Why Utah is an Ideal State for Precious Metals Investors

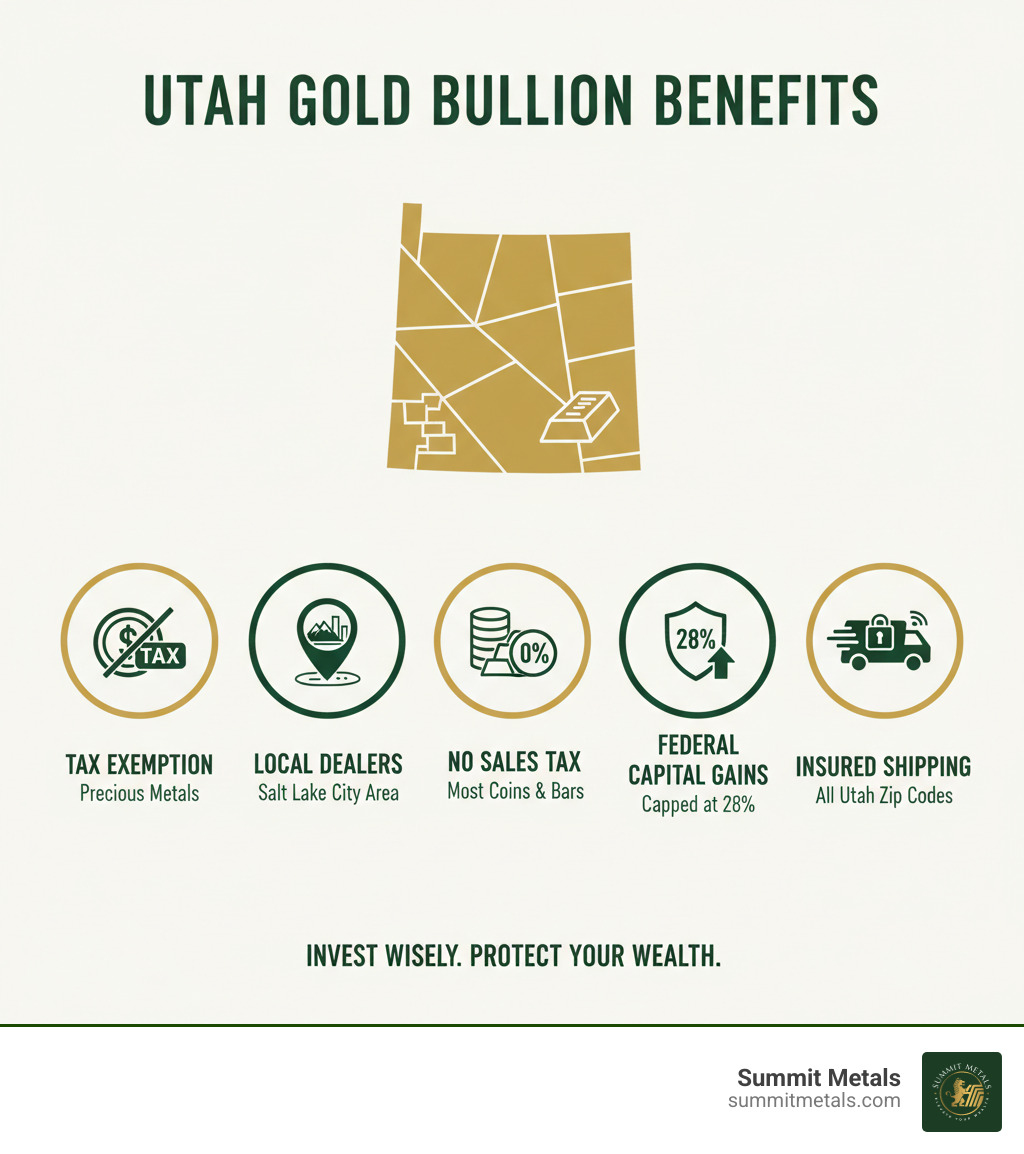

Buy gold bullion Utah residents have a unique advantage: the state offers one of the most tax-friendly environments for precious metals purchases in the country, combined with a rich mining heritage and a thriving community of reputable dealers.

