Why Understanding Gold Bar vs Coin Differences Matters for Your Investment Success

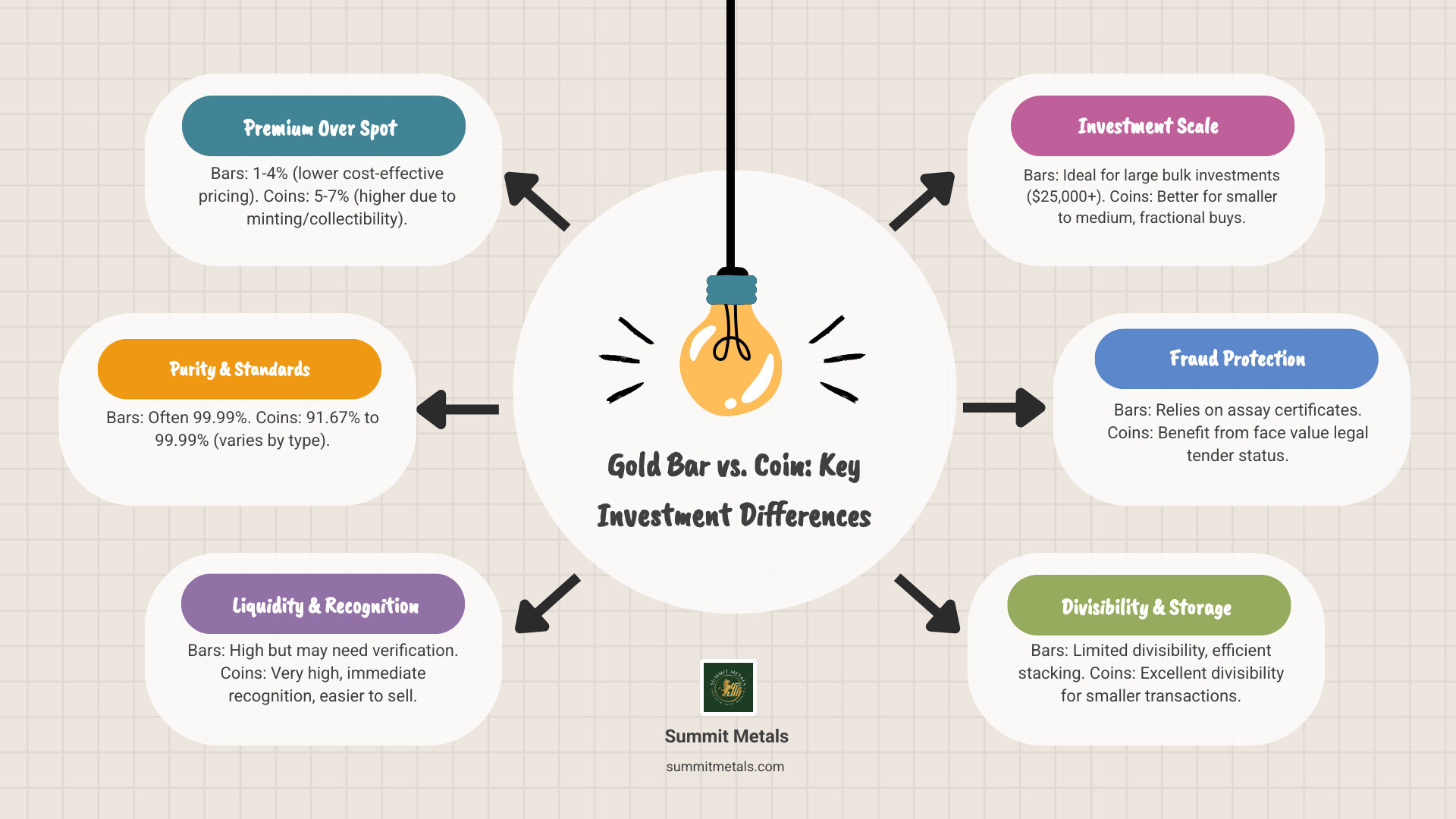

The gold bar vs coin decision is one of the most critical choices for a precious metals investor. Here's a quick comparison:

| Factor | Gold Bars | Gold Coins |

|---|---|---|

| Premium over spot | 1-4% | 5-7% |

| Purity | 99.99% | 91.67%-99.99% |

| Best for | Large investments ($25,000+) | Small to medium investments |

| Liquidity | High (may need verification) | Very high (immediate recognition) |

| Fraud protection | Assay certificates | Face value legal tender status |

| Divisibility | Limited | Excellent |

Choosing between bars and coins has significant financial implications. A $100,000 investment in bars can save you $2,000-$4,000 in premiums compared to coins. However, coins offer unique advantages like easier resale and legal tender status, which provides an extra layer of fraud protection.

Gold bars deliver maximum metal for your money, while gold coins provide flexibility, instant recognition, and the security of government backing. Many smart investors use both. You can use Summit Metals' Autoinvest program to dollar-cost average into gold monthly, just like a 401(k), removing the stress of timing the market.

I'm Eric Roach, a former Wall Street investment advisor. My experience in hedging and market analysis now helps everyday investors make informed gold bar vs coin decisions, translating institutional tactics into clear guidance for your portfolio.

Key Gold bar vs coin vocabulary:

- Reputable gold dealer

The Fundamentals: Production, Purity, and Value

How gold bars and coins are made explains their different premiums and investment roles. The manufacturing philosophy behind each product shapes its core characteristics.

Gold bars represent efficiency. They are created by casting molten gold into molds. This simple process keeps manufacturing costs low, resulting in lower premiums for investors.

Gold coins are crafted through an intricate minting process. Each coin starts as a blank that is struck with immense pressure to create detailed designs and security features. This artistic complexity adds to the cost but also the appeal.

The intrinsic value of both comes from their gold content, but the production journey affects price and resale. Bars maximize metal per dollar, while coins balance metal content with craftsmanship and legal tender status.

Purity Levels: What Does 99.99% Really Mean?

"99.99% pure gold" is the industry standard for investment-grade bullion, known as "four nines fine."

Gold bars typically achieve this 99.99% purity, with each bar accompanied by an assay certificate guaranteeing its weight and purity.

Gold coins have varying purity levels. Modern bullion coins like the Canadian Maple Leaf are 99.99% pure. However, popular coins like the American Gold Eagle are 91.67% gold (22-karat). These coins are not less valuable; they are alloyed with copper and silver for improved durability. A one-ounce American Gold Eagle contains exactly one troy ounce of gold, with the alloy adding to the total weight. Importantly, these 22-karat coins are explicitly approved for inclusion in precious metals IRAs, confirming their investment-grade status.

The Role of Mints and Refiners

The source of your gold is a key factor in the gold bar vs coin decision.

Government mints, like the U.S. Mint, provide legal tender status. An American Gold Eagle is official U.S. currency, which offers powerful fraud protection because counterfeiting legal tender is a serious federal crime. This government backing ensures instant global recognition, making the coins easy to sell without extra verification.

Private refiners, such as PAMP Suisse, focus on efficiency and security innovation, often including features like holographic strips or unique serial numbers on their bars. Products from LBMA-approved refiners meet strict global standards, ensuring they trade easily on international markets.

Brand recognition is crucial for resale. Well-known mints and refiners command better prices. The choice comes down to your priorities: government coins for liquidity and fraud protection, or private refiner bars for cost-effective accumulation. Summit Metals' Autoinvest program allows you to build positions in both over time, using dollar-cost averaging to remove market-timing stress.

A Head-to-Head Gold Bar vs Coin Comparison

Choosing between gold bars and coins is like picking a vehicle: both get you there, but they excel in different ways. Gold bars typically have premiums of 1-4% over spot price, while coins run 5-7%. On a $50,000 purchase, choosing bars could save you up to $3,000. However, coins offer something bars can't: legal tender status with a face value, providing built-in fraud protection.

| Feature | Gold Bars | Gold Coins |

|---|---|---|

| Typical Premium | 1-4% over spot | 5-7% over spot |

| Purity Standard | 99.99% (maximum gold content) | 91.67% to 99.99% (varies by coin) |

| Liquidity | High (may need verification) | Very High (instant recognition) |

| Divisibility | Limited (sell whole bar) | Excellent (sell individual coins) |

| Storage Efficiency | Superior (stackable, compact) | Good (may need individual protection) |

| Fraud Protection | Assay certificates, serial numbers | Face value legal tender status |

| Best Investment Size | $25,000+ (maximize cost savings) | Any amount (great for beginners) |

Many smart investors use both strategically—bars for core holdings and coins for flexibility. With Summit Metals' Autoinvest program, you can dollar-cost average into both formats monthly, building your position systematically like a 401(k).

