currency goes up. For investors, physical gold can protect you from currency fluctuations and devaluations.

Low Correlation with Other Assets

Gold has low or negative correlations with other asset classes like stocks and bonds. This means that when stocks or bonds go down, gold stays stable or goes up. This low correlation makes gold a great diversifier and reduces overall portfolio volatility.

Liquidity and Tactibility

Physical gold is liquid and can be bought or sold in many markets around the world. It is also a tangible asset you can physically hold, which gives you a sense of security that you don’t get with digital or paper assets.

For those looking to buy gold coins at competitive prices, consider reputable dealers and online platforms that offer a wide selection and transparent pricing.

Long-Term Store of Value

Throughout history, gold has maintained its value over the long term. Unlike fiat currencies, which can be inflated and devalued, gold’s value is inherent and stable. This makes it an asset for preserving wealth over generations.

How Gold Prices Today Add to Overall Returns

Gold investors can benefit from including physical gold in their portfolios as it can increase overall returns by reducing risk and providing stability during market downturns. Here’s how:

To further enhance financial security, investors should consider the process and options to buy gold bullion, including physical bullion and gold certificates, from reputable sellers and secure storage solutions.

Risk Reduction

Gold’s safe-haven nature means it performs well during economic or market stress. Having gold in your portfolio can reduce the impact of market downturns on your overall returns. This risk reduction is especially valuable during high volatility and economic uncertainty.

Better Risk-Adjusted Returns

When evaluating an investment portfolio’s performance, you need to consider the returns and the risk taken to achieve those returns. Gold’s low correlation with other assets can improve the portfolio’s risk-adjusted returns, meaning investors get better returns for the risk they take.

Performance in Bear Markets

Historically, gold has performed better than other assets in bear markets. For example, during the dot-com bubble burst in the early 2000s and the global financial crisis in 2008, gold was positive while equities were down big time. This ability to generate positive returns in market downturns adds to the overall performance of a diversified portfolio.

Stability in Economic Uncertainty:

Gold’s value is stable during economic uncertainty, such as recessions or geopolitical tensions. This stability can act as a buffer to losses in other parts of the portfolio and give more consistent returns over time.

