Why Recurring Silver Purchases Are Your Key to Consistent Wealth Building

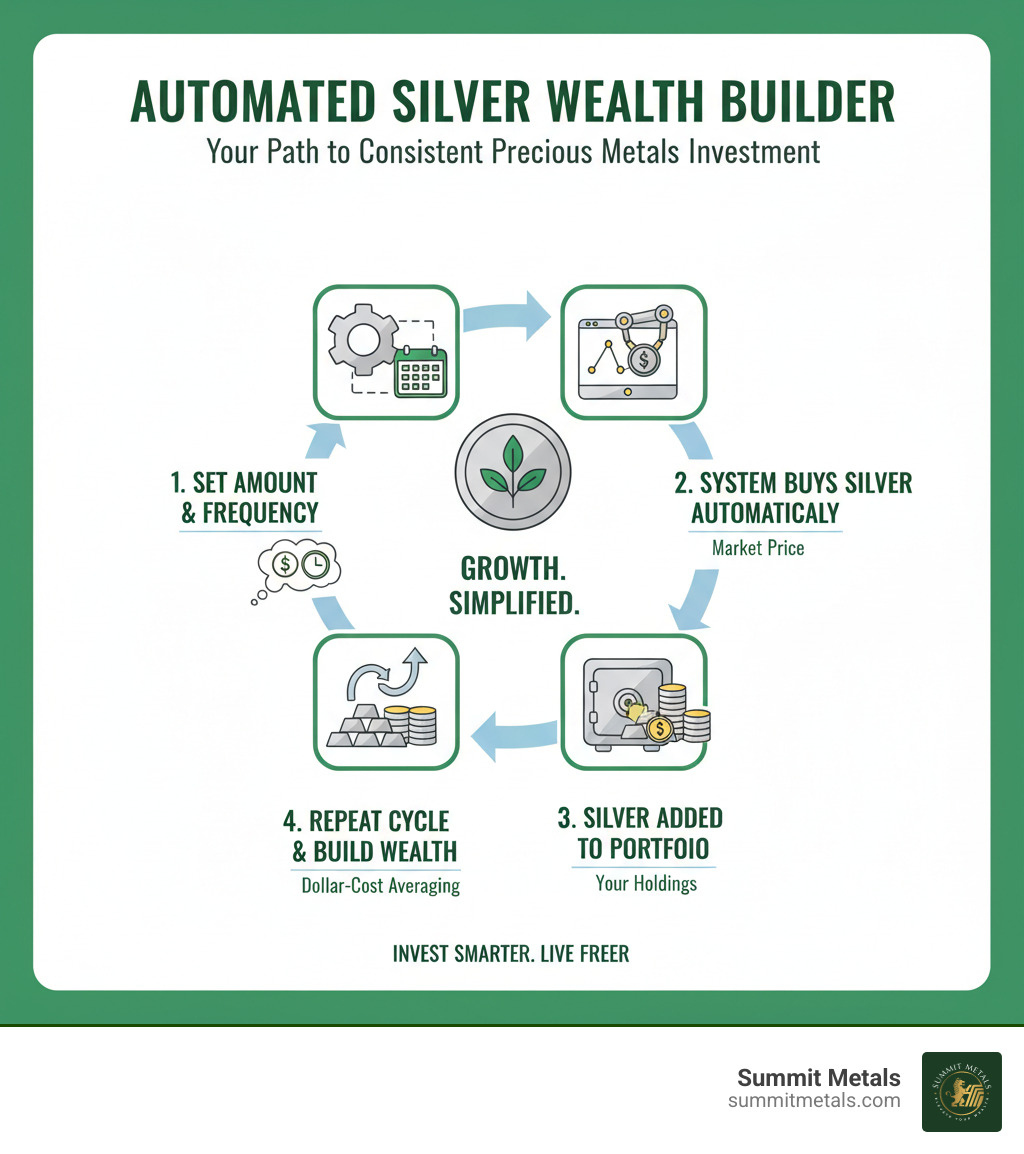

A recurring silver purchase is an automated investment plan where you buy silver at regular intervals (weekly, monthly, or quarterly) with a fixed dollar amount. Here's how to set one up:

Quick Setup Guide:

- Choose a reputable dealer with AutoInvest programs

- Set your budget (many plans have minimums from $50-$100 per purchase)

- Pick your frequency (weekly, monthly, or quarterly)

- Select silver products (coins, bars, or rounds)

- Link your payment method (ACH or eCheck are often best)

- Activate your schedule and let it run automatically

Let's face it - with everything happening in today's economy, the last thing you need is another item on your weekly to-do list. Yet building wealth through precious metals has never been more important for protecting your financial future.

