Why IRA Gold Investment is Gaining Momentum in Today's Economic Climate

IRA gold investment allows you to hold physical precious metals in a tax-advantaged retirement account, providing portfolio diversification and protection against inflation. Here's what you need to know:

- What it is: A self-directed IRA that holds physical gold, silver, platinum, or palladium instead of traditional securities

- How it works: You work with an IRS-approved custodian to purchase and store precious metals in an approved depository

- Key benefits: Tax advantages, inflation hedge, portfolio diversification, and tangible asset ownership

- Investment limits: $7,000 annually for 2024-2025 ($8,000 if age 50+)

- Storage requirement: Must be held by an IRS-approved custodian or depository - no home storage allowed

With inflation hitting 2.7% in November 2024 and gold reaching all-time highs over $2,000 per ounce, more Americans are exploring precious metals as a hedge against economic uncertainty. Gold has historically maintained value during periods of market volatility, making it an attractive option for retirement planning.

The mechanics are straightforward but require careful attention to IRS regulations. You'll need to choose an approved custodian, fund your account through rollovers or contributions, purchase IRS-eligible metals, and store them in an approved facility. The precious metals must meet specific purity requirements - gold at 99.5% fineness, silver at 99.9%, and platinum and palladium at 99.95%.

However, IRA gold investment isn't without risks. Higher fees for storage and insurance, lack of dividend income, and potential liquidity challenges are important considerations. Experts recommend limiting precious metals to 10% or less of your overall portfolio for proper diversification.

I'm Eric Roach, and during my decade as an investment banking advisor in New York, I've helped Fortune 500 clients steer complex hedging strategies and market volatility. Today, I apply that Wall Street expertise to help individuals understand how IRA gold investment can serve as a defensive strategy within a diversified retirement portfolio.

What is a Gold IRA? Understanding the Fundamentals

A Gold IRA is a specialized, Self-Directed IRA (SDIRA) that allows you to hold physical precious metals like gold, silver, platinum, and palladium. Unlike a traditional IRA filled with paper assets like stocks and mutual funds, a Gold IRA holds tangible assets—real gold bars and coins. This structure provides the security of physical ownership combined with the tax-advantaged growth of a standard retirement account, meaning your metals can appreciate in value without being taxed until withdrawal in retirement. The IRS created a specific exception to allow certain high-purity precious metals in IRAs. For more details, you can review the official IRS guidelines on Individual Retirement Arrangements (IRAs) or our guide on Gold Investment 101: Turning Your Savings into Solid Gold.

