Why Copper Bullion Has Become a Hot Commodity

Selling copper bullion is gaining traction as more investors recognize copper's unique position in today's economy. Here's what you need to know:

Quick Guide to Selling Copper Bullion:

- Where to sell: Online bullion dealers, local coin shops, pawn shops, or e-commerce platforms

- Pricing: Copper is priced per pound using the Avoirdupois system (not troy ounces like gold/silver)

- Purity: Look for .999 fine copper bullion for best value

- Process: Get quotes, lock in price, package securely, ship with insurance, receive payment

- Timeline: Most dealers pay within 1-3 business days after approval

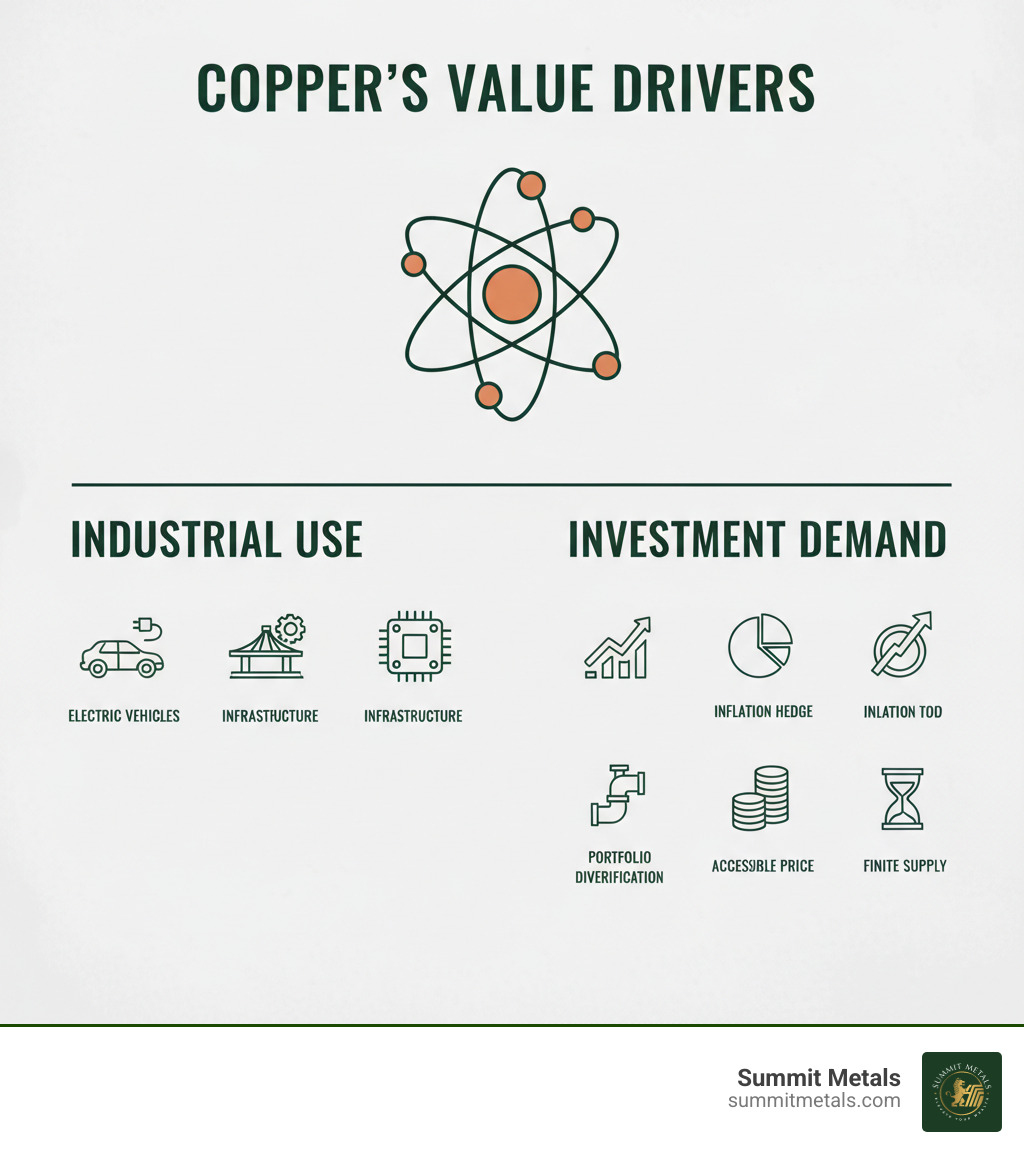

Copper's industrial demand has skyrocketed thanks to electric vehicles and infrastructure projects. Unlike gold or silver, copper trades at about $4.30 per pound, making it accessible to new investors. However, this lower price point means you'll need significant weight to store meaningful value.

