Why Secure Storage Matters for Your Precious Metals Investment

Precious metals depository services are professional, third-party facilities where investors can safely store their gold, silver, platinum, and palladium. These specialized vaults offer high-security storage, comprehensive insurance, and professional management with regular audits. Storage fees typically range from $100 to $500 annually, varying by storage type and asset value.

When you own physical precious metals, deciding where to store them is critical. Home storage exposes you to theft and insurance gaps, while bank safety deposit boxes offer limited protection and access. Professional depositories solve these problems by providing military-grade security and full insurance coverage that individual storage cannot match. For Gold IRA investors, using an IRS-approved depository is mandatory to maintain the account's tax-advantaged status.

As Eric Roach, I've guided clients through multi-billion-dollar transactions during my investment banking career and now help individual investors protect their wealth through precious metals. My experience has shown me how proper storage can make the difference between a successful long-term investment and unnecessary risk.

What is a Precious Metals Depository and Why Use One?

Once you've invested in physical gold, silver, or platinum, the crucial question becomes: where do you keep it? This is where a precious metals depository service is essential. A depository is a high-security vault designed specifically to safeguard your physical bullion. It provides a professional, audited environment that offers peace of mind far beyond a home safe or bank deposit box.

For investors with significant holdings, storing metals at home can make your residence a target, risking your assets and personal safety. A depository removes this risk by placing your investments in a purpose-built, highly protected facility, offering robust protection from theft and protection from damage.

At Summit Metals, we understand the importance of security. We consistently emphasize the value of professional precious metals depository services so our clients can feel confident their assets are safe. To learn more, see The Ultimate Guide to Gold and Other Precious Metals Storage.

Key Storage Options Explained

When using precious metals depository services, you'll encounter several storage terms. Understanding them is key to managing your ownership, access, and costs.

- Segregated Storage: Your specific bars and coins are held in a private, sealed space separate from all other assets. This ensures direct ownership of your exact items.

- Allocated Storage: Similar to segregated, specific bullion is assigned directly to you and earmarked as your property, though it may not be in a separate physical locker. This also confirms your direct ownership.

- Non-Segregated (Commingled) Storage: Your metals are stored alongside identical items from other investors. The depository tracks your ownership by quantity, but you may not receive the exact same bars or coins upon withdrawal. This option typically has lower fees.

- Unallocated Storage: You hold a claim against a pool of metal owned by the institution, rather than owning specific physical bullion. This is more of a credit and carries different risks. At Summit Metals, we advocate for allocated or segregated storage to ensure true ownership of physical assets.

The Core Benefits of Professional Precious Metals Depository Services

Choosing professional precious metals depository services provides a suite of benefits that far outweigh the risks of self-storage.

- High-Level Security: Facilities use Class III vaults, 24/7 surveillance, biometric access, armed guards, and 'dual-control' procedures to prevent unauthorized access.

- Professional Management: Experienced teams handle secure transport, inventory, and regular independent audits to ensure your assets are accounted for.

- Insurance Coverage: Depositories offer all-risk insurance, often from world-renowned insurers like Lloyd's of London. This protects the full market value of your assets against theft, damage, fire, and natural disasters—coverage that homeowner's policies rarely provide.

- Regulatory Compliance: Reputable depositories follow strict IRS rules, making them suitable for Gold IRAs, and are often approved by major exchanges like COMEX/CME.

- Reduced Personal Risk: Storing wealth off-site eliminates the personal danger of keeping large amounts of valuables at home.

- Liquidity Access: Your metals remain accessible for sale or physical delivery, with many depositories offering online portals for easy transaction requests.

For more tips, explore Top Tips for Precious Metals Storage: Secure Your Investments.

Potential Disadvantages and Limitations

While depositories offer immense benefits, it's important to consider their limitations.

