Why Bullion Investing is Your Key to Financial Security

Investing in bullion—physical gold, silver, or platinum—puts a real, enduring asset in your hands. Unlike paper securities, precious metals can’t default or vanish in a data glitch.

Key benefits of investing in bullion:

- Inflation protection – metals help preserve purchasing power as currencies erode

- Portfolio diversification – bullion often moves differently than stocks or bonds

- Crisis insurance – gold and silver tend to shine during recessions or geopolitical stress

- No counterparty risk – you own the asset outright

- Global liquidity – universally recognised and easily exchanged

Since the 2008 crisis, investors and central banks alike have increased their bullion holdings. In 2022, while major stock indexes fell double digits, gold held steady, silver rose 6%, and platinum gained 12%.

The three basic forms:

- Bullion coins – government-minted, legal-tender pieces

- Bullion bars – low-premium ingots from refineries

- Bullion rounds – privately minted pieces without a face value

Finding authentic metal at a fair price is critical. As one dealer notes, "We regularly turn away sealed bars from online marketplaces that test out as plated brass." With more than a decade on Wall Street advising Fortune-500 clients, I now help everyday investors use the same disciplined approach when buying physical metals.

What is Bullion and Why Does It Matter?

Bullion is simply precious metal refined to at least 99.9% purity—nothing but gold, silver, platinum, or palladium. Because its value comes almost entirely from metal content, it’s a direct store of wealth, not a fashion piece or industrial component.

History underlines the point: an ounce of gold bought a quality suit in Shakespeare’s England and still does today, even though the pound and dollar have lost enormous purchasing power.

Strict global standards maintain confidence. Exchanges such as the London Bullion Market Association (LBMA) and COMEX trade hundreds of billions of dollars in metal each day, setting transparent prices.

More info about the history of precious metals

The Different Forms of Physical Bullion

Bullion coins are government-minted and instantly recognisable, but carry higher premiums. Bars provide the most ounces for your dollar. Rounds sit in between—private-mint products without legal-tender status.

| Feature | Bullion Coins | Bullion Bars | Bullion Rounds |

|---|---|---|---|

| Premium over Spot | Higher | Lowest | Moderate |

| Liquidity | Highest | High | Moderate |

| Divisibility | Excellent | Limited | Good |

| Best For | Beginners | Large buys | Cost-conscious |

Understanding Bullion's Value: Spot Price and Premiums

The spot price is the live market quote for unallocated metal. Dealers add a premium to cover minting, shipping, and a modest profit. Smaller coins cost more per ounce; large bars cost less. Premiums also rise when demand spikes—yet another reason to buy steadily instead of waiting for a panic.

More info on how pricing works

The Core Reasons for Investing in Bullion

Owning bullion is like carrying insurance for your portfolio. When paper assets falter, metals historically cushion the blow.

- Diversification – gold often rises when stocks fall

- Safe-haven appeal – wars, banking crises, or policy mistakes typically boost demand

- Tangible ownership – bars and coins can’t default or be hacked

- Zero counterparty risk – value comes from the metal itself, not a promise to pay

