Why Gold Sovereign Coins Matter for Today's Investor

Gold sovereign coins have been a cornerstone of British bullion for over 200 years, offering investors a unique combination of historical prestige and intrinsic gold value. Whether you're diversifying your portfolio or starting your precious metals journey, understanding these iconic coins is essential.

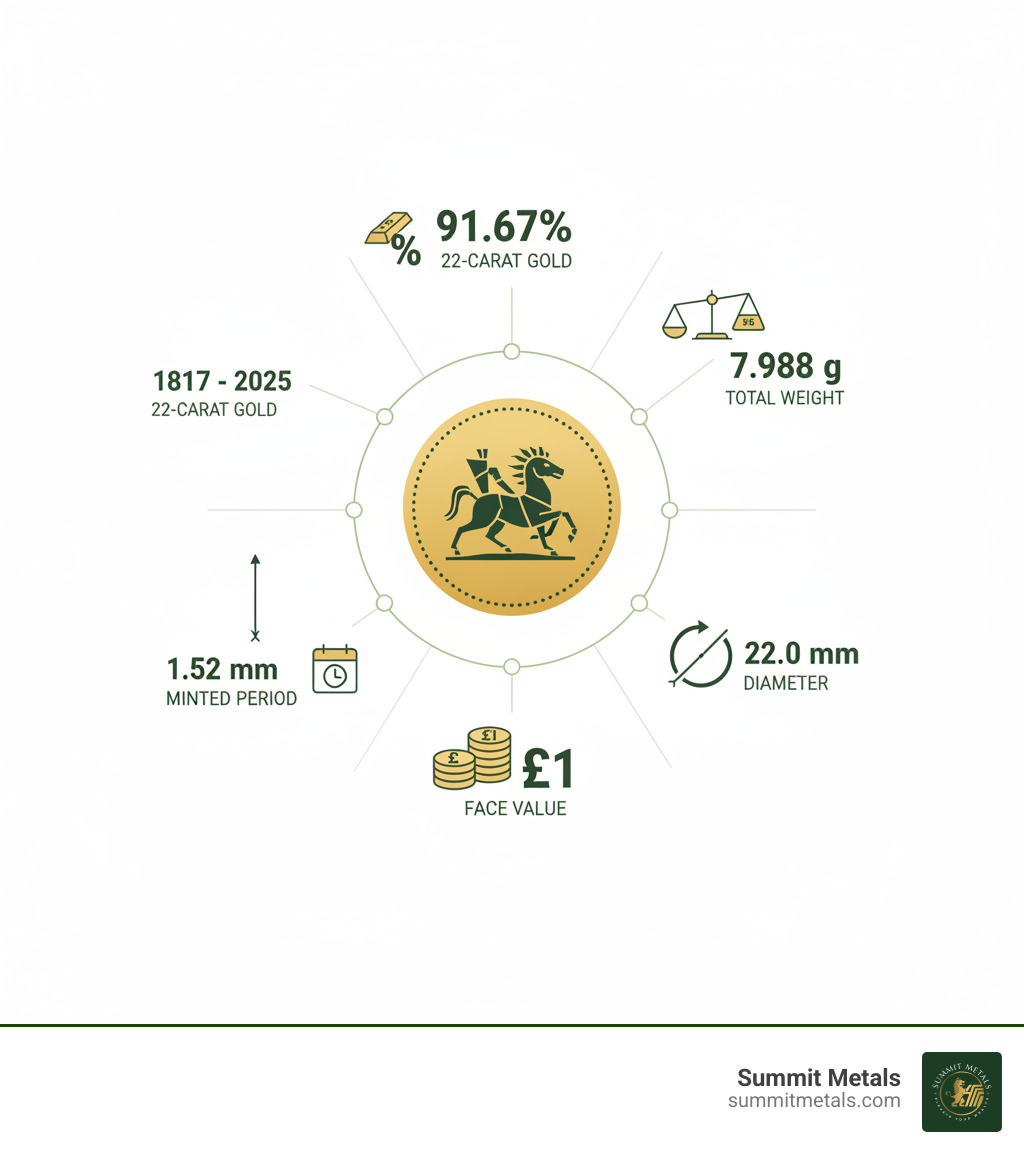

Quick Facts About Gold Sovereign Coins:

