Understanding Your Gold Investment Options

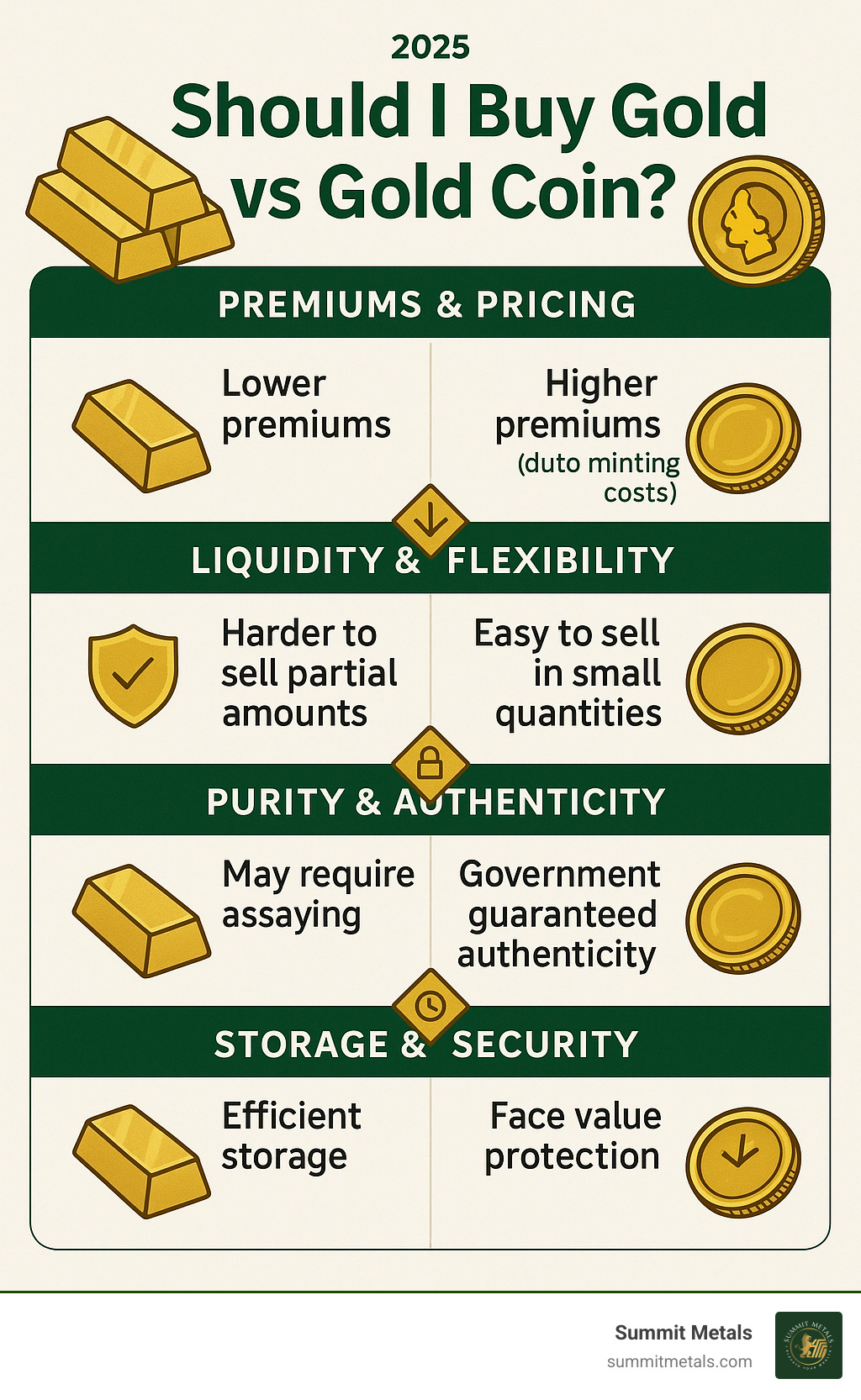

Should I buy gold bar vs gold coin is one of the most common questions new precious metals investors face. The answer depends on five key factors: premiums, liquidity, authenticity, storage, and your investment timeline.

