Why Building a Precious Metals Portfolio Matters Now

A precious metals portfolio is a strategic allocation of physical gold, silver, platinum, and palladium that serves as a hedge against inflation and economic uncertainty. With US Federal Debt rising and central banks continuing expansionary monetary policies, the purchasing power of fiat currencies faces ongoing pressure. In 2022, when stocks and bonds saw double-digit losses, gold climbed 0.4%, silver rose 6.3%, and platinum jumped 12.2%, highlighting why savvy investors use precious metals as portfolio stabilizers.

Physical precious metals offer what paper assets cannot: tangible wealth with no counterparty risk and a 5,000-year history as a store of value. This guide will show you how to build a resilient portfolio using institutional-grade risk management principles.

Why Add Precious Metals to Your Investment Strategy?

While traditional investments struggled in 2022, precious metals demonstrated their unique value. Gold climbed 0.4%, silver rose 6.3%, and platinum jumped an impressive 12.2%—all while stocks and bonds recorded painful double-digit losses. This resilience comes from their intrinsic value. Unlike stocks or bonds, precious metals can't be printed by a central bank, making them a true safe-haven asset.

The key benefit lies in their low correlation to other assets. When stocks zig, precious metals often zag, which helps smooth out your portfolio's performance and reduce overall risk. Even a modest allocation of 5% to 15% can act as powerful wealth insurance. Gold has a history of strong performance during downturns, proving its role as a portfolio stabilizer.

This is especially critical today. With the US Federal Debt rising by $1 trillion every 90 days, the risk of currency debasement is real. Precious metals have a centuries-long track record of maintaining purchasing power through inflation. During the 2008 financial crisis, gold prices climbed while the S&P 500 crashed. This counter-cyclical performance is why smart investors use precious metals to hedge against economic turmoil and uncertain central bank policies.

The Core Four: Understanding Your Metal Choices

Building a precious metals portfolio involves four main players: gold, silver, platinum, and palladium. Each has unique characteristics, from industrial demand and rarity to market size. Understanding these differences helps you build a balanced portfolio.

Gold: The Foundation of Your Portfolio

Gold is the cornerstone of a precious metals portfolio, boasting the largest market and highest liquidity. It has served as a monetary metal for millennia, and central banks worldwide hold vast reserves for stability. The U.S. holds the largest gold reserves at 8,133.5 tons as of August 2024. While used in jewelry and electronics, its primary role is as the ultimate store of value during economic uncertainty.

Silver: The Versatile Performer

Silver plays a dual role as both a monetary metal and an industrial workhorse. It is essential for solar energy, electronics, and other technologies. This industrial demand makes silver more volatile but also gives it higher growth potential than gold. Because its price is tied to both investment and industrial trends, silver often makes larger percentage moves. The USGS Silver Commodity Summary highlights its diverse modern applications.

Platinum and Palladium: The Industrial Powerhouses

These metals are the heroes of the automotive industry, used in catalytic converters to reduce emissions. They are incredibly rare, with production concentrated in South Africa and Russia. This supply concentration can lead to higher price volatility, as geopolitical issues or mining strikes can significantly impact the market. The auto industry consumes about 80% of the world's palladium, tying its price closely to vehicle sales. You can Learn about Platinum Group Metals to explore their unique market dynamics.

How to Invest: Choosing Your Method

When building your precious metals portfolio, your investment method impacts everything from ownership to liquidity. At Summit Metals, we champion owning physical precious metals—real assets you can hold.

Physical Metals: The Tangible Asset

Investing in physical coins and bars gives you true ownership without counterparty risk. You aren't relying on a third party's promise; you hold genuine wealth. At Summit Metals, we specialize in authenticated gold and silver with transparent, real-time pricing.