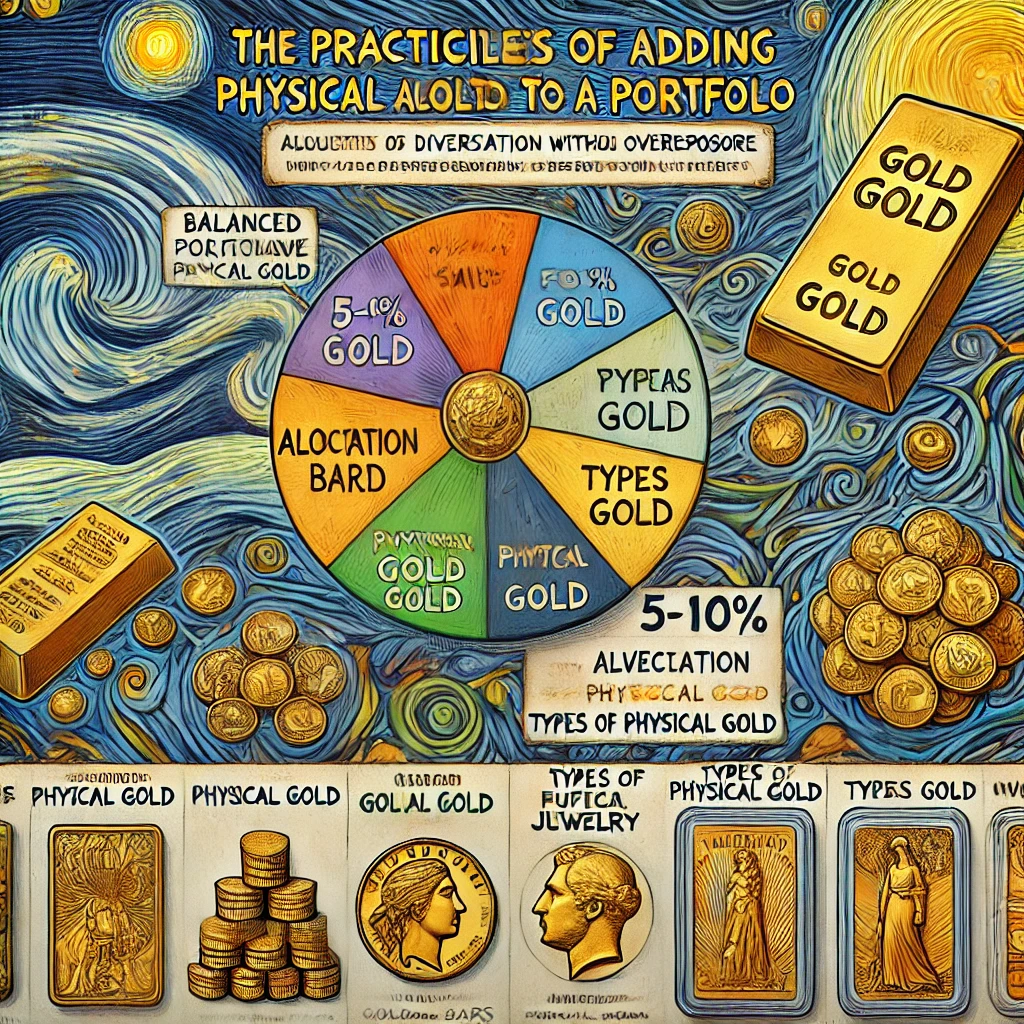

Practicalities of Adding Gold to Your Portfolio

While gold has many benefits, here are some practicalities to consider when adding physical gold to your portfolio:

Allocation Size

Deciding the proper allocation to gold in your portfolio is essential. While gold adds diversification, too much can hurt returns when equities or other assets perform well. A general rule of thumb is allocating 5-10% of your portfolio to gold, which can vary depending on your risk tolerance and investment goals.

Types of Physical Gold

Investors can choose from various forms of physical gold, bullion bars, coins, and jewelry. Products created by sovereign mints, such as American Gold Buffalo coins, are considered legal tender, unlike those produced by private mints. Bullion bars and coins are preferred for investment as they are standardized in purity and weight. Coins like the American Gold Eagle or Canadian Gold Maple Leaf are widely recognized and can be easily traded.

Storage and Security

Physical gold must be stored in a home safe, a bank’s safety deposit box, or a specialized bullion vault. Investors need to consider the costs and risks of storage. Some opt for insured vault storage provided by reputable companies for security and peace of mind.

Understanding market dynamics and ensuring secure transactions are crucial aspects of the precious metals industry.

Liquidity and Market Access

Physical gold is generally liquid, but the ease of buying and selling can depend on its form and location. Coins and small bars are easier to sell quickly than large bars. Investors should restrict their purchases to reputable dealers such as Summitmetals.com when buying or selling physical gold.

Silver bullion also serves as an investment option alongside gold, valued primarily for its metal content and offering affordability and accessibility for a wider range of investors.

Tax

Depending on the jurisdiction, the sale of physical gold may be subject to capital gains tax. Investors should be aware of the tax implications of their gold investments and consider this when planning their portfolios.

Cost

Physical gold has costs beyond the purchase price, premiums over the spot price, storage fees and insurance. These costs should be considered in the overall investment strategy as they can impact the net returns from holding gold.

Conclusion: Gold in a Diversified Portfolio

In summary, physical gold has been a valuable diversifier that adds to overall portfolio performance. Its historical performance during inflation, economic uncertainty, and market downturns proves its role as a hedge and a store of value. Gold is an essential component of long-term investment success by reducing risk, improving risk-adjusted returns, and providing stability in volatile times. The Shanghai Gold Exchange, Comex and the LBMA play a significant role in the global gold trading landscape, further enhancing the accessibility and liquidity of precious metal investments.

Investors who add physical gold to their portfolio can benefit from its low correlation to other assets, liquidity, and ability to hedge against various economic risks. However, gold investment requires care, considering factors like allocation size, storage, and costs.

Physical gold is a powerful tool for wealth preservation and growth in a diversified portfolio. Whether you’re a seasoned investor or new to precious metals, understanding gold can help you build a better investment strategy.