Understanding the True Cost of Copper Investment

The 1kg copper ingot price typically ranges from $125 to $165, but understanding what drives this cost requires looking beyond the sticker price. Here's what you need to know:

Current 1kg Copper Ingot Pricing Breakdown:

- Spot copper price: ~$9.90 per kilogram

- Typical retail price: $125-$165 per 1kg ingot

- Premium over spot: 1,200-1,600%

- Main cost drivers: Manufacturing, dealer margins, shipping, design complexity

Unlike precious metals where premiums typically run 3-8% over spot price, copper ingots carry massive premiums that can make them challenging investments. A Reddit user recently shared buying a 1kg copper bar for $39.30 when the actual melt value was only about $9 - highlighting the premium problem that defines this market.

Copper sits in a unique position as an industrial metal with growing investment interest. While it's not classified as a precious metal like gold or silver, copper's role in electric vehicles, renewable energy, and global infrastructure makes it increasingly attractive to investors seeking portfolio diversification.

The challenge? Those sky-high premiums mean you're paying far more than the metal's intrinsic value, which creates problems for profitable investment strategies.

I'm Eric Roach, and during my decade as an investment banking advisor in New York, I've seen how institutional investors approach commodity exposure - including understanding when 1kg copper ingot price premiums make sense versus when they don't. My experience guiding Fortune 500 companies through complex hedging strategies helps everyday investors steer these alternative asset decisions with the same disciplined approach used by major corporations.

Where to Buy Copper Ingots and What to Expect

Shopping for a 1kg copper ingot feels a bit like treasure hunting - you'll find them everywhere from professional bullion dealers to quirky Etsy shops, and the variety might surprise you. The challenge isn't finding copper ingots; it's understanding why prices can swing so wildly depending on where you shop and what catches your eye.

Where can you purchase 1kg copper ingots?

Professional bullion dealers offer the most straightforward path to copper ownership. Companies like APMEX and JM Bullion treat copper with the same professionalism they bring to gold and silver. You'll find properly stamped .999 fine copper bars with clear weight markings and certificates of authenticity. These dealers understand metals, offer secure shipping, and stand behind their products - but you'll pay for that peace of mind.

Online marketplaces like eBay and Etsy open up a whole different world. Here's where you'll stumble across everything from simple elemental bars to copper ingots shaped like bullets or stamped with zodiac signs. We've seen 1kg copper bars on Etsy listed around CA$125.38, though shipping costs can add up quickly. The variety is incredible, but buyer beware - always check seller ratings and verify what you're actually getting.

Local scrap dealers represent the wild card option. While most focus on buying rather than selling finished ingots, they can offer insights into raw copper values. Some Reddit users have found success working with scrap yards that have XRF guns for accurate metal testing, though you're more likely to find raw copper than polished investment bars.

The 1kg copper ingot price across these channels typically ranges from $125 to $165, remember that's a massive premium over the ~$9.90 spot price per kilogram. Prices shown are at the time of this publication.

How do designs and types affect the price?

Here's where things get interesting - and expensive. The simplest elemental design copper bars feature the periodic symbol "Cu," atomic number "29," and basic weight stamps. These no-frills options usually carry the lowest premiums because they're straightforward to manufacture.

Cast versus minted bars represent your first real choice. Cast bars have that rustic, handmade feel because they're literally poured into molds while hot. Minted bars start as copper blanks that get struck with precision dies, creating sharp details and uniform surfaces. The minted versions cost more, but they definitely look more professional on a shelf.

Then we enter novelty and collectible designs. Walking Liberty designs, buffalo stamps, Morgan dollar replicas, national landmarks - you name it, someone's probably stamped it onto a copper bar. These artistic touches can double or triple the premium you pay. They're conversation starters, but remember you're buying craftsmanship and marketing, not just metal.

Quality stamps matter more than you might think. Reputable ingots clearly display their weight (1 Kilo or 1000g), purity (.999 Fine Copper), and manufacturer information. This transparency builds trust, though it should be standard rather than premium-worthy.

The reality? If you're focused on copper as an investment, stick with simple designs. But if you're buying for the joy of ownership or as conversation pieces, those fancy designs might be worth the extra cost. Just know that every dollar spent on aesthetics is a dollar that needs to be recovered when you eventually sell.

Deconstructing the 1kg Copper Ingot Price

The 1kg copper ingot price is like an iceberg - what you see on the surface is just a small part of the whole story. When you're paying $125-$165 for that shiny copper bar, you're not just buying metal. You're buying into a complex web of global economics, manufacturing costs, and market dynamics that most people never think about.