How a Gold IRA Differs from a Traditional IRA

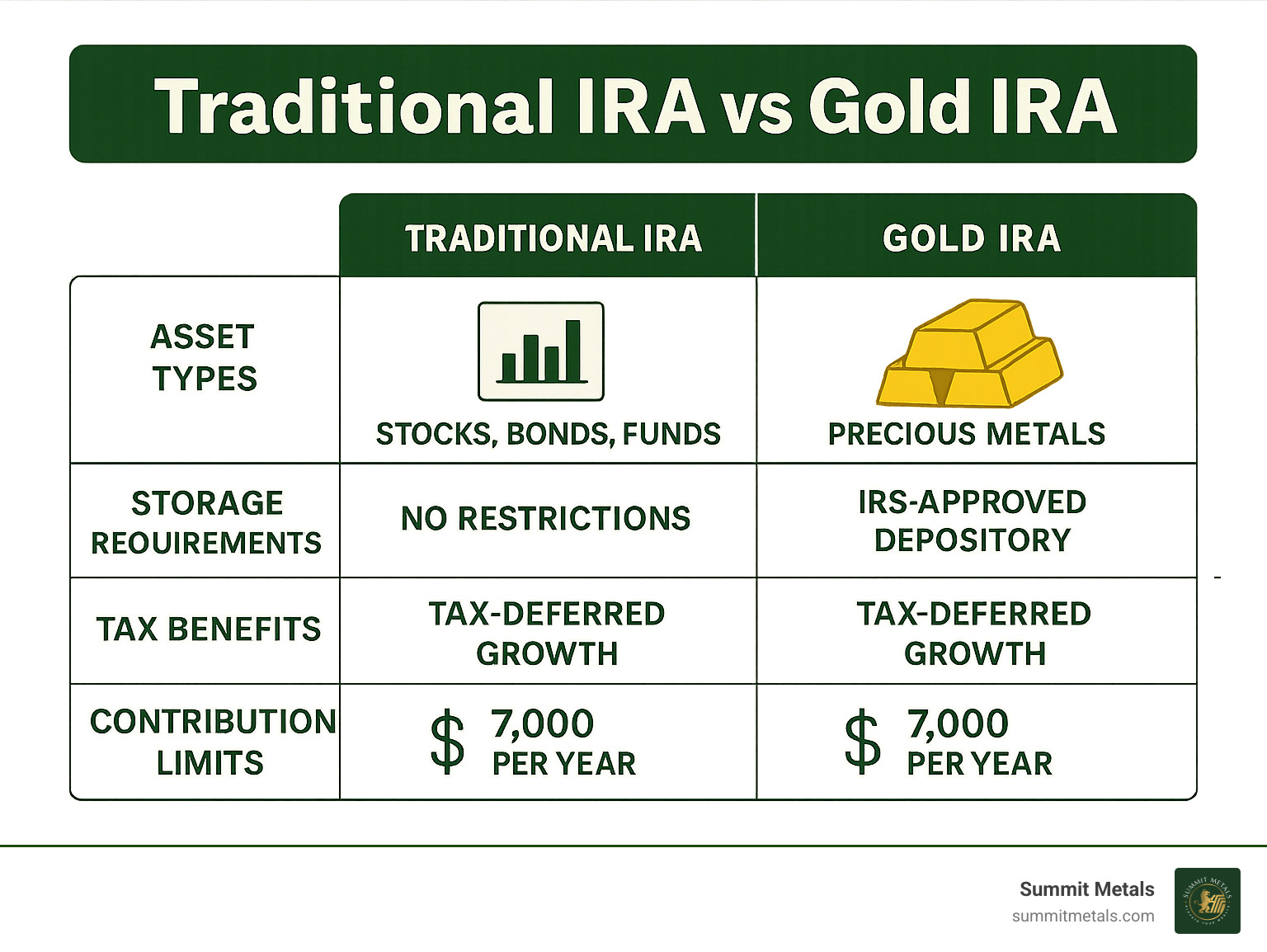

The core difference lies in the assets held.

- Traditional IRA: Holds paper or digital assets like stocks, bonds, and mutual funds.

- Gold IRA: Holds physical bullion, such as gold coins and bars.

This distinction affects practical matters like custodian requirements and fee structures, as managing physical assets is more complex than managing digital records. It also gives you more direct control over the specific physical products in your portfolio.

Types of Gold IRAs

Gold IRAs come in the same varieties as conventional IRAs, each with a different tax structure.

- Traditional Gold IRA: Contributions are often tax-deductible, and the investment grows tax-deferred. Withdrawals in retirement are taxed as ordinary income.

- Roth Gold IRA: You contribute with after-tax dollars (no upfront deduction), but your investment grows tax-free, and qualified withdrawals in retirement are also completely tax-free.

- SEP Gold IRA: Designed for self-employed individuals and small business owners, this account functions like a Traditional Gold IRA but allows for much higher annual contribution limits.

The Mechanics of an IRA Gold Investment: How It Works

Setting up an IRA gold investment is a structured process. It involves four main steps: choosing an IRS-approved custodian to set up the account, funding the account, purchasing your precious metals, and arranging for their secure storage in an approved depository.

The Role of Custodians and Depositories

The IRS requires that every Gold IRA be managed by an IRS-approved custodian. These specialized firms handle all administrative tasks, ensure IRS compliance, and have a fiduciary responsibility to act in your best interest. You can find a list of approved nonbank trustees and custodians on the IRS website.

Crucially, the IRS prohibits the home storage of IRA-owned precious metals. Taking physical possession is considered a taxable distribution, potentially subject to penalties. Your metals must be shipped directly from the dealer to an IRS-approved depository. These are highly secure, insured facilities. You can typically choose between:

- Segregated storage: Your specific coins and bars are held separately.

