Why Real-Time Precious Metal Prices Matter for Your Wealth

Real-time precious metal prices are the heartbeat of the precious metals market, reflecting the exact value of gold, silver, platinum, and palladium as they update. For anyone building a retirement hedge or protecting wealth from inflation, live prices are essential for making informed buying decisions at the right moment.

Current Live Prices (as of this publication):

| Metal | Spot Price | 24-Hour Change |

|---|---|---|

| Gold | $4,076.80/oz | +$12.60 (+0.31%) |

| Silver | $50.11/oz | +$0.17 (+0.34%) |

| Platinum | $1,536.00/oz | +$21.00 (+1.39%) |

| Palladium | $1,375.00/oz | +$11.00 (+0.81%) |

Unlike stocks, precious metal prices aren't tied to company performance. They respond directly to global supply and demand, geopolitical events, and currency fluctuations. This means the price shifts constantly based on worldwide trading activity.

Understanding these movements is your competitive advantage. As one market analyst noted, "Precious metals offer an investment that provides the means to weather economic storms and retain value when all else fails." But you can only capture that value if you know what you're paying right now. Tracking real-time precious metal prices lets you see exactly how metals are trending, so you can stop guessing and start investing strategically.

I'm Eric Roach. After a decade in investment banking using these same real-time data points for Fortune 500 clients, I now help individuals apply institutional tactics to build wealth with physical gold and silver.

Today's Market Snapshot: Current Precious Metal Prices

The precious metals market is always active, with real-time precious metal prices shifting by the second. The prices in our opening table—Gold at $4,076.80/oz, Silver at $50.11/oz, Platinum at $1,536.00/oz, and Palladium at $1,375.00/oz—are spot prices. This is the current rate for immediate delivery of physical metal.

At Summit Metals, we provide access to these live prices with total transparency. Our bulk purchasing model ensures you get competitive rates reflecting the real market, not inflated dealer markups. While the spot price is the baseline, the final price includes a premium for minting, authentication, and delivery. We explain this in our guide on Spot Price vs. Premium: How Precious Metals Pricing Works.

What is the Difference Between Spot Price and Futures Contracts?

When you buy physical metals, you're dealing with the spot market—the price for metal you can hold today. Futures contracts, on the other hand, are agreements to buy or sell metal at a set price on a future date. Traded on exchanges like COMEX, they are primarily used by large institutions to hedge risk. While futures trading influences the spot price you pay, as a physical investor, you are buying a tangible asset, not a paper contract. For a look into this world, COMEX Live offers a window into institutional trading.

Understanding the Gold-to-Silver Ratio

The gold-to-silver ratio is a powerful tool that tells you how many ounces of silver it takes to buy one ounce of gold. Currently around 81:1, this ratio helps investors gauge relative value. Historically, it has ranged from 15:1 to over 100:1.

A high ratio may suggest silver is undervalued compared to gold, while a low ratio might mean gold is the better bargain. The ratio also reflects market sentiment; it often rises during economic uncertainty as investors flock to gold. This investment indicator can help you time your purchases more strategically, whether you're buying a few coins or using Summit Metals' Autoinvest program. For a deeper dive, read our analysis: The Gold and Silver Ratio: A Timeless Measure for Precious Metals Investors.

Decoding the Ticker: Factors Driving Daily Price Fluctuations

The daily fluctuations in real-time precious metal prices aren't random; they're driven by global economic, industrial, and political forces. Understanding these drivers helps you interpret market movements and invest with insight.

Economic Indicators and Currency Strength

Precious metal prices are highly sensitive to economic health.

- Inflation Rates: As inflation erodes the purchasing power of currency, investors often turn to gold as a proven inflation hedge, driving its price up.

- Interest Rates: Higher interest rates can make interest-bearing assets like bonds more attractive than non-yielding gold and silver. Conversely, when rates fall, precious metals often become more appealing.

- U.S. Dollar Value: Since metals are priced in dollars, a stronger dollar makes them more expensive for foreign buyers, which can lower prices. A weaker dollar often has the opposite effect.

To learn more, see our guide on The Interplay of Interest Rates, The Dollar, and Gold Prices.

Industrial and Investment Demand

Precious metals have a dual role as both investments and essential industrial materials.

- Industrial Use: Demand for silver in solar panels and platinum and palladium in catalytic converters directly impacts their prices. As green energy and stricter emissions standards grow, demand for these metals increases.

- Investment Demand: In times of uncertainty, investors flock to the safety of physical bullion and ETFs. This investment demand creates a strong price floor, especially for gold. Wondering if silver is right for you? Read our analysis: Is Silver a Good Investment?.

