Why Silver Investment Strategies Matter More Than Ever

In today's volatile economy, silver investment strategies offer multiple pathways to benefit from this versatile precious metal. With silver prices surging and industrial demand at record levels, understanding your options is critical.

Key Silver Investment Strategies:

- Physical Silver Bullion: Direct ownership of coins and bars.

- Silver ETFs: Liquid exposure without storage concerns.

- Silver Mining Stocks: Leveraged exposure to silver prices.

- Dollar-Cost Averaging: Systematic purchases to reduce timing risk.

- Portfolio Allocation: A 5-10% precious metals allocation is recommended.

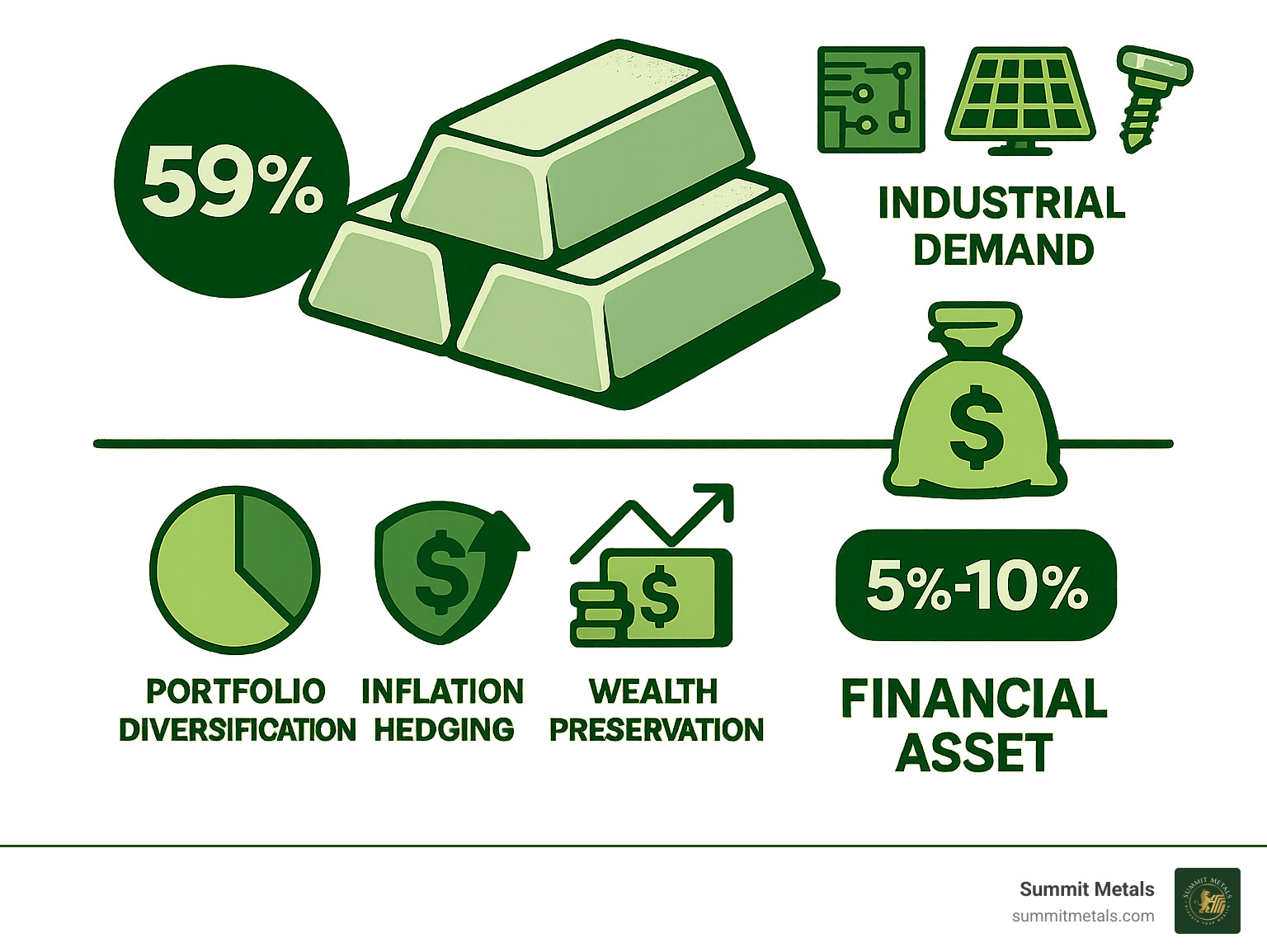

Silver's unique position as both an industrial metal (59% of usage) and a store of value creates compelling opportunities. It benefits from economic uncertainty (as a safe haven) and economic growth (through industrial consumption), making it attractive when traditional assets face headwinds. The global silver market also faces a seventh consecutive year of supply deficit in 2025, further strengthening its investment case.

