Why International Gold Storage is Becoming Essential for Modern Investors

International gold storage has emerged as a critical strategy for protecting wealth as gold prices have surged over 20% in 2024 alone, doubling in value over the past decade. With economic uncertainty mounting and governments increasingly eyeing private assets, storing gold across multiple jurisdictions offers unprecedented protection against confiscation, currency devaluation, and political instability.

Top International Gold Storage Locations:

- Switzerland - Traditional safe haven with 70% of world's gold refining capacity

- Singapore - Modern infrastructure with AAA credit rating and tax-free investment metals

- Cayman Islands - Proximity to North America with competitive fees and IRA compliance

- Austria - Strong privacy laws with anonymous storage options

- New Zealand - Geographic isolation with stable government and robust legal framework

Key Benefits:

- Asset protection from government overreach and confiscation

- Geographic diversification to reduce single-country risk

- Improved privacy through offshore jurisdictions

- Professional vault security with Class 3 UL ratings

- Allocated and segregated storage with full insurance coverage

Storage Options:

- Allocated Storage - Gold held in your name with specific ownership

- Segregated Storage - Your specific bars isolated from others

- Private Vaults - Improved privacy with bespoke services

- Secure Depositories - State-of-the-art security with regulatory compliance

As an investment banking veteran who guided Fortune-500 clients through complex hedging programs on Wall Street, I've seen how institutional investors use international gold storage to protect billions in assets. Today, I help individual investors apply these same sophisticated wealth protection strategies that blue-chip companies use to safeguard their balance sheets.

Why Go Global? The Core Benefits and Risks of Storing Gold Overseas

Let's be practical—keeping all your gold at home concentrates your risk. International gold storage spreads that risk across borders and, done correctly, gives you a buffer against events you can’t control.

The Case for Asset Protection

Government asset grabs are not ancient history. In 1933, Executive Order 6102 forced Americans to turn in their gold at $20.67/oz, then Washington promptly re-priced it to $35. That 70-year-old example still matters: when governments are desperate, private wealth is an easy target. Gold held in Switzerland or Singapore sits outside your home jurisdiction, making any confiscation order far harder to enforce.

Offshore vaults also shield assets from domestic lawsuits and keep wealth outside the banking system—useful when payment networks freeze or bank runs occur.

Geographic and Political Diversification

You wouldn’t put every dollar in one bank; don’t park all your bullion in one country. Splitting holdings between stable, neutral jurisdictions hedges you against local political upheaval, currency devaluation, or capital controls. Central banks already diversify their reserves this way, as the World Gold Council shows.

Understanding the Risks and Downsides

Going offshore isn’t magic. You’ll deal with extra paperwork, higher annual fees (0.5 – 1.5%), and potential delays if you need rapid physical access. Regulations differ by country, and a jurisdiction that looks safe today could change. The answer is due diligence and using experienced providers—our guide on precious metals storage walks you through the practical steps.

How to Choose the Right Offshore Gold Storage Solution

Choosing a provider isn’t just about price; it’s about keeping control of your metal under any circumstance.

Criteria for Selecting a Jurisdiction

Start with countries known for political neutrality, strong rule of law, and favorable tax treatment on bullion. Switzerland and Singapore remain benchmarks, but the Cayman Islands, Austria, and New Zealand also tick these boxes. Look for AAA credit ratings, low corruption, and a proven track record of protecting foreign investors.

Comparing Storage Providers: Private Vaults vs. Secure Depositories

- Private vaults: extra privacy, bespoke services, and operation outside the banking system.

- Secure depositories: bank-grade Class 3 UL vaults, round-the-clock monitoring, strict regulatory compliance.

Whichever you pick, insist on transparent fee schedules, regular independent audits, and the option for allocated or segregated storage. Our detailed guide on secure facilities and storage options explains what to ask before you sign.

Key Considerations for International Gold Storage

- Class 3 UL–rated security and biometric access.

- Independent audits (e.g., Bureau Veritas).

- Insurance through global underwriters such as Lloyd’s of London.

- 24/7 online account visibility and responsive customer service.

If a provider can’t demonstrate all four, keep looking.