Geopolitical Climate and Market Uncertainty

Precious metals are the ultimate safe-haven assets. During global conflicts, economic recessions, or political instability, investors move capital from volatile stocks into the perceived safety of gold and silver, often causing their prices to surge. These events underscore why precious metals are essential for wealth protection. Our guide on Price of Gold and Silver Bullion: Essential Investments for Wealth Protection Amid Economic Uncertainty in 2024 explains how to position your portfolio.

Mastering the Charts: Using Real-time Precious Metal Prices for Investment Strategy

Using real-time precious metal prices is about turning data into a smart investment strategy. Understanding price movements allows you to invest with confidence, not emotion.

How Real-time Precious Metal Prices Compare to Historical Averages

Daily volatility is just noise without context. While prices fluctuate daily, long-term trends are what build wealth. For example, silver's price has doubled over the last decade, a powerful upward trend that daily dips don't erase. Historical charts reveal these larger market cycles, helping you see if current prices are high or low relative to the past. For a closer look, explore our Gold Prices Today: Live Gold Price Chart, Historical Data.

A Guide to Reading Real-time Precious Metal Prices Charts

Reading a price chart is simple once you know what to look for.

- Chart Timeframes: Use long-term charts (1-year, 5-year) to identify major trends and short-term charts (24-hour) to see immediate market reactions.

- Support and Resistance: These are price levels where a metal historically stops falling (support) or rising (resistance).

- Trend Lines: These lines help you visualize the overall direction of the price over time.

For more tips, check out The Silver Lining: How to Track and Understand Silver Prices.

From Data to Decisions: Choosing Your Physical Metals

Once you're ready to buy, you'll choose between coins and bars. While both are tangible wealth, coins offer distinct advantages for many investors.

| Feature | Gold Coins | Gold Bars |

|---|---|---|

| Face Value | Yes (e.g., American Gold Eagle) | No |

| Fraud Protection | Backed by sovereign government; intricate designs make counterfeiting difficult | Authenticity relies on refiner/dealer reputation; easier to counterfeit |

| Divisibility | Easy to sell smaller units (1 oz, 1/2 oz, 1/4 oz) without breaking anything | Requires selling larger units, limiting flexibility |

| Resale Market | Highly liquid and universally recognized by dealers worldwide | Liquid, but may require additional verification steps |

| Premium | Higher premium over spot price due to minting costs and collector value | Lower premium over spot price, closer to raw metal value |

| Storage | Compact and easy to store securely | Can be cumbersome for larger quantities |

At Summit Metals, we often recommend gold coins for their superior security and flexibility. A government-minted coin like the American Gold Eagle has a face value, guaranteeing its weight and purity. This sovereign backing is a powerful anti-counterfeiting feature that bars lack. Coins are also easier to sell in smaller increments, giving you more control over your investment. While coins have a higher premium, it buys you peace of mind, liquidity, and fraud protection. For other options, see Platinum Bullion and Spot Price: What You Need to Know.

Smart Investing with Autoinvest from Summit Metals

Trying to time the market is a stressful and often losing game. A better approach is Autoinvest from Summit Metals. This program allows you to make consistent, automated monthly investments in gold and silver.

It's like a 401k for precious metals. This strategy uses dollar-cost averaging, one of the most effective wealth-building techniques. Your fixed investment buys more ounces when prices are low and fewer when they are high, averaging out your cost over time. It's a disciplined, low-stress way to build your holdings and mitigate market volatility. Learn more about gold's role in a smart portfolio in The Midas Touch: Exploring the Benefits of Gold Investment.

