Why Gold and Silver Belong in Your Financial Strategy

Learning how to buy gold and silver is about understanding their power to hedge against inflation, diversify your portfolio, and act as a store of value during economic uncertainty. Here's the quick answer:

- Choose your form: Physical bullion (coins or bars) offers direct ownership with no counterparty risk.

- Select a reputable dealer: Look for transparent pricing, authentication guarantees, and strong customer reviews.

- Understand the costs: Pay attention to the spot price plus the premium--avoid dealers who hide fees.

- Secure storage: Plan for a home safe, bank deposit box, or third-party vault.

- Start small: Begin with recognizable 1 oz coins or bars, or use dollar-cost averaging to build your position.

While gold is the ultimate monetary metal, silver's demand is surging from industrial use in solar panels, EVs, and electronics. Silver is also more accessible for new investors, costing a fraction of gold. Both metals share a 5,000-year history as tangible assets that can't be devalued by government or central bank policies.

The challenge? Opaque pricing and inauthentic products can turn a smart move into a costly mistake.

I'm Eric Roach. After a decade in investment banking, I now help everyday investors learn how to buy gold and silver with a disciplined, risk-aware approach. This guide will show you how to acquire authenticated bullion at competitive rates, avoid common pitfalls, and build a precious metals position that strengthens your long-term wealth.

Step 1: Understand Your Options - Physical Gold and Silver

Before you learn how to buy gold and silver, you must understand their different roles in your portfolio.

Gold vs. Silver: Two Metals, Two Personalities

Think of gold as the steady anchor. It's what central banks hold to back national currencies. When markets tumble, gold typically holds its value or climbs. Its value is driven by investor demand and its 5,000-year history as the ultimate monetary metal.

Silver is gold's more energetic cousin. It shares gold's safe-haven qualities, but with a twist: over half of all silver demand now comes from industry. We're talking solar panels, electric vehicles, and smartphones. Industrial demand for silver is surging, meaning silver responds to both economic uncertainty and technological innovation.

This dual nature makes silver more volatile than gold, with price swings two to three times larger. This means bigger potential gains and dips. The upside is that silver's lower price per ounce makes it far more accessible for beginners. Investors often watch the gold-to-silver ratio--how many ounces of silver it takes to buy one ounce of gold--to spot potential bargains.

Physical Bullion (Coins & Bars)

The beauty of physical bullion is that you own it outright. When you hold a gold or silver coin, you're holding an asset with intrinsic value that stands on its own, unlike stocks or bonds. If a bank fails or markets crash, your metal still has value.

This is called zero counterparty risk. Your bullion's value doesn't depend on anyone else's promise. You have direct control, which is powerful in a fragile financial world. Physical metal can be traded almost anywhere, anytime. For investors seeking true security, physical metals offer protection that paper alternatives can't match.

At Summit Metals, we offer a wide selection of authenticated bullion coins and bars from reputable mints. Starting with physical bullion from a transparent dealer is the foundation of a solid precious metals strategy.

Step 2: Choose the Right Product - Coins, Bars, or Rounds

Once you've decided on physical metals, what form should you buy? When learning how to buy gold and silver, you'll weigh three factors: premiums (cost above the raw metal price), liquidity (ease of selling), and divisibility (breaking holdings into smaller units).

The premium covers manufacturing, distribution, and dealer overhead on top of the spot price (the real-time market value of the metal).

How to Buy Gold and Silver Coins

For most beginners, government-minted coins are the perfect starting point. A one-ounce American Gold Eagle coin, for example, has a $50 legal tender face value. This isn't just symbolic--it provides a unique layer of fraud protection and instant recognizability that private mints can't match. Committing fraud with a government-backed coin is a federal crime, a serious deterrent to counterfeiting.

Popular coins like the American Gold Eagle, Canadian Gold Maple Leaf, and American Silver Eagle are trusted worldwide. This universal recognition gives them very high liquidity, meaning you can sell them quickly at competitive prices. The trade-off is slightly higher premiums, but the peace of mind is often worth it for new investors.

At Summit Metals, we offer a curated selection of these highly recognizable, authenticated coins.

