What Is a Silver Starter Kit and Who Is It For?

If you're looking to begin your journey into physical precious metals, silver bullion starter packs offer an ideal entry point. But what exactly are these packs, and who are they designed for?

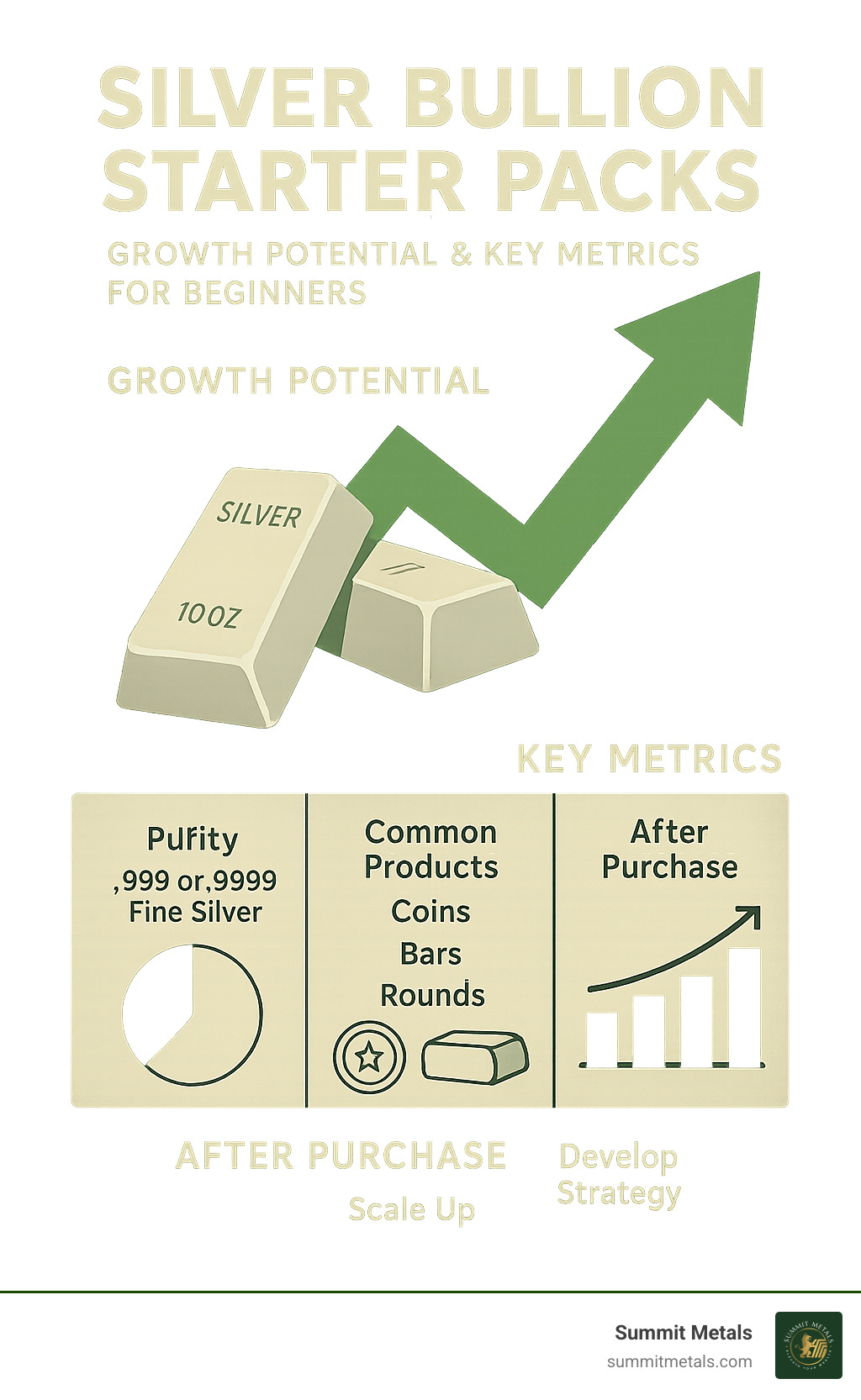

- Definition: Silver bullion starter packs are curated collections of silver products, like coins, rounds, or bars, put together by dealers. They are often offered at special prices, usually for first-time customers.

