Understanding Constitutional Silver

Constitutional silver refers to U.S. coins that contain real silver—most struck before 1965—whose worth today comes almost entirely from their precious-metal content rather than collectible rarity.

-

What is Constitutional Silver?

- Pre-1965 dimes, quarters and half-dollars made of 90 % silver.

- 40 % silver Kennedy half-dollars (1965-1970) and 35 % silver “War Nickels” (1942-1945).

- The term nods to the Constitution’s grant of power “to coin money.”

-

Why is it called “Junk” Silver?

- “Junk” simply means the coins are common and worn, so premiums stay low.

- Value tracks the melt value of the silver, offering an affordable entry into physical metals.

Because they are government-issued, widely recognized and inexpensive to buy over spot, these coins remain a popular starting point for anyone stacking tangible wealth.

What is Constitutional Silver and Why Does It Matter?

The story of constitutional silver begins with the U.S. Constitution itself. Article I, Section 8, Clause 5 grants Congress the power "to coin money, regulate the value thereof." This constitutional authority led to the creation of silver-based currency that served as the backbone of American commerce for over 170 years.

From the Coinage Act of 1792 through 1964, the U.S. Mint produced coins containing substantial silver content. These weren't just currency - they were tangible stores of value that people could trust. Each coin represented a specific weight of precious metal, making them inherently valuable beyond their face value.

For today's investors, constitutional silver matters because it represents one of the most liquid and recognizable forms of precious metals. Unlike modern silver rounds or bars, these coins carry the backing of the U.S. government and are instantly recognizable worldwide. They offer a unique combination of historical significance, intrinsic value, and practical investment benefits that make them perfect for the basics of gold and silver stacking.

Defining "Constitutional" vs. "Junk" Silver

Here's where things get interesting - and a bit confusing. The terms "constitutional silver" and "junk silver" actually refer to the same coins, but they tell different stories about what these pieces of metal represent.

The "constitutional" name comes from that constitutional clause giving Congress the power to create our nation's money. These coins are part of America's lawful money system - real money backed by precious metal rather than government promises.

The "junk" label sounds harsh, but it's actually good news for investors. It simply means these coins are valued for their silver content rather than their rarity or condition. Most constitutional silver coins show wear from decades of use in everyday commerce. This wear keeps premiums low while maintaining the intrinsic silver value.

As experts point out in A Constitutional Dollar, these coins represent "lawful money" as defined by the Constitution. They're different from modern fiat currency because they contain actual precious metal. The focus on silver content rather than collectible value makes them accessible to investors who want physical precious metals without paying high numismatic premiums.

Types of U.S. Constitutional Silver by Purity

Constitutional silver comes in three main purity levels, and understanding these differences helps you make smart investment choices.

The 90% silver coins represent the largest and most popular category. These include the iconic Morgan and Peace dollars, which contain nearly three-quarters of an ounce of silver each. The Mercury dimes, Roosevelt dimes, Washington quarters, Walking Liberty half dollars, Franklin half dollars, and 1964 Kennedy half dollars all contain 90% silver with 10% copper for durability.

The 40% silver Kennedy half dollars were minted from 1965-1970 and represent a transitional period. While they contain less silver than their 90% predecessors, they still offer value for investors, especially when silver prices are high.

The 35% silver "War Nickels" from 1942-1945 are the odd ones out. These were made during World War II when nickel was needed for the war effort. They're easily identified by their large mint mark over Monticello on the reverse.

Here's a quick reference for silver content:

| Coin Type | Years of Issue | Silver Purity | Fine Silver Content (Troy Ounces) |

|---|---|---|---|

| War Nickel | 1942-1945 | 35% | 0.0563 |

| Kennedy Half Dollar | 1965-1970, 1976 | 40% | 0.1479 |

| Roosevelt Dime | 1946-1964 | 90% | 0.0723 |

| Washington Quarter | 1932-1964 | 90% | 0.1808 |

| Franklin Half Dollar | 1948-1963 | 90% | 0.3617 |

| Kennedy Half Dollar | 1964 | 90% | 0.3617 |

| Walking Liberty Half Dollar | 1916-1947 | 90% | 0.3617 |

| Morgan Dollar | 1878-1921 | 90% | 0.7735 |

| Peace Dollar | 1921-1935 | 90% | 0.7735 |

The History Behind America's Silver Coinage

The journey of American silver coinage tells the story of our nation's monetary evolution - and it's more dramatic than you might expect.