Quick Answer: Where to Buy Gold Bullion in Utah

| Purchase Method | Best For | Key Benefits |

|---|---|---|

| Local Dealers | In-person buyers, immediate possession | Physical inspection, relationship building, no shipping wait |

| Online Retailers | Best prices, wider selection | Lower premiums, insured delivery, 24/7 shopping |

| Reputable Local Shops | Utah-based transactions | Access to dealers in the Salt Lake City metro area |

| Top Online Retailers | Competitive national pricing | A+ BBB rated companies with transparent pricing |

Utah's economy has deep roots in mining—gold, silver, and copper remain vital economic drivers. This heritage has fostered a knowledgeable investor community. More importantly, Utah exempts most investment-grade bullion and coins from state sales tax, putting more of your money directly into physical gold.

Gold serves three essential purposes in a modern portfolio: it acts as a hedge against inflation, provides stability during economic uncertainty, and offers true diversification away from paper assets. With gold hitting all-time highs above $3,500 in 2025 and maintaining a floor around $3,300, the metal has validated its role as a wealth preservation tool that governments cannot print.

Whether you're considering gold bars for their lower premiums or gold coins for their liquidity, Utah offers both local expertise and access to competitive online pricing. The state's population, concentrated in the Salt Lake City metro area, supports multiple brick-and-mortar dealers alongside convenient nationwide shipping from major online platforms.

I'm Eric Roach, and after more than a decade in New York investment banking, I now help everyday investors buy gold bullion Utah residents can trust. My institutional experience in risk management translates directly into practical guidance for building precious metals positions that protect your wealth.

Why Invest in Gold Bullion in Utah?

Gold is a time-tested financial tool that has protected wealth for thousands of years. In 2025, its role as a tangible asset you can hold in your hand feels more important than ever. Unlike stocks or bonds, which exist as digital entries or paper promises, physical gold is real. This provides genuine economic stability when other assets are volatile.

Gold shines brightest when economic conditions are shaky. When inflation erodes your purchasing power or stock markets decline, gold often holds or increases its value. This makes it an essential tool for wealth preservation—a financial insurance policy that has historically appreciated over time. From ancient civilizations to modern central banks, gold has always been the go-to asset for stability. For a deeper understanding of why gold and silver work so well as protective assets, check out Why Gold and Silver: Understanding Their Value as Safe Haven Assets.

Tax-Friendly Environment: A Major Perk to Buy Gold Bullion Utah

Utah residents have a significant advantage over investors in many other states: Utah exempts most precious metals coins and bullion from state sales tax (see the Utah State Tax Commission’s overview of Sales and Use Tax Exemptions). This is a meaningful benefit that puts more of your investment dollars directly into gold.

For example, on a $10,000 purchase, you could save $600-$700 that would otherwise be lost to taxes in other states. This tax-friendly stance reflects Utah's recognition of precious metals as legitimate investment vehicles. You can learn more about gold's historic role in A Brief History of Gold as Currency and Store of Value.

However, it's important to understand the federal tax implications. While Utah doesn't charge sales tax on the purchase, the federal government will tax your profits if you sell. Federal capital gains tax applies to precious metals, with profits taxed as collectibles at a maximum rate of 28% (see IRS Publication 550 for details on collectibles). If you buy gold at $2,000 per ounce and sell it later at $3,500, the $1,500 gain is taxable. Always consult a tax professional to understand the specifics of your situation.

The combination of no state sales tax and manageable federal capital gains makes Utah one of the most attractive states to buy gold bullion Utah investors can use for long-term wealth building.

Where to Buy Gold Bullion in Utah: Online vs. Local Dealers

When you're ready to buy gold bullion Utah, you have two main options: a local coin shop or an online retailer. Both get you physical gold, but the experience is different.

Visiting a local dealer allows you to inspect the gold and take immediate possession. This face-to-face interaction is valuable for asking questions and building relationships, especially for first-time buyers. With about 80% of Utah's population near Salt Lake City, finding a trustworthy local dealer is convenient.

Online dealers, however, offer compelling advantages in price and selection. Their lower overhead often translates into lower premiums over the spot price. You'll also find a much wider variety of products, from common coins to specialty bars. The convenience is best—you can compare prices and place orders 24/7. For a detailed comparison, see our Online Bullion Dealer Comparison.