- Purpose: These kits simplify your first purchase. They help you get started with silver without having to choose every single piece or worry about high premiums. They make it easy to diversify your holdings from day one.

- Target Audience: They are perfect for new investors, those just beginning their coin collection, or anyone wanting a low-commitment way to try out a new dealer. They remove the guesswork and make it simple to "stack" silver.

Starting with physical silver can feel daunting. There are many options, and it's easy to get lost in all the choices. That's where starter packs come in. They take the guesswork out of your first purchase. These kits are put together by trusted dealers to give you a solid foundation. They help you protect your money and diversify your investments easily.

I'm Jose Gomez, and my background in Wall Street finance has shown me how physical assets protect wealth. I believe silver bullion starter packs offer a strategic and accessible starting point for everyday investors to build a resilient portfolio. Now, let's dive deeper into what these packs offer.

For reading this article I want to offer you silver at a discounted price:

Summit Silver Starter Pack, use the discount code at checkout: SnaggedSilverAtSpot

A silver starter kit is essentially a carefully curated bundle of silver bullion products designed to make your first precious metals purchase as straightforward as possible. Think of it as a "sampler platter" for silver investors - you get to try different types of silver products without having to research and select each piece individually.

These kits typically contain a mix of silver coins, bars, and rounds, giving you exposure to different forms of silver bullion. The beauty of a starter kit lies in its simplicity. Instead of spending hours researching which specific coins or bars to buy, you can trust that the dealer has assembled a well-balanced collection that represents good value and variety.

At Summit Metals, we understand that entering the precious metals market can feel overwhelming. That's why we believe in the power of The Ultimate Beginner's Guide to Investing in Precious Metals to help newcomers steer their first purchase with confidence.

The Purpose of a Starter Pack

The primary purpose of a starter pack is to eliminate the "analysis paralysis" that often stops people from making their first precious metals purchase. When you're faced with hundreds of different silver products, it's easy to get stuck in research mode without ever actually buying anything.

A starter pack serves several key purposes:

Ease of Entry: You don't need to become an expert overnight. The dealer has done the heavy lifting by selecting products that work well together and represent good value.

Diversification from Day One: Instead of putting all your money into one type of silver product, you immediately get exposure to different forms - perhaps a government-minted coin, a private mint round, and a silver bar. This diversification helps you understand what you prefer as you continue building your stack.

Educational Tool: Each piece in your starter kit teaches you something different about silver bullion. You'll learn about different mints, security features, and how various products feel in your hand. This hands-on education is invaluable for future purchases.

Building Confidence: There's something powerful about holding your first pieces of physical silver. A starter pack gives you that confidence boost that comes from actually owning precious metals, not just thinking about it.

For those ready to dive deeper into the fundamentals, The Basics of Gold and Silver Stacking provides excellent guidance on building your precious metals portfolio systematically.

Ideal Candidates for a Starter Kit

Silver bullion starter packs aren't for everyone, but they're perfect for certain types of buyers:

First-Time Precious Metals Buyers: If you've never owned physical silver before, a starter kit removes the intimidation factor. You don't need to worry about making the "wrong" choice because the dealer has already made good choices for you.

Gift Givers: Looking to introduce someone to precious metals? A starter kit makes an excellent gift because it provides variety and education in one package. Many people have started their silver journey thanks to a thoughtful gift.

Budget-Conscious Stackers: If you're working with a smaller budget, starter kits often provide better value than buying individual pieces. The bundled pricing typically offers savings compared to purchasing each item separately.

Investors Testing a New Dealer: Even experienced stackers sometimes use starter kits to test out a new dealer's products, shipping, and customer service before making larger purchases.

Those Seeking Simplicity: Some people simply prefer the convenience of a pre-selected bundle rather than spending time researching individual products.

