Why the Platinum 100 Gram Price Matters for Your Portfolio

The platinum 100 gram price typically ranges from $3,350 to $3,850, influenced by the mint, payment method, and live spot price. Here’s a snapshot of current pricing:

Current 100g Platinum Bar Prices (as of publication):

| Brand | Purity | Approximate Price Range | Payment Method |

|---|---|---|---|

| PAMP Suisse Fortuna | .9995 | $3,840 - $3,995 | Wire/Check vs Credit/PayPal |

| Argor-Heraeus | .9995 | $3,359 - $3,494 | Wire/Check vs Credit/PayPal |

| Valcambi | .9995 | $3,359 - $3,494 | Wire/Check vs Credit/PayPal |

| Baird & Co | .9995 | $3,359 - $3,494 | Wire/Check vs Credit/PayPal |

Prices shown are at the time of this publication.

Platinum stands out among precious metals because it's 30 times rarer than gold. While many investors focus on gold and silver, platinum is an industrial workhorse—essential for catalytic converters and emerging hydrogen fuel cell technology—while also serving as a reliable store of wealth.

The 100 gram bar offers a strategic advantage. It's large enough to lower the premium you pay per ounce but small enough to provide liquidity when you need to sell. You avoid the higher markups of fractional coins and the large capital outlay of a full kilogram bar.

However, not all 100g bars are priced equally. A PAMP Suisse bar can cost significantly more than an Argor-Heraeus bar of the same purity, and your payment method can alter the price by over $150. This guide will break down what drives the platinum 100 gram price, compare top mints, and show you how to get the best value.

I'm Eric Roach, and with over a decade of experience in precious metals and on Wall Street, I know that understanding these market dynamics is key to building a resilient portfolio.