How to Buy Gold and Silver Bars

If your goal is to get the most metal for your money, bars are the workhorses of the precious metals world. Bars carry lower premiums per ounce than coins, especially in larger sizes. For investors making bulk purchases, this cost-efficiency adds up quickly.

Bars are also practical for storage, as they stack neatly. They come in a wide range of sizes, from one gram to 400 ounces, fitting nearly any budget. The main consideration is that their authenticity relies on the reputation of the mint or refiner, not a government. That's why sourcing from a reputable dealer like Summit Metals, who authenticates every bar, is critical.

[COMPARISON CHART] Bullion Coins vs. Bullion Bars

| Feature | Bullion Coins | Bullion Bars |

|---|---|---|

| Premium | Higher | Lower |

| Liquidity | Very High | High |

| Best For | Beginners, Small Purchases | Bulk Investors |

| Recognizability | High (Gov't Backed) | Varies by Mint |

| Fraud Protection | High (Face Value, Gov't Backed) | Relies on Assay/Mint |

| Divisibility | Easy (1 oz, 1/2 oz, etc.) | Varies (1 oz, 10 oz, kilo, etc.) |

Tip: Coins offer added fraud protection due to their legal tender status and government backing. That face value--even if symbolic--provides a baseline of recognition and legal protection that is invaluable when you sell.

Step 3: The Smart Way on How to Buy Gold and Silver

Now let's cover the practical steps of how to buy gold and silver securely. This knowledge can save you thousands and protect you from common pitfalls.

Spot Price vs. Premium: The Real Cost

The "spot price" is the real-time market price for raw metal. You will always pay a "premium" above this price. This legitimate cost covers minting, shipping, insurance, and dealer overhead. A reputable dealer will always be transparent about both the spot price and the premium. If they hide fees, walk away.

Vetting Dealers: Your Due Diligence is Key

Choosing the right dealer is paramount to getting authentic products at a fair price.

- Reputation and reviews: Check for a long history of positive customer feedback. Patterns of complaints are a serious red flag.

- Transparency: A trustworthy dealer offers real-time pricing, clearly showing the spot price and premium. No hidden fees.

- Authentication and sourcing: Ensure the dealer works with reputable mints and guarantees product authenticity.

- Accreditations: Look for affiliations with industry groups like the American Numismatic Association (ANA) or a Better Business Bureau (BBB) accreditation.

- Buy-back policy: A reputable dealer will buy metals back from you at competitive rates, showing they stand behind their products.

Payment Methods: Choose Wisely

How you pay affects your total cost. Wire transfers and e-checks often qualify for a discount but may have longer clearance times. Cryptocurrency payments also qualify for discounts and offer added privacy. Credit cards are convenient but don't qualify for discounts due to higher processing fees.

Why Buy from Summit Metals?

We built Summit Metals on transparency, authenticity, and value.

- Transparent, real-time pricing: You always know the exact cost above spot. No hidden fees.

- Authenticated bullion: We source directly from reputable mints and refiners, guaranteeing every product.

- Competitive rates: Our bulk purchasing power means we pass savings directly to you.

- Excellent customer reviews: Our customers praise our clear communication and knowledgeable support.

- Fair buy-back policy: We make liquidating your assets simple and transparent.

- Secure checkout: We use robust encryption to protect your information.

Smart Buying & Investing Strategies

Smart investors use proven strategies to build their positions over time.

- Start small: If you're new, begin with recognizable 1-ounce coins or bars. Silver is a great, affordable starting point.

- Avoid excessive premiums: Use our transparent pricing to compare products and find fair deals.

- Dollar-cost averaging with Summit Metals' Autoinvest: This is one of the smartest strategies. Instead of trying to time the market, you set up automatic monthly purchases. Just like a 401k, you buy a fixed dollar amount regularly. This averages out your purchase price over time and removes emotion from investing. It's a disciplined way to build your position without a large initial outlay. Explore Autoinvest options or Subscription services.

