Why Utah Gold Coins Legal Tender Status Matters for Your Financial Future

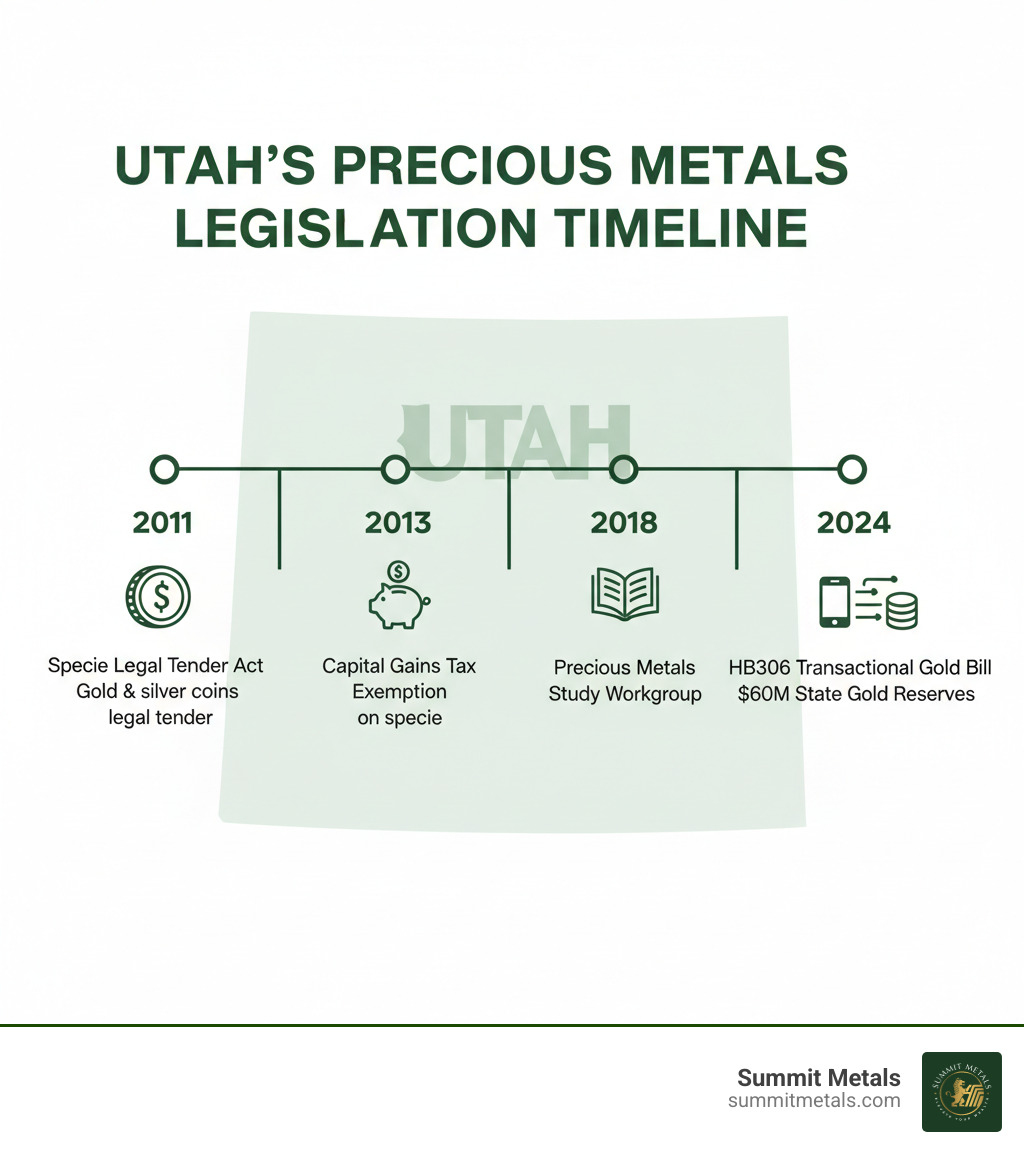

Utah is America's leader in the "sound money" movement, establishing Utah gold coins legal tender status for U.S. government-issued gold and silver coins with the 2011 Specie Legal Tender Act and expanding it with 2024's HB306 legislation.

Quick Facts:

- Legal Status: Gold and silver coins issued by the U.S. government are legal tender in Utah.

- Voluntary Acceptance: No one can be forced to accept specie legal tender except by contract.

- Tax Benefits: Utah offers a nonrefundable capital gains tax credit for exchanges of specie legal tender.

- Sales Tax Exemption: Bullion with 50%+ precious metal content is exempt from Utah sales and use tax.

- 2024 Expansion: HB306 authorizes electronic payment platforms backed by precious metals and allows state vendors to accept gold and silver.

This framework creates unique advantages for those looking to protect wealth from inflation and diversify their portfolios. By allowing gold and silver to function alongside traditional currency, Utah provides a practical roadmap for financial stability. The state backs this commitment with $60 million in gold reserves and authority for the treasurer to invest up to 20% of certain reserve funds in precious metals.