If you're wondering about the broader investment case for silver, Does it Really Make Sense to Invest in Silver? provides a comprehensive analysis of silver's role in a diversified portfolio.

The Core Components: What's Typically Inside a Kit?

When you open your first silver bullion starter pack, you're getting more than just silver - you're getting an education. Most kits contain between 4 and 10 troy ounces of silver, carefully selected to give you a taste of what the precious metals world has to offer.

Every piece in your kit will be investment-grade silver, meaning it contains .999 (99.9%) or .9999 (99.99%) fine silver. You'll see this purity stamped right on each piece. This isn't jewelry silver or silverware - this is the real deal that serious investors buy.

Silver Bullion Coins

Government-minted silver coins are often the stars of starter kits, and for good reason. They're like the "blue chip stocks" of the silver world - widely recognized, highly liquid, and backed by their issuing countries.

The American Silver Eagle is probably the most famous silver coin you'll encounter. With Lady Liberty on one side and a majestic eagle on the other, each coin contains exactly one troy ounce of .999 fine silver. These coins are so popular that when the new Type 2 design launched in 2021, it sold out in under 12 minutes. That's faster than concert tickets!

Canadian Silver Maple Leafs take purity to the next level with .9999 fine silver. The Royal Canadian Mint produces these beauties, and they're recognized worldwide for their quality. The maple leaf design is instantly recognizable, making these coins excellent for both investment and potential trading.

Austrian Silver Philharmonics celebrate Austria's rich musical heritage with designs featuring various musical instruments. Between 2008 and 2012, over five million of these coins found their way into investors' hands - that's 1,800 tons of silver! Clearly, people love both music and precious metals.

British Britannias feature the iconic Britannia figure and include some of the most advanced security features in the coin world. We're talking holographic elements and micro-engraving that would make a counterfeiter's head spin.

Australian Kangaroos round out the "big five" with their distinctive kangaroo design and "four nines" (.9999) purity. These coins often include sophisticated anti-counterfeiting measures that are as impressive as they are effective.

All these coins share something special: they have legal tender face values, global recognition, and unique security features. This makes them perfect for both investment and potential bartering if times get tough.

Silver Bars

If coins are the celebrities of the silver world, then bars are the workhorses. They typically offer the best bang for your buck because they carry lower premiums than coins while containing the same pure silver.

1 oz silver bars are perfect for beginners. They're affordable, portable, and as one dealer wisely noted, "a 1 oz bar hurts a LOT less if you drop one on your foot" compared to larger bars. They're also great conversation starters when you want to show friends and family what real silver looks like.

5 oz silver bars hit the sweet spot between affordability and substance. They feel substantial in your hand without being too expensive for most budgets. Many new investors find these bars particularly satisfying to hold.

10 oz silver bars sometimes appear in larger starter kits. They're popular because they balance cost-effectiveness with easy storage and transport. Plus, there's something undeniably impressive about holding a 10 oz bar of pure silver.

Silver bars come in different styles too. Minted ingots have clean, precise edges and detailed designs. Cast bars have a more rustic, old-school appearance with slightly irregular edges. Hand-poured bars are artisanal pieces where each bar has its own unique character.

The variety in silver bars is amazing - different mints, different designs, different shapes. This diversity makes them popular with both collectors and serious investors. For those wanting to understand the bigger picture of physical precious metals, Physical Bullion vs. Gold & Silver ETFs: Pros and Cons offers valuable insights.

Silver Rounds and Fractional Silver

Private mints produce silver rounds, which look like coins but don't have legal tender status. Think of them as the "generic brand" of silver - same great silver content, lower price.

Privately minted rounds come from reputable mints like Golden State Mint, Sunshine Mint, Monarch, and Scottsdale. They offer incredible design variety and typically cost less than government coins while containing the same amount of pure silver. It's like getting designer looks at discount prices.

