Why Silver Matters

Silver is a truly remarkable precious metal, valued throughout history for its unique properties and diverse uses. It's more than just a shiny object; it plays a vital role in our modern world and in smart investment strategies.

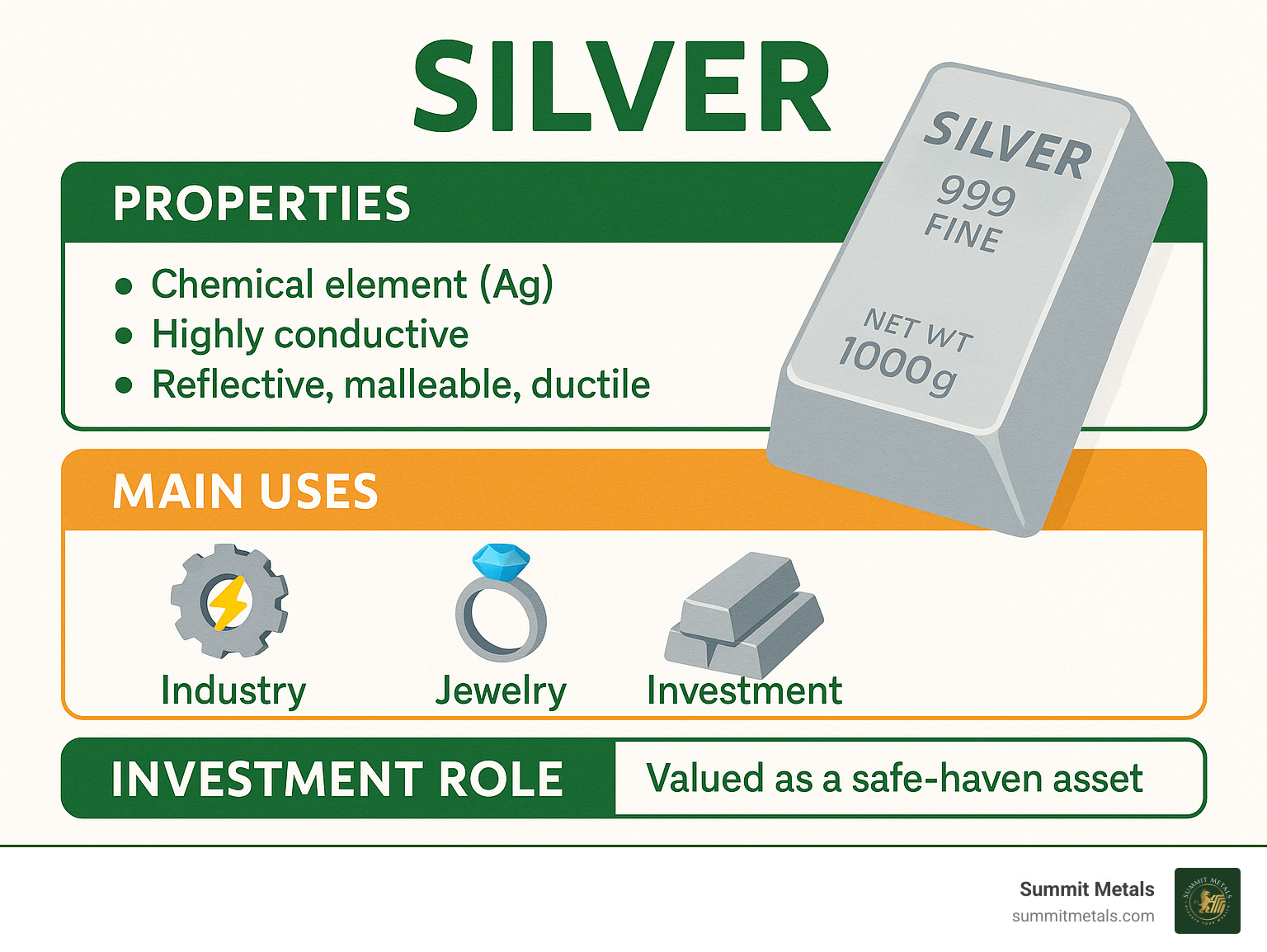

Here's a quick look at what silver is and why it’s important:

- What it is: A chemical element (Ag, atomic number 47) and a precious metal. It has the highest electrical and thermal conductivity of all metals.