The Coinage Act of 1792 established the dollar as 371.25 grains of silver, creating a bimetallic standard where both gold and silver served as money. This system worked beautifully for over a century, providing stable, intrinsic value to American currency. People trusted their money because it contained actual precious metal.

But economic pressures began mounting in the 1960s. Rising silver prices made the metal content of coins worth more than their face value. Imagine finding quarters in your pocket that were worth 30 cents each just for their silver content! People began hoarding silver coins, removing them from circulation. Vending machines sat empty because nobody wanted to feed them valuable silver coins.

The situation became unsustainable when silver prices reached levels that made it profitable to melt down coins for their metal content. Something had to give.

The Coinage Act of 1965 marked the end of an era. Congress eliminated silver from dimes and quarters entirely, replacing them with copper-nickel clad coins. Half-dollars were reduced from 90% to 40% silver content before silver was eliminated from them too by 1971.

This change represented a fundamental shift from commodity money to fiat currency - money backed by government decree rather than precious metal content. You can see how silver prices have evolved over time in our historical price of silver graph to understand the economic forces that drove these changes.

Today, those "old" silver coins that disappeared from circulation have become constitutional silver - a way for investors to own a piece of American monetary history while holding real, tangible wealth.

How to Value Constitutional Silver

Understanding the value of constitutional silver doesn't require a degree in economics. These coins have real, measurable worth based on their silver content and current market prices. Unlike collectible coins that depend on rarity or condition, constitutional silver's value comes from something much more straightforward - the precious metal inside.

The beauty of constitutional silver lies in its predictable value. When silver prices rise, your coins become more valuable. When prices dip, you still own the same amount of silver. This direct relationship between metal content and value makes constitutional silver an excellent choice for investors who want transparency in their precious metals holdings.

To determine what your coins are worth, you'll need to consider their face value, silver content, the current spot price of silver, and any premiums dealers charge. Don't worry - it's simpler than it sounds.

A Step-by-Step Guide to Calculating Melt Value

Let's walk through valuing your constitutional silver step by step. I'll use real numbers to make this practical.

Start with your face value. Gather all your silver coins and add up their face values. Let's say you have 10 dimes ($1.00), 8 quarters ($2.00), and 4 half-dollars ($2.00). Your total face value is $5.00.

Apply the magic number: 0.715. This multiplier accounts for the silver content in circulated 90% silver coins. Multiply your face value by 0.715 to get troy ounces of silver. So $5.00 × 0.715 = 3.575 troy ounces of silver.

Why 0.715 instead of the original 0.723? Years of circulation wear away tiny amounts of silver. The 0.715 figure represents the average silver content you'll actually find in circulated coins.

Check the current silver spot price. Silver prices change constantly during trading hours. Let's use $30.00 per troy ounce for our example.

Calculate your melt value. Here's the simple formula: (Total Face Value × 0.715 × Current Silver Spot Price)

Using our example: 3.575 troy ounces × $30.00 = $107.25

Your $5.00 in face value constitutional silver is worth $107.25 in silver content - more than 20 times its face value! You can verify your calculation with an online tool to double-check your math.

For more detailed information about specific coins, our half dollar coin value guide: turning coins into cash provides additional insights.

Does Wear and Tear Affect Value?

Here's some good news: that worn, tarnished quarter in your collection is worth just as much as a shiny one. Normal wear from circulation has minimal impact on the silver value of constitutional silver.

The 0.715 multiplier we use already accounts for typical wear and tear. This number comes from analyzing millions of circulated coins over decades. Whether your coins are dark with tarnish or show heavy wear, they still contain virtually the same amount of silver.

Think about it this way - silver doesn't just disappear from normal handling. The tiny amounts lost through circulation are so small they're statistically insignificant. A worn 1964 quarter still contains approximately 0.1808 troy ounces of silver, just like it did when it left the mint.