[COMPARISON CHART] Summit Metals Autoinvest vs. One-Time Purchase

| Feature | Autoinvest | One-Time Purchase |

|---|---|---|

| Consistency | Monthly, automatic | Manual, as needed |

| Dollar-Cost Averaging | Yes | No |

| Minimum Investment | Low | Varies |

| Best For | Long-term, steady growth | Lump-sum buyers |

Step 4: Secure and Manage Your Investment

You've learned how to buy gold and silver, but protecting your investment is just as crucial. This means secure storage, understanding taxes, and knowing the risks.

Storing Your Physical Metals

Where you keep your metals depends on your holdings and comfort level.

- Home storage: This gives you direct control. Use a high-quality, bolted-down safe. Be aware that standard home insurance likely won't cover the full value; you'll need a special rider. Keep metals, especially silver, in a dry environment.

- Bank safe deposit boxes: These are secure and off-site, but you can only access them during bank hours. The bank's insurance coverage for contents is also typically limited.

- Third-party depositories: For larger investments, these specialized facilities offer the best security, with 24/7 surveillance and full insurance. Summit Metals can guide you to recommended storage partners.

No matter your choice, keep detailed purchase records separate from your metals for insurance and tax purposes.

Understanding Taxes and Risks

In the U.S., the IRS treats physical precious metals as collectibles. Long-term capital gains (held over a year) can be taxed up to 28%--higher than stocks. Always consult a tax professional, as rates can change.

A Self-Directed IRA (Precious Metals IRA) offers a tax-advantaged way to hold metals, allowing gains to be deferred or avoided. These accounts require an IRS-approved custodian and depository, which involves annual fees and minimum investments. Summit Metals can connect you with reputable custodians to get started.

Be aware of the risks:

- Market volatility: Prices fluctuate. Silver is especially volatile. Precious metals are a long-term strategy, not a get-rich-quick scheme.

- Theft or loss: This is a key risk for physical assets. Secure storage and proper insurance are essential.

- Counterparty risk with "paper" metals: This guide focuses on physical metals because you own them directly. "Paper" assets like ETFs rely on a third party, which can be a risk in a financial crisis.

- Paying excessive premiums: Overpaying hurts your returns. This is why choosing a dealer with transparent pricing, like Summit Metals, is so important.