- Gold Content: 0.2354 troy ounces of pure gold

- Purity: 22-carat gold (91.67% or .917 fineness)

- Weight: 7.98805 grams total

- Diameter: 22.0 mm

- Legal Tender: £1 face value in the United Kingdom

- First Minted: 1817 (modern version)

- Still Produced: Yes, by The Royal Mint

Once known as the "chief coin of the world," the Gold Sovereign emerged from the Great Recoinage of 1816 to stabilize Britain's economy. By the late 1800s, these coins circulated globally, minted at colonial branch mints to fuel international trade. By 1900, roughly 40% of sovereigns in Britain had been minted in Australia.

Today, the Gold Sovereign has evolved from currency into a respected bullion and collector's coin. It vanished from circulation during World War I but was revived by The Royal Mint as a bullion product in 1957. Modern sovereigns carry the same specifications as their 19th-century predecessors—22-carat gold alloyed with copper for durability—making them instantly recognizable and trusted worldwide.

What sets sovereigns apart is their dual appeal. As a bullion coin, each sovereign contains a fixed amount of gold tied to spot prices. As a collector's item, rare dates, mint marks, and low-mintage issues can command significant premiums. For example, the 1937 Edward VIII pattern sovereign sold for £1,000,000 in 2020.

For UK residents, sovereigns offer a unique tax advantage—they're exempt from Capital Gains Tax and VAT-free. US investors should understand that different rules apply. Regardless of location, these coins deliver liquidity, portability, and peace of mind. Their compact size makes them ideal for building wealth incrementally, and their global recognition means you can sell them almost anywhere.

I'm Eric Roach. After a decade on Wall Street, I saw how institutional investors use hard assets to hedge risk. Now, I help everyday investors apply that same strategy with Gold sovereign coins and other precious metals. Whether you're using an Autoinvest program or hunting for rare mint marks, this guide will show you how to buy, store, and profit from one of history's most enduring gold coins.

A Rich History: From Tudor Times to Modern Minting

The Gold Sovereign coin has a fascinating backstory that weaves through royal dynasties, global empires, and economic upheaval. While the modern sovereign dates to 1817, its roots reach much deeper into British history.

The first sovereign emerged in 1489 under King Henry VII. This large Tudor Sovereign was a statement of power, weighing 15.55 grams, but it disappeared from circulation around 1603.

Fast forward to 1816. Britain faced economic chaos after the Napoleonic Wars. The Great Recoinage of 1816 aimed to stabilize the nation's finances, and from this reform came the rebirth of the sovereign. This Modern Sovereign, first struck in 1817, was a one-pound coin containing 0.2354 troy ounces of pure gold, beginning its journey to becoming the "chief coin of the world."

For nearly a century, Gold Sovereign coins circulated across the British Empire and beyond. Merchants, traders, and bankers trusted these coins because their gold content never varied. They were as good as gold—because they were gold.

Then came World War I. In 1914, Britain suspended the gold standard, and the sovereign vanished from circulation, replaced by paper banknotes. By 1932, the era of the circulating sovereign had ended.

However, the sovereign remained popular as a trade coin. In 1957, The Royal Mint officially revived production as a bullion coin for investors. From 1979 onward, proof versions joined the lineup for collectors. This remarkable evolution showcases why Gold Sovereign coins remain relevant more than 200 years after their modern debut. For a concise overview, see the Sovereign (British coin)) entry.

The Iconic Designs of the Gold Sovereign

Part of what makes Gold Sovereign coins so recognizable is their artwork. The reverse design—Saint George slaying the Dragon—is one of the most iconic images in coinage history. Created in 1817 by Italian engraver Benedetto Pistrucci, his powerful neoclassical design has remained the standard ever since, with occasional variations.

While the reverse is timeless, the obverse tells a story through a visual timeline of British royalty. Key monarchs include:

- George III (1817-1820)

- George IV and William IV

- Queen Victoria, with her famous "Young Head," "Jubilee Head," and "Old Head" portraits.