- Key Properties: Highly reflective, malleable (can be hammered into thin sheets), and ductile (can be drawn into wire).

- Main Uses: Used extensively in jewelry, electronics, solar panels, and medical applications due to its unique physical and chemical traits.

- Investment Role: Valued as a safe-haven asset, it protects wealth during uncertain times. Many call it "the poor man's gold" because it's more accessible than gold but offers similar benefits.

Silver holds a unique dual identity. It is a timeless store of value, deeply woven into human history as currency and adornment. Yet, it's also a critical industrial component, essential for cutting-edge technology. Understanding both aspects is key to seeing its full potential, especially for your investment portfolio.

As an expert in the field, I’ve helped many individuals understand how physical silver can protect and grow their wealth. My background in Wall Street finance and hands-on precious metals insight allows me to translate complex market dynamics into clear, actionable guidance for investors seeking stability through alternative assets.

What is Silver? Unpacking its Fundamental Properties

Here at Summit Metals, we believe that understanding an asset at the atomic level helps you invest with confidence. Silver (Ag) impresss the eye, but its true value lies in a toolbox of scientific super-powers.

Physical Characteristics: More Than Just a Pretty Shine

- Brilliant metallic luster that resists dulling.

- Extreme malleability and ductility. A single ounce can be pressed into sheets thinner than a human hair or stretched into miles of wire.

- The highest electrical and thermal conductivity of any metal – even better than copper – making it indispensable in high-performance circuits and heat sinks.

- Outstanding reflectivity, a key reason mirrors and solar panels rely on it.

- Relatively soft (Mohs 2.5), so it is often alloyed with copper to create tougher sterling silver.

Fun fact: during WWII, the U.S. borrowed 13,540 tons of silver from the Treasury to build electromagnets for uranium enrichment when copper supplies ran low. That strategic flexibility still sets silver apart today. Learn more about silver's strategic edge.

Chemical Profile and Isotopes of Silver

- Symbol: Ag (from the Latin argentum, meaning “shining white metal”).

- Atomic number 47, atomic weight 107.8682.

- A noble metal: it resists most chemical reactions; the dark tarnish you see is merely silver sulfide forming from airborne sulfur.

- Common oxidation state: +1 (with rare +2 or +3).

- Two stable isotopes: 107Ag (≈51.8 %) and 109Ag (≈48.2 %). Scientists have catalogued another 28 radio-isotopes in laboratories.

This chemical stability, combined with best conductivity, explains why engineers and investors alike prize the metal. Curious how those traits translate into returns? See: Is silver a good investment for your portfolio?

The Dual Role of Silver: Industrial Powerhouse and Investment Asset

Silver’s magic is its split personality: it drives modern technology yet doubles as time-tested money.

