Why Certified American Silver Eagles Are the Gold Standard of Silver Investment

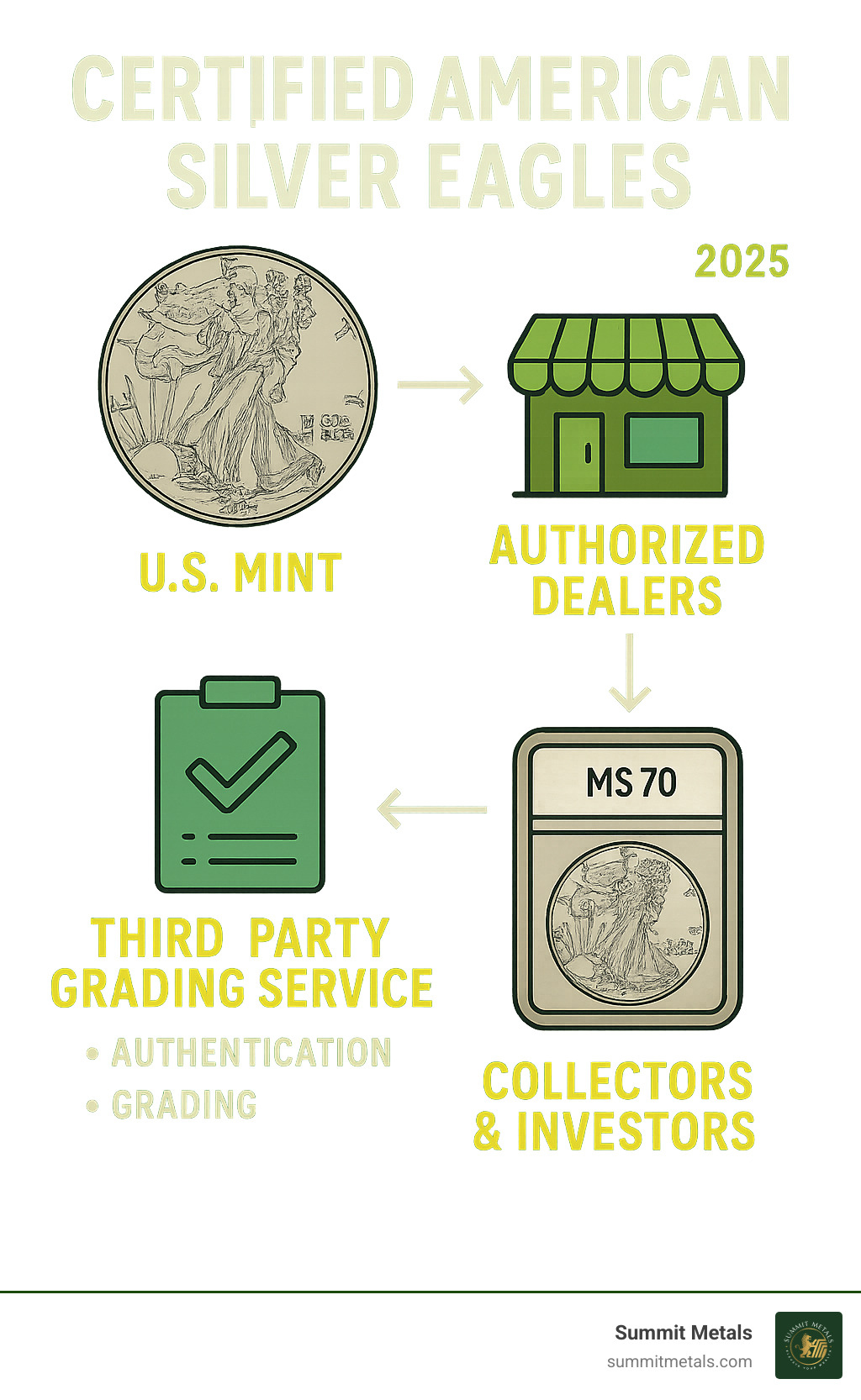

Certified American Silver Eagles are U.S. Mint bullion coins that have been professionally graded and sealed by independent services. Certification delivers three huge advantages most bullion never enjoys:

- Authenticity Guarantee – third-party verification ends worries about fakes.

- Condition Grading – a universal 1-70 Sheldon score shows exactly how pristine the coin is.