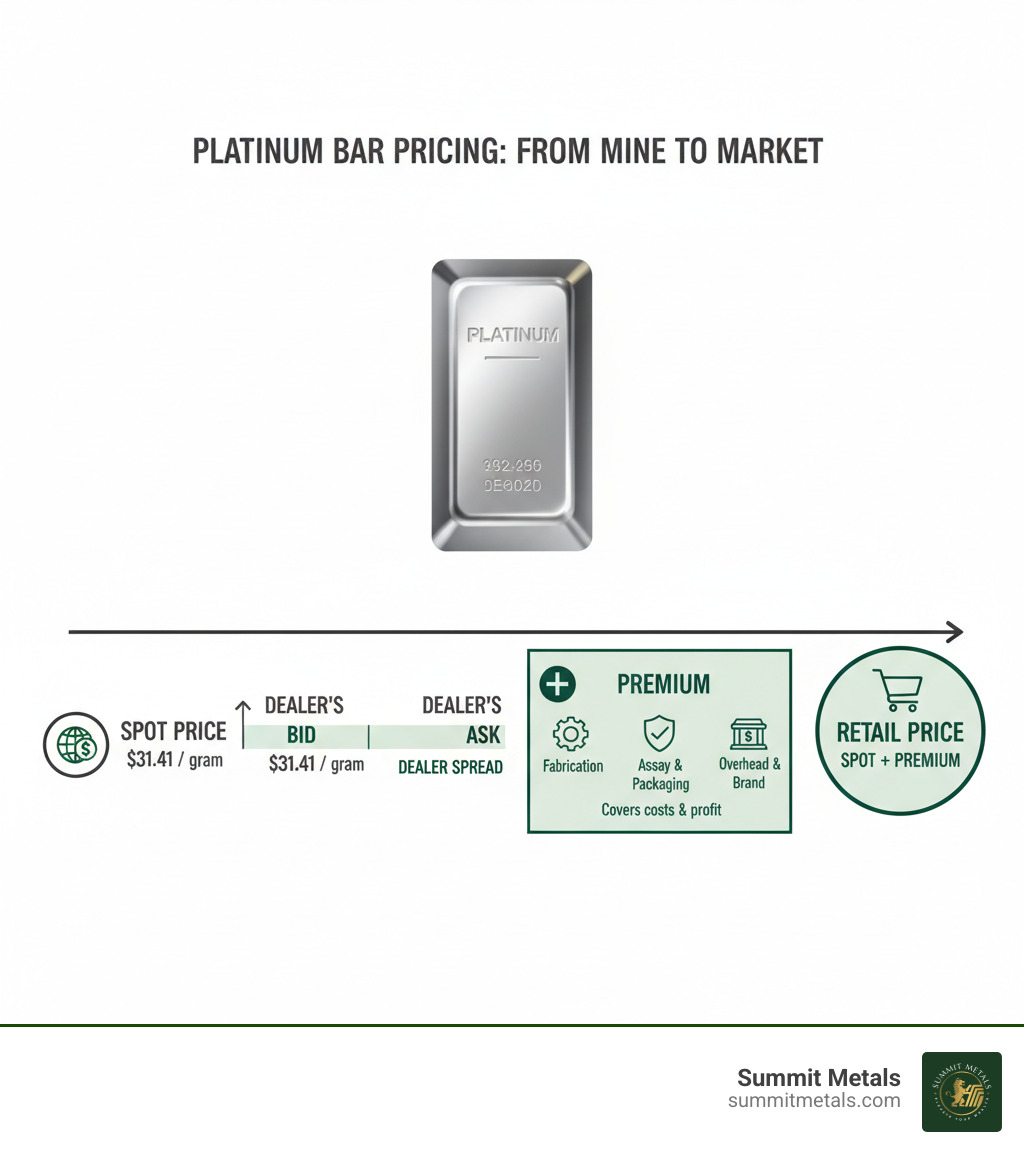

Understanding Platinum Bar Pricing: Spot Price vs. Premiums

New platinum investors are often confused why they can't buy a 100 gram bar at the spot price quoted online. Here’s a simple breakdown.

The spot price is the baseline price for one troy ounce (31.1035 grams) of raw platinum on global markets. It changes constantly based on supply and demand. This is the wholesale price every dealer uses as a starting point.

However, you are buying a refined, stamped, and authenticated bar, not raw metal. The final platinum 100 gram price you pay is the spot price plus a premium. The premium covers all the costs to get the bar from the mine to you:

- Fabrication & Assay: The cost of minting the bar to .9995 purity, verifying its authenticity, and sealing it in secure packaging.

- Dealer Overhead: This includes secure storage, insurance, shipping logistics, and other business operating costs.

- Dealer Spread: This is the difference between the bid price (what a dealer pays to buy from you) and the ask price (what they charge to sell to you). It represents the dealer's margin for facilitating the transaction. At Summit Metals, we keep our spreads tight by buying in bulk and passing the savings to you.

Brand recognition also affects the premium. A PAMP Suisse bar commands a higher premium because its reputation ensures high liquidity and trust, making it easier to resell. You pay more upfront for that peace of mind.

Finally, your payment method matters. A wire transfer or check is cheapest. Using a credit card or PayPal adds 3-4% in processing fees, which dealers pass on to the buyer. On a 100g bar, that can be a difference of over $135.

Understanding these components helps you see beyond the headline number and know exactly what you're paying for. For a deeper dive, see our guide on Platinum Bullion and Spot Price: What You Need to Know. If you want a neutral primer on key terms, see Wikipedia overviews of the spot price, troy ounce, and the bid-ask spread.

What is the Current Platinum 100 Gram Price? A Brand Roundup

Let's talk real numbers. The platinum 100 gram price isn't a single figure; it shifts with market forces, manufacturer premiums, and your payment method. The spot price is the foundation, but the final cost of a physical bar is more nuanced.

At Summit Metals, we believe in transparency. We leverage our bulk purchasing power to negotiate better rates and pass those savings directly to you. No hidden fees, just honest pricing.