A look at gold as a safe-haven asset Why gold and silver are safe havens

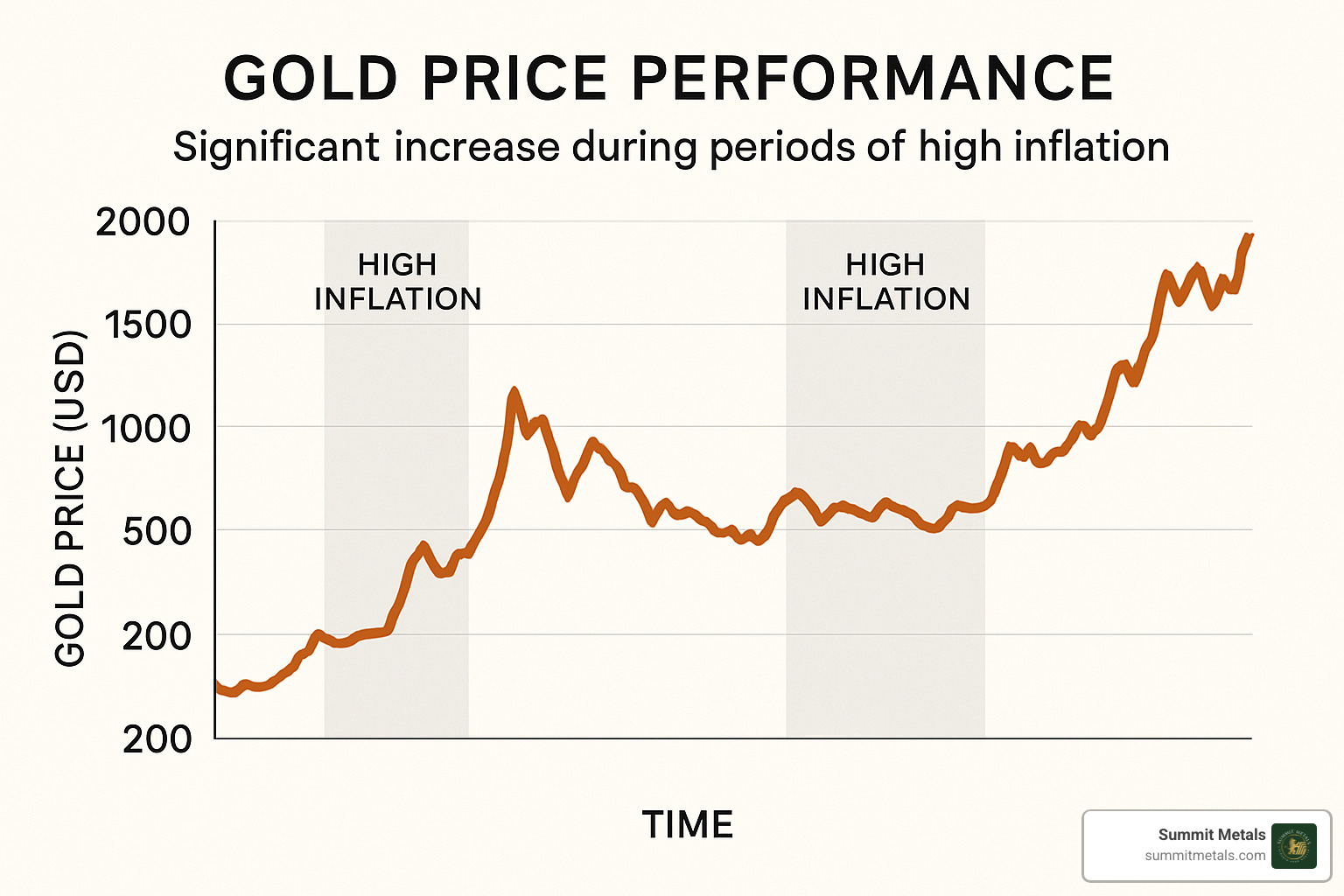

Bullion as a Hedge Against Inflation and Market Volatility

Because governments can print currency but cannot print gold, the metal tends to rise as purchasing power falls. Central banks understand this—they hold roughly one-fifth of all the gold ever mined.

During market sell-offs, capital often rotates into bullion, driving prices higher. The relationship isn’t perfect day to day, but over full cycles metals have preserved value better than most paper instruments.

Key Risks to Consider When Investing in Bullion

- Price swings – especially with silver and platinum

- Storage & insurance – vault fees typically run 0.5-2% per year

- No yield – metals pay no interest or dividends

- Liquidity differences – gold sells fastest; platinum the slowest

- Transaction costs – dealer spreads and shipping can reach a few percent

Knowing these limitations helps set realistic expectations rather than chasing quick gains.

How much of your portfolio should be in precious metals?

How to Start Investing: Physical Bullion Ownership

Buying physical metal is straightforward: choose a reputable dealer, pick your products, and decide where you’ll store them. You control what you buy, when you buy, and where it sits—no fund manager, no counterparty.

The Ultimate Beginner's Guide to Investing in Precious Metals

Holding Physical Bullion: The Traditional Approach

Direct ownership is the oldest form of wealth preservation and gives:

- Complete control over purchases and sales

- Freedom from third-party failures

- Immediate access in an emergency

The trade-off is that you must arrange secure storage and insurance.