Top Jurisdictions for International Gold Storage

Quick list of investor-favored locations:

- Switzerland – centuries of neutrality and 70 % of global gold refining.

- Singapore – tax-free investment metals and modern infrastructure.

- Cayman Islands – IRA-friendly and close to North America.

- Austria – robust privacy laws within the EU.

- New Zealand – remote, stable, and common-law based.

Switzerland: The Traditional Safe Haven

Swiss vaults combine decades of expertise with Class 3 security. Costs run higher than elsewhere, but many investors view the premium as insurance.

Singapore: The Modern Asian Hub

AAA-rated Singapore scrapped all taxes on investment-grade gold, offers cutting-edge vault tech, and sits at the crossroads of Asia’s fast-growing wealth markets.

Other Notable Jurisdictions

- Cayman Islands: British legal framework, competitive fees, and direct flights from the U.S.

- Austria: One of the last places in the EU where anonymous storage is still possible.

- New Zealand: Geographic insulation from most geopolitical hotspots and a stable, investor-friendly government.

Even central banks diversify this way, as shown in the World Gold Council data.

The Nitty-Gritty: Understanding Costs, Insurance, and Key Terms

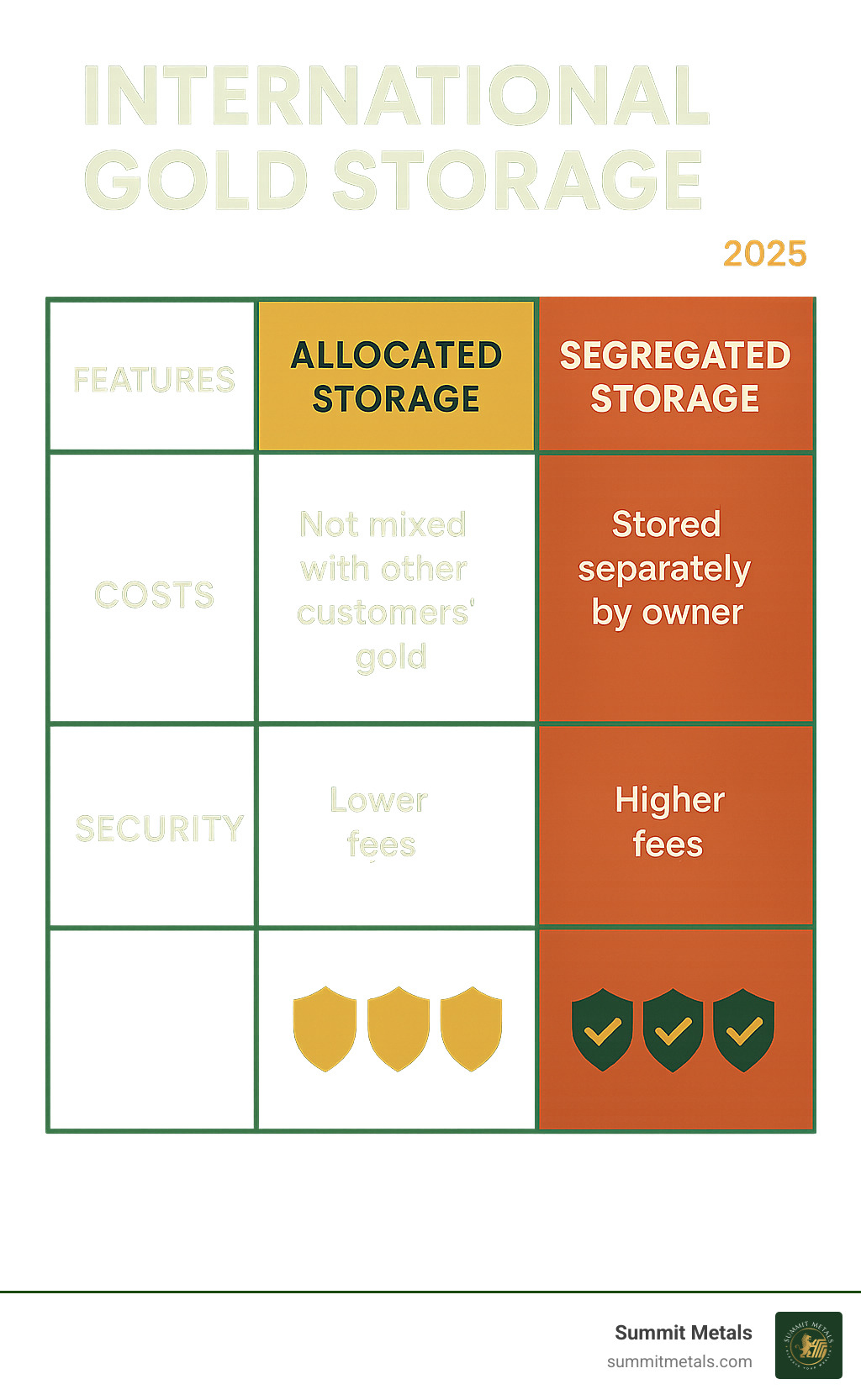

Allocated vs. Segregated Storage

- Allocated: specific bars or coins in your name—no counterparty risk.

- Segregated: your bars stored separately, serial numbers matched to your account.

- Avoid unallocated: you become a creditor, not an owner.

Typical Costs and Fees

Annual fees usually range from 0.5 – 1.5 % of metal value, with minimums around $180–$500. Expect one-off shipping and handling charges for deposits or withdrawals.

How Insurance for Stored Gold Works

Reputable vaults carry all-risk policies—covering theft, fire, natural disasters, and “mysterious disappearance”—underwritten by major insurers like Lloyd’s of London. Coverage should equal current market value and be audited independently.