The metal's widespread industrial use—from electrical wiring to transportation—creates steady demand that traditional precious metals don't enjoy. But selling copper bullion comes with unique challenges. The high premiums you paid when buying (often 300%+ over spot price) mean your exit strategy matters more than with gold or silver.

I'm Eric Roach. After a decade on Wall Street, I learned that a solid exit strategy is crucial for any investment. Now, I help individual investors steer the precious metals markets, including selling copper bullion, with that same disciplined approach.

Understanding Your Copper Bullion's Value

When you're ready for selling copper bullion, understanding what you actually own is your first step to getting the best price. Think of copper bullion as physical copper that's been refined and cast into bars, rounds, or ingots with verified purity. It's not quite the same as your grandmother's gold jewelry or silver coins.

Here's where things get interesting: Is copper really a "precious metal"? Technically, no. Traditional precious metals like gold, silver, and platinum earn that title through their rarity and high value. Copper is far more common and trades at much lower prices. But copper has carved out its own niche as an industrial metal with investment appeal.

The magic happens because copper powers our modern world. Every electric vehicle needs about 180 pounds of copper. Your smartphone, your home's wiring, even the infrastructure projects happening in your city - they all depend on copper. This steady industrial demand gives copper a unique stability that many investors find attractive.

Your copper's value breaks down into two parts: the spot price and the premium. The spot price is simply what raw copper trades for on commodity markets right now. Think of it as the wholesale price for the metal itself. Premiums cover everything else - manufacturing those neat bars and rounds, shipping costs, dealer overhead, and profit margins.

Here's the tough reality about selling copper bullion: those premiums can be brutal. When you bought your copper, you might have paid 300% or more above the spot price. When selling, buyers typically offer you something closer to spot price, minus their own profit margin. Unless copper prices have soared since your purchase, you're likely selling below what you paid. For a broader understanding of how this works across all metals, check out The Ultimate Beginner's Guide to Investing in Precious Metals.

Purity, Weight, and Pricing

Most investment-grade copper bullion carries a .999 fine marking, meaning it's 99.9% pure copper. This purity standard is what separates bullion from regular scrap copper and helps establish its commodity value.

But here's where copper throws you a curveball. While gold and silver get weighed and priced in troy ounces, copper follows the Avoirdupois system and gets priced per pound. This difference matters more than you might think.

| Unit | Weight in Grams | Notes |

|---|---|---|

| 1 Avoirdupois Ounce | 28.35 grams | 16 ounces make 1 Avoirdupois pound |

| 1 Troy Ounce | 31.10 grams | 12 troy ounces make 1 troy pound (rarely used) |

An Avoirdupois ounce weighs slightly less than a troy ounce, so when you see copper priced at $4.30 per pound (prices shown are at the time of this publication), that's for 16 Avoirdupois ounces.

This lower price point makes copper incredibly accessible for new investors. You can own physical metal without the sticker shock of gold or silver. The trade-off? As one investor put it, "you have to lug around a lot of it to store much value." A thousand dollars in copper weighs significantly more than a thousand dollars in gold. For more discussion on copper's place in the precious metals world, explore Why is Copper Bullion being offered as a precious metal?.

Factors That Affect Your Payout

Beyond the spot price, several factors influence what buyers will actually pay for your copper bullion. The condition of your pieces plays a bigger role than many sellers expect. While copper naturally develops a patina over time, excessive scratches, dents, or damage can hurt your payout. Think of it like selling a used car - presentation matters.

Tarnish is copper's natural response to air and moisture. Some collectors actually appreciate a nice, even patina, while others prefer that fresh-from-the-mint shine. Uneven or heavy tarnishing might slightly reduce offers, though it doesn't change the metal's intrinsic value.

Brand recognition can work in your favor. Copper from established mints or well-known refiners often commands better prices than generic, unmarked pieces. Buyers trust quality from reputable sources, and that trust translates to better offers.

Some copper bullion features collectible designs that mimic popular American coins or showcase intricate artwork. If your pieces have particularly desirable designs or come from limited series, you might attract collectors willing to pay premiums beyond just melt value.

Don't underestimate the power of proof of purchase. Original receipts, certificates of authenticity, or even the original packaging add credibility. They assure buyers about purity and provenance, especially important when dealing with private collectors or smaller dealers.

