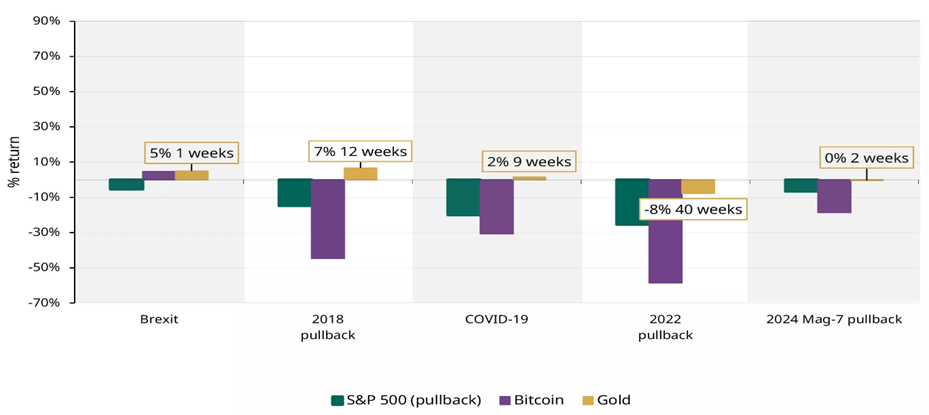

Several vital differences emerge when analyzing Bitcoin’s and gold’s performance during economic stress, reflecting their unique characteristics and investor behaviors.

Tracking the gold price is crucial, as it provides real-time data on price fluctuations and historical trends, aiding investors in making informed decisions about gold today.

Historical Context and Stability of Gold

Gold has a long history as a safe-haven asset, with over 5,000 years of use as a store of value and a hedge against inflation and economic uncertainty. Gold prices have historically fluctuated due to various factors, including global economic events, investment supply and demand, and other influences. Options for investing in physical gold include gold bars and gold coins, both of which have historical significance. Its intrinsic value is widely recognized, making it a reliable choice during financial turmoil. Historically, gold performs well when economic conditions deteriorate, as investors flock to it for security.

In contrast, Bitcoin has only been around for about 15 years and is still establishing its reputation. While it has shown significant growth and is touted as “digital gold,” its volatility and relatively short track record make it less predictable during economic stress.

Correlation Coefficient with Other Assets

Gold typically correlates negatively with equities during economic stress, as indicated by the correlation coefficient. For calculating this correlation, it is crucial to have a proper data set and understand the concept of a linear relationship. The Pearson product-moment correlation coefficient normalizes the covariance between two variables with the square root of their variances. Gold’s value often rises when stock markets fall, demonstrating a negative correlation. In correlation studies, it is important to understand how one variable relates to another and how two variables move together. The population correlation coefficient is also relevant in statistical analysis, as it measures the dependence between two random variables.

On the other hand, Bitcoin has shown a higher positive correlation with equities, particularly during market downturns. This behavior suggests that Bitcoin may not effectively hedge against economic stress as gold does. Instead, it can amplify losses when stock markets decline, diminishing its appeal as a safe-haven asset.

Volatility and Risk of Bitcoins

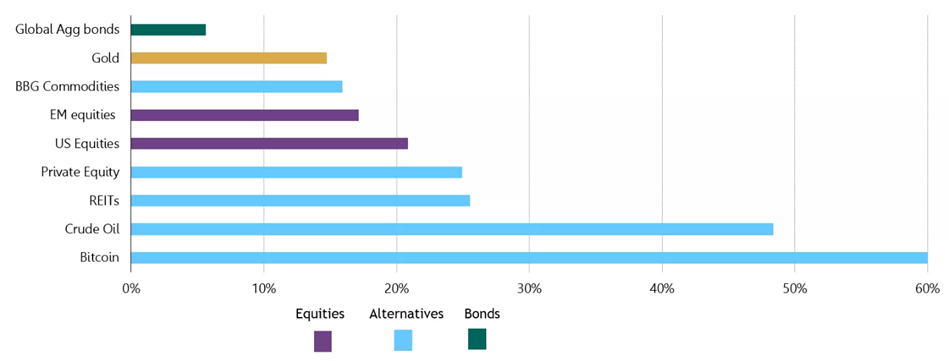

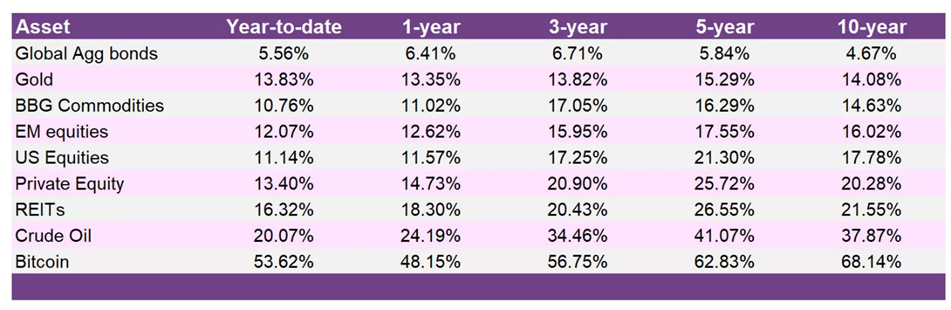

Volatility is another critical factor. Bitcoin is known for its extreme price fluctuations, which can be exacerbated during economic uncertainty. Gold bullion, with its investment potential, also experiences price fluctuation based on market demand and economic events. While Bitcoin has the potential for high returns, it also carries significant risk, often leading to sharp declines in value during market stress.

In contrast, gold tends to be more stable, providing a more predictable store of value. This stability is particularly appealing to risk-averse investors during economic downturns.

Liquidity and Accessibility

Bitcoin benefits from high liquidity and ease of trading on various platforms, which can be advantageous during economic stress when quick access to cash is necessary. Different methods are available to buy gold, including coins and bars, with advantages such as security, liquidity, and serving as a hedge against economic fluctuations. This liquidity can attract investors looking for rapid transactions, but it also means that market sentiment and speculative trading can influence Bitcoin’s price.

While also liquid, gold is often viewed as a more traditional asset. Its physical nature and historical significance contribute to its status as a reliable store of value, especially in uncertain times. Additionally, one cannot overstate the importance of holding the physical asset when times are tough. The process of selling gold involves placing orders through a reputable dealer, settling sales, and understanding the associated costs, ensuring an efficient trading experience. Understanding market fluctuations and trends is crucial when you sell gold, as these factors can significantly impact the selling process. At Summitmetals.com, we do not see each asset as a zero-sum game. They both have their place, but Gold uniquely balances portfolios and provides higher overall returns when compared using risk vs reward tools such as the Sharpe Ratio.

Conclusion

In summary, Bitcoin and gold have their merits but serve different roles in investment strategies during economic stress. The influence of financial markets on the prices of precious metals like gold is significant, as various economic factors, including supply and demand and central bank monetary policies, play a crucial role. Gold remains a time-tested safe haven with a stable value, making it a preferred choice for risk-averse investors. Investing in precious metals can add value to an investment portfolio by providing diversification and acting as a hedge against economic uncertainties. While offering the potential for high returns, Bitcoin is more volatile and closely tied to equity markets, which can limit its effectiveness as a hedge during economic downturns. Investors should consider these differences when deciding how to allocate their assets during financial uncertainty.

Images World Gold Council