Why Silver Deserves a Place in Your Financial Strategy Today

Investment in silver gives you tangible wealth protection and flexible ways to add diversification.

Quick Answer: How to Invest in Silver

- Physical Silver: Buy coins, bars, or rounds for direct ownership

- Silver Stocks: Shares of miners or streaming/royalty firms

- Silver ETFs: Fund exposure (for example, iShares Silver Trust (SLV))

- Silver Futures: Leveraged contracts (advanced investors only)

- Recommended Allocation: 5-10% of your portfolio in precious metals

- For consistency: Dollar-cost average with Summit Metals Autoinvest (buy monthly like a 401(k))

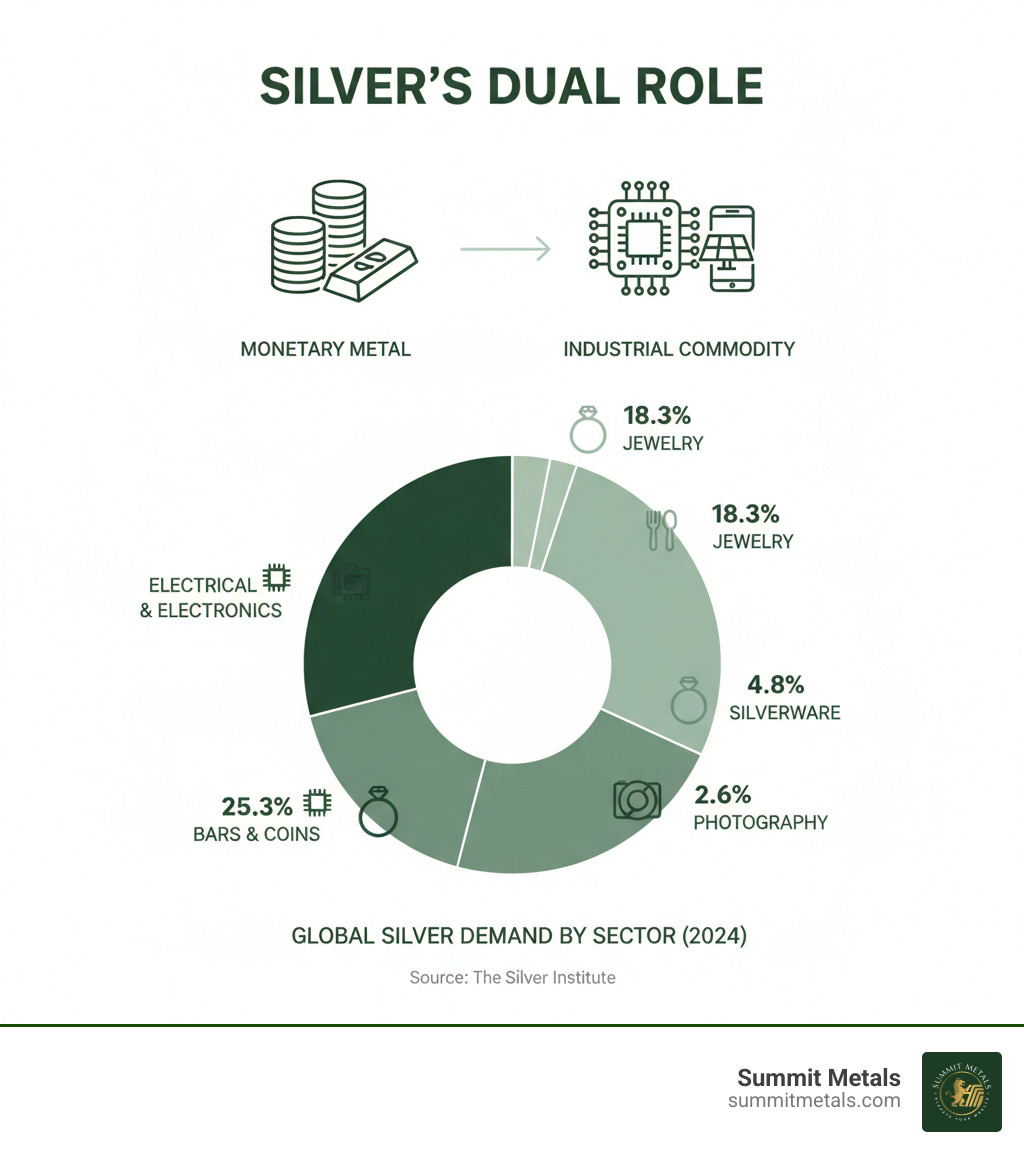

Why now? Silver’s dual role stands out. It is a 5,000-year store of value and a modern industrial workhorse used in solar, EVs, and electronics. In 2024, industrial demand hit a record 680.5 million ounces. With silver typically around 1% of gold’s price per ounce and often 2-3x more volatile, even a modest allocation can move the needle.