What factors influence the price of copper?

Copper isn't sitting in some vault waiting to be finded - it's working hard every single day. Unlike gold, which gets its value partly from being pretty and rare, copper earns its keep through pure utility. That's what makes its price so interesting to watch.

Supply and demand drives everything in the copper world. When Chile (one of the world's biggest copper producers) has an earthquake, copper prices jump. When China's economy slows down, copper prices drop. It's that simple and that complicated at the same time.

The real excitement comes from copper's role in our changing world. Electric vehicles need about four times more copper than regular cars. Solar panels, wind turbines, and all that green energy infrastructure? They're copper-hungry monsters. Every time someone plugs in a Tesla or installs solar panels, they're creating demand for more copper.

China's economy deserves special mention here - they consume about half the world's copper. When Chinese construction booms, copper soars. When their factories slow down, copper takes a hit. It's like having one really big customer who can make or break your day.

Mining isn't getting easier either. The easy-to-reach copper deposits are mostly tapped out, so mining costs keep climbing. Add in environmental regulations (which are necessary but expensive), and you've got upward pressure on prices that isn't going away.

You can track all this drama in real-time on the London Metal Exchange's copper price charts or by reviewing a neutral overview like Copper. Watching copper prices move is like watching the world's economic heartbeat.

How does purity and origin impact the 1kg copper ingot price?

Here's where copper keeps things refreshingly simple compared to its precious metal cousins. Most investment-grade copper ingots come in .999 fine copper (99.9% pure), and that's about as fancy as it gets. Some mints push it to .9999, but honestly? The price difference is minimal because we're not talking about gold here.

Reputable mints matter more for peace of mind than premium pricing. When you buy from established names or get a Certificate of Authenticity (COA), you're paying for trust, not necessarily higher metal value. JM Bullion, for instance, backs their copper products with mint guarantees. It's nice to have, but it won't dramatically change your 1kg copper ingot price.

The real story is in the melt value versus everything else. Reddit user who paid $39.30 for a copper bar worth $9 in raw metal? That's copper investing in a nutshell. You're not paying for purity variations or mint prestige - you're paying for the change from industrial commodity to finished product.

Numismatic value barely exists in the copper world. Unlike silver coins that might gain collector premiums over time, copper ingots pretty much stay tied to their utilitarian value. A really unique design might appeal to collectors, but don't count on it for investment returns.

