Why Silver Remains a Smart Investment Choice in Today's Market

Finding silver for sale online has never been easier, but choosing the right product and a trustworthy dealer is crucial. Silver offers unique advantages as an investment. Unlike paper assets, physical silver is a tangible hedge against inflation and economic uncertainty. With industrial demand booming in sectors like solar panels and electric vehicles, silver combines investment appeal with real-world utility. It's also significantly more affordable than gold, making it accessible for investors building their first precious metals portfolio.

The online marketplace allows you to compare prices, access live spot pricing 24/7, and have authentic products delivered securely. However, this convenience comes with risks like counterfeit products and fraudulent websites. This guide will walk you through buying silver online safely, helping you distinguish between coins, bars, and rounds, understand pricing, and identify reputable dealers.

I'm Eric Roach. During my decade on Wall Street, I saw how institutional investors use precious metals to hedge risk. Today, I help individual investors access the same strategies, showing them how to find quality silver for sale online and build resilient portfolios.

Understanding the Types of Silver Bullion

When looking for silver for sale online, you'll encounter three main forms of physical silver bullion: coins, bars, and rounds. Each serves a different purpose depending on your investment goals. Understanding these options is the first step to building a smart portfolio.

Silver Coins: Government-Backed and Collectible

Silver coins are produced by government mints and offer a unique advantage: government backing and legal tender status. This means their weight, content, and purity are guaranteed by the country of origin.

The U.S. Mint produces the famous American Silver Eagle Bullion Coins, while the Royal Canadian Mint makes the Canadian Silver Maple Leaf, the first coin to achieve .9999 fine silver purity. Other popular sovereign coins include Australia's Kangaroo, Mexico's Libertad, and China's Panda.

The trade-off for this government guarantee and artistic design is a higher premium over the spot price of silver. However, their legal tender face value provides a nominal floor price, and their recognizability ensures high liquidity.

Silver Bars: The Investor's Choice for Bulk Weight

If your goal is to acquire the most silver for your money, bars are the ideal choice. Produced by private refineries like PAMP Suisse, bars are focused on efficient, low-cost silver storage. They carry the lowest premiums over spot price.

Silver bars come in sizes from 1 oz to large kilo bars, allowing you to scale your investment. Larger bars typically have a lower cost per ounce. Their uniform shape makes them easy to stack and store securely. Whether you choose minted bars with precise designs or cast bars with a rustic finish, they are the most cost-effective way to accumulate silver weight. For more, see The 7 Best Places to Buy Silver Bars Compared and Stacking Silver: Here's Where to Buy 15 Kilos of Silver Bars.

Silver Rounds: The Private Mint Alternative

Silver rounds offer a middle ground, combining a coin-like shape with bar-like pricing. Produced by private mints, they have no legal tender status, which keeps their cost lower than official coins. Rounds feature a vast array of creative designs, from historical replicas to original artwork, and are often available in fractional sizes. This makes them a flexible and affordable option for investors who appreciate artistry but want to avoid the higher premiums of government coins. Learn more in our guide Get Your Rounds In: Where to Purchase Silver Rounds.

[TABLE] comparing Silver Coins vs. Bars vs. Rounds

| Feature | Silver Coins | Silver Bars | Silver Rounds |

|---|---|---|---|

| Issuer | Government mints (U.S. Mint, Royal Canadian Mint) | Private refineries (PAMP Suisse, etc.) | Private mints |

| Legal Tender | Yes - official face value | No | No |

| Premium Cost | Highest - government backing adds value | Lowest - pure efficiency | Moderate - design without government premium |

| Liquidity | Excellent - globally recognized | Very good - widely accepted | Good - recognized by dealers |

| Best For | Collectors seeking government backing and investors wanting maximum liquidity | Investors focused on accumulating maximum silver weight | Budget-conscious investors who want attractive designs without coin premiums |