- Edward VII and George V, whose sovereigns from colonial mints are highly sought after.

- Edward VIII, whose pattern coins are extraordinarily rare after his abdication. One sold for £1,000,000 in 2020.

- George VI, with limited production.

- Elizabeth II, whose 70-year reign produced numerous portraits.

- King Charles III, inaugurating a new chapter in 2022.

This parade of monarchs makes each Gold Sovereign coin both a miniature artwork and a tangible piece of British history.

The Sovereign's Global Reach: The Role of Branch Mints

To avoid shipping raw gold across the globe, the British Empire established colonial branch mints. From the 1850s until 1932, Gold Sovereign coins were struck in Australia, Canada, South Africa, and India. Each branch stamped its coins with a distinctive mint mark, a small letter on the reverse.

- Sydney (S): Began in 1855, reflecting Australia's massive gold rushes.

- Melbourne (M) and Perth (P): Also major Australian producers.

- Ottawa (C): Struck sovereigns from 1908 to 1919. These Canadian issues often command premiums.

- Pretoria (SA): Produced sovereigns until 1932.

- Bombay (I): Struck a limited, rare number of coins.

For investors, these mint marks matter. A common-date sovereign with a scarce mint mark can be worth substantially more than its London-minted counterpart. Understanding where your Gold Sovereign was struck adds depth and potential value to your collection, especially when building a portfolio with a consistent Autoinvest strategy.

Investing in Gold Sovereign Coins: A Modern Perspective

In today's economic climate, Gold Sovereign coins offer a tangible asset with centuries of trust. Unlike stocks or bonds, each sovereign contains 0.2354 troy ounces of pure gold, struck in a durable 22-carat alloy.

Sovereigns are compelling due to their dual nature as both bullion and collectibles. At minimum, every sovereign trades at its gold value, making it an excellent store of value. However, many sovereigns—especially older dates or those with specific mint marks—carry a numismatic premium that can exceed their gold value.

This combination creates opportunities for portfolio diversification. Physical gold often moves independently of stock markets, shining when other assets stumble. Because sovereigns are globally recognized and highly liquid, you can sell them almost anywhere, making them a genuine safe haven asset. The historical appeal adds another dimension; you're not just buying gold, you're acquiring a piece of history. To explore more about why gold works as a wealth protection strategy, check out our guide on The Midas Touch: Exploring the Benefits of Gold Investment.

How to Buy Gold Sovereign Coins Safely

Starting your Gold Sovereign collection can be exciting, but it's crucial to avoid counterfeits and overpaying. Your first line of defense is choosing reputable dealers with proven track records. Look for established companies with transparent pricing, positive customer reviews, and clear guarantees of authenticity. Here at Summit Metals, we've built our business on authenticated precious metals with transparent, real-time pricing—no hidden markups or bait-and-switch tactics. Our guide on How to Buy Gold and Silver Online Safely walks you through the process.

Authentication is critical. Reputable dealers guarantee their coins' authenticity. For valuable sovereigns, consider coins certified by independent grading services like PCGS or NGC, which verify authenticity and grade condition.

Understanding condition helps you pay the right price. Bullion-grade sovereigns show normal wear and are perfect for accumulating gold. Uncirculated (BU) coins retain their mint luster and command moderate premiums. Proof coins, struck for collectors with mirror-like finishes, are at the top of the price range.

The year and mint mark also affect value. A common-date Victorian sovereign might trade 10-15% over bullion value, while the same year from a scarcer mint could fetch double that premium. If you're investing purely for gold content, stick with modern bullion strikes. If you're building a collection, research key dates and mints.

Finally, compare pricing, but be wary of deals that seem too good to be true. Legitimate dealers work on thin margins, so dramatically lower prices can be a red flag. At Summit Metals, our real-time pricing and bulk purchasing power allow us to offer competitive rates without compromising on authenticity or service.

Building Your Collection with Autoinvest

Trying to time the gold market is nearly impossible. The most successful investors buy consistently, which is the power of dollar-cost averaging. This is exactly how our Autoinvest feature works.