Recurring silver purchase plans solve this problem by automating your investments. Instead of watching spot prices and timing the market, you invest a set amount regularly. This approach, called dollar-cost averaging, helps smooth out price swings and builds your stack consistently without the stress.

Many dealers now offer sophisticated AutoInvest programs that allow purchases at various frequencies, from daily to quarterly. The beauty is simple: you decide how much to invest and how often, then let the system handle everything else. No more emotional buying decisions or missed opportunities.

I'm Eric Roach, and during my decade on Wall Street advising Fortune 500 companies, I learned that the most successful investment strategies are systematic and consistent. Today I help everyday investors apply these same principles to precious metals, including setting up recurring silver purchase plans that build wealth automatically while you focus on everything else in your life.

What is a Recurring Silver Purchase Plan?

Picture this: you're building wealth in precious metals while you sleep, work, or enjoy time with family. That's exactly what a recurring silver purchase plan does for you. It's like having a personal investment assistant that never takes a day off.

Think of it as a 401k for your physical silver holdings. Just like a retirement account deducts money from each paycheck, your AutoInvest program pulls your chosen amount and converts it into real, tangible silver that gets added to your stack. Different dealers may call these programs "AutoInvest," "Auto Buy," or "Dollar Cost Averaging" plans, but they all accomplish the same goal: systematic wealth building through The Basics of Gold and Silver Stacking without the hassle.

The Core Concept: Investing on Autopilot

Life is busy enough without constantly watching silver charts and trying to guess if prices will go up or down tomorrow. A recurring silver purchase plan removes all the guesswork and emotional stress from precious metals investing. Instead of trying to time the perfect moment to buy, you simply commit to consistent purchases regardless of what the market is doing.

This consistency is key. When you remove emotion from your investment decisions, you avoid classic mistakes like waiting for the "perfect price" while silver climbs higher or panic buying during a spike. Your automated system just keeps working, steadily accumulating physical silver for your portfolio. Whether you're wondering Is Silver a Good Investment? or you're already convinced of its value, consistency beats perfect timing every single time.

Who Are These Plans For?

Recurring silver purchase plans are perfect for a wide range of investors:

- New Investors: You don't need to be an expert. Set your budget, pick a schedule, and start learning as your stack grows. It's a fantastic way to begin with The Ultimate Beginner's Guide to Investing in Precious Metals.

- Busy Professionals: The "set it and forget it" approach lets you build wealth without adding another task to your full schedule.

- Long-Term Wealth Builders: If you're thinking in decades, not months, automation ensures you consistently add to your holdings over the long haul.

- Portfolio Diversifiers: Regular purchases consistently strengthen your hedge against economic uncertainty.

The bottom line? If you want to own physical silver without the hassle of manual purchasing, a recurring silver purchase plan is an ideal solution.

The Strategic Edge of Automation: Why Set Up a Recurring Silver Purchase?

Picture this: it's Monday morning, you're rushing to get the kids ready for school, and you remember you meant to check silver prices over the weekend. Sound familiar? This is exactly why setting up a recurring silver purchase plan gives you such a strategic advantage over manual buying.