Deciding between coins and bars is a key step. Here’s a comparison:

| Key Factors | Gold Coins | Gold Bars |

|---|---|---|

| Premium over spot | Generally higher due to minting costs and design intricacy. | Typically lower per ounce, making them more cost-efficient for larger investments. |

| Liquidity | Highly liquid and easily recognizable. Government-minted coins are accepted worldwide. | Very liquid, but larger bars may require specialized buyers. |

| Divisibility | Perfect for small transactions; you can sell one coin at a time. | Less flexible, as you typically must sell the entire bar. |

| Counterfeit Protection/Face Value | Government-minted coins carry a legal tender face value, providing an extra layer of authenticity and legal fraud protection. | Rely on assay certificates and the mint's reputation for verification. |

| Storage | Easy to store in smaller quantities. | Larger bars can be bulky and require more robust storage. |

Gold coins offer a significant advantage: their legal tender face value provides an additional layer of fraud protection that bars cannot match. For more insights, Find the best silver and gold to buy and learn why liquidity is crucial.

Automating Your Investment with Summit Metals Autoinvest

Building your precious metals portfolio is simple with automation. Summit Metals' Autoinvest strategy allows you to make consistent monthly contributions, just like a 401(k).

This approach uses dollar-cost averaging to mitigate volatility. Your fixed dollar amount buys more metal when prices are low and less when they are high. It removes the stress of trying to time the market. With Autoinvest, you build your holdings steadily and methodically. Set it up once, and your portfolio grows automatically, month after month.

Set up your monthly purchase plan with Summit Metals and join our exclusive group of customers building wealth the smart way. No market timing needed—just consistent, disciplined investing.

Why Add Precious Metals to Your Investment Strategy?

Picture this: while your friends were watching their stock portfolios tumble in 2022, you could have been sipping your coffee with a smile. That year, when traditional investments were getting hammered with double-digit losses, precious metals told a different story entirely. Gold climbed 0.4%, silver jumped 6.3%, and platinum soared an impressive 12.2%. It's like having that one reliable friend who stays calm while everyone else is panicking!

Here's what makes precious metals so special: they march to their own beat. Unlike stocks that depend on company performance or bonds that rely on government promises, precious metals have intrinsic value. They can't be "printed away" by central banks or wiped out by a CEO's bad decision. This makes them your financial umbrella for those inevitable rainy days.

The magic happens because precious metals have a low correlation to traditional assets like stocks and bonds. When the stock market zigs, your gold might zag – or at least stand its ground. This isn't just theory; gold has a history of strong performance during downturns, proving time and again that it's genuine "upheaval insurance" against financial storms and geopolitical chaos.

The Role of Precious Metals in a Modern Portfolio

Think of precious metals as the steady, reliable anchor in your investment harbor. While your other investments might get tossed around by market waves, precious metals act as a portfolio stabilizer. They're not trying to be the star of the show – they're the dependable supporting actor that makes everything else work better.

The sweet spot for most investors? A modest allocation of 5% to 15% of your total investment portfolio. Yes, precious metals can be volatile – silver, for instance, tends to swing more dramatically than gold. But here's the beautiful part: that small percentage can actually reduce your overall portfolio risk while providing crucial long-term growth potential.

Many seasoned investors view gold as the ultimate "wealth insurance" – a tangible asset you can actually hold that preserves value across generations. It's not about getting rich quick; it's about staying rich over time.

Hedging Against Inflation and Economic Turmoil

Let's talk about the elephant in the room: our money is losing value faster than ice cream melts in summer. With the US Federal Debt rising by $1 trillion every 90 days and central banks worldwide printing money like it's going out of style, traditional currencies face constant pressure.

Here's where precious metals shine brightest. Gold has been the ultimate purchasing power protector for thousands of years. Want proof? In 1935, a basic car cost about $500 – equivalent to 14 ounces of gold. Today, those same 14 ounces are worth roughly $28,000, still enough to buy a decent vehicle. That's maintaining purchasing power in action!

During the 2008 financial crisis, while stocks were plummeting, gold prices actually climbed. This counter-cyclical performance isn't a fluke – it's what makes precious metals such powerful hedges against economic uncertainty and currency debasement. For centuries, countries tied their money directly to gold because they understood its inherent stability.