Why Silver is a Strategic Asset in Today's Economy

Silver is a financial powerhouse, acting as both an industrial workhorse and a trusted store of value. This dual role makes silver investment strategies particularly compelling. We're facing a perfect storm of rising demand and shrinking supply, with industrial demand hitting record levels and 2025 marking the seventh consecutive year of a supply deficit.

Industrial use accounts for 59% of all silver consumption. It's essential in smartphones, medical equipment, and especially green energy. Solar panel demand alone has grown at 12.6% annually since 2015 and now represents 17% of total silver demand. This trend is set to continue as the world pushes for cleaner energy.

Unlike purely industrial metals, silver also serves as a reliable store of value during uncertain times. It benefits from economic growth through industrial demand and from economic uncertainty as a safe-haven asset. With a cumulative supply shortfall of nearly 800 million ounces from 2021-2025, the fundamental case for silver is strong.

To understand how these forces affect pricing, see our guide on Why Gold and Silver Prices Fluctuate.

Key Factors Influencing Silver's Price

Silver's price is influenced by several key factors:

- Supply and Demand: The foundation of silver's value. When industrial consumption outpaces mine production, as it has recently, upward price pressure builds. The electronics sector alone has increased silver demand by 51% since 2016.

- Economic and Geopolitical Events: Economic growth boosts industrial demand, while uncertainty increases safe-haven demand. Silver often thrives in both sunshine and storms.

- Investor Sentiment: Fear and optimism can amplify price moves. Fear drives investors to precious metals for safety, while optimism can cause temporary dips that present buying opportunities.

- U.S. Dollar and Interest Rates: A stronger dollar can make silver more expensive for international buyers, while higher interest rates can make non-yielding assets like silver less attractive than bonds.

- Mining Costs and Production: Production costs set a natural floor for prices. If prices fall too low, miners reduce output, tightening supply and supporting prices.

For a deeper dive into silver's upside, explore The Bullish Case for Silver.

Core Silver Investment Strategies: From Physical to Paper

Your silver investment strategies should match your personal style, risk tolerance, and goals. Whether you want to hold physical metal or prefer digital convenience, there's a suitable path. Silver works best as a long-term investment, and diversification is key. For more on systematic approaches, see our guide on Strategic Approaches to Investing in Gold and Silver.

Here's how the main investment methods stack up:

| Investment Method | Liquidity | Costs (Premiums/Fees) | Ownership Type | Key Advantage | Key Disadvantage |

|---|---|---|---|---|---|

| Physical Bullion | Moderate | Higher (premiums, storage) | Direct | Tangible asset, ultimate safe haven | Storage concerns, less liquid, no income |

| Silver ETFs | High | Lower (expense ratios) | Indirect | Ease of trading, no storage hassle | Counterparty risk, no physical possession |

| Silver Mining Stocks | High | Brokerage fees | Indirect | Leveraged exposure, potential dividends | Operational risks, high volatility |

Method 1: Physical Silver Bullion (Bars and Coins)

Investing in physical silver bullion means you own the actual metal, typically 99.9% pure. This classic approach offers a tangible connection to your wealth.

Popular forms include silver bars, which offer lower premiums per ounce in larger sizes, and government-minted silver coins like the American Silver Eagles and Canadian Silver Maple Leafs. Privately minted silver rounds are another option, often with lower premiums than official coins.

The primary advantage is direct ownership, free from counterparty risk. It's a tangible hedge against inflation and economic turmoil. However, physical ownership has trade-offs. You'll pay premiums over spot price (around 10-20%) to cover manufacturing and dealer costs. You are also responsible for storage and insurance. Physical silver generates no income, with returns coming purely from price appreciation.

Choosing a trusted dealer is crucial. For guidance, see How to Buy Gold and Silver Online Safely and Top Storage for Silver: Best Practices.