- Commingled storage: Your metals are held with those of other investors.

For more on storage, see our guide: The Ultimate Guide to Gold and Other Precious Metals Storage.

Funding Your Gold IRA Account

You have several options for funding your IRA gold investment:

- Rollovers: You can move funds from an eligible retirement account, such as a 401(k), 403(b), or Traditional IRA, into your Gold IRA without tax penalties. A direct rollover is the simplest method.

- Transfers: You can move funds from an existing IRA to your new Gold IRA custodian. This is a non-reportable event.

- Annual Contributions: You can make annual contributions up to the IRS limit, which is $7,000 for 2024-2025 ($8,000 if you are age 50 or older). This limit applies to all your IRAs combined.

While the IRS sets contribution limits, many Gold IRA companies have their own minimum investment requirements. Learn more about funding your account here: Maximizing Retirement Security: Using a Precious Metals IRA to Invest in Gold and Silver with Summitmetals.com.

IRS Rules for Precious Metals in an IRA

Understanding IRS rules is critical for a successful IRA gold investment. The Taxpayer Relief Act of 1997 created an exception to the general prohibition on holding collectibles in an IRA, allowing for specific types of investment-grade bullion.

The IRS rules, detailed in Publication 590, ensure that investments are in bullion valued for its metal content, not its rarity as a collectible. Getting this wrong can lead to significant taxes and penalties. For a complete overview, consult The Ultimate Rulebook for Precious Metals IRA Investors.

Eligible Precious Metals and Purity Requirements

The IRS allows four precious metals in an IRA, each with strict purity standards:

- Gold: Must be at least 99.5% pure (.995 fineness).

- Silver: Must be at least 99.9% pure (.999 fineness).

- Platinum: Must be at least 99.95% pure (.9995 fineness).

- Palladium: Must be at least 99.95% pure (.9995 fineness).

A notable exception is the American Gold Eagle coin, which is permitted despite its .9167 fineness due to its status as U.S. legal tender. Other popular IRA-eligible coins include Canadian Maple Leafs and American Silver Eagles. Bars from recognized refiners are also eligible if they meet the purity standards.

Contribution Limits and Withdrawal Rules for an IRA Gold Investment

Contribution limits for a Gold IRA are the same as for other IRAs: $7,000 for 2024-2025, plus a $1,000 catch-up contribution for those age 50 and over.

Withdrawal rules also mirror those of conventional IRAs.

- You can begin taking penalty-free distributions at age 59½.

- Withdrawals before this age typically incur a 10% penalty in addition to income taxes.

- Required Minimum Distributions (RMDs) for Traditional and SEP Gold IRAs begin at age 73.

- You have the option of taking in-kind distributions, where you receive the physical metal instead of cash. This is still a taxable event based on the metal's fair market value at the time of distribution.

Weighing the Pros and Cons of a Gold IRA

Deciding on an IRA gold investment requires weighing its unique benefits against its potential drawbacks. It is a long-term strategy focused on wealth preservation and diversification, not aggressive growth.

The Advantages: Why Consider a Gold IRA?

An IRA gold investment offers several key benefits within a tax-advantaged account:

- Portfolio Diversification: Gold often has a low correlation to stocks and bonds, meaning it can hold its value or rise when other assets fall.

- Inflation Protection: Historically, gold has maintained its purchasing power during periods of inflation when the value of fiat currency declines.

- "Safe Haven" Asset: During times of economic or geopolitical uncertainty, investors often turn to gold, which can drive up its price.

- Tangible Asset Ownership: Unlike digital stocks, physical gold is a tangible asset that cannot be erased or devalued by accounting scandals.

- Tax Benefits: A Gold IRA provides the same tax-deferred growth (Traditional) or tax-free withdrawals (Roth) as a conventional IRA.

For more on gold's role in a portfolio, see our guide on The Strategic Role of Gold in Long-Term Portfolio Management.

The Disadvantages and Risks of an IRA Gold Investment

It's crucial to be aware of the challenges associated with an IRA gold investment:

- Higher Fees: Gold IRAs typically have higher costs than traditional IRAs, including setup, annual administration, and storage fees. Bullion also carries a premium over the spot market price.