Building a precious metals portfolio isn't about betting against the economy – it's about protecting yourself when the economy bets against you.

The Core Four: Understanding Your Metal Choices

When we talk about a precious metals portfolio, we're primarily focusing on four key players: gold, silver, platinum, and palladium. Each of these investment-grade metals brings unique characteristics to the table, from their industrial demand and rarity to their market size and typical price behavior. Understanding these differences is crucial for building a diversified and resilient portfolio.

Gold: The Foundation of Your Portfolio

Gold is, without a doubt, the cornerstone of any precious metals portfolio. It boasts the largest market and the highest liquidity among all precious metals, making it incredibly easy to buy and sell. In fact, in 2021, an astounding US$130.9 billion worth of gold changed hands on an average day, cementing its status as one of the most liquid assets globally.

Historically, gold has served as a monetary metal, with central banks around the world holding vast reserves to stabilize their economies and currencies. Did you know that The U.S. holds the largest gold reserves, amounting to 8,133.5 tons as of August 2024? That's a lot of shiny stuff! Beyond its investment appeal, gold has practical applications in jewelry, dentistry, and electronics due to its excellent conductivity and corrosion resistance. Its primary role, however, remains as a timeless store of value, especially during times of financial instability or political crises. It's the ultimate "just in case" asset.

Silver: The Versatile Performer

If gold is the reliable patriarch, silver is the dynamic younger sibling in your precious metals portfolio. Silver plays a dual role, serving as both a monetary metal and a crucial industrial commodity. This versatility, however, also makes its price more volatile than gold's. While gold's price is heavily influenced by sentiment and economic factors, silver's price is significantly impacted by its broad industrial uses and fluctuating demand.

Silver is a workhorse metal, integral to various modern technologies. It's essential in solar energy panels, electronics (from batteries to microcircuits), and even water purification. Historically, it was also vital in photography. Because of its diverse applications, silver's value isn't solely tied to its role as a store of value; its industrial demand can drive significant price movements. For a deeper dive into silver's industrial applications and market, check out the USGS Silver Commodity Summary. We often see silver making bigger percentage moves than gold, offering higher growth potential for those with a bit more appetite for volatility.

Platinum and Palladium: The Industrial Powerhouses

While gold and silver often steal the spotlight, platinum and palladium are the unsung heroes of the precious metals portfolio, particularly due to their critical roles in industry. These metals are primarily consumed by the automotive sector, where they are indispensable components in catalytic converters. These devices reduce harmful emissions from vehicles, making platinum and palladium vital for environmental regulations worldwide.

What makes them so special? Rarity. Platinum, for instance, is far rarer than gold, with significantly less of it pulled from the ground annually. Both platinum and palladium mines are heavily concentrated in just a few locations globally, primarily South Africa and Russia. This supply concentration can lead to higher price volatility, as geopolitical events or mining disruptions in these regions can have a disproportionate impact on global supply. In 2023, South Africa was the world's largest producer of platinum and the second-largest producer of palladium (Russia was the first). About 80% of global palladium supplies, in particular, are used in catalytic converters, making its price highly sensitive to the automotive industry's health. To explore more about these fascinating metals, Learn about Platinum Group Metals.

How to Invest: Choosing Your Method

Now that we've explored the "why" and the "what," let's dive into the "how." When it comes to building your precious metals portfolio, choosing the right investment method is key. It impacts everything from accessibility and liquidity to your direct ownership of the asset. At Summit Metals, we believe in the unparalleled benefits of owning physical precious metals.

Physical Metals: The Tangible Asset

Investing in physical metals means owning actual coins and bars. This is the most direct way to invest, offering true ownership without counterparty risk – meaning you don't rely on a third party's promise. When you hold a gold coin or silver bar from Summit Metals, you hold real wealth. We specialize in authenticated gold and silver, ensuring trust and value for our investors with transparent, real-time pricing and competitive rates due to our bulk purchasing power.