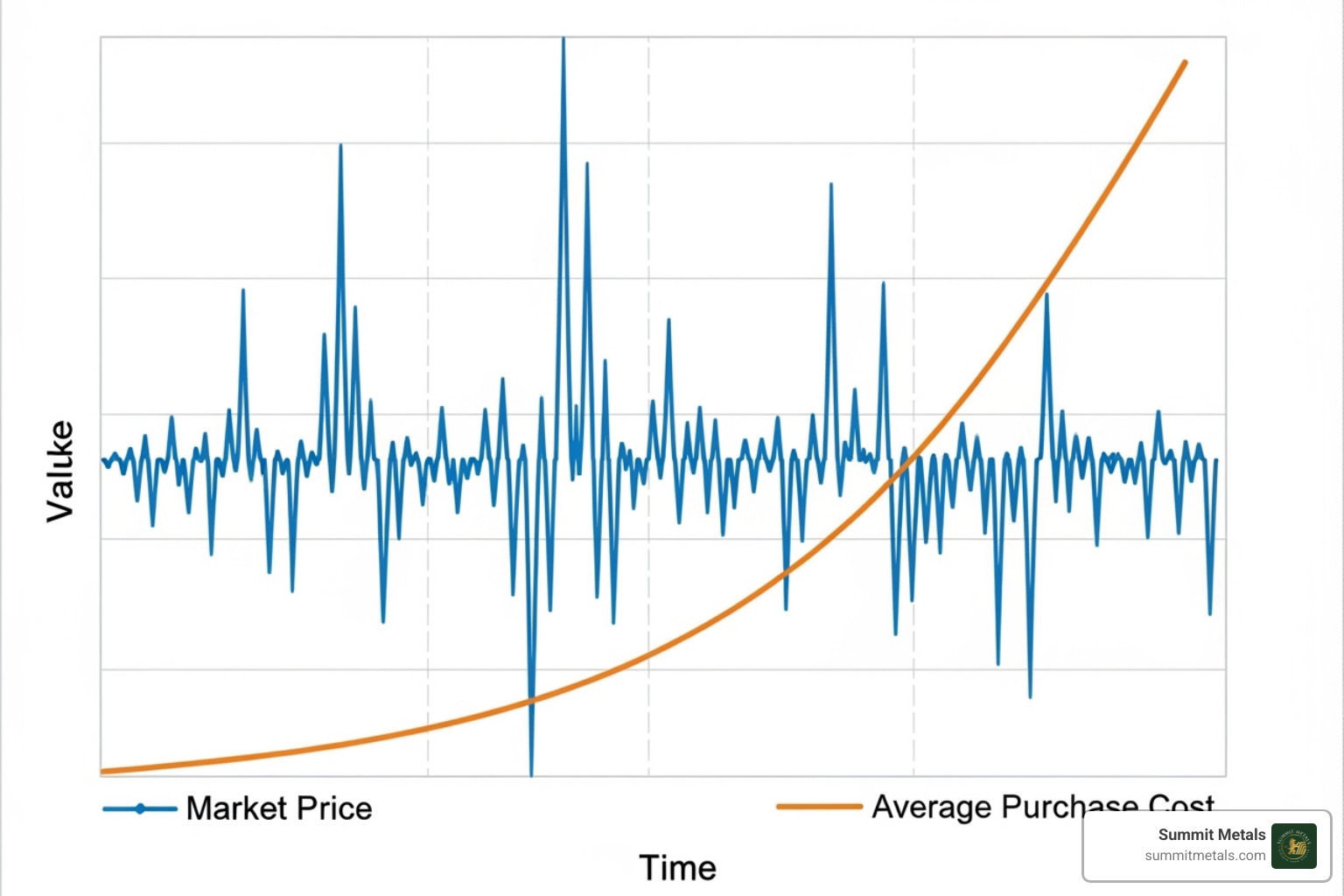

The magic happens through automation's ability to harness dollar-cost averaging (DCA), which transforms market volatility from your enemy into your friend. Instead of wondering when to jump in, you simply invest the same amount every month. When silver prices dip, your fixed dollar amount automatically buys more ounces. When prices rise, you get fewer ounces. Over time, this approach smooths out price swings and helps you build wealth without losing sleep over market timing. If you want a quick primer on the concept, see Dollar-cost averaging on Wikipedia. As detailed in The Power of Dollar-Cost Averaging in Gold and Silver Investments, consistency beats perfection every time.

