Why Buying Silver at Spot Price Is Your Best Entry Point

Buy silver at spot deals offer new investors the chance to acquire precious metals without the typical 10-30% dealer markups. These promotions are the lowest-cost entry point into precious metals, allowing you to pay only the raw market price for the metal itself.

Typically offered to first-time buyers, these deals are for limited quantities (usually 5-10 ounces) and can be found through reputable online bullion dealers and their promotional newsletters. While you can't normally buy silver at spot price due to minting and distribution costs, dealers use these "loss-leader" promotions to attract new customers.

With industrial demand for silver rising from the solar and EV sectors, and central banks increasing their holdings, the market presents a unique opportunity. My name is Eric Roach, and with a decade of investment banking experience, I've seen how these spot price deals can serve as the perfect foundation for building a resilient precious metals portfolio.

Buy silver at spot further reading:

- physical gold purchase

- silver investment strategies

What "Buying Silver at Spot Price" Really Means

Think of buying silver at spot as getting silver at its "wholesale" price—the raw cost before any markups. This almost never happens, which makes these deals so valuable for new investors.

Defining Spot Price vs. Bullion Price

The spot price of silver is the live market price for one troy ounce (about 31.1 grams) of pure silver. You can't normally buy physical silver at this price because of premiums—the extra costs for fabrication, dealer operations, and shipping.

The bullion price is the final retail price: spot price plus these premiums. When a dealer lets you buy silver at spot, they are absorbing these costs as a promotion to earn your business.

| Feature | Spot Price (Raw Metal) | Retail Bullion Price |

|---|---|---|

| What it includes | Just the raw metal cost | Spot price + fabrication + dealer markup |

| Who can access it | Banks, large institutions | Everyone (but with premiums) |

| Typical premium | None (it's the baseline) | Usually 15-30% over spot |

| Example cost | $29.37 per ounce* | $33.75-$38.18 per ounce* |

*Prices shown are at the time of this publication.

How Silver's Spot Price Fluctuates

Silver's spot price is dynamic, driven by several key factors. Understanding these market dynamics helps you appreciate its value.

- Supply and Demand: The fundamental driver. High demand with limited supply pushes prices up.

- Industrial Demand: Silver is essential for solar panels, EVs, and electronics. As green technology expands, so does the demand for silver.

- Investment Demand: During economic uncertainty or inflation, investors often turn to precious metals as a safe haven, increasing demand.

- Currency Strength: Since silver is priced in U.S. dollars, a weaker dollar can make it cheaper for foreign buyers, boosting demand.

For a deeper understanding of what makes silver tick, check out our Beginner's Guide to Silver Properties.

The Unbeatable Benefit for New Investors

Buy silver at spot deals are ideal for beginners because you eliminate the premium. This gives you the lowest cost of entry into precious metals.

If spot is $30 and retail is $36, you normally pay a 20% premium. With a spot deal, you get that silver for $30, meaning your investment can grow from its true market value immediately. You don't have to wait for the price to rise 20% just to break even.

This is the perfect way to start building a physical asset portfolio and test the waters of precious metals investing. Once you've made your first purchase, consider Summit Metals' Autoinvest program. It lets you dollar-cost average by making automated monthly purchases, smoothing out price fluctuations over time, much like a 401(k).

Ready to explore whether silver makes sense for your portfolio? Our guide Does It Really Make Sense to Invest in Silver? breaks down the pros and cons.

The Anatomy of a "Silver at Spot" Deal

"Buy silver at spot" offers are a well-established marketing strategy in the precious metals industry. Understanding how they work will help you take advantage of them with confidence.

Why Dealers Offer to Let You Buy Silver at Spot

Dealers use these deals as a "loss leader"—selling a product at or below cost to attract new clients. The goal is to build a long-term relationship. By offering an unbeatable entry point, dealers like Summit Metals hope to earn your trust and become your go-to source for future precious metals investments where normal premiums apply. It's a way to introduce you to their service and product quality without a large upfront cost.

Common Restrictions and Eligibility

These deals come with specific rules to ensure they reach new investors as intended. Expect to see:

- First-Time Buyer Requirement: Promotions are almost always for new customers only.