Not all 100 gram platinum bars of identical purity cost the same. Here’s a breakdown of what you can expect to pay from the industry's most respected names:

| Brand | Purity | Approx. Price Range (Wire/Check) | Approx. Price Range (Credit/PayPal) | Unique Feature |

|---|---|---|---|---|

| PAMP Suisse Fortuna | .9995 | $3,841.53 | $3,995.19 | Iconic Fortuna design, highly recognized |

| Argor-Heraeus | .9995 | $3,359.27 | $3,493.64 | LPPM-approved Swiss quality, classic design |

| Valcambi Suisse | .9995 | $3,359.27 | $3,493.64 | Swiss precision, various innovative bar designs |

| Baird & Co | .9995 | $3,359.27 | $3,493.64 | UK-based refiner, strong reputation |

| Generic Platinum Bar | .9995 | $4,002.28 | $4,162.37 | Variable premium based on availability |

Prices shown are at the time of this publication and are subject to change.

Analyzing the Platinum 100 Gram Price from Top Mints

PAMP Suisse Fortuna is a top choice for collectors and investors. Its iconic design is instantly recognizable, ensuring high liquidity. You pay a premium for the brand, but it often translates to a faster, easier sale.

Argor-Heraeus and Valcambi Suisse offer superb Swiss quality without the high brand markup. Both are on the London Platinum and Palladium Market (LPPM) 'Good Delivery List,' guaranteeing their quality and authenticity. They represent excellent value for investors focused on acquiring metal content.

Baird & Co is a highly respected UK-based refiner offering .9995 fine platinum bars at a competitive price point, typically in line with other major Swiss mints.

"Generic Platinum Bars" can have fluctuating prices based on a dealer's inventory. Sometimes they are cheaper, but other times they can be more expensive than branded bars if supply is tight. Always compare specific products, not just categories.

How Payment Method Affects Your Final Price

Your payment method can change the platinum 100 gram price by over $150.

- Wire Transfer/Check: This is the cheapest option, as dealers have minimal processing costs. You get the lowest price on the metal.

- Credit Card/PayPal: These methods add 2-4% in processing fees, which are passed on to you. For a $3,800 bar, that's over $114 extra.

Quick cost comparison by payment method:

| Payment Method | Typical fee impact | Approx. effect on a $3,800 bar |

|---|---|---|

| Wire Transfer/Check | 0% | Baseline (lowest cash price) |

| Credit Card/PayPal | +2% to +4% | +$76 to +$152 |

| Recurring bank transfer (Autoinvest) | 0% | Baseline pricing plus automated dollar-cost averaging |

For larger purchases, a wire transfer saves you significant money. Enroll in Autoinvest to lock in cash pricing via recurring bank transfers and build your position every month—just like your 401(k).