Gold bars typically offer better value per ounce due to lower manufacturing costs, making them ideal for long-term wealth builders. In contrast, gold coins provide superior liquidity and flexibility due to their smaller denominations, government backing, and universal recognition. Their legal tender status also offers built-in fraud protection that bars don't have.

Here's a quick comparison to help you decide:

| Gold Bars | Gold Coins |

|---|---|

| Lower premiums (closer to spot price) | Higher premiums (due to minting costs) |

| Best for bulk investment | Better for small purchases |

| Harder to sell partial amounts | Easy to sell in small quantities |

| May require assaying | Government guaranteed authenticity |

| Efficient storage | Face value protection against fraud |

Your choice should align with your investment strategy. At Summit Metals, we help investors steer the should I buy gold bar vs gold coin decision based on their unique financial goals, prioritizing either cost efficiency or liquidity to build a resilient portfolio.

Factor 1: Premiums and Pricing

When shopping for gold, you'll pay the "spot price" plus a premium. This is where the should I buy gold bar vs gold coin question becomes a dollars-and-cents decision. Premiums cover refining, manufacturing, and dealer costs. Understanding them helps you maximize your investment.

Understanding Gold Bar Pricing

Gold bars are the cost-effective champions of precious metals. Their simple design keeps manufacturing costs low, meaning more of your money goes toward actual gold. Both cast (poured) and minted (cut) bars cost significantly less to produce than coins.

Larger bars offer better value due to economies of scale. A 1-kilogram gold bar has a much lower premium per ounce than a small 1-gram bar. Fractional gold bars are an affordable entry point, and while their premiums are higher per gram, they are often cheaper than equivalent-weight coins. They are perfect for building your position gradually through Summit Metals' Autoinvest program, which allows for consistent monthly purchases.

Understanding Gold Coin Pricing

Gold coins command higher premiums due to the detailed craftsmanship required for their designs. More importantly, they come with government guarantees of weight, purity, and authenticity. When you buy an American Gold Eagle or Canadian Maple Leaf, you're buying a promise from that nation's government.

This backing, along with their legal tender status, provides peace of mind and built-in fraud protection. Some coins may also develop numismatic value beyond their gold content, adding another potential layer of appreciation.

| Feature | 1 oz Gold Bar | 1 oz American Gold Eagle |

|---|---|---|

| Typical Premium | $35-40 over spot | ~9% (approx. $160 over spot)* |

| Government Backing | Private mint reputation | U.S. government guarantee |

| Legal Tender Status | No | Yes ($50 face value) |

| Fraud Protection | Serial numbers, assay cards | Legal tender status, intricate design |

| Best Investment Use | Bulk accumulation, long-term holding | Liquidity needs, flexible selling |

*Prices shown are at the time of this publication.

The bottom line: Bars maximize your gold per dollar, while coins maximize your options and security.

Factor 2: Liquidity and Flexibility

When deciding should I buy gold bar vs gold coin, liquidity—how easily you can convert your gold to cash—is crucial. Flexibility is about having options, like selling only what you need without liquidating a larger asset.

The High Liquidity of Gold Coins

Gold coins are the clear winners in liquidity. Their globally recognized designs, like the American Gold Eagle, are instantly trusted by dealers worldwide, leading to faster transactions.

The divisibility factor is a major advantage. If you own several 1-ounce gold coins and need to raise a small amount of cash, you can sell just one coin. Fractional coins (e.g., 1/10 oz) offer even greater flexibility, ensuring you only sell what you must. Furthermore, government-minted coins typically require no assaying upon resale, as their authenticity is backed by the issuing nation.

The Liquidity Challenge of Gold Bars

Gold bars, especially larger ones, present a liquidity challenge. Owning a 1-kilogram gold bar (worth over $79,000 at the time of publication) is great for storage, but selling a portion is impossible. You must liquidate the entire bar, even if you only need a fraction of its value.