Here's a quick comparison to help you decide between gold coins and gold bars for your portfolio:

| Key Factors | Gold Coins | Gold Bars |

|---|---|---|

| Premium over spot | Generally higher per ounce due to minting costs, intricate designs, and collectibility. | Typically lower per ounce, especially for larger bars, making them more cost-efficient for significant investments. |

| Liquidity | Highly liquid and easily recognizable, making them simple to sell in small increments. Government-minted coins are widely accepted. | Liquid, but larger bars might require more specialized buyers and could be less divisible for smaller transactions. |

| Divisibility | Excellent for small transactions or gifts. You can sell one coin at a time without breaking up a larger asset. | Less divisible. Selling a portion of a bar is not practical; you sell the whole bar. |

| Counterfeit Protection/Face Value | Government-minted coins have a legal tender face value (e.g., American Gold Eagle), which provides an additional layer of authenticity and legal protection against fraud. This face value is often nominal but signifies official backing. | Bars typically do not have a face value. Their authenticity relies on manufacturer hallmarks and assay certificates, which may require more verification when selling. |

| Storage | Easier to store in smaller quantities, whether in a home safe or a deposit box. | Larger bars can take up more space and may require more robust storage solutions. |

While bars offer a lower premium per ounce for larger investments, coins often provide greater flexibility and ease of transaction. The government-minted coins we offer, such as the American Gold Eagle or Canadian Maple Leaf, come with an assurance of purity and a legal tender face value. This face value, though typically below the melt value, adds a layer of fraud protection and makes them highly recognizable and easy to liquidate. It's like having official backing for your tangible wealth! For more insights on selecting your physical metals, check out Find the best silver and gold to buy.

Automating Your Investment with Summit Metals Autoinvest

Building a precious metals portfolio doesn't have to be complicated or require constant market watching. At Summit Metals, we've made it easier than ever with our Autoinvest program. This strategy allows you to set up monthly contributions, just like you might for a 401k or other retirement savings plan.

Autoinvest is our unique solution for dollar-cost averaging into precious metals. Instead of trying to time the market (which, let's be honest, is a fool's errand for most of us!), you consistently buy a set amount of gold or silver at regular intervals. This approach helps mitigate volatility because you're buying at various price points, averaging out your cost over time. It's a disciplined way to build your position in physical precious metals without the stress of daily market fluctuations.

This consistency is key. By making regular, automated purchases, you're steadily accumulating tangible wealth, building a robust precious metals portfolio brick by brick. It's exclusive to Summit Metals customers, designed to provide you with a hands-off, yet highly effective, investment strategy. No need to time the market—just buy every month automatically, and watch your physical holdings grow.

Set up your monthly purchase plan with Summit Metals today and start building your financial security with ease.

Building Your Precious Metals Portfolio: A Step-by-Step Guide

Building your precious metals portfolio is a thoughtful process. This guide provides a blueprint for creating a resilient allocation based on your goals.

Step 1: Define Your Allocation Strategy

Most experts recommend the 5-15% rule: allocate between 5% and 15% of your total investment portfolio to precious metals. This range provides meaningful diversification and inflation protection without over-concentration. Starting small is a smart way to learn the market dynamics. Your allocation should reflect your personal financial goals, risk tolerance, and investment timeframe.