Many sellers make costly mistakes during the selling process that could have been easily avoided. Learn from others' experiences by reading Beginner Gold and Silver Selling Mistakes (And How to Avoid Them).

The Ultimate Guide to Selling Copper Bullion

Ready to turn your copper bullion into cash? You're not alone. More investors are finding that selling copper bullion can be a smart way to rebalance their portfolios or capitalize on favorable market conditions.

The process might seem daunting at first, but it's actually quite straightforward once you understand the steps. Think of it like selling any valuable item - you want to find reputable buyers, get competitive quotes, and secure the best possible transaction.

Here's what the journey typically looks like: You'll start by researching potential buyers and getting quotes for your specific pieces. Once you find an offer you're comfortable with, you'll lock in that price to protect yourself from market fluctuations. Then comes the careful packaging and shipping (or in-person exchange), followed by verification and payment.

Throughout this entire process, security should be your top priority. Just as you protected yourself when buying, you need to stay vigilant when selling. The precious metals market has its share of bad actors, so familiarize yourself with red flags. Our guide on How to Avoid Common Precious Metals Scams will help you spot trouble before it finds you.

Where to Sell Your Copper Bullion for the Best Price

Choosing where to sell can make or break your profit margins. Each selling venue has its sweet spot, and the "best" choice depends on how much you're selling, your comfort with online transactions, and how quickly you need the money.

| Selling Venue | Pros | Cons | Best For |

|---|---|---|---|

| Online Bullion Dealers | Most competitive pricing; Streamlined process with price lock-ins and insured shipping. | Requires shipping your metal; Delay between shipping and payment. | Maximizing returns on larger quantities. |

| Local Coin Shops | Immediate payment; Face-to-face transaction builds trust. Summit Metals serves clients who prefer this approach at our Salt Lake City, Utah location. | Lower offers due to higher overhead; Limited customer base. | Quick cash for smaller quantities and in-person service. |

| Pawn Shops | Fast cash with minimal hassle. | Lowest offers; Not bullion specialists, so they build in high margins. | Emergency situations when speed is the only priority. |

| E-commerce Platforms (eBay) | Potential to attract collectors and get higher premiums for unique items. | Seller fees; Shipping logistics; Risk of buyer disputes. | Rare or collectible copper pieces with unique designs. |

| Scrap Metal Yards | Straightforward process for non-bullion copper. | Pay only for scrap metal weight; No premium for bullion form or design. | Old pipes, wiring, or industrial scrap—not investment bullion. |

For broader insights on weighing online versus local options, check out our article Online vs. Local: Where to Sell Silver - many of the same principles apply.

Step-by-Step Process for selling copper bullion Online

Online sales can maximize your returns, but they require careful attention to detail. Here's how to steer the process like a pro.

Getting your quote starts with contacting several reputable online bullion dealers. Most have "Sell to Us" pages on their websites, or you can call directly. Be precise about your copper's weight, purity, and form - whether you have bars, rounds, or ingots matters to buyers.

Once you receive quotes you're happy with, it's time for the price lock-in procedure. This is your safety net against market volatility. The dealer will confirm your selling price over the phone or through their online system, and that price stays fixed even if copper spot prices fluctuate before your shipment arrives. Always get email confirmation of this locked price.

Secure packaging is where many sellers make costly mistakes. Follow the dealer's instructions to the letter. Use plenty of bubble wrap or stuffing to prevent movement during transit. If you're shipping tubes of rounds, tape them shut securely. For larger bars, place protective material between them to prevent scratching.

The golden rule? Double-box everything. Use new, unmarked boxes that don't scream "valuable contents inside." Seal all seams with plenty of tape. Print your shipping label twice - one for the inner box, one for the outer box. Include a printed copy of your sales confirmation inside the package.

Insured shipping isn't optional - it's essential. Reputable dealers often provide pre-paid, insured shipping labels for qualifying sales. If you're arranging your own shipping, make sure it's fully insured for your metals' value. This protects you if something goes wrong in transit.

The verification process happens once your package arrives. The dealer's team will inspect your copper for authenticity, purity, and accuracy against what you declared. This typically takes one to three business days. Some dealers even record the unboxing process for security purposes.

Payment comes after verification and approval. You'll usually have options: ACH transfers are free and take 24-48 hours, wire transfers are faster (often same-day) but cost $25-30, and checks are the slowest option but sometimes preferred by sellers who like paper trails.

For additional guidance on working with online bullion dealers, resources like Online Bullion Dealers can provide helpful context.