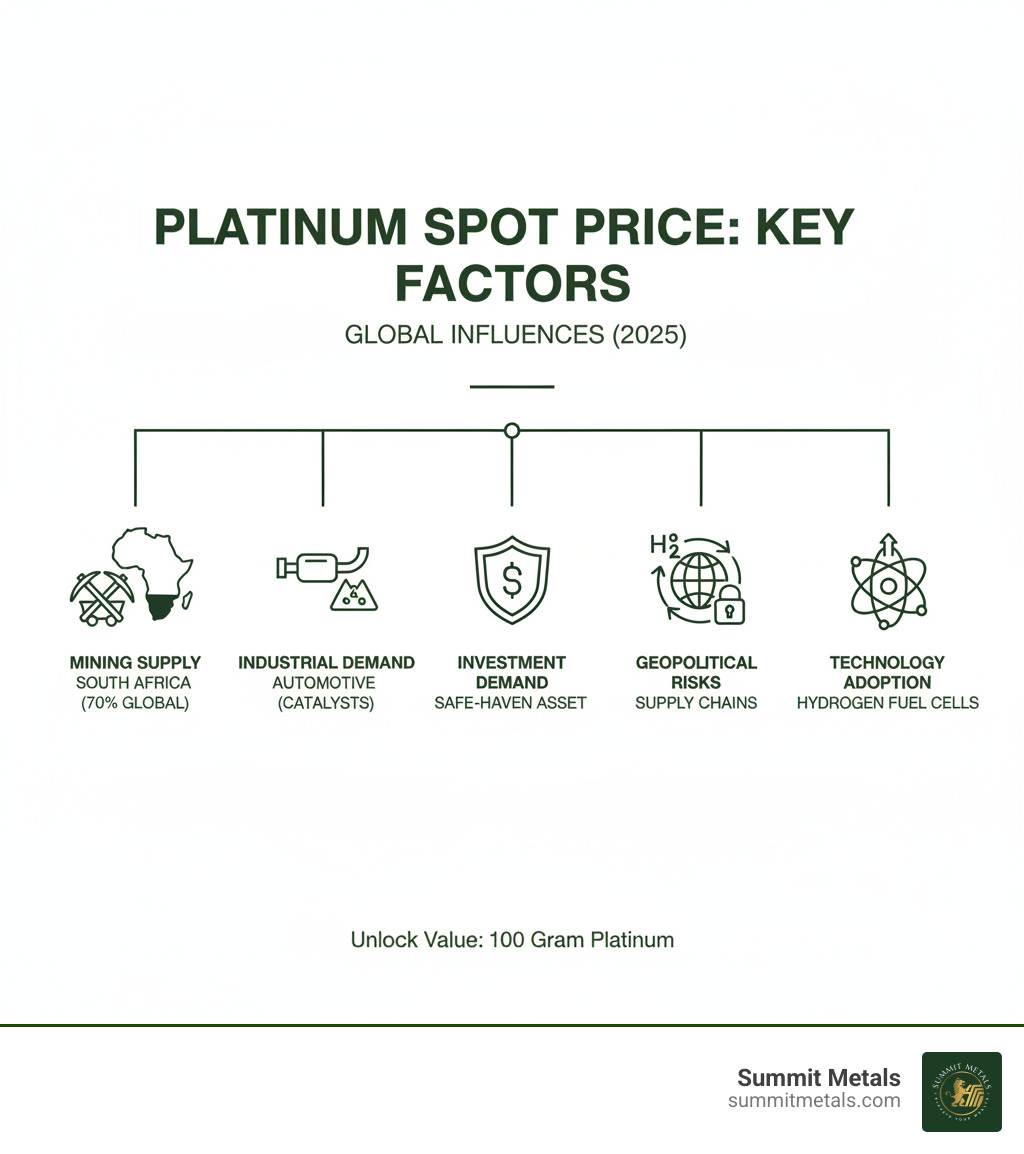

Key Factors That Influence the Price of 100g Platinum Bars

Understanding the platinum 100 gram price means grasping the core forces of supply and demand. Unlike gold, which is primarily a monetary asset, platinum is an industrial workhorse, making its price sensitive to economic activity.

The price you see is shaped by three major forces: industrial demand, mining supply, and investment sentiment.

Industrial Demand: Where Platinum Goes to Work

Over 80% of annual platinum demand comes from industrial applications. This tangible use provides a strong floor for its value.

- Automotive Sector: Platinum is critical for catalytic converters in gasoline and diesel engines to reduce harmful emissions. Stricter global standards are increasing the amount of platinum needed per vehicle.

- Hydrogen Fuel Cells: As the world moves toward clean energy, Fuel Cell Electric Vehicles (FCEVs) are a major growth area. Platinum is the key catalyst, and this demand is projected to rise significantly.

- Other Industries: Platinum is also essential in petroleum refining, fertilizer production, medical devices like pacemakers, and luxury jewelry.

A strong global economy boosts industrial demand and can push the platinum 100 gram price higher.