However, there are exceptions. Coins that have been damaged, clipped, or holed will have reduced silver content. These damaged pieces might trade at a discount to standard melt value. When buying constitutional silver, look for obvious damage, but don't worry about normal wear, scratches, or tarnishing.

This consistency makes constitutional silver wonderfully predictable for investors. You don't need to be a coin grading expert to know what you own.

Beyond Melt Value: Is There Numismatic Potential?

While most constitutional silver trades based on silver content, some coins carry extra value for collectors. Understanding when this happens can help you spot potentially valuable pieces in your collection.

Certain factors can add numismatic premiums to constitutional silver: key dates from years when fewer coins were minted, mint marks indicating specific production facilities, exceptional condition in uncirculated coins, and minting varieties with errors or design differences.

For example, a 1916-D Mercury dime is worth far more than its silver content because so few were made. Similarly, Morgan dollars in uncirculated condition often command premiums from collectors.

But here's the reality for most investors: the vast majority of circulated constitutional silver will trade at or near melt value. This is actually good news. It means you're buying silver, not paying extra for collectible premiums that may or may not hold their value.

Focus on the silver content rather than hoping for numismatic windfalls. Constitutional silver's strength lies in its reliable, transparent value based on precious metal content. If you happen to find a valuable date or mint mark, consider it a bonus.

For investors interested in understanding different precious metals options, our guide on what's the difference between physical gold, silver, and ETFs? provides helpful context for building a diversified precious metals portfolio.

The Pros and Cons of Investing in Constitutional Silver

Like any asset, constitutional silver comes with clear strengths and a few trade-offs. Understanding both helps you decide where it fits in your portfolio.