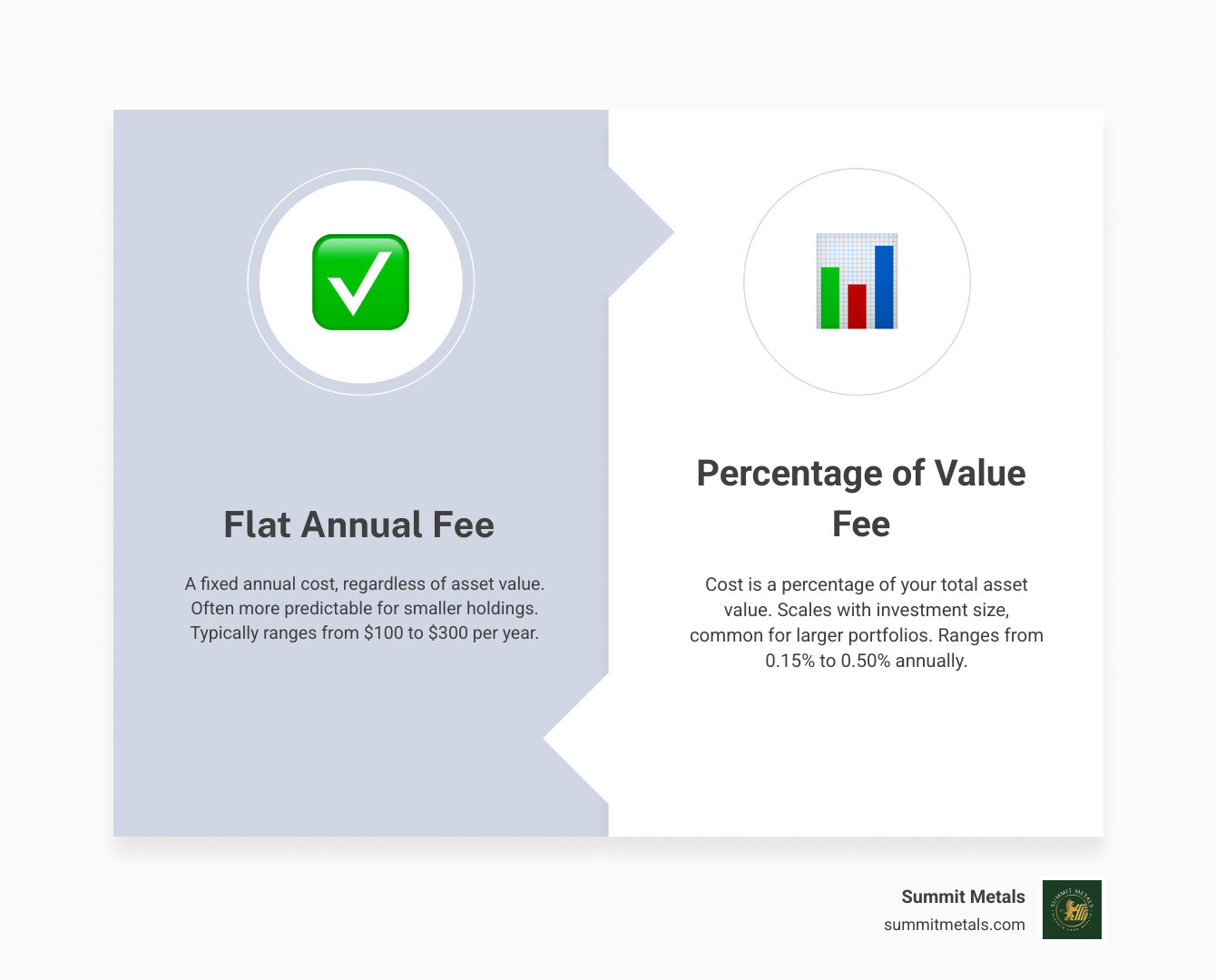

- Storage Fees: Professional storage has costs, typically annual fees based on asset value, which can affect long-term returns. These are a necessary expense for top-tier security.

- Limited Physical Access: Access to your metals requires an appointment due to high-security protocols, so you cannot visit spontaneously.

- Geographic Distance: Your metals may be stored far from your home, which can make physical visits or quick withdrawals more challenging.

- Withdrawal Process: Taking delivery involves a formal request, identity verification, and shipping arrangements, which is less immediate than accessing a home safe and may involve transaction fees.