Additional comparison: Silver Coins vs. Silver Bars

| Aspect | Silver Coins (Sovereign) | Silver Bars (Private/Brand) |

|---|---|---|

| Legal tender and face value | Yes; small face value adds government guarantee and easy recognition | No legal tender status |

| Anti-counterfeiting features | Often advanced (e.g., micro-engraving, radial lines on Maple Leafs) that deter fraud | Security varies; many bars use serial numbers and assay cards (e.g., PAMP) |

| Premiums over spot | Higher due to minting complexity and government backing | Lowest cost per ounce for stacking |

| Liquidity and resale spreads | Typically the tightest spreads for top sovereign coins due to global recognition | Strong liquidity; spreads can be slightly wider than top sovereigns |

| Storage efficiency | Slightly less efficient per ounce due to thickness and packaging | Highly efficient to stack and store in bulk |

| Best fit | Buyers who value recognizability, security features, and legal tender status | Buyers prioritizing maximum ounces for each dollar spent |

Key Factors to Consider When You Find Silver for Sale Online

When browsing for silver for sale online, understanding a few key factors can save you from costly mistakes. Let's break down what separates a smart purchase from a poor one.

Purity, Weight, and Design

These three elements are the foundation of any silver purchase.

Purity: Investment-grade silver should be at least .999 fine (99.9% pure). Some products, like the Canadian Silver Maple Leaf, are .9999 fine. This purity is stamped on the bullion and guarantees the precious metal content you're paying for. Our Beginner's Guide to Silver Properties explains why this is critical.

Weight: Silver is measured in troy ounces, which are about 10% heavier than a standard ounce (31.1 grams vs. 28.35 grams). Always confirm you are comparing weights in the same unit, as bars and coins are sold in Troy ounces.

Design: Design impacts value and liquidity. Government coins like the American Eagle have intricate, recognizable designs that add numismatic value. Private mint rounds offer creative freedom, while bars are typically simpler, though some premium brands like PAMP Suisse feature artistic designs.

Understanding Silver Pricing: Spot Price vs. Premium

Many new buyers are confused by silver pricing. The price you see on the news is not the price you'll pay for a coin or bar.

The spot price is the live market price for one Troy ounce of pure silver. It fluctuates constantly based on global supply, demand, and economic events.

The premium is the amount added to the spot price to cover the costs of fabrication, distribution, and the dealer's profit. Premiums vary by product type. Government coins have higher premiums due to their official status, while bars have the lowest premiums. Rounds fall in between.

Factors like industrial demand for solar and EVs, economic uncertainty, and currency fluctuations all influence silver's price. Understanding this helps you recognize fair pricing. Learn more in our guides on Spot Price vs. Premium and Why Gold and Silver Prices Fluctuate.

Investor vs. Collector: What's Your Goal?

Before buying silver for sale online, clarify your goal. Are you building wealth or pursuing a hobby?

Investors focus on accumulating the most silver weight for the lowest cost. They prefer large silver bars, generic rounds, and 90% "junk silver" coins. The goal is to hedge against inflation and preserve wealth. Smart investors use dollar-cost averaging through programs like Summit Metals' Autoinvest feature, making consistent monthly purchases to smooth out price volatility and build a position over time.

Collectors pursue rarity and beauty. They pay higher premiums for proof coins, graded coins (authenticated by services like PCGS or NGC), and limited mintage items. Their value comes from both silver content and numismatic appeal. If this interests you, see our guide on Collecting Silver Eagles: Tips, Tricks, and Treasures.

Knowing your primary motivation will guide you to the right products and prevent you from overpaying for features you don't value.

Where and How to Safely Buy Silver Online

The digital marketplace makes it easy to find silver for sale online, but separate legitimate dealers from scammers. Choosing a dealer is like choosing a financial advisorthe right one protects your investment.

What to Look for in a Reputable Dealer of silver for sale online

Trustworthy dealers share several key traits:

Transparent Pricing: A reputable dealer like Summit Metals displays real-time pricing that clearly separates the spot price from the premium. There should be no hidden fees or surprises at checkout.

