Why the Gold Price American Dollar Matters Now More Than Ever

The gold price american dollar relationship is a crucial dynamic in modern finance. Understanding how these two assets typically move against each other is key to protecting your wealth and making smarter investment decisions.

Quick Answer: Gold Price in American Dollars Today

- Current Live Price: As of this publication, gold trades at approximately $3,850–$3,900 per troy ounce in USD.

- Price Per Gram: Roughly $124–$125 USD.

- Price Per Kilogram: Approximately $124,000–$125,000 USD.

- Key Relationship: Gold typically moves inversely to the US Dollar. When the dollar weakens, gold prices usually rise, and vice versa.

Because the US Dollar is the world's primary reserve currency, gold is almost always priced in dollars on international markets. This creates a powerful dynamic: when the dollar loses purchasing power, investors often turn to gold as a store of value. Conversely, a strong dollar can make gold less attractive to foreign buyers, potentially lowering prices.

This isn't just theory. In 2024, gold prices surged over 26% to record highs above $2,786. By summer 2025, gold had hit $3,500. These gains coincided with inflation concerns, Federal Reserve policy shifts, and geopolitical uncertainty that weakened confidence in the dollar.

For investors, gold acts as financial insurance. During economic instability—inflation, political turmoil, or market crashes—gold tends to hold or increase its value while paper currencies fluctuate. Central banks understand this well, collectively owning more than one-fifth of all gold ever mined.

Whether you're preserving retirement funds or diversifying beyond stocks and bonds, understanding how the dollar affects gold is essential. While not perfectly predictable daily, the long-term inverse correlation is clear.

I'm Eric Roach. After a decade structuring multi-billion-dollar hedging programs on Wall Street, I now translate that expertise into clear guidance for individuals seeking to protect their wealth with physical precious metals.

Understanding the Live Gold Price in USD

When tracking the gold price american dollar, you're watching the live spot price—the current market value for immediate gold trades. However, the spot price is a wholesale baseline, not what you'll pay a dealer for physical gold.

The retail price for gold coins or bars is always higher, as it includes the dealer's markup, manufacturing costs, and insurance. This difference is the premium. Understanding it is key to being a smart buyer. Learn more in our guide on Spot Price vs. Premium: How Precious Metals Pricing Works.

The live gold price in USD updates every few seconds as global trades are negotiated. You can View a live Gold Price chart by TradingView to see this in action.

What is the Spot Price of Gold?

The spot price is the current market price for immediate delivery of gold. It's determined by thousands of trades on major exchanges, with COMEX in New York setting the benchmark through gold futures contracts.

These contracts are agreements to trade gold at a set price on a future date. The most active contract serves as the reference for today's spot price. Because gold markets are global, trading is nearly 24 hours a day during the week (Sunday 6 PM EST to Friday 5:15 PM EST). This means breaking news can instantly move prices at any time.

As of this publication in early October 2025, the live gold spot price is around $3,878 per troy ounce. These constant price fluctuations respond to everything from Federal Reserve policy to investor sentiment. We explore these forces in our article Why Gold and Silver Prices Fluctuate.

From Ounces to Grams: Gold's Units of Measurement

Gold is priced in troy ounces, an international standard for precious metals. A troy ounce is heavier than a standard (avoirdupois) ounce:

- 1 Troy Ounce = 31.103 grams

- 1 Standard Ounce = 28.35 grams

This standardization ensures that a price quote of $3,850 per ounce means the same thing in Wyoming, London, or Hong Kong.

For metric conversions, one kilogram equals 32.151 troy ounces. So, a one-kilogram bar would cost approximately $123,781 at a spot price of $3,850 per troy ounce (before premiums). Understanding these units helps you compare prices across different products, from one-gram bars to one-ounce coins. Learn more in our guide Gold Prices Today in USA Per Gram.

This system provides a simple, universal baseline for all gold investments: the live spot price per troy ounce.