Here's where silver bullion starter packs really shine: fractional silver. These smaller pieces include 1/2 oz rounds for medium-value transactions, 1/4 oz rounds for smaller purchases, and 1/10 oz rounds for very small transactions or bartering.

Why does this matter? Imagine you're in a situation where you need to use silver for everyday purchases. You don't want to trade a full ounce of silver for a loaf of bread if that's way more than it's worth. Having smaller denominations gives you flexibility and practicality.

Comparing Silver Coins, Bars, and Rounds

| Feature | Silver Coins | Silver Bars | Silver Rounds |

|---|---|---|---|

| Premiums | Highest | Lowest | Medium |

| Liquidity | Excellent | Good | Good |

| Government Backing | Yes | No | No |

| Design Variety | Limited | High | Very High |

| Global Recognition | Excellent | Good | Fair |

This comparison shows exactly why silver bullion starter packs typically include a mix of all three types. You get the benefits of each while learning about their different characteristics. It's like getting a complete education in one convenient package.

Unpacking the Value: Pricing, Premiums, and Promotions

When you're looking at silver bullion starter packs, understanding the pricing can feel like learning a new language. But once you get the basics, it all makes perfect sense.

Every piece of silver you buy has two parts to its price: the spot price and the premium. Think of spot price as the raw material cost - it's what silver is trading for on the global market right now. This number changes constantly throughout the day, just like stock prices.

The premium is everything else on top of that spot price. It covers the cost of turning raw silver into beautiful coins and bars, the dealer's operating costs, shipping, and yes, a reasonable profit margin. Without premiums, dealers couldn't stay in business, and you wouldn't have access to physical silver at all.

Fabrication costs are a big part of premiums. It takes sophisticated equipment and skilled workers to create those stunning American Eagles or perfectly rectangular silver bars. Supply and demand also plays a role - popular products often carry higher premiums because people are willing to pay more for them.

At Summit Metals, we believe in complete transparency when it comes to pricing. Our real-time pricing system shows you exactly what you're paying and why. Thanks to our bulk purchasing power, we can offer competitive rates that deliver genuine value to our customers. For a deeper dive into how this all works, Spot Price vs. Premium: How Precious Metals Pricing Works breaks it down in detail.

Are Starter Kits a Good Deal?

Here's the honest answer: silver bullion starter packs are usually excellent value, but not always in the way you might expect.

The most obvious benefit is introductory pricing. Many dealers offer starter kits at reduced premiums to welcome new customers. This means you're getting more silver for your dollar compared to buying the same items individually. It's like a "welcome to the family" discount.

Bundled savings work in your favor too. Even without special promotional pricing, buying multiple items together typically results in lower per-ounce costs. It's the same principle as buying in bulk at the grocery store - economies of scale benefit everyone.

But here's where it gets interesting: the real value often lies in what you can't put a price tag on. The educational value of getting your hands on different types of silver products is worth its weight in... well, silver. You'll learn which products you prefer, how different mints compare, and what various security features look and feel like.

There's also the convenience factor. The time you save by not having to research dozens of individual products has real value, especially if you're busy with work, family, or other commitments. Someone has already done the heavy lifting of selecting quality products that work well together.

Now, let's be completely transparent: starter kits may not always offer the absolute lowest premiums available in the market. Dealers balance competitive pricing with the need to provide variety and educational value. But when you factor in the learning experience, convenience, and typically reduced pricing, most people find starter kits offer excellent overall value.

Market conditions also affect pricing across the board. As detailed in Key Factors Influencing Gold & Silver Prices: Supply, Demand, Geopolitics, various external factors can influence both spot prices and premiums.

Understanding Purchase Limits and Restrictions

Don't be surprised when you see restrictions on silver bullion starter packs. These limitations exist for good reasons, and understanding them helps you plan your purchase effectively.

The most common restriction is the one-per-household limit. This prevents someone from ordering five starter kits to the same address, which would defeat the purpose of promotional pricing for new customers. It's designed to spread the benefits around rather than letting one person monopolize the deal.