This guide shows the main ways to invest in silver, the trade-offs, and how to build a strategy that fits your goals.

Why Silver is Gaining Momentum in Today's Economy

When inflation lingers, debt rises, and geopolitics stay tense, investors look for assets that don’t move in lockstep with stocks and bonds. Precious metals, including investment in silver, can act as financial insurance and diversifiers. Central banks continue to favor gold, and that pro-precious-metals sentiment often supports silver, too. Explore the macro case here: Maximizing Your Investment in a Chaotic Global Economy: Why Gold and Silver Are Essential for Portfolio Diversification in 2024.

A key driver today is supply and demand. Global silver demand hit a record 1.112 billion ounces in 2022, and industrial demand reached 680.5 million ounces in 2024. With deficits projected for consecutive years and demand outpacing supply in 7 of the last 10 years, the setup remains constructive.

The Industrial Powerhouse: How Technology Fuels Silver Demand

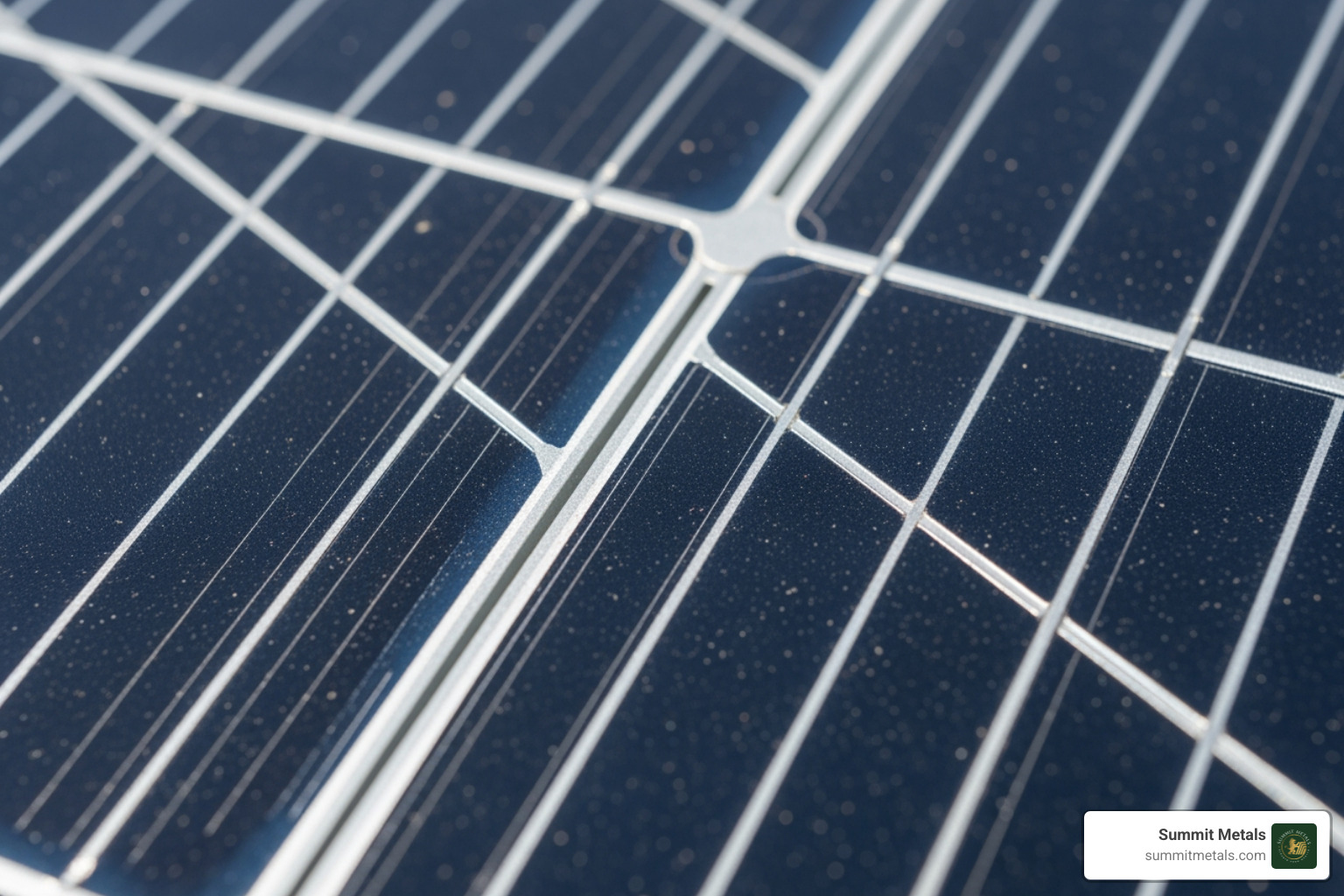

Industrial uses provide a strong base for silver demand. 2024 industrial demand was 680.5 million ounces (about 49% of total) and is projected to reach roughly 690 million ounces in 2025. Solar is the standout—panels can contain up to ~20 grams of silver, and higher-efficiency cell types are using more. EVs also consume more silver than ICE vehicles, and billions of devices from phones to PCs rely on silver’s best conductivity. See the broader drivers: Key Factors Influencing Gold & Silver Prices: Supply, Demand, Geopolitics.

Silver as a Financial Safe Haven and Portfolio Diversifier

Silver also plays the classic role of hedge and store of value, moving differently from stocks and bonds. It’s more affordable than gold—roughly 1% of gold’s price per ounce—so it’s easy to start stacking. The gold/silver ratio has generally ranged from 1:75 to 1:105 since June 2022; many view the higher end as potential relative value for silver. Learn more: Why Gold and Silver: Understanding Their Value as Safe Haven Assets and The Gold and Silver Ratio: A Timeless Measure for Precious Metals Investors.

To build a position without timing stress, set up Summit Metals Autoinvest and dollar-cost average monthly, just like your 401(k).

Your Guide to the Different Ways for an Investment in Silver

Several vehicles can give you silver exposure. Pick the mix that matches your goals, risk tolerance, and how hands-on you want to be. See a broad overview: How to Invest in Silver: Buying Bullion, Stocks and More.

Physical Silver: Owning Tangible Wealth

Physical silver means direct ownership—no counterparty risk. Options include:

- Silver bullion bars and rounds: Typically .999 fine; efficient ounces-per-dollar.

