Unpacking the Goldback Phenomenon

Are goldbacks a scam? No, goldbacks are not a scam. They are legitimate physical gold products from Valaurum containing 24-karat gold. However, they are often misrepresented by sellers who falsely claim they are legal tender or sell them at inflated prices without proper disclosure.

Quick Answer: Goldback Legitimacy

- Real gold content: Contains 1/1000 troy ounce of 99.99% pure gold

- Not a scam product: Legitimate manufacturing with anti-counterfeiting features

- Warning signs: Sellers claiming "legal tender" status

- High premium: Cost roughly 100% over gold spot price

- Limited acceptance: Voluntary use only in select businesses

Since launching in Utah in 2019, Goldbacks have sparked intense debate. These unique notes contain real gold within a polymer coating, but confusion over their legal status has enabled fraudulent sales tactics. With over $20 million in circulation, many still question their legitimacy.

The controversy isn't about the product—a genuine gold item with advanced security—but its marketing. Some sellers mislead seniors and patriotic groups with false legal tender claims, operating cash-only and providing no receipts. They disappear when buyers realize Goldbacks aren't universally accepted.

Understanding the difference between legitimate sales and fraudulent schemes is crucial. The high premium over gold's spot price—around 100%—makes them expensive compared to traditional bullion, but this doesn't make them a scam.

I'm Eric Roach. My decade as a Wall Street investment banking advisor taught me how misinformation creates fraud from legitimate products. I'll use that experience to help you evaluate if are goldbacks a scam concerns are valid or if they're a viable alternative.

What Exactly Is a Goldback? A Look at Composition and Design

Goldbacks offer a way to carry physical gold in your wallet. They are a form of private currency, putting pure gold into a thin format that fits alongside credit cards.

Are goldbacks a scam regarding their composition? Absolutely not. These notes are an innovation in precious metals, created by Valaurum using a process called vacuum deposition.