- Lack of Cash Flow: Gold does not produce income like dividends from stocks or interest from bonds. Returns depend solely on price appreciation.

- Price Volatility: The price of gold can be volatile and may experience long periods of stagnant growth.

- Liquidity Issues: Selling physical gold is less immediate than selling stocks. It involves finding a dealer and arranging the transfer, which takes time.

- Fraud Risk: The industry has attracted some bad actors who use aggressive sales tactics or push overpriced collectible coins. The U.S. Securities and Exchange Commission's guidelines warn investors to perform thorough due diligence.

Is a Gold IRA Right for You?

Deciding if an IRA gold investment is right for you is a personal choice based on your financial goals, risk tolerance, and investment timeline. It's wise to assess your own investor profile and consider consulting with a qualified financial advisor. You can find resources to locate a professional at investor.gov.

Who is a Gold IRA Best Suited For?

A Gold IRA often appeals to:

- Long-term investors who can hold the asset through market cycles.

- Investors seeking diversification to hedge against volatility in stock and bond markets.

- Individuals concerned about economic stability, inflation, and currency devaluation.

- Self-directed investors who want more control over their retirement assets.

Most financial experts recommend allocating 10% or less of an overall portfolio to precious metals to achieve diversification without overexposure to gold's specific risks.

Considerations When Investing in a Gold IRA

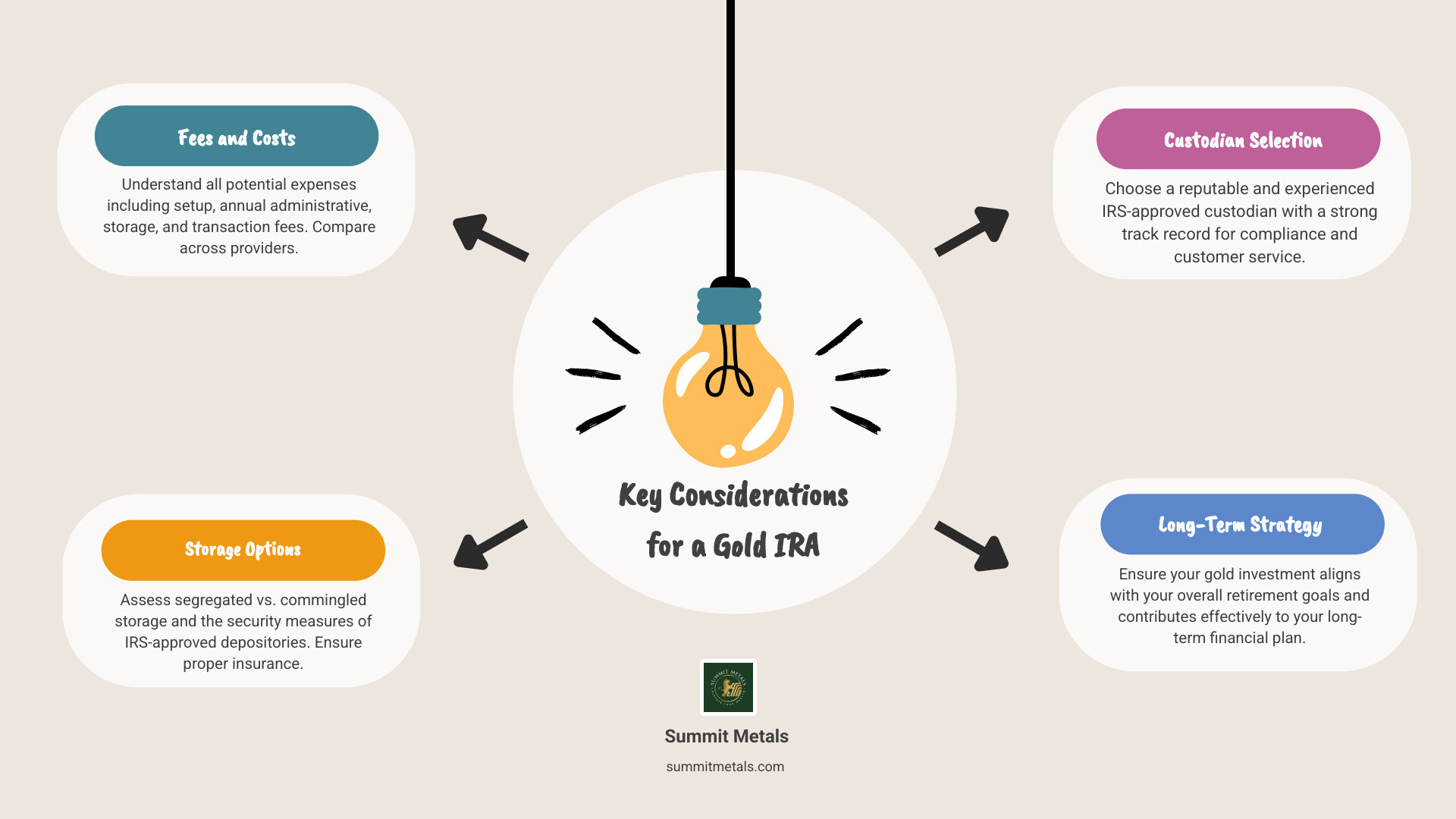

Before proceeding with an IRA gold investment, conduct thorough due diligence on these key factors:

- Fees: Understand all costs involved, including setup, administrative, and storage fees. At Summit Metals, we provide transparent, real-time pricing.

- Custodian and Storage: Select a reputable, IRS-approved custodian and depository. Decide between segregated and commingled storage based on your preference.

- IRS Compliance: Ensure any metals you purchase meet strict IRS purity and type requirements to avoid penalties.

- Reputable Provider: Work with a trusted company that prioritizes education and transparency over high-pressure sales tactics. Summit Metals has built its reputation on trust and helping investors make informed decisions.

Frequently Asked Questions about IRA Gold Investments

Here are answers to some of the most common questions we receive at Summit Metals about IRA gold investment.

Can I store my IRA gold at home?