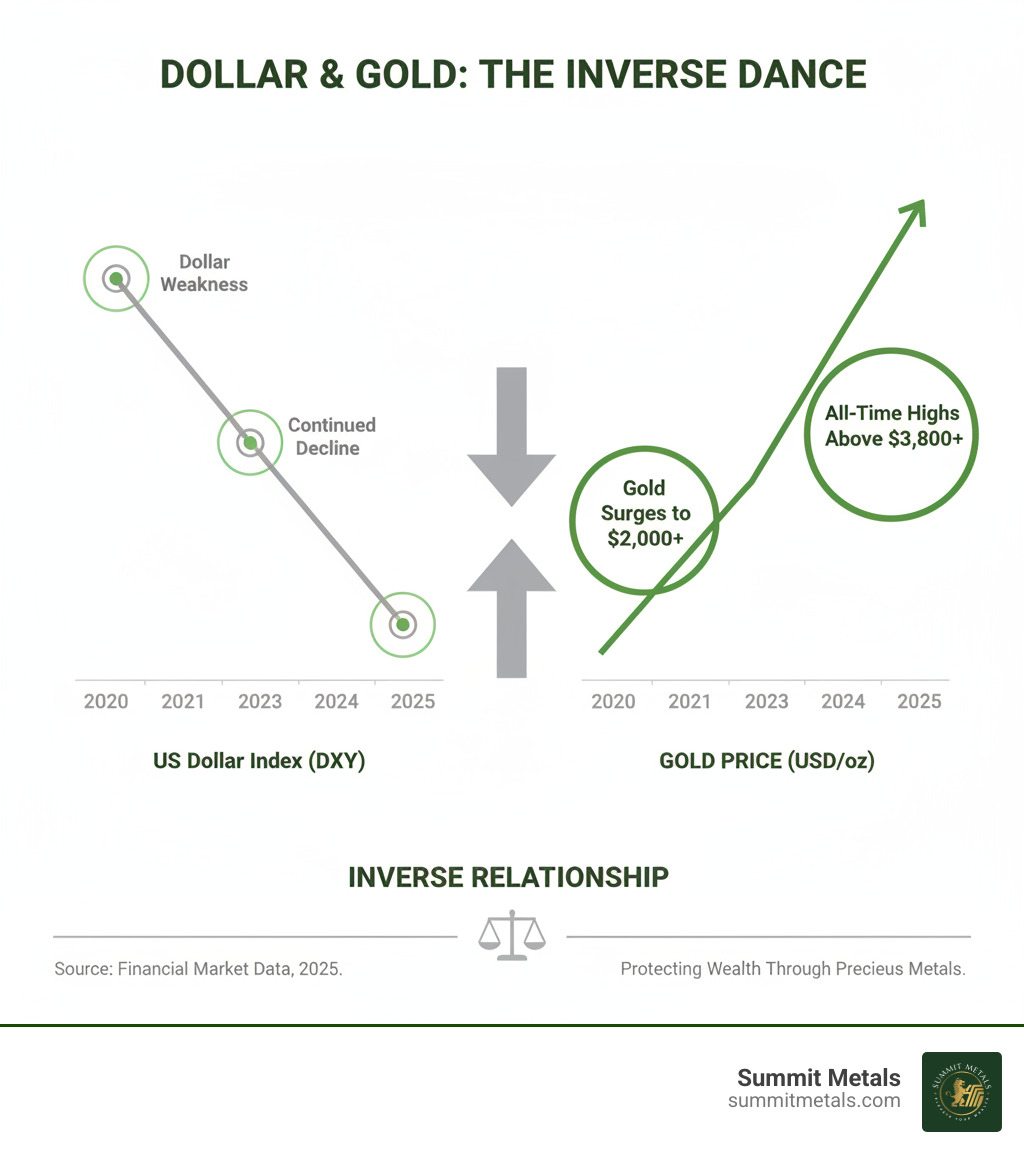

The Inverse Dance: How the American Dollar Dictates Gold's Value

There's a fascinating relationship between the US dollar and gold that plays out every single day in global markets. Think of it like a seesaw: when one side goes up, the other naturally comes down. This gold price american dollar dynamic directly affects the value of your investments.

The US dollar holds a unique position in the world economy as the primary reserve currency. This means most international transactions—including gold purchases—are conducted in USD, giving the dollar a unique influence over gold's price.

When the dollar strengthens, gold becomes more expensive for foreign investors using other currencies. This can dampen international demand and push gold prices down. A strong dollar also signals confidence in the US economy, making safe-haven assets like gold less appealing.

Conversely, when the dollar weakens, gold becomes cheaper for international buyers, which often increases demand and drives prices higher. Dollar weakness typically reflects deeper concerns like inflation or political uncertainty, making gold's stability more attractive.

The US Dollar Index (DXY), which tracks the dollar against other major currencies, is a key indicator for gold's next move. Significant swings in the DXY often precede corresponding movements in gold prices.

While this inverse relationship isn't perfect daily, the long-term pattern is clear. During periods of dollar weakness, gold has consistently risen to fill the gap as a reliable store of value. Understanding this dance is essential for diversifying beyond dollar-denominated assets. Learn more in our analysis on The Declining Power of the US Dollar and Its Global Implications: What It Means for Precious Metals Investors.

