Why Precious Metals Retirement Planning is Gaining Ground

Precious metals retirement planning is a popular way for investors to protect their wealth from inflation and economic uncertainty. A Gold IRA allows you to hold physical gold, silver, platinum, and palladium in your retirement account, diversifying beyond just stocks and bonds.

Key benefits of precious metals retirement planning:

- Inflation hedge - Precious metals often maintain value when currency loses purchasing power.

- Portfolio diversification - Adds stability beyond traditional stocks and bonds.

- Tax advantages - Same tax benefits as traditional or Roth IRAs.

- Tangible assets - You own physical metals stored in secure depositories.

- Economic protection - Safe-haven assets during market volatility.

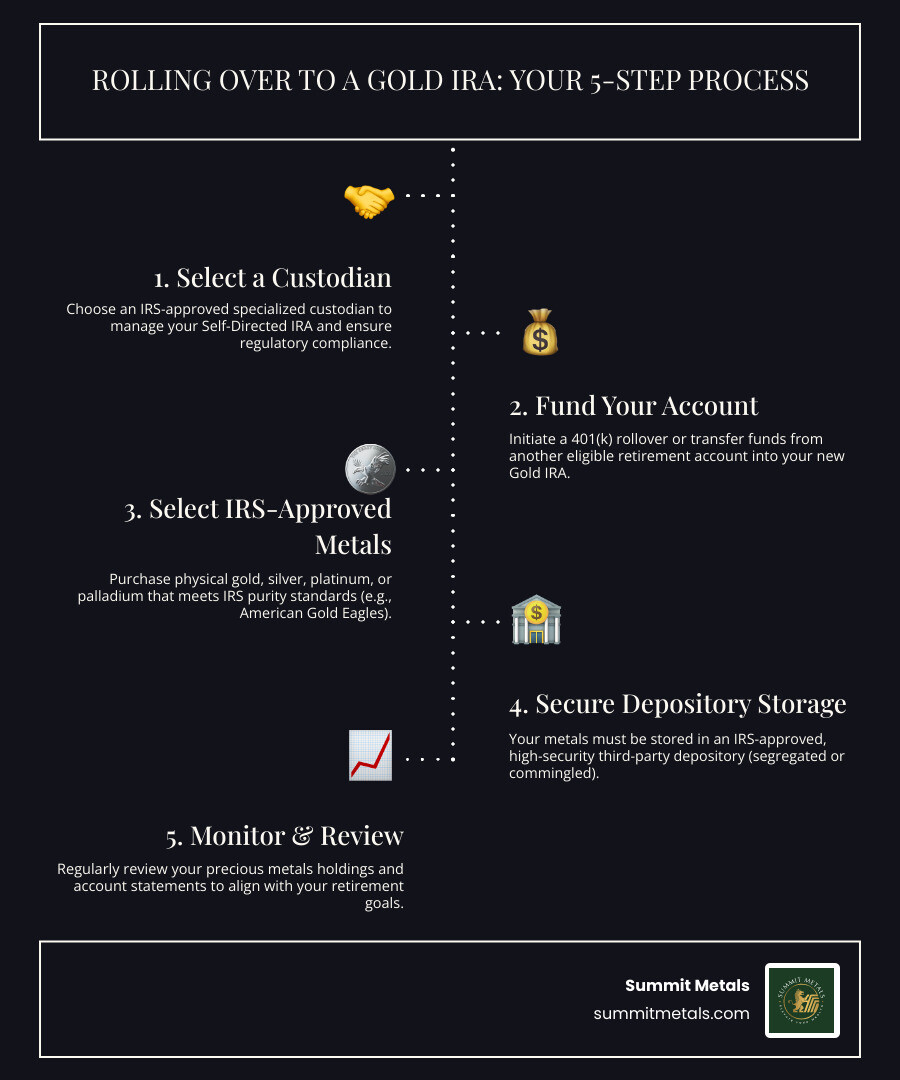

Getting started requires four main steps:

- Choose a specialized IRA custodian

- Fund your account through contributions or rollovers

- Select IRS-approved precious metals

- Store metals in an approved depository

The IRS sets strict rules for precious metals IRAs. Gold must be 99.5% pure, silver 99.9% pure, and all metals must be stored by an approved custodian—not at home. Most experts recommend allocating 5-10% of your retirement portfolio to precious metals for optimal diversification.