No. IRS regulations strictly prohibit home storage for IRA-owned precious metals. The assets must be held in the physical possession of an IRS-approved custodian or depository. Taking personal possession is treated as a taxable distribution and may incur a 10% early withdrawal penalty if you are under age 59½.

What's the difference between a Gold IRA rollover and a transfer?

A transfer moves funds directly from one IRA custodian to another. It is a non-reportable event to the IRS. A rollover moves funds from a different type of retirement account (like a 401(k)) into an IRA, or involves you taking a temporary distribution and depositing it into another IRA within 60 days. Rollovers have stricter rules and are reportable to the IRS. A direct transfer is generally simpler and safer.

Are there minimum investment amounts for a Gold IRA?

The IRS does not set minimum investment amounts. These are established by the Gold IRA companies and custodians themselves. Minimums can range from a few thousand dollars to $25,000 or more, so it is important to check the requirements of any company you consider working with.

Conclusion

An IRA gold investment is a significant decision that can add a powerful layer of security to your retirement plan. We've covered the fundamentals, from how Gold IRAs work to the specific IRS rules that govern them. While they involve higher fees and specific storage requirements, the benefits of portfolio diversification, inflation protection, and tangible asset ownership can be invaluable, especially in uncertain economic times.

Success with an IRA gold investment depends on careful due diligence. This includes understanding IRS purity requirements, choosing a reputable custodian, and working with a trusted dealer. Most experts suggest limiting precious metals to 10% or less of your total portfolio to maintain balance. This strategy is not about replacing traditional investments, but about strengthening them with an asset that behaves differently.

At Summit Metals, our reputation is built on transparent, real-time pricing and competitive rates. Our Wyoming-based team is committed to providing authentic gold and silver and ensuring you have the information to make confident choices for your retirement. An IRA gold investment can be a key component in a strategy designed to weather economic storms and preserve your purchasing power for the long term.

Ready to explore how precious metals can strengthen your retirement portfolio? Set up your Precious Metals IRA with Summit Metals today and take the first step toward a more diversified financial future.