Historical Trends and the Future 1kg Copper Ingot Price

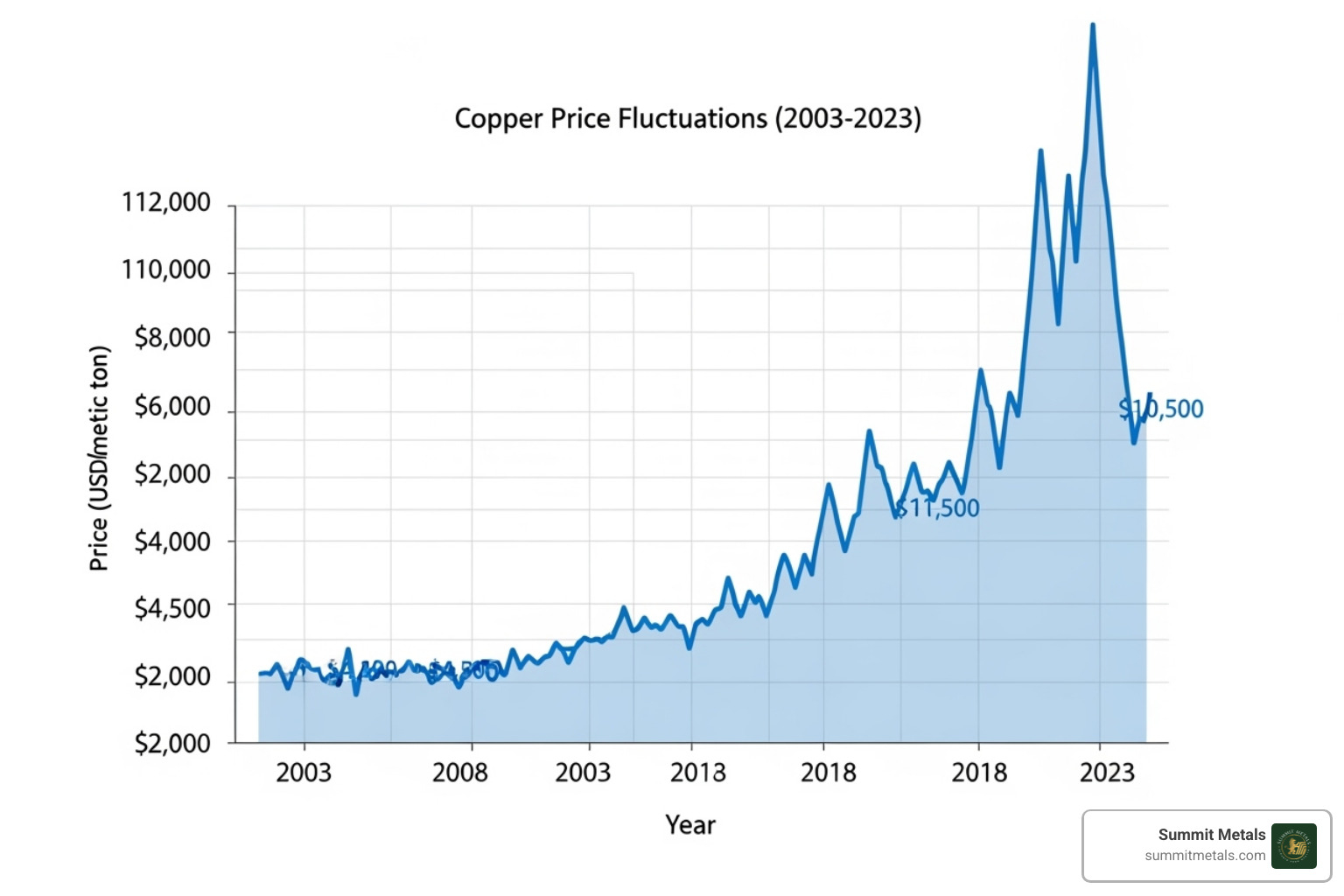

Copper's price history reads like a thriller novel with all the ups and downs. Back in 2000, copper was trading under $1 per pound - practically giving it away. By 2011, it had rocketed to over $4 per pound. That's the kind of volatility that makes copper both exciting and nerve-wracking.

The 21st-century price rise wasn't just random market noise. It reflected the world's growing appetite for technology, infrastructure, and industrial development. Countries were building like crazy, and copper was the backbone of it all.

But copper doesn't go up in a straight line. Price fluctuations are part of its personality. Economic booms send it soaring, recessions knock it down, and recovery cycles bring it back up. It's often called "Dr. Copper" because it's so good at diagnosing the health of the global economy.

Looking ahead, the long-term outlook for copper gets pretty exciting. The green energy transition isn't just a trend - it's a fundamental shift that requires massive amounts of copper. Electric vehicle adoption, smart grids, renewable energy projects - they all need copper, and lots of it.

The challenge for ingot investors is that while the underlying commodity might do well, those massive premiums over spot price create a completely different investment equation. Understanding these market cycles and building wealth consistently is where strategies like dollar-cost averaging really shine - which is exactly what we explore in our guide on strategic investing approaches.

Prices shown are at the time of this publication.

Copper vs. Other Metals: An Investment Comparison

When we're looking at the 1kg copper ingot price as an investment, it's like comparing apples to... well, much more expensive apples. Understanding how copper stacks up against precious metals helps us see exactly what we're getting into.

| Metric | Copper | Silver | Gold |

|---|---|---|---|

| Price per kg | ~$125 - $165 (ingot) / ~$9.90 (spot) | ~$1,000 - $1,500 (ingot) / ~$900 (spot) | ~$70,000 - $80,000 (ingot) / ~$68,000 (spot) |

| Industrial Use | High (electrical, construction, EVs) | High (electronics, solar, jewelry) | Moderate (electronics, dentistry, jewelry) |

| Monetary Use | Low | High (historical currency, store of value) | Very High (ultimate store of value, currency) |

| Volatility | Moderate to High (tied to industrial demand) | High (industrial + monetary demand) | Moderate (safe haven, monetary policy) |

| Storage Space | Very High (low value-to-weight ratio) | High | Low (high value-to-weight ratio) |

| Liquidity | Low (niche market, high premiums) | Moderate to High | Very High |

The numbers tell quite a story. While gold and silver typically carry modest premiums of 3-8% over spot price, copper ingots can command premiums ranging from 400% to over 1,600%. That's not a typo - we're talking about paying fifteen times more than the metal's actual value in some cases.

