Why Understanding the Silver Spot Price in Utah Matters for Your Investment

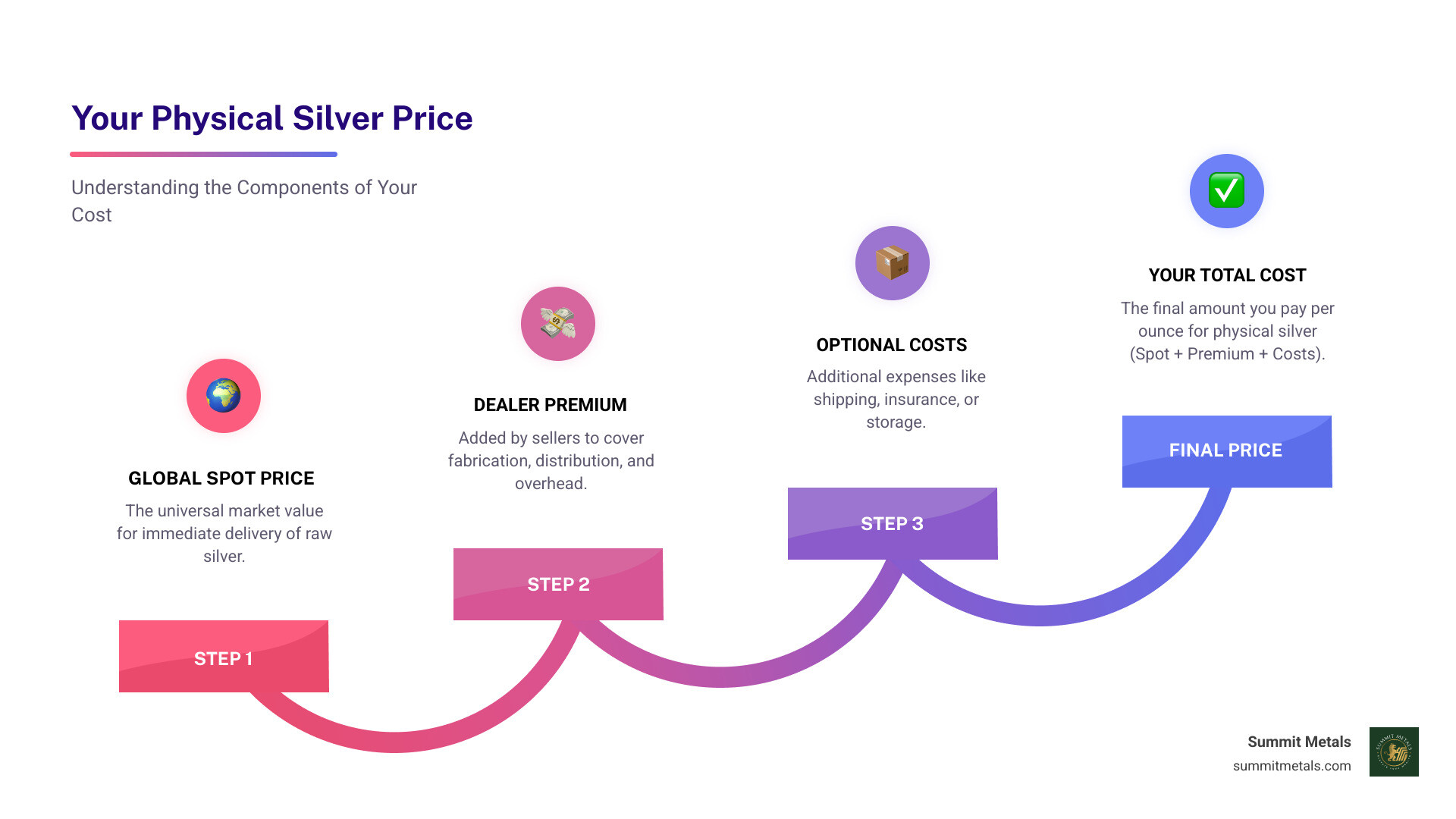

The silver spot price Utah investors track is the same global benchmark that determines silver's value worldwide. Many first-time buyers are confused when they see the spot price online but can't buy physical silver at that rate. Here’s what you need to know:

- The spot price is universal: The base price is the same in Utah, New York, or London.

- You'll always pay more than spot: Dealers add a premium (typically $2-$5 per ounce) to cover costs like fabrication and overhead.

- The price updates constantly: Silver trades nearly 24/7 on global exchanges like COMEX.

- Your final price = Spot + Premium: If the spot price is $30, you might pay $33-$35 per ounce for a physical coin.

The spot price is the current market value for immediate delivery of one troy ounce of .999 fine silver, established through futures contracts traded globally. It’s the foundation of every silver transaction, whether you're buying American Eagles in Salt Lake City or 100-ounce bars online.

This guide will show you how silver pricing works, what moves the market, and how to make strategic investment decisions. You'll learn the difference between coins and bars, why Utah's tax laws favor precious metals investors, and how dollar-cost averaging can build lasting wealth.