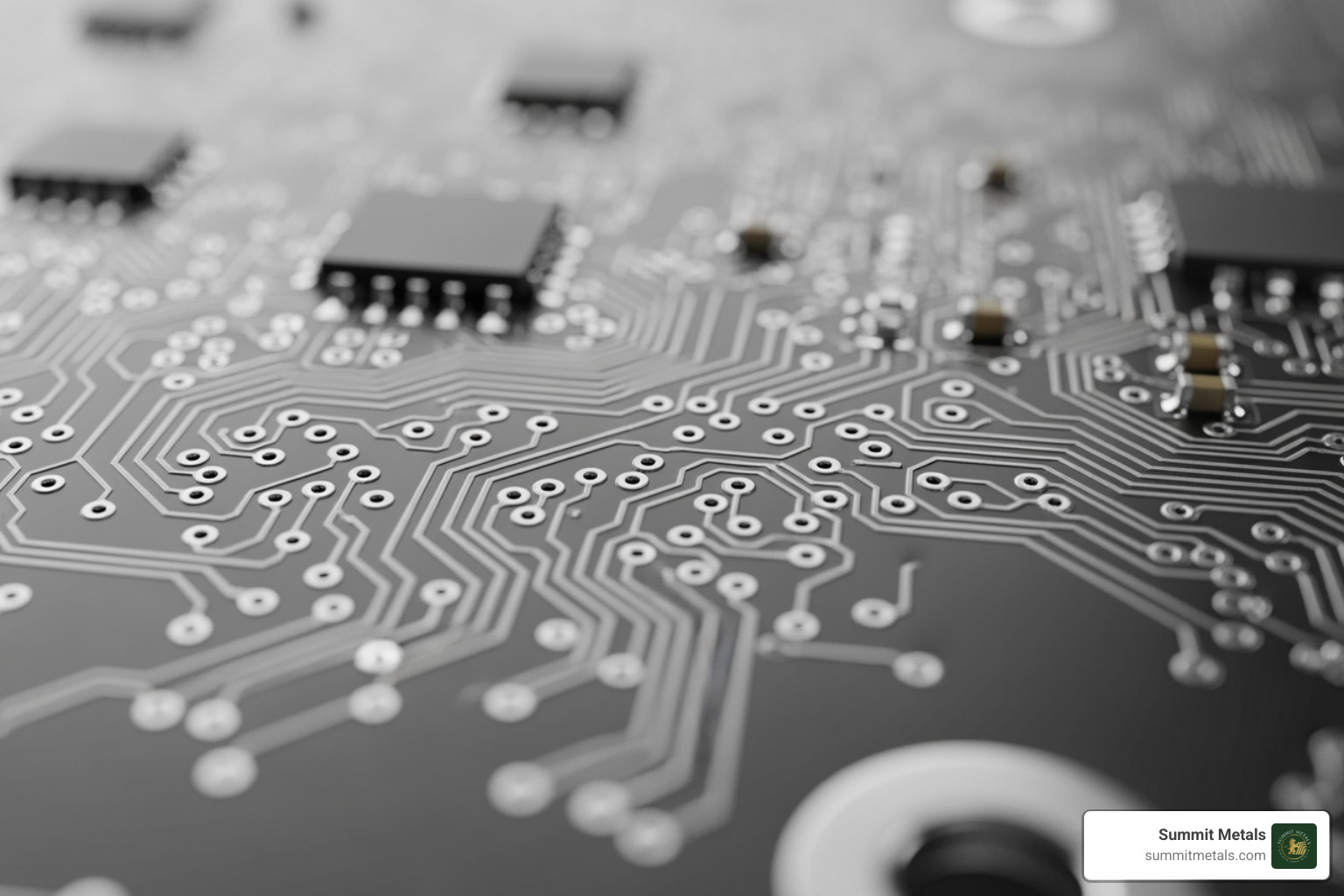

Industrial and Technological Applications

Today roughly 56 % of annual supply is consumed by industry:

- Micro-electronics: contacts, solder, and printed circuit paths.

- Solar cells: each photovoltaic panel contains 15–20 g of silver paste.

- Medicine & water treatment: natural antimicrobial properties fight bacteria.

- Classic uses: jewelry, tableware, high-strength brazing alloys, catalytic converters, RFID antennas.

As the world electrifies and decarbonises, these high-tech applications keep demand rising.

Silver as a Monetary Metal and Investment Vehicle

Long before silicon chips, silver coins greased the wheels of global commerce. That legacy still matters:

- Tangible store of value and hedge against inflation.

- Historically outperforms many assets during geopolitical stress.

- Lower unit price than gold, making portfolio diversification approachable for all budgets.

Find more on why gold and silver are considered safe-haven assets and the importance of holding physical silver.

Understanding the Silver Market: Price, Production, and Influences

The silver price never sits still. It reflects real-time tug-of-war between supply, industrial users, and investors.

How the Price of Silver is Determined

The quoted “spot price” is the cost for one troy ounce (31.103 g) of pure silver for immediate delivery. It is set by continuous trading on COMEX and is cross-checked each day by the London Bullion Market Association (LBMA).