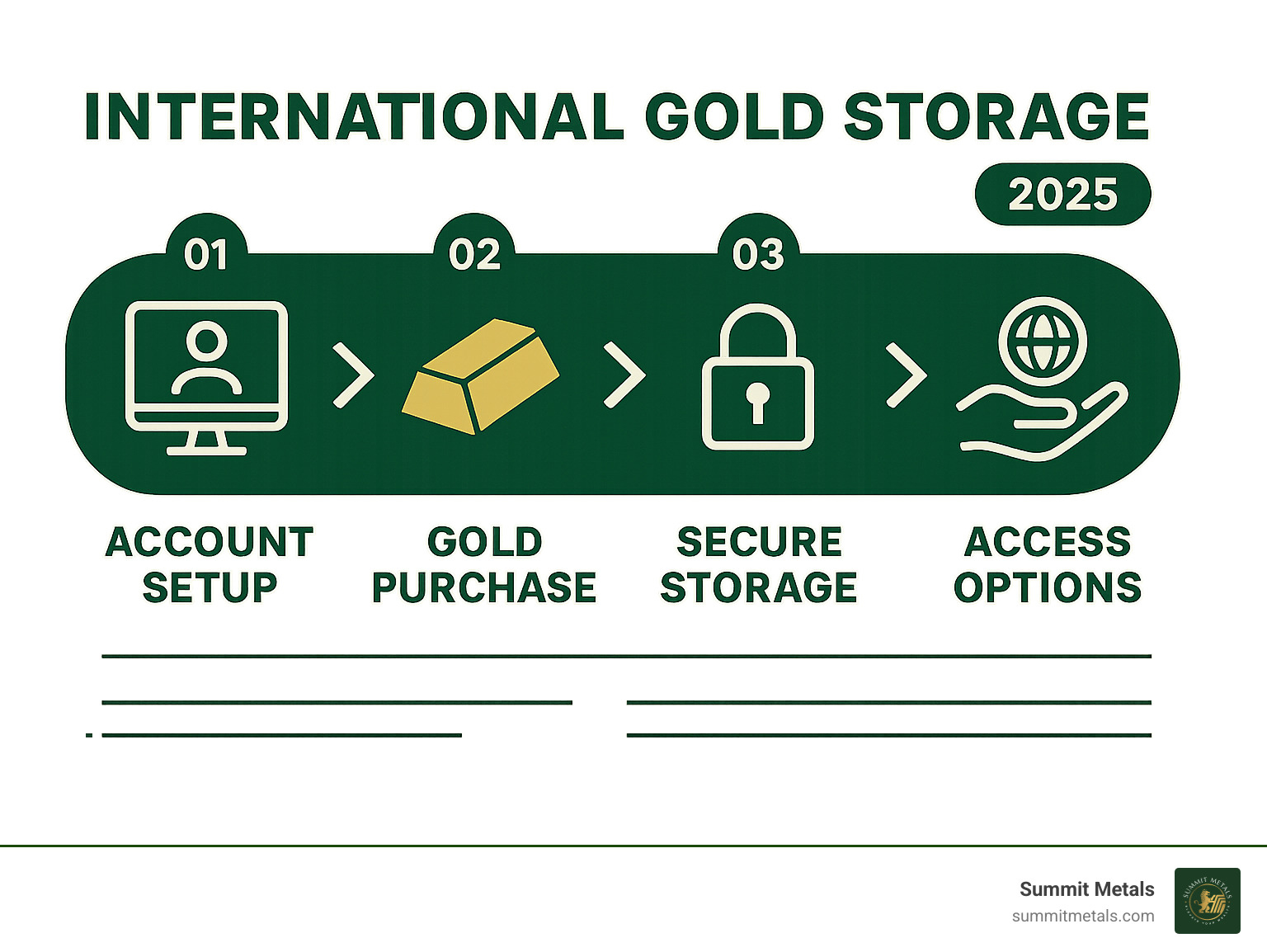

From Plan to Vault: A Practical Guide to Setup, Access, and Reporting

Opening an Account

- Complete an application (anti-money-laundering rules apply).

- Provide ID and proof of address; trusts/LLCs need organizing docs.

- Fund via wire and purchase metal or arrange transfer of existing bars.

Most accounts are live within 1–4 weeks.

Accessing and Liquidating Your Gold

- Inspection: book 24–48 hours ahead.

- Delivery: insured courier; $50–$150 handling plus shipping.

- Sell-back: many vaults provide two-way liquidity, often cheaper than shipping.

- Warehouse receipts: transfer ownership without moving the metal.

Tax & Reporting Basics

For U.S. citizens, allocated and segregated physical gold generally isn’t reportable under FBAR/FATCA. Capital-gains tax still applies on sale. Regulations vary, so consult an international-tax professional. For more on advanced options like transferable warehouse receipts, see our in-depth resources.

Conclusion

International gold storage represents one of the most sophisticated wealth protection strategies available to modern investors. As we've explored throughout this guide, the benefits extend far beyond simple security - they encompass asset protection, geographic diversification, and protection against government overreach that has historically threatened private wealth.

The key to successful international gold storage lies in thorough due diligence and careful selection of both jurisdiction and storage provider. Whether you choose Switzerland's traditional banking expertise, Singapore's modern innovation, or another jurisdiction that fits your specific needs, the fundamental principles remain the same: seek allocated and segregated storage, comprehensive insurance coverage, and providers with proven track records.