- Silver coins: Government-issued (for example, American Silver Eagles, Canadian Maple Leafs) with legal-tender status and broad recognition.

- Junk silver: Pre-1965 U.S. coins at 90% silver; useful for divisibility.

You’ll pay a premium over spot to cover minting, distribution, and dealer costs—often 2-15%, with smaller items and coins higher. Understand pricing: Spot Price vs. Premium: How Precious Metals Pricing Works. For help choosing formats, see: Bars or Coins? Your Ultimate Silver Investment Guide.

Decision helper: coins vs. bars vs. rounds

| Feature | Silver Coins | Silver Bars | Silver Rounds |

|---|---|---|---|

| Legal status | Legal tender (government-issued) | None | None |

| Typical premium | Higher | Lower (best per-ounce pricing at larger sizes) | Mid-to-low |

| Liquidity/recognition | Excellent, global | High with reputable mints | High with reputable mints |

| Anti-counterfeit/assurance | Strong (mint security features; legal protections) | Varies by mint; serial numbers/certs on larger bars | Varies by mint |

| Best for | Maximum recognition, portability | Lowest cost stacking | Low-cost stacking with smaller pieces |

Tip: Automate accumulation with Summit Metals Autoinvest to dollar-cost average monthly, just like funding a 401(k).

Silver Stocks: Investing in the Industry

Mining stocks and streaming/royalty companies can amplify silver price moves—both up and down. Evaluate management, costs, jurisdictional risk, reserves, and dividends. Streaming/royalty firms (for example, Wheaton Precious Metals) avoid direct operating risk in exchange for capped upside. Research tools like Fidelity's stock screener can help compare fundamentals.

Silver ETFs and Mutual Funds: Digital Exposure

ETFs offer simplicity and speed through a brokerage account. Some funds, like the iShares Silver Trust (SLV), hold physical bullion (over $13B AUM in Aug 2024). Others focus on miners or futures. Understand expense ratios, tracking, and counterparty risk. Mutual funds are priced once daily and often hold miners. Compare structures here: What's the Difference Between Physical Gold, Silver, and ETFs?.

Silver Futures: For the Experienced Trader

Futures on exchanges like COMEX are leveraged and volatile. Small margin can control large notional exposure, magnifying gains and losses. The silver derivatives market’s notional value once reached ~$5T (2014), with estimates of ~83 ounces of derivatives per 1 ounce of bullion—illustrating the speculative nature. Futures are best suited for pros hedging or short-term trading, not long-term wealth building.

Physical vs. Paper: A Head-to-Head Comparison

When making an investment in silver, decide whether you prefer direct ownership or the convenience of securities. Physical silver offers control and independence; ETFs and stocks offer speed and ease.