Instead of worrying if gold is "high" or "low," you invest a fixed amount at regular intervals—weekly, bi-weekly, or monthly. When prices dip, your investment buys more gold; when prices rise, it buys less. Over time, this smooths out volatility and typically results in a lower average cost per ounce.

Think of it like a 401k, where you contribute every paycheck to build wealth consistently. Autoinvest brings that same disciplined approach to precious metals. Set it up once, choose your schedule, and your Gold Sovereign portfolio grows automatically. This strategy is great for new investors, as it spreads risk across multiple purchases and removes the emotion from investing. At Summit Metals, our Autoinvest program is completely hands-off once you set your amount and frequency—buy every month just like your 401k contributions. If you're just starting out, our guide New to Gold? Here's How to Make Your First Investment Shine can help.

Gold Sovereign vs. Other Bullion Coins

How do Gold Sovereign coins stack up against other popular choices? Understanding the differences helps you make smarter decisions. We cover this in Bars or Coins: Your Ultimate Gold Investment Showdown, but here's a focused comparison.

One crucial advantage of government-issued coins is legal tender status. Every Gold Sovereign has a £1 face value backed by the British government. This provides fraud protection that gold bars lack. Counterfeiting a sovereign is a serious crime with severe penalties, making the coins inherently more trustworthy and easier to authenticate.

The sovereign's 22-carat purity (.917 fine gold) alloyed with copper also gives it exceptional durability compared to softer 24-carat gold, which scratches and dents easily.

Let's compare the Gold Sovereign to two other popular coins:

| Feature | Gold Sovereign | Gold Britannia | Gold Krugerrand |

|---|---|---|---|

| Purity | 22-carat (.917 fine) | 24-carat (.9999 fine) since 2013 | 22-carat (.9167 fine) |

| Gold Content | 0.2354 troy oz | 1 troy oz (standard) | 1 troy oz (standard) |

| Legal Tender | Yes (£1, UK) | Yes (£100, UK) | No official face value |

| Durability | Excellent (hardened alloy) | Good | Excellent (hardened alloy) |

| Size/Portability | Compact fractional gold | Larger one-ounce size | Larger one-ounce size |

Each coin serves different strategies. The Britannia offers maximum purity, while the Krugerrand is exceptionally liquid. The Gold Sovereign shines with its fractional size, perfect for smaller, incremental investments and providing flexibility when selling. Its compact size offers superior portability, and its deep history adds collecting interest that modern bullion can't match. For Autoinvest users, their lower price point means your monthly investment can purchase whole coins, building a diverse collection over time.

Gold Coins vs. Gold Bars: A Quick Decision Guide

Beyond coin-to-coin comparisons, many investors ask whether to focus on coins or bars. Here's a practical side-by-side to help you decide:

| Feature | Government-minted gold coins (e.g., Sovereign, Britannia) | Gold bars |

|---|---|---|

| Legal status | Legal tender; face value backed by issuing government | Not legal tender |

| Fraud/counterfeit protection | Stronger: complex minting, security features, and counterfeiting is a serious currency crime | Varies by refiner; relies on assays, stamps, serial numbers |

| Typical premium over spot | Slightly higher per ounce than large bars; competitive for fractional exposure | Lower for larger bars (1 oz+); small bars can have higher premiums |

| Liquidity & recognition | Extremely liquid worldwide; easy dealer buyback | Highly liquid, but large bars may require assay/testing at sale |

| Divisibility when selling | High (sell one coin at a time; fractional sizes available) | Lower unless you hold multiple small bars |

| Durability | 22k coins like Sovereigns resist wear well | 24k bars are softer and can scratch ding more easily |

| Best for | Flexible, incremental buying and selling; portability; collectibility | Larger, lump-sum allocations to minimize premiums |

| Autoinvest fit at Summit Metals | Excellent—set a dollar amount to buy coins every month, 401k-style | Good for periodic larger deposits (e.g., quarterly) |

Bottom line: If you value anti-fraud protections, flexibility, and monthly dollar-cost averaging via Summit Metals Autoinvest, government-minted coins like the Gold Sovereign are hard to beat. Bars can be ideal when you’re allocating larger sums and seeking the lowest per-ounce premium.