Step 2: Diversify Within Your Metals

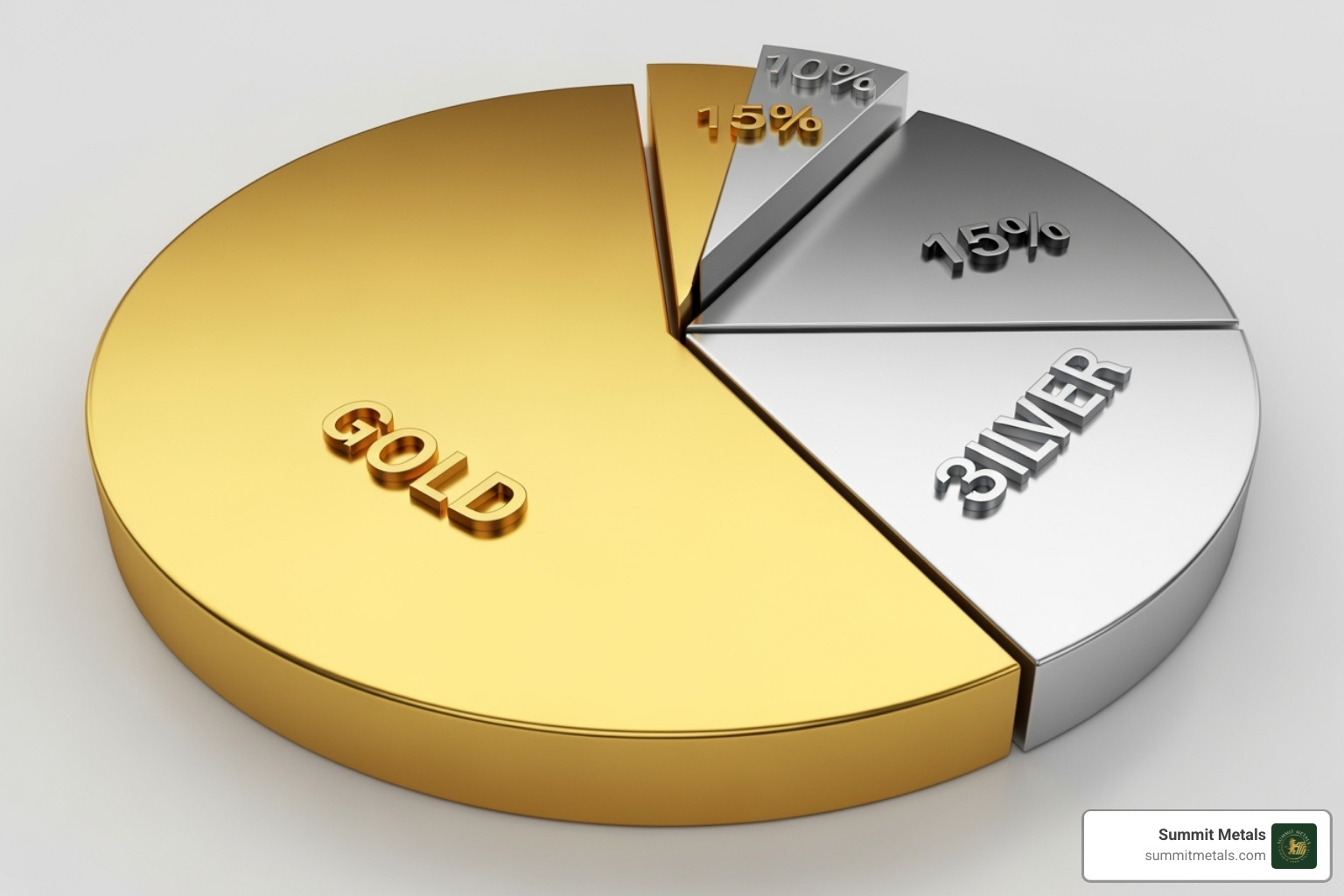

Once you set your overall allocation, diversify among the metals themselves.

- Gold (50-60% of metals allocation): As the most stable and liquid metal, gold should be the foundation of your holdings.

- Silver (30-40%): Silver's dual industrial and investment role gives it higher growth potential, though with more volatility.

- Platinum & Palladium (5-15%): These industrial metals offer further diversification, but their volatility makes a smaller allocation prudent.

The gold-to-silver ratio can help time purchases. A high ratio suggests silver may be undervalued relative to gold, and vice versa.

Step 3: Best Practices for New Investors

Follow these strategies for a successful start:

- Start with physical bullion: Owning physical coins and bars provides true ownership without counterparty risk.

- Focus on recognizable products: Government-minted coins like American Gold Eagles offer easy verification and liquidity, thanks in part to their legal tender face value.