I'm Eric Roach. After a decade on Wall Street advising Fortune 500 companies, I now focus on precious metals retirement planning for individual investors. I've seen how this strategy can pay off, like when a client's precious metals allocation outperformed traditional assets by $141,000, allowing her to retire eight months early.

Understanding Gold IRAs: The Foundation of Your Precious Metals Retirement

A Gold IRA is a self-directed individual retirement account that lets you hold physical precious metals—gold, silver, platinum, and palladium—in a secure vault, all while retaining the tax benefits of a standard IRA. The IRS requires a specialized custodian to manage your Gold IRA. Unlike a typical broker, they handle IRS compliance and arrange secure storage at an approved depository. This gives you direct ownership of tangible assets with a long history of holding value, independent of corporate earnings or market sentiment.

What is a Gold IRA and How Does it Differ from a Traditional IRA?

The key difference lies in the assets. Traditional IRA assets like stocks and bonds are "paper" investments tied to financial markets. A Gold IRA holds physical metals you actually own. Instead of owning shares in a gold mining company, you own the actual gold.

This distinction is why Gold IRAs need specialized custodians. A regular brokerage isn't equipped to authenticate, transport, or store physical metals. With a Gold IRA, you have direct ownership of a real asset, which is a cornerstone of a precious metals retirement strategy. You aren't dependent on a company's performance or the stability of a financial institution; you own something tangible.

For a deeper dive into owning physical metals versus other metal-related investments, see What's the Difference Between Physical Gold, Silver, and ETFs?.

Traditional, Roth, or SEP: Which Gold IRA is for You?

Gold IRAs come in several types, each with unique tax advantages.

Traditional Gold IRA: Your contributions may be tax-deductible, lowering your current tax bill. The metals grow tax-deferred, and you pay income tax on withdrawals in retirement. This is ideal if you expect to be in a lower tax bracket later.

Roth Gold IRA: You make post-tax contributions, but your metals grow completely tax-free. Qualified tax-free withdrawals in retirement won't cost you a penny. This is beneficial if you expect to be in a higher tax bracket in retirement.

SEP Gold IRA: Designed for self-employed individuals and small business owners, this account has much higher contribution limits—up to $69,000 for 2024, compared to the standard $7,000. It's a powerful tool for accelerating your precious metals retirement savings.

For official details, the IRS provides comprehensive information at More on Traditional and Roth IRAs.

Tax Implications: How Gold IRAs Affect Your Bottom Line

Gold IRAs offer tax-deferred growth, meaning your metals can appreciate in value without creating an annual tax bill. Taxes are paid only upon withdrawal. You can begin taking distributions at age 59.5 without facing the 10% early withdrawal penalty.

One common point of confusion is the collectibles tax rate (28%). This higher rate applies to physical gold sold for a profit outside of an IRA. However, it does not apply to distributions from a Gold IRA. Withdrawals from a Traditional Gold IRA are taxed as ordinary income, and qualified Roth distributions are tax-free.

If you have a Traditional Gold IRA, you must begin taking Required Minimum Distributions (RMDs) at age 73. This is how the government ensures it eventually collects taxes on the deferred growth.

Understanding these tax rules is crucial for any precious metals retirement plan. We recommend reviewing The Ultimate Rulebook for Precious Metals IRA Investors for a complete overview.

Setting Up Your Gold IRA: A Step-by-Step Guide

Setting up your precious metals retirement account involves four straightforward steps. Think of it as a clear roadmap to diversifying your portfolio with physical assets.

Step 1: Choose a Specialized Custodian

First, you need a specialized custodian. Unlike traditional brokers, they are equipped to handle physical precious metals and their unique IRS requirements. Your custodian acts as the administrator for your account, handling all IRS reporting, facilitating transactions, and coordinating with secure storage facilities. When choosing, look for a firm with a strong reputation, transparent fees, and excellent customer service.

Step 2: Fund Your Account via Contributions or Rollover

Next, you'll fund your Gold IRA. You have two primary options:

Direct contributions: You can contribute up to $7,000 annually for 2024, or $8,000 if you're 50 or older. For those with a SEP Gold IRA (for self-employed individuals), the limit is much higher—up to 25% of compensation or $69,000.

Rollovers: This popular, tax-free method allows you to transfer funds from an existing 401(k), 403(b), TSP, or another IRA directly into your new Gold IRA. You can check the Official IRS Contribution Limits for 2024 for current information.