Method 2: Silver Exchange-Traded Funds (ETFs)

For silver exposure without storage hassles, ETFs are an excellent choice. These funds trade on stock exchanges, offering convenience and liquidity.

Physically-backed ETFs hold silver bullion in vaults and aim to track its price. Silver mining ETFs invest in a basket of mining companies, while futures-based ETFs use derivatives and are more complex. For most investors, physically-backed ETFs are the most straightforward option.

ETFs offer high liquidity and lower transaction costs than physical premiums. The main drawbacks are expense ratios (annual fees averaging 0.73%), counterparty risk (you own shares, not metal), and potentially less favorable tax treatment. ETFs do not provide a tangible asset outside the financial system.

For a detailed comparison, read Physical Bullion vs. Gold Silver ETFs: Pros and Cons.

Method 3: Silver Mining Stocks

Investing in silver mining stocks offers leveraged exposure to silver prices. When silver prices rise, mining company profits can increase dramatically, often leading to stock price gains that outpace the metal itself.

This leveraged exposure is the main appeal. Established miners may also pay dividends, providing income. However, the risks are significant. Operational challenges like labor disputes, regulatory changes, and political instability can impact performance. Your investment's success also depends on management quality.

Mining stocks are extremely volatile, swinging much more than silver's price. A safer alternative can be silver streaming and royalty companies, which finance miners in exchange for a percentage of future production, avoiding direct operational risks.

To understand how these investments differ from direct ownership, see What's the Difference Between Physical Gold Silver and ETFs?.

Silver vs. Gold: A Comparative Analysis

When it comes to precious metals investing, the silver versus gold debate is as old as the metals themselves. Think of them as cousins in the same family – they share DNA, but each has its own distinct personality that appeals to different types of investors.

Both metals serve as reliable stores of value and can shield your portfolio during turbulent times. But understanding their differences is crucial for crafting effective silver investment strategies.

- Volatility: Silver is significantly more volatile than gold. Its price rallies have historically been more dramatic, offering greater return potential but also requiring a higher risk tolerance.

- Market Size: The gold market is much larger and more liquid. Silver's smaller market contributes to its price volatility, as smaller trades can have a larger impact.

- Affordability: Silver's lower price per ounce makes it far more accessible for new investors or those with smaller budgets.

- Primary Use: Gold is primarily a monetary metal (85-90% for jewelry and investment). Silver leads a double life: it's a precious metal, but also a critical industrial commodity. Industrial demand accounts for 59% of silver usage, making it essential for electronics, solar panels, and medical equipment. This dual nature means silver can benefit from both economic growth (industrial demand) and economic uncertainty (safe-haven demand).

For more on this dynamic, explore Understanding the Gold Silver Ratio and The Gold-to-Silver Ratio explained by Investopedia.

Understanding the Gold-to-Silver Ratio

The gold-to-silver ratio tells you how many ounces of silver are needed to buy one ounce of gold. It's a powerful but often overlooked tool.

Historically, the ratio has averaged around 50:1, but in recent years it has often been much higher, sitting around 75:1 at the time of this publication. This is interesting because silver is mined at only a 7:1 ratio to gold, suggesting silver may be undervalued relative to its scarcity.

Investors use the ratio as a market sentiment indicator. A high ratio often signals economic fear (favoring gold), while a falling ratio can indicate strengthening industrial demand or inflation concerns (favoring silver). Some investors use a high ratio as a signal to increase their silver allocation, anticipating a reversion to the historical average, which could mean silver outperforming gold.

For a more detailed exploration, check out What is the Gold to Silver Ratio? Is it Important?.

Managing Risks and Portfolio Allocation

Let's get real about the less exciting but absolutely crucial side of silver investment strategies: understanding the risks and figuring out how much silver actually belongs in your portfolio. Think of it like seasoning your favorite dish—too little and you won't taste it, too much and it overwhelms everything else.

Understanding Silver's Risk Profile

- Price Volatility: Silver's price can swing dramatically, creating opportunities for gains but also testing an investor's nerve during downturns.

- Storage and Insurance Costs: Physical silver requires secure storage and insurance, which are ongoing costs that affect net returns.

- No Income Generation: Physical silver does not pay dividends or interest. Returns depend solely on price appreciation.

- Liquidity: While generally liquid, selling physical bullion can take more effort than selling a stock or ETF.