Finding a Reputable Dealer to Buy Gold Bullion Utah

Whether you choose a storefront or a website, reputation is everything. Here’s what to look for:

- Transparent Pricing: A reputable dealer clearly displays their prices and the premium over spot. The bid-ask spread—the difference between their buy and sell price—should be reasonable.

- Positive Reviews: Look for consistent customer satisfaction across multiple independent review platforms.

- Accreditation and Longevity: An A+ rating with the Better Business Bureau and a long history of operation are strong signals of trustworthiness.

- Authentication Processes: Professional dealers use technology like non-destructive X-ray fluorescence analysis to verify metal purity and authenticity without damaging the item.

- Two-Way Market: A dealer that both buys and sells gold demonstrates confidence in their pricing and provides you with liquidity for the future.

Before any large purchase, educate yourself on spotting red flags. Our guide on Identifying Reputable Bullion Dealers: Avoiding Counterfeits is an essential resource.

The Online Advantage: Safety and Pricing

Online retailers like Summit Metals offer competitive pricing and convenience. Our transparent, real-time pricing reflects the bulk purchasing power we pass on to our customers through lower premiums.

We address security concerns with robust solutions. Every order includes insured shipping and discreet packaging, protecting your investment from our vault to your door. The packages are plain, reducing any risk of theft. For more details, read How to Buy Gold and Silver Online Safely.

For investors building long-term positions, our Autoinvest feature is a game-changer. It allows you to set up recurring monthly purchases, similar to a 401(k). This dollar-cost averaging strategy helps you accumulate gold steadily over time, removing emotion and market-timing stress from the process.

What to Buy: A Guide to Gold Bullion Products

Once you've decided where to buy gold bullion Utah, the next step is choosing what to buy. Gold bullion comes in various forms, and understanding the differences will help you match your purchase to your investment goals.

Key factors to consider include:

- Purity: Investment-grade gold is typically 24-karat (99.99% pure) or 22-karat (91.67% pure). The 22-karat alloy, used in coins like the American Gold Eagle, includes copper and silver for added durability. Learn more in Understanding Karats and Purity in Gold.

- Weight: Gold is traded in troy ounces (31.1 grams), but is also available in grams, kilos, and fractional sizes (1/10 oz, 1/4 oz). Smaller sizes offer flexibility, while larger sizes usually have lower premiums.

- Mint Reputation: Government mints (e.g., U.S. Mint) and reputable private refiners (e.g., PAMP Suisse) guarantee authenticity and global recognition.

- Condition: Most investors seek "BU" (Brilliant Uncirculated) coins, which retain their original mint luster. "Proof" coins are for collectors and carry higher premiums.

Gold Bars vs. Gold Coins: Which is Right for You?

This choice depends on your strategy. Both are excellent investments, but they serve slightly different purposes. For a complete breakdown, read Bars or Coins? Your Ultimate Gold Investment Showdown.

| Feature | Gold Bars | Gold Coins |

|---|---|---|

| Premiums | Generally lower over spot price | Generally higher (due to minting costs) |

| Liquidity | Good, especially in common sizes | Excellent, globally recognized and accepted |

| Divisibility | Less divisible | More divisible (available in fractional sizes) |

| Recognizability | High (from reputable refiners) | Very high (globally recognized designs) |

| Legal Tender/Face Value | No face value; relies on refiner/assayer reputation | Legal tender with a face value—benefits from statutory anti-counterfeiting protections and easier verification |

| Fraud Protection | Relies on assay mark and reputation | Legal tender status provides inherent fraud protection |

| Storage | More space-efficient for bulk | Easier to handle in small amounts |

Gold bars are the workhorses of bullion investing, offering the most gold for your dollar due to lower premiums. They are ideal for investors focused on cost-efficiency and bulk accumulation.

Gold coins offer unique advantages. Their legal tender status and face value provide an extra layer of fraud protection, as counterfeiting currency is a serious federal crime. Coins like the American Gold Eagle or Canadian Maple Leaf are instantly recognizable worldwide, making them extremely liquid and easy to sell.

Popular Gold Bullion Options

When you're ready to buy gold bullion Utah, you'll find these popular, liquid options are excellent choices:

- American Gold Eagles: The most popular bullion coin in the U.S., backed by the government for weight and purity. Their 22-karat composition makes them durable. Learn more in Everything You Need to Know About American Eagle Coins.