Security, Insurance, and Regulatory Compliance

Understanding the framework of security, insurance, and regulatory compliance is essential for safeguarding your precious metals. These three pillars are the bedrock of investor confidence in precious metals depository services. Conducting due diligence on these aspects is non-negotiable. To avoid common pitfalls, we encourage you to read How to Avoid Common Precious Metals Scams.

State-of-the-Art Security Measures

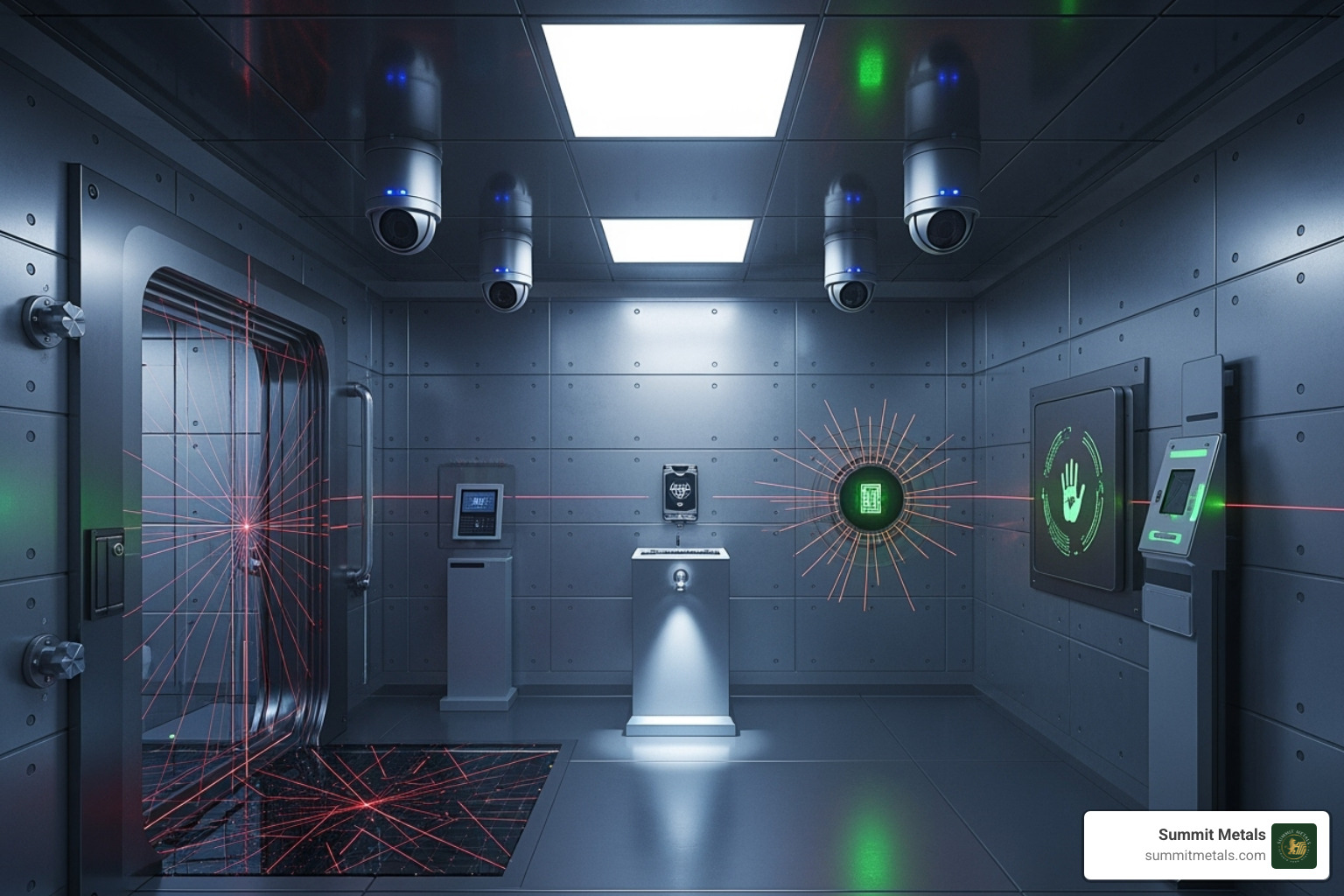

The security at precious metals depository services is designed to be virtually impenetrable. At the core are Class III vaults, among the highest-rated available, built with reinforced materials to withstand serious intrusion attempts. This physical strength is improved by multiple layers of technology and human oversight.