How does a 1kg copper ingot compare to the spot price?

Here's where things get interesting - and by interesting, I mean eye-opening. The gap between copper's spot price and retail ingot prices is absolutely massive.

Manufacturing costs play a role, sure. Melting, casting, stamping, and packaging copper into an attractive ingot isn't free. But these costs pale in comparison to what we see in the final price.

Dealer margins need to cover operational expenses and generate profit. Since copper has such low intrinsic value relative to its weight, dealers often apply higher percentage markups to make each sale worthwhile. It's basic business math, but it creates a challenging environment for investors.

Shipping costs hit particularly hard with copper. A 1kg copper ingot is heavy and relatively inexpensive, making shipping a significant percentage of the total cost. Unlike gold, where a small, high-value package justifies express shipping, copper's weight-to-value ratio works against it.

That Reddit example we mentioned earlier - where someone paid $39.30 for a bar worth $9 in melt value - perfectly illustrates this challenge. We're essentially paying $30 for the privilege of owning copper in ingot form rather than as raw commodity. Prices shown are at the time of this publication.

Advantages and Disadvantages of Copper Bullion

Let's be honest about what we're dealing with here. Copper bullion has some genuine advantages, but the disadvantages are significant enough that they deserve serious consideration.

On the positive side, copper offers remarkable affordability as an entry point into physical metal ownership. A 1kg copper ingot price won't break the bank like gold or silver might. The industrial demand story is compelling too - copper's role in electric vehicles, renewable energy, and global infrastructure provides genuine long-term support for price appreciation.

Copper also offers portfolio diversification beyond traditional precious metals, giving exposure to industrial commodities that move differently than monetary metals.

But here's where reality sets in. Those massive premiums create an immediate hurdle that's tough to overcome. We're starting each purchase significantly underwater, hoping that copper prices will rise enough to overcome not just the premium we paid, but also the premium we'll face when selling.

The storage challenge is real. Copper's low value-to-weight ratio means accumulating any meaningful dollar amount requires substantial space. A $1,000 investment in copper ingots weighs about 60-80 pounds and takes up considerable room compared to the same investment in silver or gold.

Liquidity concerns make exit strategies tricky. While gold and silver have robust, liquid markets, copper ingots occupy a much smaller niche. Finding buyers willing to pay fair prices can be challenging, especially if we're hoping to recoup some of that original premium.

Perhaps most importantly, copper lacks the monetary properties that make gold and silver attractive during economic uncertainty. Its value is purely industrial, making it more vulnerable to economic downturns when industrial demand contracts.

For investors serious about building wealth through physical metals, understanding The Basics of Gold and Silver Stacking reveals why precious metals typically offer better value propositions than industrial metals like copper.

The bottom line? Copper ingots can be interesting additions to a collection or educational tools, but the economics work against them as serious investment vehicles compared to precious metals.

Is Investing in Copper Ingots a Profitable Strategy?

Let's be honest about copper ingots as an investment strategy. After examining the 1kg copper ingot price structure and market dynamics, the financial reality is sobering for most investors seeking pure profit from metal appreciation.

What are the potential returns and risks?

The math behind copper ingot profitability tells a challenging story. While copper as a commodity has genuine appreciation potential - especially with the electric vehicle revolution and renewable energy expansion - the retail ingot market operates under very different rules.

The Premium Problem creates the biggest obstacle to profitability. When you purchase a 1kg copper ingot for $150 while the spot price sits at $9.90, you're essentially betting that copper will increase by roughly 1,400% just to break even on the metal's intrinsic value. That's asking copper to jump from around $10 per kilogram to $140 per kilogram - a massive leap that would require unprecedented industrial demand.

Selling challenges compound this issue significantly. Unlike gold and silver, which enjoy deep, liquid markets with established dealer networks, copper ingots occupy a niche space. Local scrap yards typically pay close to melt value, while online marketplaces involve fees, shipping costs, and the challenge of finding buyers willing to pay meaningful premiums.

One Reddit user shared their experience of making more profit on copper bullion than silver over the past decade, but they wisely cautioned that "past results are not indicative of future performance." Their success appears to be an outlier in a market where most participants view copper ingots as collectibles rather than serious investment vehicles.

Associated costs further erode potential returns. Storage space becomes expensive when you need significant copper weight to achieve meaningful value. Insurance, if you choose to protect your investment, adds ongoing expenses that precious metals justify more easily due to their higher value density.