I'm Eric Roach. After a decade advising on multi-billion-dollar transactions for Fortune 500 companies, I now help individual investors apply the same institutional strategies for using gold as a defensive hedge. This guide will walk you through everything you need to know about navigating Utah's evolving laws to build a resilient portfolio.

The Foundation: Utah's 2011 Specie Legal Tender Act

On March 10, 2011, Utah became the first state to pass the Specie Legal Tender Act (House Bill 317), recognizing gold and silver as legal tender. This landmark legislation affirmed that gold and silver coins issued by the U.S. government, like American Gold and Silver Eagles, are officially recognized as money in Utah. The law was not about replacing the dollar but about providing an alternative store of value.

A key principle of the utah gold coins legal tender status is voluntary acceptance. No one can be forced to accept gold or silver as payment unless specified in a contract. This approach is grounded in Article 1, Section 10 of the U.S. Constitution, which allows states to recognize gold and silver coin as a tender in payment of debts. As legal scholar William Baude argued in The Constitutionality of the Utah Legal Tender Act, the law exercises a power reserved for states without violating federal authority. For Utahns, it was a practical step toward protecting purchasing power against inflation.

Understanding the Tax Status of Utah Gold Coins Legal Tender

Utah improved its legal tender law by addressing taxes, providing significant benefits for precious metals investors.

- Capital Gains Tax Credit: Utah offers a nonrefundable capital gains tax credit for exchanges of U.S. government-issued gold and silver coins. This effectively eliminates state-level capital gains tax on these transactions, though federal capital gains taxes still apply.

- Sales Tax Exemption: Under Utah Code 59-12-104, the purchase of gold, silver, and platinum bullion or coins with at least 50% precious metal content is exempt from state sales and use tax.

These tax advantages mean your investment dollars go directly into acquiring precious metals, not to tax collectors. For investors building a position over time—much like contributing to a 401(k)—these savings can significantly compound. This framework makes Utah one of the most favorable states for precious metals ownership. To learn more about local options, see our guide on Utah Silver Shopping Made Easy: Find Trusted Dealers Near You.

A New Era: How 2024 Legislation Expands Utah's Precious Metals Framework

In 2024, Utah reaffirmed its leadership in the sound money movement with HB306, a "transactional gold bill" that moves precious metals from a store of value to a practical payment option. Sponsored by Rep. Ken Ivory and Sen. Keith Grover, and championed by State Treasurer Marlo Oaks, this legislation builds on recommendations from the Utah Precious Metals Study Workgroup [https://le.utah.gov/~2024/bills/hbillhtm/HB0348.htm].

Key provisions of HB306 include:

- Authorizing a gold-backed electronic payment platform, allowing for digital transactions backed by physical, audited gold and silver stored in Utah.

- Expanding the definition of "specie legal tender" beyond just U.S. coins to include gold or silver coin and bullion from other sources.

- Allowing state vendors to accept payments in physical gold and silver, creating real-world use cases for utah gold coins legal tender.

This legislation ([https://le.utah.gov/~2025/bills/static/HB0306.html]) creates a blueprint for integrating sound money into a modern financial system.

The Rise of Transactional Gold and State Investment

The challenge has always been using high-value assets like gold for small purchases. HB306 solves this by enabling digital platforms that fractionalize physical gold, making it usable for everyday commerce. This system combines the convenience of digital payments with the security of real, audited assets, offering a voluntary alternative to fiat currency. Unlike the U.S. dollar, whose value is based on government decree, these gold-backed currencies derive their value from the intrinsic worth of the metal they represent, making them a powerful hedge against inflation.

Utah isn't just legislating; it's investing. The state has grown its gold reserves to $60 million and authorized the State Treasurer to invest up to 20% of certain budget reserve funds in specie legal tender. This strategy aims to protect the purchasing power of the state's "rainy-day funds" from inflation.

This state-level commitment validates the same principles we advise for individual investors: diversification and long-term protection. Just as the state builds its reserves, individuals can use our Autoinvest feature to dollar-cost average into precious metals. By making regular monthly purchases, you can build your position systematically, smoothing out market volatility and securing your financial future, much like contributing to a 401(k).

Understanding Your Options: Gold Coins vs. Other Gold Investments

When investing in physical gold, the two main forms are coins and bars. Both are excellent stores of value, but they have key differences, especially concerning Utah gold coins legal tender status.