- Counterparty Risk: Paper assets like ETFs and mining stocks carry counterparty risk, meaning you rely on a third party (a fund or company) to perform. Physical ownership eliminates this risk.

The Sweet Spot: How Much Silver Makes Sense

Most financial advisors recommend a 5-10% precious metals allocation. This range provides meaningful diversification benefits without overexposing your portfolio to commodity swings. Silver often has a low correlation to stocks and bonds, which helps stabilize your overall portfolio during market turbulence.

Your personal allocation depends on your risk tolerance and timeline. Younger investors might lean toward 10%, while those nearing retirement may prefer 5%. For help determining your allocation, see How Much Gold Silver Should I Have? and How Much of My Net Worth Should Be in Gold Silver?.

Dollar-Cost Averaging: Your Best Friend for Volatile Markets

Dollar-cost averaging removes the guesswork of market timing. By investing a fixed amount at regular intervals, you buy more ounces when prices are low and fewer when they are high. This strategy reduces your average cost per ounce over time and smooths out the impact of volatility. It's a disciplined approach that turns price dips into buying opportunities without emotion.

For a deeper dive, explore The Power of Dollar Cost Averaging in Gold and Silver Investments.

Frequently Asked Questions about Silver Investing

We've covered a lot of ground, but you might still have some burning questions. Let's tackle the most common ones to help solidify your understanding of silver investment strategies.

What are the best silver investment strategies for beginners?

For beginners, the best approach is to keep it simple and build confidence.

- Start with physical bullion like American Eagles or Canadian Maple Leafs. Holding a tangible asset is a great way to learn.

- Use dollar-cost averaging. Invest a fixed amount regularly (e.g., monthly) to smooth out volatility and avoid trying to time the market.

- Focus on long-term goals. View silver as wealth preservation over years, not a get-rich-quick scheme.

- Educate yourself on basics like premiums, spot price, and storage options before buying. The Basics of Gold and Silver Stacking is a great resource.

How much of my portfolio should I allocate to silver?

This is probably the question we hear most often, and honestly, it's a smart one to ask. The standard recommendation from financial advisors is to allocate 5% to 10% of your total portfolio to precious metals, including silver. This range offers diversification benefits without excessive exposure to volatility.

Your ideal percentage depends on your personal risk tolerance and investment timeline. A more aggressive, younger investor might lean toward 10%, while a conservative investor nearing retirement might stick closer to 5%. For more guidance, see How Much of My Net Worth Should Be in Gold Silver?.

What are the primary risks of investing in silver?

Every investment has risks, and it's smart to understand silver's before you invest.

- Price Volatility: Silver's price can be much more volatile than gold or stocks.

- Storage & Insurance Costs: Physical silver requires secure storage, which is an ongoing expense.

- No Income Generation: Physical silver doesn't pay dividends or interest.

- Liquidity: Selling physical silver can be slower than selling stocks or ETFs.

- Counterparty Risk: Paper assets like ETFs and mining stocks depend on the solvency and integrity of a third party.

Understanding these risks allows you to build a strategy that fits your comfort level.

Conclusion: Securing Your Future with Silver

As we wrap up our journey through silver investment strategies, it's clear that silver isn't just another shiny object to admire. It's a hardworking metal with a fascinating dual personality – part industrial workhorse, part financial superhero. This unique combination makes it a compelling addition to any well-rounded investment portfolio.

Silver is one of the few assets that can benefit from both economic growth (via industrial demand for solar panels and electronics) and economic uncertainty (via safe-haven demand). We've explored the primary ways to invest, from the tangible security of physical bullion to the liquid convenience of silver ETFs and the leveraged potential of silver mining stocks.

With a structural supply deficit, record industrial demand, and the green energy revolution accelerating, the long-term fundamentals for silver appear strong. A 5-10% portfolio allocation can provide meaningful diversification, while a strategy like dollar-cost averaging helps manage its volatility.

At Summit Metals, we are committed to helping investors secure their future with precious metals. Based in Wyoming, we offer transparent, real-time pricing and competitive rates on authenticated gold and silver. We believe every investor deserves access to tangible wealth without hidden fees or inflated premiums.

As central banks are buying precious metals to diversify, individual investors can benefit from the same logic. Silver offers a versatile and accessible way to hedge against inflation, diversify your assets, and preserve wealth for generations.