Strategic Approaches to Metal Investing

For building long-term wealth through physical metals, we recommend focusing your energy and capital on precious metals while employing proven investment strategies that actually work with market realities.

Dollar-cost averaging remains the gold standard for metal accumulation. By investing a consistent amount monthly - say $200 - you automatically buy more ounces when prices drop and fewer when they spike. This approach smooths out volatility and removes the stress of trying to time perfect entry points.

The Autoinvest advantage makes this strategy effortless. At Summit Metals, we've designed our Autoinvest program to work exactly like your 401k contributions - automatic, consistent, and building wealth over time. You set your monthly amount, and we handle the rest, ensuring you're steadily accumulating precious metals without the emotional decision-making that derails many investors.

Beyond the strategy of how you buy, it's also important to consider what you buy. When investing in gold and silver, you can choose between bars and coins, each with unique benefits.

| Feature | Gold/Silver Bars | Gold/Silver Coins |

|---|---|---|

| Premium | Generally lower over spot price | Slightly higher due to minting costs |

| Liquidity | Highly liquid, easy to sell | Very high, recognizable worldwide |

| Security | Stamped with weight and purity | Legal tender status adds a layer of anti-counterfeiting protection |

| Face value/legal tender | No face value; purely bullion | Has a legal-tender face value, aiding recognition and providing statutory protections against counterfeiting/fraud |

| Divisibility | Larger units, harder to divide | Available in smaller, more divisible units for easier selling |

Gold and silver coins also carry a face value that improves recognition and brings additional legal protections against counterfeiting—an extra fraud deterrent versus generic bars.

While bars offer more metal for your money, government-minted coins provide an added layer of security. Their status as legal tender makes them harder to counterfeit and instantly recognizable, which can be a significant advantage when it's time to sell.

Consistent monthly purchases through our program give you access to our bulk purchasing power, meaning better prices than sporadic individual purchases. While a 1kg copper ingot price might include 400-1600% premiums, our gold and silver offerings maintain much more reasonable premiums of 3-8% over spot price.

Building a precious metals stack over time through disciplined purchasing beats trying to profit from copper's extreme premium structure. Our Bullion Investing 101 guide walks you through exactly how to build this wealth-preservation strategy effectively.

The bottom line? Copper ingots work better as conversation pieces or industrial curiosities than serious investment vehicles. For real wealth building, stick with gold and silver through proven accumulation strategies that align with actual market dynamics rather than fighting against massive built-in premiums.

Conclusion

After diving deep into 1kg copper ingot price, we've finded something quite revealing. Copper truly is the backbone of our modern world - from the wiring in our homes to the electric vehicles revolutionizing transportation. Its industrial importance is undeniable, and the long-term demand outlook looks incredibly strong.

But here's where things get interesting (and a bit sobering for investors). While copper's spot price hovers around $9.90 per kilogram, that shiny 1kg copper ingot you're eyeing will likely cost you $125 to $165. That's a premium of 1,200% to 1,600% over the actual metal value - a markup that would make even the most optimistic investor pause.

The reality is stark: those massive premiums create an almost impossible hurdle for profitable investment. Even if copper prices double or triple, you'd still be underwater on most ingot purchases. It's like buying a $40 sandwich when the ingredients cost $3 - the math just doesn't work for serious wealth building.

For collectors and enthusiasts, copper ingots can be fascinating conversation pieces or educational tools. There's something satisfying about holding a kilogram of pure elemental copper, especially one with an attractive design. But as an investment strategy? The numbers tell a different story.

At Summit Metals, we've seen countless investors drawn to alternative metals before finding the superior benefits of precious metals. Gold and silver offer everything copper lacks as an investment: lower premiums, higher value-to-weight ratios, established monetary history, and liquid markets where you can actually sell without losing your shirt.

Our Autoinvest approach makes building a precious metals portfolio as simple as contributing to your 401k. Instead of gambling on high-premium copper, you can dollar-cost average into gold and silver monthly, taking advantage of market fluctuations while building real wealth over time. Our transparent pricing and bulk purchasing power ensure you're getting authentic metals at competitive rates.

The bottom line? Save your money for metals that have stood the test of time as stores of value. Your future self will thank you for choosing substance over novelty.

Ready to build a portfolio that actually makes financial sense? Learn how to buy precious metals online safely and find why thousands of investors trust Summit Metals for their precious metals journey.