Frequently Asked Questions about Buying Precious Metals

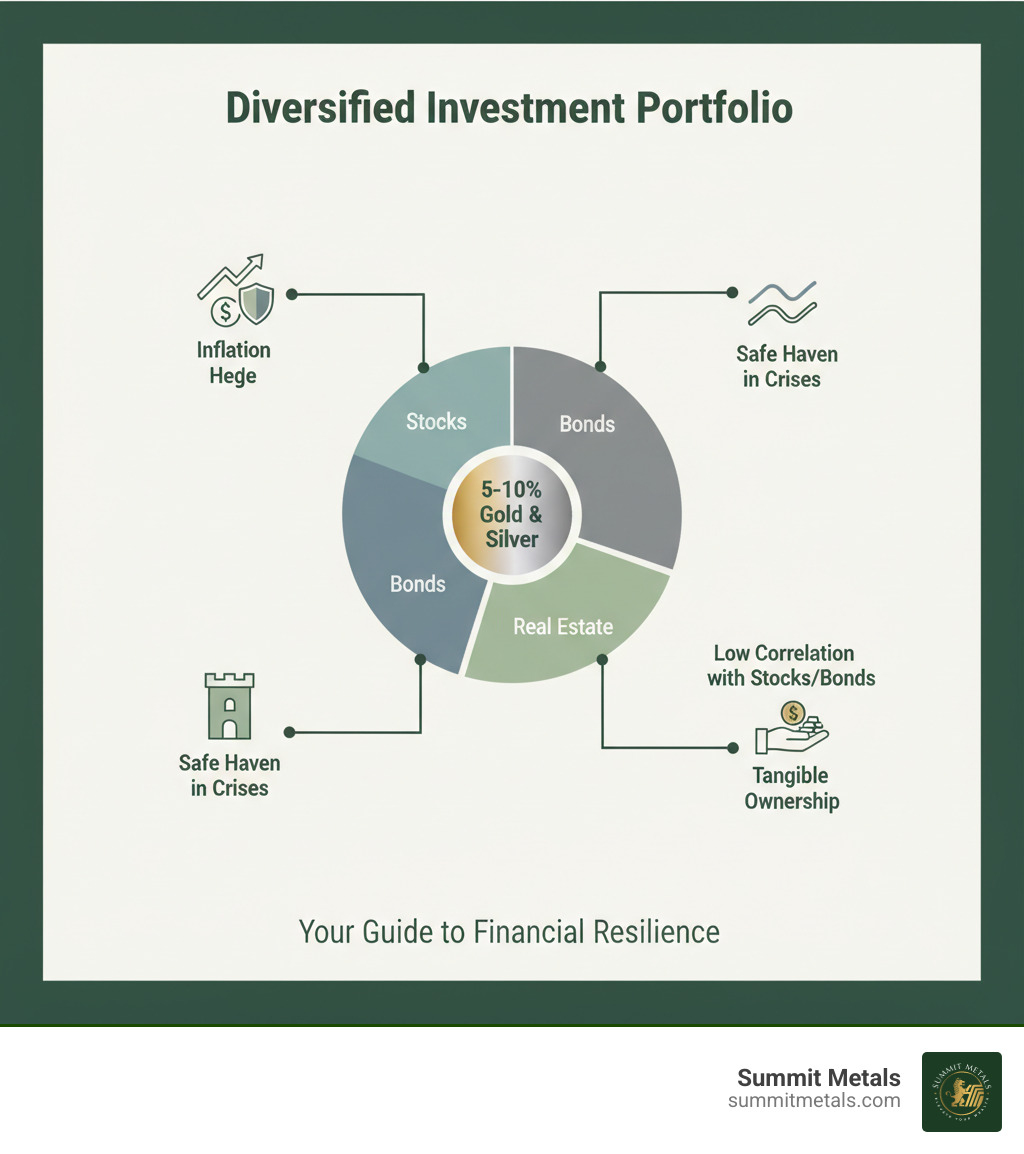

How much of my portfolio should I allocate to precious metals?

There's no single answer, as it depends on your risk tolerance and goals. However, common financial advice suggests allocating 5% to 10% of your portfolio to precious metals. This is often considered a sweet spot--enough to provide meaningful diversification and an inflation hedge without over-exposing your portfolio. Think of it as portfolio insurance.

What is the easiest way for a beginner to invest in gold and silver?

Start small with recognizable 1-ounce coins or bars. There's no need to make a huge commitment at first. Silver is often the most accessible entry point due to its lower price per ounce. A 1-ounce American Silver Eagle is a perfect first purchase.

For ultimate ease, our Autoinvest plan is designed for beginners. It allows you to set up automatic monthly purchases, similar to a 401k. This strategy, known as dollar-cost averaging, smooths out volatility by buying more when prices are low and less when they are high. It's a disciplined, automatic way to build your position over time with a low minimum investment.

What is the difference between bullion and collectible (numismatic) coins?

This is a critical distinction.

- Bullion coins are valued almost entirely for their precious metal content. Their price tracks the metal's spot price. When you buy a 1-ounce Gold Eagle, you're buying one ounce of gold in a recognizable, government-backed form.

- Collectible (numismatic) coins derive their value from rarity, historical significance, and condition. Their value is subjective and tied to collector demand, not just the metal content.

For wealth preservation, this guide focuses on bullion for investment. It's straightforward, liquid, and its value is transparent. At Summit Metals, we specialize in authenticated bullion to give you the most metal for your money.

Conclusion: Start Your Precious Metals Journey with Confidence

You now have a roadmap for how to buy gold and silver with clarity. This isn't about chasing fads; it's about protecting your wealth with assets that have stood the test of time.

The path is clear: understand the roles of gold and silver, choose your form wisely (coins for recognizability, bars for cost-efficiency), and always prioritize transparent pricing and authenticated products.

This is where Summit Metals becomes your partner. Our transparent real-time pricing, competitive rates, and commitment to authenticated bullion give you absolute confidence in every purchase. Whether you're buying your first silver coin or building a position with our Autoinvest program, you're taking a disciplined step toward true financial security.

Ready to take the next step? Learn more with our complete investing guide, explore our current offerings at Summit Metals to see today's competitive pricing, or find out how to sell your metals to us at fair market rates. Let's build your precious metals position together.