The Power of Dollar-Cost Averaging (DCA)

Here's where dollar-cost averaging becomes your secret weapon. Instead of trying to time the market with one big purchase, you spread your investments across many smaller, regular purchases.

Let's say you invest $200 monthly in silver. When silver trades at $20 per ounce, you get 10 ounces. Next month, if silver jumps to $25 per ounce, your $200 only buys 8 ounces. But here's the beautiful part - your average cost per ounce over those two months is $22.22, right in the middle of that volatile range. This strategy turns market volatility into an opportunity. Those price dips that make headlines? They become buying opportunities that automatically benefit your portfolio. By consistently investing through both ups and downs, you capture long-term growth while minimizing the impact of short-term price swings. The Strategic Approaches to Investing in Gold and Silver: Dollar Cost Averaging and Value Averaging explores these concepts in greater detail.

Automation vs. Manual Purchases

The difference between automated and manual silver purchases is like comparing a reliable monthly bill payment to remembering to mail checks every month. Automation provides clear advantages:

- Time Savings: No more spending hours researching spot prices, comparing premiums, or placing individual orders. Your recurring silver purchase plan handles it all.

- Removes Emotional Decisions: Manual purchases are often driven by fear or greed. Automation cuts through these emotions with mathematical precision.

- Effortless Consistency: Your plan keeps building your silver stack, regardless of whether you're busy, distracted, or simply forgot.

- Avoids Market Timing: Even professional traders struggle to predict short-term price movements. Automation sidesteps this challenge entirely.

- Predictable Budgeting: A fixed, regular purchase is easy to incorporate into your monthly budget, making it easier to maintain discipline.

As discussed in Turning Volatility into Opportunity: A Guide to a Silver Buy and Stacking, this systematic approach transforms market uncertainty from a roadblock into a pathway for steady wealth accumulation.

How to Set Up Your Autoinvest Plan: A Step-by-Step Guide

Setting up a recurring silver purchase plan is surprisingly straightforward, and most reputable dealers have streamlined the process to get you started in just a few minutes. Think of it like setting up automatic contributions to your 401k - once it's configured, your investment runs on autopilot.

The beauty of these programs is their simplicity. You're essentially telling your chosen dealer: "Every month, take this amount from my account and buy me silver at the current market price." No fuss, no timing decisions, no second-guessing yourself.

Step 1: Choose a Reputable Dealer and Create an Account

Your dealer choice is absolutely critical. Look for transparent pricing with no hidden fees, and check their customer satisfaction ratings. Top dealers often have thousands of positive public reviews, demonstrating a long-standing history of trust.

At Summit Metals, we've built our reputation on being completely transparent about pricing and delivering exactly what we promise. Based here in Wyoming, we authenticate every piece of gold and silver we sell, and our bulk purchasing power means you get competitive rates without sacrificing quality or service. The account creation process is quick, and security measures are in place to protect you, following the guidelines outlined in How to Buy Gold and Silver Online Safely.

Step 2: Select Your Products and Set Your Schedule

Now comes the fun part - deciding what silver to buy and how often. Most recurring silver purchase programs let you choose from popular products like American Silver Eagles, Canadian Silver Maples, or generic silver rounds.

Here's something important to consider: silver coins have face value, which provides an extra layer of protection against fraud. While a silver round is just a piece of metal, a government-minted coin is legal tender with backing from its issuing country. This face value protection makes coins slightly more expensive but adds peace of mind.

Setting your schedule aligns your investments with your budget. Weekly fits well with paycheck schedules, and monthly mirrors how most people budget. Minimum investment amounts vary, but many programs start as low as $50 per purchase. The key is finding an amount that fits comfortably in your budget. For guidance on selecting the right silver products, check out Your Ultimate Guide to Buying Silver Coins Online.

Step 3: Configure Payment and Finalize Your Recurring Silver Purchase

The final step is linking your payment method. Most dealers accept ACH transfers, eChecks, and credit cards. ACH and eCheck are usually your best bet because they have lower fees.