This indivisibility can force you to sell more of your asset than intended. Additionally, larger bars may require assaying (testing) before a dealer will buy them, adding time and cost to the sale. While bars from reputable refiners face fewer problems, the process is rarely as seamless as selling a government-backed coin.

| Feature | Gold Bar | Gold Coin |

|---|---|---|

| Liquidity | Lower, especially for large sizes | High - widely accepted globally |

| Divisibility | Must sell entire bar | Available in multiple sizes (1 oz, 1/2 oz, 1/4 oz, 1/10 oz) |

| Ease of Resale | May require assaying | No assay needed, quick transactions |

| Best For | Long-term wealth building | Flexible access, emergency liquidity |

For long-term holding, bars are cost-efficient. For flexibility and quick access to cash, coins are superior.

Factor 3: Purity, Authenticity, and Guarantees

When investing in gold, knowing what you're getting is paramount. The should I buy gold bar vs gold coin decision is clearer when you understand how each protects you from counterfeits and guarantees purity.

Gold purity is measured in karats or fineness. 24-karat gold is at least 99.9% pure (.999 fine). Some coins, like the American Gold Eagle, are 22-karat (91.67% gold), mixed with alloys for durability. However, a 1-ounce Eagle still contains exactly one troy ounce of pure gold.

Verifying Gold Bars

Gold bars rely on the refiner's reputation. Quality bars are stamped with weight, purity, the refiner's hallmark, and a unique serial number. Your best protection is choosing bars from LBMA-approved refiners, whose products are trusted globally. However, the simpler design of bars makes them a more common target for sophisticated tungsten-filled fakes, which is why purchasing from a reputable dealer who uses advanced testing is crucial.

The Government Guarantee of Gold Coins

Government-minted coins offer official backing from sovereign nations—a guarantee of weight, purity, and authenticity that bars cannot match. Their legal tender status adds another layer of security and provides built-in fraud protection. Governments also use sophisticated anti-counterfeiting features, like micro-engraving and complex designs, making coins much harder to fake than bars. This trusted certification streamlines buying and selling, removing authentication problems.

| Security Feature | Gold Bar | Gold Coin |

|---|---|---|

| Authentication Method | Refiner hallmarks, serial numbers, assay certificates | Government guarantee, legal tender status, anti-counterfeit designs |

| Counterfeit Risk Level | Higher (especially non-LBMA refiners) | Lower (government backing, complex designs) |

| Fraud Protection | Relies on dealer testing and refiner reputation | Face value protection and government guarantee |

| Verification Ease | May require specialized equipment | Often identifiable by sight |

| Market Acceptance | Varies by refiner | Universal acceptance |

The government guarantee behind coins removes much of the authentication stress from gold investing.

So, Should I Buy Gold Bar vs Gold Coin for Your Portfolio?

Now that we've explored the key differences, let's answer the question: should I buy gold bar vs gold coin for your specific situation? The right choice depends on your investment strategy and financial goals.

The Case for Gold Bars: Maximizing Weight for Long-Term Wealth

If you are a long-term, buy-and-hold investor, gold bars are likely your best choice. Their lower premiums mean you get more gold for your dollar, which is ideal for building a foundation of wealth over decades. Bars are also highly efficient for bulk storage, as they take up less space than an equivalent value in coins.

The Case for Gold Coins: Prioritizing Flexibility and Divisibility

If you value portfolio flexibility and the ability to sell small amounts as needed, gold coins are the superior option. Their divisibility allows you to liquidate precise amounts without selling a large asset. Coins also offer legal tender status for built-in fraud protection and the potential for numismatic appreciation beyond their gold content. For ease of gifting or bartering, the universal recognition of coins is best.

How to Decide: A Consistent Approach with Autoinvest

Many smart investors use both bars and coins, balancing cost-efficiency with flexibility. However, the key to successful investing is consistency. Rather than trying to time the market, a strategy of dollar-cost averaging is often more powerful.