- Instant Liquidity & Premiums – buyers worldwide know the grade, so trades are faster and often at higher prices.

Each coin contains one troy ounce of 99.9 % pure silver, but once encapsulated it also acquires a collectible, or numismatic, premium. That combination of metal value plus collectability is why certified Eagles have become a staple for serious precious-metals investors.

I’m Eric Roach. After more than a decade structuring hedging and alternative-asset strategies for Fortune-500 clients, I now help individual investors harness the same disciplined approach when adding certified American Silver Eagles to their portfolios.

Understanding Certified American Silver Eagles: More Than Just Silver

When you hold a certified American Silver Eagle, you own more than an ounce of metal—you own a professionally authenticated asset whose quality is recognized worldwide. Certification solves two chronic problems in the bullion market: counterfeit risk and subjective condition debates.

Think of it as getting an engineer’s report before buying a house. With the report in hand, both buyer and seller instantly agree on what’s being sold. The same happens when an independent service grades a Silver Eagle on the widely used Sheldon scale.

Because buyers no longer need to second-guess a coin’s genuineness or grade, liquidity improves and premiums rise. That’s why Certified Silver Eagles hold their value better than raw coins—confidence turns into cash.

The Importance of Third-Party Grading

Independent services employ multiple numismatists who review strike quality, luster, and surface preservation under magnification. After grading, the coin is sealed inside a tamper-evident plastic “slab” with holograms and a unique serial number that you can verify online.

Population reports published by the services show how many coins exist at each grade, letting investors gauge rarity in real time. That hard data prevents hype and lets supply-and-demand drive prices.

The MS70 vs. MS69 Debate

- MS70 = perfection under 5× magnification; fewer coins earn it, so premiums soar.

- MS69 = nearly perfect; minor, often invisible flaws keep costs lower.

Most portfolio builders choose MS69 for affordability, while collectors pursuing absolute perfection gravitate toward MS70. Either way, certification removes guesswork and sets clear expectations.

A Collector's Guide to the Different Types of Certified American Silver Eagles

Silver Eagles now break into two design eras:

- Type 1 (1986-2021) – John Mercanti’s classic heraldic eagle reverse.

- Type 2 (mid-2021-present) – Emily Damstra’s landing eagle with oak branch.

The obverse keeps Adolph Weinman’s timeless Walking Liberty, so collectors often pursue one of each reverse to complete a historical set.

Proof and Burnished Finishes

- Proof: multiple polished strikes create frosted devices over mirror-like fields; nearly all proofs carry a “W” or occasional “S” mint mark.

- Burnished (Uncirculated): specially tumbled blanks give a soft satin surface and lower mintages, often under 200 000 coins per year.

Because these versions start with careful handling, they frequently achieve high grades, making them excellent candidates for certification.

Modern Rarities to Watch

| Year | Mintage | Mint Mark | Why It Matters |

|---|---|---|---|

| 1995-W | 30 125 | W | Key proof; PR70 sold for $41 125 |

| 2019-S | 30 000 | S | First Improved Reverse Proof |

| 2020 (P) | 240 000 | (P) | "Emergency" COVID-19 issue |

True value comes from the mix of low mintage, an interesting story, and top-tier grades—factors that certification documents forever.

How to Buy Certified American Silver Eagles Safely and Smartly

Shopping for certified coins is simple once you follow three rules:

- Choose transparent dealers. Look for clear pricing and no high-pressure pitches. If fees or buy-back terms are fuzzy, move on.

- Verify every slab online. Enter the serial number on the grader’s website the moment your coin arrives to confirm authenticity.

- Compare premiums, not just spot price. Certification costs money, but wildly inflated mark-ups cut into returns. A quick market scan keeps you on budget.

For more on protecting yourself, read Identifying Reputable Bullion Dealers, Avoiding Counterfeits.

Storage Tips in 60 Seconds

- Small stack? A fire-rated home safe works.

- Medium stack? A bank safe-deposit box adds insured security.

- Large or IRA stack? A third-party depository offers 24/7 monitored vaults and seamless reporting.

Always keep slabs in archival-safe boxes so scratches on plastic don’t spook future buyers.

Frequently Asked Questions about Certified Silver Eagles

Are certified American Silver Eagles a good investment?