Many dealers also restrict starter kits to new customers only. While this can be challenging to enforce perfectly, it ensures that promotional pricing reaches people who are genuinely new to precious metals investing rather than experienced stackers looking to maximize their purchasing power.

Promotional terms can change over time, but the core value proposition typically remains consistent. This means you can't wait around for a "better" kit to come along - you get whatever is currently offered. In our experience, this actually helps people make decisions rather than getting stuck in analysis paralysis.

The manual review process might add a day or two to your order processing, but it serves an important purpose. It helps prevent abuse of promotional offers and ensures genuine new customers benefit from the special pricing. Think of it as quality control for fairness.

Some dealers also implement billing method restrictions, limiting starter kits to one per credit card or payment method. This prevents customers from using multiple cards to circumvent household limits.

These restrictions might seem limiting at first, but they actually protect the value of the program. Without them, promotional pricing would quickly disappear as bulk buyers exploited the system. The restrictions ensure that starter kits remain available and valuable for their intended audience: new precious metals investors taking their first steps into physical silver ownership.

How to Choose the Best Silver Bullion Starter Packs for You

Choosing your first silver bullion starter pack doesn't have to be overwhelming. Think of it like choosing your first car - you want something reliable, affordable, and suited to your needs. The good news is that most starter packs are designed with beginners in mind, so you really can't go too wrong.

Before diving into specific options, take a moment to consider what you're hoping to achieve. Are you looking to protect your savings from inflation? Building an emergency fund? Starting a collection? Maybe you're just curious about precious metals and want to dip your toes in the water. Your goals will help guide your choice.

Your budget matters too, but don't stress about having a huge amount to start. Most starter packs range from $150 to $500, making them accessible to most people. This is just your first purchase - you can always add more later as you learn and grow more comfortable with silver investing.

For newcomers who want to understand the broader context of safe purchasing, How to Buy Gold and Silver Online Safely provides essential guidance that every new investor should read.

Comparing Different Types of Silver Bullion Starter Packs

Coin-focused kits are perfect if you love the idea of owning "real money" backed by governments. These typically include 4-8 ounces of silver in beautiful coins like American Silver Eagles, Canadian Maple Leafs, and Austrian Philharmonics. The coins feel substantial in your hand and carry that special weight of history and government backing. They're also the easiest to sell when the time comes, since coin shops and dealers worldwide recognize them instantly.

Bar-focused kits appeal to the practical investor who wants the most silver for their dollar. These kits might include a mix of 1 oz, 5 oz, and 10 oz bars from various mints. Bars typically cost less than coins because they're simpler to produce, meaning you get more actual silver for your money. They're also easier to store efficiently as your collection grows.

Mixed-product kits offer the best educational experience. You might get a government coin, a private mint round, and a small bar all in one package. This variety helps you understand the differences between products and find your preferences. It's like a sampler platter at a restaurant - you get to try everything before deciding what you like best.

The choice between weight-based and piece-based kits comes down to your priorities. Weight-based kits guarantee you'll receive exactly 5 oz or 10 oz of silver, regardless of how many pieces that includes. Piece-based kits focus on giving you a specific number of items, which might total slightly different weights depending on the mix.

Consider how your starter kit fits into your long-term plans. If you're serious about building a precious metals portfolio, Bullion Investing 101: How to Safely Stack Your Wealth offers valuable insights into developing a systematic approach that grows with your knowledge and confidence.

Vetting the Dealer: What to Look For

Choosing the right dealer is just as important as picking the right starter kit. A good dealer becomes your partner in precious metals investing, while a poor one can turn your first experience into a nightmare.

Transparency should be your top priority. Look for dealers who show you exactly what you're paying - the spot price, the premium, any fees, and the total cost. At Summit Metals, we believe you should never have to guess what you're paying or why. Our real-time pricing means you always know you're getting a fair deal based on current market conditions.

Shipping and insurance policies matter more than you might think. Your silver needs to arrive safely and on time. Reputable dealers ship quickly (usually within 1-2 business days), use secure packaging, and provide full insurance coverage. They should also offer tracking so you can follow your package's journey.