- One-Per-Household Limit: To spread the opportunity, dealers enforce a strict limit.

- Quantity Limits: Purchases are typically capped at 5 to 10 ounces.

- Time Sensitivity: Many offers are flash sales or available for a limited period.

- Payment Method Rules: To avoid processing fees, dealers often require payment by check, wire, or ACH for spot pricing.

For more guidance on navigating the online buying process, check out Your Ultimate Guide to Buying Silver Coins Online.

Typical Products in Spot Price Promotions

Don't expect rare collectibles. Spot deals usually feature cost-effective, high-purity silver products, such as:

- Generic Silver Rounds: Privately minted one-ounce rounds, like the popular Buffalo design, are common. They offer pure silver without the higher premium of government coins.

- Small Silver Bars: One, five, or ten-ounce bars are often included. They are efficient to produce and perfect for stacking by weight.

- Starter Kits: Some deals bundle a few rounds and bars to give you a feel for different product types.

Often, the product is "dealer's choice," allowing them to manage inventory efficiently while giving you an unbeatable price on authentic silver.

If you're specifically interested in premium government coins like Silver Eagles, our Silver Eagles: Your Ultimate Buying Guide provides detailed insights, even though these premium products aren't always available at spot pricing.

How to Find and Safely Buy Silver at Spot

Finding a legitimate deal to buy silver at spot requires knowing where to look and how to avoid scams. Here’s a smart approach to hunting down these opportunities safely.

Where to Find Genuine "Buy Silver at Spot" Deals

Legitimate deals come from established players. Here’s where to look:

- Reputable Online Bullion Dealers: This is your primary source. Look for dealers like Summit Metals with a long track record, positive customer reviews, and a high Better Business Bureau (BBB) rating.

- Dealer Newsletters: Signing up for promotional emails is the best way to get notified about flash sales and exclusive spot price offers before they are widely advertised.

- Price Comparison Websites: These sites aggregate offers from various dealers and often highlight spot price promotions, saving you time.

- Precious Metals Forums: Online communities of investors often share deals they find, but always verify these tips independently.

For more sourcing strategies, our guide The Savvy Collector's Secret: Where to Buy Silver Coins for Less offers additional insider tips.

Red Flags: How to Spot a Scam

The allure of spot price deals attracts scammers. Here’s how to spot them:

- Offers That Are Too Good to Be True: Unlimited quantities of premium coins at spot price is a major red flag. Legitimate deals always have limits.

- High-Pressure Sales Tactics: Reputable dealers don't rush you. If you feel pressured, walk away.

- Unclear Terms and Conditions: A real offer will clearly state the rules. Vague terms are a warning sign.

- Poor Website Quality: A professional dealer has a secure, well-designed website. A sloppy site suggests a sloppy business.

- No Reviews or Bad Ratings: Look for established dealers with a history of positive, verified customer reviews and a strong BBB rating.

Understanding the Fine Print: Payment and Shipping

Before you buy, calculate your total out-of-pocket cost. The final price depends on payment and shipping.

- Payment Method: The advertised spot price is usually for cash-equivalent payments (check, wire, ACH). Using a credit card or PayPal typically adds a 2-4% surcharge that can negate your savings.

- Shipping Costs: A great deal can be ruined by high shipping fees. Look for dealers with free shipping thresholds (e.g., on orders over $199) and do the math to see if it saves you money.

- Insurance: Reputable dealers always include insured shipping with tracking. This should be standard, not an extra charge.

Beyond the First Deal: Smart Silver Stacking Strategies

Your first buy silver at spot purchase is the perfect start. Now, it's time to think about a long-term strategy for building your holdings. This means understanding your product options and embracing consistency.