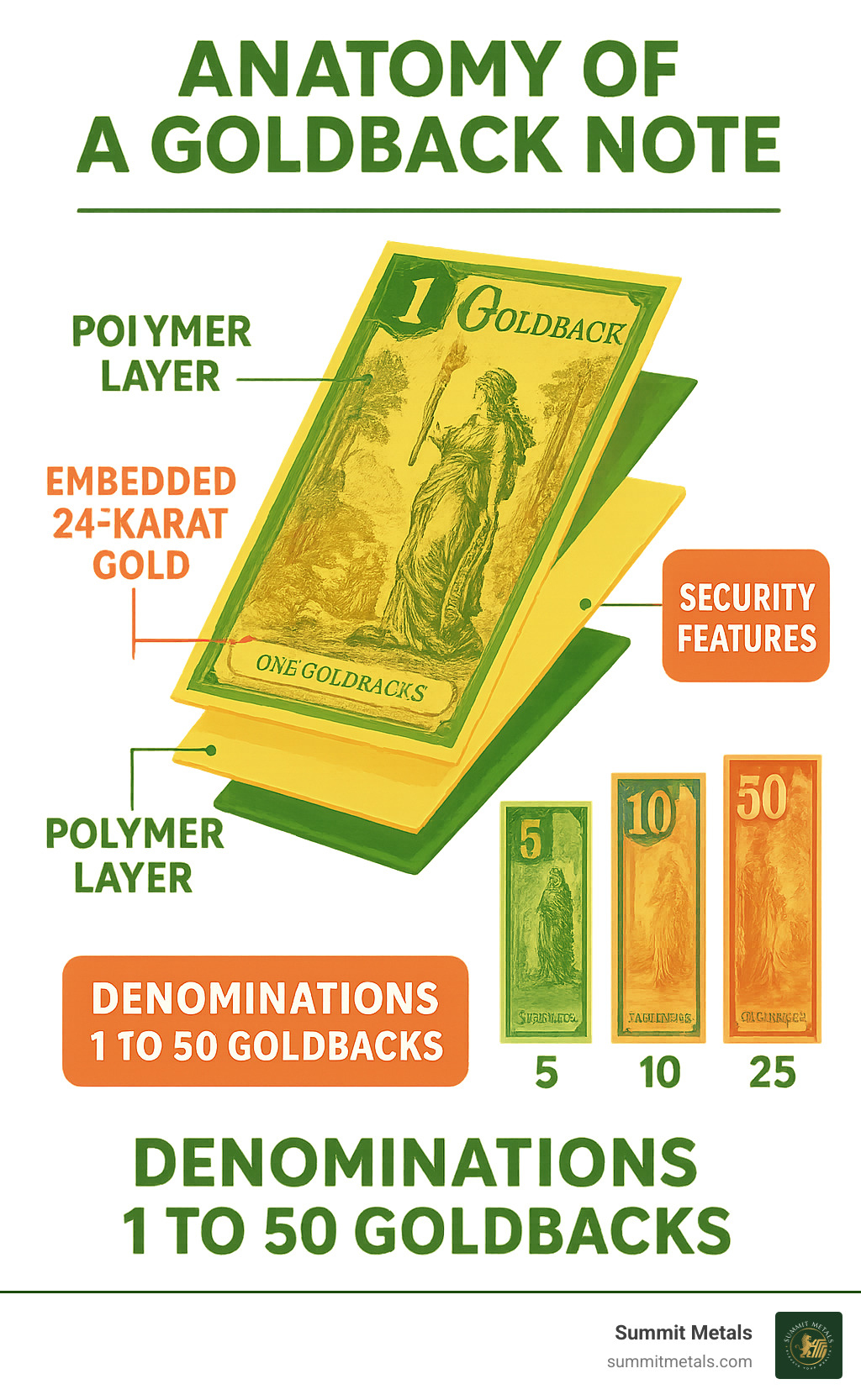

The manufacturing process is advanced. Using vacuum deposition, microscopic particles of 24-karat gold are fused onto a polymer film. This thin, durable gold layer is then sealed between protective polymer, ensuring flexibility and strength. The result is a note that handles like paper money but contains real, shimmering gold.

Goldbacks come in five denominations: 1, 5, 10, 25, and 50, each with proportionally more gold. Six states—Utah, Nevada, New Hampshire, Wyoming, South Dakota, and Florida—issue unique series. Each design showcases allegorical figures representing virtues like Liberty and Justice, along with local symbols, making them genuine works of art.

The Gold Content and Value

Each 1 Goldback contains exactly 1/1000th of a troy ounce of .9999 fine, 24-karat gold. This is exceptionally pure. A 5 Goldback holds 5/1000th of an ounce, and a 50 Goldback contains 50/1000th (1/20th) of an ounce, making gold accessible to more people.

Unlike fiat currency, Goldbacks derive their value from a direct spot price link to gold markets. Their value rises and falls with gold, giving them a tangible backing that paper money lacks.

While this fractional approach is an interesting entry point, serious investors focused on strategic investing and building wealth find better value in traditional bullion using dollar-cost averaging. For more on gold quality, see our guide on understanding karats and purity in gold.

Advanced Anti-Counterfeiting Features

Concern about counterfeiting is valid, but Goldbacks incorporate sophisticated anti-counterfeiting technology, making them very difficult to replicate.

