Why the Silver Coins vs. Bars Debate Matters for Your Investment Success

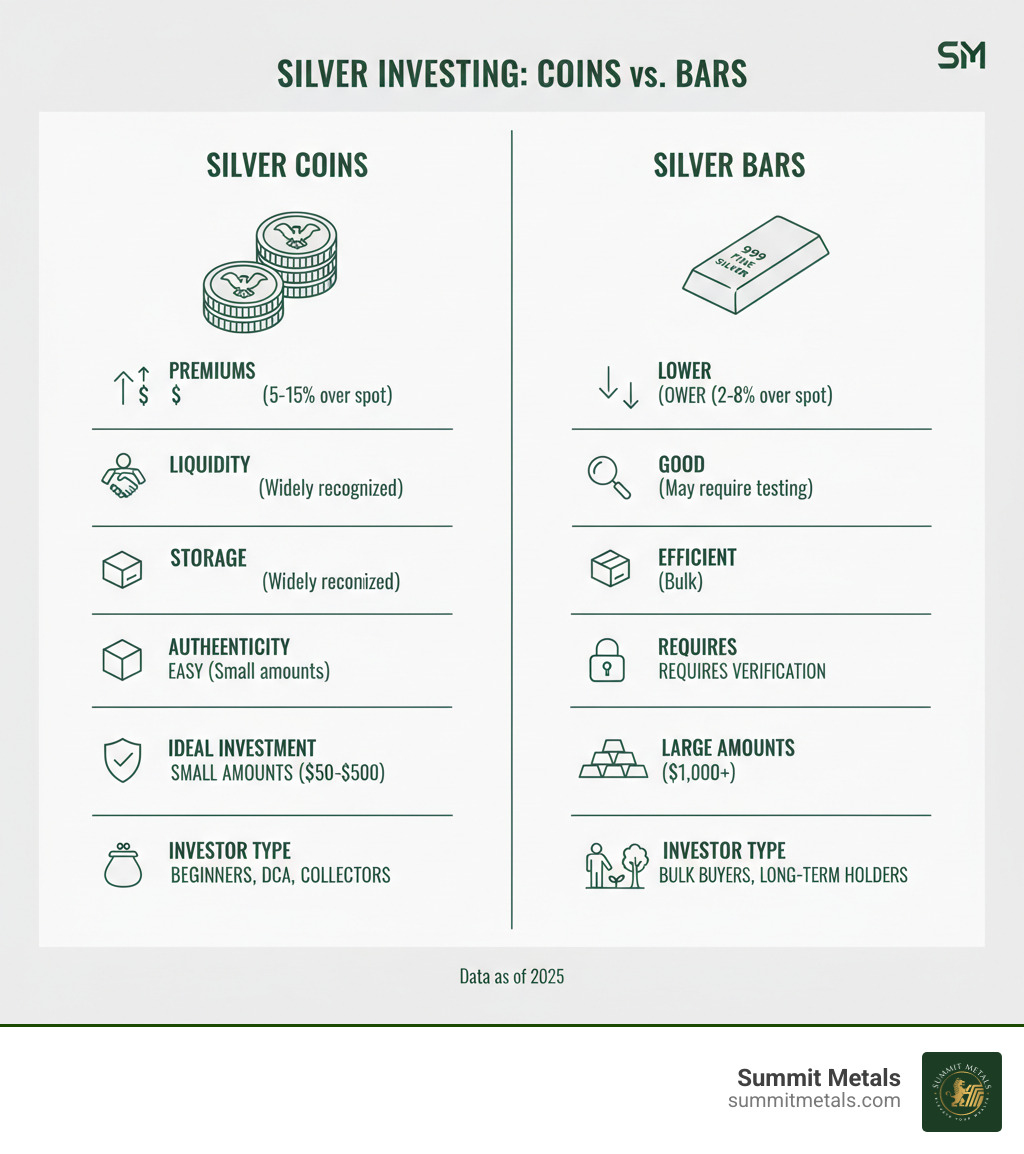

Buying silver coins or bars which is better is a foundational question for any precious metals investor. The right answer depends on your personal goals, but the choice you make will directly impact your cost, liquidity, and storage strategy. Here's a quick comparison:

| Factor | Silver Coins | Silver Bars |

|---|---|---|

| Best For | Beginners, small investments, liquidity | Bulk buyers, cost efficiency, storage |

| Premiums | Higher (5-15% over spot) | Lower (2-8% over spot) |

| Liquidity | Excellent - widely recognized | Good - may require testing |

| Storage | Easy for small amounts | More efficient for large amounts |

| Authenticity | Government guaranteed | Requires verification |

With silver trading at a much more accessible price point than gold, it's a popular entry for wealth preservation. Whether you're making small monthly purchases or a large one-time investment, understanding the coin vs. bar trade-off is key to maximizing your returns.

This guide breaks down everything you need to know. I'm Eric Roach, and with a decade of experience on Wall Street, I've seen how physical precious metals provide a hedge against market volatility. My goal is to help you make an informed decision that aligns with your financial future.

To get started, here are a few key resources:

- The American Silver Eagle: A Collector's Dream and Investment Gem

- The Best 7 Places to Buy Silver Bars Compared

- Investing in bullion

The Fundamentals: What Separates Silver Coins from Bars?

When deciding buying silver coins or bars which is better, it's crucial to understand their fundamental differences. The primary distinction lies in their production, design, and the inherent value they offer beyond their silver content.

Silver Coins

Silver coins are produced by government mints, such as the US Mint or the Royal Canadian Mint. Their key features include:

- Legal Tender Status: Each coin has a face value (e.g., $1 for an American Silver Eagle), which serves as a government guarantee of its weight and purity.

- Intricate Designs: Designs like the Walking Liberty are not just for aesthetics; they make coins harder to counterfeit and instantly recognizable to dealers worldwide.

- Numismatic Value: Some coins gain value beyond their silver content due to rarity, low mintage, or collector demand. This adds a speculative potential to your investment. You can learn more in The American Silver Eagle: A Collector's Dream and Investment Gem.

Silver Bars

Silver bars are the epitome of efficiency, produced mainly by private refineries like PAMP Suisse. They are focused on function over form:

- Essential Information: Bars are stamped with their purity (.999 fine is standard), weight, and often a serial number for tracking. The design is simple, which keeps production costs low.

- Stackability: Their uniform, rectangular shape makes them highly efficient for storage, a feature prized by those accumulating large quantities.

If you're ready to explore bar options, our guide on The Best 7 Places to Buy Silver Bars Compared is a great resource.

The choice often comes down to whether you prefer the government backing and potential collectibility of coins or the cost efficiency and storage advantages of bars. Many investors start with coins through Summit Metals' Autoinvest feature—buying a little each month—to learn the market before considering bars for larger purchases.

Cost vs. Value: Premiums, Purity, and Potential Returns

When buying silver coins or bars which is better, the price you pay above the market rate—the premium—is a critical factor. The "spot price" is the base value of silver, but your final cost will always include a premium to cover manufacturing, distribution, and dealer profit.

Understanding Premiums

Silver coins carry higher premiums (5% to 15% over spot) because they are intricately designed and backed by governments. The U.S. Mint, for example, invests heavily in the design, quality control, and anti-counterfeiting features of each American Silver Eagle.

Silver bars have lower premiums (2% to 8% over spot) because they are produced with efficiency in mind. Private refineries focus on function, not artistry, resulting in more silver for your money. This difference is significant for large purchases. For more on silver's price, see Silver Price: The Bullish Case for Silver with a Potential 20% Upside.

Purity and Authenticity

Fortunately, purity is not a major differentiator. Both modern coins and bars are typically .999 or .9999 fine silver. Government mints and reputable private refiners adhere to strict quality standards.

Authenticity, however, is where coins have an edge. Government guarantees mean sovereign mints stake their reputation on each coin. The US Secret Service actively investigates counterfeiting, adding a layer of security. Coins often have anti-counterfeiting features that are easy to verify.