Reputation and Reviews: Check independent review sites like the Better Business Bureau. Look for consistent praise regarding product authenticity, shipping speed, and customer service.

Shipping and Insurance: Your silver should be shipped in discreet packaging and be fully insured during transit. A signature upon delivery is standard practice for secure orders.

Authenticity Guarantees: The best dealers are often Authorized Purchasers for government mints, ensuring they source genuine products directly. They should guarantee the authenticity of everything they sell.

Secure Payments: Look for encrypted websites (with HTTPS in the URL) and trusted payment options like credit cards or bank wires to established company accounts. Good dealers also provide educational resources to help you make informed decisions. For more tips, read our guide on Identifying Reputable Bullion Dealers.

Smart Investing with Dollar-Cost Averaging (Autoinvest)

Trying to time the market is a common mistake that paralyzes new investors. Dollar-cost averaging removes the guesswork. At Summit Metals, we call this our "Autoinvest" feature, and it works like a 401(k) for precious metals.

You invest a fixed amount of money on a regular schedule (e.g., monthly). When prices are high, you buy fewer ounces. When prices are low, you buy more. Over time, this strategy averages out your cost per ounce and builds a substantial holding without the stress of market timing. With Autoinvest, you can set Summit Metals to buy every month automatically, just like contributing to a 401(k). It's a disciplined, automated way to mitigate market volatility and systematically build wealth. Learn about The Power of Dollar-Cost Averaging in Gold and Silver Investments.

Common Scams to Avoid with silver for sale online

Knowing the tactics of scammers is your best defense.

Counterfeit Products: Modern fakes can be convincing. Always buy from established dealers who stake their reputation on authenticity.

Fake Websites: Scammers create professional-looking sites that mimic legitimate dealers. Verify the dealer's physical address and contact information. Summit Metals, for instance, operates from real locations in Wyoming and Utah.

High-Pressure Sales: Legitimate dealers inform; scammers pressure. Be wary of anyone creating artificial urgency.

Unrealistic Pricing: Silver has a global market price. If a deal seems too good to be true, it is. Avoid sellers offering bullion significantly below the spot price.

Unsecured Payments: Never send wire transfers to individuals, pay with gift cards, or use untraceable methods. Stick to credit cards or bank wires to corporate accounts. Our guide on How to Avoid Common Precious Metals Scams offers more detail.

The Advantages and Logistics of Owning Physical Silver

Once you've found silver for sale online and made a purchase, the next step is understanding its role in your portfolio and how to protect it. Physical silver is like a financial insurance policy you can hold in your hand, maintaining its intrinsic value regardless of what happens in the economy.