This is where Summit Metals' Autoinvest program shines. You can buy every month, just like investing in a 401k, removing market timing stress and building your position steadily. When prices dip, your fixed investment buys more gold; when they rise, you buy less. This disciplined approach smooths out volatility and helps you achieve a better average price over time.

| Your Primary Goal | Gold Bars | Gold Coins | Autoinvest Strategy |

|---|---|---|---|

| Maximum gold for your dollar | Best Choice - Lower premiums | Higher Cost - Higher premiums | Excellent - Averages out price over time |

| Flexibility to sell small amounts | Poor - Must sell entire bar | Ideal - Multiple size options | Great - Builds diverse holdings |

| Long-term wealth building | Ideal - Cost-efficient accumulation | Good - Still builds wealth | Excellent - Disciplined, consistent growth |

| Easy to sell when needed | Fair - May require assaying | Best - Widely recognized | Great - Regular purchases build liquid holdings |

| Protection against fraud | Good - Depends on refiner reputation | Superior - Government backing | Strong - Trusted dealer relationship |

| Storage efficiency | Best - Compact for large amounts | Fair - Takes more space | Good - Can choose optimal mix |

Frequently Asked Questions about Gold Bars vs. Gold Coins

What is the main advantage of gold bars over coins?

The biggest advantage is their lower premiums over spot price. Because bars are cheaper to manufacture, you get more gold for your money. This cost-efficiency makes bars ideal for large-volume, long-term investors focused on maximizing their physical gold holdings.

Why are gold coins typically more expensive than bars of the same weight?

Coins have higher premiums due to several factors: higher manufacturing costs for their intricate designs, the value of the government guarantee of weight and purity, and their legal tender status, which provides fraud protection. Some coins may also carry potential numismatic value based on rarity and demand.

What should I consider when deciding if I should buy gold bar vs gold coin?

Your decision should be based on your investment goals. Do you prioritize low cost for long-term holding (bars), or do you need liquidity and divisibility (coins)? Also consider your budget, storage plans, and how much you value the convenience and government backing of coins. Our Autoinvest program can help you build a position in either, removing the pressure of making a single large purchase.

How does the liquidity of gold bars compare to that of gold coins?

Gold coins offer superior liquidity. They are universally recognized, available in small denominations, and rarely require assaying (testing) before a sale. In contrast, gold bars, especially large ones, are less liquid. You cannot sell a portion of a bar, and it may require costly and time-consuming verification before a dealer will purchase it.

How can investors authenticate gold bars and coins to ensure they are genuine?

For bars, authentication relies on refiner hallmarks, serial numbers, and purchasing from trusted dealers who use professional testing. For coins, government backing is the ultimate authentication. Their legal tender status, intricate anti-counterfeiting designs, and global recognition make them far more secure. At Summit Metals, we source all products from reputable mints and refiners, guaranteeing authenticity so you can invest with confidence.

Conclusion: Making the Right Choice for Your Financial Future

After exploring the should I buy gold bar vs gold coin debate, it's clear there is no single correct answer. The best choice depends on your personal investment goals.

- Choose Gold Bars if your priority is maximizing your gold holdings for the lowest cost, focusing on long-term wealth preservation.

- Choose Gold Coins if you value flexibility, liquidity, and the peace of mind that comes with a government guarantee and built-in fraud protection.

Many savvy investors adopt a balanced approach, building a core position with cost-effective bars while holding coins for liquidity. This strategy gives you the best of both worlds.

Consistency is more important than timing. The Summit Metals Autoinvest program allows you to dollar-cost average into a strong position over time. You can buy every month just like investing in a 401k, smoothing out market volatility and steadily building your portfolio.

At Summit Metals, our transparent, real-time pricing and bulk purchasing power ensure you get competitive rates and trusted products. We're here to help you make informed decisions with confidence. The most important step is getting started.