The Collector's Guide to Gold Sovereigns

Beyond their gold value, Gold Sovereign coins open up a fascinating world for collectors. Their long history, evolving designs, and varying production numbers create a rich landscape for numismatists.

Coin Types: Bullion, Proof, and Commemorative

Gold Sovereign coins come in several distinct varieties:

Bullion sovereigns are the foundation of most investment collections. Their value comes directly from their gold content, and they trade at a modest premium over the spot price of gold.

Proof sovereigns are the artistic pinnacle of coin production. First issued for collectors in 1979, they are made with polished dies and multiple strikes to create a stunning mirror-like finish. They arrive in protective cases and command significantly higher premiums.

Commemorative editions mark significant moments in British history, such as the 2022 Platinum Jubilee issue, which featured a unique Royal Arms reverse. These limited releases are often highly sought after by collectors.

Strike-on-the-day coins are unique pieces minted on historically significant dates like royal birthdays or coronations. For example, the 2012 Diamond Jubilee issue had a mintage of only 2,012 coins. These coins come with special packaging confirming the exact striking date, making them tangible pieces of history.

Understanding Rarity and Value

For collectors, a Gold Sovereign coin's value goes far beyond its weight in gold. As we explore in Why Gold and Silver: Understanding Their Value as Safe Haven Assets, true value encompasses scarcity, history, and condition.

Mintage numbers are a key rarity indicator. The 1819 George III sovereign, with a mintage of just 3,574, is one of the rarest issues.

Survival rate is also crucial. Many coins were melted down or lost, making surviving examples in good condition far more valuable.

Key rare dates have legendary status. The 1937 Edward VIII pattern sovereign is the pinnacle, with one selling for £1,000,000 in 2020. George III sovereigns also command high premiums due to their scarcity.

Mint marks from branch mints in Sydney (S), Melbourne (M), Perth (P), Ottawa (C), and Pretoria (SA) add another layer of rarity. Some of these are significantly rarer than their London counterparts.

Condition and grading can make or break a coin's value. Professional grading uses the Sheldon Scale (1-70). Grades like MS-65 (Mint State) or PR-70 (Proof) indicate exceptional quality prized by collectors. Independent services like PCGS and NGC provide authentication and grading.

Storing and Protecting Your Investment

Protecting your Gold Sovereign coins is essential to maintaining their condition and value. A single scratch can diminish a coin's grade. Our philosophy at Summit Metals emphasizes secure, long-term asset protection, as discussed in The Strategic Role of Gold in Long-Term Portfolio Management.

For individual coin protection, use inert, PVC-free coin capsules. These create a barrier against environmental damage and scratches while allowing you to admire your coins.

For secure storage, you have several options. A high-quality, fire-resistant home safe works for smaller collections. For larger holdings, a bank safe deposit box offers improved security. For serious collectors, professional vaulting services provide the best solution, offering segregated, insured, and allocated storage in high-security vaults with climate control and 24/7 monitoring.

Ensure your coins are adequately insured. Your homeowner's policy may have low limits on precious metals, so you might need a separate rider. Professional vaulting services typically include comprehensive insurance.

Finally, maintain a detailed inventory of your collection, including purchase dates, prices, grades, and mint marks. Store this documentation separately from your coins for insurance purposes.

Frequently Asked Questions about Gold Sovereign Coins

We talk with investors every day about Gold Sovereign coins. Let's walk through the questions we hear most often.

Are Gold Sovereigns a good investment?

Yes, Gold Sovereign coins can be an excellent investment. They combine reliable bullion value with potential collector upside. We explore this in our guide Gold Investment 101: Turning Your Savings into Solid Gold, but here's a breakdown.

- Intrinsic Value: Every sovereign contains 0.2354 troy ounces of gold, providing a hedge against inflation and economic uncertainty.

- Numismatic Premium: Many sovereigns carry a premium based on their year, mint mark, or condition, offering value beyond just the gold content.

- Liquidity: Sovereigns are recognized and trusted worldwide, making them easy to sell.