Customer reviews tell the real story. Look for dealers with thousands of positive reviews from actual customers. Pay attention to comments about product quality, shipping speed, and how the company handles problems. A few negative reviews are normal, but notice how the dealer responds to complaints.

Security measures protect both your purchase and your personal information. Make sure the dealer uses secure payment processing, encrypts your data, and packages shipments discreetly. Your neighbors don't need to know you're receiving precious metals.

Return policies show how confident a dealer is in their products and service. Good dealers will work with you if there's a problem, offer satisfaction guarantees, and have clear policies for returns or exchanges.

The precious metals industry has its share of questionable operators, so doing your homework pays off. Identifying Reputable Bullion Dealers: Avoiding Counterfeits provides detailed guidance on protecting yourself from scams and ensuring you receive genuine products.

Your first purchase is just the beginning of your precious metals journey. Choose a dealer you can trust for the long haul, not just for one transaction.

Frequently Asked Questions about Silver Starter Packs

Starting your precious metals journey naturally brings up questions. Here are the most common ones I hear from new investors about silver bullion starter packs.

What is the typical purity of silver in silver bullion starter packs?

You'll find that virtually all silver in starter packs meets investment-grade standards. This means purity levels of .999 (99.9%) or .9999 (99.99%) fine silver. The purity is always stamped directly on each piece, so you can verify it yourself.

The .999 purity means your silver is 99.9% pure, while .9999 (often called "four nines fine") represents 99.99% purity. Both are considered excellent for investment purposes. The higher purity sometimes commands slightly higher premiums, but both will serve you well as an investor.

This isn't something you need to worry about when choosing a starter pack. Reputable dealers only include investment-grade silver in their kits. You're getting real, pure silver regardless of which specific products are included.

Can I choose the specific coins or bars in my starter kit?

Here's where starter packs differ from regular purchases - you generally cannot choose the specific items. The dealer pre-selects everything to offer a particular value or product mix. Some dealers might offer different themed kits (like all-coins versus all-bars), but the exact pieces are chosen from their available inventory.

This might seem limiting at first, but it's actually the whole point. The beauty of a starter pack is that it removes the decision-making burden from your shoulders. You don't need to spend hours researching which specific year American Silver Eagle to buy or which mint produces the best bars.

The dealer uses their expertise to select products that work well together and provide good educational value. Think of it like a wine tasting flight - you're getting a curated experience designed to teach you about different options.

After I buy a starter pack, what's the next step?

Once you've received and examined your starter pack, you'll have a much better sense of what appeals to you. This hands-on experience is invaluable for making future decisions.

Developing a buying strategy becomes your next priority. Based on what you learned from your starter pack, decide how much you want to invest regularly and which types of products interest you most. Maybe you finded you love the feel of silver bars, or perhaps the security features on government coins impressed you.

Scaling up your purchases is the natural next step. You might focus on larger quantities of your favorite products from the starter pack, or branch out into different sizes and types based on your growing knowledge.

Secure storage planning becomes crucial as your holdings grow. A small starter pack might fit in a home safe, but as you continue stacking, you'll need a more comprehensive storage strategy. Top Storage for Silver: Best Practices for Safekeeping Your Investment provides detailed guidance on protecting your growing investment.

Continued education will serve you well throughout your precious metals journey. Keep learning about market dynamics, different products, and investment strategies. The more you understand, the better decisions you'll make as you build your portfolio.

Conclusion: Launch Your Silver Stack with Confidence

Every seasoned stacker began with a single purchase. Silver bullion starter packs turn “someday” into “today” by eliminating information overload and giving you tangible experience for a modest outlay.

With Summit Metals you see live pricing, pay competitive premiums thanks to our bulk buying power, and receive fully insured delivery straight to your door. Once your starter kit is in hand, you’ll know exactly which products you enjoy and how you want to expand.

The journey of a thousand ounces begins with one well-chosen pack—take that first step now, and let your future self enjoy the financial resilience that only physical silver can provide.