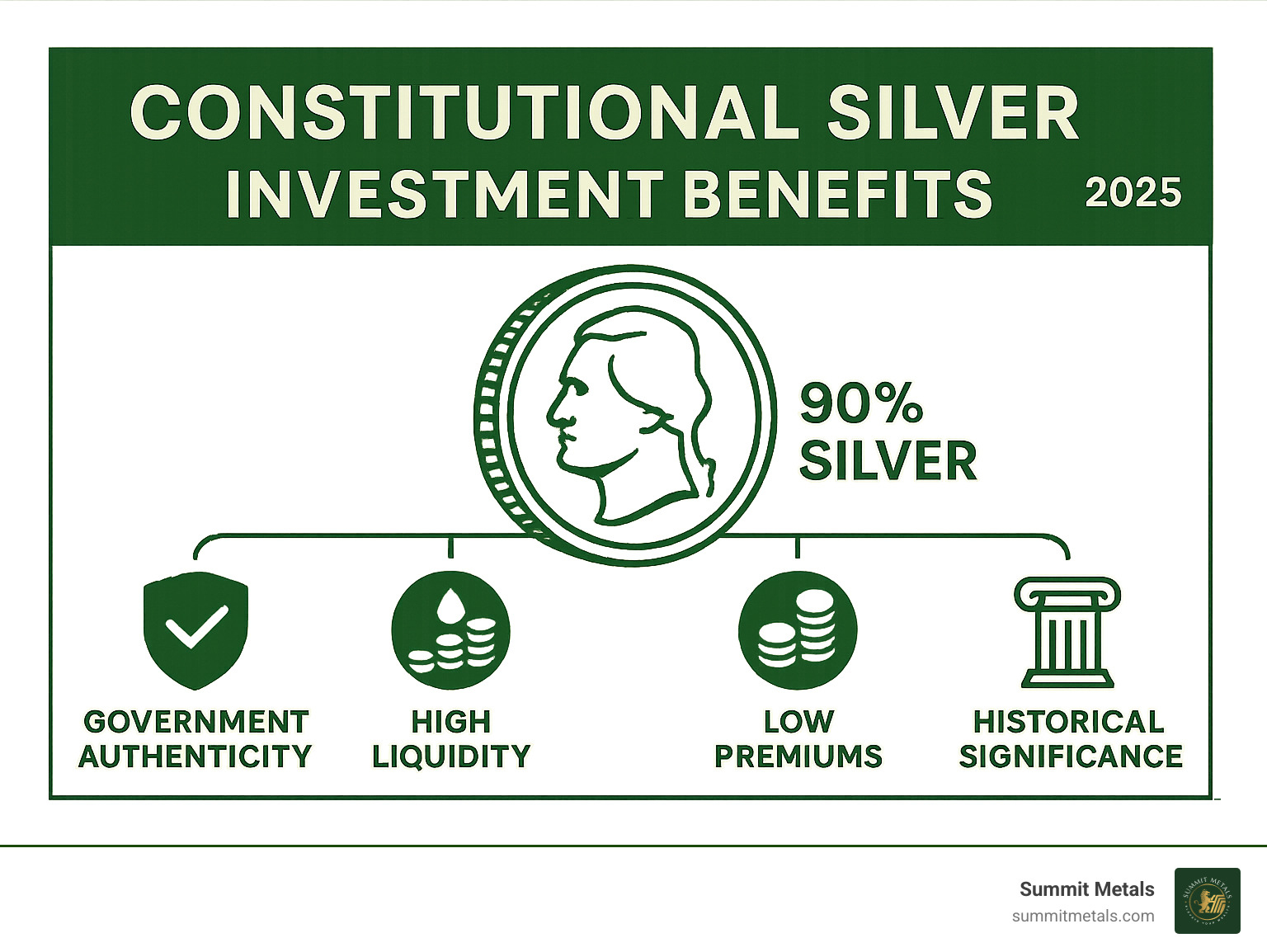

The Enduring Appeal of Constitutional Silver for Investors

- Low Premiums – Circulated coins cost only a small amount over melt, so more of your cash buys metal.

- Divisible – With values ranging from a dime (≈0.07 oz) to a dollar (≈0.77 oz), you can sell or barter in small increments.

- Government Authenticity – U.S. Mint strikes are instantly trusted worldwide, limiting counterfeit risk.

- High Liquidity & Recognizability – Any coin shop can quote you a price within seconds.

- Potential Barter Use – In a currency crisis, fractional silver coins may function as day-to-day money.

- Hedge Against a Weakening Dollar – Physical silver historically moves opposite paper-currency purchasing power. See our analysis of the declining power of the US dollar.

Key Considerations and Potential Downsides

- Bulk & Weight – $100 face (≈71.5 oz) weighs over five pounds; large stacks need space.

- 90 % Purity – Some investors prefer .999 fine bullion for IRAs or refining.

- Minor Weight Variation – Circulation wear is accounted for by the 0.715 multiplier but individual coins differ slightly.

- Manual Sorting & Bookkeeping – Mixed bags take longer to inventory than uniform bars.

- Generally Not IRA-Eligible – Most self-directed precious-metals IRAs require .999 purity.

- Storage & Security – Decide between a home safe, bank box or professional vault before you buy.

Balancing these points helps determine whether constitutional silver, modern bullion or a blend provides the right mix of liquidity, portability and long-term value for you. For a wider market view, review the gold and silver ratio and our article is silver a good investment?.

Acquiring and Storing Your Silver Coins

Buying from trustworthy sources and storing coins correctly are the two practical skills every stacker needs.

Where to Buy and Sell Constitutional Silver

- Reputable online dealers – Often the lowest premiums thanks to high volume and real-time pricing.

- Local coin shops – Immediate, face-to-face transactions; great for small buys or quick sales.

- Coin shows – Compare several sellers in one place and inspect merchandise on the spot.

Before sending any money, read our guide on identifying reputable bullion dealers: avoiding counterfeits and, if purchasing online, follow the tips in how to buy gold and silver online safely.

When it’s time to liquidate, most established dealers—including Summit Metals—offer straightforward buy-back programs that reference the live silver spot price.

Best Practices for Storing and Preserving Your Coins

- Coin tubes – Ideal for rolls of the same denomination; stack neatly in safes.

- Canvas bags – Traditional, breathable option for bulk lots.

- Coin albums – Protect and organize pieces with extra numismatic potential.

Store silver in a cool, dry place and avoid PVC plastics, which can harm the metal. Match your security method—home safe, bank box or professional vault—to the value of your holdings. See our full guide, top storage for silver: best practices for safekeeping your investment, for more detail.

Frequently Asked Questions about Constitutional Silver

Can constitutional silver still be used as legal tender?