Gold Coins vs. Gold Bars

| Criteria | Gold Coins (e.g., American Gold Eagle) | Gold Bars (e.g., 1 oz Gold Bar) |

|---|---|---|

| Legal Tender Status | Yes, U.S. government-issued coins have a nominal face value, making them legal tender. | No, bars are not legal tender and have no face value. |

| Government Guarantee | Weight and purity are guaranteed by the issuing government. | Guaranteed by a private mint or refiner. |

| Fraud Protection | Harder to counterfeit due to government-backed designs and security features. | Authenticity relies on the refiner's reputation and assay. |

| Premium Over Spot | Generally higher due to minting costs, design, and legal tender status. | Typically lower due to simpler manufacturing. |

| Divisibility | Excellent; available in sizes from 1/10 oz to 1 oz. | Less divisible; common sizes are 1 oz and larger. |

| Liquidity | Highly liquid and globally recognized. | Liquid, but recognition depends on the brand. |

Why Gold Coins Can Be a Superior Choice

For many investors, gold coins offer distinct advantages. Their Utah gold coins legal tender status, while symbolic in value, provides an extra layer of legal recognition. The primary benefits include:

- Trust and Security: Government-issued coins like the American Gold Eagle come with a guarantee of weight and purity from a sovereign mint. This backing, combined with advanced anti-counterfeiting features, provides unparalleled security and peace of mind.

- High Liquidity: Government coins are recognized and accepted by dealers worldwide, making them easy to buy and sell.

- Flexibility: Available in various fractional sizes (1/10 oz, 1/4 oz, 1/2 oz), coins allow you to sell smaller portions of your holdings without liquidating a large bar.

While gold bars are a great way to acquire more gold for your dollar due to lower premiums, the security and flexibility of gold coins make them a cornerstone of many resilient portfolios. For more insights, see our guide on Utah's Top Spots to Buy Gold Bars and Bullion.

Frequently Asked Questions about Utah Gold Coins Legal Tender

Navigating Utah's unique precious metals laws can raise questions. Here are answers to some of the most common inquiries about Utah gold coins legal tender status.

Can I pay my Utah state taxes with gold coins?

No, not at this time. The Utah Legal Tender Act is based on voluntary acceptance, and the state government cannot be compelled to accept gold or silver for tax payments. State systems are currently set up for U.S. dollars. However, the 2024 HB306 legislation allows state vendors to opt-in to accepting precious metals, and the development of a gold-backed electronic payment platform may create future possibilities. As Ballotpedia notes, precious metals are legal tender but "not yet accepted" for state taxes [https://ballotpedia.org/PreciousmetalsarelegaltenderinUtahbutarenotyet_accepted].

Are capital gains on gold and silver sales taxed in Utah?

Utah offers significant tax advantages at the state level.

- State Capital Gains: Utah provides a nonrefundable tax credit for capital gains from the sale or exchange of U.S. government-issued gold and silver coins (specie legal tender), as established in HB 317 [https://static.votesmart.org/static/billtext/37655.pdf]. This effectively eliminates state capital gains tax on these assets.

- Federal Capital Gains: This state-level benefit does not affect federal taxes. The IRS still classifies precious metals as "collectibles," which are subject to federal capital gains tax.

- Sales Tax: Utah exempts investment-grade bullion and coins (50%+ precious metal content) from sales tax under Utah Code 59-12-104 [https://le.utah.gov/xcode/Title59/Chapter12/59-12-S104.html?v=C59-12-S104_2019051420191001], meaning your entire investment goes toward acquiring metal.

How does Utah compare to other states on precious metals laws?

Utah pioneered the modern sound money movement in 2011. While several other states now recognize gold and silver as legal tender (including Arizona, Oklahoma, Texas, and Wyoming) [https://worldpopulationreview.com/state-rankings/gold-and-silver-legal-tender-states], Utah remains the most progressive.

What sets Utah apart is its comprehensive, forward-thinking approach. For example, while Texas established the impressive Texas Bullion Depository [http://texasdepository.com/] for storage (HB 483 [http://www.legis.state.tx.us/tlodocs/84R/billtext/pdf/HB00483F.pdf#navpanes=0]), Utah's 2024 HB306 bill [https://le.utah.gov/~2025/bills/static/HB0306.html] focuses on usability by creating a framework for a gold-backed electronic payment system. This combination of legal tender status, tax exemptions, and transactional infrastructure makes Utah the nation's leader in sound money policy.

Conclusion: Securing Your Wealth in the Beehive State and Beyond

Utah's journey, from recognizing Utah gold coins legal tender in 2011 to launching gold-backed digital payment frameworks in 2024, provides a powerful blueprint for financial security. The state has created a complete ecosystem where precious metals serve as a practical tool for protecting wealth against inflation.

Physical gold's enduring value offers a stable foundation when markets are volatile. Owning a tangible asset means you have wealth that exists outside of digital ledgers and government promises—real value that you control.

A consistent investment strategy is key to building this foundation. Our Autoinvest feature allows you to dollar-cost average into precious metals with automatic monthly purchases, similar to a 401(k). This disciplined approach removes emotion from investing and helps you systematically accumulate real assets over time.

As Utah continues to lead with its $60 million gold reserves and innovative payment systems, the case for precious metals has never been stronger. At Summit Metals, we provide the authenticated products, transparent pricing, and tools you need to take advantage of these opportunities and build lasting wealth.

Explore your precious metals investment options with our Utah guide

Your financial future deserves a foundation built on something real. Let's build it together.