Premium Costs: Getting More Gold for Your Dollar

The premium is what you pay above gold's spot price to cover manufacturing, distribution, and dealer markup. Gold bars win on cost, with low premiums of 1-4% due to their simple manufacturing. This makes them ideal for large investors. Coins have higher premiums of 5-7% because of their intricate minting process, but this cost includes benefits like instant recognition and legal tender protection. While smaller products have higher premiums per ounce, The Benefits of Buying Fractional Gold can be significant for those building wealth gradually.

The Allure of Coins: Numismatic Value and Collectibility

Coins can gain value beyond their gold content. This numismatic value is driven by rarity, historical significance, and collector demand. While bullion coins like American Gold Eagles are primarily valued for their gold, certain years or special editions can develop collector premiums. For more on this, see our Guide to Authentic Gold Buffalo Coins. This potential comes with responsibility, as a coin's condition is crucial to its numismatic value.

The Practicality of Bars: Purity and Efficiency

For investors focused on acquiring the most gold per dollar, bars are the clear choice. They typically offer 99.99% purity, meaning your money goes directly toward gold, not alloys. Their lower premiums translate into significant savings on large purchases. Bars are also highly efficient for storage due to their stackable, uniform shape. For those starting out, Fractional Gold Bars as an entry point provide these same benefits in smaller, more affordable sizes.

Practicalities of Ownership: Liquidity, Storage, and Taxes

Beyond the initial purchase, owning physical gold involves practical considerations that impact your investment experience. Understanding liquidity, storage, and taxes is crucial for success, whether you're making a large purchase or using Summit Metals' Autoinvest program for monthly acquisitions.

Liquidity and Divisibility: Cashing Out Your Investment

When you need to convert gold to cash, the gold bar vs coin choice matters.

Gold coins offer superior flexibility. Their standardized smaller sizes (e.g., 1/10 oz to 1 oz) allow you to sell only what you need. This divisibility is a major advantage. Furthermore, the legal tender status of government-issued coins means dealers worldwide recognize them instantly, ensuring a quick sale.

Gold bars are highly liquid but less divisible. You must sell a whole bar, which may be more than you intend. While bars from major refiners like PAMP Suisse are easily sold to dealers, they may require an extra verification step, unlike instantly recognizable sovereign coins.

Secure Storage: Protecting Your Assets

Keeping your gold safe is paramount. The form of your gold affects storage efficiency.

- Home Storage: A quality home safe offers 24/7 access but has security and capacity limitations. Standard homeowner's insurance policies typically offer minimal coverage for precious metals.

- Professional Storage: Bank safety deposit boxes are an option, but professional bullion depositories offer the highest level of security and full insurance.

Gold bars are more space-efficient. Their rectangular shape allows for dense, neat stacking, which can reduce storage costs in professional vaults that charge by volume.

Understanding the Tax Implications of a Gold Bar vs Coin

In the U.S., the IRS treats both gold bars and coins as "collectibles" for tax purposes. This means your gold bar vs coin choice does not affect your tax liability.

- Holding Period: Profits from gold held for one year or less are taxed as ordinary income. If held for more than a year, profits are taxed at the long-term collectibles rate, which is a maximum of 28%.

- Record Keeping: It is essential to track purchase dates and prices. Dealers are required to file Form 1099-B for certain large transactions.

These tax rules encourage a long-term, buy-and-hold strategy, which aligns well with using a program like Summit Metals' Autoinvest to build your position over time. For authoritative details, see IRS guidance: IRS Topic No. 409 and Publication 544.