Prices can swing dramatically. For example, silver touched USD 49.51/t oz in April 2011 and dipped below USD 4/t oz in the mid-1990s. As of July 11 2025 it traded at USD 38.37/t oz. For context on these moves see why gold and silver prices fluctuate and our primer on the gold-silver ratio.

Key Factors Influencing Silver's Price

- Industrial demand – rises with global manufacturing and green-tech expansion.

- Investor demand – spikes when markets fear inflation or recession.

- Geopolitical tensions – wars and trade disputes push buyers toward safe assets.

- US-dollar strength – because silver is priced in USD, a rising dollar can cap gains.

- Inflation & interest rates – loose monetary policy often lifts precious metals.

- Mining output – new findies, regulatory changes, or mine disruptions tighten supply.

For a deeper dive, read Key factors influencing precious metals prices.

Global Production and Supply

Unlike gold, most silver is a by-product of mining copper, lead, zinc, or gold, so production can’t ramp up overnight in response to price.

Top producers (2022):

- Mexico – 6,300 t

- China – 3,600 t

- Peru – 3,100 t

Recycling already supplies nearly 20 % of annual needs and is ready to grow as more electronics reach end-of-life. Explore the numbers at scientific data on silver production.

How to Invest in Physical Silver

Owning physical metal provides certainty that no paper claim can match. Summit Metals offers authenticated products shipped worldwide or stored in insured vaults.

Forms of Investment-Grade Silver

- Bullion bars – .999+ fine silver in sizes from 1 oz to 1,000 oz. Lowest premiums per ounce and easy to stack.

- Bullion coins – government-minted pieces like the American Silver Eagle or Canadian Maple Leaf. Highly liquid, with built-in anti-counterfeit features.

- Silver rounds – privately-minted, no face value, usually the lowest-cost choice after bars.

- Junk silver – pre-1965 U.S. dimes, quarters and halves containing 90 % silver; convenient fractional pieces.

Compare costs with our guide to valuing silver coins and bars or browse silver bullion starter packs.

Key Considerations for Buying and Storing Physical Silver

- Purity – look for .999 or .9999 fine.

- Premium over spot – bars < rounds < coins, in most markets.

- Liquidity – well-known hallmarks sell fastest.

- Authenticity – buy from vetted dealers; every Summit Metals product is backed by our guarantee.

- Secure storage – a quality home safe suits small amounts; larger holdings are best kept in a fully insured, climate-controlled depository or within a Precious Metals IRA. UK investors can avoid the 20 % VAT by holding wholesale 1,000 oz bars in an LBMA-approved vault.

See best practices for safeguarding your investment and our tips on buying gold and silver online safely.

Frequently Asked Questions about Silver

Below are the questions we hear most often at Summit Metals, along with concise answers.

What's the difference between a silver coin and a silver round?

A coin is struck by a government mint and bears a legal-tender face value (e.g., the $1 on an American Silver Eagle). A round is produced by a private mint, carries no face value, and is valued purely for its metal content. Because they skip the extra security features of sovereign mints, rounds usually have a lower premium.

Is silver a good investment?

Silver can serve as both an inflation hedge and a portfolio diversifier. Its lower entry price versus gold lets investors accumulate more ounces, though its heavy industrial use makes the price more volatile. For a detailed discussion, read Does it really make sense to invest in silver?.

Why is silver metal sometimes called "junk silver"?

“Junk silver” refers to circulated U.S. coins minted before 1965 that contain 90 % silver. They have little collector value but are prized for their recognizable fractional silver content, making them handy for small trades. Learn more in our guide to silver coins and their value.

Conclusion

Silver’s appeal is lasting and multifaceted. Its best conductivity powers the devices of tomorrow, while its 5,000-year history as money anchors portfolios today. By understanding the forces that shape price, production, and demand—and by choosing the right form of physical metal—you can add a durable, tangible asset to your long-term strategy.

Summit Metals, headquartered in Wyoming and serving clients worldwide, delivers authenticated gold and silver with transparent, real-time pricing. Ready to keep learning? Explore our full Silver Blog for market updates, how-to guides, and investment insights.