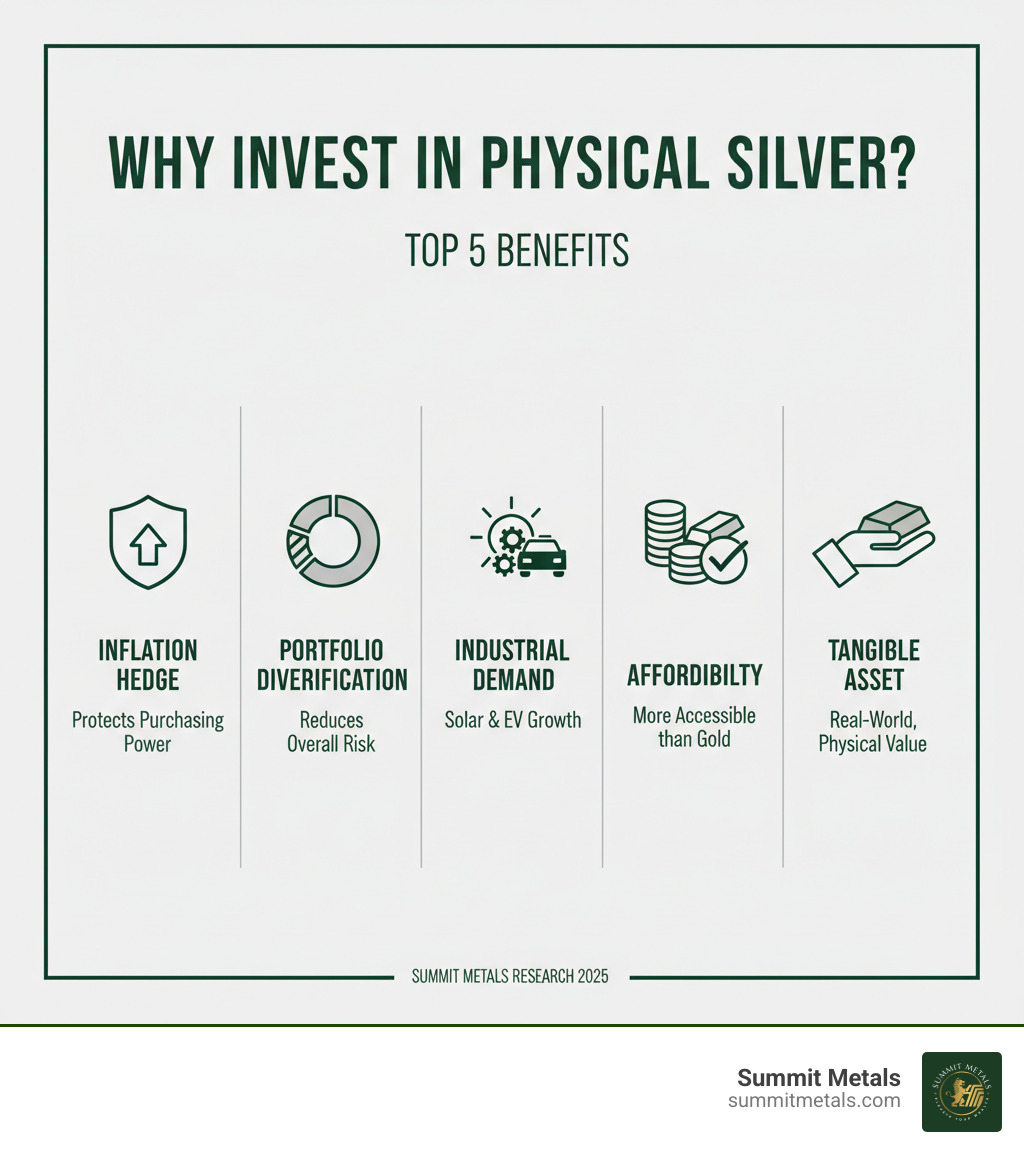

Why Invest in Silver? Hedging, Diversification, and Growth

Silver's dual nature as both a precious metal and an industrial commodity creates multiple sources of demand. Key benefits include:

- Inflation Protection: Silver has historically maintained its purchasing power when currencies lose value.

- Portfolio Diversification: Silver often moves independently of stocks and bonds, reducing overall portfolio risk.

- Industrial Demand: The green energy revolution is creating unprecedented demand for silver in solar panels, electric vehicles (EVs), and electronics.

- Affordability: Silver's lower price point makes it more accessible than gold for investors starting out.

- Store of Value: As a tangible asset, silver is a store of value independent of any government or financial institution.

For more, explore Is Silver a Good Investment? and Why Gold and Silver: Understanding Their Value as Safe Haven Assets.

Secure Storage Solutions for Your Silver Bullion

Where do you keep your precious metals? The answer depends on your collection size and comfort level.

Home Storage: A quality, fireproof safe that is bolted down and hidden can work for smaller collections. However, be aware that most homeowner's insurance policies have very low coverage limits for precious metals.