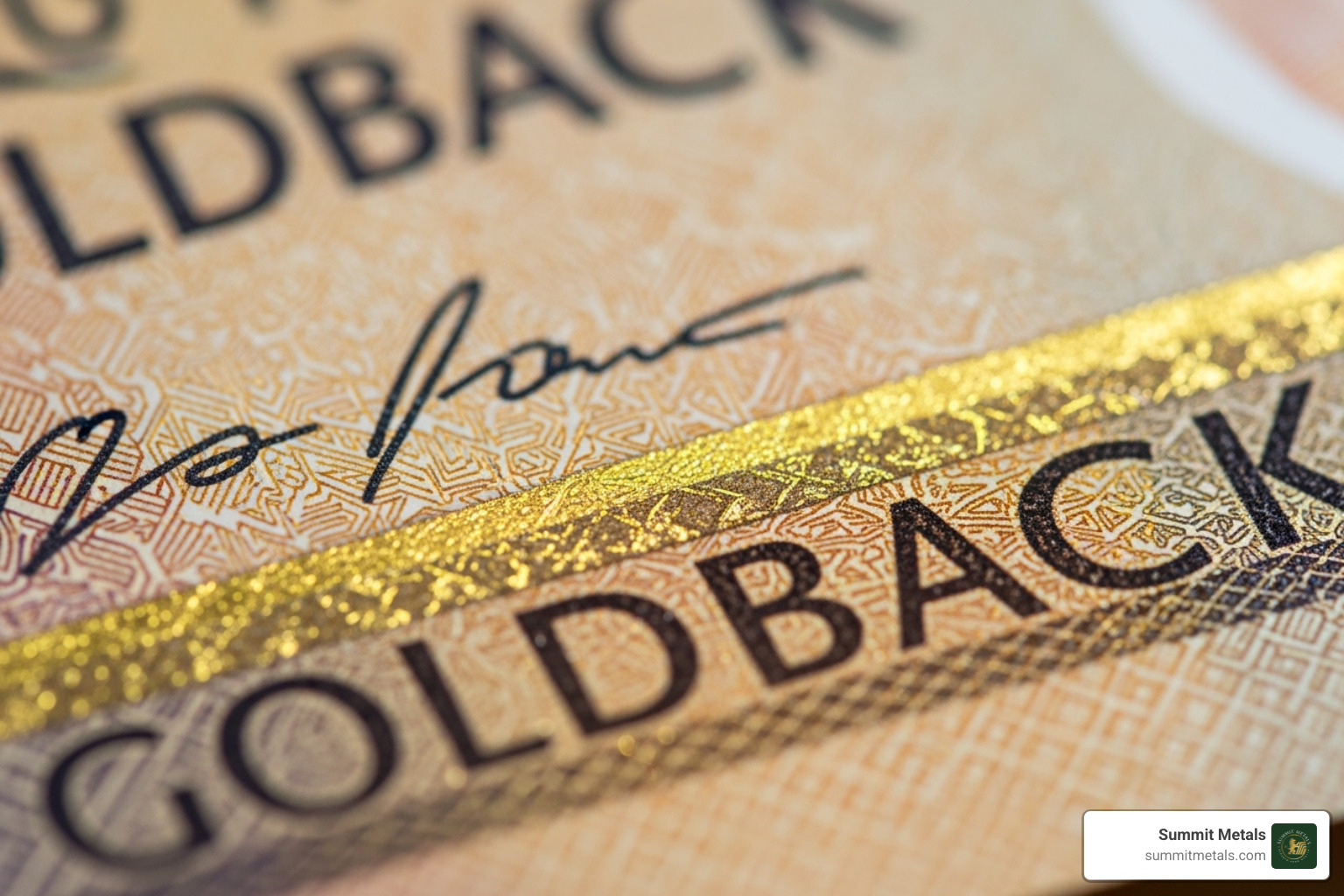

The security features are multilayered. A negative image on the reverse creates a unique texture. Microprinting adds details impossible for standard printers to copy. The unique texture and shimmer from real gold cannot be mimicked by inks. Each note also has serial numbers and other proprietary security measures.

Many experts consider Goldbacks harder to counterfeit than gold coins due to their unique manufacturing. This robust security establishes their legitimacy and protects consumers.

If you're ever unsure about a gold product's authenticity, our guide on how to spot fakes offers valuable tips.

The Legal Question: Are Goldbacks Legal Tender?

This legal gray area is what allows scam artists to make people ask, "are goldbacks a scam?" Let's clarify the facts.

The truth is Goldbacks are not federal legal tender. Businesses are not required to accept them for debts as they are with U.S. dollars. They are not government-issued currency. The notes themselves state they are a "Voluntary Negotiable Instrument" and "Privately Issued, Not U.S. Dollar Legal Tender." Valaurum is upfront about their status.

Goldbacks emerged from a movement to use precious metals in daily transactions. It began with laws like Utah's 2011 Utah Specie Legal Tender Act, which legalized the voluntary use of gold and silver for commerce. Wyoming, South Dakota, and other states followed with similar laws.

In practice, this means a growing network of businesses in these states voluntarily accepts Goldbacks. It's like bartering with a standardized, gold-backed medium. The key word is voluntary; no business is forced to accept them.