Mining Supply: Why Scarcity Matters

Platinum is about 30 times rarer than gold, and its supply is geographically concentrated, creating significant risk.

- South Africa Dominance: Over 70% of the world's platinum is mined in South Africa. Any political instability, labor strikes, or power grid failures there can disrupt global supply and cause prices to spike.

- Geopolitical Risk: Russia accounts for another 10-12%, adding another layer of geopolitical uncertainty to the supply chain.

- Supply Deficit: For several years, demand for platinum has outstripped new mining supply. This fundamental imbalance is projected to continue, putting upward pressure on prices.

This tight supply is a key reason savvy investors are watching the platinum 100 gram price closely.

Investment Demand: The Safe-Haven Factor

Like other precious metals, platinum is a safe-haven asset during times of economic uncertainty. However, it has a unique investment case.

Historically, platinum traded at a premium to gold. In recent years, it has traded at a discount, which many investors see as a historical buying opportunity. Because it is less common in investment portfolios, platinum offers excellent diversification benefits, as its price often moves independently of stocks and bonds.

At Summit Metals, we've seen growing interest in platinum from investors who recognize its dual role as both an industrial and monetary metal. This unique combination makes the platinum 100 gram price attractive for building a diversified portfolio. For more on this topic, see our guide on Key Factors Influencing Gold & Silver Prices.

A Strategic Guide to Investing in 100g Platinum Bars

Ready to add platinum to your portfolio? A platinum 100 gram bar is tangible wealth, but investing smartly requires knowing what to look for.

First, always insist on .9995 fine platinum. This purity should be stamped on the bar, along with its weight and the manufacturer's hallmark. The bar should come sealed in a tamper-evident package with an assay card, which certifies its authenticity. If the seal is broken, walk away.

Stick with globally recognized manufacturers on the London Platinum and Palladium Market (LPPM) 'Good Delivery List'. Names like PAMP Suisse, Argor-Heraeus, Valcambi, and Baird & Co produce bars that are trusted and easily sold anywhere in the world. This recognition ensures liquidity.

For storage, a high-quality home safe is suitable for smaller holdings, but check that your homeowner's insurance covers precious metals. For larger investments, consider professional depository storage for ultimate security and insurance. You can also hold physical platinum in a Precious Metals IRA for tax-advantaged growth, provided the bars meet purity standards. Our Beginner's Guide to Investing in Precious Metals covers these fundamentals.

Why the Platinum 100 Gram Price Offers a Sweet Spot for Investors

The platinum 100 gram price is ideal for serious investors for two key reasons:

- Cost-Effectiveness: Premiums are significantly lower on 100g bars (typically 5-10% over spot) compared to smaller 1g bars (30-40% over spot). More of your money buys metal, not manufacturing costs.

- Liquidity & Flexibility: A 100g bar is easier to sell than a large kilo bar. If you need to raise a few thousand dollars, you can sell a single bar without liquidating your entire position. It perfectly balances value and flexibility.

Automating Your Investment: Dollar-Cost Averaging with Platinum

Don't try to time the market. The most successful investors use dollar-cost averaging—a strategy that builds wealth consistently over time.

With an Autoinvest strategy, you commit to buying a fixed dollar amount of platinum each month. When prices are low, you get more metal; when they're high, you get less. This smooths out your average cost and removes emotion from your investment decisions. It's the same disciplined approach used in a 401(k).

At Summit Metals, our Autoinvest program was designed for this purpose. Set your budget, choose your products, and let the system build your platinum stack automatically. It's the simplest way to mitigate volatility and consistently grow your holdings.

Frequently Asked Questions about the Platinum 100 Gram Price

Here are answers to some of the most common questions we hear from investors about the platinum 100 gram price.

How does the price of a 100g bar compare to a 1 oz platinum coin?

While both are excellent ways to own physical platinum, they serve slightly different strategic purposes. Bars are typically more cost-effective for pure accumulation, while coins offer government backing and numismatic potential.