Yes, constitutional silver remains legal tender in the United States, but spending it would be like using a $20 bill to buy a candy bar. These coins retain their face value status, meaning you could technically walk into a store and spend a silver quarter for 25 cents.

However, that same 1964 silver quarter contains silver worth approximately $5.40 at current prices. You'd essentially be giving away over $5 in value for every quarter you spend. This is why constitutional silver has evolved from everyday pocket change into a precious metals investment.

The legal tender status does provide some unique benefits beyond nostalgia. In uncertain economic times, this government backing adds credibility that makes these coins excellent for bartering. People instinctively trust currency issued by the U.S. Mint, even decades after it left circulation.

Is 90% silver the same as sterling silver?

No, and the difference matters for investors. Constitutional silver contains 90% silver and 10% copper, while sterling silver contains 92.5% silver and 7.5% other metals, usually copper.

The composition difference reflects their intended uses. Sterling silver's higher purity makes it ideal for jewelry and decorative items where appearance matters most. Constitutional silver's 90% composition was specifically chosen for durability in everyday circulation.

That 10% copper content made coins harder and more resistant to wear as they passed from hand to hand, pocket to pocket, for decades. The U.S. Mint prioritized longevity over maximum purity, which is why these coins survived daily use so well. Today, this durability continues to benefit investors who want silver that can withstand handling and storage.

How can I tell if a coin is 90% silver just by looking at it?

Several reliable methods can help you identify constitutional silver without special equipment. The date check is your first and easiest tool - U.S. dimes, quarters, and half-dollars dated 1964 and earlier contain 90% silver. For nickels, look for dates between 1942-1945 with large mint marks over Monticello, which indicates 35% silver content.

The edge inspection provides another clear identifier. Silver coins show a solid silver stripe around the edge, while modern clad coins reveal a copper stripe sandwiched between silver-colored layers. This visual difference is usually obvious once you know what to look for.

Many experienced collectors rely on the sound test - silver coins produce a distinctive, clear ring when dropped on a hard surface, while clad coins make a duller thud. While not foolproof, this "ping test" can be surprisingly accurate with practice.

You might also notice differences in color and luster between silver and clad coins, though tarnishing can affect appearance over time. The combination of these methods gives you confidence in identifying authentic constitutional silver whether you're buying from a dealer or checking coins you've inherited.

Conclusion

Constitutional silver tells a remarkable story - one that bridges America's monetary past with today's investment opportunities. These coins aren't just pieces of metal; they're tangible connections to a time when our currency carried real, intrinsic value.

What makes constitutional silver so compelling for modern investors? It's the unique combination of government authenticity, historical significance, and practical investment benefits all wrapped into coins you can hold in your hand. Unlike paper investments that can disappear with a market crash, these silver coins represent wealth you can touch and store.

The beauty of constitutional silver lies in its simplicity. Once you understand the basic valuation formula - multiplying face value by 0.715 and the current silver spot price - you have the tools to make informed decisions. Whether you're examining a worn Mercury dime or a tarnished Walking Liberty half dollar, you know exactly what you're looking at in terms of silver content and value.

Constitutional silver has its quirks. It takes up more space than modern silver bars, and sorting through different denominations can be time-consuming. But these minor inconveniences pale compared to the advantages: low premiums, instant recognizability, and exceptional liquidity that makes buying and selling straightforward.

The key to success with constitutional silver is working with dealers who understand both the market and your investment goals. Proper storage protects your investment, while staying informed about silver prices helps you make smart timing decisions for both buying and selling.

For investors ready to add highly liquid, recognizable silver to their portfolio, working with a trusted dealer like Summit Metals ensures access to authenticated precious metals at transparent, real-time prices. Our commitment to competitive rates through bulk purchasing and clear pricing helps investors maximize their precious metals investments.

Constitutional silver represents more than just an investment - it's a hedge against economic uncertainty and a store of value that has proven itself over decades. In a world of digital assets and paper promises, there's something reassuring about owning real silver coins that have weathered economic storms for generations.

To explore how constitutional silver fits into a broader precious metals strategy, consider reading what is the best silver & gold to buy and why liquidity matters for additional insights into building a well-rounded precious metals portfolio.