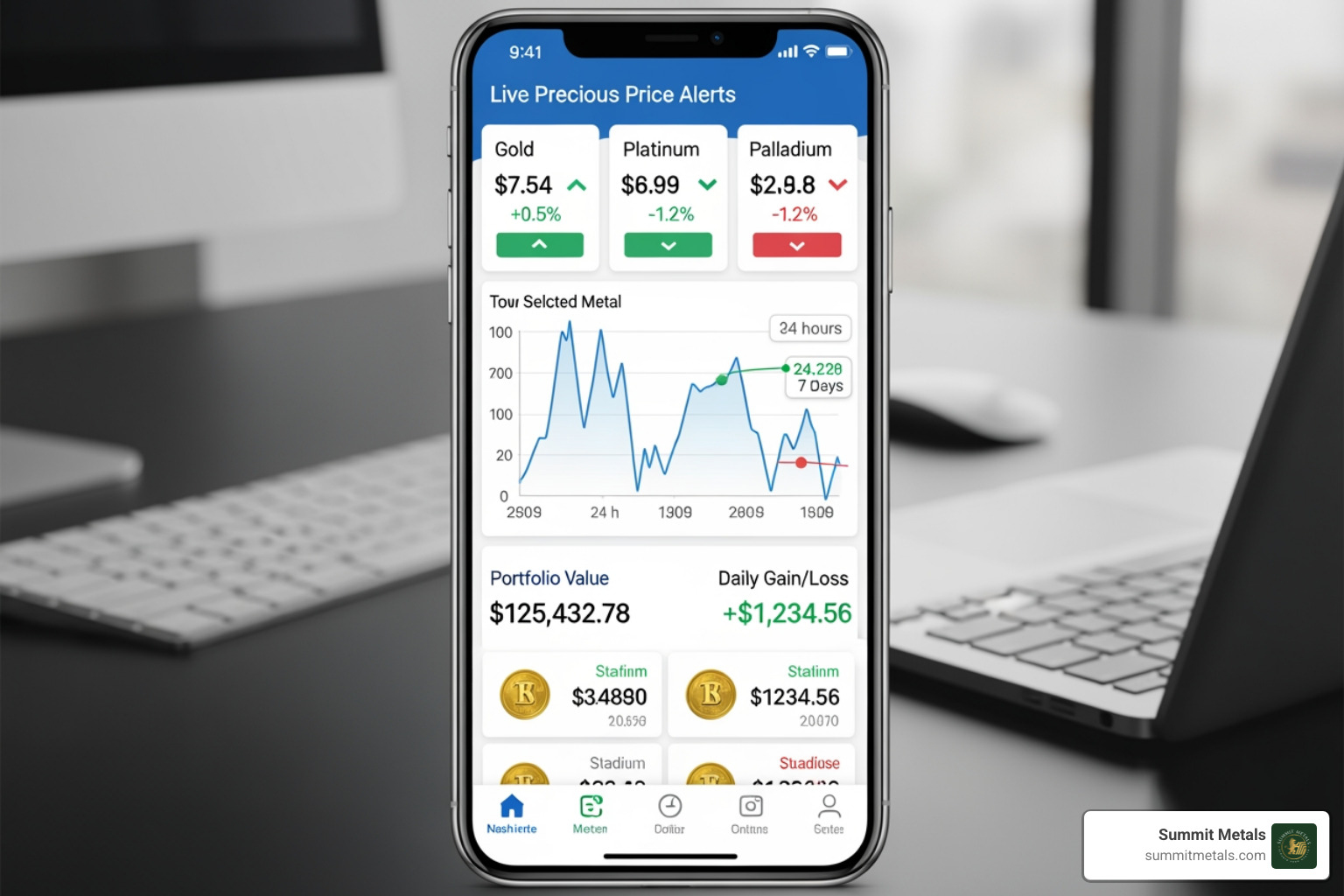

Where to Find Reliable Live Prices and Data

Access to accurate real-time precious metal prices is essential for smart investing. At Summit Metals, we prioritize transparency by giving you the tools to see what's happening in the market at any moment.

Reputable Online Data Providers and Tools

You no longer need a Wall Street connection to track precious metals. Several reliable sources are available to individual investors.

Our Summit Metals live price dashboard is your primary resource for current prices. We designed it to be straightforward and user-friendly, reflecting our commitment to market transparency. For investors who like to cross-reference data, major financial news websites and market data providers also offer live charts and analysis.

When using these tools, they show the spot price. The final retail price for physical bullion will include a premium to cover minting, shipping, and insurance. At Summit Metals, our bulk purchasing model helps keep these premiums competitive, ensuring you get excellent value.

Understanding the Major Pricing Hubs

Real-time precious metal prices are generated by trading activity at key global hubs.

- COMEX: Operating out of New York, COMEX is the primary market for gold and silver futures contracts. Its trading activity is a key driver for global price findy.

- LBMA (London Bullion Market Association): The LBMA is the center of the global over-the-counter market for physical precious metals. It administers the official pricing benchmarks for platinum and palladium.

These hubs ensure that the prices you see on our dashboard are globally recognized and reflect true market supply and demand. You can learn more about the London benchmarks at Precious metals | London Metal Exchange.

Conclusion: Turning Market Data into Your Financial Advantage

Understanding real-time precious metal prices empowers you to make strategic decisions for your long-term wealth protection. It's not about predicting the market, but about acting with knowledge.

You now know the key drivers—from inflation rates to industrial demand—and how to interpret price charts. Most importantly, you know that daily volatility is part of a larger trend and that strategic, consistent action is the key to success.

This is why dollar-cost averaging through our Autoinvest program is so powerful. By making consistent monthly purchases of gold and silver, you smooth out price fluctuations and build your holdings systematically, just like contributing to a 401k. It's a disciplined strategy for long-term wealth building.

At Summit Metals, our business is built on transparency. Our Wyoming-based reputation is founded on providing authenticated metals with clear, real-time pricing and competitive rates from our bulk purchasing power. You always know what you're paying and why.

Armed with the right knowledge and tools, you are no longer a bystander but an informed investor. You can make strategic moves to protect your purchasing power and build generational wealth.

Ready to take the next step? Learn how to integrate physical gold and silver into your retirement plan with our guide on how to Secure your retirement with a Gold IRA Investment. Let's build your financial future together.