Here’s a direct comparison:

| Feature | 100g Platinum Bar | 1 oz Platinum Coin |

|---|---|---|

| Premiums | Lower per ounce; more metal for your money. | Higher per ounce due to minting costs and design. |

| Primary Goal | Cost-efficient wealth accumulation. | Collectibility, government guarantee, and investment. |

| Authenticity | Guaranteed by a private refiner's assay card. | Backed by a sovereign government as legal tender. |

| Face Value (Legal Tender) | None. | Yes—legal tender with a face value, adding a sovereign guarantee. |

| Fraud Protection | Relies on reputable dealers and assay verification. | Legal tender status and enforcement make counterfeiting a federal crime, offering strong deterrence. |

| Liquidity | Highly liquid, especially from LPPM-approved refiners. | Extremely liquid and recognized worldwide. |

| Storage | Uniform shape makes for efficient, dense stacking. | Round shape is less space-efficient for bulk storage. |

The Bottom Line: If your goal is to acquire the most platinum for your dollar, 100g bars are the clear winner. If you value government backing and potential collector value, coins are an excellent choice. For a neutral overview of how sovereign bullion coins work, see Bullion coin.

Who are the most reputable manufacturers of 100g platinum bars?

Reputation is everything. To ensure authenticity and liquidity, always buy bars from refiners on the London Platinum and Palladium Market (LPPM) Good Delivery List. These manufacturers meet the highest international standards.

Top-tier refiners include:

- PAMP Suisse (Premium brand, iconic designs)

- Argor-Heraeus (Excellent value, Swiss quality)

- Valcambi Suisse (Precision engineering, modern designs)

- Baird & Co (Established UK refiner)

- The Royal Mint (UK sovereign mint)

- Perth Mint (Australian sovereign mint)

Sticking to these names ensures your investment will be recognized and accepted by dealers globally when it's time to sell.

Are there additional costs when buying a 100g platinum bar?

Yes, the advertised price isn't always the final cost. A reputable dealer will be transparent about all charges. Be aware of:

- Premiums: The amount charged over the spot price to cover fabrication and dealer costs.

- Shipping & Insurance: A valuable shipment requires secure, insured delivery. At Summit Metals, we offer free, insured shipping on orders over $199.

- Payment Processing Fees: Paying with a credit card or PayPal can add 3-4% to your total cost. A wire transfer is almost always cheaper for large purchases.

- Sales Tax: Tax laws on precious metals vary by state. Some states charge full sales tax, while others offer exemptions. Summit Metals calculates any applicable taxes at checkout, so there are no surprises.

Your Next Step in Platinum Investing

You now understand what drives the platinum 100 gram price and why it represents a strategic sweet spot for investors. It's time to put that knowledge into action.

A 100 gram platinum bar is a powerful tool for portfolio diversification, offering a hedge against uncertainty with the backing of real industrial demand. It balances the cost-efficiency of bulk metal with the flexibility needed for a personal portfolio.

Here at Summit Metals, we are committed to making your investment journey transparent and valuable. Based in Wyoming, USA, with a presence in Salt Lake City, Utah, we provide real-time, competitive pricing sourced through our bulk purchasing power. We only sell authenticated bullion from the world's most reputable mints—like PAMP Suisse, Argor-Heraeus, and Valcambi—so you can invest with total confidence.

What truly sets us apart is our mission to make precious metals investing as systematic as saving for retirement. You wouldn't try to time the market with your 401(k); you invest consistently. Our Autoinvest program brings that same disciplined strategy to platinum.

Set a monthly budget, and our system automatically purchases platinum for you. This dollar-cost averaging approach smooths out market volatility and builds your wealth steadily over time, removing the stress and guesswork. It's your personal 401(k) for precious metals.

Whether you're making your first purchase or adding to your stack, Summit Metals is your trusted partner. We focus on education and long-term value, not just one-time sales.