Silver bars rely on the refiner's reputation and may require more advanced verification, such as XRF analysis, especially for private sales. While reputable dealers guarantee their products, the verification process for bars can be more involved.

| Metric | Silver Coins | Silver Bars |

|---|---|---|

| Typical Premium | Higher (5-15% over spot) | Lower (2-8% over spot) |

| Liquidity | Excellent (globally recognized, easy to trade) | Good (may require more verification) |

| Divisibility | High (small, standard units) | Lower (larger units, less flexible) |

| Storage Efficiency | Less efficient for bulk (bulky for weight) | High (stackable, compact for weight) |

| Authenticity Guarantee | Government-backed, anti-counterfeiting features | Relies on refiner reputation, advanced testing |

| Best For | Beginners, smaller investments, collectors | Bulk buyers, cost-efficiency, maximizing weight |

Coins offer peace of mind and easy authentication, while bars provide more silver per dollar. Your choice depends on whether you're willing to pay a higher premium for convenience and security.

Liquidity, Divisibility, and Storage: The Practical Side of Ownership

Beyond purchase price, the practical aspects of owning physical silver—how you sell, divide, and store it—are crucial to your investment strategy. These factors often determine whether coins or bars are the better fit.

Liquidity

Liquidity is how easily you can convert your silver to cash. Silver coins are the clear winner here. Their global recognition means any dealer can instantly identify an American Silver Eagle or Canadian Maple Leaf, making transactions fast and simple. While silver bars are also liquid, they may require extra verification steps like testing or serial number checks, which can slow down the process. For guidance on buying, see Your Ultimate Guide to Buying Silver Coins Online.

Divisibility

Divisibility is about financial flexibility. If you need to sell a small portion of your holdings, which is easier?

Silver coins offer superior divisibility. Available in standard 1-ounce and fractional sizes, they allow you to sell exactly the amount you need. This makes them ideal for smaller transactions or for bartering in a crisis scenario.

Large bars are an all-or-nothing proposition. You cannot sell a piece of a 100-ounce bar without destroying its value. This locks up your capital in larger, less flexible units.

Storage

Storing physical silver requires a secure plan. Your choice depends on the size of your investment.

- Home Safes: Ideal for modest collections of coins and small bars. Ensure your safe is bolted down and check your insurance policy, as standard coverage for precious metals is often low.

- Bank Safety Deposit Boxes: A secure option for moderate holdings, but access is limited to banking hours and the contents are not typically insured by the bank.

- Professional Vault Storage: The best choice for large holdings. These facilities offer climate control, full insurance, and institutional-grade security. Summit Metals partners with leading depositories to provide this service.

This is where bars have an advantage: stackability and space efficiency. A thousand ounces of silver in bars takes up far less space than the same weight in coins, reducing storage costs in professional vaults. For more on safe practices, read How to Buy Gold and Silver Online Safely.

In short, coins offer flexibility and liquidity, while bars provide storage efficiency and lower costs.

Making Your Choice: Buying Silver Coins or Bars Which is Better for You?

The decision of buying silver coins or bars which is better ultimately comes down to which option best fits your investment goals, budget, and risk tolerance. There is no single right answer, only the right answer for you. For a foundational overview, read The Basics of Gold and Silver Stacking.

For the Beginner Investor: Start with Coins

If you're new to silver, 1-ounce government-minted coins are the ideal starting point.

- Low Entry Cost: You can start with a single coin, like an American Silver Eagle, making it easy to get started without a large capital outlay.

- Easy to Learn: Their popularity and recognizability help you quickly understand how premiums and spot prices work.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount regularly to average out your purchase price. Summit Metals' Autoinvest feature automates this process, allowing you to build your stack consistently, much like a 401(k). Learn more about this strategy in The Strategic Approaches to Investing in Gold and Silver.

Popular beginner coins include the American Silver Eagle, Canadian Silver Maple Leaf, and Austrian Silver Philharmonic.

For the Bulk Buyer: Focus on Bars

When investing larger sums (e.g., $5,000 or more), silver bars are the most cost-effective choice.

- Lower Premiums: The 2-5% premium on 10-ounce or 100-ounce bars means more of your money goes toward pure silver, maximizing your weight.

- Storage Efficiency: Larger bars are compact and stackable, significantly reducing storage space and associated costs for substantial holdings.