To build your holdings steadily, consider dollar-cost averaging. At Summit Metals, our Autoinvest program lets you purchase metals monthly, similar to your 401(k) contributions. This strategy smooths out price volatility over time. Learn more about The Power of Dollar-Cost Averaging in Gold and Silver Investments.

Step 3: Select Your IRS-Approved Precious Metals

The IRS has strict purity requirements for IRA-eligible metals: gold must be 99.5% pure, silver 99.9% pure, and platinum and palladium must be 99.95% pure. One notable exception is the American Gold Eagle coin, which is 91.67% pure (22-karat) but is specifically permitted by law.

When choosing between coins and bars, consider their distinct advantages.

| Feature | Gold Coins (e.g., American Eagle) | Gold Bars |

|---|---|---|

| Premiums | Typically higher premiums over spot price. | Generally lower premiums, more gold for your dollar. |

| Liquidity | Highly liquid and easy to sell in small increments. | Can be less liquid unless selling the entire bar. |

| Recognizability | Globally recognized, making them easy to trade. | May require assaying to verify purity and weight. |

| Security | Legal tender status and face value offer protection against counterfeiting. | Higher risk of counterfeiting for less-known brands. |

For a detailed comparison, check out How to Compare Gold Bars vs. Gold Coins: 5 Factors to Consider.

At Summit Metals, we offer a wide selection of authenticated, IRS-approved precious metals with transparent, real-time pricing, so you always know what you're paying.

Step 4: Choose an IRS-Approved Depository

The IRS mandates that your precious metals must be stored in an approved depository. Home storage is not allowed and would trigger taxes and penalties.

These high-security facilities offer advanced security, comprehensive insurance, and professional oversight. You'll choose between two storage types:

- Segregated storage: Your specific coins and bars are stored by themselves. You get back the exact items you deposited.

- Commingled storage: Your metals are stored alongside identical metals from other investors. You get back the same type and amount, but not the exact same items.

Most clients prefer segregated storage for the added peace of mind, despite the slightly higher cost. Storage fees typically range from $100 to $300 annually. For a full breakdown, explore our guide: Depository Deep Dive: Understanding Precious Metals Storage Options and Fees.

With a clear understanding of these four steps, you can confidently add precious metals to your precious metals retirement strategy.

The Pros and Cons of Precious Metals Retirement Planning

Like any investment, precious metals have pros and cons. Understanding both is key to making an informed decision for your retirement.

Key Benefits of a Precious Metals Retirement Strategy

A strategic allocation to precious metals can fortify a retirement portfolio. Here are the core benefits:

Inflation protection: Gold has a long history of preserving purchasing power while inflation erodes the value of paper money.

Portfolio diversification: Precious metals often move independently of stocks and bonds, creating a more resilient portfolio that can better withstand economic downturns.

Safe-haven asset: During economic uncertainty or geopolitical turmoil, investors flock to gold for its stability, as seen during the 2008 financial crisis and 2020 pandemic.

Currency devaluation protection: Gold tends to perform well when the US dollar weakens, providing a hedge against the declining purchasing power of fiat currencies.

Tangible asset ownership: Owning a physical asset provides security in a digital world. Real metals aren't subject to cyberattacks or institutional failures and have held value for millennia.

To learn more about why these metals are considered safe havens, explore Why Gold and Silver: Understanding Their Value as Safe Haven Assets.

Understanding the Risks of Precious Metals Retirement

It's equally important to understand the potential risks associated with precious metals retirement planning.

Price volatility: While stable long-term, gold prices can fluctuate significantly in the short term. Returns come only from price appreciation.

No dividends or interest: Unlike stocks or bonds, precious metals do not generate passive income.

Storage and insurance costs: Storing physical metals in an approved depository involves annual fees that accumulate over time.

Tax considerations: When held outside an IRA, profits from selling physical gold are taxed as collectibles at a high 28% rate. This does not apply to IRA distributions, which are taxed as ordinary income (for Traditional IRAs) or are tax-free (for qualified Roth IRAs).

Liquidity factors: Converting physical metals to cash involves more steps than selling stocks. You'll also encounter bid-ask spreads and potential fees when selling.

The industry can attract bad actors. The CFTC has issued warnings about precious metals schemes. It's critical to work with reputable dealers and custodians who offer transparent pricing.