I'm Eric Roach, a former Wall Street investment-banking advisor. I now use the same institutional tactics to help everyday investors protect their wealth with physical silver. My experience has shown me how the silver spot price Utah investors monitor is a powerful tool for portfolio diversification and inflation protection.

Decoding the Live Silver Spot Price in Utah

The silver spot price is the current market value for one troy ounce of pure silver available for immediate delivery. Think of it as the baseline "wholesale" price for every silver transaction worldwide. This price is not set by a single entity but emerges from continuous trading on commodity exchanges like COMEX in New York, which operate nearly 24 hours a day.

It's important to know that silver is measured in troy ounces (31.1035 grams), which are about 10% heavier than the standard ounces used for groceries. All precious metal prices are quoted in troy ounces.

Why You Can't Buy at Spot Price

There is no special "Utah silver price." The silver spot price Utah residents see is identical to the global price. The difference in what you pay comes from dealer premiums. You cannot buy physical silver at the exact spot price because every dealer adds a premium to cover legitimate business costs:

- Fabrication: Turning raw silver into coins or bars.

- Distribution: Shipping and logistics.

- Overhead: Rent, security, staff, and insurance.

- Profit Margin: To stay in business.

So, while the spot price is the same everywhere, the final price varies based on the premium charged by the dealer and the type of product. You can watch the spot price fluctuate in real-time on charts like this live silver price chart by TradingView.

What Factors Influence Silver Prices?

Silver's price is dynamic because it's both an investment asset and a critical industrial metal. Key drivers include:

- Industrial Demand: Over half of silver is used in industry. It's essential for solar panels, electric vehicles (EVs), smartphones, and medical devices. Growing demand in green technologies creates strong upward price pressure.

- Investment Demand: During economic uncertainty, inflation, or geopolitical turmoil, investors flock to silver as a safe-haven asset to preserve wealth.

- Inflation and U.S. Dollar Strength: Silver is a traditional hedge against inflation. Because it's priced in U.S. dollars, a weaker dollar often makes silver cheaper for foreign buyers, increasing demand and prices.

- Mining Supply: For several years, global silver demand has outstripped mining production, creating a supply deficit that supports higher prices.

Strategic Silver Investing for Utah Residents

Investing in silver is a strategic move to diversify your portfolio and protect your wealth. Unlike stocks, silver often holds its value or appreciates during economic downturns, acting as a hedge against inflation and uncertainty. The key is to adopt a long-term perspective rather than trying to time short-term market swings.

Using the Gold-to-Silver Ratio

A simple yet powerful tool is the gold-to-silver ratio, which tells you how many ounces of silver it takes to buy one ounce of gold. You find it by dividing the gold price by the silver price. Historically, this ratio has fluctuated. A high ratio (e.g., above 80:1) suggests that silver may be undervalued compared to gold, signaling a potential buying opportunity for silver. Conversely, a low ratio suggests silver is relatively expensive.

Physical Silver: Coins vs. Bars for Utah Investors

Choosing between coins and bars depends on your goals. Both are excellent ways to own physical silver.

Silver coins, like American Silver Eagles, are government-backed for weight and purity, making them highly recognizable and liquid. Their legal tender status and intricate designs also provide strong fraud protection. This security comes at the cost of a higher premium per ounce.

Silver bars are the most cost-effective way to accumulate silver. Premiums per ounce are significantly lower, especially for larger sizes like 10 oz and 100 oz bars. They are also designed for efficient, compact storage, making them ideal for investors focused on maximizing their silver holdings for the lowest cost.

| Feature | Silver Coins | Silver Bars |

|---|---|---|

| Government Backing | Yes—minted by sovereign governments | No—produced by private mints |

| Face Value | Yes (provides legal fraud protection) | No |

| Fraud Protection | Highest | Moderate |

| Premium per Ounce | Higher | Lower, especially in larger sizes |

| Stacking Efficiency | Moderate | High—designed for compact storage |

| Liquidity | Very high—universally recognized | High—but sold in larger increments |

| Ideal For | New investors, those prioritizing security | Bulk purchasers, lowest premium focus |

Many investors hold both: coins for liquidity and bars for cost-efficient bulk accumulation.

The Smart Way to Invest: Dollar-Cost Averaging with Autoinvest

Trying to time the market is risky. A smarter strategy is dollar-cost averaging: investing a fixed amount of money at regular intervals. By doing this, you buy more ounces when prices are low and fewer when they are high, averaging out your purchase cost over time and removing emotion from your decisions.

This disciplined approach is the principle behind successful 401(k) investing. Small, consistent monthly purchases compound over the years into a significant silver stack.

At Summit Metals, our Autoinvest program makes this easy. You can set up automated monthly purchases of physical silver, allowing you to build wealth steadily and effortlessly.

A Practical Guide to Buying, Selling, and Storing Silver in Utah

Understanding the silver spot price Utah investors follow is the first step. Next comes the practical side of buying, selling, and storing your investment securely.