- Canadian Gold Maple Leafs: Known for their 24-karat (99.99%) purity and advanced security features, these are a top choice for investors prioritizing maximum gold content.

- American Gold Buffalos: The U.S. Mint's 24-karat coin, featuring a classic American design. It combines pure gold with the backing of the U.S. government.

- South African Krugerrands: The original modern bullion coin, these 22-karat coins have a long history and are recognized globally.

- PAMP Suisse Bars: These Swiss-made bars are famous for their quality, iconic designs, and verifiable assay certificates.

For a disciplined approach, our Autoinvest program lets you buy gold bullion Utah residents trust on a monthly schedule—just like contributing to a 401(k). This dollar-cost averaging strategy smooths out price volatility and builds your holdings steadily over time.

Smart Investing: Long-Term Strategy and Selling Your Gold

When you buy gold bullion Utah, you're not just making a purchase—you're adopting a long-term strategy for wealth preservation. Gold has served as a hedge against inflation and economic instability for centuries, and its role in a diversified portfolio is more critical than ever.

Unlike stocks or bonds, gold's value comes from its timeless role as a safe-haven asset. While short-term price fluctuations are inevitable, a long-term perspective reveals gold's power to protect purchasing power across decades. For more on this, explore The Strategic Role of Gold in Long-Term Portfolio Management.

Automating Your Investment with Dollar-Cost Averaging

One of the smartest ways to build a gold position is through dollar-cost averaging. This strategy involves making regular, fixed-amount purchases over time, regardless of daily price movements.

Our Autoinvest program at Summit Metals brings this disciplined, 401(k)-style approach to precious metals. You set up recurring monthly purchases of gold or silver, and we handle the rest. When prices are low, your fixed investment buys more ounces; when prices are high, it buys fewer. This averages out your cost basis and removes the stress of trying to time the market. It's a powerful way to build a robust portfolio one purchase at a time. Learn more in The Power of Dollar Cost Averaging in Gold and Silver Investments.

How to Sell Gold Bullion in Utah

Eventually, you may need to liquidate some of your holdings. Knowing how to sell gold bullion in Utah is as important as knowing how to buy it. Reputable gold bullion is highly liquid and can be converted to cash relatively quickly.

At Summit Metals, we facilitate a true two-way market. Our online buy-back program offers transparent pricing based on real-time spot prices, making the selling process straightforward and fair. You get competitive offers without leaving home, backed by the same transparent philosophy that guides our sales.

Local coin shops throughout Utah also actively buy gold bullion. When selling locally, get quotes from multiple dealers to ensure you receive fair market value. A reputable dealer will offer a price close to spot, minus a small, transparent margin.

We generally recommend avoiding pawn shops for bullion sales, as they typically offer prices significantly below market value. You will almost always get a better price from a specialized bullion dealer.

Before selling, know the current spot price of gold. Reputable buyers offer clear terms and prompt payment. For comprehensive guidance, explore our resource on Selling Gold and Silver.

Conclusion: Start Your Utah Gold Investment Journey

You're serious about protecting your wealth, and that's the mindset that builds lasting financial security.

When you buy gold bullion Utah, you're making a strategic decision to diversify your portfolio and preserve your purchasing power. Utah's tax-friendly environment, combined with access to both local experts and competitive online retailers like Summit Metals, creates an ideal landscape for your investment.

We've covered why gold belongs in your portfolio, how to find a reputable dealer, the differences between coins and bars, and how to build your position strategically. The key is to get started.

The beauty of our Autoinvest program is that it removes the guesswork. Set it up once, and you're consistently adding to your precious metals holdings every month—just like a 401(k), but with tangible assets. This disciplined approach builds a substantial stack over time without the stress of market timing.

At Summit Metals, we provide transparent, real-time pricing and competitive rates because we believe informed investors make the best decisions. Our Wyoming-based operation focuses on authenticated gold and silver, ensuring every ounce you purchase meets the highest standards. We are committed to earning your trust through fair pricing and straightforward service.

Physical gold has weathered every financial storm in history. The question isn't whether you should own it, but when you'll get started.

Ready to take the next step? Explore your options for Utah Precious Metals with Summit Metals today. Your future self will thank you for the financial security you're building right now.