Market Dynamics: Timing Your Sale and Understanding Risks

Understanding market timing can make the difference between a profitable sale and a disappointing one when selling copper bullion. Unlike precious metals that often move on sentiment and monetary policy, copper dances to the rhythm of global industry.

Think of copper as the economy's pulse checker. Wall Street traders nicknamed it "Dr. Copper" because this red metal has an uncanny ability to predict economic health. When factories hum with activity and construction cranes dot city skylines, copper demand soars. When recessions hit and industrial activity slows, copper prices typically follow suit.

This industrial connection creates both opportunity and challenge. Copper's price volatility can be dramatic - I've seen it swing 20% or more in a matter of months based on economic news from China (the world's largest copper consumer) or supply disruptions from major mining regions.

Like gold and silver, copper has historically served as an inflation hedge. When the dollar's purchasing power erodes, tangible assets like copper tend to hold their value. However, copper's industrial nature means it responds differently than traditional precious metals to economic pressures.

The key is watching for economic indicators that drive industrial demand. Are governments announcing infrastructure spending? Is the electric vehicle market expanding faster than expected? These trends directly impact copper's future value. For broader insights on timing precious metals sales, check out When Is the Best Time to Sell Your Silver & Gold?.

The Future Outlook for Copper

The stars are aligning for copper in ways we haven't seen in decades. We're witnessing a green energy revolution that's absolutely copper-hungry, and this trend is just getting started.

Consider this: a single electric vehicle contains over 180 pounds of copper - nearly four times more than a traditional gas-powered car. With EV sales growing exponentially and governments worldwide mandating electric vehicle adoption, we're talking about millions of additional tons of copper demand over the next decade.

But it doesn't stop there. The electrification trend extends far beyond cars. Wind turbines, solar panels, charging stations, and the massive electrical grid upgrades needed to support them all require substantial copper. A single wind turbine can contain up to 5 tons of copper!

Infrastructure spending provides another powerful tailwind. The Biden Administration's Infrastructure Investment and Jobs Act alone represents hundreds of billions in spending that will require copper for everything from broadband cables to water systems. Similar programs are launching worldwide.

Here's the kicker: copper demand has outpaced copper production in recent years, creating supply deficits that many analysts expect to continue. New copper mines take years to develop, while demand is accelerating now. This supply-demand imbalance suggests strong price support for those considering selling copper bullion in the coming years.

For a deeper dive into various copper investment strategies, explore How to invest in copper: 5 ways to buy and sell it.

Risks and Rewards of selling copper bullion

While the long-term outlook for copper is promising, it's important to understand the real challenges and rewards before selling copper bullion.

Key Risks:

- Storage & Weight: At roughly $4.30 per pound, storing meaningful value requires significant space. A $1,000 investment equals about 230 pounds of copper.

- High Premiums: You likely paid a premium of 300% or more over the spot price when buying. When selling, you'll typically be offered a price closer to spot, meaning the market price must rise significantly for you to break even.

- Price Volatility: Copper prices are volatile and swing with economic news and supply disruptions. Gains can be substantial but can also disappear quickly.

- Lower Liquidity: Finding a buyer willing to pay a premium for copper bullion takes more effort than for gold or silver.

Potential Rewards:

- Price Appreciation: The green energy transition and infrastructure growth are driving massive demand, suggesting strong potential for price increases.

- Portfolio Diversification: Copper's price moves differently than gold or silver, offering exposure to industrial growth.

- Accessibility: Its low price point makes it an accessible entry into owning physical, tangible assets for new investors.

Think of copper bullion as a long-term play on global electrification. If you believe in that future, copper offers a way to participate, but be prepared for the storage challenges and the critical importance of your exit strategy.

Frequently Asked Questions about Selling Copper Bullion

What are the tax implications of selling copper bullion?

When selling copper bullion, any profit is subject to capital gains tax. Understanding the rules, which have important nuances for physical assets, can help you keep more of your gains.

If you've held your copper bullion for less than a year, any profit gets taxed as short-term capital gains at your ordinary income tax rate. Hold it for more than a year, and you qualify for long-term capital gains treatment, which typically means lower tax rates.

Here's where it gets interesting: physical bullion sometimes gets classified as a collectible, especially if it has unique designs or limited edition features that command a premium. Collectibles face a maximum long-term capital gains tax rate of 28%, which is higher than the standard long-term rates for stocks or bonds.

The reporting requirements add another layer of complexity. When you sell significant amounts to a dealer, they may need to file Form 1099-B with the IRS, particularly if your sale exceeds certain dollar thresholds. This creates a paper trail that the IRS can match against your tax return.