Key security features include:

- 24/7 surveillance with advanced camera systems.

- On-site armed guards around the clock.

- Biometric access controls (like fingerprint or retinal scans).

- Dual-control procedures, requiring two or more authorized individuals for any sensitive task.

- Regular audits by independent firms to verify inventory and protocols.

- Fortified facilities with reinforced structures and specialized entryways.

These comprehensive measures ensure your assets are protected by the highest standards of physical and technological security. If you’re curious about protecting smaller bullion packages, you can Watch our video on securing small bullion packages.

Is Your Bullion Insured?

One of the most compelling reasons to use professional precious metals depository services is the comprehensive insurance they provide. Reputable depositories offer all-risk insurance, protecting your metals against a wide array of dangers, including theft, damage, and natural disasters like fire or floods.

Many leading depositories are 100% insured by Lloyd's of London, a globally recognized and trusted provider of precious metals insurance. This level of coverage is rarely available for metals stored at home, as standard homeowner's policies have very low limits for bullion. Similarly, bank safe deposit boxes typically offer little to no insurance from the bank itself.

When choosing a depository, always review their insurance policy to confirm it covers the full market value of your holdings. This robust insurance framework ensures that your investment remains secure even in a catastrophic scenario.

The Critical Role of Depositories in Gold IRAs

For those integrating precious metals into their retirement planning, precious metals depository services play a critical, IRS-mandated role. According to Section 408 of the Internal Revenue Code, precious metals owned by a Self-Directed IRA cannot be stored at home. They must be held by an IRS-approved depository to maintain the account's tax-advantaged status. Failure to comply can result in severe tax penalties.

IRS-approved depositories work with Gold IRA custodians to ensure your investment is both secure and compliant. They help meet key IRS requirements:

- Fineness Standards: They verify and store only metals that meet IRS purity mandates (e.g., 0.995 for gold, 0.999 for silver).

- Approved Facilities: Only specific, vetted depositories are authorized to hold IRA assets.

- Clear Ownership: They facilitate segregated or allocated storage to ensure clear title to your metals, which is preferred for IRAs.

This partnership between your Gold IRA company, custodian, and depository ensures your retirement savings are protected and fully compliant with all IRS regulations. For a deeper dive, see The Ultimate Rulebook for Precious Metals IRA Investors and the official Internal Revenue Service (IRS) website.

Understanding Depository Costs and Choosing the Right Facility

Choosing the right precious metals depository services requires understanding the costs and evaluating facilities to find the perfect fit for your assets. It's about finding a partner that offers security, reliability, and fair pricing.

Understanding the Costs of Precious Metals Depository Services

Professional storage is an investment in security. Annual storage fees are the primary cost, often calculated as a percentage of your holdings' market value (e.g., 0.29% to 0.80% annually). Many depositories also have minimum monthly fees (e.g., $10 to $15) to cover basic operational costs for all accounts.

Transaction fees apply when moving metals. While many facilities have zero setup fees, you may encounter withdrawal fees plus shipping and insurance costs. When purchasing metals for delivery to a depository, some dealers waive shipping on larger orders. Always request a current, detailed fee schedule to calculate the total annual cost and avoid surprises.

At Summit Metals, we believe in transparent pricing and encourage the same when choosing storage. For more insights, explore Bullion Investing 101: How to Safely Stack Your Wealth.

How to Choose the Right Precious Metals Depository Services for Your Needs

Selecting a depository is a critical decision. Look beyond the price to find a true partner in wealth protection.

- Security Protocols: Prioritize facilities with Class III vaults, 24/7 surveillance, armed guards, and regular independent audits.

- Insurance Coverage: Ensure they offer all-risk insurance from a reputable provider like Lloyd's of London, covering the full market value of your assets.

- Fee Transparency: A reputable depository provides a clear, itemized breakdown of all costs upfront.

- Storage Options: Choose a facility that offers segregated or allocated storage to match your ownership preferences, especially for IRAs.