This is where fraudulent sellers cross the line. They mislead buyers by calling Goldbacks "legal tender" without explaining their voluntary, state-specific nature. They falsely imply you can use them for federal taxes or court-ordered debts, which is impossible.

While Utah's law exempts Goldbacks from state sales tax, it doesn't make them universally accepted currency. Goldbacks are a modern attempt to bridge gold's intrinsic value with currency's convenience, but only within willing communities. For more context, see our guide on a brief history of gold as money.

The bottom line: Goldbacks operate in a legitimate but limited legal space. They aren't a scam, but anyone selling them as universal legal tender is.

The Big Question: Are Goldbacks a Scam or a Legitimate Investment?

So, are goldbacks a scam? No. They are legitimate, innovative products with real gold and advanced security. The "scam" concerns stem from unscrupulous sellers who misrepresent them, not the product itself. The two main issues are the high premium over gold's spot price and the fraudulent sales tactics used by bad actors.

Why Some People Ask "Are Goldbacks a Scam?": The Premium Problem

The main issue is the high premium. Goldbacks often cost 100% or more over the spot price of gold, meaning you pay roughly double the value of the gold content. This premium understandably raises questions.

Here's what the premium covers:

- Manufacturing costs: Valaurum's vacuum deposition process is cutting-edge and expensive.

- Technology and research: Years of R&D went into perfecting the durable, secure notes.

- Divisibility and convenience: Goldbacks solve the problem of using gold for small transactions, which is impossible with coins or bars.

- Artistic and collectible value: The intricate, state-specific artwork appeals to collectors, adding to the price.

This premium makes Goldbacks inefficient for pure investment growth compared to traditional bullion, but it doesn't make them a scam. Learn more in our guide on understanding precious metals pricing.

How to Avoid Actual Scams Involving Goldbacks

The real danger lies with dishonest sellers. These scammers create the "are goldbacks a scam" narrative by targeting vulnerable groups with false promises.

Be aware of these red flags:

- Targeting seniors and patriotic groups with fear-based tactics.

- False legal tender claims, stating they can be used to pay federal taxes or debts.

- High-pressure, cash-only sales, often door-to-door with no paper trail.

- No recourse or contact information, leaving you with no way to get a refund.

- Outrageous pricing far beyond the already high standard premium.

To protect yourself, research any purchase, demand receipts, and use payment methods that create a record. If you encounter suspicious activity, contact your State Attorney General or the FTC at reportfraud.ftc.gov.

Buying from a reputable dealer is the safest approach. Our guide on how to avoid common precious metals scams offers more protection strategies. The bottom line: Goldbacks aren't a scam, but some sellers are. Know the difference.

Goldbacks vs. Traditional Gold: A Head-to-Head Comparison

Since Goldbacks themselves aren't a scam, let's compare them to traditional gold investments. The right choice depends on your goals.

| Feature | Goldbacks | Gold Coins (e.g., American Eagle) | Gold Bars |

|---|---|---|---|

| Premium Over Spot | Very High (often 100%+) due to manufacturing, divisibility, and artistry. | Moderate to High (due to minting, collectible appeal, legal tender status). | Low to Moderate (closest to spot, especially for larger bars). |

| Divisibility | Excellent (available in 1/1000 oz increments). | Good (available in fractional sizes like 1/10 oz, 1/4 oz, 1/2 oz, 1 oz). | Poor (typically 1 oz and larger, difficult to divide without melting). |

| Liquidity (Resale) | Limited (niche market, acceptance varies). | High (globally recognized, easy to buy/sell). | High (globally recognized, easy to buy/sell). |

| Transactional Use | Voluntary (accepted in limited, specific local economies). | Limited (not practical for small transactions, but can be used for large exchanges). | None (pure investment vehicle, not for transactions). |

| Government Backing | None (privately issued). | Yes (often issued by sovereign mints, legal tender face value). | None (pure bullion product). |

| Counterfeit Protection | Advanced (proprietary technology, intricate design). | High (mint security features, recognized designs, expert verification). | Moderate (serial numbers, assay cards, but simpler to fake than coins/notes). |

| Portability | Excellent (thin, flexible, lightweight). | Good (small, stackable, but heavier than Goldbacks for same value). | Moderate (dense, heavier, less portable for same value). |

| Investment Goal | Niche (barter, collecting, local economy support). | Primary (wealth preservation, diversification, collectible). | Primary (wealth preservation, diversification). |