Given these complexities, consulting with a qualified tax professional is money well spent. They can help you understand your specific situation and potentially structure your sales to minimize your tax burden.

How do I safely store my copper bullion before selling?

Proper storage preserves your copper bullion's condition, which directly impacts its resale value. While copper naturally tarnishes, smart storage can slow this process and prevent damage.

The enemy of copper is humidity and moisture. Store your bullion in a cool, dry environment away from basements, attics, or anywhere temperature and humidity fluctuate wildly. Even a small amount of moisture in the air can accelerate the oxidation process that creates that green patina.

For individual pieces, especially those with collectible designs, protective sleeves or airtight capsules are your best friend. These create a barrier against environmental exposure while preventing scratches and dings that can reduce resale value. Think of it as insurance for your investment.

Your storage options depend on how much you own. A fireproof home safe works well for smaller quantities, giving you easy access while protecting against theft and fire. For larger holdings, a bank safe deposit box offers professional security, though you're limited to banking hours for access.

If you've accumulated substantial quantities (remember, copper is heavy!), consider a third-party precious metals depository. While this might seem like overkill given copper's lower value density compared to gold, it provides audited, insured storage that some serious copper investors appreciate.

The key is maintaining your bullion in the best possible condition until you're ready to sell. A well-preserved piece will always command a better price than one that's been carelessly stored.

Can I sell old copper pennies or scrap copper as bullion?

Understanding the difference between copper bullion, scrap copper, and copper pennies is crucial for your selling strategy.

Copper bullion versus scrap copper are two different animals entirely. True copper bullion consists of specially minted bars, rounds, or ingots with .999 fine purity, designed specifically for investment or collecting. Scrap copper includes old pipes, electrical wiring, or industrial offcuts - valuable for their metal content but lacking the premium associated with bullion form.

Pre-1982 pennies present an interesting case study. These coins are 95% copper, and their melt value often exceeds their one-cent face value. However - and this is crucial - it's illegal to melt U.S. pennies and nickels for their metal content. While you can collect them for their copper value, you cannot legally convert them into sellable copper. They trade as "junk copper" coins by volume rather than weight, creating a unique niche market.

When it comes to selling to scrap yards, they're interested purely in raw copper weight and current market prices. They won't pay premiums for bullion form, collectible designs, or mint marks. The purity differences also matter - industrial scrap copper might be C110 grade (99.90% copper) while investment bullion is typically C101 or .9999% pure copper, affecting the price you'll receive.

If you have actual scrap copper from home projects, scrap yards are your best bet. But if you're selling copper bullion, you'll want to target bullion dealers, coin shops, or collectors who understand and pay for the premium associated with investment-grade copper products.

Understanding these distinctions helps you choose the right buyer and set appropriate expectations for your sale.

Conclusion: Turning Your Copper into Capital

Selling copper bullion represents more than just a transaction—it's about making strategic decisions that align with your financial goals and market understanding. Throughout this guide, we've walked through the unique landscape of copper as an investment metal, from its industrial significance to the practical realities of turning your physical holdings into cash.

The path to a successful copper bullion sale starts with knowing your asset inside and out. Copper trades by the pound using the Avoirdupois system, not troy ounces like gold and silver. Understanding your copper's .999 fine purity, its exact weight, and any collectible features puts you in a strong negotiating position.

Research is your best friend when choosing where to sell. Online bullion dealers often provide the most competitive pricing due to their lower overhead costs, while local coin shops offer the convenience of immediate payment and face-to-face transactions. Each venue serves different needs, and the right choice depends on your timeline, comfort level, and the quantity you're selling.

Securing your transaction cannot be overlooked. Whether you're shipping to an online dealer or meeting locally, following proper packaging protocols and ensuring adequate insurance protects your investment right through to the final handoff. The extra care you take here directly impacts your final payout.

While Summit Metals specializes in authenticated gold and silver precious metals for investment, we believe that understanding the complete metals market—including copper—creates more informed investors. Our commitment to transparent, real-time pricing and competitive rates through bulk purchasing reflects the same principles that should guide any metals transaction.

Building wealth through precious metals is a long-term strategy. To invest consistently, consider a service like Autoinvest. It allows you to dollar-cost average by making regular monthly purchases of gold and silver, similar to contributing to a 401k plan. This disciplined approach smooths out market volatility and helps your precious metals portfolio grow steadily over time.

Whether you're selling copper to rebalance your portfolio or transition into other precious metals, the principles remain the same: knowledge, research, and security lead to better outcomes.

Ready to sell your precious metals? Learn about our transparent buy-back process.