Here's how the two stack up side by side:

| Feature | Physical Silver (Bars, Coins, Rounds) | Silver ETFs/Stocks (e.g., SLV, Mining Stocks) |

|---|---|---|

| Ownership | Direct ownership of tangible metal—you hold it, you own it | Indirect ownership through shares representing silver or company equity |

| Storage | Requires secure storage (home safe, bank box, or depository); insurance recommended | No storage needed—held electronically in brokerage account |

| Costs | Premiums over spot price (2-15%); storage and insurance costs | Expense ratios (typically 0.5% annually for ETFs); trading commissions |

| Liquidity | Moderate—requires finding a buyer or dealer; may take days to sell | High—can be sold instantly during market hours at current prices |

| Counterparty Risk | None—you physically possess the asset | Yes—dependent on fund manager, custodian, or company's financial health |

| Privacy | Can be purchased and held privately | Transactions are recorded through brokerage accounts |

| Tax Treatment | May have different tax implications depending on storage method | Capital gains tax on profits from sales |

Many investors use both: physical silver for long-term wealth preservation and paper silver for tactical allocation. Learn more: Beyond the Digital: Making Your Move into Physical Silver.

At Summit Metals we emphasize physical ownership with transparent, real-time pricing and authenticated products—plus Autoinvest for steady monthly purchases.

Mastering Your Silver Strategy: Key Considerations and Risks

A Smart Approach to Your First Investment in Silver

Timing is hard. Dollar-Cost Averaging (DCA) makes it simple—invest a fixed amount on a schedule and let volatility work for you. Summit Metals Autoinvest automates monthly buys so you accumulate like a 401(k) contribution. More on DCA: The Power of Dollar Cost Averaging in Gold and Silver Investments. For allocation ideas, see: How Much Gold, Silver Should I Have?.

Silver vs. Gold: Understanding the Key Differences

Silver is usually about 1% of gold’s price per ounce and is 2-3x more volatile. That adds upside—and downside. Silver’s heavy industrial use ties it more to economic cycles; gold is driven more by monetary and macro risk. The gold/silver ratio (recently ~1:75 to 1:105) can highlight relative value swings. Deeper comparison: Gold vs. Silver: Which Is The Better Investment?.

Navigating Risks and Historical Price Trends for an Investment in Silver

Expect swings. Silver can move 5% in a day. It reached ~$50 in 1980 and 2011 during periods of market stress and speculation, then retreated. Over long horizons, metals are primarily wealth preservers and diversifiers, not pure growth engines. Tactics for using volatility: Turning Volatility into Opportunity: A Guide to a Silver Buy and Stacking.

Storing Your Physical Silver Securely

- Home safes: Convenient, but standard homeowner policies often cover only $250–$2,500 in precious metals—consider riders.

- Bank safety deposit boxes: Secure location, but contents aren’t FDIC-insured; separate coverage is needed.

- Third-party depositories: Purpose-built security, audits, and insurance; required for Precious Metals IRAs.

Storage resources: From Eagles to Ingots: Your Guide to Storing All Types of Silver and Storing Your Shine: A Guide to IRS-Approved Precious Metals Depositories.

Frequently Asked Questions about Investing in Silver

Who is the biggest silver investor?

JPMorgan Chase is widely believed to hold the largest position in physical silver, including as custodian for SLV and via substantial COMEX holdings. Warren Buffett also famously invested—Berkshire bought about 129 million ounces between 1997 and 1998, much under $5/oz—based on silver’s real-world industrial and medical utility.

How much of my portfolio should be in silver?

Many investors keep 5-10% of total assets in precious metals, adjusted for risk tolerance and time horizon. Start modestly and scale with comfort and objectives. Portfolio guidance: Shine On: Your Essential Guide to a Gold and Silver Portfolio.

Is silver a better investment than gold right now?

It depends on your goal. Silver offers more volatility and industrial tailwinds; gold offers stability as a monetary safe haven. Many hold both. The gold/silver ratio (recently ~1:75 to 1:105) can hint at relative value. Learn more: What is the Gold-to-Silver Ratio? Is It Important?.

Conclusion: Start Your Silver Investment Journey

Silver’s dual role—industrial backbone and monetary hedge—makes it a timely addition to diversified portfolios. With record industrial demand of 680.5 million ounces in 2024 and recurring supply deficits, the case for a measured allocation is strong.

However you invest—physical coins and bars, ETFs, or mining stocks—consistency often beats timing. Use Summit Metals Autoinvest to dollar-cost average monthly, just like your 401(k).

Summit Metals delivers authenticated metals with transparent, real-time pricing and competitive rates from bulk purchasing you can trust.

Explore our collection of silver products and start investing today.