A guide to buying physical bullion

The Practical Guide to Investing in Bullion

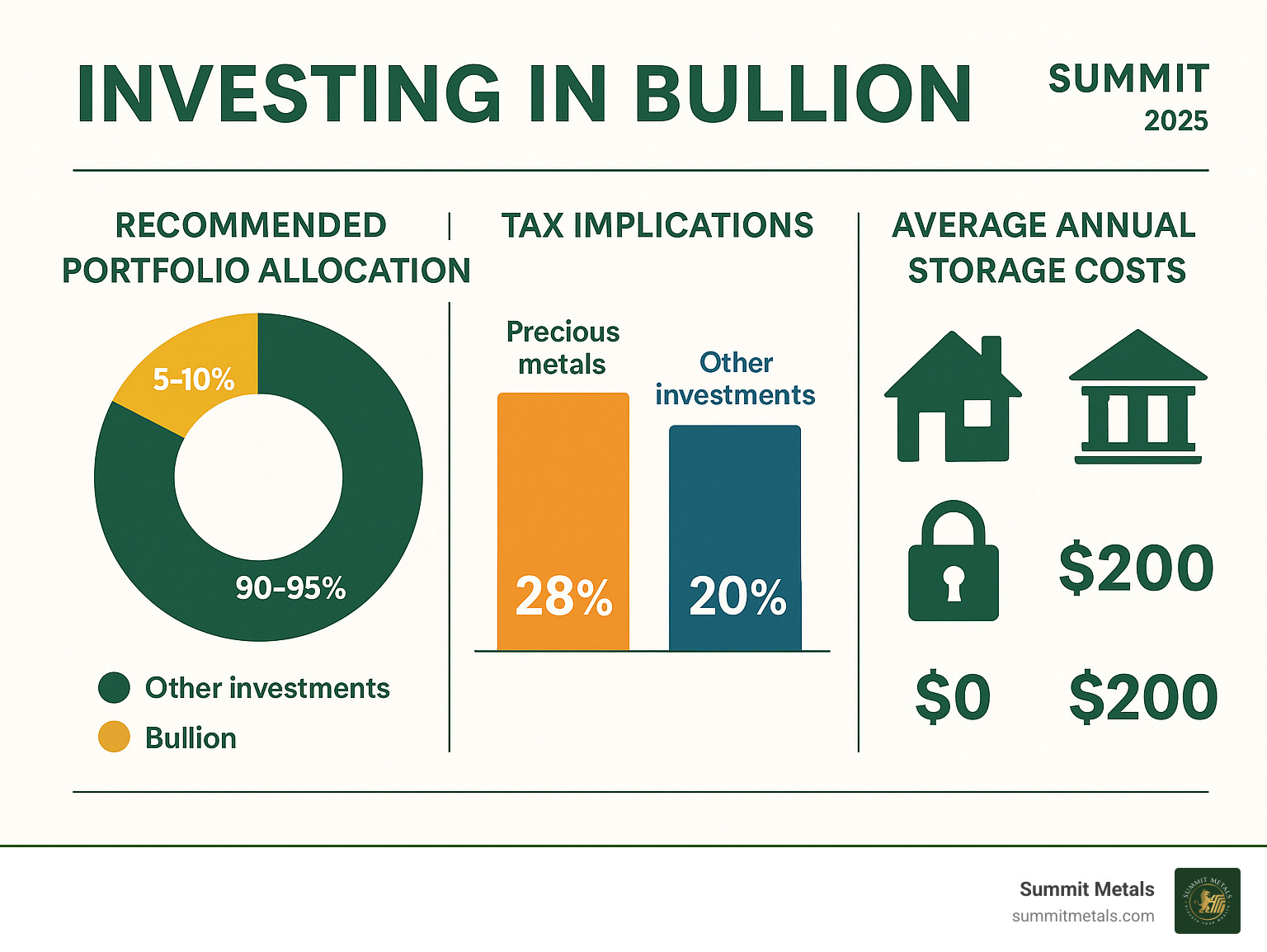

Think of bullion as the foundation—not the skyscraper—of your portfolio. A simple plan works best:

- Allocate 5-15% of investable assets to precious metals.

- Use dollar-cost averaging—buy the same dollar amount at regular intervals.

- Hold for the long term; ignore daily price noise.

Strategic approaches to investing

Choosing a Metal: Gold, Silver, or Platinum for Your First Purchase

- Gold – most liquid, lowest volatility; ideal starting point

- Silver – cheaper per ounce; more price movement

- Platinum – rare and industrially important; less liquid, higher volatility

Many newcomers start with gold, add silver for growth potential, and consider platinum once comfortable.

Is Gold a Good Investment?

Is Silver a Good Investment?

Finding a Reputable Dealer

Look for:

- Transparent, real-time pricing

- Clearly stated premiums and buy-back policies

- Direct sourcing from recognised mints and refineries

- Positive customer reviews

Summit Metals meets all of these criteria through bulk purchasing and rigorous authentication.

Identifying Reputable Bullion Dealers

Information on the London Bullion Market Association

Secure Storage: Protecting Your Investment

Options:

- Home safe – immediate access; be sure to insure

- Bank safe-deposit box – inexpensive but limited hours

- Professional depository – highest security, full insurance, modest annual fee

Many investors keep a small amount at home and the rest in a vault.

The Ultimate Guide to Gold and Other Precious Metals Storage

Frequently Asked Questions about Bullion Investing

How much should I invest in bullion?

Most portfolios benefit from a 5-10% allocation, adjusted up or down for your age, risk tolerance, and outlook.

Are bullion profits taxed?

Yes. In the U.S., physical metals are classified as collectibles. Long-term gains (held over one year) can be taxed up to 28%; short-term gains are ordinary income. Sales tax may also apply when you buy. Consult a tax professional for the rules in your state.

How do I sell my bullion?

Contact trusted dealers for a live quote, ship insured, and receive payment after verification. Government-minted coins and bars from recognised refiners fetch the tightest spreads and are easiest to liquidate.

When Is the Best Time to Sell Your Silver & Gold?

Conclusion: Start Stacking Your Wealth with Confidence

Precious metals have preserved purchasing power for millennia and can play the same role in your portfolio today. You don't need perfect timing—just a plan, consistency, and proper storage.

Summit Metals offers authenticated gold and silver at transparent, real-time prices from its Wyoming headquarters, serving investors nationwide and worldwide.

Begin with a single coin or bar, add steadily, and let bullion provide the stability that paper assets sometimes lack.