Where can you buy or sell physical silver in Utah?

- Local Coin Shops: Offer in-person service and immediate possession of your silver. However, their higher overhead often results in higher premiums.

- Reputable Online Dealers: Companies like Summit Metals leverage bulk purchasing and lower overhead to offer more competitive pricing and a wider selection. Your purchase is securely shipped and insured.

- Popular Products: For the best value and liquidity, consider American Silver Eagles, generic silver rounds, and 10-ounce or 100-ounce silver bars.

- A Word of Caution: Avoid pawn shops for investment-grade silver, as they typically offer poor pricing and lack specialized knowledge.

Always compare the total price (spot + premium) from multiple reputable dealers to ensure you get the best value.

Are there specific tax implications for buying silver in Utah?

Utah offers a significant advantage to precious metals investors: sales tax exemption. You do not pay state sales tax on investment-grade silver coins, bars, or rounds. This provides substantial savings on every purchase.

On the federal level, the IRS classifies precious metals as collectibles. When you sell for a profit, long-term capital gains are taxed at a maximum rate of 28%, which is higher than the rate for stocks. Additionally, dealers are required to report cash transactions over $10,000 to the IRS. We recommend consulting a tax professional to understand your specific obligations.

How to Securely Store Your Silver Investment

Protecting your physical silver is crucial. Here are your main options:

- Home Storage: A high-quality, bolted-down safe offers immediate access. However, it may be vulnerable to theft or fire, and standard homeowner's insurance often has very low coverage limits for precious metals (e.g., $1,000-$2,500). You will likely need a separate insurance policy.

- Bank Safe Deposit Box: Provides high security at a bank, but access is limited to banking hours. Critically, the contents are not insured by the FDIC or the bank; you must purchase separate insurance.

- Professional Depository: The highest level of security for serious investors. These facilities offer specialized, fully insured storage with climate control and regular audits. This provides the ultimate peace of mind for a storage fee.

No matter your choice, ensure your investment is fully insured. For more details on securing your metals in Utah, visit our resource page: More info about Utah precious metals.

Frequently Asked Questions about the Silver Spot Price Utah

Here are concise answers to common questions from Utah investors about the silver spot price Utah markets track.

Can I buy silver at the spot price in Utah?

No. The spot price is a raw material benchmark. All physical silver products include a dealer premium to cover the costs of minting, distribution, security, and business overhead. An offer to sell you physical silver at or below the spot price is a major red flag and almost certainly a scam.

What's better for a Utah investor: silver coins or silver bars?

It depends on your goals. Coins offer maximum security, government backing, and liquidity, making them ideal for new investors. Bars offer the lowest cost per ounce, making them perfect for accumulating bulk silver efficiently. Many savvy investors own both.

| Feature | Silver Coins (e.g., American Silver Eagles) | Silver Bars (e.g., 10 oz, 100 oz bars) |

|---|---|---|

| Government Backing | Yes, typically from sovereign mints (e.g., U.S. Mint, Royal Canadian Mint) | No, typically from private mints or refiners |

| Face Value | Yes (e.g., $1 for an American Silver Eagle) | No |

| Fraud Protection | Higher due to intricate designs, anti-counterfeiting measures, and recognition | Moderate, relies on dealer reputation and assay marks |

| Premium per Ounce | Higher, due to minting costs, artistry, and collectibility | Lower, especially for larger bars, making it more cost-effective for bulk |

| Stacking Efficiency | Moderate, can be bulky | High, designed for efficient storage |

| Liquidity | Very high, widely recognized and easily traded | High, but typically sold in larger increments |

| Ideal For | New investors, smaller purchases, those prioritizing recognition/security | Bulk purchasers, those focused purely on silver content and lower premiums |

How is the silver spot price Utah determined if it's a global market?

The silver spot price Utah residents see is determined by the continuous trading of silver futures contracts on global commodity exchanges, primarily COMEX in New York. The price is set in U.S. dollars, creating a single, universal benchmark. The final retail price you pay in Utah is this global spot price plus the local dealer's premium.

Conclusion: Securing Your Financial Future with Silver in Utah

You now understand that the silver spot price Utah investors watch is just the starting point. Real strategy lies in understanding premiums, choosing the right products, and adopting a disciplined investment approach.

Physical silver is a tangible asset that has preserved wealth for millennia. It serves as a powerful hedge against inflation and economic uncertainty while also being an essential commodity for our technological future, from solar panels to electric vehicles.

For Utah residents, silver offers a way to diversify a portfolio and protect purchasing power. It's the kind of real asset that provides peace of mind in a volatile world.

The most effective way to build your holdings is through consistent, regular purchases. Our Autoinvest program makes this effortless, allowing you to set up automated monthly buys and grow your silver stack over time—just like a 401k.

At Summit Metals, our commitment is to provide Utah investors with transparent, real-time pricing and competitive rates. We believe in empowering you with the knowledge and tools to make confident financial decisions.

Your financial future deserves a plan built on tangible assets. Every ounce you acquire is a step toward greater security.