Building Your Stack: Coins vs. Bars vs. Rounds

Beyond your initial deal, you'll encounter three main types of silver. Each has unique advantages, and many investors hold a mix of all three.

| Feature | Silver Coins | Silver Bars | Silver Rounds |

|---|---|---|---|

| Premium over Spot | Often highest (due to government backing, collectibility) | Generally lower (especially larger bars) | Typically lowest (privately minted) |

| Liquidity | Very high (globally recognized, easy to sell) | High (standard weights, recognized refiners) | Moderate to high (recognized by most dealers) |

| Recognizability | Excellent (e.g., American Eagle, Canadian Maple Leaf) | Good (reputable refiners like PAMP, Johnson Matthey) | Varies (depends on design and private mint) |

| Security Features | Advanced anti-counterfeiting (e.g., micro-engravings) | Often include serial numbers, assay cards | Limited, relies on dealer reputation |

| Face Value | Yes (legal tender, though intrinsic value is higher) | No | No |

- Government-Backed Coins (e.g., American Silver Eagle): These have the highest premiums but offer unparalleled security. Their legal tender status, guaranteed by a sovereign government, provides strong protection against counterfeiting.

- Silver Bars: The workhorse for serious stackers. Available in sizes from 1 oz to 100 oz, larger bars offer a lower premium per ounce, making them the most cost-effective way to accumulate weight. Our guide on The 7 Best Places to Buy Silver Bars Compared can help you source quality bars.

- Privately Minted Rounds: These coin-shaped pieces offer the lowest premiums, giving you the most silver for your dollar. They are easily bought and sold by dealers, making them a popular choice for cost-conscious stackers.