Key Factors Driving the Gold Price American Dollar

The gold price american dollar is influenced by a web of economic forces, central bank decisions, and global events. Understanding these drivers helps you anticipate price movements.

Economic Indicators: Inflation and Interest Rates

Inflation and interest rates are the two most powerful economic forces affecting gold.

Gold is a classic inflation hedge. When inflation erodes the dollar's purchasing power, investors seek assets that preserve wealth. Gold has historically filled this role, as its value tends to hold or increase while cash loses real-term value. Even "Bond King" Jeffrey Gundlach has highlighted gold as a key tool to prepare for higher inflation.

Interest rates present an "opportunity cost." When the Federal Reserve raises rates, interest-bearing assets like bonds become more attractive. Higher interest rates generally push gold prices down, while lower rates make gold more appealing. The key metric is real interest rates (nominal rates minus inflation). When real rates are negative, holding cash means losing purchasing power, making gold an especially strong alternative. Explore this in The Interplay of Interest Rates, the Dollar and Gold Prices.

Geopolitical Climate and Market Sentiment

Gold is a "safe-haven asset" that thrives in turbulent times. Geopolitical tensions, political instability, and financial crises drive investors toward gold's perceived safety. During the 2008 financial crisis, for example, gold prices climbed as stock markets fell.

Recently, gold has rallied even alongside a strong stock market, signaling deep underlying concerns. Worries about government shutdowns, global unrest, and inflation have sustained risk aversion, creating upward pressure on the gold price american dollar as investors seek portfolio balance.

Central Bank Activity and Global Demand

Central banks are major players in the gold market. The USA holds the world's largest reserve at 8,133 metric tons. When central banks buy gold, it signals institutional confidence and creates significant demand. Strong central bank buying in recent years has been a key driver of gold's price appreciation.

Consumer demand, led by China and India, also plays a crucial role. Cultural traditions and economic growth in these nations drive consistent demand for gold jewelry and investment products. Industrial demand for gold in electronics provides a smaller but steady source of consumption.

Projections from institutions like UBS, which forecast prices reaching $3,900 by mid-2026, reflect this combination of strong investment demand, central bank buying, and expectations of falling real interest rates. This confluence of factors highlights gold's role in wealth protection, as explored in Price of Gold and Silver Bullion: Essential Investments for Wealth Protection Amid Economic Uncertainty in 2024 and Gold Surges Past $2,700: What It Means for Investors and How to Protect Your Wealth in 2024.

A Historical Look at the Gold Price American Dollar

The history of the gold price american dollar reveals a story of economic shifts and gold's resilience. Understanding this past helps clarify its role today.

For much of the 20th century, the Gold Standard tied the US dollar to a fixed amount of gold. This provided currency stability but limited economic flexibility.

Everything changed in 1971 when President Nixon severed the dollar's link to gold. This "Nixon Shock" allowed gold's price to float freely. In the inflationary 1970s that followed, gold skyrocketed from $35 per ounce to over $800 by 1980 as investors fled the eroding dollar.

The 1980s and 1990s were calmer, with gold prices stabilizing. However, the 2000s brought a new bull market. The 2008 financial crisis, in particular, drove investors back to gold's safety, pushing prices from around $250 in 2000 to over $1,900 in 2011.

After a pullback to around $1,050 in 2015, gold began its most recent, remarkable surge. It broke $2,700 in 2024 and climbed past $3,800 by late 2025. This rally reflects persistent inflation, unprecedented monetary policy, and geopolitical tensions. The gold price american dollar relationship continues to show that when confidence in paper money falters, gold shines.

Explore these trends with our Gold Prices Today: Live Gold Price Chart, Historical Data.

What's the lesson from this history? While gold prices fluctuate, the long-term trend demonstrates its enduring role as a hedge against currency debasement and economic instability.

Investing in Gold: Strategies and Options

Understanding the gold price american dollar relationship leads to the next step: how to invest. Physical gold offers tangible security that paper assets cannot. It's a form of wealth that has outlasted every financial crisis in history.

Gold plays a unique role in portfolio diversification. It often moves independently of stocks and bonds, providing a cushion during market downturns. This is about creating balance and resilience in your financial plan. For more on precious metals strategy, see our guide on Understanding the Gold, Silver Ratio: A Key Indicator for Precious Metals Investors.

Physical Gold: Coins vs. Bars

When buying physical gold, the main choice is between coins and bars. Both are excellent forms of bullion, but they serve different investor needs.