- Understand premiums: You will pay a small amount over the spot price to cover minting and dealer costs. Summit Metals offers transparent, real-time pricing.

- Automate your purchases: Consider Summit Metals' Autoinvest program to dollar-cost average into physical metals with regular monthly buys, removing the stress of market timing.

Navigating the Market: Risks, Taxes, and Outlook

Investing in a precious metals portfolio requires understanding its unique market dynamics, from risks and volatility to tax implications.

Understanding Risks and Volatility

While precious metals are stabilizers, they are not immune to price swings, as tracked by indicators like the CBOE Gold Volatility Index. Unlike stocks, metal volatility is often a rational response to broad economic forces like inflation or currency concerns.

Owning physical metals also involves storage costs and security. Whether you choose a home safe, bank deposit box, or professional vault, these costs are part of the investment. You may also need additional insurance, as standard homeowner's policies may not fully cover your holdings. Many investors find these expenses a worthwhile price for the peace of mind that comes with owning a tangible asset.

Tax Implications for U.S. Investors

In the U.S., the IRS classifies physical precious metals as collectibles. This has a significant tax implication: long-term capital gains (on assets held over a year) are taxed at a collectibles tax rate of 28%. This is higher than the 15-20% long-term rate for most other investments like stocks. Short-term gains are taxed at your regular income rate. You must report all precious metals sales to the IRS. While the tax rate is higher, the diversification and wealth preservation benefits often outweigh this consideration. For details, see this guide on how collectibles are taxed and consult a tax professional.

Outlook for Your Precious Metals Portfolio in 2025

Looking ahead, the environment for precious metals remains favorable. Analysis from institutions like the World Bank points to ongoing economic uncertainty as a key driver. Central bank buying continues to provide a strong floor for gold prices, signaling institutional confidence. Persistent inflation trends and rising government debt also maintain the appeal of metals as a hedge against currency debasement. Building your position gradually through a program like Summit Metals' Autoinvest can help you steer price movements over the long term.

Frequently Asked Questions about Building a Precious Metals Portfolio

How much of my portfolio should be in precious metals?

Most experts recommend an allocation of 5% to 15% of your total investment portfolio. This range provides significant diversification and a hedge against inflation without overexposing your portfolio. Beginners can start at the lower end and increase their allocation as they become more comfortable.

What's better for a beginner: gold or silver?

Gold is often the best starting point for beginners due to its stability and high liquidity. It's the ultimate safe-haven asset. Silver offers a lower price per ounce and higher growth potential due to its industrial demand, making it a great addition for those with a slightly higher risk tolerance. Many investors start with a foundation in gold before diversifying into silver.

Why is owning physical metal important?

Owning physical metal provides direct ownership without counterparty risk, acting as true wealth insurance. Unlike paper assets, a physical coin or bar in your hand is a tangible asset independent of any financial institution's solvency. Its value is inherent. During a crisis, this independence is invaluable. Summit Metals specializes in authenticated physical gold and silver, offering you tangible wealth with transparent pricing and the security that comes from holding a real asset.

Conclusion: Securing Your Financial Future

Building a precious metals portfolio is a proactive step toward taking control of your financial destiny. These timeless assets provide crucial diversification, inflation protection, and long-term security that traditional investments often lack. While stocks can go to zero, physical gold and silver have preserved wealth for millennia, offering peace of mind that a portion of your assets exists outside the conventional financial system.

Taking control of your wealth means making smart choices to protect it. A 5-15% allocation to physical precious metals provides the stability your portfolio needs to weather any storm. Whether you start with a single coin or use our Autoinvest program for consistent monthly purchases, every ounce brings you closer to true financial independence.

At Summit Metals, we are your partner in achieving financial security. Our authenticated gold and silver, transparent pricing, and commitment to education make us a trusted ally in building generational wealth. We are here to help you turn uncertainty into opportunity.

Ready to take the next step? Whether you're buying your first piece or are ready to sell your precious metals, Summit Metals is here to support your journey with expertise and integrity.