Government backing is where gold coins excel. An American Gold Eagle has a legal tender face value backed by the U.S. government. While its $50 face value is symbolic compared to its gold value, it provides significant fraud protection. Counterfeiting government currency brings severe federal penalties, a deterrent private products like Goldbacks lack.

Premiums are lowest for gold bars, making them ideal for accumulating the most gold for your dollar. Goldbacks have the highest premiums, while coins are in the middle.

Divisibility is where Goldbacks shine, offering tiny denominations for small transactions. Liquidity is the strength of traditional gold; coins and bars are easily sold worldwide, whereas Goldbacks have a niche market.

For serious wealth building, use a dollar-cost averaging strategy with traditional gold via our Autoinvest program. Like a 401k, regular purchases smooth out price volatility and build your holdings over time.

The bottom line: Goldbacks are for barter, collecting, and supporting local economies. Traditional gold coins and bars are the workhorses for wealth preservation due to their liquidity and lower premiums. For a deeper dive, compare gold bars vs coins.

Frequently Asked Questions about Goldbacks

Let's answer some common questions about these unique gold notes.

What is the actual gold value of a 1 Goldback note?

A 1 Goldback note contains 1/1000th of a troy ounce of .9999 fine, 24-karat gold. Its intrinsic value fluctuates with the spot price of gold. To calculate it, divide the current gold price per ounce by 1,000. However, you'll pay a significant premium over spot to cover manufacturing, technology, and divisibility. This premium is why some question if "are goldbacks a scam" from an investment standpoint.

Can I really use Goldbacks to buy things?

Yes, but only where they are voluntarily accepted. Goldbacks are not federal legal tender. A growing network of businesses, especially in states like Utah, Wyoming, and New Hampshire, accepts them. Think of it as a sophisticated barter system. Always call ahead to confirm acceptance as the network is still niche.

Given the high premium, are Goldbacks a scam for investors?

This is key to the "are goldbacks a scam" question for wealth building. The answer: Goldbacks aren't a scam, but they are an inefficient investment vehicle. The high premium (often 100%+) means gold's price would need to double for you to break even on the metal content. For pure capital appreciation, traditional gold coins or bars offer better value.

Goldbacks are better suited as a practical barter tool, a unique collectible, or for their extreme divisibility. For wealth building, consider dollar-cost averaging with traditional gold products through our Autoinvest program. This strategy offers better long-term value for investors focused on wealth preservation.

The Verdict: Are Goldbacks Right for Your Portfolio?

So, let's answer the final question: are goldbacks a scam? The answer is a clear no. Goldbacks are legitimate, innovative products with real 24-karat gold, advanced manufacturing, and strong anti-counterfeiting features. The "scam" accusations stem from dishonest sellers, not the product itself.

Goldbacks occupy a specific niche. They are ideal for barter enthusiasts, collectors who appreciate their unique artwork, and those who want to support local economies that accept alternative currencies. They are educational tools and conversation starters about sound money.

However, as an investment vehicle, they are inefficient. For those focused on building wealth, the high premium—often 100% over spot—means you're paying double the gold's actual value, making them a poor choice for strategic investing compared to traditional bullion.

At Summit Metals, we prioritize transparency. While we appreciate Goldback innovation, we guide investors toward products that maximize their precious metals exposure. Our real-time, competitive pricing ensures you get the best value.

If your goal is building a portfolio over time, a dollar-cost averaging approach is superior. This involves investing a fixed amount regularly, which smooths out price volatility and removes market-timing guesswork.

Our Autoinvest program simplifies this process. You can set up automatic purchases of gold and silver, consistently building wealth without high premiums eroding your returns.

Ready to take a strategic approach to precious metals investing? Let's help you build real wealth with authentic gold and silver that maximizes your investment potential.