Gold coins like the American Gold Eagle are minted by governments and carry legal tender face value. This government backing provides an extra layer of security and fraud protection, as they are difficult to counterfeit. Coins are also easily divisible for smaller sales and can carry numismatic value for collectors. Learn more in The Golden Truth: A Guide to 50 Buffalo Gold Coin Values & Prices.

Gold bars are the most efficient way to acquire the maximum amount of gold for your money. They typically have lower premiums per ounce than coins, especially in larger sizes. Produced by private mints, their authenticity is verified by assay certificates and dealer reputation.

Here is a quick comparison:

| Feature | Gold Coins | Gold Bars |

|---|---|---|

| Security | High (Government-backed, legal tender, anti-counterfeit designs) | Moderate (Relies on assay and dealer reputation) |

| Premiums | Generally higher per ounce | Generally lower per ounce, especially for larger bars |

| Liquidity | High (Easy to sell in small, standardized units) | Lower (Harder to divide; best for large transactions) |

| Best For | Investors prioritizing security, flexibility, and government backing. | Investors focused on acquiring the most gold for the lowest cost. |

The bottom line: Coins offer superior security and flexibility, while bars offer maximum efficiency for large investments. Many investors choose to hold both.

A Smart Approach to the Gold Price American Dollar: Dollar-Cost Averaging with Autoinvest

Trying to time the market is a losing game. The gold price american dollar fluctuates daily, and waiting for the "perfect" price often means never investing at all.

A better strategy is dollar-cost averaging: investing a fixed amount at regular intervals. This removes emotion and market timing from the equation. When prices are low, you buy more gold; when they are high, you buy less. Over time, this averages out your purchase price. It's the same disciplined approach used in 401(k) plans.

Summit Metals' Autoinvest program makes this simple. You can set up automatic monthly purchases to build your precious metals portfolio systematically, just like your retirement savings. Set up your monthly gold purchase with Autopays and let discipline build your wealth.

With Autoinvest, you're not trying to outsmart the market. You're consistently accumulating real, physical wealth, ensuring you're prepared for inflation or market turmoil. It's the smartest way to invest in gold without the stress of daily price watching.

Frequently Asked Questions about the Gold Price American Dollar

Here are answers to some of the most common questions about the gold price american dollar.

How often does the gold price change?

The gold spot price changes every few seconds during market hours (Sunday 6 PM EST to Friday 5:15 PM EST). This constant movement reflects real-time supply and demand as traders react to news and economic data on global exchanges like COMEX.

Why is gold priced in US dollars?

Gold is priced in US dollars because the USD is the world's primary reserve currency. Most international trade, especially for commodities, is conducted in dollars. This makes the USD the universal benchmark for pricing gold, affecting its cost for investors everywhere. A weaker dollar makes gold cheaper for foreign buyers, often increasing demand and price.

Is physical gold a good hedge against inflation?

Yes, historically gold has been one of the most reliable hedges against inflation. Because it is a finite physical asset that cannot be printed like currency, its value tends to hold or increase when the purchasing power of paper money falls. This pattern was clear during the high inflation of the 1970s and has been seen again in the 2020s as gold prices reached new highs.

For those looking to use gold as an inflation hedge, a consistent approach is best. Consider dollar-cost averaging through our Autoinvest program to build your holdings steadily over time, smoothing out price fluctuations.

Conclusion

The gold price american dollar relationship is a fundamental dynamic affecting your financial security. As we've seen, gold typically strengthens when the dollar weakens, driven by inflation, interest rates, and geopolitical events.

Gold's ultimate value lies in its proven ability to preserve wealth through every major economic crisis in modern history. From the 1971 end of the gold standard to the financial crises of 2008 and the uncertainties of today, gold has consistently served as a safe-haven asset.

For investors, gold is financial insurance—a tangible asset that protects your wealth when paper currencies and markets are volatile. It's an essential tool for diversification, retirement protection, and long-term wealth building.

At Summit Metals, we make precious metals investing straightforward and transparent. Based in Wyoming, USA, we provide authenticated gold and silver at competitive rates with real-time pricing and no hidden fees. Whether you prefer the government-backed security of coins or the low-premium efficiency of bars, we are here to help.

The simplest way to build your holdings is through consistency. Our Autopays program allows you to use dollar-cost averaging to invest steadily, taking emotion and market timing out of the equation.

Ready to protect your financial future? Explore our selection of authenticated precious metals. Learn Everything You Need to Know About American Eagle Coins to see why these government-backed coins offer best security and peace of mind.