- Location and Jurisdiction: Storing assets in stable jurisdictions with strong property rights (like Wyoming, Delaware, Texas, or Canada) adds a layer of security.

- Reputation and Reviews: Look for industry accreditations and positive customer feedback.

- Accessibility: User-friendly online portals and responsive customer service make managing your assets more convenient.

For guidance on finding trustworthy partners, see Identifying Reputable Bullion Dealers: Avoiding Counterfeits.

Domestic vs. International Storage

Deciding whether to store your metals domestically or abroad is a strategic choice based on your goals.

Domestic storage (e.g., in the U.S. or Canada) offers simpler accessibility, a familiar regulatory environment, and the comfort of geopolitical stability in jurisdictions known for strong property rights.

International storage provides geopolitical diversification, potentially spreading risk across multiple stable countries. It may also offer different asset protection frameworks, though this requires expert guidance. However, be mindful of more complex tax implications and reporting requirements, as well as the added logistical challenges of accessing your metals from overseas.

At Summit Metals, our Wyoming base gives us a unique perspective on stability and global opportunities. The right choice balances convenience with diversification. For more on this topic, explore Where in the World is Your Gold Safest? International Gold Storage Explained.

Frequently Asked Questions about Depository Services

It's natural to have questions when exploring precious metals depository services. Here are answers to some of the most common inquiries to help you make confident storage choices.

Can I visit the depository to see my stored metals?

Yes, many reputable depositories allow you to visit and inspect your stored metals. However, due to the high-security nature of these facilities, visits are strictly by appointment only and require advance scheduling. You will need to undergo a thorough identity verification process and follow strict security protocols upon arrival. The ability to view specific items is typically straightforward with segregated storage, where your metals are held in a private, dedicated space.

What happens if I want to sell or take delivery of my metals?

While highly secure, your assets remain liquid and accessible. The process for selling or taking delivery is streamlined for security and efficiency.

To sell your metals, you can often do so directly from your storage account. Many depositories have relationships with bullion dealers, allowing you to lock in a price and authorize the sale without physically shipping the metal. This saves time and reduces handling fees.

To take physical delivery, you will submit a formal withdrawal request. The depository will verify your identity, prepare your metals, and ship them via a secure, insured courier. This ensures your investment is protected against loss or damage during transit. Be aware that this process involves handling and shipping fees.

For more on securing your investments, consult Top Storage for Silver: Best Practices for Safekeeping Your Investment.

How often are depositories audited?

Regular auditing is a cornerstone of trust and transparency for precious metals depository services. It provides independent verification that your assets are accounted for and secure.

Reputable depositories undergo frequent audits:

- External Audits: Independent, third-party accounting firms typically conduct comprehensive audits annually or semi-annually. They rigorously verify the physical inventory against client records.

- Internal Audits: In addition to external oversight, many facilities perform their own stringent internal checks and inventory reconciliations on a much more frequent basis, sometimes daily or monthly.

These audits confirm inventory accuracy, ensure regulatory compliance (especially for IRAs), and verify security protocols, providing an essential layer of protection and peace of mind for investors.

Conclusion

We've explored precious metals depository services, from high-tech security to the details of storage fees. The key takeaway is clear: professional storage is not an optional add-on but a fundamental component of a sound precious metals investment strategy.

For long-term wealth building, portfolio diversification, or a Gold IRA, the benefits of a reputable depository are too significant to ignore. You gain military-grade security, comprehensive insurance coverage, and crucial regulatory compliance.

While there are costs and you can't access your gold on a whim, these are minor trade-offs for reduced personal risk and the peace of mind that comes from knowing your assets are in a fortress, not your closet.

At Summit Metals, we are built on helping you make informed decisions. Just as we champion transparent pricing for our metals, we believe you deserve the same excellence in protecting them. Our Wyoming-based approach emphasizes honesty and long-term value—principles that should guide your storage choices.

Understanding these services puts you in control, allowing you to make strategic choices that safeguard your hard-earned assets. That's the confidence that lets you sleep soundly, knowing your wealth is protected by the best security available.

Ready to secure your financial future? Explore our IRA-eligible precious metals and secure storage solutions and see how quality metals and professional storage can lift your investment strategy.