- Focus on Bullion Value: If your goal is wealth preservation by accumulating the maximum amount of silver, bars are the most direct path. For more on silver's role, see Is Silver a Good Investment?.

For the Collector or Speculator: Choose Coins

If you're drawn to the history, artistry, and potential for appreciation beyond metal content, silver coins are your best bet.

- Numismatic Value: Rarity, historical significance, and low mintage can cause a coin's value to far exceed its silver content.

- Appreciation Potential: Even common bullion coins can develop modest collector premiums over time, adding another layer of potential return. Explore this topic in Silver Eagle Silver Dollar Secrets Every Collector Should Know.

Your investment philosophy is the deciding factor. Do you prioritize maximum weight and cost efficiency, or do you value liquidity, divisibility, and collector potential?

Frequently Asked Questions about Buying Silver

The buying silver coins or bars which is better debate brings up several practical questions. Here are concise answers to the most common ones.

What are the tax implications for silver coins vs. bars?

Tax laws vary by location, so always consult a tax professional. However, here are some general points:

- In the U.S., the IRS classifies both silver coins and bars as "collectibles." Profits from sales held over a year are taxed at a maximum capital gains rate of 28%.

- Reporting requirements can differ. While dealers must report large cash transactions, certain government-issued coins like American Silver Eagles are exempt from specific dealer reporting rules, which some investors see as a privacy benefit.

- State sales tax is another variable. Some states exempt precious metals from sales tax entirely. Summit Metals is based in Wyoming, which does not charge sales tax on precious metals.

- In the UK, there's a major advantage for certain coins. UK legal tender silver coins, like the Britannia, are exempt from Capital Gains Tax (CGT), while bars are not if your profits exceed the annual threshold. You can find more on the capital gains tax threshold on the official government site.

Which is more popular with retail investors, coins or bars?

Silver coins are overwhelmingly more popular with retail investors. The reasons are straightforward: they are instantly recognizable, have a much lower entry point (you can buy a single 1-ounce coin), and hold a collector appeal that bars lack. Our Autoinvest feature, which allows for small, regular purchases, is almost exclusively used for buying coins, demonstrating their popularity for building wealth over time.

How do I safely store my silver investment?

Secure storage is non-negotiable. Your choice depends on the size of your holdings and your need for access.

- Home Safe: Good for smaller collections. Ensure it's fire-resistant and bolted down. Standard homeowner's insurance for precious metals is very limited; you may need a separate policy.

- Bank Safety Deposit Box: Offers high security for a moderate annual fee. However, access is limited to bank hours, and the contents are not insured by the bank.

- Professional Vault Storage: The best option for substantial holdings. These depositories provide climate control, full insurance, and top-tier security. Summit Metals facilitates storage with trusted partners to keep your bullion safe.

A solid storage plan is as important as the investment itself. The choice between coins and bars will also influence your strategy, as bars are more space-efficient for large quantities.

Conclusion: The Final Verdict on Your Silver Investment

So, buying silver coins or bars which is better? The answer is clear: it depends entirely on your goals. There is no universal best choice, only the best choice for your specific strategy.

Choose Silver Coins for flexibility, liquidity, and peace of mind. Their government backing and easy divisibility make them ideal for beginners, those investing gradually, and anyone who values quick access to their funds.

Choose Silver Bars for cost efficiency and maximizing weight. Their lower premiums mean you get more silver for your money, making them the workhorse for bulk investors focused on long-term wealth preservation.

A popular and effective strategy is to use a diversified approach: start with coins to build a liquid foundation, then add larger bars to your stack as your investment grows to lower your average cost per ounce. This gives you the best of both worlds.

At Summit Metals, we provide transparent, real-time pricing on all our authenticated bullion. Our bulk purchasing power allows us to offer competitive rates, ensuring you get fair value with every purchase.

Our Autoinvest feature simplifies the process of dollar-cost averaging. You can set up automatic monthly purchases, allowing you to build your silver position steadily over time without trying to time the market—just like a 401(k).

Ready to secure your financial future with a tangible asset? Start building your precious metals portfolio today with Summit Metals.