Here's how the pricing works: each time your recurring silver purchase executes, you pay the current spot price plus premium. The spot price is what silver is trading for on the global market, and the premium covers fabrication and dealer costs. This means your $100 monthly investment might buy 3.2 ounces one month and 2.8 ounces the next, depending on market conditions. That's the magic of dollar-cost averaging at work.

Once you confirm your schedule and payment details, your first order will process, and you're officially on your way to building wealth through automated precious metals investing. For a deeper understanding of how precious metals are priced, read Spot Price vs. Premium: How Precious Metals Pricing Works.

Customizing Your Plan: Key Features and Options

The beauty of modern recurring silver purchase programs is their flexibility. Think of it like customizing your favorite streaming service - you get to pick exactly what you want, when you want it, and how often. These plans adapt to your lifestyle and budget.

At Summit Metals, our AutoInvest program brings this same flexibility to Wyoming, with transparent pricing that updates in real-time. No hidden fees, no surprise markups - just honest precious metals investing that works around your schedule. For a broader look at different dealers and their offerings, especially for silver bars, check out The 7 Best Places to Buy Silver Bars Compared.

Choosing What to Buy: Coins, Bars, or Rounds?

Deciding what physical silver to add to your stack is an important choice. Here’s a breakdown of the most common options:

| Feature | Government Coins (e.g., Silver Eagles) | Private Rounds (e.g., Buffalo Rounds) | Silver Bars |

|---|---|---|---|

| Premium | Highest | Lower | Lowest |

| Liquidity | Very High | High | High |

| Security | Highest (Gov't backed, legal tender) | Moderate (Reputable mint) | Moderate (Reputable refiner) |

| Best For | Investors prioritizing trust and recognizability. | Investors maximizing silver weight for the cost. | Investors focused purely on accumulating ounces at the lowest premium. |

Government coins like the American Silver Eagle are the gold standard. Backed by the U.S. government, they guarantee weight, content, and purity. They carry a higher premium, but they're also incredibly liquid. The legal tender status provides real fraud protection. For the full scoop, visit Shop American Eagle Coins: Find Your Perfect Silver Eagle Today.

Silver rounds and bars from reputable private mints offer the most bang for your buck. Lower premiums mean more actual silver in your stack, though they lack the government backing and legal tender status of coins. The choice often boils down to your priorities: maximum security or maximum ounces per dollar. Many savvy stackers mix both approaches in their recurring silver purchase plans.

Gold Coins vs. Gold Bars: Quick Comparison

Even if your primary focus is silver, many investors also automate monthly gold purchases with Summit Metals’ Autoinvest—just like contributing to a 401k. Here’s a simple side-by-side to help you choose if you add gold to your plan:

| Feature | Gold Coins (e.g., American Gold Eagle) | Gold Bars (e.g., 1 oz, LBMA-recognized) |

|---|---|---|

| Premium | Higher (design, minting, legal tender) | Lower (most cost-efficient per ounce) |

| Liquidity/Recognizability | Very High (widely recognized, easy resale) | High (best with well-known refiners) |

| Security | High: Legal tender with face value and government backing; strong anti-counterfeit features | High: Often serialized with assay cards; rely on recognized refiners for trust |

| Best For | Investors prioritizing trust, recognizability, and ease of resale | Investors maximizing ounces of gold per dollar |

Note: Gold coins’ legal tender face value and government backing add an extra layer of protection against counterfeiting concerns and can simplify resale verification. Bars typically offer the lowest premiums, especially from reputable refiners, making them ideal for cost-focused accumulation.

Pro tip: Use Summit Metals’ Autoinvest to schedule small, recurring purchases—monthly or biweekly—so you dollar-cost average into both silver and gold automatically, just like a 401k.

Managing Your Recurring Silver Purchase Plan

Life happens, and your AutoInvest plan should be flexible. The best programs offer an intuitive online dashboard where you can easily manage your account.

- Adjust Your Schedule: Most programs let you switch from weekly to monthly, increase your investment amount, or make other changes in minutes.

- Pause or Cancel: Need to take a break? Look for plans that let you pause and resume whenever you're ready. The best part is that most recurring silver purchase programs are no-contract affairs. You should be able to cancel anytime from your dashboard without calling customer service or paying a fee.