Making Your Choice: Strategy and Security

Your gold bar vs coin decision should align with your personal investment goals, budget, and risk tolerance. A diversified approach, incorporating both forms of gold, can create a more resilient portfolio.

Which is Right for Your Investment Goals?

Your ideal choice depends on your strategy:

- Large-Scale Investors (over $25,000): Gold bars are often preferred for their lower premiums, maximizing the amount of gold acquired.

- Collectors and Smaller Investors: Coins are appealing for their artistry, history, and smaller unit sizes.

- Active Traders: Coins are favored for their superior liquidity and instant recognition, facilitating quick transactions.

- The Hybrid Approach: Many investors find success by combining both. Use bars for cost-effective core holdings and coins for flexibility and divisibility. For more on this strategy, see our guide on How to Compare Gold Bars vs Gold Coins.

The Importance of Reputable Dealers

Choosing the right dealer is even more critical than choosing between bars and coins. A reputable dealer is your guide to the precious metals market.

At Summit Metals, we stake our reputation on:

- Authenticity Guarantees: Every product is verified for weight and purity.

- Transparent Pricing: We offer competitive rates through our bulk purchasing power with no hidden fees.

- Purity Verification: Bars come with assay certificates, and coins have government backing.

Our Wyoming-based team is committed to your success. Look for dealers with a strong track record and clear policies.

Building Your Portfolio with Autoinvest

Trying to time the market is stressful and often ineffective. Dollar-cost averaging, which involves investing a fixed amount regularly, is a proven strategy to smooth out volatility.

Summit Metals' Autoinvest program automates this process. Like a 401(k) contribution, it allows you to systematically grow your precious metals holdings with consistent monthly purchases. This "set it and forget it" approach removes emotion from investing and builds wealth steadily over time.

Ready to build your portfolio without the guesswork? Explore Autoinvest options and start your journey with consistent, automated investing.

Frequently Asked Questions about Gold Bar vs Coin Investments

Here are concise answers to the most common questions investors have when weighing their gold bar vs coin options.

Are gold bars a better investment than gold coins?

Neither is universally "better." The best choice depends on your goals. Bars are better for maximizing gold weight for your money due to lower premiums, making them ideal for large-scale wealth preservation. Coins are better for flexibility, divisibility, and liquidity, and they offer potential numismatic value and added fraud protection via their legal tender status.

Which is more liquid, gold bars or gold coins?

Both are highly liquid, but coins generally have the edge in ease and speed of sale. Their government backing and standardized nature mean they are instantly recognized by dealers worldwide, eliminating verification delays. Reputable bars are also very liquid but may require an authentication step, especially at the local retail level.

Can I put gold bars and coins in a retirement account (IRA)?

Yes, both can be held in a self-directed IRA, provided they meet IRS requirements. The key standard is a minimum purity of .995 fine gold. This includes most investment-grade bars and many popular coins like the Canadian Maple Leaf. The American Gold Eagle is a notable exception, approved despite its 22-karat purity. The gold must be held by an approved custodian in a depository, not at home.

Your Final Verdict: Building a Resilient Portfolio

The gold bar vs coin debate has no single right answer—only the right answer for you. Think of it simply: bars are for maximizing weight, and coins are for maximizing flexibility.

- Gold Bars: Offer the most metal for your money with low premiums (1-4%) and 99.99% purity. They are the workhorses for efficient, large-scale wealth preservation.

- Gold Coins: Provide superior liquidity, divisibility, and government-backed fraud protection. Their higher premiums (5-7%) buy you flexibility and the potential for collector appeal.

For many, a balanced approach combining both is best. Build a core position with cost-effective bars and add coins for liquidity. Summit Metals' Autoinvest program makes this easy, allowing you to dollar-cost average into both formats monthly, building a diversified portfolio without the stress of market timing.

At Summit Metals, our Wyoming-based team is committed to being your trusted partner, offering transparent pricing and authentic products. Whether you choose the efficiency of bars, the flexibility of coins, or a strategic mix, we are here to help you build a resilient portfolio.

Get started with your gold investment strategy today and find how physical gold can strengthen your financial future.