Who is a Gold IRA Best Suited For?

A Gold IRA isn't for everyone, but it's well-suited for certain investor profiles:

Investors seeking genuine diversification to balance a portfolio heavy in paper assets.

Those concerned about inflation and currency devaluation who want a proven store of value.

Long-term focused investors who prioritize wealth preservation over short-term gains.

Individuals approaching or in retirement who are shifting from growth to wealth preservation strategies.

Those with sufficient assets to absorb setup and annual fees, making them proportionally less significant.

Most experts recommend allocating 5% to 10% of a retirement portfolio to precious metals. This provides diversification and inflation protection without overly sacrificing the growth potential of other assets. For help determining your ideal allocation, see How Much of My Net Worth Should Be in Gold & Silver?.

A precious metals retirement plan is about creating a more resilient, diversified portfolio that preserves purchasing power over time.

Frequently Asked Questions about Precious Metals IRAs

Considering a precious metals retirement strategy? Here are answers to the most common questions we receive.

Can I store my IRA gold at home?

The short answer is absolutely not. While the appeal is understandable, IRS rules are strict. If you take physical possession of your IRA metals, the IRS considers it a taxable distribution. This means you would owe income taxes on the full value, plus a 10% early withdrawal penalty if you're under 59½.

The IRS requires all precious metals in a Gold IRA to be held by an approved, third-party depository. This rule maintains the integrity of the retirement account. Be wary of companies promoting "home storage IRAs," as the IRS has discouraged these risky arrangements which could disqualify your entire IRA.

This requirement ultimately protects your retirement savings from costly tax mistakes. For a full overview of the rules, see Precious Metals Storage Regulations 101.

What happens when I want to take a distribution from my Gold IRA?

When you're ready for distributions (typically after age 59½ to avoid penalties), you have two flexible options:

In-kind distributions: You can take physical possession of your actual metals. For example, your American Silver Eagles can be shipped directly to you. You'll owe ordinary income tax on the market value of the metals if it's a Traditional IRA; qualified Roth IRA distributions are tax-free.

Cash distributions: Your custodian sells the metals on your behalf, and you receive the cash proceeds. The tax treatment is the same as an in-kind distribution.

Having both options provides flexibility. You can take some metals physically and liquidate others for cash. Traditional Gold IRAs are subject to Required Minimum Distributions (RMDs) starting at age 73.

What are the fees associated with a Gold IRA?

Gold IRAs have more fees than standard IRAs. Understanding them is key to deciding if the benefits outweigh the costs. Common fees include:

- Account setup fees: A one-time charge, typically $50 to $250.

- Annual custodian fees: An annual charge for account administration and IRS reporting, usually $75 to $250.

- Depository storage fees: An annual fee for secure storage, which can be a flat rate ($100-$300) or a percentage of the assets' value. Segregated storage usually costs slightly more than commingled storage.

- Transaction fees: The markup over the spot price when you buy or sell metals. Reputable dealers like Summit Metals provide transparent, real-time pricing.

- Wire transfer fees: A small fee of around $15 to $30 for wire transfers.

These fees cover the professional management, secure storage, and regulatory compliance for your precious metals retirement assets. Always request a full fee disclosure in writing before committing.

Conclusion: Securing Your Golden Years

Your journey to a secure precious metals retirement requires informed choices and trusted partners. A Gold IRA can shield your wealth from inflation and provide the peace of mind that comes from owning a real, tangible asset.

The path forward is clear: diversification through precious metals builds resilience into your retirement portfolio. By following IRS rules—using approved metals and storing them in a depository—you can access one of history's most enduring stores of value within a tax-advantaged account.

At Summit Metals, we believe your retirement security is too important to leave to chance. Our Wyoming-based company is built on transparent pricing and authentic products. Our real-time pricing means no hidden markups, and our bulk purchasing power ensures competitive rates. Every product we sell is authenticated, because trust is non-negotiable.

We also make precious metals investing accessible. Our Autoinvest program allows you to dollar-cost average into gold and silver monthly, just like with a 401(k), helping to smooth out price volatility while you consistently build your position.

Your golden years should be secure. By incorporating precious metals into your strategy, you're not just preparing for the future; you're building a legacy that can weather any economic storm.

Ready to take the next step? Explore our comprehensive resource: Precious Metals IRA: A Comprehensive Guide to Securing Your Future to deepen your understanding.