The Power of Consistency: Dollar-Cost Averaging with Autoinvest

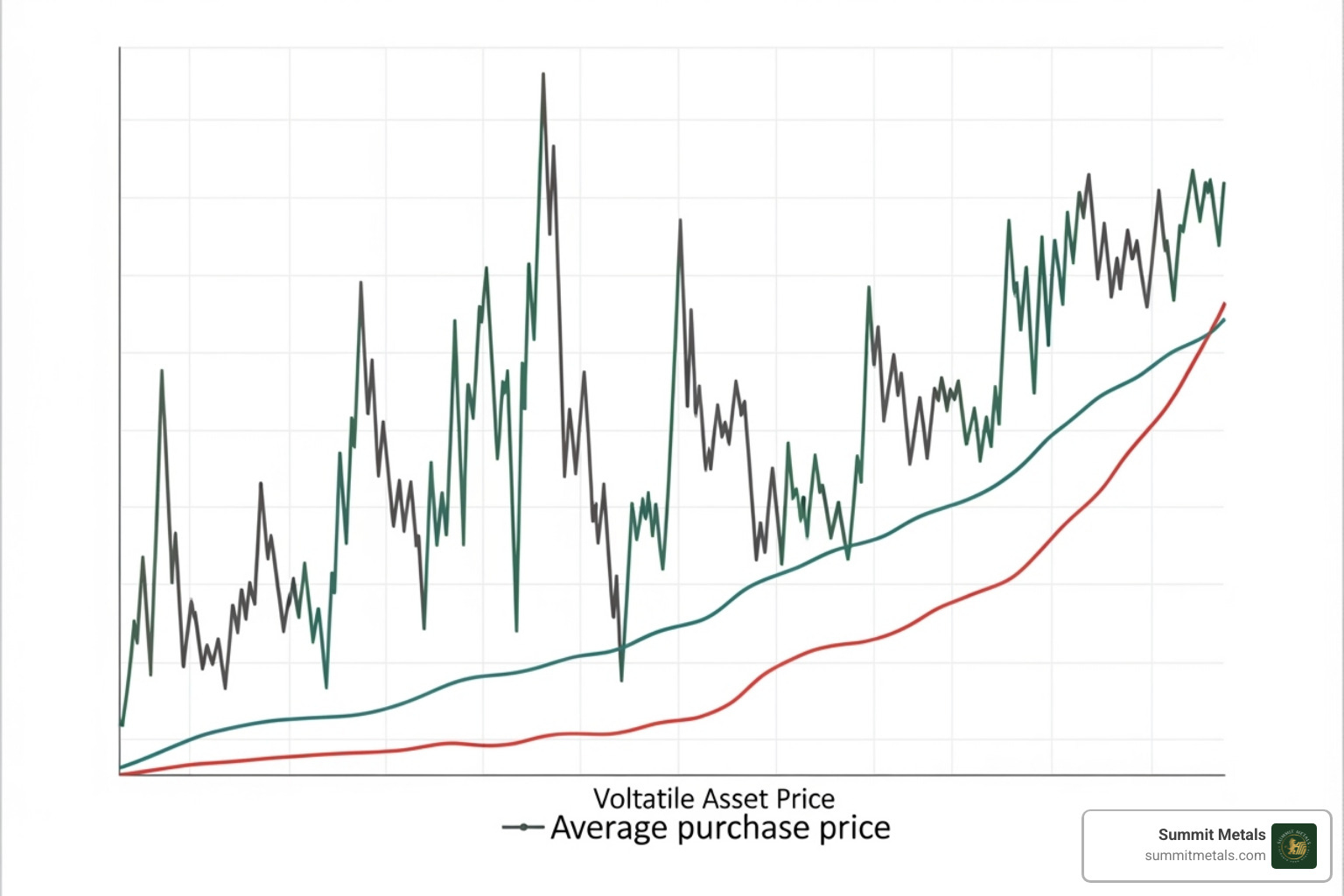

After your first spot purchase, consistency is key. The most effective strategy is Dollar-Cost Averaging (DCA). Instead of trying to time the market, you invest a fixed amount at regular intervals.

This approach mitigates market volatility. When prices are high, you buy fewer ounces; when prices are low, you automatically buy more. Over time, this smooths out your average cost per ounce and removes emotion from your investment decisions.

Think of it as the "401k for precious metals." Summit Metals' Autoinvest program makes this easy. You set a monthly budget, choose your products, and build your stack automatically. It's a disciplined, hands-off way to accumulate tangible wealth.

This strategy has helped countless investors build substantial holdings without the stress of market timing. For a deeper dive, check out Silver Linings: Smart Strategies for Investing in Precious Metal.

Frequently Asked Questions about Buying Silver at Spot

Here are quick answers to the most common questions about buy silver at spot deals.

Can I really buy physical silver at the exact spot price?

Yes, but only through limited-time promotions. Normally, physical silver is sold with a premium to cover minting, shipping, and dealer costs. In a spot price deal, the dealer absorbs these costs as a marketing incentive to attract new customers. These offers are genuine but are special occasions, not the everyday price.

Are "silver at spot" deals a good investment?

Yes, they are an excellent entry point. By eliminating the premium, your investment starts at the true market value of the silver. This means any price increase translates directly into a gain for you, without having to first overcome the initial markup. It's the smartest way to begin a long-term precious metals strategy. The current market makes this especially timely, as outlined in our Bullish Case for Silver.

What's the catch with buying silver at spot price?

There's no catch, just a clear business strategy. It's a "loss leader" marketing tool to earn your future business. The "catch" is that these deals have limitations:

- They are for first-time customers only.

- There are quantity limits (e.g., 5-10 ounces).

- They are one-per-household.

It's a win-win: you get silver at an unbeatable price, and the dealer gets a chance to demonstrate their quality and service, hoping you'll become a long-term client.

Conclusion

Your journey to buy silver at spot is the smartest first step into precious metals. These rare promotional deals allow you to acquire physical silver at its raw market value, eliminating the dealer premiums that typically act as a barrier to entry.

We've shown you how to find these legitimate offers, avoid scams, and understand the common restrictions. These deals are limited, but their value is undeniable. They provide the perfect foundation for a long-term investment strategy.

Your first spot purchase is just the beginning. The real power comes from consistent stacking over time. Using a tool like Summit Metals' Autoinvest program allows you to apply dollar-cost averaging, building your holdings automatically and mitigating market volatility.

At Summit Metals, we are committed to transparency and value. Based in Wyoming, we leverage our bulk purchasing power to offer competitive rates on authenticated gold and silver. We're here to support your journey, from your first ounce at spot to building a substantial portfolio.

These opportunities are fleeting. Be prepared to act when they arise.

Ready to find your first deal? Learn more and start your stacking journey today: How to Snag Silver Bullion at Spot Price? Yes, Really!