The costs associated with international gold storage - typically 0.5% to 1.5% annually - represent a small price to pay for the peace of mind and protection these arrangements provide. When you consider the potential risks of keeping all your wealth within a single jurisdiction, the diversification benefits alone justify the expense.

As economic uncertainty continues to mount and governments worldwide face increasing fiscal pressures, the arguments for international gold storage become more compelling. The strategy that once seemed reserved for the ultra-wealthy is now accessible to any investor serious about protecting their wealth across borders.

At Summit Metals, we understand that navigating the complexities of international precious metals storage can seem daunting. That's why we've built our reputation on transparent, real-time pricing and competitive rates that help our clients make informed decisions about their wealth protection strategies. Our Wyoming-based operations provide the stability and integrity you need when venturing into international markets.

The gold you own today could be the foundation of your family's financial security for generations to come. By storing it strategically across multiple jurisdictions, you're not just protecting an investment - you're securing your financial future against the uncertainties that lie ahead.

Ready to take the next step in protecting your wealth? Explore our secure depository services and find how we can help you implement a comprehensive international gold storage strategy that fits your specific needs and objectives.

The best time to plan for wealth protection is before you need it. The strategies we've discussed in this guide have helped countless investors preserve their wealth through economic downturns, political upheavals, and currency crises. Now it's your turn to take control of your financial destiny.