Bank Safety Deposit Boxes: These offer high security in a climate-controlled environment. The main drawbacks are limited access during banking hours and the fact that contents are typically not insured by the bank.

Third-Party Depositories: For serious investors, specialized precious metals depositories are the gold standard. These facilities offer professional, 24/7 security, climate control, and comprehensive insurance coverage for your holdings. Your silver is kept safe, tracked, and fully insured against theft, damage, or loss.

Insurance is a critical consideration for any storage method. Ensure you have adequate coverage for the full value of your investment. For detailed guidance, see Top Storage for Silver and Your Guide to Storing All Types of Silver.

Storage options compared

| Option | Access | Insurance | Cost | Privacy | Best For |

|---|---|---|---|---|---|

| Home safe | Immediate, 24/7 | Limited via homeowner's policy caps unless you add a rider | One-time safe purchase; optional insurance rider | Highest privacy | Small to mid-size stacks and quick access |

| Bank safety deposit box | Bank hours only | Typically not insured by the bank | Annual fee | High privacy | Moderate holdings where bank access is acceptable |

| Professional depository | By appointment or via shipping | Comprehensive, purpose-built coverage | Ongoing storage fee based on value or weight | High privacy with audit trails | Larger holdings needing maximum security, auditability, and full insurance |

Frequently Asked Questions about Buying Silver Online

As you prepare to find silver for sale online, you likely have a few questions. Here are answers to the most common concerns from new investors.

What's the best type of silver for a beginner to buy?

For most beginners, 1 oz silver rounds are an excellent starting point. They offer authentic .999 fine silver at low premiums, allowing you to start stacking without a large initial investment. If you prefer the security of government backing, American Silver Eagles or Canadian Silver Maple Leafs are globally recognized and guaranteed for weight and purity, though they carry a higher premium. Another great option is a silver bullion starter pack, which provides a variety of products so you can find what you like. Our guide on Understanding Silver Bullion Starter Packs can help you choose.

How can I be sure the silver I buy online is real?

This is a valid concern. The single most important step is to buy only from reputable dealers with long track records and authenticity guarantees. At Summit Metals, we guarantee every product we sell. Once you receive your silver, you can perform basic checks. Authentic bullion will have clear mint marks and purity stamps. You can also try the ping test (real silver has a distinct ring) or a magnet test (silver is not magnetic). For larger collections, a precious metals verifier offers definitive, non-invasive testing.

Are there taxes on buying or selling silver?

Tax implications for silver can be complex. Sales tax on purchases varies by state, with many states exempting precious metals. When you sell for a profit, you may owe capital gains tax. The IRS often treats physical precious metals as "collectibles," which can be taxed at a different rate than stocks. Additionally, dealers may have reporting requirements for certain large transactions. Because tax laws change and personal situations vary, we strongly recommend consulting with a qualified tax professional to ensure you are compliant and making tax-efficient decisions.

Your Guide to a Secure Silver Purchase

You now have the knowledge to confidently find and purchase silver for sale online. You understand the key differences between products: government-backed coins for security, silver bars for maximum weight per dollar, and silver rounds for a blend of affordability and design.

The most critical step is to vet your dealer. Look for transparent pricing, a strong reputation, and clear policies. At Summit Metals, we believe in earning your trust through real-time pricing and competitive rates made possible by our bulk purchasing power.

Defining your goals upfrontwhether you're an investor stacking weight or a collector seeking raritywill guide your purchases. Once you own silver, secure storage and proper insurance are essential to protect your assets.

For those looking to invest systematically, our Autoinvest feature allows you to use dollar-cost averaging, building your holdings over time without trying to time the market. Set it once and buy every month automatically, just like contributing to a 401(k).

Based in Wyoming, Summit Metals is proud to serve investors with authenticated precious metals at transparent, competitive prices. Every successful silver stacker started with their first ouncenow you have the knowledge to make that purchase count.

Ready to take the next step? Start your investment journey by learning how to buy gold and silver online safely.