- Durability: Struck in a 22-carat gold alloy, they resist scratches and wear better than softer 24-carat coins.

- Accessibility: Their fractional size makes them perfect for building wealth gradually. This is ideal for our Autoinvest program, where you can make recurring purchases—like a 401k for precious metals.

While no investment is guaranteed, the dual nature of Gold Sovereign coins makes a compelling case for their place in a diversified portfolio.

What are the most valuable Gold Sovereigns?

The most valuable Gold Sovereign coins combine extreme rarity, historical significance, and exceptional condition.

The undisputed champion is the 1937 Edward VIII pattern sovereign. Only a handful were struck before his abdication, and one sold for £1,000,000 in 2020.

The 1819 George III sovereign is another top prize for collectors. With a tiny mintage of just 3,574 coins, finding one in good condition is exceptionally rare.

Branch mint issues with low production numbers, such as certain Ottawa (C) or early Sydney (S) mint mark sovereigns, can also command substantial premiums.

Modern proof and commemorative issues with ultra-low mintages, like the 2023 King Charles III Coronation sovereign (1,250 pieces), can also appreciate rapidly. Even common dates in exceptional condition (e.g., MS-65 grade) can be highly valuable.

Are Gold Sovereigns tax-free in the USA?

The tax treatment of Gold Sovereign coins depends entirely on where you live.

For UK residents, sovereigns offer a significant advantage. Because they are legal tender currency, they are exempt from Capital Gains Tax (CGT) and are also VAT-free. This makes them one of the most tax-efficient investments available in the UK.

For US residents, the tax picture is different. The IRS classifies physical precious metals, including sovereigns, as "collectibles." Profits from selling sovereigns held for more than one year are subject to the collectibles capital gains tax rate, which can be up to 28%. Sales tax also varies by state, with some states exempting precious metals purchases and others not.

While Gold Sovereign coins generally do not trigger IRS Form 1099-B reporting requirements upon sale due to their fractional size, you are still responsible for reporting any capital gains on your tax return.

Tax laws are complex. We always recommend consulting with a qualified tax advisor who understands precious metals to ensure you are handling everything correctly.

The bottom line: Gold Sovereign coins offer remarkable tax advantages for UK investors, while US investors should plan for collectibles taxation.

Conclusion: Is the Gold Sovereign Right for You?

The Gold Sovereign coin is more than an investment—it's a piece of living history. From Tudor times to the modern King Charles III issues, these coins have remained constant, trusted, and valuable through centuries of change.

What makes the Gold Sovereign a compelling choice? It's the rare combination of benefits:

- Historical Significance: Every sovereign tells a story of the British Empire.

- Intrinsic Value: The 0.2354 troy ounces of pure gold in each coin anchors your investment to an enduring store of wealth, protecting against inflation.

- Collectibility: Rare dates, mint marks, and exceptional condition can deliver returns well beyond the spot price of gold.

The Gold Sovereign's global recognition makes it exceptionally liquid and easy to sell. Its 22-carat alloy ensures durability, and its fractional size makes it accessible for new investors to start building real wealth in physical gold.

At Summit Metals, we make precious metals investing straightforward and trustworthy. Our authenticated gold and silver comes with transparent, real-time pricing—no hidden fees or inflated premiums. Our bulk purchasing power means you get competitive rates. Whether you're buying your first sovereign or adding to a collection, we ensure you get genuine coins at fair prices.

Our Autoinvest program makes building your collection effortless. By setting up recurring purchases, you harness the power of dollar-cost averaging without the stress of timing the market. Choose a fixed dollar amount and let Autoinvest buy every month—just like contributing to a 401k. It's like a 401k for your precious metals: consistent, disciplined investing that builds substantial holdings over time.

Is the Gold Sovereign right for you? If you value tangible assets, appreciate the intersection of history and investment, or seek to diversify your portfolio, the sovereign deserves serious consideration. For more insights, explore The Strategic Role of Gold in Long-Term Portfolio Management.

We believe every investor deserves to own real, physical precious metals without confusion or worry. That's the Summit Metals promise. Start building your precious metals portfolio today with Gold Sovereign coins that combine British tradition with modern investment wisdom.