Certified American Silver Eagles offer compelling investment opportunities, though like any investment, they come with both potential rewards and considerations worth understanding before diving in.

The investment potential of these coins extends far beyond their silver content. While regular bullion coins primarily track silver spot prices, certified coins add a numismatic layer that can provide additional appreciation potential. This dual value proposition - both precious metal content and collector appeal - creates multiple pathways for growth.

These coins serve as an effective hedge against inflation and currency uncertainty. Throughout history, silver has maintained purchasing power during economic turbulence, and the certification process adds stability through verified authenticity and condition. When markets get shaky, having tangible assets with government backing can provide peace of mind that paper investments simply can't match.

The liquidity advantages of certified coins really shine when it's time to sell. Buyers know exactly what they're getting - no guesswork about authenticity or condition. This transparency speeds up transactions and often results in better prices compared to uncertified coins where buyers might lowball offers to account for uncertainty.

Long-term value appreciation potential exists, especially for high-grade examples and key dates. While a regular Silver Eagle might trade close to spot price, a certified MS70 example can command premiums of 50-100% or more. Special issues and rare dates can appreciate even more dramatically over time.

However, certified coins typically carry higher initial premiums than bullion, which affects short-term returns. You'll need larger silver price movements to reach profitability, so patience often becomes part of the investment strategy.

For broader perspective on precious metals investing approaches, check out Physical Bullion Vs. Gold Silver ETFs: Pros And Cons to see how physical coins fit into modern portfolios.

What is the face value of a Silver Eagle and does it matter?

Every American Silver Eagle carries a face value of $1, making it official legal tender. But here's the thing - that dollar face value is purely symbolic and has zero practical relevance to what these coins are actually worth.

The intrinsic value comes from the silver content - one full troy ounce of 99.9% pure silver. With silver prices around $25 per ounce (prices shown are at the time of this publication), you're looking at roughly 25 times the face value just in metal content. For certified American Silver Eagles, the collector premium often pushes values much higher still.

The legal tender status does provide some benefits, including potential tax advantages and regulatory protections. That government backing adds credibility and international recognition that private silver rounds can't match. But let's be honest - nobody in their right mind would spend a Silver Eagle at face value when the silver alone is worth 25 times more.

Think of the face value as a legal requirement for official U.S. coinage rather than a practical pricing mechanism. It's like having a classic car with a $100 registration fee - that fee has nothing to do with what the car is actually worth.

The collector value for certified coins often adds significant premiums on top of the silver content. So while that $1 face value might seem quaint, these coins regularly trade for $30-50 or more, depending on grade, rarity, and market conditions.

Can I get my own Silver Eagles certified?

Absolutely! You can submit your own American Silver Eagles for certification, though the process requires some planning to make sure it's worth your time and money.

The submission process typically works through authorized dealers who handle the paperwork, shipping, and insurance. While direct submission is possible, most collectors find working with dealers more convenient and often more cost-effective due to bulk submission discounts.

Grading fees usually range from $20-50 per coin for standard service, with express options costing more for faster turnaround. Don't forget additional costs like shipping, insurance, and potential dealer handling fees. These costs add up quickly, so you'll want coins that can justify the expense.

Turnaround times vary dramatically based on service level and submission volume. Standard service might take anywhere from a few weeks to several months. During busy periods, patience becomes essential - but good things come to those who wait.

The key question is whether certification will add enough value to justify the costs. Common date coins in average condition rarely benefit from certification, while key dates or potentially high-grade coins often make the process worthwhile.

Before submitting, carefully evaluate your coins' condition and potential grades. Coins with obvious damage, heavy wear, or environmental issues like milk spots are unlikely to achieve grades that justify certification costs. When in doubt, consult with experienced dealers who can provide honest assessments of your coins' certification potential.

The process can be rewarding both financially and personally - there's something exciting about getting back a perfectly graded coin in its protective holder, knowing you've preserved a piece of American numismatic history.

Conclusion

Certified American Silver Eagles blend the intrinsic strength of silver with third-party verified quality, giving investors two potential growth engines instead of one. Pair that with Summit Metals’ real-time transparent pricing from Wyoming, and you have a straightforward path into hard-asset ownership.

Visit us at https://summitmetals.com/ to explore today’s inventory and see how effortless owning authenticated precious metals can be.