- Update Payment Info: Changed banks or got a new card? You should be able to swap payment methods without skipping a beat.

This flexibility ensures your precious metals investing adapts to your life, not the other way around. It's part of building a comprehensive retirement security strategy, as explored in Maximizing Retirement Security: Using a Precious Metals IRA to Invest in Gold and Silver With SummitMetals.com.

Frequently Asked Questions about Recurring Silver Purchases

Starting a recurring silver purchase plan can feel like uncharted territory, but the answers to common questions are simpler than you might think. These automated programs are designed to handle the complexities for you.

What happens if the silver spot price changes on my purchase day?

This is where the magic of dollar-cost averaging really shines. When your scheduled purchase day arrives, your order executes at the current market price (the spot price plus the dealer's premium at that moment).

This might sound unpredictable, but it's the whole point. If silver prices dropped since your last purchase, your fixed dollar amount buys you more ounces. If prices rose, you get fewer ounces. Over time, these ups and downs balance out, giving you a reasonable average cost per ounce without the stress of trying to time the market. You can see this pattern play out over decades in any Historical Price of Silver Graph.

Can I choose a specific dollar amount to invest?

Most recurring silver purchase programs give you flexibility. Some dealers let you set a specific dollar amount, often with a minimum of around $50-$100 per purchase. Other programs are product-based, where you choose to buy a specific item (like one American Silver Eagle) on a regular schedule. In that case, your cost will be whatever that item costs on purchase day.

At Summit Metals, our Autoinvest program lets you dollar-cost average just like contributing to a 401k. You can set up regular purchases that fit your budget, building your precious metals stack systematically over time.

If you're working with a smaller budget, don't let that stop you. As discussed in The Benefits of Buying Fractional Gold: Why Smaller Is Often Better Than Waiting for a 1oz Gold Coin, starting small and staying consistent often beats waiting to make larger purchases.

How do I cancel or pause my recurring purchases?

Life happens, and good recurring silver purchase programs understand that. The vast majority of reputable dealers make it incredibly easy to adjust your schedule without penalties.

Canceling is typically as simple as logging into your account dashboard and clicking a button. Look for programs with no contracts or cancellation fees, as this is a standard feature for trusted dealers.

Pausing your purchases is often even easier. If you have an unexpected expense or just want to skip a month, you should be able to pause your plan and resume it when you're ready. Some programs even offer the flexibility to pause a transaction on the day it is scheduled to occur.

The key is knowing your dealer's specific cutoff times for making changes. This flexibility ensures your recurring silver purchase strategy adapts to your life, not the other way around.

Conclusion: Automate Your Way to a Stronger Portfolio

Setting up a recurring silver purchase plan isn't just about buying precious metals—it's about creating a systematic path to financial security that works even when life gets busy. It is your personal wealth-building machine that never takes a day off.

The power of automation lies in its simplicity. While others stress about timing the market, your recurring silver purchase schedule ensures you're consistently building your stack through market ups and downs, letting dollar-cost averaging smooth out price swings.

Consistency is the key. Just like contributing to a 401k, regular precious metals investments compound over time. This disciplined approach has helped countless investors build substantial portfolios without losing sleep over daily price fluctuations.

At Summit Metals, we've designed our Autoinvest programs for investors who want the benefits of precious metals without the complexity. Our transparent, real-time pricing and bulk purchasing power mean you get competitive value. We handle the heavy lifting so you can focus on what matters most.

Don't let perfect be the enemy of good. You don't need to time the market or invest thousands at once. Start with what you can afford, set up your schedule, and let the system work for you. Your future self will thank you for the decision you make today.

Learn more about Dollar Cost Averaging with Summit Metals

Ready to take control of your financial future with automated silver investments? Explore Summit Metals' Autopays options to start your recurring silver purchase today! Or, if you're looking to sell, we're here to help: Sell to Us Find out more about how we can help you grow your wealth: Summit Metals Home Find our subscription options for even more convenience: Subscription Services